Grow Trade Matrix Review 5

No scam best platform

best platform

Positive trader. Recommended😎

positive result, good for trading

This is very best platform for the forex Trading.. you should try this guys

Grow Trade Matrix Forex Broker provides real users with 5 positive reviews, * neutral reviews and * exposure review!

Business

License

No scam best platform

best platform

Positive trader. Recommended😎

positive result, good for trading

This is very best platform for the forex Trading.. you should try this guys

This Grow Trade Matrix review examines a new forex broker in the competitive foreign exchange trading world. Grow Trade Matrix is registered in Saint Vincent and the Grenadines and positions itself as a technology-focused trading platform offering modern solutions for forex traders. The broker operates with limited regulatory oversight typical of its jurisdiction, but it has gained attention for its MetaTrader WebTrader platform and user-friendly approach to online trading.

The broker's standout features include its MetaTrader WebTrader platform, which removes the need for software downloads while keeping full trading functionality. Traders can access tight spreads, Level II pricing, and one-click trading capabilities directly through their web browsers across different operating systems. The platform also features a personalized trader dashboard that allows users to monitor their positions efficiently at a glance.

Grow Trade Matrix targets forex traders seeking convenient and accessible trading experiences without the complexity of traditional desktop installations. The broker's web-based approach appeals to traders who value flexibility and cross-device compatibility in their trading activities.

Regional Entity Differences: Grow Trade Matrix operates under the regulatory framework of Saint Vincent and the Grenadines, which maintains a different regulatory environment compared to major financial jurisdictions such as the UK, EU, or Australia. Traders should understand that this jurisdiction typically offers less comprehensive investor protection compared to more strict regulatory environments.

Review Methodology: This evaluation is based on publicly available information, official broker documentation, and user feedback collected from various sources. The assessment does not involve actual trading conditions testing and focuses on analyzing the broker's stated offerings and market reputation.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Insufficient information available |

| Tools and Resources | 8/10 | Strong MetaTrader WebTrader platform with comprehensive features |

| Customer Service | N/A | Limited information on support quality |

| Trading Experience | 8/10 | Positive user feedback and robust platform functionality |

| Trust and Safety | 4/10 | Limited regulatory oversight and transparency concerns |

| User Experience | N/A | Insufficient detailed user experience data |

Grow Trade Matrix operates as a forex-focused brokerage firm registered in Saint Vincent and the Grenadines. The company has positioned itself within the online trading sector by emphasizing technological convenience and accessibility through web-based trading solutions. While specific founding details remain limited in available documentation, the broker has established connections within the trading technology ecosystem, including relationships with trading tool providers like BotBro.

The broker's business model centers around providing streamlined forex trading services through its proprietary implementation of the MetaTrader WebTrader platform. This approach reflects a growing trend among newer brokers to prioritize accessibility and user convenience over traditional desktop-heavy trading environments. The company focuses exclusively on forex trading services, maintaining a specialized approach rather than expanding into diverse asset classes.

Grow Trade Matrix operates without major regulatory oversight, relying on its Saint Vincent and the Grenadines registration for legal compliance. This regulatory approach is common among offshore brokers but may present considerations for traders accustomed to more comprehensive regulatory protections. The broker's platform infrastructure supports cross-device compatibility and browser-based trading functionality.

Regulatory Jurisdiction: Grow Trade Matrix maintains its registration in Saint Vincent and the Grenadines, a jurisdiction known for relatively relaxed regulatory requirements for financial services providers. This regulatory environment offers operational flexibility but may provide limited investor protection compared to major financial centers.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available documentation. Traders should contact the broker directly for comprehensive information about supported payment methods and processing procedures.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit requirements in publicly available materials. Prospective clients should verify current account opening requirements through direct broker communication.

Promotional Offers: Current promotional offerings and bonus structures are not specified in available documentation. Traders interested in potential incentives should inquire directly with the broker about any available promotional programs.

