Vestle 2025 Review: Everything You Need to Know

Summary

This Vestle review looks at a forex and CFD broker that started in 2011 under CySEC rules. Vestle is the new name for iFOREX Europe, which is run by iCFD Ltd, and it has a rating of ★★☆☆☆, which means users are not happy with it. The broker lets you trade forex, indices, commodities, shares, ETFs, and cryptocurrencies using FXnet and mobile apps.

Vestle follows CySEC rules in Cyprus and offers many trading tools, but users are not satisfied with the service. The broker mainly works with traders in the European Economic Area and offers CFD trading in many markets. The low rating shows that Vestle needs to improve customer service, trading conditions, and user experience. Reports show that users have problems with different parts of the broker's services, which explains the poor rating.

Important Disclaimer

Regional Entity Differences: Vestle is the new name for iFOREX Europe and focuses on clients in the European Economic Area. Different countries have different rules, so traders from different places might get different terms and conditions. The services that Vestle offers might be different from other iFOREX companies in other countries.

Review Methodology: This review uses user feedback, regulatory information, and market data to give you a complete picture. We look at account conditions, trading tools, customer support, and user experience to give you a fair view of what Vestle offers.

Rating Framework

Broker Overview

Company Background and Establishment

Vestle started in 2011 and is the new name for iFOREX Europe, with offices in Limassol, Cyprus. The company works as a forex and CFD broker under iCFD Ltd and mainly serves traders in the European Economic Area. Vestle's business focuses on giving access to financial markets through contracts for difference, which let clients trade on price changes without owning the actual assets.

The change from iFOREX Europe to Vestle shows the company wants to create a new identity in the European market while keeping its main operations and rules. The broker targets European traders who want access to global financial markets through a Cyprus-based, regulated company.

Trading Infrastructure and Asset Coverage

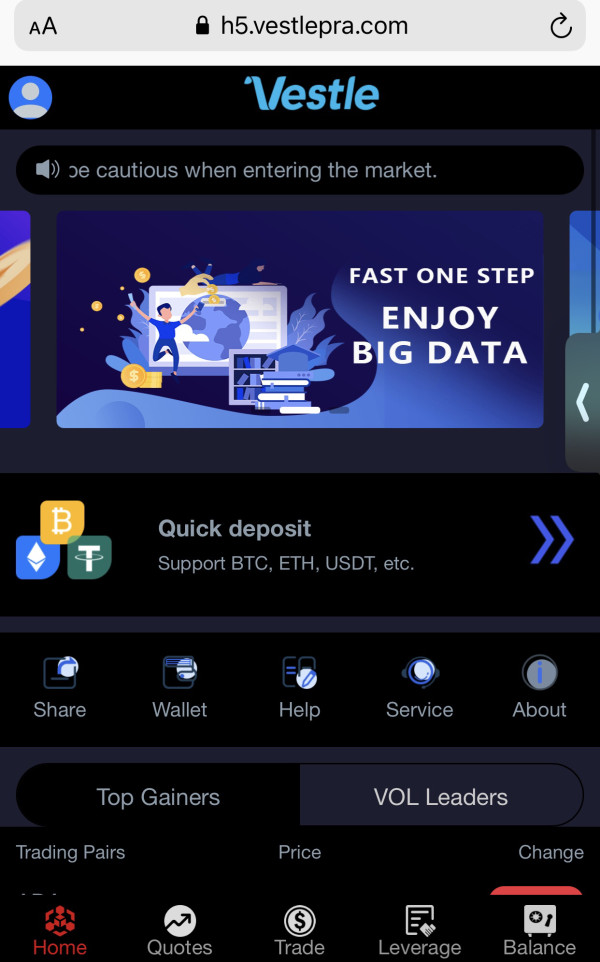

Vestle offers trading through multiple platforms, including FXnet and mobile forex apps. The broker gives access to many asset classes like forex pairs, CFDs on indices, commodities, stocks, ETFs, and cryptocurrencies. This wide selection aims to meet the different trading needs of European Economic Area clients.

