Winson 2025 Review: Everything You Need to Know

Executive Summary

This Winson review looks at a trading company that has gotten attention in different financial areas. Information about its forex trading services stays limited in public sources. Based on data from multiple sources, Winson seems to work in different ways across various markets, including what looks like custom financial services that focus on personal client experiences.

The analysis shows that Winson has built a presence in certain trading circles. Details about its forex trading operations, regulatory status, and specific trading conditions are not well documented in mainstream financial databases. This creates both opportunities and challenges for potential clients who want detailed information about their trading services.

Our investigation suggests that Winson may serve a niche market segment. The company potentially focuses on clients who value personal service and custom trading solutions. However, the lack of public information raises important questions for traders who want transparency when choosing their broker.

Important Notice

Regional Entity Variations: Winson may operate different entities across various jurisdictions, each potentially offering distinct services and operating under different regulatory frameworks. The availability and quality of services may vary significantly between regions.

Review Methodology: This evaluation is based on publicly available information, user feedback where accessible, and industry analysis. Due to limited comprehensive data about Winson's forex trading operations, some aspects of this review rely on indirect indicators and comparative analysis with industry standards.

Rating Framework

Broker Overview

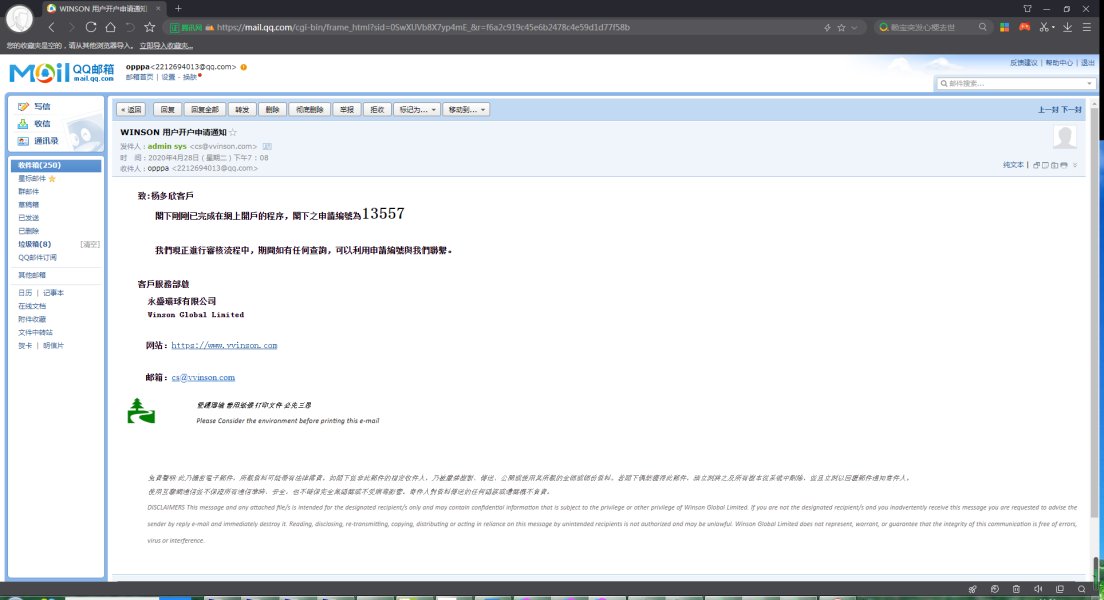

Winson operates as a financial services entity. Specific details about when it was established and its company background are not easy to find in public financial databases. The organization seems to keep a low profile when it comes to marketing and public disclosure, which is typical of certain boutique financial service providers that focus on specialized client segments rather than mass market appeal.

The company's business model seems to emphasize personal service delivery. The specific structure of their forex trading operations remains unclear from available sources. This approach suggests a potential focus on high-touch client relationships rather than the high-volume, technology-driven models common among major retail forex brokers.