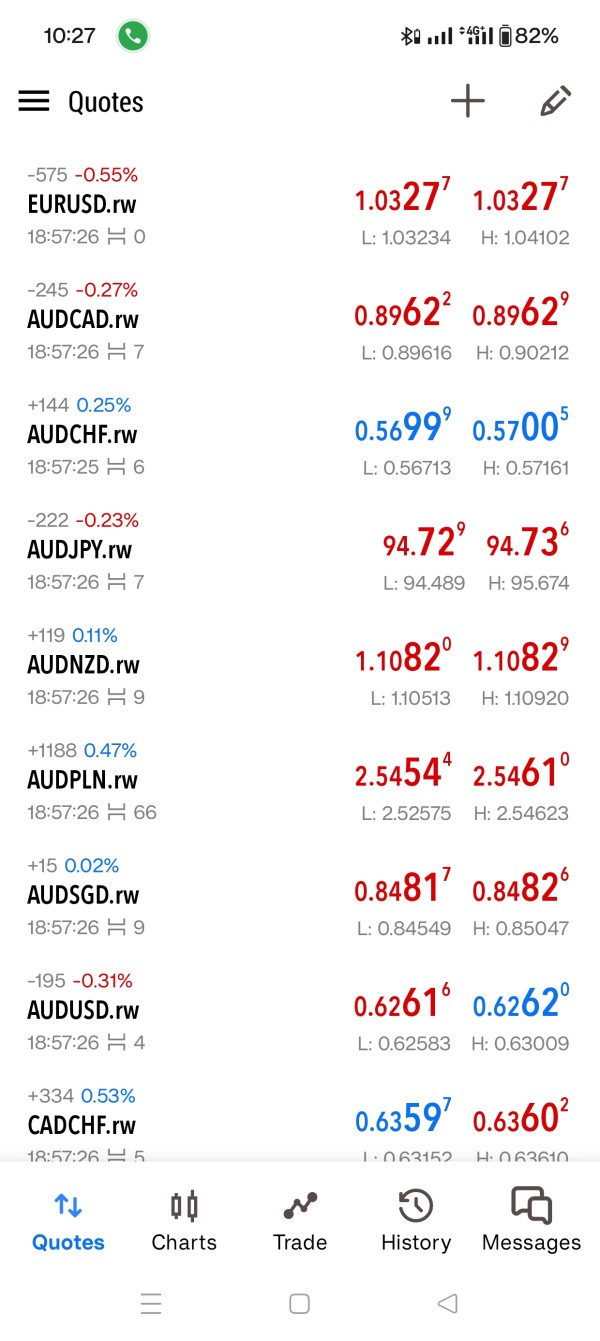

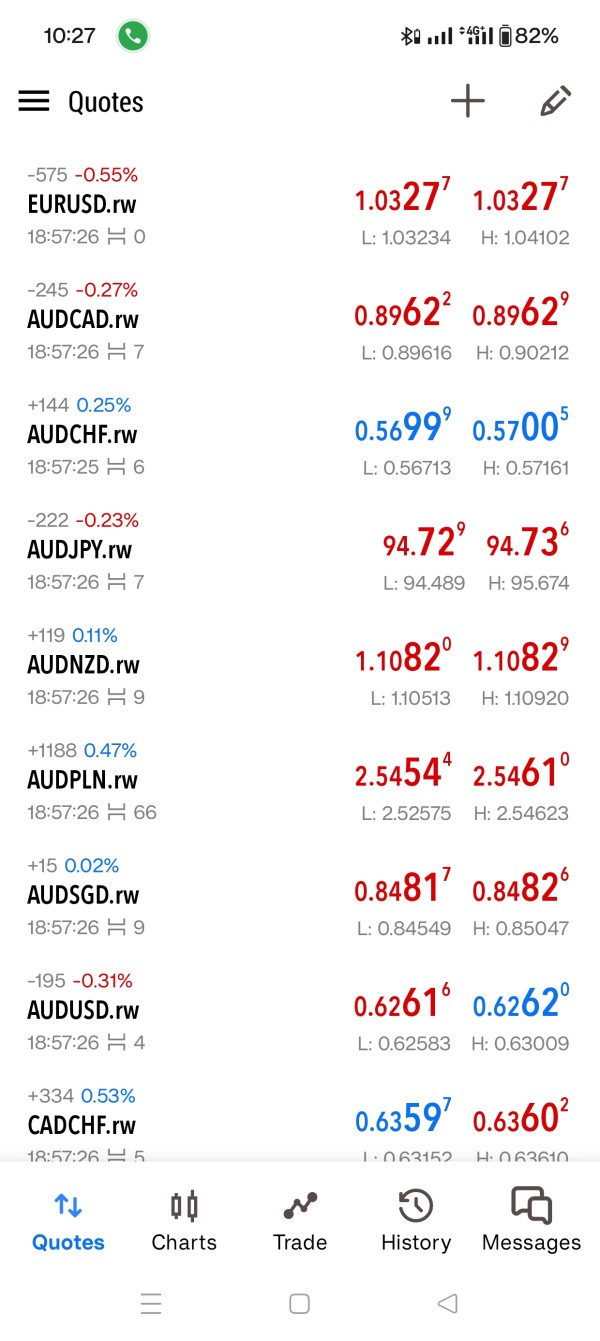

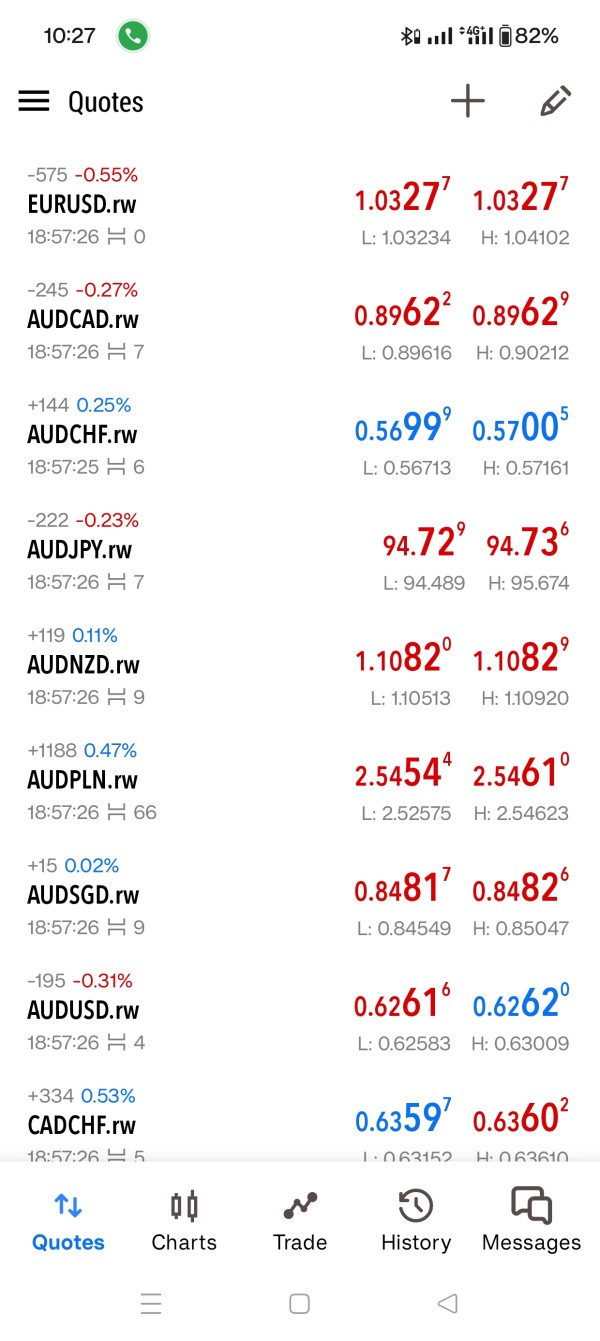

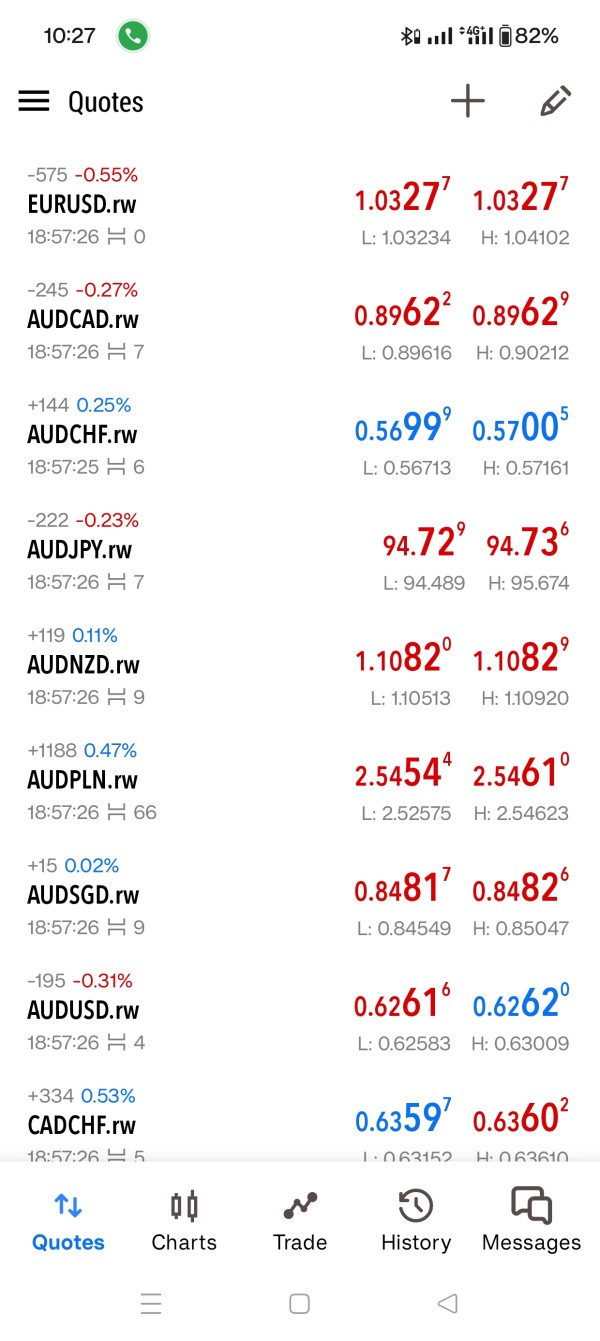

Tradeable Assets: The broker primarily focuses on forex trading, though specific currency pairs and asset availability details are not comprehensively outlined in public materials. The platform appears designed specifically for foreign exchange market participation.

Cost Structure: Grow Trade Matrix advertises tight spreads as part of its competitive offering, though specific spread ranges and commission structures are not detailed in available information. The broker mentions Level II pricing availability through its platform.

Leverage Options: Specific leverage ratios and margin requirements are not disclosed in publicly available documentation. Traders should verify current leverage offerings directly with the broker.

Platform Selection: The primary trading platform is MetaTrader WebTrader, which provides browser-based access across different operating systems without requiring software downloads. This Grow Trade Matrix review notes the platform's comprehensive feature set including one-click trading capabilities.

Geographic Restrictions: Specific regional availability and restrictions are not detailed in current documentation.

Customer Support Languages: Available customer service languages are not specified in accessible materials.

The evaluation of Grow Trade Matrix's account conditions faces significant limitations due to insufficient publicly available information. The broker has not disclosed comprehensive details about its account structure, including the variety of account types offered to different trader segments. Without specific information about minimum deposit requirements, account tiers, or specialized features, it becomes challenging to assess the competitiveness of the broker's account offerings.

The absence of detailed account opening procedures and verification requirements in public documentation suggests that prospective clients must engage directly with the broker to understand the onboarding process. This lack of transparency may concern traders who prefer to research account conditions thoroughly before committing to a broker relationship.

Additionally, the availability of specialized account features such as Islamic accounts, professional trading accounts, or demo account options remains unclear from available sources. The broker's approach to account management and client categorization requires further investigation through direct communication channels.

This Grow Trade Matrix review cannot provide a definitive assessment of account conditions without more comprehensive information from the broker regarding its account structure and client onboarding procedures.

