Regarding the legitimacy of INZO forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is INZO safe?

Pros

Cons

Is INZO markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

INZO GROUP LTD

Effective Date:

--Email Address of Licensed Institution:

information@inzo.coSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

IMAD Complex Office 6, Ile Du Port, SeychellesPhone Number of Licensed Institution:

+248 4 226 157Licensed Institution Certified Documents:

Is Inzo A Scam?

Introduction

Inzo is a relatively new player in the forex market, having been established in 2021. Operating from Saint Vincent and the Grenadines, Inzo presents itself as a broker offering a diverse range of trading instruments, including forex, indices, commodities, and cryptocurrencies. However, the rapid growth of online trading has also led to an increase in fraudulent practices, making it essential for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to provide a comprehensive analysis of Inzo, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on a thorough review of various online sources, customer feedback, and industry standards.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its legitimacy. Inzo claims to be regulated by the Seychelles Financial Services Authority (FSA), but the effectiveness of this regulation is questionable. The Seychelles is known as an offshore financial center with less stringent regulatory requirements compared to jurisdictions like the UK or the EU.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 163 | Seychelles | Not fully verified |

The Seychelles FSA does not impose the same level of oversight as other major financial regulatory bodies, which raises concerns about the safety of client funds and the broker's adherence to ethical trading practices. Additionally, there have been no significant regulatory actions or compliance issues reported against Inzo, which could suggest a lack of transparency in its operations.

Company Background Investigation

Inzo operates under the name Inzo LLC and is headquartered in Saint Vincent and the Grenadines. The company was founded in 2021, and while it claims to provide a user-friendly trading experience, details regarding its ownership and management team remain obscure. This lack of transparency can be concerning for potential investors, as it raises questions about the accountability of the broker.

The management teams background and professional experience are crucial indicators of a broker's reliability. Unfortunately, Inzo does not disclose sufficient information about its leadership, making it difficult to assess their expertise and integrity. Furthermore, the absence of clear information regarding the company's operational history and ownership structure contributes to an overall perception of opacity.

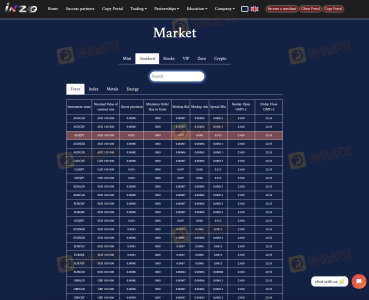

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its competitiveness and fairness. Inzo presents a variety of account types, each with its own fee structure. However, the overall cost of trading with Inzo appears to be higher than the industry average, which could affect profitability for traders.

| Fee Type | Inzo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 0.6 pips |

| Commission Model | Varies by account | Generally low |

| Overnight Interest Range | Varies | Varies |

Inzo's spreads start at 0.8 pips for major currency pairs, which is slightly above the industry average. Additionally, the commission structure can vary significantly depending on the account type, with some accounts incurring higher fees. Traders should be cautious of any unusual or hidden fees that may not be clearly communicated during the account opening process.

Customer Funds Security

The safety of client funds is paramount when choosing a forex broker. Inzo claims to implement various security measures, including the segregation of client funds and negative balance protection. However, the effectiveness of these measures is hard to verify due to the lack of regulatory oversight.

Inzo does not provide detailed information on its fund protection policies, which is a significant red flag. The absence of investor protection schemes, such as those offered by FCA-regulated brokers, further exacerbates concerns about fund safety. Historical issues regarding fund security have not been reported, but the overall lack of transparency makes it difficult to ascertain the broker's reliability in this regard.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's performance. Reviews of Inzo reveal a mixed bag of experiences, with some users praising its trading platform while others report significant issues regarding withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Support | Medium | Varied responses |

| Account Verification Issues | High | Lack of clarity |

Common complaints include delays in processing withdrawal requests and difficulties in account verification. Some users have reported that their requests for withdrawals were met with unnecessary delays, leading to frustration and distrust. The company's response to these complaints has been inconsistent, which could indicate a lack of effective customer service protocols.

Platform and Trade Execution

The trading platforms offered by Inzo, including MetaTrader 5 and cTrader, are well-regarded in the industry. However, the performance of these platforms, particularly in terms of stability and execution quality, is vital for the trading experience.

Traders have reported mixed experiences with order execution, with some experiencing slippage and rejection of orders during high volatility periods. These issues can significantly impact a trader's ability to capitalize on market movements and raise concerns about the broker's reliability.

Risk Assessment

Using Inzo as a trading platform carries inherent risks, primarily due to its regulatory status and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulatory oversight |

| Fund Safety Risk | High | Uncertain fund protection measures |

| Customer Service Risk | Medium | Inconsistent support and response times |

To mitigate risks, traders should conduct thorough due diligence before investing with Inzo. It is advisable to start with a small deposit and to be prepared for potential challenges regarding withdrawals and customer support.

Conclusion and Recommendations

In conclusion, while Inzo presents itself as a legitimate forex broker, significant concerns regarding its regulatory status, transparency, and customer service warrant caution. The lack of robust oversight and mixed customer feedback suggest that traders should be vigilant when considering this broker.

For traders seeking reliable alternatives, it is recommended to consider brokers regulated by reputable authorities such as the FCA or ASIC, which offer better investor protection and a more transparent trading environment. By choosing a well-regulated broker, traders can enhance their trading experience and minimize potential risks associated with unregulated platforms like Inzo.

Is INZO a scam, or is it legit?

The latest exposure and evaluation content of INZO brokers.

INZO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INZO latest industry rating score is 2.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.