From available information, Winson does not seem to operate on the mainstream retail forex trading platforms commonly used by major industry players. The absence of detailed platform specifications and asset class information in public sources indicates either a very specialized operation or limited retail forex trading services. Regulatory oversight details are not documented in accessible regulatory databases, which raises important considerations for potential clients regarding compliance and investor protection measures.

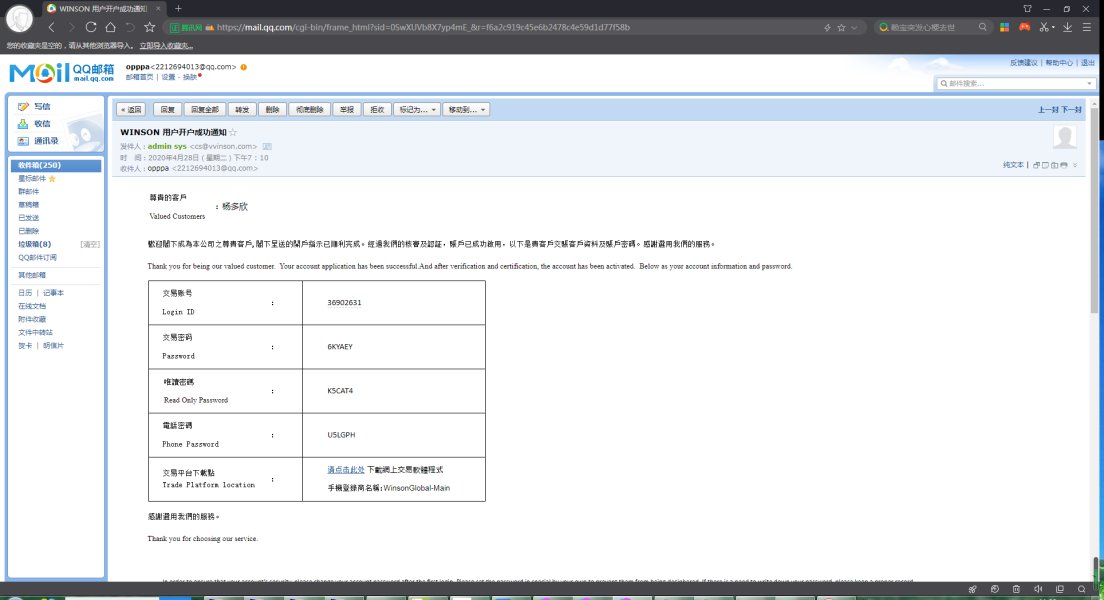

Regulatory Jurisdictions: Specific regulatory information is not documented in available public sources. This makes it difficult to verify compliance with major financial regulatory bodies.

Deposit and Withdrawal Methods: Payment processing options and procedures are not detailed in accessible documentation.

Minimum Deposit Requirements: Entry-level investment requirements are not specified in available materials.

Bonuses and Promotions: No promotional offers or bonus structures are documented in public sources.

Tradeable Assets: The range of available financial instruments for trading is not outlined in accessible information.

Cost Structure: Detailed fee schedules, spreads, and commission structures are not publicly available. This makes cost comparison difficult.

Leverage Ratios: Maximum leverage offerings are not specified in available documentation.