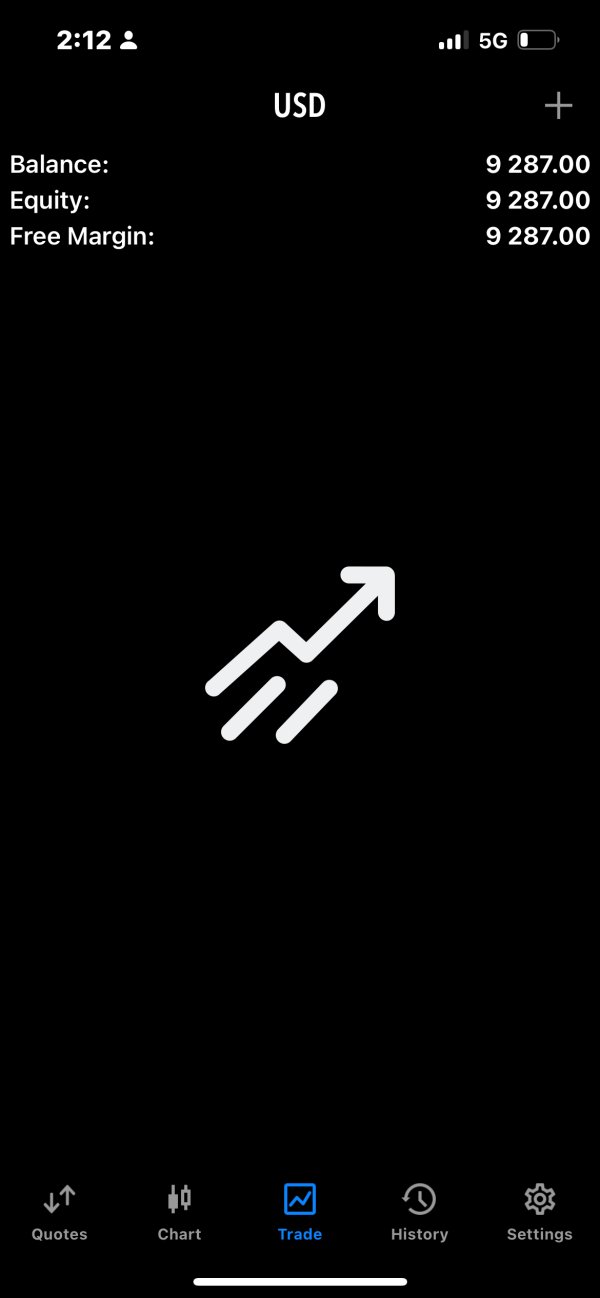

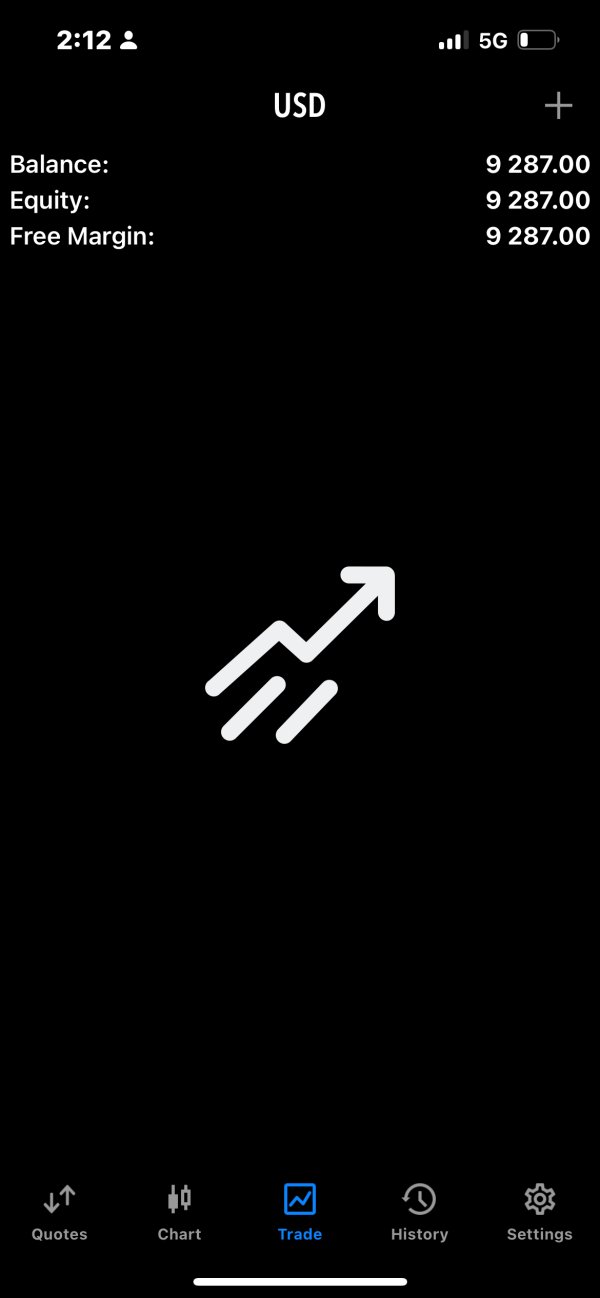

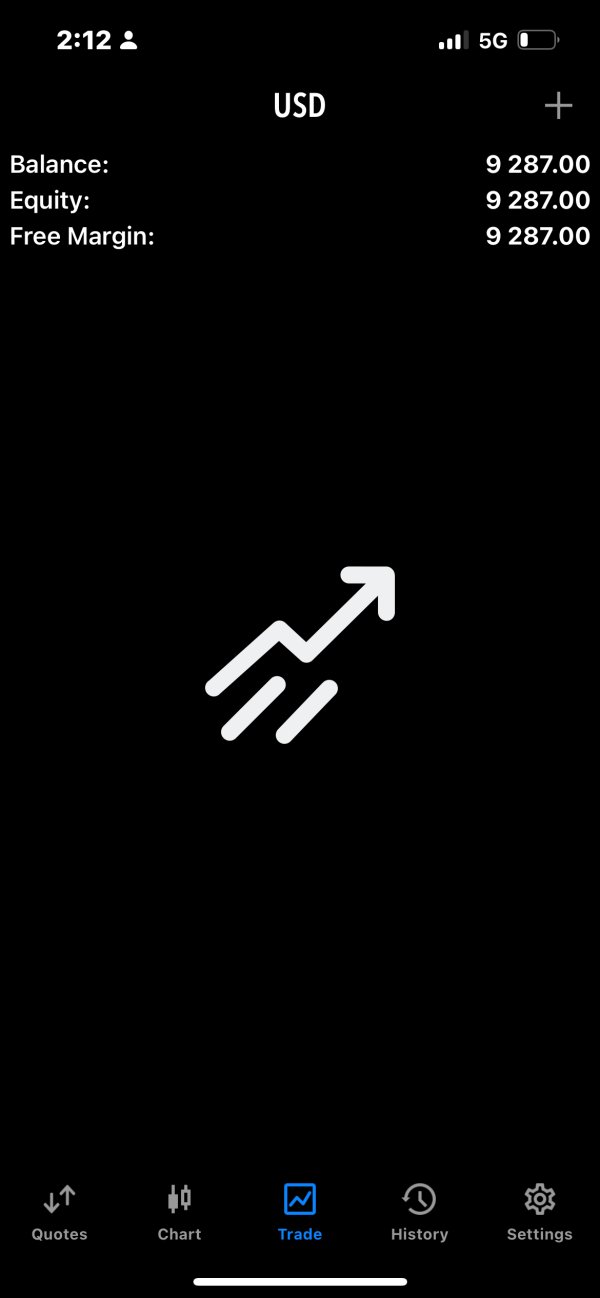

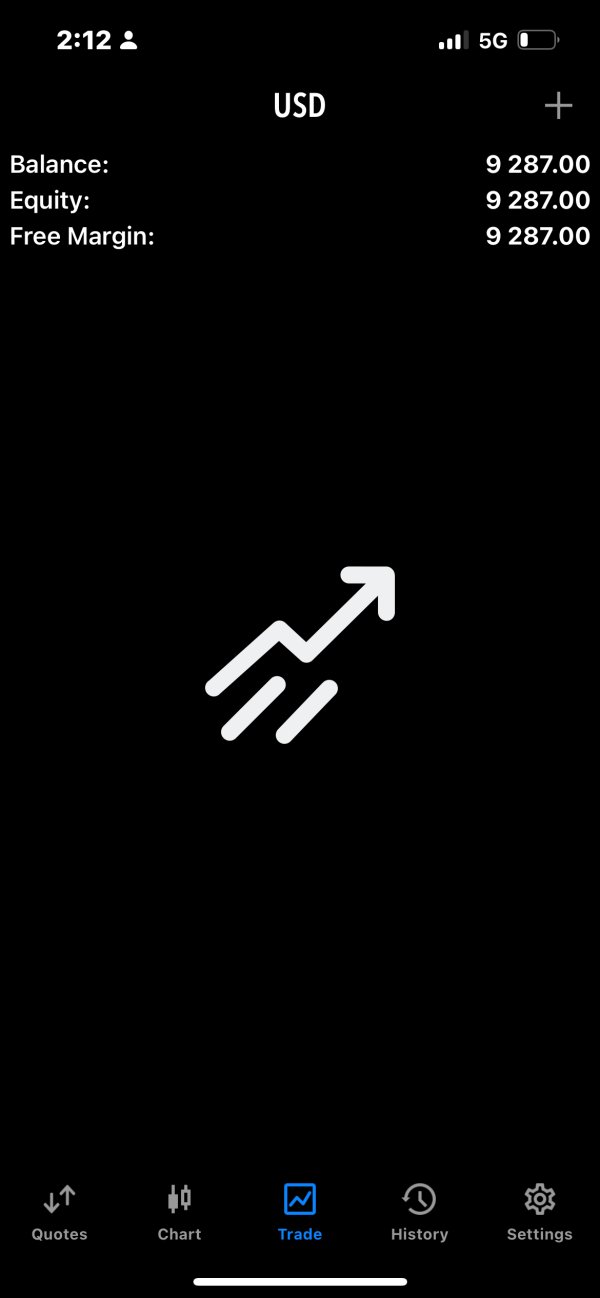

Grow Trade Matrix demonstrates strength in its technological offering through the MetaTrader WebTrader platform implementation. The broker's web-based trading solution provides significant advantages for traders seeking flexibility and convenience. The platform delivers full MetaTrader functionality without requiring desktop software installation, supporting seamless trading across different operating systems including Windows and Mac environments.

The platform features include tight spreads integration, Level II pricing access, and one-click trading capabilities that match desktop MetaTrader versions. The personalized trader dashboard represents a valuable addition, allowing users to monitor their trading positions efficiently through an intuitive interface. This technological approach addresses common trader concerns about software compatibility and device limitations.

