Is CoinBits safe?

Pros

Cons

Is Coinbits Safe or Scam?

Introduction

Coinbits is an online trading platform that positions itself as a broker for cryptocurrency trading, particularly focused on contracts for difference (CFDs). The rise of digital currencies has led to an influx of trading platforms, making it essential for traders to conduct thorough due diligence before investing. With numerous reports of scams in the forex and cryptocurrency markets, understanding the legitimacy of a broker like Coinbits is crucial. This article aims to investigate whether Coinbits is a safe trading option or a potential scam. Our investigation draws upon various online reviews, regulatory information, and user feedback to provide a comprehensive assessment.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental factor in determining its legitimacy. Coinbits operates under the auspices of Gama Solutions Ltd., a company registered in Saint Vincent and the Grenadines (SVG). Unfortunately, SVG is known for its lack of stringent regulatory oversight, which raises concerns about the safety of funds deposited with such brokers.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a credible regulatory body overseeing Coinbits is alarming. The Financial Conduct Authority (FCA) in the UK has blacklisted Coinbits, warning investors that it operates without authorization and may be involved in fraudulent activities. This lack of regulation and oversight means that traders are exposed to significant risks, as they have limited recourse in case of disputes or fund mismanagement.

Company Background Investigation

Coinbits claims to provide a user-friendly trading experience, but its corporate structure and ownership remain murky. Gama Solutions Ltd. is the parent company, but there is little information available regarding its history or management team. This lack of transparency raises red flags about the company's intentions and its commitment to ethical trading practices.

The management team behind Coinbits is not publicly disclosed, which is concerning for potential investors. A reputable broker typically provides information about its executives and their professional backgrounds. The absence of such information makes it difficult to assess the company's credibility and operational integrity.

Trading Conditions Analysis

Understanding the trading conditions offered by Coinbits is vital for assessing its overall value. The broker advertises competitive spreads and leverage options, but these claims require scrutiny.

Trading Costs Comparison Table

| Cost Type | Coinbits | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 1.5 pips |

| Commission Model | $4.95 per trade | $5.00 - $7.00 |

| Overnight Interest Range | Not Specified | 2% - 3% |

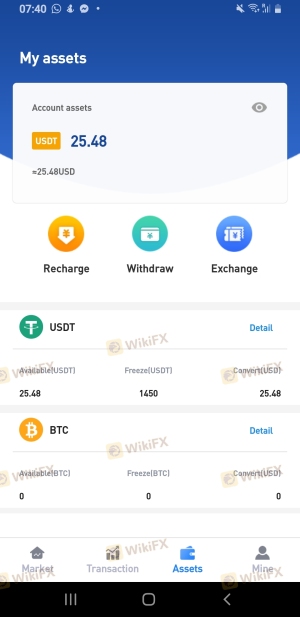

While Coinbits claims to offer low trading fees, the lack of clear information on spreads and commissions raises concerns. The broker does not disclose the minimum deposit required to start trading, which is unusual for a legitimate brokerage. Furthermore, an excessively high minimum withdrawal amount of €10,000 or GBP is not standard practice and may indicate an attempt to limit access to funds.

Client Funds Safety

The safety of client funds is paramount when considering a broker. Coinbits does not provide adequate information regarding its fund protection measures. The absence of segregated accounts and investor protection schemes means that traders' funds could be at risk in the event of the broker's insolvency.

Historically, unregulated brokers like Coinbits have been associated with fund mismanagement and fraudulent activities. Without a regulatory body to enforce compliance, the likelihood of encountering issues with fund withdrawals or misappropriation of funds increases significantly.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Reviews of Coinbits reveal a pattern of negative experiences among users. Common complaints include difficulty withdrawing funds, lack of customer support, and aggressive sales tactics.

Complaint Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Average |

| Misleading Information | High | Unresponsive |

One notable case involved a trader who reported being unable to withdraw their funds after multiple attempts. The broker's customer service allegedly provided vague responses, further exacerbating the situation. Such experiences highlight the potential risks associated with trading on platforms like Coinbits.

Platform and Execution

The trading platform offered by Coinbits is another area of concern. Users have reported that the platform is rudimentary and lacks essential features commonly found in reputable trading software, such as MetaTrader 4 or 5. The absence of advanced trading tools can hinder traders' ability to make informed decisions.

Additionally, there are reports of order execution issues, including slippage and rejected orders. These problems can significantly impact trading outcomes, especially for those employing high-frequency trading strategies.

Risk Assessment

Using Coinbits carries inherent risks that potential traders should carefully consider. The lack of regulation, combined with a history of negative user experiences, contributes to an overall high-risk profile for this broker.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated and blacklisted |

| Fund Safety | High | No protection measures in place |

| Customer Support | Medium | Poor response and availability |

To mitigate risks, traders should consider using regulated brokers with a proven track record and robust customer support systems. Additionally, employing risk management strategies, such as setting stop-loss orders, can help protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Coinbits operates as an unregulated broker with significant risks for traders. The lack of transparency regarding its regulatory status, combined with numerous complaints from users, raises serious concerns about the safety of funds and the overall integrity of the platform.

For traders seeking a reliable trading experience, it is advisable to steer clear of Coinbits. Instead, consider reputable alternatives that are regulated by recognized authorities, such as FCA or ASIC, which offer better protection for your investments. Always conduct thorough research and prioritize your financial security when choosing a trading platform.

In summary, is Coinbits safe? The overwhelming consensus is that it is not, and traders should exercise extreme caution when considering this broker.

Is CoinBits a scam, or is it legit?

The latest exposure and evaluation content of CoinBits brokers.

CoinBits Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CoinBits latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.