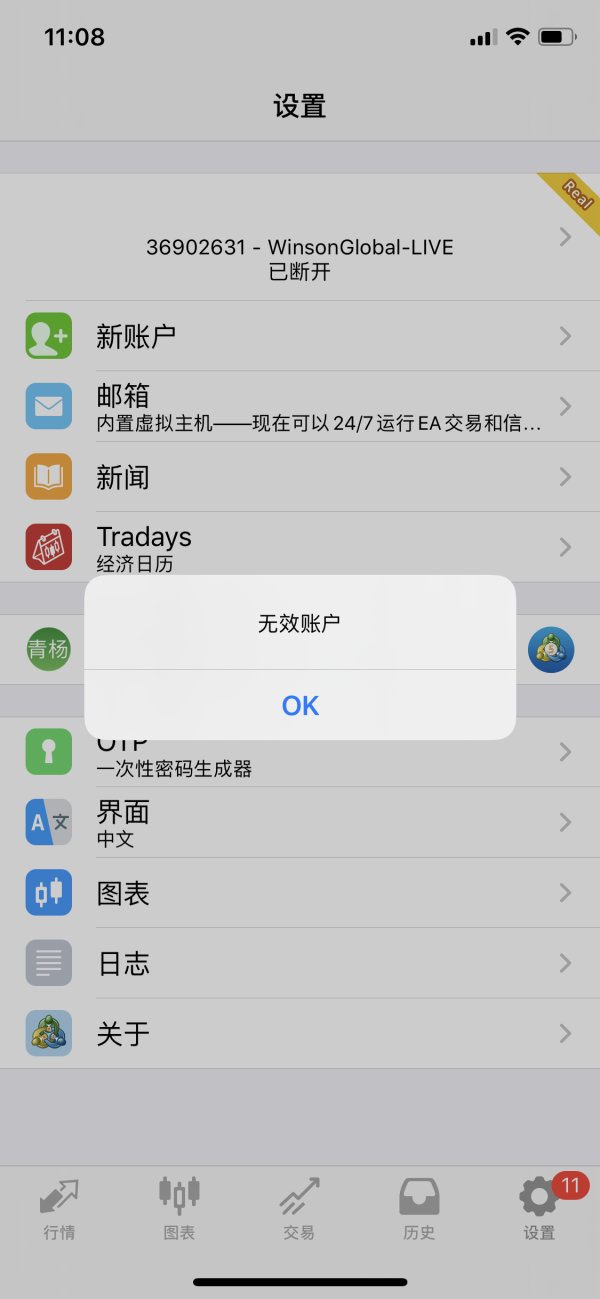

Platform Options: Trading platform specifications and technology infrastructure details are not documented.

Regional Restrictions: Geographic limitations on service availability are not clearly outlined.

Customer Support Languages: Multi-language support capabilities are not specified in available sources.

This Winson review highlights the significant information gaps that exist regarding the broker's standard operating procedures and service offerings.

