Concap 2025 Review: Everything You Need to Know

In the evolving landscape of forex brokerage, Concap has emerged as a noteworthy contender since its inception in 2022. However, a thorough examination of the available reviews reveals a mixture of commendations and concerns. While it offers a range of investment advisory services, its regulatory standing and user experiences present a complex picture that potential clients should consider carefully.

Note: It is crucial to highlight that Concap operates across different jurisdictions, which can significantly impact user experiences and regulatory oversight. This review aims to provide a fair and accurate assessment based on multiple sources.

Rating Overview

How We Rate Brokers: Our ratings are derived from a comprehensive analysis of user feedback, expert opinions, and factual data from reliable sources.

Broker Overview

Concap, officially known as Continental Capital Management (Pvt.) Ltd., was registered in 2022 and currently manages approximately $3.3 million in assets. The firm operates with a single licensed advisor, maintaining a client-to-advisor ratio of 19:1. While it aims to provide investment advisory services, a notable concern is its lack of regulation, which raises questions about its trustworthiness and operational integrity. The broker primarily offers services through the MT4 trading platform, catering to various asset classes, including forex and CFDs.

Detailed Analysis

Regulatory Status and Geographic Reach

Concap is registered in Pakistan, and its lack of regulation by a recognized financial authority is a significant red flag. According to WikiFX, there is no valid regulatory information available, which poses a high risk for potential investors. The absence of oversight can lead to concerns regarding the safety of client funds and the overall legitimacy of the broker.

Deposit/Withdrawal Currencies and Minimum Deposit

The broker accepts deposits in major currencies, but specific details regarding the minimum deposit requirements are not clearly outlined in the reviews. Potential clients should inquire directly with Concap to clarify these terms.

There is limited information regarding any promotional offers or bonuses that Concap may provide. This lack of transparency can be a disadvantage compared to other brokers that offer clear incentives for new clients.

Tradable Asset Classes

Concap primarily focuses on forex trading but also offers access to CFDs. However, the range of tradable assets is not as extensive as that of more established brokers, which can limit opportunities for diversification.

Costs (Spreads, Fees, Commissions)

The reviews do not provide specific details about the spreads, fees, or commissions associated with trading on Concap. This lack of clarity can be concerning for potential clients who prioritize transparency in cost structures.

Leverage

Information regarding leverage options is not explicitly mentioned in the reviews. Traders should be cautious and seek clarification from the broker, as leverage can significantly impact trading outcomes.

Concap primarily operates on the MT4 platform, which is widely regarded for its user-friendly interface and robust features. However, the absence of additional platforms like MT5 may deter some advanced traders looking for more sophisticated tools.

Restricted Regions

While the reviews do not specify any restricted regions, potential clients should verify whether their country of residence is eligible to open an account with Concap.

Available Customer Service Languages

The reviews indicate limited information on the languages offered for customer support. A lack of multilingual support can be a barrier for non-English speaking clients seeking assistance.

