Fxcc Markets Ltd 2025 Review: Everything You Need to Know

Fxcc Markets Ltd has garnered varied opinions from users and experts alike, making it a subject of interest in the forex trading community. Overall, it is seen as a low-cost broker with a commission-free trading model and competitive spreads. However, concerns about its limited educational resources and the absence of a web trading platform have been noted. Additionally, the regulatory landscape is complex, with different entities operating in various jurisdictions, which can impact the trading experience.

Note: It is essential to understand that Fxcc operates through multiple entities across different regions, which can lead to varying trading conditions and regulations. This distinction is crucial for traders considering their options with this broker.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Founded in 2010, Fxcc Markets Ltd operates as a forex and CFD broker, primarily regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker offers a single trading platform, MetaTrader 4 (MT4), which is widely recognized in the industry for its reliability and advanced features. Traders can access a variety of asset classes, including forex, commodities, indices, and cryptocurrencies. However, there is a notable absence of stock trading options, which may be a drawback for some investors.

Detailed Analysis

Regulatory Regions

Fxcc is primarily regulated by CySEC and operates under the Vanuatu Financial Services Commission (VFSC). While CySEC provides a robust regulatory framework, the VFSC is considered less stringent. This dual regulation allows Fxcc to cater to a broader audience, but traders should be mindful of the implications of trading under different jurisdictions.