Account Conditions Analysis

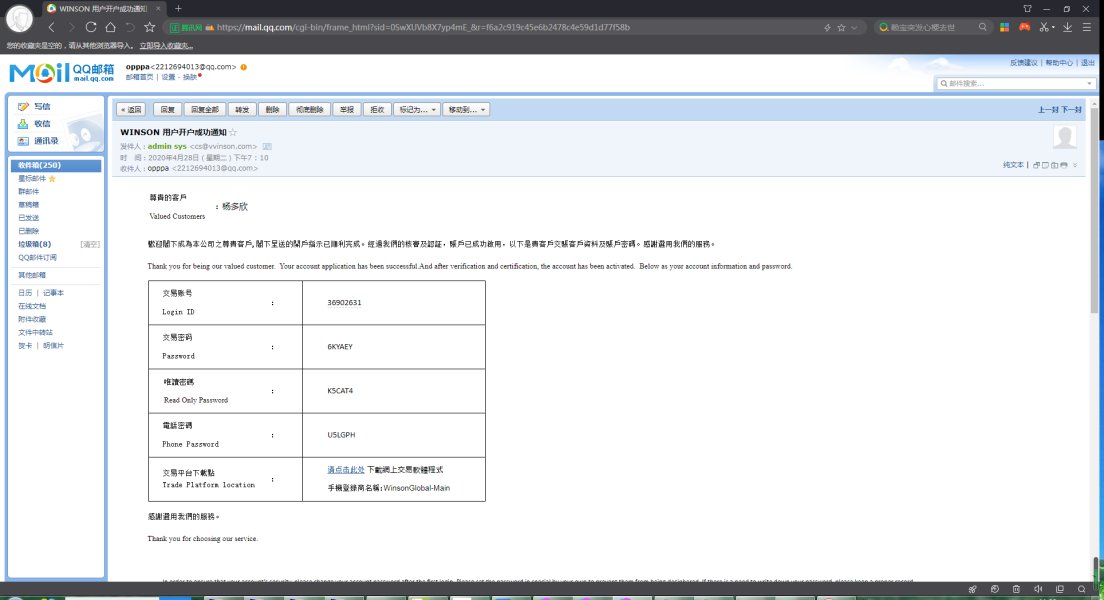

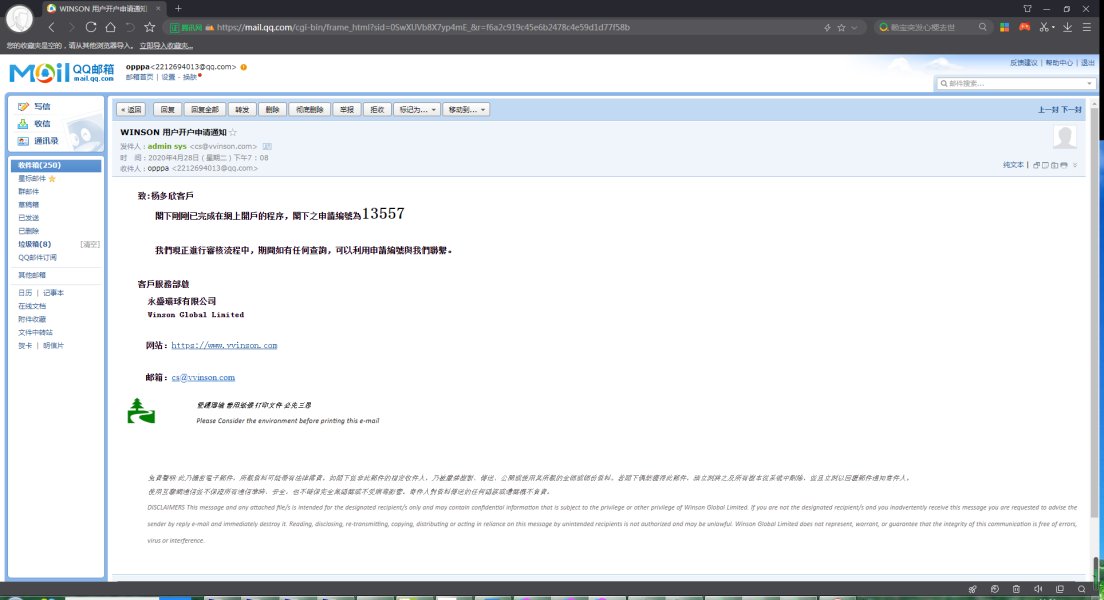

The evaluation of Winson's account conditions proves challenging due to limited information about their account structures and requirements. Unlike major retail forex brokers that typically offer detailed specifications about account types, minimum deposits, and trading conditions, Winson's account offerings are not well documented in public sources.

This lack of transparency regarding account conditions may indicate either a highly personal approach to client onboarding, where terms are negotiated individually, or a limited retail forex trading operation. For potential clients, this presents both opportunities and challenges. On one hand, personal account structures might offer more flexibility for specific trading needs. On the other hand, the absence of standardized, publicly available terms makes it difficult to compare offerings with industry competitors.

The account opening process, verification requirements, and special account features such as Islamic accounts or professional trading accounts are not detailed in accessible sources. This information gap is particularly significant for traders who require specific account features to meet their trading strategies or religious requirements.

For this Winson review, the lack of detailed account condition information represents a significant limitation in providing guidance to potential clients.