Reiterated Rating Overview

Detailed Breakdown

Account Conditions

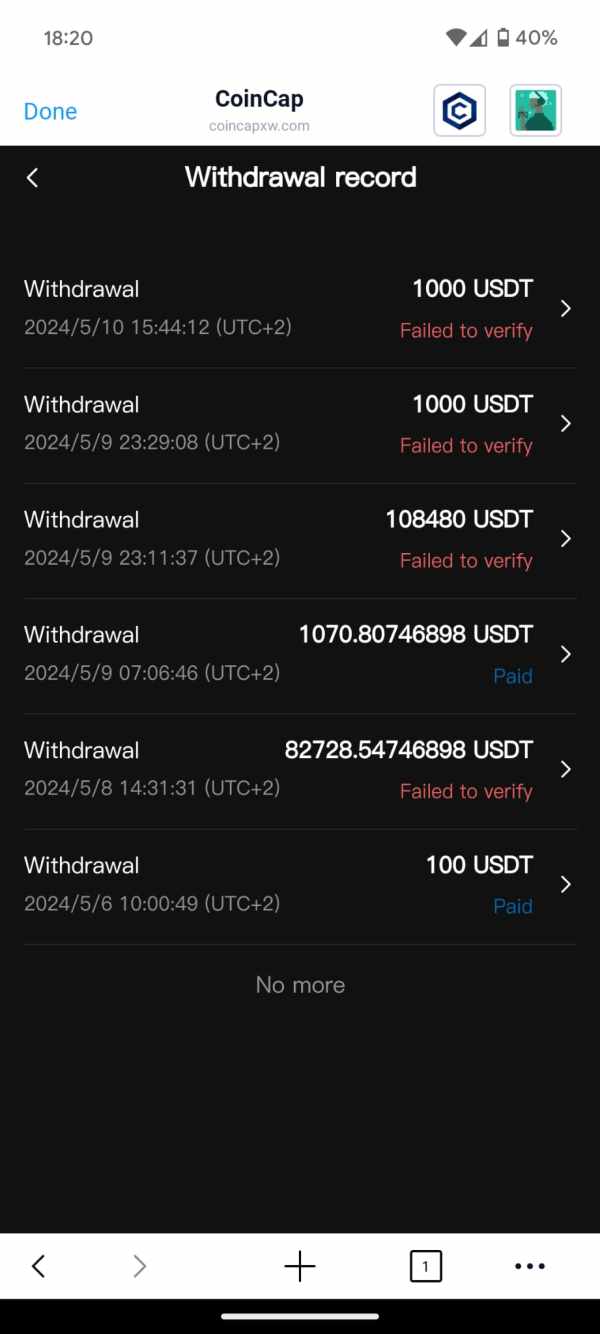

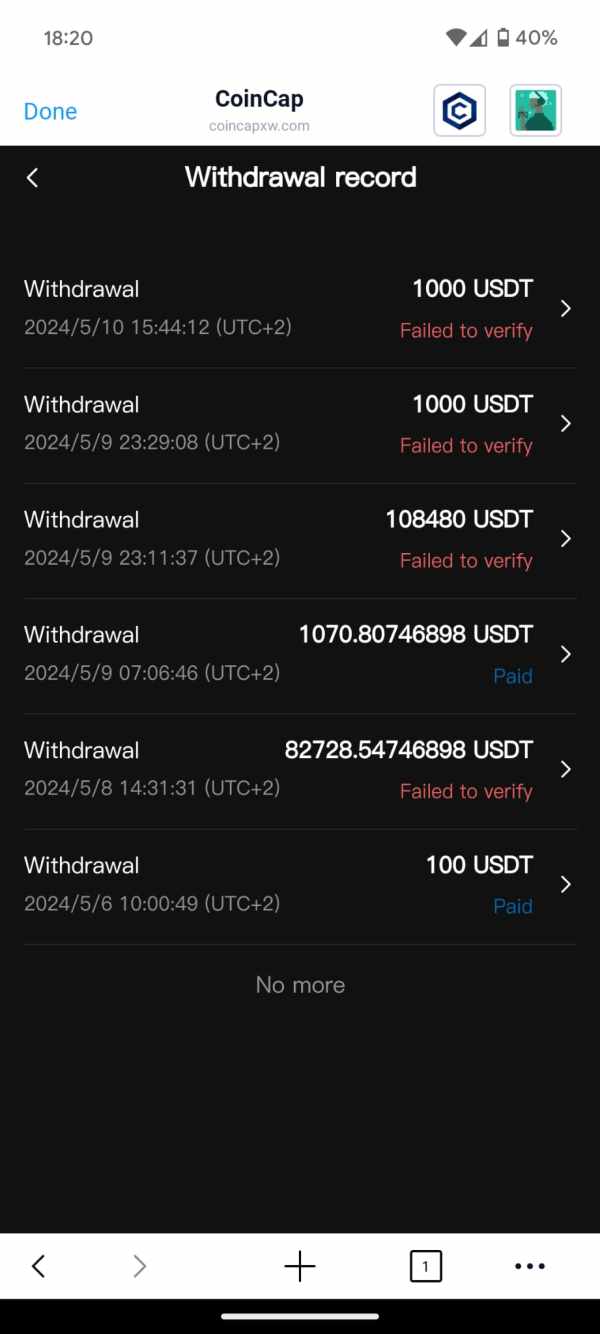

The account conditions at Concap receive a moderate rating due to the unclear terms regarding minimum deposits and withdrawal processes. The lack of regulation further complicates the situation, making it essential for potential clients to exercise caution.

Concap offers the MT4 platform, which is a widely recognized trading tool. However, the absence of additional resources or educational materials may limit the overall trading experience for novice traders.

