APEC Investments 2025 Review: Everything You Need to Know

Executive Summary

This apec investments review gives you a complete look at a broker that started trading in the forex market on February 24, 2010. APEC Investments is based in Texas and calls itself a multi-asset broker that offers trading services for forex, commodities, and stocks. Our review shows big information gaps that potential traders need to think about carefully.

The broker has been around for over 15 years, which shows it might be stable. APEC Investments wants to help forex and stock market traders who are looking for different trading chances across many types of assets. But the lack of clear regulatory information and limited user feedback that we can find raises questions about how open they are and where they stand in the market.

We give a neutral assessment because we don't have enough solid facts about key trading conditions, regulatory oversight, and user experiences. The broker does give access to various financial tools, but they don't share specific details about trading platforms, account conditions, and customer support, which makes it hard to give a clear recommendation for different types of traders.

Important Notice

This apec investments review uses information from many sources, including industry databases and broker comparison websites. Readers should know that regulatory rules and broker services can be very different in different places. Our review method looks at information that everyone can see, though specific user stories and detailed operational data are hard to find in available sources.

Potential clients should do their own research and check all information directly with the broker before making any trading decisions. This review tries to give you an objective assessment based on current available data, but traders should know that broker conditions and services may have changed since the information was last updated.

Rating Framework

Broker Overview

APEC Investments started its operations on February 24, 2010, which means it has been in the financial services sector for over a decade. The company has its main office in Texas, United States, and has set itself up as a multi-asset broker that serves clients who want to trade forex, commodities, and stocks. The broker's business plan focuses on giving access to various financial markets, though we don't have much detailed information about how they operate and deliver services in available sources.

The broker works in the competitive forex and multi-asset trading space where established players usually offer complete trading platforms and wide market access. APEC Investments provides trading services across multiple asset classes, which suggests they try to meet different trading preferences. But we don't have much specific information about trading platforms, technology setup, and what makes them special in publicly available sources, which makes it hard to judge how they compete accurately.

Regulatory Status: Available sources don't tell us which main regulatory authorities watch over APEC Investments' operations, which is a big information gap for potential clients who want regulatory clarity.

Deposit and Withdrawal Methods: We don't have specific information about available funding methods, processing times, and fees in current available sources.

Minimum Deposit Requirements: The minimum money needed to open trading accounts isn't listed in available documentation.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs aren't mentioned in sources we can access.

Tradeable Assets: The broker offers access to forex markets, commodities trading, and stock investments, giving multi-asset trading opportunities for clients who want portfolio diversification.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs isn't available in current sources, making cost comparison difficult.

Leverage Options: Specific leverage ratios offered across different asset classes and account types aren't documented in available materials.

Platform Selection: The trading platforms supported by APEC Investments aren't specifically mentioned in current sources.

Geographic Restrictions: Information about countries or regions where services may be restricted isn't available.

Customer Support Languages: Available support languages aren't specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The assessment of APEC Investments' account conditions has big limitations because there isn't enough publicly available information. Standard broker reviews usually look at account type varieties, minimum deposit requirements, account features, and special offerings such as Islamic accounts for Sharia-compliant trading. But specific details about these basic aspects remain undocumented in sources we can access.

Most established brokers in the forex industry offer tiered account structures that range from basic accounts for beginners to premium accounts for high-volume traders. These usually include different minimum deposit levels, varying spread conditions, and exclusive features. The lack of such detailed information for APEC Investments makes it difficult for potential clients to understand what account options might be available or how they compare to industry standards.

The account opening process, verification requirements, and any special account features that might make APEC Investments different from competitors aren't specified in available sources. This lack of openness about basic account conditions adds to the moderate rating because traders need clear information about account structures to make smart decisions. Without specific user feedback about account experiences or detailed broker documentation, a complete assessment of account conditions remains challenging in this apec investments review.