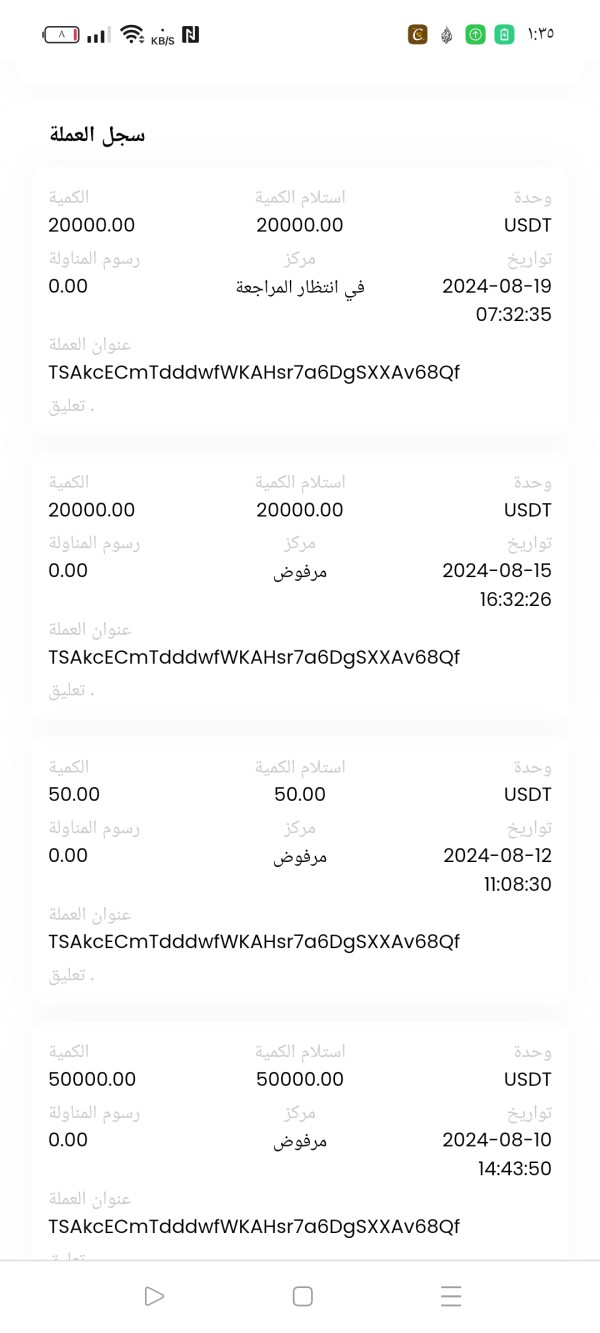

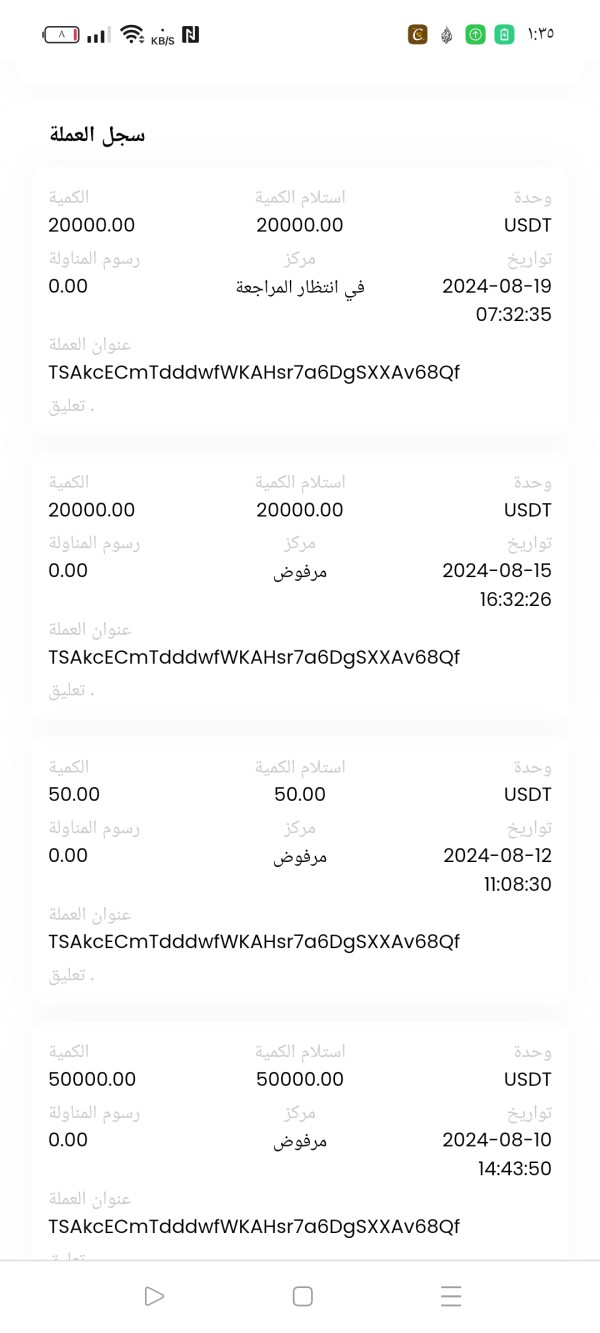

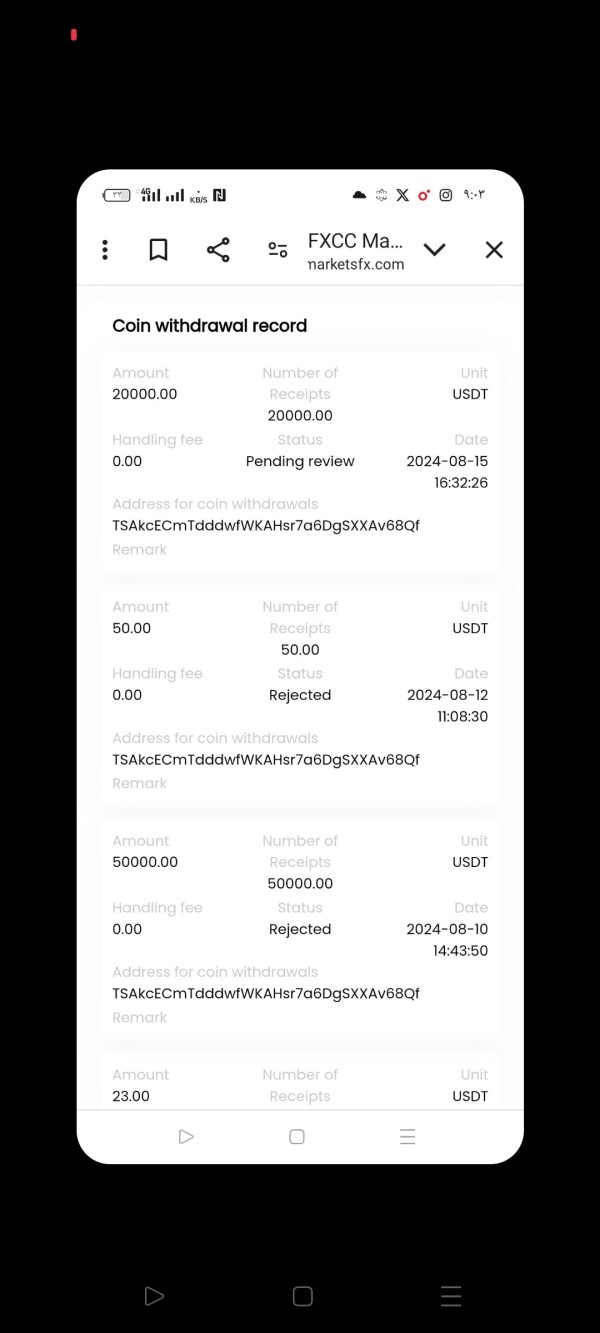

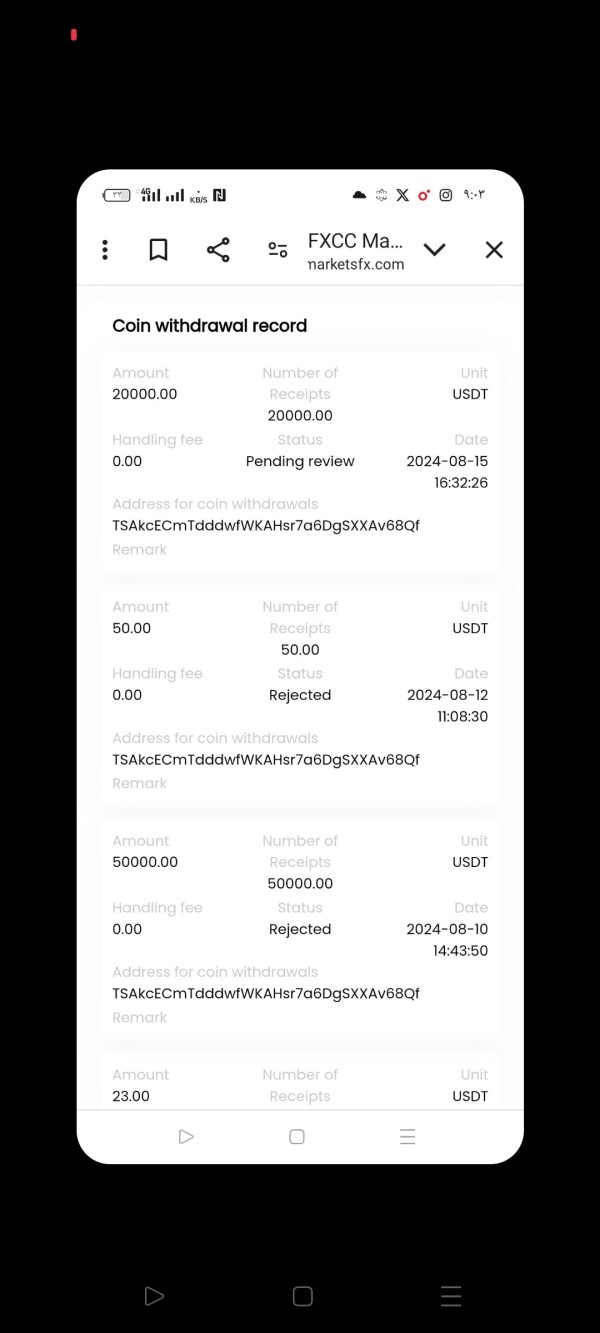

Deposit/Withdrawal Methods

Fxcc supports multiple currencies for deposits and withdrawals, including USD, EUR, and GBP. Traders can utilize various payment methods, such as credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller. Notably, there are no deposit fees, which is a significant advantage. However, withdrawal fees may apply depending on the payment provider, and the minimum withdrawal amount is set at $50.

Minimum Deposit

There is no minimum deposit requirement for opening an account with Fxcc, making it accessible for traders of all experience levels. This feature is particularly appealing to beginners who want to start trading without a substantial upfront investment.

Fxcc offers a 100% first deposit bonus for new traders, which can significantly enhance initial trading capital. However, the availability of bonuses may vary depending on the regulatory entity, with some regions not offering these promotions due to local regulations.

Tradable Asset Classes

Fxcc provides a diverse range of trading instruments, including major, minor, and exotic currency pairs, as well as commodities, indices, and cryptocurrencies. However, the lack of stock trading options may limit the appeal for those seeking a more comprehensive investment portfolio.

Costs (Spreads, Fees, Commissions)