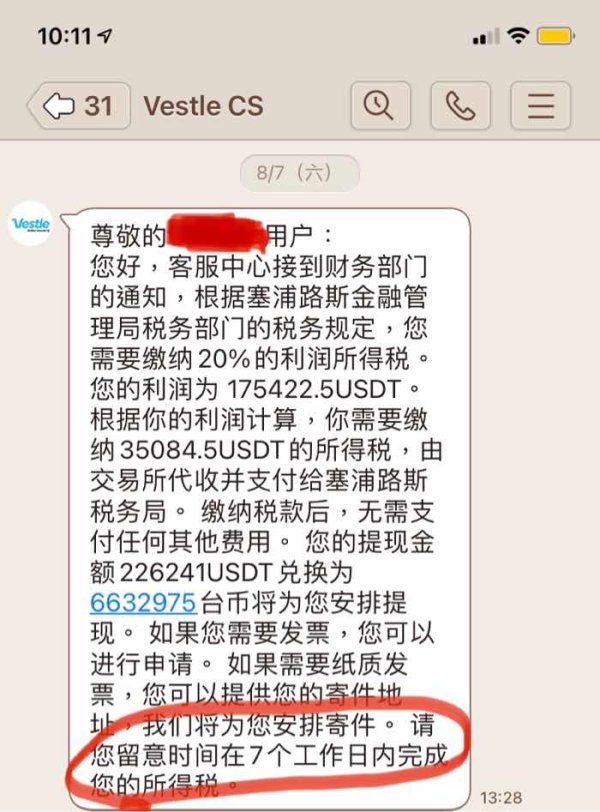

The company follows CySEC rules, which provide oversight and make sure it follows European financial regulations. This framework offers some protections for EEA traders, though specific details about compensation and investor protection are not clearly explained in available sources.

Regulatory Framework: Vestle follows Cyprus Securities and Exchange Commission rules, making sure it meets European Union financial regulations and MiFID II rules for EEA traders.

