Is AFXTrade safe?

Business

License

Is Afxtrade A Scam?

Introduction

Afxtrade is an online forex and CFD broker that has emerged in the financial trading landscape, claiming to offer a range of trading services across various markets, including forex, commodities, indices, and cryptocurrencies. As the forex market continues to attract traders globally, it becomes crucial for potential investors to thoroughly evaluate brokers before committing their funds. Given the prevalence of scams and unregulated entities in the trading industry, traders must exercise due diligence to ensure their investments are safe. This article aims to analyze Afxtrade's legitimacy by examining its regulatory status, company background, trading conditions, and customer experiences. The assessment is based on a comprehensive review of various online sources, including regulatory warnings, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining a broker's reliability. Afxtrade has been flagged by the UK's Financial Conduct Authority (FCA) for operating without proper authorization, which raises significant concerns about its legitimacy. The absence of regulation from a recognized authority means that Afxtrade does not adhere to the stringent standards that protect traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Blacklisted |

| SVG FSA | N/A | St. Vincent and the Grenadines | Unregulated |

The FCA's warning indicates that Afxtrade is not only unregulated but also potentially involved in fraudulent activities. Operating from offshore jurisdictions such as St. Vincent and the Grenadines, known for their lax regulatory frameworks, further compounds the risk. Without oversight from a reputable regulator, traders' funds are at significant risk, as there are no guarantees for fund safety or recourse in the event of disputes or malpractices.

Company Background Investigation

Afxtrade presents itself as a broker based in the UK, yet it is registered in offshore territories, raising questions about its transparency. The company's ownership structure is unclear, and there is a lack of detailed information regarding its management team. This obscurity is a red flag, as reputable brokers typically provide comprehensive information about their leadership and operational practices.

The absence of a verifiable history further complicates the assessment of Afxtrade. While some sources suggest that it was founded in 2021, the lack of detailed operational history and management experience indicates a potential lack of credibility. Investors should be wary of brokers with such opaque backgrounds, as they often lack the necessary infrastructure to support their trading services.

Trading Conditions Analysis

When evaluating a broker, understanding their trading conditions is essential. Afxtrade claims to offer competitive spreads and leverage options; however, many reviews indicate that its trading costs are not favorable compared to industry standards.

| Cost Type | Afxtrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Afxtrade are significantly higher than the industry average, which can erode potential profits for traders. Additionally, the lack of clarity regarding commissions and overnight interest raises concerns about hidden costs that could impact trading outcomes. Such unfavorable trading conditions are often indicative of a broker's intent to maximize their profits at the expense of their clients.

Client Fund Safety

The safety of client funds is paramount in the trading industry. Afxtrade's lack of regulation means that there are no mandated measures in place to protect traders' deposits. The absence of segregated accounts and investor protection schemes significantly heightens the risk of fund misappropriation.

Historically, many brokers operating without regulation have faced allegations of fraud, including withholding withdrawals and misusing client funds. Given Afxtrade's unregulated status, traders should be particularly cautious about depositing large sums of money, as there is little recourse if the broker fails to honor withdrawal requests or engages in dishonest practices.

Customer Experience and Complaints

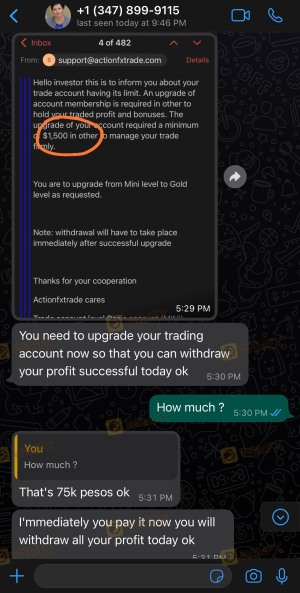

Customer feedback is a vital aspect of assessing a broker's reliability. Afxtrade has received numerous negative reviews from users, with common complaints including difficulties in withdrawing funds, high fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Poor |

| Customer Support | High | Poor |

Many traders report being unable to withdraw their funds, often citing excessive fees or delays in processing requests. These issues, coupled with the company's lack of transparency and accountability, paint a concerning picture of Afxtrade's operations. In some cases, users have had to escalate their disputes to regulatory bodies or seek legal action to recover their funds.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Afxtrade claims to offer popular platforms such as MetaTrader 4 and 5; however, many reviews suggest that the versions provided may not be fully functional or tailored to the broker's operations.

Concerns about order execution quality, including slippage and rejected orders, have also been raised. Such issues can severely impact trading performance, leading to unexpected losses. The potential for platform manipulation further exacerbates the risks associated with trading through Afxtrade, as traders may not receive fair execution of their trades.

Risk Assessment

Using Afxtrade poses several risks that potential investors should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Safety Risk | High | Lack of investor protection and segregated accounts. |

| Trading Cost Risk | Medium | Higher spreads and unclear fee structures can erode profits. |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should thoroughly research any broker before investing. Additionally, opting for well-regulated brokers with transparent practices and positive customer feedback can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the analysis of Afxtrade raises significant concerns regarding its legitimacy and safety. The lack of regulation, unclear company background, unfavorable trading conditions, and numerous customer complaints suggest that Afxtrade may not be a trustworthy broker.

Traders should be particularly cautious when considering Afxtrade, as the absence of regulatory oversight and historical issues with fund safety indicate a higher risk of encountering fraudulent practices. For those seeking a reliable trading experience, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of positive customer experiences.

In summary, Afxtrade is not safe and presents several red flags that warrant serious consideration before engaging with them.

Is AFXTrade a scam, or is it legit?

The latest exposure and evaluation content of AFXTrade brokers.

AFXTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AFXTrade latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.