However, the evaluation reveals gaps in information about additional research and analysis resources. The broker has not detailed whether it provides market analysis, economic calendars, trading signals, or educational materials to support trader development. The absence of information about automated trading support and Expert Advisor compatibility limits the assessment of the platform's advanced trading capabilities.

While the core trading platform appears robust, the overall tools and resources offering requires more comprehensive documentation to fully evaluate its competitiveness against established brokers with extensive research and educational support systems.

The assessment of Grow Trade Matrix's customer service capabilities encounters significant information limitations. Available documentation does not provide details about customer support channels, availability hours, or service quality standards. This absence of information creates uncertainty about the broker's commitment to client support and problem resolution capabilities.

Without specific information about support channels such as live chat, telephone support, email responsiveness, or help desk ticketing systems, traders cannot adequately evaluate the broker's accessibility during trading hours or emergency situations. The lack of disclosed response time commitments or service level agreements raises questions about support reliability.

The broker has not specified its multilingual support capabilities, which may limit accessibility for international traders requiring assistance in languages other than English. Additionally, the absence of information about support team expertise levels and training standards makes it difficult to assess the quality of assistance traders can expect.

The evaluation cannot determine whether the broker provides 24/5 support during market hours, weekend assistance availability, or specialized support for technical platform issues. This information gap represents a significant consideration for traders who prioritize responsive customer service in their broker selection process.

