Is APEC investments safe?

Business

License

Is Apec Investments Safe or Scam?

Introduction

Apec Investments positions itself as a global investment organization, offering a variety of trading services across multiple asset classes, including forex, commodities, and stocks. As the forex market continues to grow, it attracts a diverse range of traders, making it crucial for potential investors to conduct thorough due diligence before engaging with any broker. This article aims to provide an objective analysis of Apec Investments, scrutinizing its legitimacy, regulatory status, and overall safety for traders. Our investigation is based on a comprehensive review of various online sources, including regulatory databases, customer feedback, and expert opinions.

Regulatory and Legitimacy

Understanding the regulatory status of any broker is essential for assessing its legitimacy. A well-regulated broker operates under strict guidelines imposed by financial authorities, which helps safeguard investors funds and ensures transparent operations. Unfortunately, Apec Investments is reported to be unregulated, which raises significant red flags for potential investors.

The following table summarizes the core regulatory information regarding Apec Investments:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from reputable authorities such as the FCA in the UK or ASIC in Australia is concerning. Brokers under these agencies are required to adhere to strict operational guidelines and provide a level of protection for their clients. The lack of oversight often correlates with a higher risk of fraud, making it imperative for traders to be cautious when considering Apec Investments. Furthermore, the lack of warnings from regulatory bodies adds to the skepticism surrounding this broker's operations.

Company Background Investigation

Apec Investments claims to have a global reach and offers a wide array of financial services. However, details about its history, ownership structure, and management team are notably scarce. This lack of transparency can be a warning sign, as reputable brokers usually provide comprehensive information about their operational background.

The management teams expertise is crucial for the credibility of any investment firm. Unfortunately, Apec Investments does not provide sufficient information about its leadership, raising questions about the qualifications and experience of those at the helm. The absence of clear ownership and operational details can lead to concerns regarding the company's accountability and overall integrity.

Moreover, the company's website does not offer adequate financial disclosures or insights into its operational methodologies, which are essential for potential investors. This opacity can indicate a lack of commitment to transparency, further contributing to the perception that Apec Investments may not be a safe option for traders.

Trading Conditions Analysis

When evaluating a broker, it's vital to understand their trading conditions and fee structures. Apec Investments promotes itself as a competitive trading platform, but potential clients should be wary of any hidden fees or unusual policies that could affect their trading experience.

Apec Investments' fee structure appears to be opaque, with many users reporting unexpected charges. The following table provides a comparison of core trading costs:

| Fee Type | Apec Investments | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Varies | 1.0 - 2.0 pips |

| Commission Model | Unclear | $5 - $10 per lot |

| Overnight Interest Range | Unspecified | 2.5% - 5.0% |

The lack of clarity regarding spreads and commissions is concerning. Traders should be cautious if a broker does not clearly outline its fee structure, as this can lead to unexpected costs that diminish profitability. Additionally, Apec Investments has been criticized for its withdrawal policies, with reports of delays and complications when clients attempt to access their funds. Such issues are significant warning signs and should not be overlooked.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. A reputable trading platform implements robust security measures, including fund segregation, investor protection schemes, and negative balance protection. However, Apec Investments lacks transparency regarding these critical aspects.

There is no clear information on whether Apec Investments segregates client funds from its operational capital or if it offers any form of investor protection. This raises concerns, especially in the event of financial difficulties or insolvency. Furthermore, historical complaints about withdrawal issues suggest that client funds may not be secure, reinforcing the need for caution.

Traders should always prioritize brokers that offer clear and comprehensive information about their fund safety measures. A lack of transparency in this area can indicate potential risks, making it essential for investors to proceed with caution when considering Apec Investments.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Apec Investments has received numerous negative reviews, with many clients expressing dissatisfaction with their trading experience. Common complaints include issues with fund withdrawals, lack of responsive customer support, and unclear trading conditions.

The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unresolved |

| Misleading Information | High | No clarification |

Several users have reported that their withdrawal requests were either delayed or denied altogether, which is a significant concern for anyone considering trading with Apec Investments. The lack of responsive customer support exacerbates the situation, leaving clients feeling frustrated and unsupported.

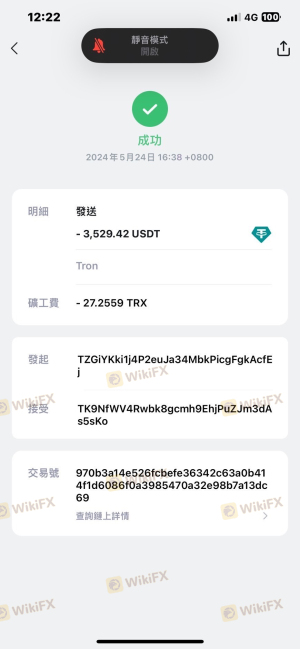

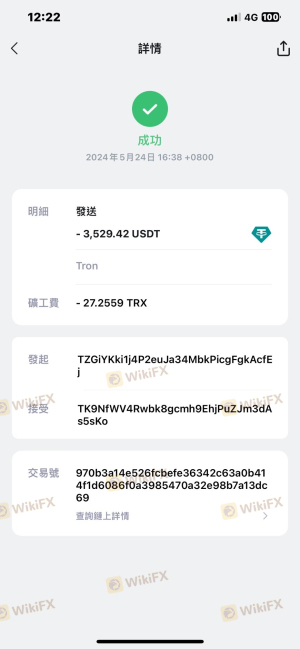

For instance, one trader reported waiting weeks for a withdrawal, only to receive vague responses from customer service. Such experiences raise serious questions about the broker's reliability and commitment to its clients.

Platform and Trade Execution

The trading platform's performance and execution quality are crucial for any trader's success. Apec Investments claims to offer a user-friendly platform, but reviews suggest that it may not live up to these expectations. Users have reported issues with platform stability, slow order execution, and instances of slippage.

The quality of order execution is particularly important in the fast-paced forex market. Traders expect their orders to be executed quickly and at the desired price. However, reports of rejected orders and significant slippage raise concerns about Apec Investments' trading infrastructure. If a broker cannot provide reliable execution, it can significantly impact a trader's profitability and overall experience.

Additionally, any signs of platform manipulation or technical issues should be taken seriously. Traders should always ensure that their broker provides a robust and stable trading environment to mitigate risks associated with execution failures.

Risk Assessment

Using Apec Investments comes with inherent risks that potential traders should carefully consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | Medium | Lack of transparency regarding fund safety. |

| Operational Risk | High | Reports of withdrawal issues and poor support. |

Given these risk factors, it is advisable for traders to exercise caution when engaging with Apec Investments. To mitigate these risks, potential investors should consider starting with a small investment and thoroughly researching the broker's policies before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Apec Investments may not be a safe choice for traders. The lack of regulation, coupled with numerous negative reviews and complaints, raises significant concerns about the broker's legitimacy and reliability. Traders should be particularly wary of the reported withdrawal issues and the company's opaque fee structure.

For those looking to trade in the forex market, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of client satisfaction. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC. Always prioritize safety and transparency when selecting a broker to ensure a secure trading experience.

In summary, is Apec Investments safe? Based on the analysis, the answer leans towards no, and potential traders should proceed with extreme caution or seek more reliable options.

Is APEC investments a scam, or is it legit?

The latest exposure and evaluation content of APEC investments brokers.

APEC investments Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APEC investments latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.