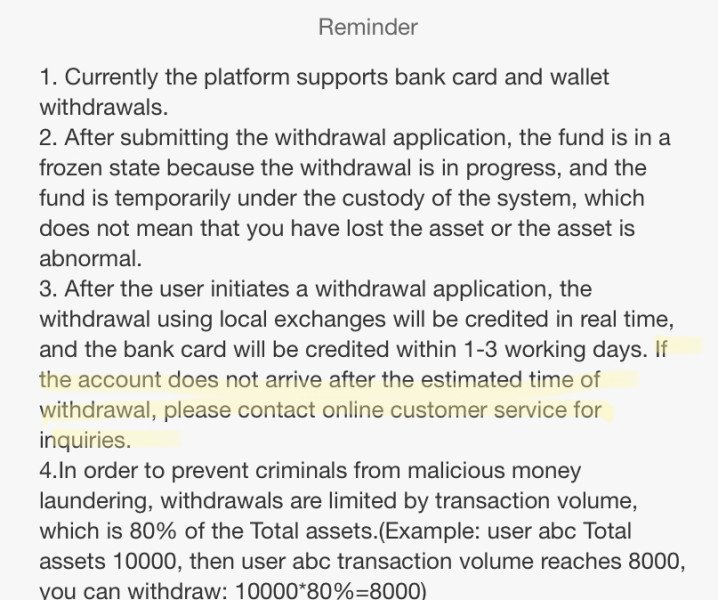

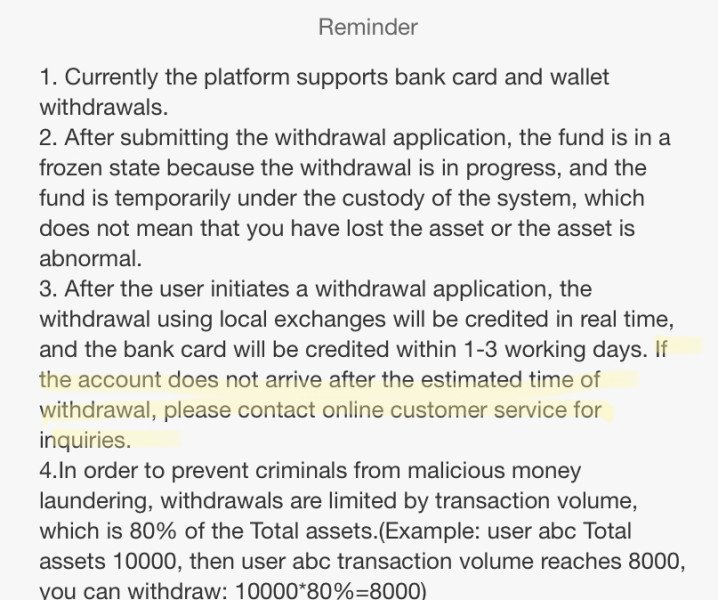

Deposit and Withdrawal Methods: Available sources don't give specific information about deposit and withdrawal options, so potential clients need to contact the broker directly for complete payment details.

Minimum Deposit Requirements: Sources don't specify the minimum deposit needed to open trading accounts with Vestle, so this information must be obtained directly from the broker.

Promotional Offers: No specific information about bonus promotions or special offers is mentioned in available sources, so any current promotional activities would need direct inquiry with the broker.

Tradeable Assets: Vestle provides access to foreign exchange pairs, CFDs on stock indices, commodities, individual company shares, ETFs, and cryptocurrency instruments for diverse trading strategies.

Cost Structure: Detailed information about spreads, commissions, overnight costs, and other trading fees is not specified in available sources, so traders must get this important information directly from Vestle.

Leverage Ratios: Specific leverage ratios offered by Vestle are not detailed in available sources, though as a CySEC-regulated broker, leverage would follow ESMA restrictions for retail clients.

Platform Options: Vestle offers the FXnet trading platform and mobile trading apps, giving traders both desktop and mobile access to financial markets.

Geographic Restrictions: The broker mainly serves traders in the European Economic Area, though specific restrictions for other regions are not detailed in available sources.

Customer Support Languages: Information about supported languages for customer service is not specified in available sources.

This Vestle review shows that while the broker offers regulated trading services, many important details about trading conditions need direct communication with the company for complete information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions that Vestle offers have several problems based on available information. While the broker follows CySEC rules, specific details about account types, features, and benefits are not clearly documented in available sources. This lack of clear information about account structures makes it hard for potential traders to make good decisions about which account type might work best for their trading needs.

The missing information about minimum deposit requirements makes the evaluation process even harder. Most good brokers provide clear information about their account levels, minimum funding needs, and the specific features available at each level. The limited availability of such basic information in this Vestle review suggests possible problems with the broker's communication and transparency practices.

Also, without clear details about commission structures, spread types, or special account features like Islamic accounts for Muslim traders, it becomes hard to judge how competitive Vestle's account offerings are. The 2.0-star user rating shows that existing clients have expressed major dissatisfaction, which may partly relate to unclear or unfavorable account conditions. Compared to other established brokers in the market, Vestle's lack of readily available account information represents a major disadvantage for potential clients seeking transparent trading conditions.

Vestle shows reasonable ability in terms of trading tools and available resources, offering CFD trading across multiple asset classes including forex, indices, commodities, shares, ETFs, and cryptocurrencies. The variety of available instruments gives traders opportunities to diversify their portfolios and explore different market sectors, which represents a positive aspect of the broker's offerings.

The provision of both FXnet trading platform and mobile trading apps shows that Vestle recognizes the importance of multi-platform accessibility in today's trading environment. However, specific details about the quality, functionality, and advanced features of these platforms are not extensively documented in available sources, making it difficult to assess their competitiveness against industry-standard platforms.

The absence of detailed information about research and analysis resources, educational materials, or advanced trading tools like automated trading support represents a significant gap in the evaluation. Most modern brokers provide comprehensive educational resources, market analysis, economic calendars, and sophisticated charting tools to support trader decision-making. Without clear evidence of such resources, Vestle appears to lag behind more comprehensive broker offerings. User feedback has not provided specific insights into the quality or effectiveness of available tools, though the overall low rating suggests that the current tool set may not meet trader expectations adequately.

