USDC Investment 2025 Review: Everything You Need to Know

Executive Summary

USDC Investment is a new forex broker that entered the trading market in 2022. This broker wants to be a multi-asset trading platform that gives access to forex pairs, indices, commodities, and stocks through their own trading platform. Our detailed usdc investment review shows major concerns that potential clients should think about carefully.

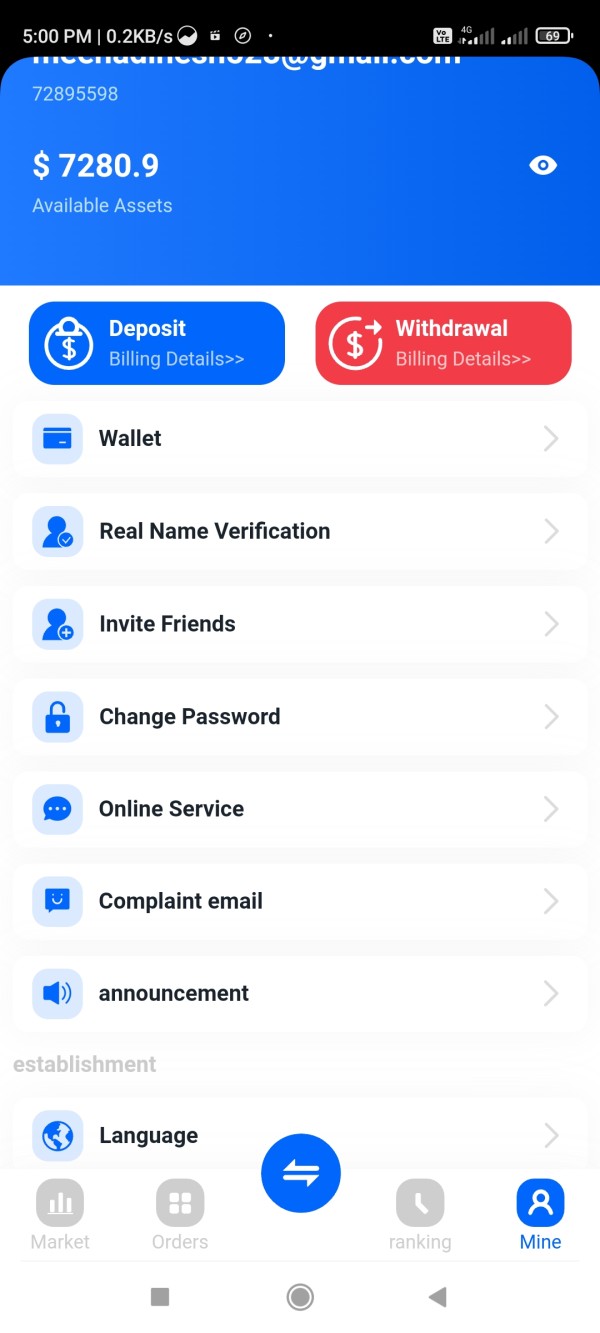

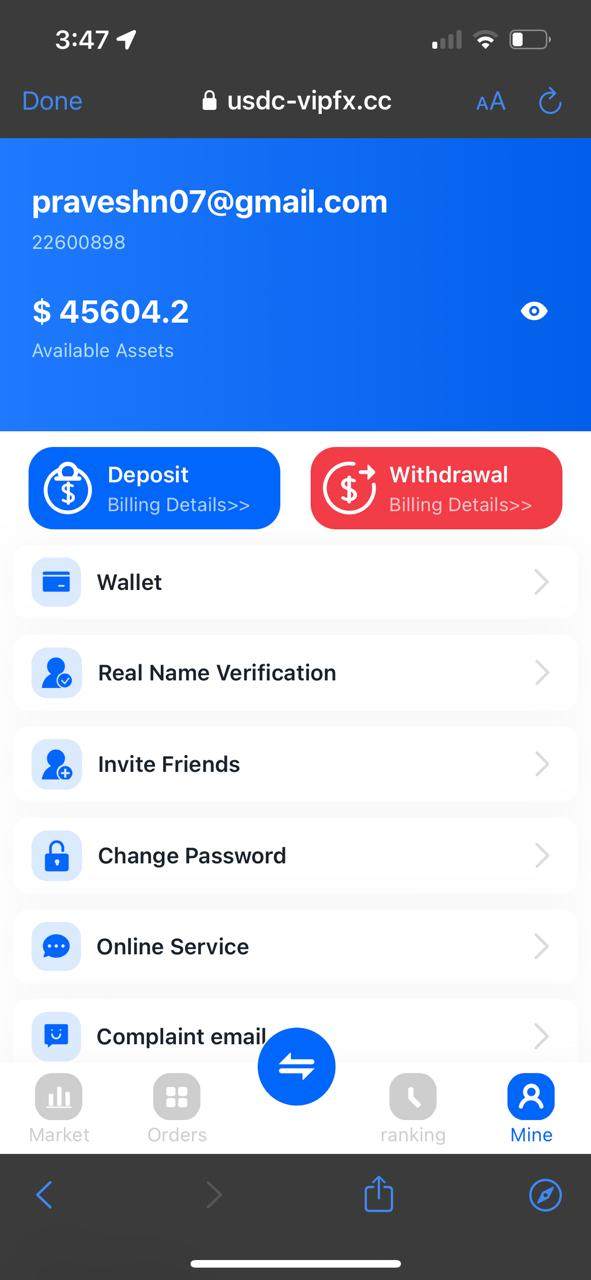

The broker offers diverse assets and a proprietary trading platform for traders who want portfolio diversification. These positives are overshadowed by concerning user feedback and poor performance scores. WikiFX ratings give USDC Investment a troubling score of just 1.31 out of 10, which shows big problems with user satisfaction and service quality.

