Alpha Fx 2025 Review: Everything You Need to Know

Summary: The Alpha Fx review reveals a mixed reputation, with several users expressing concerns over transparency and regulatory compliance. While it offers a range of trading options, the lack of a demo account and unclear fee structures have raised red flags for potential investors.

Note: It is crucial to recognize that Alpha Fx operates under different entities across regions, which may affect regulatory oversight and user experience. This review synthesizes various expert opinions and user experiences to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Ratings are based on a combination of user feedback, expert analysis, and the availability of relevant features.

Broker Overview

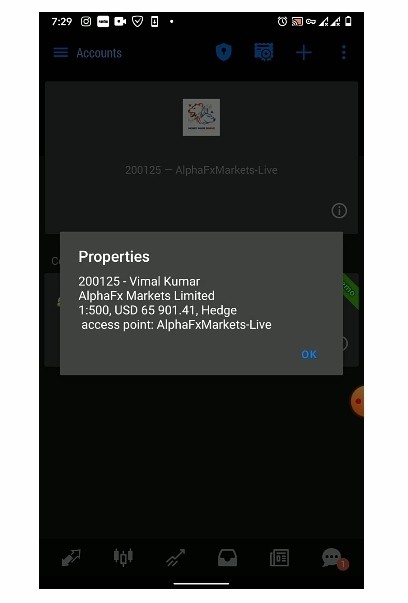

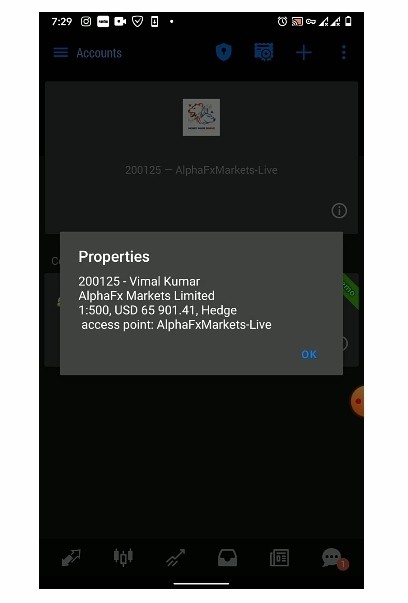

Founded in 2009, Alpha Fx is a UK-based broker that primarily focuses on forex trading. It operates under several regulatory bodies, including the FCA, but faces scrutiny due to limitations on its ability to hold client funds. The broker utilizes a proprietary trading platform rather than widely recognized platforms like MetaTrader 4 or 5. Alpha Fx offers trading in various asset classes, including 88 currency pairs, but does not support cryptocurrencies or CFDs.

Detailed Breakdown

-

Regulated Geographies/Regions:

Alpha Fx is regulated by the Financial Conduct Authority (FCA) in the UK, as well as other entities like FINTRAC and the MFSA in Malta. However, the FCA prohibits Alpha Fx from holding client money, which raises concerns about its operational integrity (source).

Deposit/Withdrawal Currencies/Cryptocurrencies:

