Regarding the legitimacy of OM forex brokers, it provides FMA and WikiBit, .

Is OM safe?

Pros

Cons

Is OM markets regulated?

The regulatory license is the strongest proof.

FMA Inst Forex Execution (STP)

Financial Markets Authority

Financial Markets Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

OM FINANCIAL LIMITED

Effective Date:

2016-10-01Email Address of Licensed Institution:

brent.weenink@omf.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-08-31Address of Licensed Institution:

Level 2, 37 Galway Street Britomart Auckland 1010Phone Number of Licensed Institution:

09 520 9326Licensed Institution Certified Documents:

Is OM Safe or a Scam?

Introduction

OM is a relatively new player in the forex trading market, established in 2017 and based in New Zealand. As with any forex broker, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it also harbors risks, including the potential for fraud. Therefore, assessing the legitimacy and safety of brokers like OM is vital for safeguarding investments. This article will investigate OM's regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile to determine whether OM is safe or a scam.

Regulation and Legality

The regulatory landscape is one of the most critical factors in determining a broker's legitimacy. A well-regulated broker is more likely to be trustworthy and adhere to industry standards. OM claims to be regulated by the Financial Markets Authority (FMA) in New Zealand, which is a reputable regulatory body. Below is a summary of OM's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Markets Authority (FMA) | 15922 | New Zealand | Verified |

The FMA is known for its stringent regulations, which include requirements for transparency, client fund protection, and ethical practices. However, it is worth noting that OM has been flagged as a "suspicious clone" by some sources, raising questions about its regulatory compliance. While no negative disclosures have been found against OM, the lack of a comprehensive regulatory framework can be concerning for potential investors. Therefore, assessing the quality of regulation is essential when evaluating whether OM is safe or a scam.

Company Background Investigation

OM was founded in 2017 and has positioned itself as a forex broker that uses the popular MetaTrader 4 (MT4) platform. The companys ownership structure and management team are crucial for understanding its operational integrity. Unfortunately, detailed information about the management team is scarce, making it challenging to evaluate their expertise and experience in the financial markets. Transparency is a significant factor when determining a broker's trustworthiness; a lack of information may raise red flags for potential clients.

The company has been in operation for a relatively short time, which can be both an advantage and a disadvantage. While new brokers may offer innovative services, they may also lack the track record needed to instill confidence. In conclusion, while OM is operational and claims to be regulated, the limited information about its management and ownership structure leaves room for skepticism regarding its safety.

Trading Conditions Analysis

Understanding the trading conditions offered by OM is vital for evaluating its overall value proposition. OM claims to provide competitive spreads and a user-friendly trading environment. However, the fee structure must be carefully scrutinized to identify any hidden costs that could affect profitability. Below is a comparison of OM's core trading costs:

| Fee Type | OM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not specified) | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not specified | 2% - 5% |

While OM does not explicitly mention its spreads or commission structure, the lack of clarity could be a concern for potential traders. Transparency in fees is crucial for traders to make informed decisions. Additionally, any unusual or excessive fees could be a warning sign, indicating that OM may not be as safe as it claims.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a forex broker. OM claims to have measures in place to protect client funds, including fund segregation and negative balance protection. Segregation of funds means that client money is kept in separate accounts from the broker's operational funds, which is a standard practice among reputable brokers. However, the effectiveness of these measures can only be verified through customer feedback and regulatory oversight.

Historically, there have been no significant reports of fund safety issues related to OM. However, the absence of negative disclosures does not necessarily guarantee that funds are entirely safe. Traders should remain vigilant and assess the broker's financial stability and operational practices to ensure their investments are secure. Overall, while OM claims to prioritize fund safety, the lack of detailed information necessitates caution when considering whether OM is safe or a scam.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Analyzing user experiences with OM reveals a mixed bag of reviews. Some traders report positive experiences with the trading platform and customer service, while others have raised concerns about withdrawal delays and unresponsive support. Below is a summary of common complaint types associated with OM:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

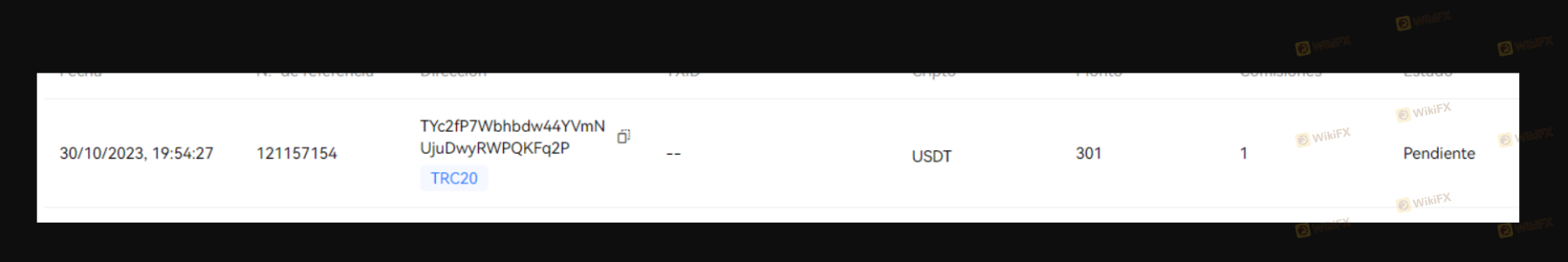

| Withdrawal Delays | High | Slow response |

| Customer Service Issues | Medium | Unresponsive |

| Platform Stability | Medium | Average response |

One notable case involved a trader who faced difficulties withdrawing funds after a series of profitable trades. The trader reported that customer service was slow to respond, leading to frustration and uncertainty about the safety of their funds. Such experiences highlight the importance of reliable customer support and responsiveness, which are critical for maintaining trust in a broker.

Platform and Execution

The trading platform's performance is another essential factor in evaluating a broker's reliability. OM utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, the stability of the platform and the quality of trade execution can significantly impact a trader's experience. Reports of slippage and order rejections can be indicative of underlying issues.

While some users have praised the platform's functionality, concerns about execution quality have also surfaced. Traders should be aware of potential issues, especially during high-volatility periods when execution delays could affect profitability. Overall, while OM's platform appears to be generally reliable, traders should remain vigilant and monitor execution quality to ensure their trading experience is satisfactory.

Risk Assessment

Engaging with any forex broker carries inherent risks. For OM, several risk factors warrant attention. Below is a summary of the key risk areas associated with trading with OM:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory scrutiny is limited |

| Fund Safety | Medium | Segregation claimed, but unverified |

| Customer Support | High | Reports of slow and unresponsive service |

To mitigate these risks, traders should consider starting with a small investment to test the broker's reliability. Additionally, maintaining a diversified portfolio can help reduce the impact of any potential losses incurred while trading with OM.

Conclusion and Recommendations

In conclusion, the investigation into whether OM is safe or a scam reveals a mixed picture. While OM is regulated by the FMA, the lack of transparency regarding its management and the mixed customer feedback raise concerns. The absence of clear information about trading costs and potential withdrawal issues further complicates the assessment.

For traders considering OM, it is crucial to weigh these factors carefully. If you prioritize regulatory oversight and customer service, you may want to explore alternative brokers with a more robust reputation. Some reputable alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which generally offer better investor protection.

In summary, while OM operates within the forex market, potential traders should exercise caution and conduct thorough research before engaging with this broker. The question "Is OM safe?" remains a valid concern for many, and prudent trading practices are always recommended.

Is OM a scam, or is it legit?

The latest exposure and evaluation content of OM brokers.

OM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OM latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.