The trading experience evaluation reveals positive indicators based on available user feedback and platform capabilities. Users have provided favorable assessments of the platform's performance, suggesting satisfactory stability and functionality during trading operations. The MetaTrader WebTrader implementation appears to deliver reliable execution and user-friendly navigation that meets trader expectations for web-based trading environments.

The platform's one-click trading functionality and tight spreads contribute to a streamlined trading experience that can enhance execution efficiency. The browser-based approach eliminates common technical barriers associated with software installation and compatibility issues, potentially improving overall user satisfaction. The personalized dashboard feature adds value by providing quick position monitoring capabilities.

However, the evaluation lacks specific information about order execution quality, slippage rates, and platform stability during high-volatility market conditions. Without detailed performance metrics or extensive user testimonials, it becomes challenging to assess the platform's reliability under various market scenarios.

The absence of information about mobile trading capabilities and cross-device synchronization limits the evaluation of the complete trading experience. This Grow Trade Matrix review notes that while initial user feedback appears positive, more comprehensive performance data would strengthen the assessment of the broker's trading environment quality.

The trust and safety evaluation reveals significant concerns regarding Grow Trade Matrix's regulatory framework and transparency level. The broker's registration in Saint Vincent and the Grenadines provides minimal regulatory oversight compared to major financial jurisdictions, potentially limiting investor protection and recourse options for traders experiencing disputes or issues.

The regulatory environment in Saint Vincent and the Grenadines typically lacks the comprehensive oversight mechanisms found in jurisdictions such as the FCA, ASIC, or CySEC. This regulatory limitation may affect fund segregation requirements, compensation scheme availability, and dispute resolution procedures that traders might expect from more heavily regulated brokers.

The broker's connection to BotBro, as mentioned in available documentation, adds another layer of complexity to its operational structure. Without detailed information about corporate ownership, financial backing, or operational transparency, traders face uncertainty about the company's stability and long-term viability.

The absence of detailed information about client fund protection measures, segregated account policies, and audit procedures raises additional trust considerations. While user feedback appears generally positive, the limited regulatory framework and transparency gaps represent significant factors in the overall trust assessment for potential clients considering this broker.

The user experience evaluation faces limitations due to insufficient comprehensive feedback data, though available indicators suggest generally positive user sentiment. The broker's focus on web-based trading through MetaTrader WebTrader appears to address common user preferences for accessibility and convenience, eliminating traditional barriers associated with software installation and device compatibility.

The platform's cross-browser functionality and operating system independence likely contribute to user satisfaction by providing consistent access across different computing environments. The personalized dashboard feature represents a user-centric design approach that can enhance trading workflow efficiency and position management capabilities.

However, the evaluation lacks detailed information about user interface design quality, navigation intuitiveness, and learning curve considerations for new traders. Without comprehensive user testimonials or satisfaction surveys, it becomes challenging to assess the complete user experience across different trader skill levels and preferences.

The absence of information about user onboarding processes, educational support, and account management tools limits the evaluation of the broker's commitment to user experience optimization. Additionally, the lack of details about common user complaints or satisfaction improvement initiatives prevents a thorough assessment of the broker's responsiveness to user feedback and experience enhancement efforts.

Grow Trade Matrix presents a mixed profile as a forex broker with notable technological strengths but significant transparency limitations. The broker's MetaTrader WebTrader platform implementation demonstrates technical competency and user-focused design, offering convenient browser-based trading without software installation requirements. The positive user feedback regarding platform performance suggests satisfactory trading experience delivery for current clients.

However, the broker's regulatory framework in Saint Vincent and the Grenadines and limited transparency regarding account conditions, costs, and operational procedures present considerable concerns for potential clients. The absence of comprehensive information about customer support, account structures, and safety measures creates uncertainty about the broker's overall reliability and client protection capabilities.

Grow Trade Matrix may suit traders prioritizing convenience and web-based trading accessibility who are comfortable with limited regulatory oversight. However, traders seeking comprehensive regulatory protection, detailed cost transparency, and extensive educational resources may find the broker's current offering insufficient for their requirements.

FX Broker Capital Trading Markets Review