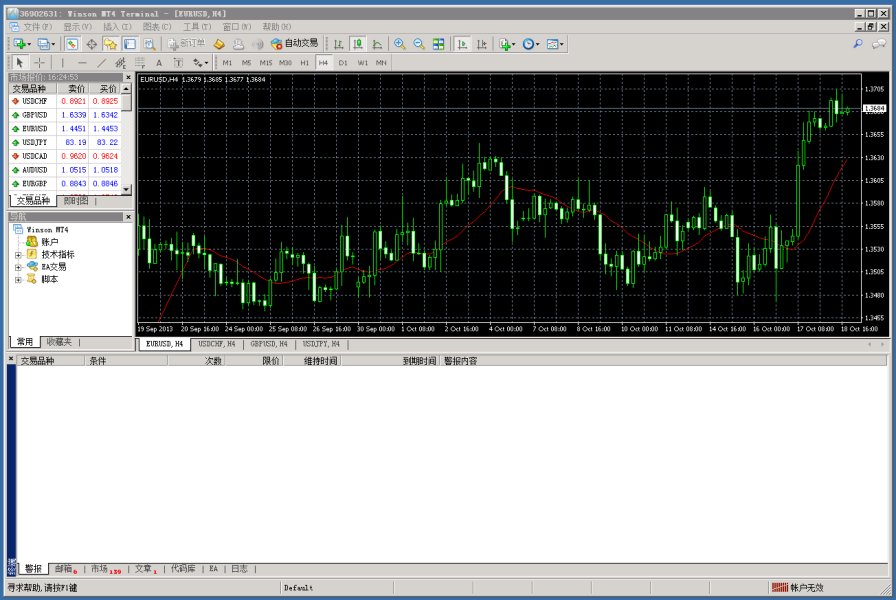

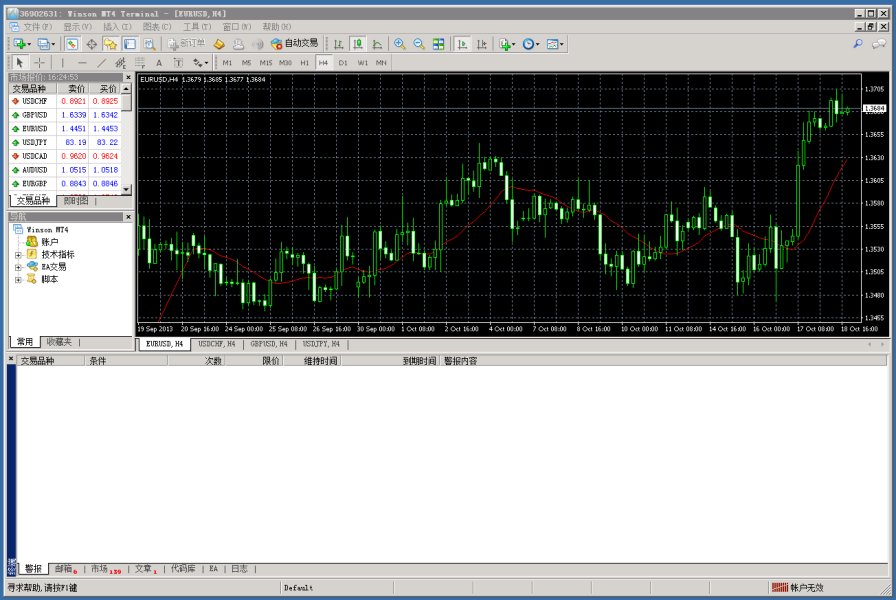

The assessment of Winson's trading tools and resources reveals a notable absence of detailed information about their technology offerings and analytical capabilities. Unlike established forex brokers that typically provide suites of trading tools, market analysis resources, and educational materials, Winson's tool portfolio is not well documented in accessible sources.

This information gap makes it challenging to evaluate the quality and breadth of trading instruments available to clients. Modern forex trading typically requires access to advanced charting tools, technical indicators, economic calendars, and real-time market data. The absence of detailed information about such tools raises questions about how complete Winson's trading infrastructure is.

Educational resources, which are increasingly important for trader development and retention, are not documented in available sources. This includes the absence of information about webinars, trading guides, market analysis reports, or educational partnerships that many brokers use to support client success.

Automated trading support, including Expert Advisor compatibility and API access, is not detailed in accessible documentation. For traders who rely on algorithmic trading strategies, this information gap represents a significant consideration in broker selection.

Customer Service and Support Analysis

Based on limited available feedback, Winson appears to maintain a focus on customer service quality. Documentation of their support infrastructure is not readily available. The few references to customer service suggest a commitment to client satisfaction, though the scope and availability of support services require further clarification.