APEC Investments shows some strength in asset diversity by offering forex, commodities, and stocks, which gives traders multiple market exposure opportunities. This multi-asset approach lets clients diversify their trading strategies across different financial tools and market conditions. But the specific trading tools, analytical resources, and research materials available to clients aren't detailed in current sources.

Modern forex brokers usually provide complete analytical tools including technical indicators, charting packages, economic calendars, market analysis, and educational resources. The quality and range of these tools often separate serious brokers from basic service providers. Without specific information about APEC Investments' tool offerings, it's hard to assess how well-equipped traders would be for market analysis and decision-making.

Educational resources, which are becoming more important for broker differences, aren't mentioned in available sources. Many brokers offer webinars, trading guides, video tutorials, and market commentary to support trader development. The lack of information about such resources represents a missed opportunity for evaluation. Also, automated trading support, API access, and advanced order types aren't documented, which limits the assessment of the broker's technology capabilities and trader support setup.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation for APEC Investments proves challenging because there's limited available information about support channels, service quality, and client assistance setup. Effective customer support usually includes multiple contact methods such as live chat, telephone support, email assistance, and complete FAQ sections. The availability of these channels and their operational hours aren't specified in current sources.

Response times, which are crucial for traders who may need urgent help during market hours, aren't documented. Quality forex brokers often provide 24/5 support during market hours and maintain multilingual support teams to serve diverse client bases. The lack of specific information about APEC Investments' support capabilities makes it difficult to assess how well they serve client needs during critical trading periods.

Service quality indicators, such as first-contact resolution rates, average response times, and customer satisfaction metrics, aren't available in sources we can access. User feedback about support experiences, which usually provides valuable insights into real-world service quality, is notably absent. This information gap significantly impacts the ability to evaluate customer service effectiveness and adds to the below-average rating in this category.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation faces big limitations because there's no specific user feedback and detailed platform information in available sources. Key factors that usually influence trading experience include platform stability, execution speed, order processing quality, and overall user interface design. Without specific user testimonials or platform performance data, assessing these critical aspects becomes challenging.

Platform stability and execution quality are basic concerns for active traders, particularly during high-volatility periods when reliable order processing becomes crucial. Slippage rates, rejection frequencies, and platform downtime statistics aren't available for APEC Investments, making it impossible to evaluate execution quality objectively. These factors significantly impact trading outcomes and trader satisfaction.

Mobile trading capabilities, which have become essential for modern traders, aren't specifically addressed in available sources. The quality of mobile applications, synchronization with desktop platforms, and mobile-specific features represent important aspects of contemporary trading experience. Also, advanced order types, one-click trading, and customization options aren't documented, limiting the assessment of platform sophistication and trader convenience features in this apec investments review.

