Is CAPITALPURSE safe?

Business

License

Is CapitalPurse Safe or a Scam?

Introduction

CapitalPurse is a forex broker that positions itself in the rapidly evolving online trading landscape, offering a variety of financial instruments, including forex, commodities, and cryptocurrencies. However, the importance of due diligence when selecting a trading partner cannot be overstated. Traders need to carefully evaluate the legitimacy and reliability of forex brokers to safeguard their investments. In this article, we will investigate whether CapitalPurse is safe or if it raises red flags that could indicate potential risks. Our assessment will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the first indicators of a broker's credibility is its regulatory status. CapitalPurse operates without any regulatory oversight, which is a significant cause for concern. Unregulated brokers often lack the consumer protections that regulated entities provide, leading to an environment where traders may face higher risks. Here is a summary of the regulatory information for CapitalPurse:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory framework means that CapitalPurse does not adhere to the stringent standards that govern reputable brokers. This raises questions about the level of consumer protection and accountability that traders can expect. The lack of oversight can lead to issues such as unfair trading practices, lack of transparency in fees, and potential difficulties in withdrawing funds. Therefore, it is crucial for traders to approach CapitalPurse with caution and to consider the risks associated with trading with an unregulated broker.

Company Background Investigation

CapitalPurse is headquartered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. The company's ownership structure and management team details are not readily available, which may further complicate the assessment of its credibility. Transparency regarding company operations and management is essential for establishing trust with potential clients. A lack of publicly available information about the management team can lead to skepticism regarding the broker's intentions and operational integrity.

The absence of a clear history or developmental milestones for CapitalPurse also raises concerns. Without a documented track record, it becomes challenging for traders to evaluate the broker's reliability or past performance. In summary, the company's lack of transparency in its background and ownership structure is a significant factor that traders should consider when evaluating whether CapitalPurse is safe.

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions they offer is vital. CapitalPurse advertises a variety of trading instruments and account types, but the specifics regarding fees and commissions are often vague. This lack of clarity can lead to unexpected costs for traders. Here's a comparative overview of the core trading costs associated with CapitalPurse:

| Fee Type | CapitalPurse | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Moderate |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Not Specified | Specified |

The potential for high spreads and an unclear commission structure may indicate a lack of competitiveness compared to other brokers. Furthermore, the absence of detailed information about overnight interest rates can leave traders in the dark about the costs of holding positions overnight. Such uncertainty can be detrimental to traders' financial planning and overall trading experience.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. CapitalPurse's lack of regulation raises questions about the security measures in place to protect client funds. Regulated brokers typically offer features such as segregated accounts, investor protection schemes, and negative balance protection, ensuring that clients' funds are safeguarded against mismanagement or insolvency. However, CapitalPurse does not provide information on these critical security measures.

Without established protocols for fund segregation and protection, traders may find themselves exposed to significant risks. The absence of a clear policy regarding fund security can lead to potential losses in the event of financial mismanagement or operational failures. This lack of transparency regarding customer fund safety is a critical factor in evaluating whether CapitalPurse is safe for trading.

Customer Experience and Complaints

Analyzing customer feedback and experiences is essential for understanding a broker's reputation. Reviews of CapitalPurse reveal a mixed bag of experiences, with some users reporting positive interactions while others express frustration over withdrawal difficulties and unresponsive customer service. Heres a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Issues | Moderate | Inconsistent |

| Transparency Concerns | High | Unaddressed |

The frequent mention of withdrawal issues is particularly alarming. Traders should be able to access their funds without undue delays or complications. Additionally, the inconsistency in customer support responses can create an environment of uncertainty, further exacerbating traders' concerns regarding the reliability of CapitalPurse. These complaints highlight the potential risks associated with trading through this broker.

Platform and Execution

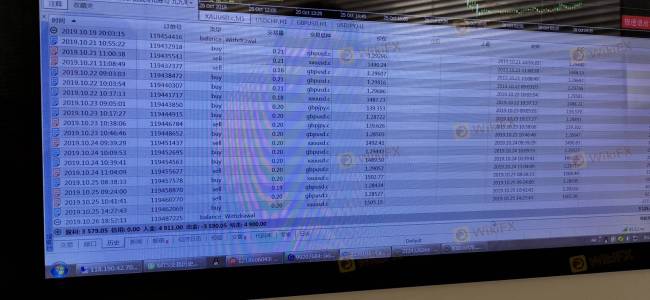

The trading platform offered by CapitalPurse is proprietary and web-based. While a user-friendly interface is essential, the platform's performance, stability, and execution quality are equally important. Traders rely on a seamless experience when executing trades, and any issues with slippage or order rejections can lead to significant financial consequences. However, reviews suggest that there may be concerns regarding order execution quality, with reports of slippage during volatile market conditions.

If there are indications of platform manipulation or irregularities in trade execution, these factors could contribute to an overall negative trading experience. Traders should consider these aspects when evaluating whether CapitalPurse is safe for their trading activities.

Risk Assessment

Using CapitalPurse for trading carries inherent risks, primarily due to its unregulated status and lack of transparency. Here is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of information on fund protection. |

| Execution Risk | Medium | Reports of slippage and execution issues. |

| Customer Support Risk | High | Inconsistent responses to inquiries. |

Traders should be aware of these risks and take appropriate measures to mitigate them. It is advisable to start with smaller investments and to thoroughly research the broker's practices before committing significant capital.

Conclusion and Recommendations

In conclusion, the investigation into CapitalPurse raises several concerns regarding its legitimacy and safety. The broker's unregulated status, lack of transparency, and mixed customer experiences suggest that traders should exercise caution. While there are some positive aspects, such as a diverse range of trading instruments, the potential risks outweigh the benefits.

For those considering trading with CapitalPurse, it is essential to remain vigilant and informed. Traders may want to explore alternative brokers that are regulated and offer robust consumer protections. Reliable options include brokers with a strong regulatory framework, transparent fee structures, and positive customer feedback. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading partner.

Is CAPITALPURSE a scam, or is it legit?

The latest exposure and evaluation content of CAPITALPURSE brokers.

CAPITALPURSE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAPITALPURSE latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.