Customer Service and Support Analysis

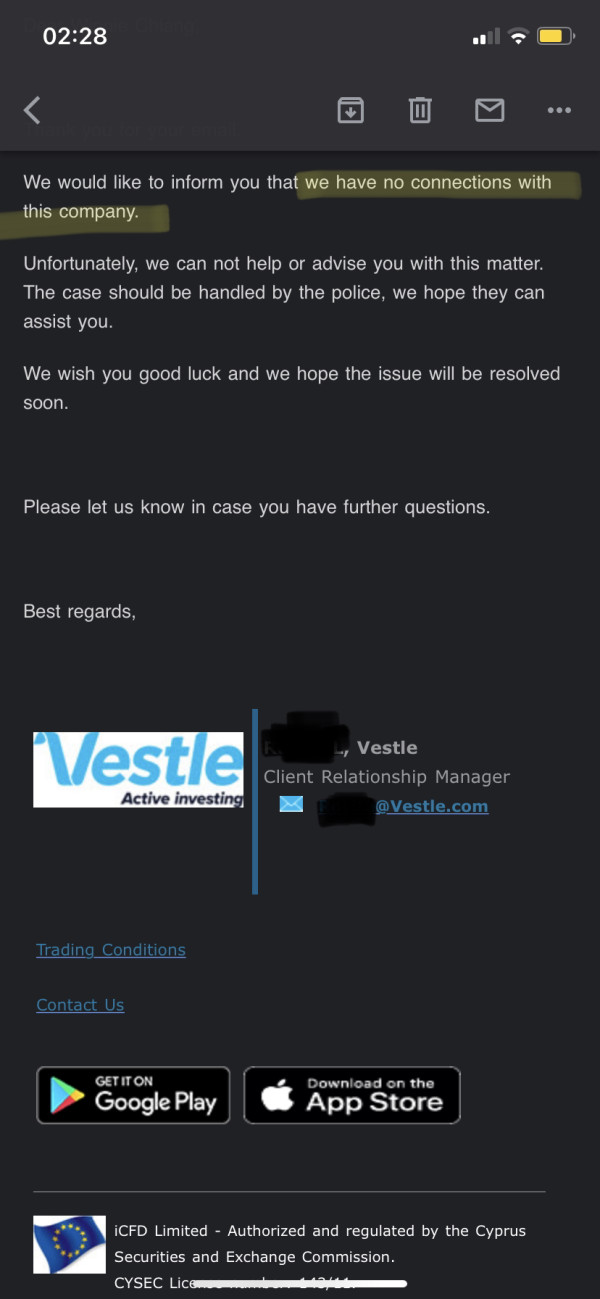

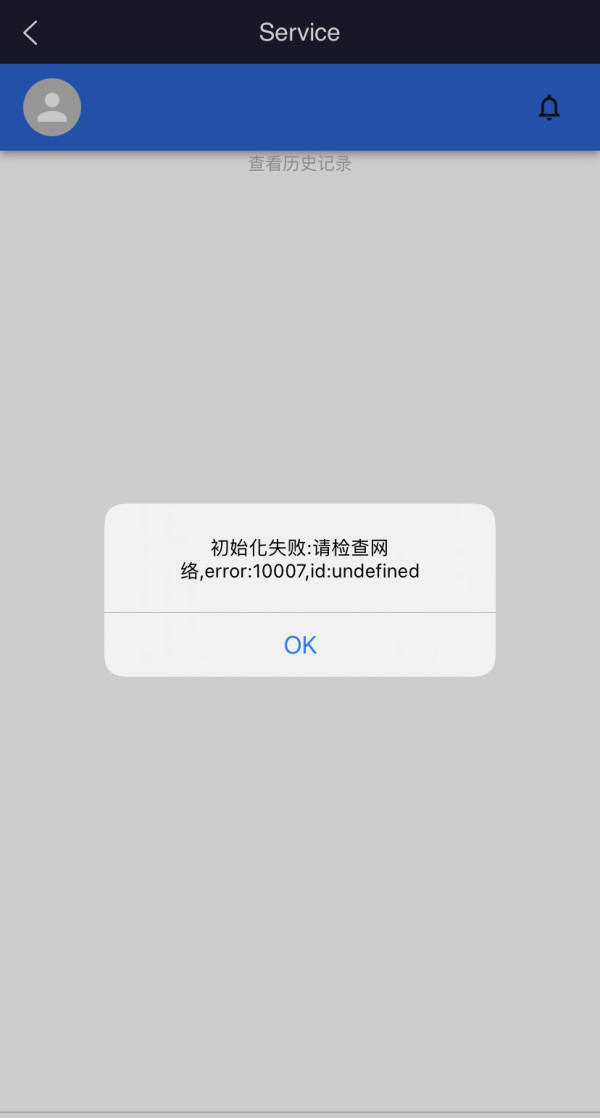

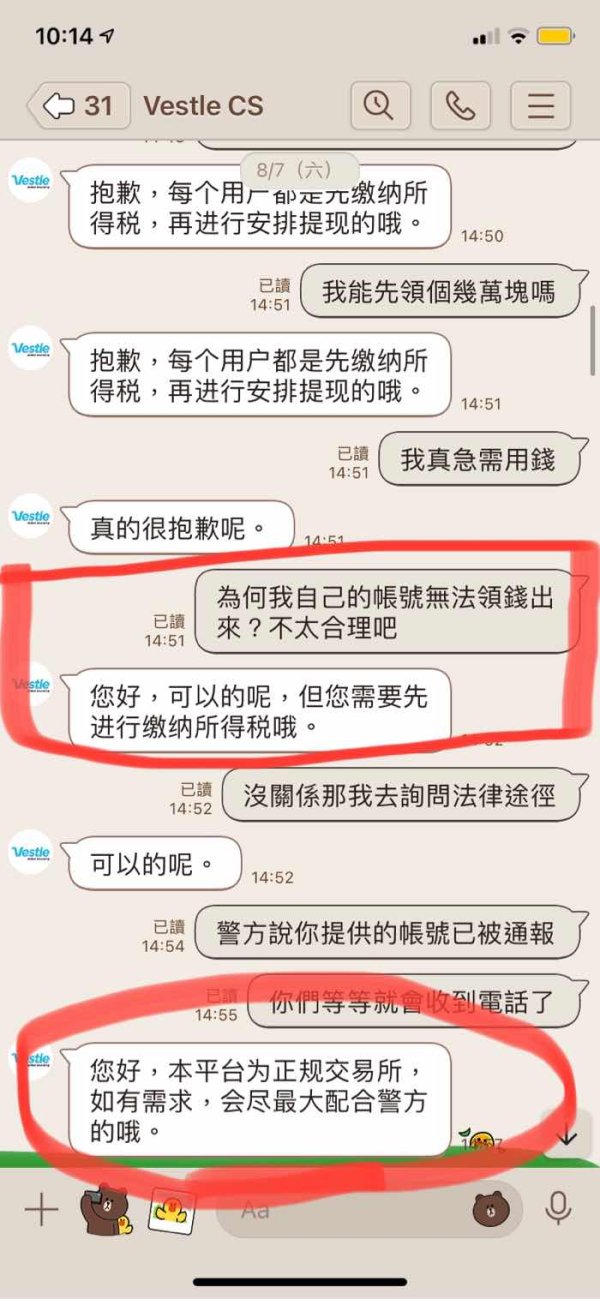

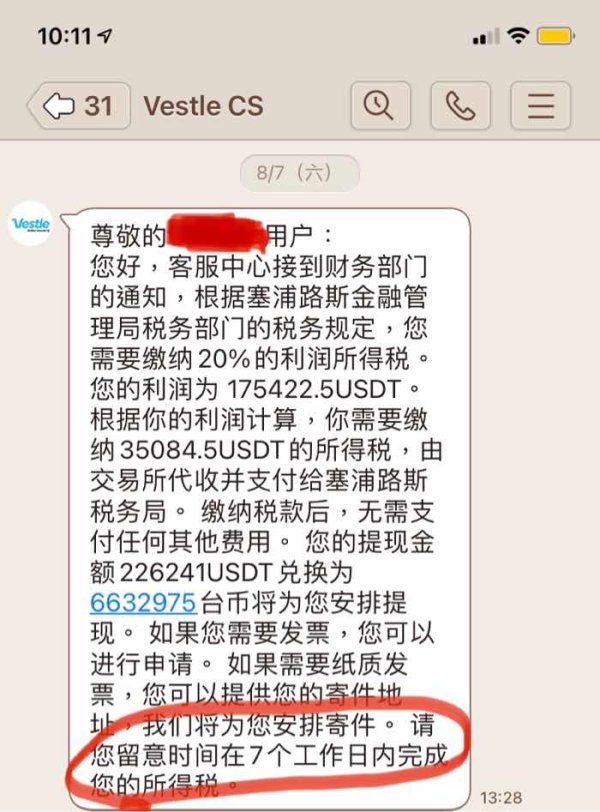

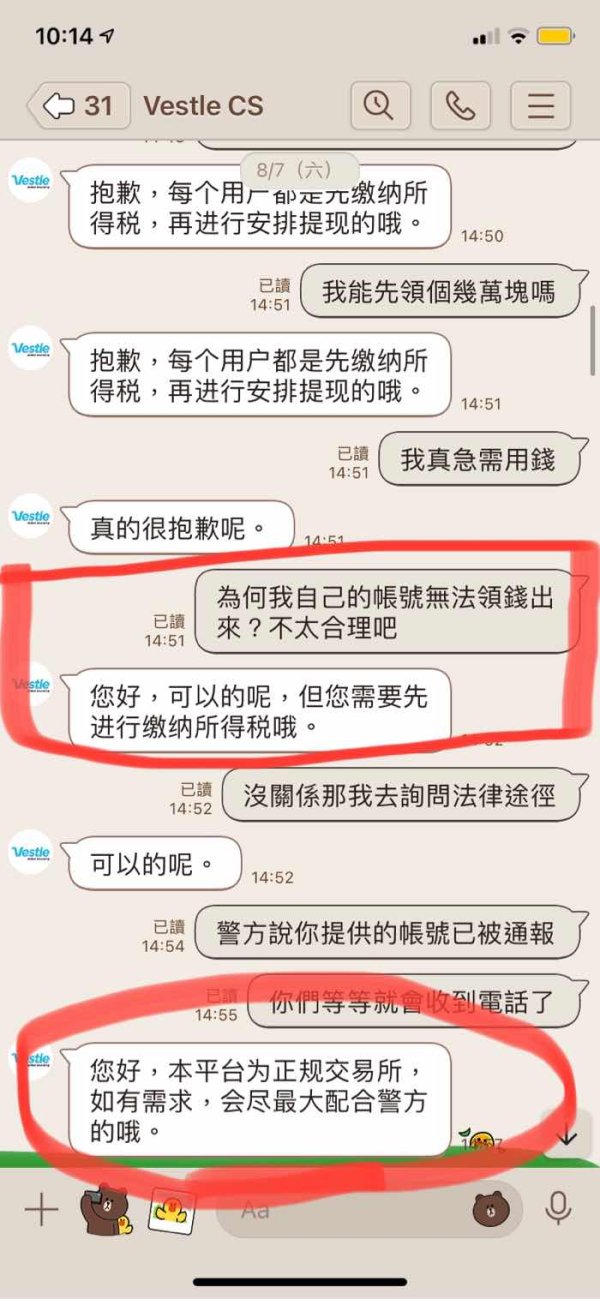

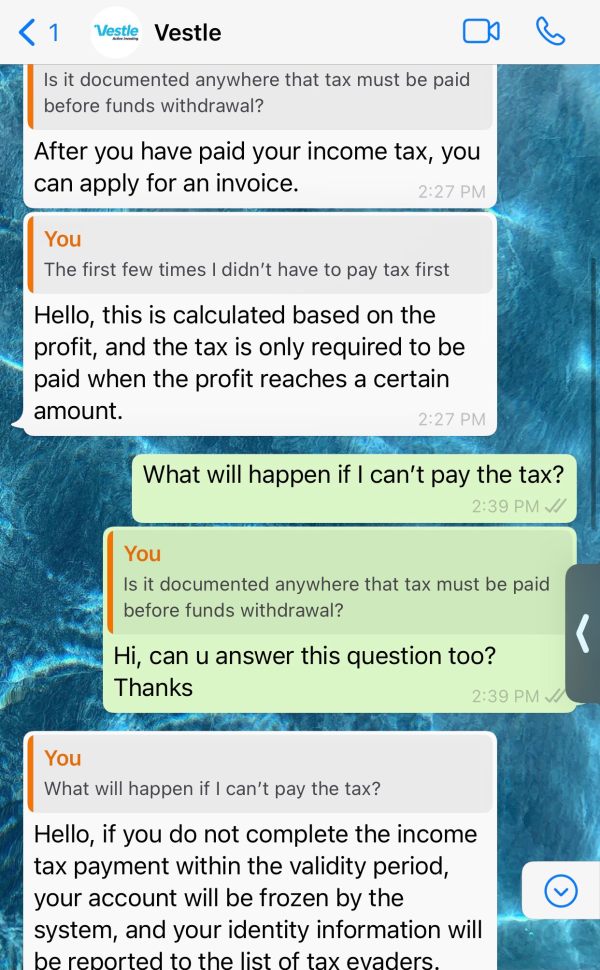

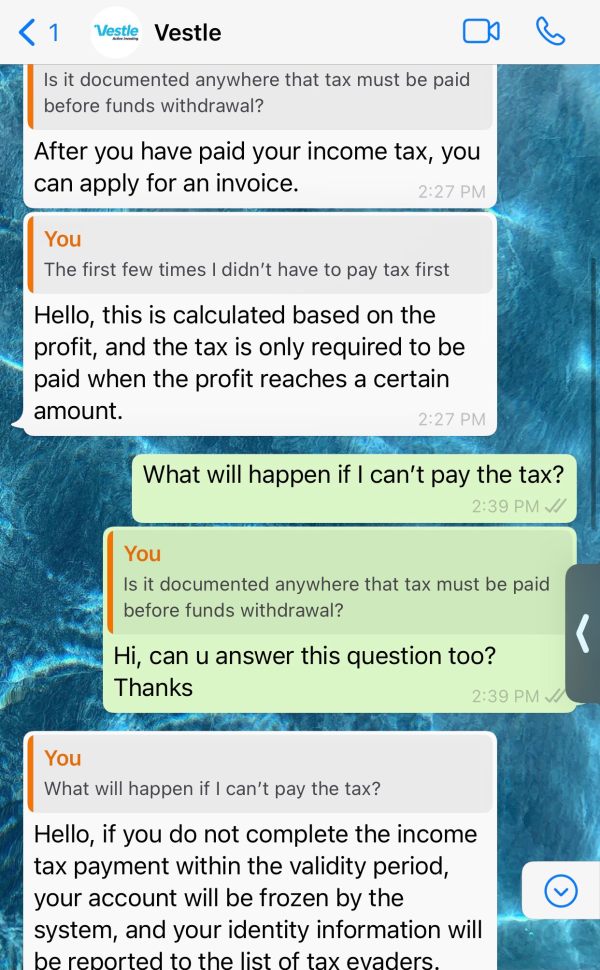

Customer service represents a critical area where Vestle faces major challenges, as shown by the overall 2.0-star user rating. While specific details about customer service channels, response times, and service quality are not extensively documented in available sources, the low overall rating suggests that users have experienced difficulties with support services.

The lack of detailed information about available customer service channels, including whether the broker offers live chat, phone support, email assistance, or comprehensive FAQ sections, raises concerns about accessibility and responsiveness. Modern forex brokers typically provide multiple contact methods and ensure reasonable response times, particularly for urgent trading-related inquiries.

Furthermore, information about multilingual support capabilities, which is particularly important for a broker serving the diverse European Economic Area market, is not specified in available sources. The absence of clear information about customer service hours, whether support is available during major trading sessions, and the qualifications of support staff represents additional areas of concern.

The consistently low user ratings suggest that existing clients have encountered difficulties with problem resolution, communication quality, or overall service responsiveness. For a financial services provider where trust and reliable support are paramount, these indicators suggest significant room for improvement in customer service delivery and support infrastructure.

Trading Experience Analysis

The trading experience that Vestle offers appears to face substantial challenges, as reflected in the consistently low user ratings and limited positive feedback available in public sources. Platform stability, execution speed, and overall trading environment quality are fundamental factors that significantly impact trader satisfaction, and the 2.0-star rating suggests deficiencies in these critical areas.