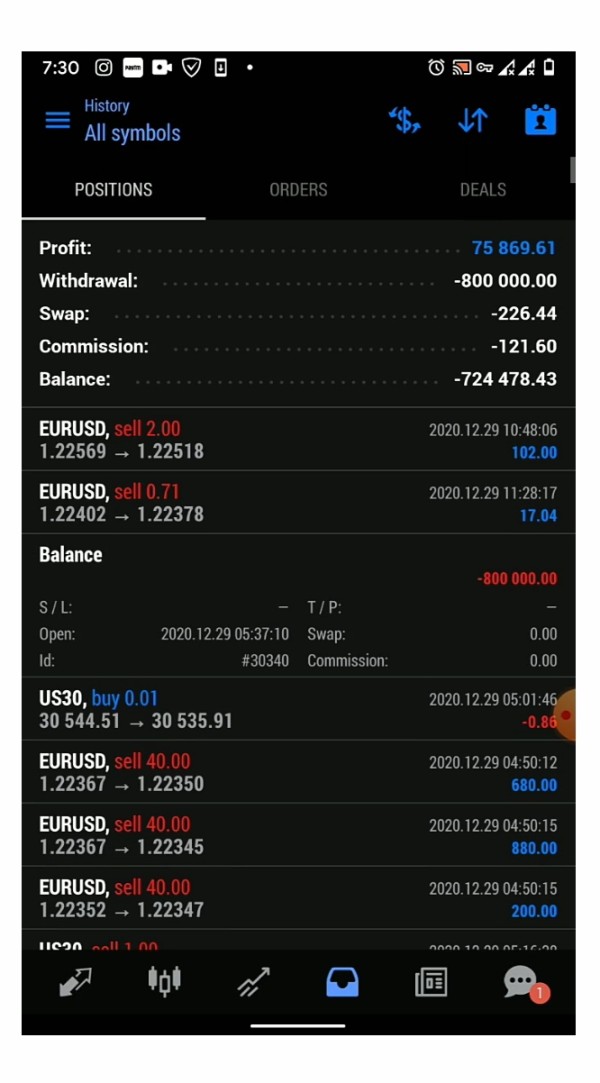

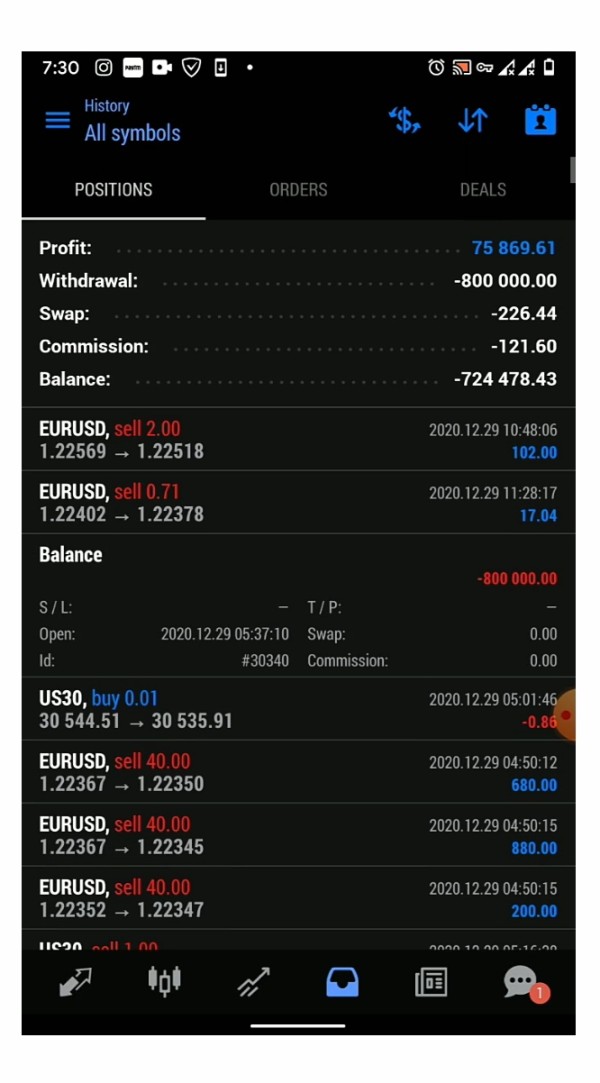

The broker supports deposits in major currencies such as GBP, USD, and EUR. However, the lack of cryptocurrency support may deter some traders. Users have reported issues with withdrawal processes, often citing delays and complications when trying to access their funds (source).

Minimum Deposit:

The minimum deposit requirement for opening an account with Alpha Fx is set at $300, which is relatively standard in the industry. However, the absence of a demo account for practice trading raises concerns for novice traders (source).

Bonuses/Promotions:

Alpha Fx does not appear to offer any significant bonuses or promotions, which is a common practice among many brokers to attract new clients. This lack of incentives may limit its appeal compared to competitors who offer promotional trading credits (source).

Tradable Asset Classes:

The broker specializes in forex trading, providing access to 88 different currency pairs. However, it does not offer trading in stocks, cryptocurrencies, or commodities, which may limit the options for traders looking to diversify their portfolios (source).

Costs (Spreads, Fees, Commissions):

Alpha Fx has been criticized for its lack of transparency regarding fees. While some sources indicate average spreads of around 1.5 pips for major currency pairs, the absence of detailed fee structures can lead to confusion among traders (source).