Customer Service and Support

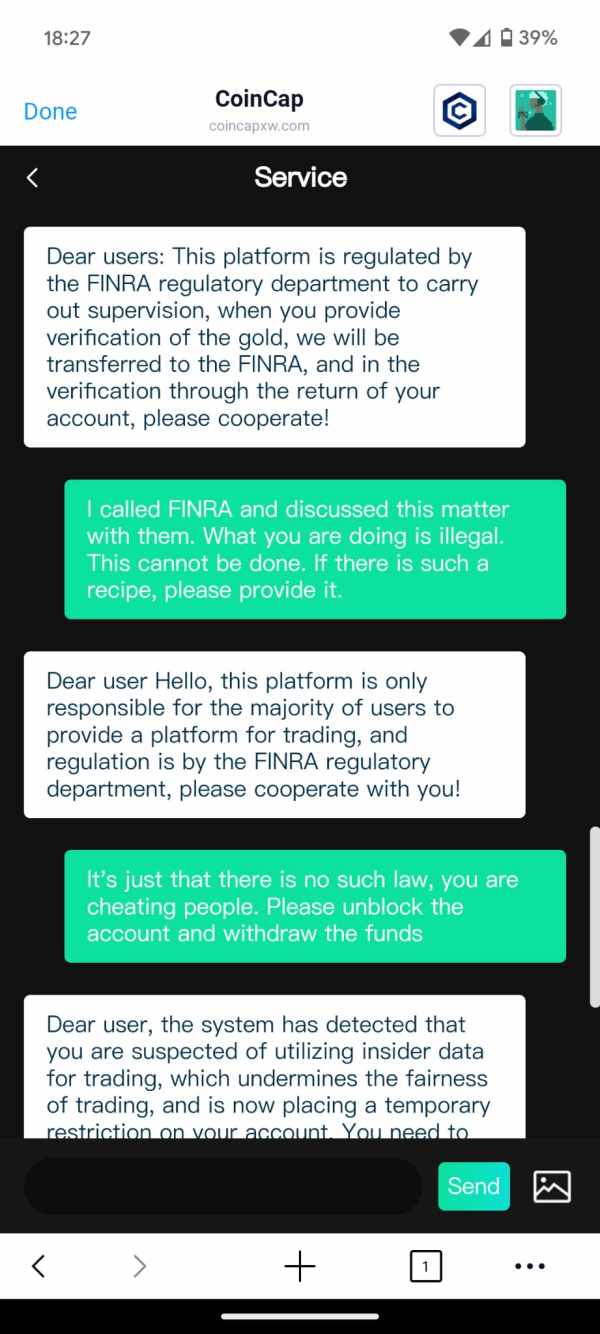

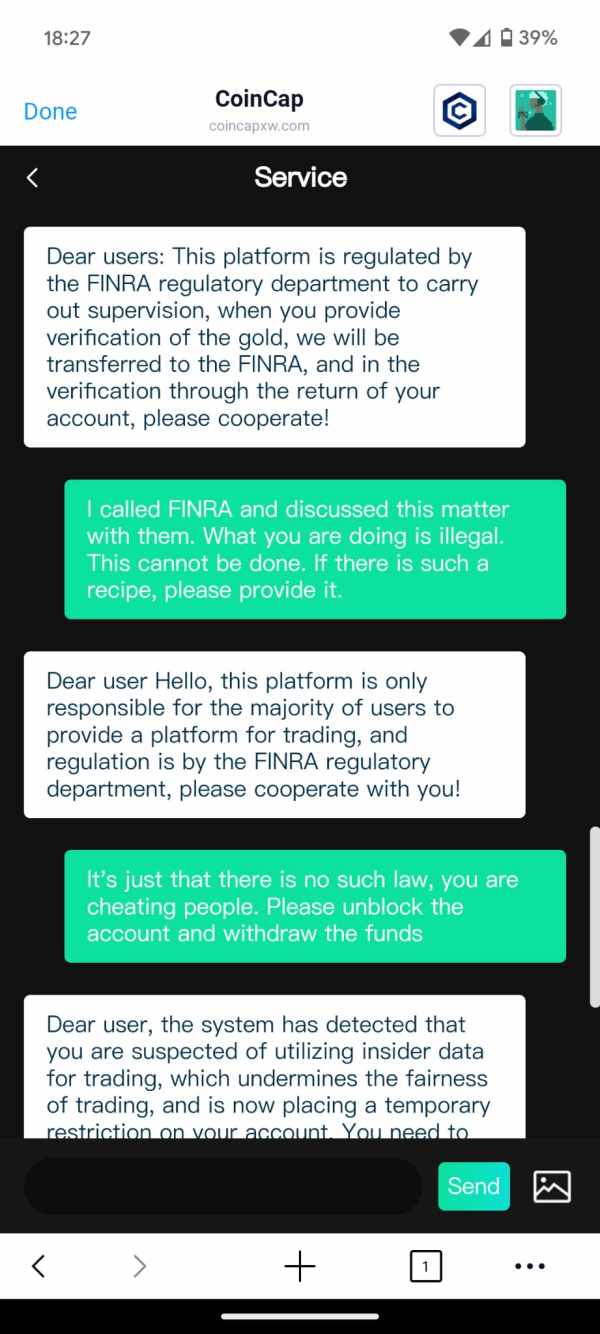

Customer service at Concap has been rated poorly, with users reporting difficulties in obtaining timely responses. This can be a significant drawback for traders who require immediate assistance or have urgent inquiries.

Trading Experience

While the trading experience on the MT4 platform is generally positive, the lack of clarity regarding costs and potential regulatory issues may detract from overall satisfaction.

Trustworthiness

Concap's trustworthiness is a major concern due to its lack of regulation and transparency. Potential clients should proceed with caution, as the absence of oversight raises significant risks.

User Experience

User experiences tend to vary, with some praising the platform's usability while others express concerns about customer support and regulatory issues. This inconsistency can lead to uncertainty for potential traders.

Regulatory Compliance

The lack of regulation is a critical issue for Concap. Without oversight from a recognized authority, clients may face increased risks regarding the safety of their funds and the legitimacy of the broker's operations.

In conclusion, the Concap review indicates a broker that offers some appealing features but is marred by significant concerns regarding regulatory compliance and customer service. Potential clients should weigh these factors carefully before deciding to engage with Concap.