While Vestle offers both FXnet and mobile trading platforms, specific information about platform performance, order execution quality, slippage rates, and system reliability during high-volatility periods is not detailed in available sources. The absence of performance metrics or user testimonials praising platform functionality raises concerns about the overall trading environment quality.

Order execution quality, including fill rates, execution speed, and price accuracy, represents another area where detailed information is lacking. Professional traders require reliable execution, particularly during fast-moving market conditions, and any deficiencies in this area could significantly impact trading results and user satisfaction.

The mobile trading experience, which has become increasingly important for modern traders, also lacks detailed evaluation in available sources. Without specific information about mobile platform functionality, features, and user interface quality, it becomes difficult to assess whether Vestle meets contemporary mobile trading standards. This Vestle review indicates that the broker's trading experience requires substantial improvement to meet modern trader expectations and industry standards.

Trust and Safety Analysis

Vestle's trust and safety profile presents a mixed picture, with regulatory oversight from CySEC providing some level of institutional credibility, while user feedback suggests underlying trust concerns. CySEC regulation ensures compliance with European Union financial regulations, including client fund segregation requirements and adherence to MiFID II directives, which provides basic regulatory protections for EEA traders.

However, the consistently low user ratings indicate that regulatory oversight alone has not been sufficient to address user concerns about the broker's operations. While specific details about fund safety measures, client money protection schemes, and transparency practices are not extensively documented in available sources, the regulatory framework should provide basic protections.

Company transparency, including clear communication about trading conditions, fee structures, and business practices, appears to be an area requiring improvement based on the limited availability of detailed information. Most reputable brokers provide comprehensive disclosure about their operations, risk management practices, and client protection measures.

The absence of detailed information about how the broker handles negative events, client complaints, or dispute resolution processes represents another area of concern. Industry reputation, as reflected in the available user ratings, suggests that Vestle faces challenges in maintaining client trust and confidence. Third-party evaluations and independent assessments are limited in available sources, making it difficult to obtain objective verification of the broker's trustworthiness beyond the basic regulatory compliance.

User Experience Analysis

User experience represents Vestle's most significant challenge area, with the 2.0-star overall rating clearly indicating widespread user dissatisfaction across multiple service aspects. This low satisfaction rating suggests fundamental issues with the broker's service delivery, platform functionality, or trading conditions that significantly impact client relationships.

While specific details about interface design, platform usability, and navigation efficiency are not extensively documented in available sources, the consistently poor ratings suggest that users encounter difficulties with the overall trading environment. Modern traders expect intuitive platforms, efficient workflows, and seamless integration between different service components.

The registration and account verification process efficiency is not detailed in available sources, though streamlined onboarding represents a basic expectation for contemporary brokers. Similarly, information about the fund deposit and withdrawal experience, processing times, and associated difficulties is not specifically documented, though such operational aspects significantly impact overall user satisfaction.

Common user complaints appear to center around service quality and trading experience issues, though specific recurring problems are not detailed in available sources. The consistently low ratings suggest that multiple aspects of the user journey require substantial improvement. User demographic analysis indicates that the broker primarily serves European Economic Area traders, though whether the service adequately meets the needs of this target market is questionable given the poor satisfaction ratings. Immediate improvements in service quality, platform functionality, and customer support appear necessary to address the significant user experience deficiencies indicated by current ratings.

Conclusion

This comprehensive Vestle review reveals a broker that, despite maintaining CySEC regulatory compliance and offering access to multiple asset classes, faces significant challenges in user satisfaction and service delivery. With an overall rating of 2.0 stars, Vestle clearly struggles to meet modern trader expectations across multiple service dimensions.

The broker may be suitable for European Economic Area traders seeking basic access to forex and CFD markets through a regulated entity, particularly those who prioritize regulatory oversight over service excellence. However, potential clients should carefully consider the consistently poor user feedback before committing to this platform.

The main advantages include regulatory compliance through CySEC, access to diverse asset classes including forex, indices, commodities, shares, ETFs, and cryptocurrencies, and availability of both desktop and mobile trading platforms. However, these benefits are significantly overshadowed by substantial disadvantages including poor user satisfaction ratings, limited transparency about trading conditions and fees, inadequate customer service quality, and suboptimal overall trading experience as indicated by user feedback.