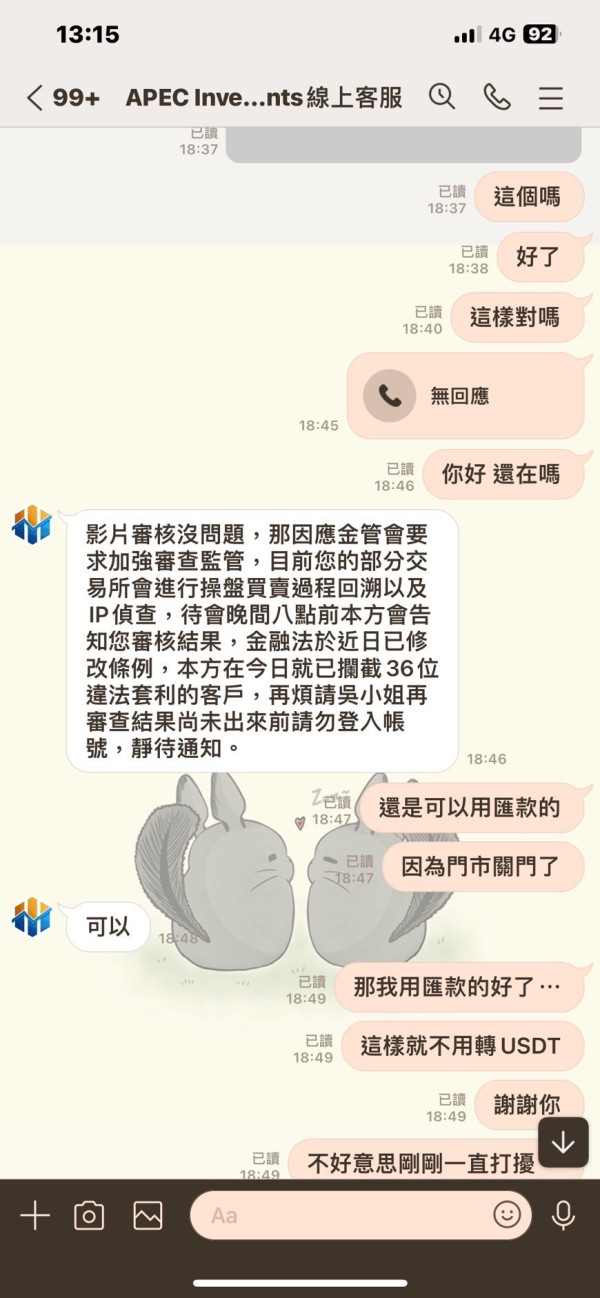

Trust Factor Analysis (Score: 4/10)

Trust factor assessment for APEC Investments encounters significant challenges because there's limited regulatory information and transparency details in available sources. Regulatory oversight represents the foundation of broker trustworthiness, giving clients legal protections, dispute resolution mechanisms, and operational standards compliance. The lack of specific regulatory authority information creates uncertainty about the level of oversight and client protection available.

Fund security measures, including segregated account policies, deposit insurance, and client money protection protocols, aren't detailed in sources we can access. These safeguards are essential for trader confidence and represent standard practices among reputable brokers. Without clear information about how client funds are protected and managed, potential clients cannot adequately assess the security of their investments.

Company transparency, including financial reporting, operational disclosure, and management information, isn't readily available. Established brokers usually provide complete company information, regulatory compliance details, and operational transparency to build client confidence. The limited availability of such information for APEC Investments impacts the trust assessment and suggests potential areas for improvement in public communication and transparency practices.

User Experience Analysis (Score: 5/10)

User experience evaluation for APEC Investments faces big limitations because there's a scarcity of user reviews and experience feedback in available sources. Overall user satisfaction indicators, which usually provide valuable insights into real-world broker performance, are notably absent. This lack of user voice makes it challenging to assess how well the broker meets client expectations and needs.

Interface design and platform usability, crucial factors for trader productivity and satisfaction, aren't specifically documented. Modern trading platforms require intuitive navigation, efficient order placement, and complete market data presentation. Without user feedback about these aspects, evaluating the practical usability of APEC Investments' trading environment becomes difficult.

The registration and account verification process, which represents the first client interaction with the broker, isn't detailed in available sources. Streamlined onboarding processes contribute significantly to positive user experiences, while complicated or lengthy procedures can create frustration. Similarly, fund management experiences, including deposit and withdrawal processes, aren't documented, limiting the assessment of operational efficiency and client convenience in day-to-day broker interactions.

Conclusion

This apec investments review reveals a broker with over 15 years of operational history and multi-asset trading capabilities, but significant information gaps limit the ability to provide a strong recommendation. The company's longevity since 2010 and Texas-based operations suggest some level of stability, while the offering of forex, commodities, and stocks provides asset diversification opportunities for traders.

But the lack of detailed regulatory information, specific trading conditions, and user feedback creates uncertainty about the broker's competitive positioning and service quality. Potential clients who want complete broker transparency and detailed service information may find APEC Investments lacking in publicly available documentation. The broker may be suitable for traders who prioritize asset variety over detailed service specifications, though thorough due diligence is recommended before account opening.

The main strengths appear to be asset class diversity and operational longevity, while the primary concerns include limited regulatory transparency and insufficient public information about trading conditions and user experiences.