Leverage:

The leverage offered by Alpha Fx is not clearly stated across sources, but it is suggested to be around 1:30, which is standard for regulated brokers in the UK. This leverage cap may limit the potential for higher returns but also helps mitigate risk (source).

Allowed Trading Platforms:

Alpha Fx utilizes a proprietary trading platform, which lacks the established features and user interfaces of MetaTrader platforms. This can be a disadvantage for traders who prefer the familiar tools and functionalities offered by MT4 or MT5 (source).

Restricted Regions:

While Alpha Fx claims to serve clients globally, it is essential to note that its operations may be limited in certain jurisdictions due to regulatory restrictions. This can affect the availability of services for traders in specific countries (source).

Available Customer Service Languages:

Customer service at Alpha Fx is reportedly available in English, but user experiences indicate that support may be lacking in responsiveness and effectiveness, leading to dissatisfaction among clients (source).

Repeat Ratings Overview

Detailed Analysis

-

Account Conditions: Users have expressed concerns about the lack of transparency regarding account types and minimum deposit requirements, which can make it difficult for traders to make informed decisions (source).

Tools and Resources: The absence of a demo account and limited educational resources can hinder new traders from gaining the necessary experience before trading with real money (source).

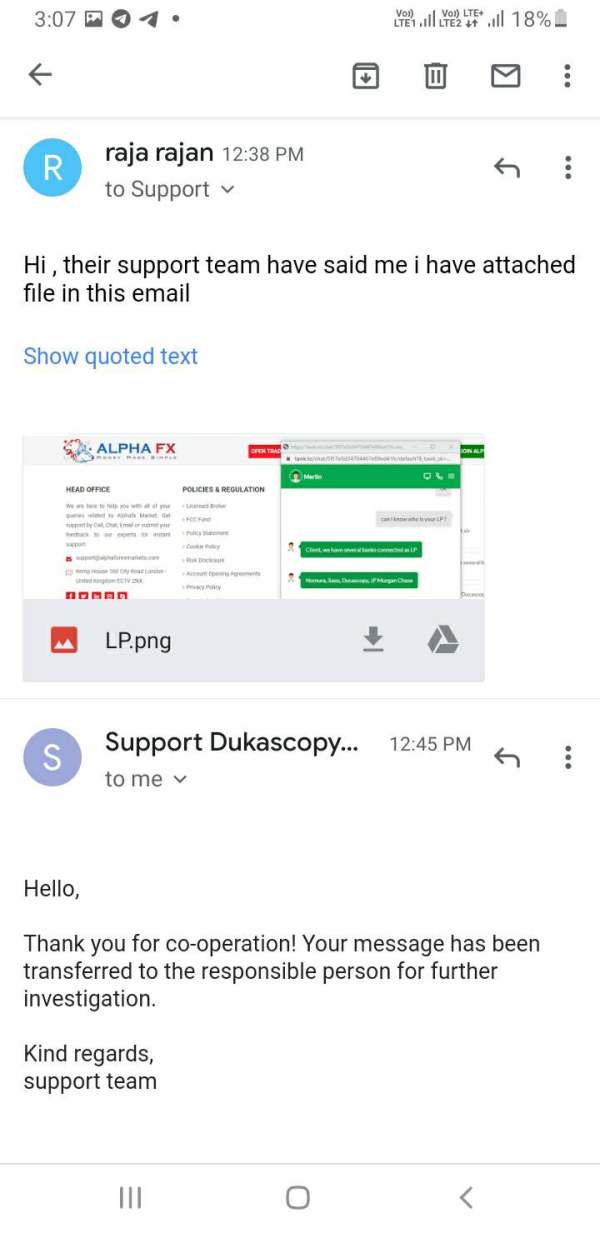

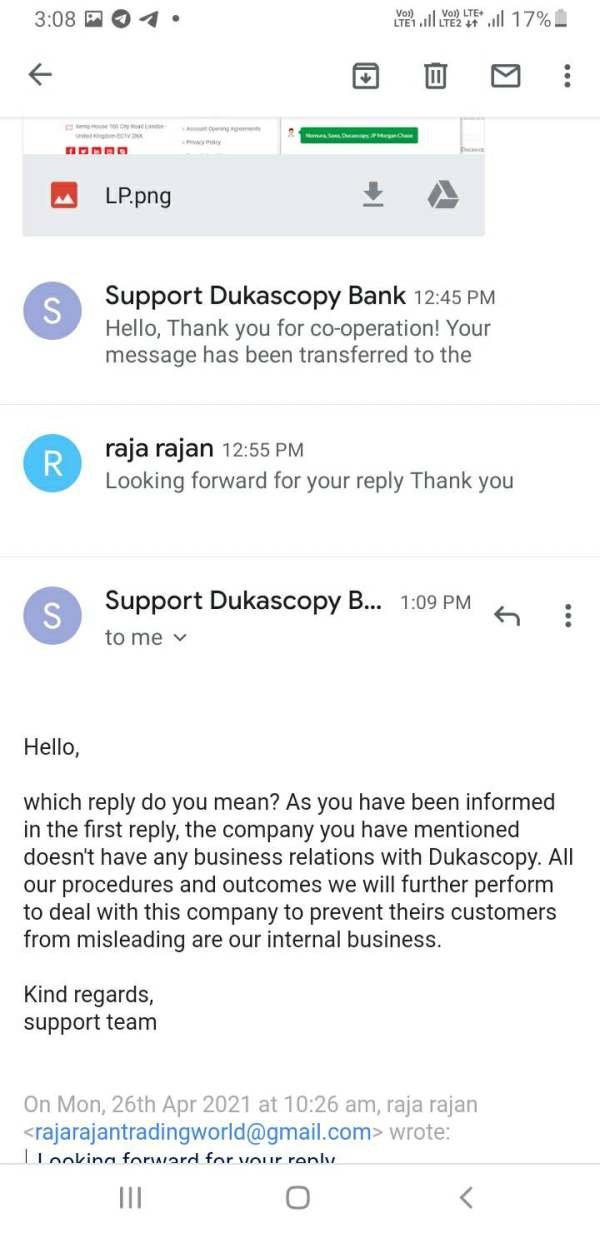

Customer Service and Support: Many users report slow response times and difficulties in resolving issues, which can be frustrating for those seeking assistance (source).

Trading Setup (Experience): The proprietary platform lacks the advanced features of established platforms like MT4 and MT5, which could limit trading capabilities for experienced users (source).

