Regarding the legitimacy of Vestle forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Vestle safe?

Pros

Cons

Is Vestle markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

ICFD Ltd

Effective Date:

2011-05-23Email Address of Licensed Institution:

info@iforex.euSharing Status:

No SharingWebsite of Licensed Institution:

www.iforex.eu, www.iforex.pl, www.iforex.nl, www.iforex.es, www.iforex.fr, www.iforex.it, www.iforex.gr, de.iforex.eu, https://hu.iforex.eu, www.iforex.huExpiration Time:

--Address of Licensed Institution:

Corner of Agiou Andreou and Eleftheriou Venizelou Str, Vashiotis Agiou Andreou Bld, 2nd Floor - Office 202, CY-3035 Limassol or P. O. Box 54216, CY-3722 LimassolPhone Number of Licensed Institution:

+357 25 204 600Licensed Institution Certified Documents:

Is Vestle Safe or a Scam?

Introduction

Vestle, a relatively new player in the forex market, has garnered attention since its establishment in 2018 as a rebranding of the iForex group. This broker positions itself as a platform for trading various financial instruments, including CFDs on forex, commodities, and cryptocurrencies. Given the volatile nature of the forex market and the prevalence of scams, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to investigate the legitimacy of Vestle by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. Our assessment draws from a variety of credible sources, including regulatory bodies, user reviews, and expert analyses, to provide a comprehensive overview of whether Vestle is safe or poses potential risks to traders.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is a critical factor in determining its legitimacy. Vestle operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), a reputable regulatory authority in the European Union. Regulation by CySEC means that Vestle must comply with strict financial standards, including maintaining segregated accounts for client funds and ensuring transparency in its operations.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 143/11 | Cyprus | Verified |

The importance of regulation cannot be overstated; it provides a safety net for traders, ensuring that their funds are protected in the event of broker insolvency. Vestle's compliance with CySEC regulations suggests a level of credibility. However, it is important to note that while CySEC is a respected regulator, it has been criticized for allowing certain brokers with questionable practices to operate. Therefore, while Vestle is regulated, potential clients should remain vigilant and consider the overall reputation of the broker within the trading community.

Company Background Investigation

Vestle is a trading name of ICFD Limited, which is part of the iForex group established in 1996. The company is headquartered in Limassol, Cyprus, and has expanded its operations to serve clients across Europe and beyond. The management team behind Vestle consists of professionals with extensive experience in finance and trading, which adds to the broker's credibility.

Despite its relatively short history, Vestle claims to have over 60,000 clients. However, transparency regarding the company's ownership structure and detailed information about the management team is limited. This lack of transparency can raise concerns among potential investors, as it becomes challenging to assess the broker's commitment to ethical practices and customer service.

The overall level of information disclosure on Vestle's website is moderate. While it provides essential details about trading conditions and available instruments, it lacks comprehensive insights into the company's operational practices and management. This could be a red flag for traders seeking a broker with a clear and transparent operational framework.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are paramount. Vestle provides a range of trading instruments, including over 80 currency pairs, commodities, indices, and shares. However, the costs associated with trading on the platform are an essential consideration.

Vestle's fee structure is somewhat competitive, but it is crucial to analyze specific costs associated with trading.

| Fee Type | Vestle | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Vestle does not charge commissions on trades, the spreads, particularly on major currency pairs, are slightly higher than the industry average. This could affect overall trading profitability, especially for high-frequency traders. Additionally, the lack of a clear outline regarding overnight interest rates could lead to unexpected costs for traders holding positions overnight.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Vestle claims to implement several security measures to protect client funds. These measures include segregated accounts, which ensure that client funds are kept separate from the company's operational funds, thereby providing a layer of protection in case of insolvency. Additionally, Vestle adheres to the Investor Compensation Fund (ICF) regulations, which could reimburse clients up to €20,000 in case of broker bankruptcy.

Despite these measures, it is essential to remain cautious. Historical issues related to fund security and withdrawals have been reported by users, raising concerns about the broker's reliability. Traders should be aware of these potential risks and consider them when deciding whether Vestle is safe for their trading activities.

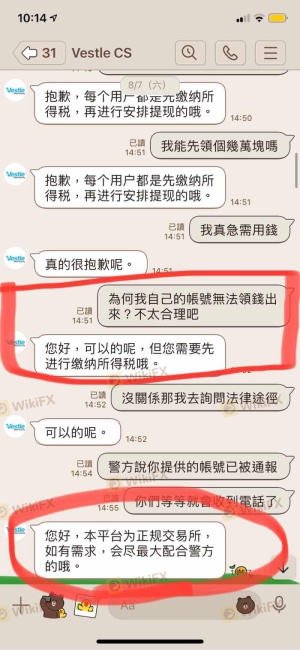

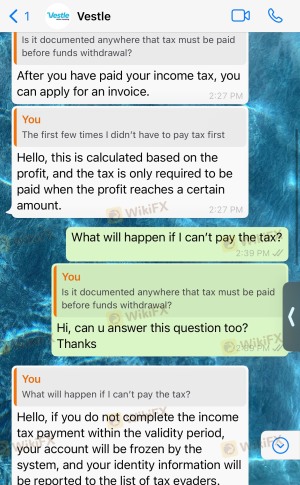

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining a broker's reliability. Reviews for Vestle are mixed, with some users praising its educational resources and customer support, while others report issues related to withdrawals and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Blocking | Medium | No Clear Policy |

| Poor Customer Support | High | Inconsistent |

Common complaints include delays in processing withdrawals, which can be a significant concern for traders looking to access their funds promptly. Additionally, some users have reported difficulties in reaching customer support, particularly during critical moments. These issues could indicate a lack of operational efficiency and responsiveness, raising questions about whether Vestle is safe for traders who may need immediate assistance.

Platform and Execution

The trading platform offered by Vestle is proprietary and web-based, which means that traders do not have access to popular platforms like MetaTrader 4 or 5. While the platform is designed to be user-friendly, its performance and execution quality are vital for traders.

Order execution quality appears to be a concern, with some users reporting instances of slippage and order rejections. Such issues can significantly impact trading outcomes, particularly in fast-moving markets. Furthermore, any signs of platform manipulation or irregularities in order execution should be closely scrutinized by potential users.

Risk Assessment

Engaging with any broker carries inherent risks, and Vestle is no exception. The following risk assessment summarizes key areas of concern for potential traders:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with mixed reviews |

| Withdrawal Issues | High | Complaints about delays and blocking |

| Transparency Concerns | Medium | Limited information on management |

| Platform Execution Quality | High | Reports of slippage and rejections |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform before committing substantial capital. Additionally, maintaining a cautious approach and withdrawing profits regularly can help safeguard against potential issues.

Conclusion and Recommendations

In conclusion, while Vestle is regulated by CySEC and offers a range of trading instruments, there are several red flags that potential traders should consider. The mixed reviews regarding customer experiences, concerns about withdrawal delays, and the proprietary trading platform's execution quality raise questions about whether Vestle is safe for trading.

For traders seeking a reliable broker, it may be prudent to explore alternatives with a more established reputation and proven track record. Brokers with robust regulatory oversight, transparent operations, and positive user feedback should be prioritized to ensure a safer trading environment. Always conduct thorough research and consider your trading needs before making any commitments in the forex market.

Is Vestle a scam, or is it legit?

The latest exposure and evaluation content of Vestle brokers.

Vestle Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vestle latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.