The channels available for customer support, including phone, email, live chat, or ticket systems, are not detailed in public sources. Response time commitments and service level agreements are similarly undocumented, making it difficult to set appropriate expectations for support interactions.

Multi-language support capabilities, which are crucial for international trading operations, are not specified in available information. This represents a potential limitation for non-English speaking clients who require native language support for complex trading inquiries.

Support availability hours and global coverage are not detailed, which is particularly important for forex trading that operates across multiple time zones. The absence of this information makes it challenging for potential clients to assess whether support will be available during their preferred trading hours.

Trading Experience Analysis

The evaluation of Winson's trading experience proves particularly challenging due to limited information about their trading platform infrastructure and execution capabilities. Platform stability and execution speed, which are fundamental to successful forex trading, are not documented in accessible sources.

Order execution quality, including information about slippage rates, requote frequency, and fill rates, is not available for analysis. These factors are crucial for traders, particularly those using scalping or high-frequency trading strategies where execution quality directly impacts profitability.

Platform functionality, including the availability of advanced order types, risk management tools, and market depth information, is not detailed in public documentation. Modern forex traders typically require sophisticated platform capabilities to implement complex trading strategies effectively.

Mobile trading capabilities, which have become essential for active traders who need market access while away from their primary trading stations, are not documented. The absence of mobile platform information represents a significant gap in understanding the complete trading experience offered by Winson.

This Winson review identifies the trading experience as an area requiring significant additional disclosure for evaluation.

Trust and Regulation Analysis

The assessment of Winson's trustworthiness and regulatory compliance reveals significant information gaps that are crucial for trader confidence and security. Regulatory licensing and oversight details are not documented in major financial regulatory databases, which raises important questions about compliance frameworks and investor protection measures.

Fund security measures, including segregated account policies, deposit insurance, and third-party custodial arrangements, are not detailed in available sources. These protections are fundamental to trader confidence and are typically highlighted by reputable brokers as key safety features.

Company transparency, including detailed disclosure of ownership structure, financial statements, and operational procedures, is limited in public sources. This lack of transparency contrasts with the extensive disclosure practices of major regulated brokers and may concern traders who prioritize operational transparency.

Industry reputation and standing within professional trading communities are difficult to assess due to limited presence in mainstream financial industry discussions and regulatory announcements. The absence of significant industry recognition or awards makes it challenging to gauge peer recognition and professional standing.

User Experience Analysis

The evaluation of overall user experience with Winson is limited by the scarcity of user feedback and detailed documentation about client interaction processes. The available information suggests some positive experiences in specialized contexts, though the breadth and depth of user satisfaction data are insufficient for analysis.

Interface design and platform usability, which significantly impact daily trading operations, are not documented in available sources. Modern traders expect intuitive, responsive interfaces that facilitate efficient trade execution and portfolio management.

Registration and verification processes, including know-your-customer requirements and account approval timelines, are not detailed in accessible documentation. These processes significantly impact the initial user experience and set expectations for ongoing client relationships.

Fund operation experiences, including deposit and withdrawal processing times, acceptable payment methods, and any associated fees, are not documented. These operational aspects directly impact user satisfaction and trading convenience.

Conclusion

This Winson review reveals a trading entity that operates with limited public disclosure about its forex trading services and operational procedures. While some positive feedback exists regarding customer service quality in specialized contexts, the overall lack of detailed information about trading conditions, regulatory compliance, and platform capabilities presents significant challenges for potential clients seeking broker evaluation.

Winson may be suitable for traders who prioritize personal service and are comfortable with limited public disclosure about operational procedures. However, traders seeking transparency in regulatory compliance, detailed trading conditions, and platform documentation may find the available information insufficient for informed decision-making.

The primary advantages appear to center around potential personal service delivery, while the main disadvantages include limited transparency regarding regulatory oversight, trading conditions, and platform capabilities. Potential clients should conduct thorough due diligence and direct communication with Winson to obtain the detailed information necessary for informed broker selection.