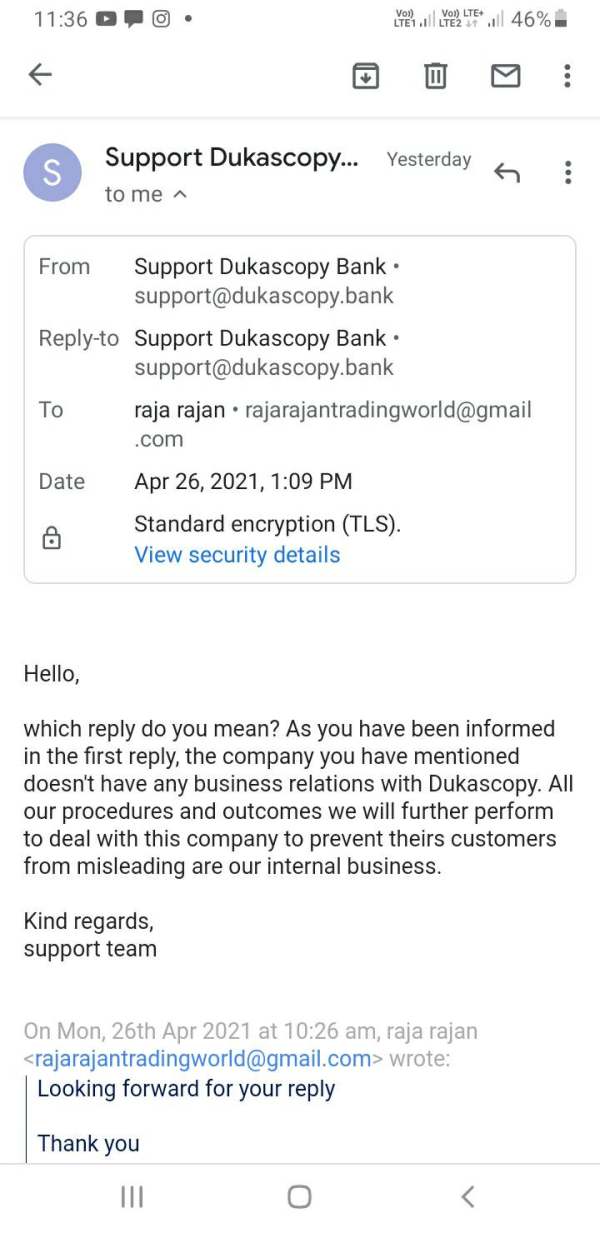

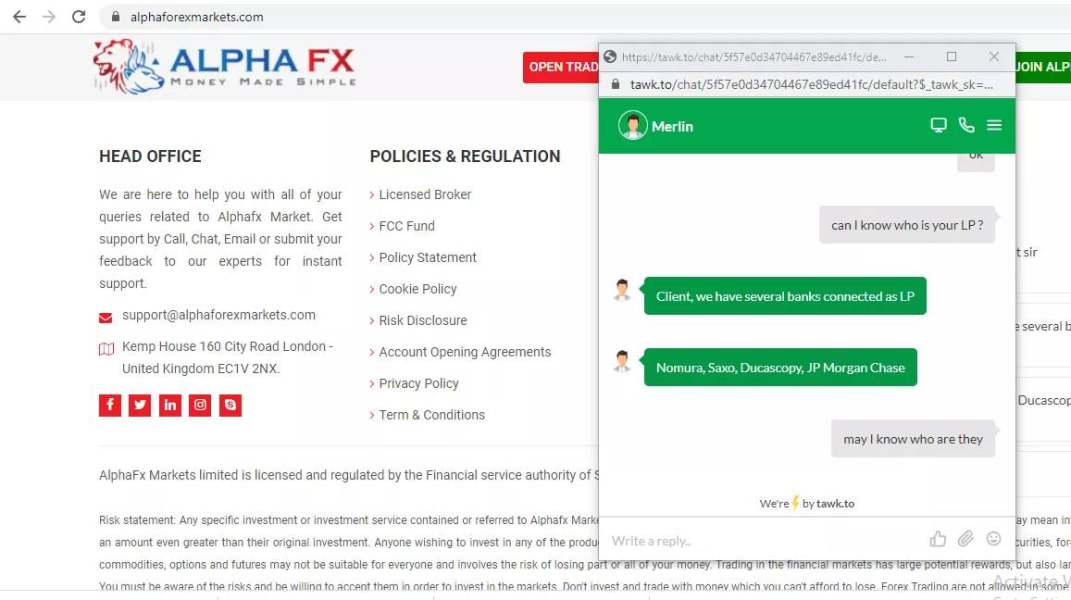

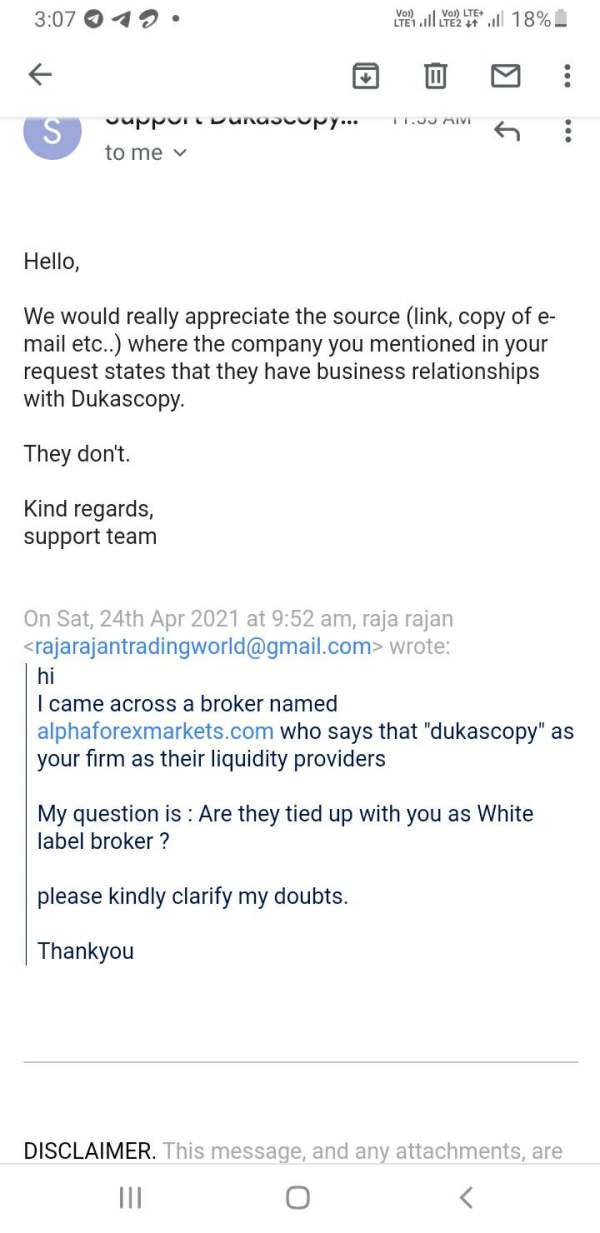

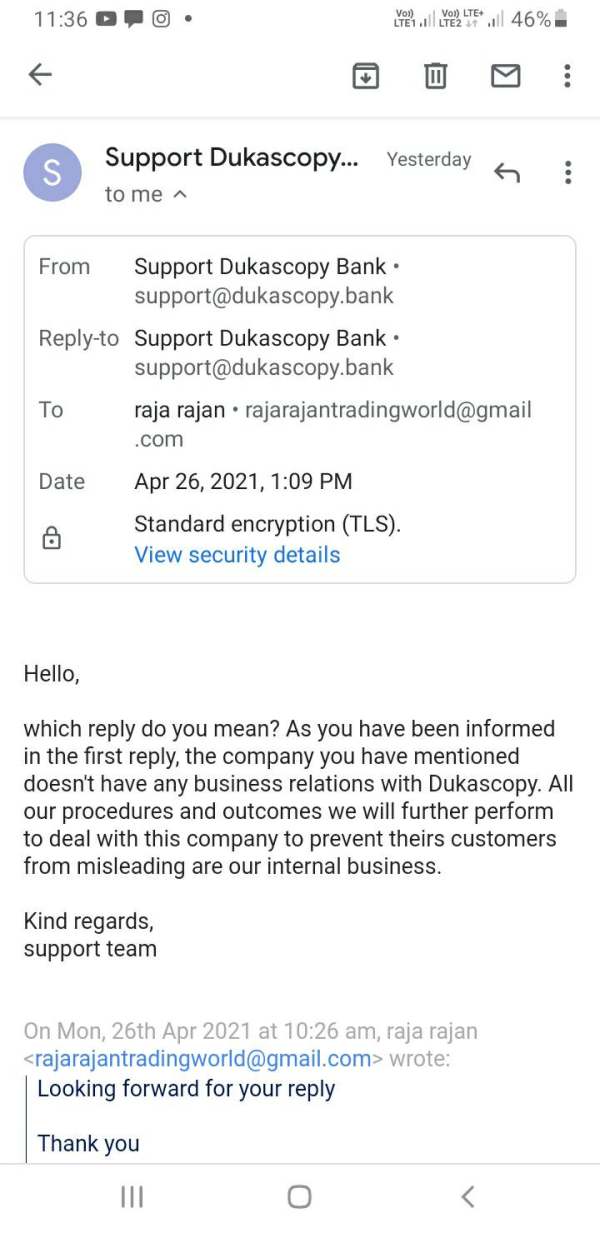

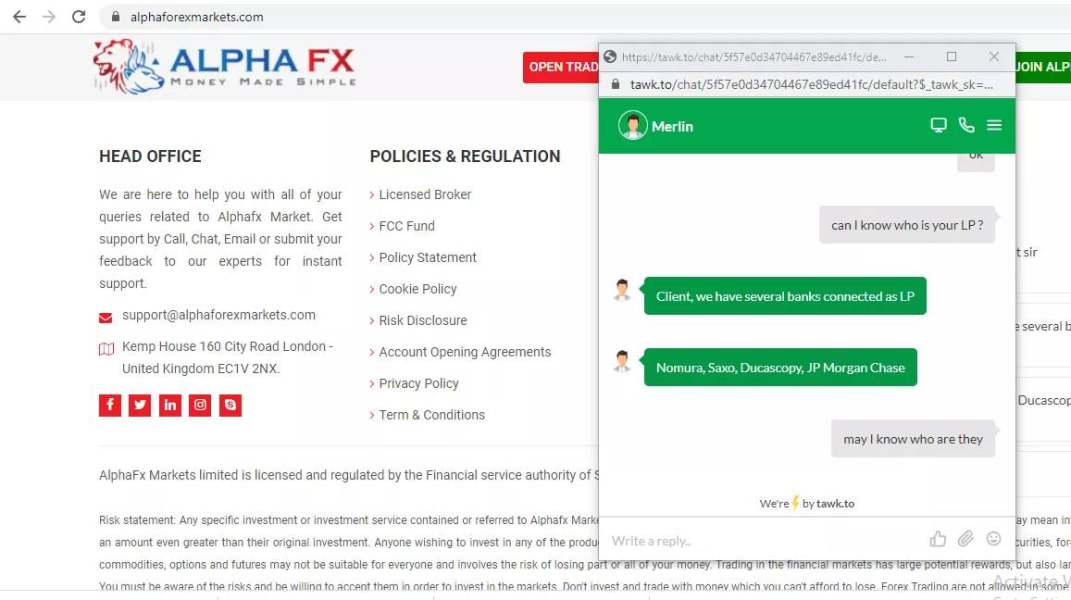

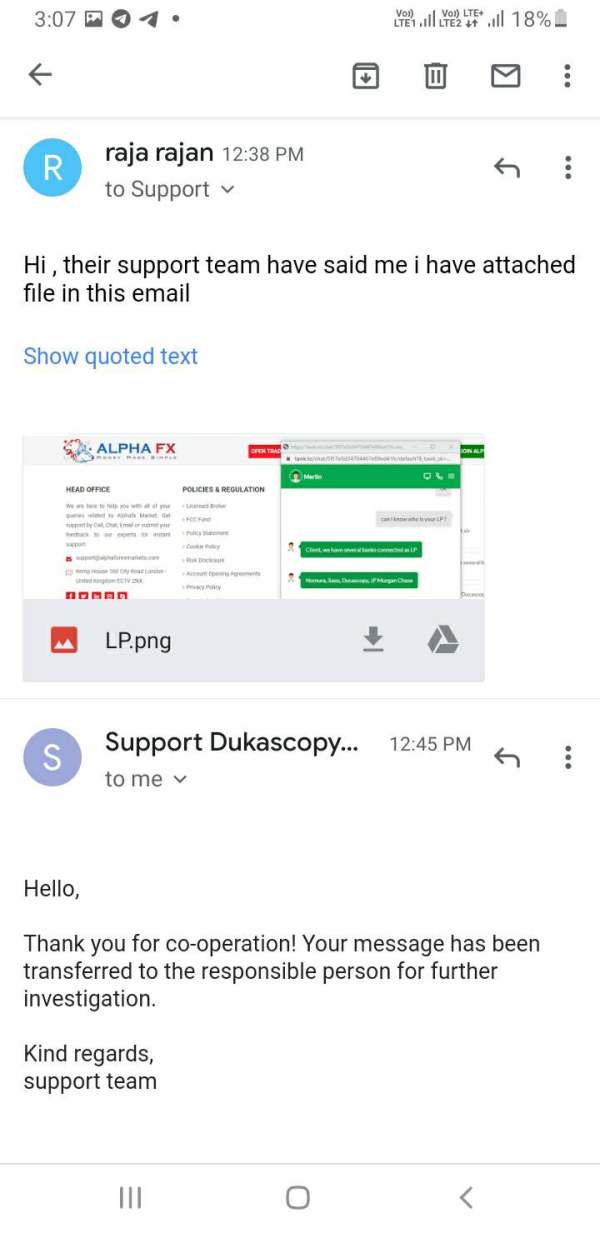

Trustworthiness: The regulatory limitations and mixed user reviews regarding withdrawal issues raise significant concerns about the broker's reliability (source).

User Experience: Overall user experiences are mixed, with some appreciating the forex trading options but many expressing concerns about transparency and customer support (source).

In conclusion, the Alpha Fx review highlights a broker that offers forex trading with several regulatory challenges and user concerns regarding transparency, customer support, and overall trustworthiness. Potential traders are advised to conduct thorough research and consider alternative brokers with clearer operational practices and better user experiences.