Is Alpha FX safe?

Business

License

Is Alpha FX Safe or a Scam?

Introduction

Alpha FX is a financial services company that operates in the foreign exchange (forex) market, primarily catering to corporate clients looking to manage currency risks. Founded in 2009 and based in the United Kingdom, Alpha FX has positioned itself as a specialist in providing advanced forex trading solutions and risk management strategies. However, with a surge in online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article aims to provide a comprehensive analysis of Alpha FX, using various sources and regulatory frameworks to assess whether Alpha FX is safe for trading or if it exhibits characteristics of a scam.

To conduct this investigation, we analyzed multiple online reviews, regulatory information, and customer feedback. The evaluation framework includes regulatory compliance, company background, trading conditions, customer fund safety, user experience, and risk assessment. By combining both qualitative and quantitative data, we aim to provide a balanced perspective on Alpha FX's credibility.

Regulation and Legitimacy

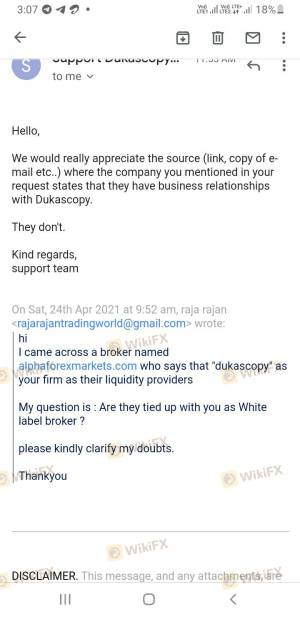

The regulatory environment in which a broker operates is a significant factor in determining its trustworthiness. Alpha FX claims to be regulated by several authorities, including the UK's Financial Conduct Authority (FCA) and Malta's Financial Services Authority (MFSA). However, the FCA has explicitly stated that Alpha FX "cannot hold or control client money," which raises questions about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Verified |

| MFSA | N/A | Malta | Verified |

| FINTRAC | N/A | Canada | Verified |

While Alpha FX is registered with these regulators, the quality of oversight varies. The FCA is considered a Tier 1 regulator, enforcing strict compliance and operational standards. In contrast, the MFSA is categorized as a Tier 2 regulator, which may not offer the same level of investor protection. Furthermore, Alpha FX is not listed under the Investment Industry Regulatory Organization of Canada (IIROC), which is a requirement for legitimate brokers operating in Canada. This discrepancy raises concerns about the overall regulatory framework surrounding Alpha FX, making it essential for potential clients to consider these factors when asking, "Is Alpha FX safe?"

Company Background Investigation

Alpha FX was established in 2009 and has grown rapidly, expanding its operations to include offices in Toronto and Amsterdam. The company is publicly traded on the London Stock Exchange, which adds a layer of transparency to its operations. However, the ownership structure and management team warrant further scrutiny. The founder, Morgan Tillbrook, has a background in technology and finance, which suggests a solid foundation for managing a financial services firm.

Despite its growth and public listing, there are notable gaps in the company's transparency. For instance, the lack of detailed information regarding its ownership structure and the qualifications of its management team raises questions about accountability. The company's website provides limited information about its operations, which could be a red flag for potential investors. In assessing whether Alpha FX is safe, it is crucial to consider the company's transparency and the level of information disclosed to clients.

Trading Conditions Analysis

Alpha FX offers a range of trading services focused primarily on forex, with claims of providing competitive spreads and low fees. However, the lack of clarity regarding its fee structure raises concerns. For example, specific details about spreads, commissions, and overnight interest rates are not readily available on its website, which can be a significant drawback for potential traders.

| Fee Type | Alpha FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Structure | Not disclosed | $5-10 per lot |

| Overnight Interest Range | Not disclosed | 0.5-1.5% |

The absence of transparent fee policies can lead to unexpected costs for traders, making it difficult to assess the overall trading conditions. Furthermore, the lack of a demo account limits potential clients' ability to test the platform before committing funds. These factors contribute to a growing skepticism regarding whether Alpha FX is safe for trading.

Customer Fund Safety

The safety of customer funds is a paramount concern for traders. Alpha FX claims to implement various measures to protect client funds, including segregating client accounts from company funds. However, the company has faced scrutiny regarding its ability to safeguard these funds effectively.

While the FCA's regulations mandate that client funds be held in segregated accounts, the fact that Alpha FX cannot hold client money directly raises concerns about the actual safety of these funds. Additionally, there have been no notable investor protection schemes mentioned, which could leave clients vulnerable in the event of financial distress.

Historical issues with fund safety have not been reported extensively, but the lack of comprehensive information on this topic creates uncertainty for potential clients. To determine if Alpha FX is safe, it is essential to consider these factors in light of the broader regulatory landscape.

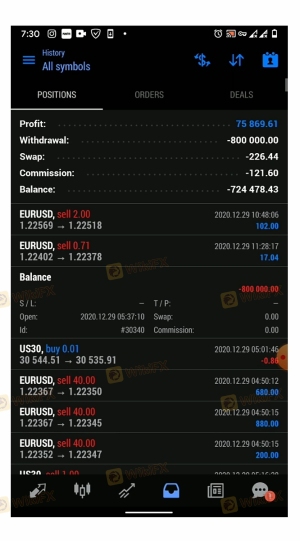

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. A review of online platforms reveals a mixed bag of experiences with Alpha FX. While some users report positive interactions, a significant number of complaints highlight issues related to withdrawal delays, lack of customer support, and unclear fee structures.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Automated replies |

| Unclear Fees | High | No clarification |

For instance, one user reported that their account was blocked without notice after requesting a withdrawal, while another mentioned being charged a "tax" on their earnings before being allowed to withdraw funds. These complaints suggest a pattern of operational inefficiency that could indicate deeper issues within the company.

Platform and Trade Execution

The trading platform offered by Alpha FX is proprietary, and while it is designed for forex trading, there are concerns about its performance and reliability. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

The absence of a widely recognized platform like MetaTrader 4 or 5 may deter experienced traders who prefer established tools known for their reliability and functionality. Additionally, the lack of mobile trading options limits accessibility for traders who prefer to manage their accounts on the go.

Risk Assessment

Using Alpha FX presents several risks that potential clients should carefully consider. The combination of regulatory concerns, unclear trading conditions, and mixed customer feedback contributes to an overall risk profile that is less than reassuring.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unclear status with major regulators |

| Fund Safety | Medium | Segregation of funds but lacks clarity |

| Customer Support | High | Numerous complaints about responsiveness |

To mitigate these risks, potential clients should conduct thorough research, consider using smaller amounts to start, and be cautious about the promises made by the broker.

Conclusion and Recommendations

In conclusion, while Alpha FX presents itself as a legitimate forex broker, the various factors examined raise significant concerns about its safety and reliability. The lack of clarity in regulatory compliance, mixed customer experiences, and operational transparency suggest that traders should exercise caution.

For those considering trading with Alpha FX, it is advisable to closely evaluate the risks and perhaps explore alternative brokers with more robust regulatory frameworks and clearer trading conditions. Reliable options include brokers that are fully regulated by top-tier authorities and provide comprehensive customer support and transparent fee structures. Ultimately, the question of whether Alpha FX is safe remains open, and potential clients should proceed with due diligence.

Is Alpha FX a scam, or is it legit?

The latest exposure and evaluation content of Alpha FX brokers.

Alpha FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alpha FX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.