The broker operates on a spread-only model, with spreads starting as low as 0.0 pips for major currency pairs. This competitive pricing structure is a significant draw for high-frequency traders. However, traders should be aware of potential rollover fees for overnight positions, which can add to the overall trading costs.

Leverage

Fxcc offers leverage up to 1:500, providing traders with the ability to amplify their trading positions. However, this high leverage comes with increased risk, and traders should exercise caution and implement proper risk management strategies.

The primary trading platform offered by Fxcc is MT4, which is compatible with desktop and mobile devices. While MT4 is a popular choice among traders, the absence of MT5 or other platforms may deter those looking for more advanced trading tools and features.

Restricted Areas

Fxcc does not accept clients from the United States, which may limit its accessibility for some traders. This restriction is common among many brokers due to regulatory considerations.

Available Customer Support Languages

Fxcc provides customer support in multiple languages, including English, Spanish, Portuguese, Italian, and German. This multilingual support is beneficial for traders from diverse backgrounds.

Repeat Ratings Overview

Detailed Breakdown

-

Account Conditions: Fxcc offers a single ECN XL account with no minimum deposit and competitive spreads, making it suitable for various trading strategies. However, the lack of multiple account types may not cater to all traders' needs.

Tools and Resources: The educational resources provided by Fxcc are relatively limited, lacking in-depth training materials that could benefit novice traders. While there are some basic articles and guides, more advanced educational tools are needed.

Customer Service and Support: Customer support is available 24/5 through various channels, including live chat and email. While generally responsive, the absence of 24/7 support may be a drawback for some traders.

Trading Setup (Experience): The trading experience is enhanced by the use of MT4, which is well-regarded for its functionality. The absence of a web-based platform may be a limitation for those who prefer trading without downloading software.

Trustworthiness: Fxcc is regulated by CySEC and VFSC, providing a level of security for traders. However, the presence of multiple entities operating under different regulations may create confusion regarding the safety of funds.

User Experience: Overall, user experience is rated moderately, with many traders appreciating the competitive spreads and commission-free trading. However, the limited educational resources and support may affect the experience for less experienced traders.

Bonus and Promotions: The 100% first deposit bonus is an attractive feature, but its availability may vary based on the trader's location, which could limit its appeal.

In conclusion, the Fxcc Markets Ltd review reveals a broker that offers competitive trading conditions, particularly for forex and CFD trading. However, potential clients should carefully consider the regulatory landscape, available resources, and their individual trading needs before engaging with this broker.