The platform has received 16 user complaints in just the past three months. This suggests ongoing problems with their operations. The broker targets traders who want to diversify their investments across multiple asset classes.

Given the low user ratings and high complaint numbers, potential clients should be very careful. They should research other options before putting money into this platform.

Important Notice

Regional Entity Differences: USDC Investment has not given clear regulatory information across different areas. Traders must do their own research and make sure they follow their local financial rules before using this broker.

The lack of clear regulatory disclosure raises more concerns about the broker's legitimacy and oversight. Review Methodology: This evaluation uses publicly available data, user feedback, and third-party ratings.

Our analysis does not include direct trading experience with USDC Investment. All assessments come from external sources and user reports available when this was written.

Rating Framework

Broker Overview

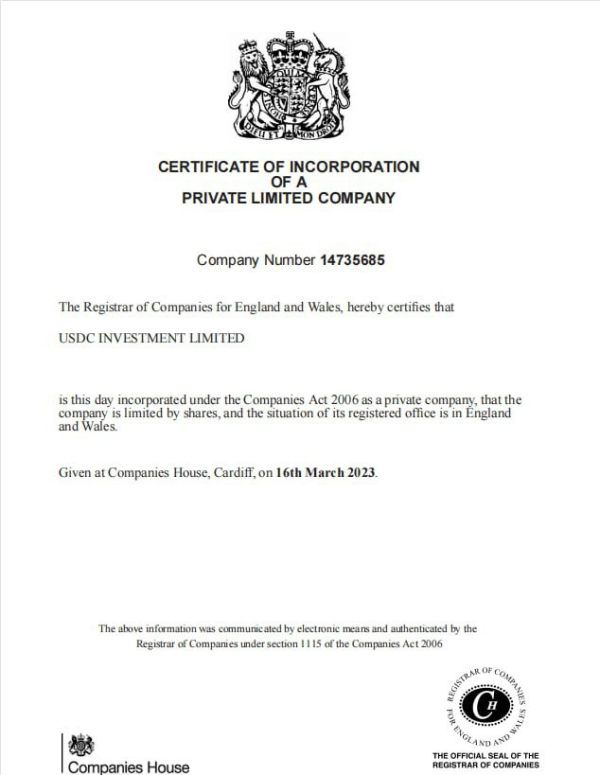

USDC Investment started in the forex and CFD trading space in 2022. The company says it is based in the United States and focuses on giving access to multiple financial markets through one platform interface.

Despite being new, the broker has tried to get market share by offering many tradeable assets and promoting its own trading technology. The broker's business model centers on providing multi-asset trading through their custom platform.

This approach aims to attract traders who want access to various markets rather than managing multiple platforms. USDC Investment offers trading in forex pairs, global indices, commodities, and individual stocks as a one-stop solution for diversified trading strategies. However, the company's short history and lack of clear regulatory information raise questions about its long-term success and commitment to industry standards.

The broker's quick entry into the market without building a solid reputation has contributed to mixed reception from the trading community. This is reflected in our usdc investment review findings.

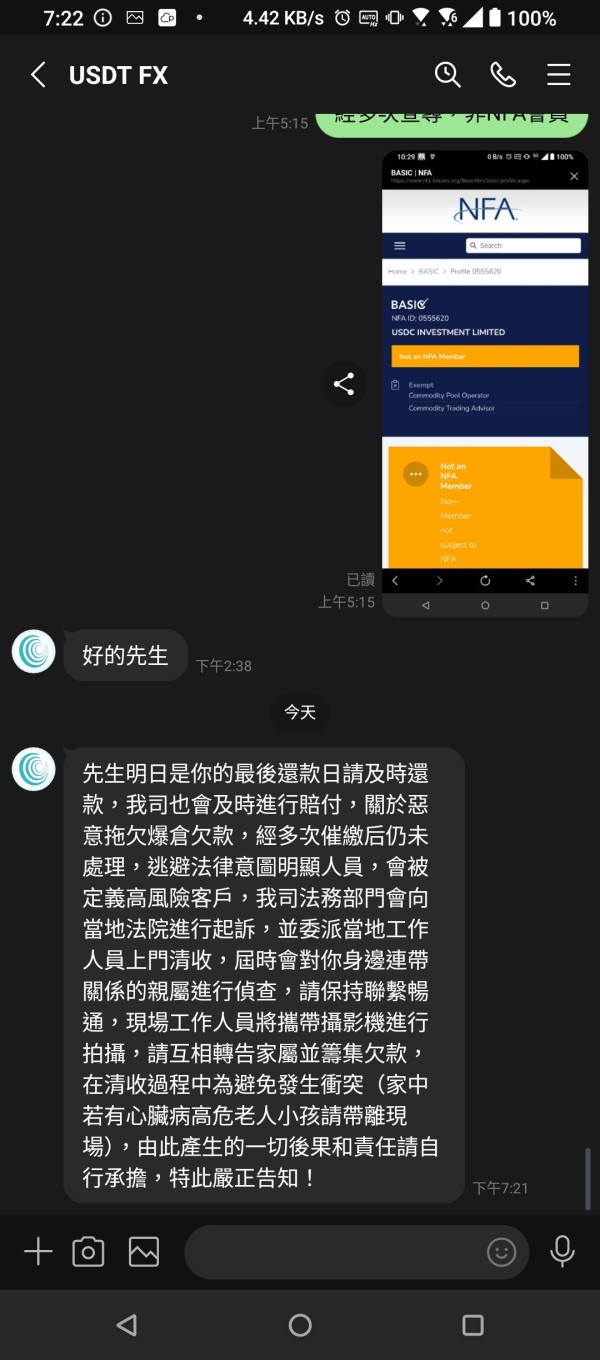

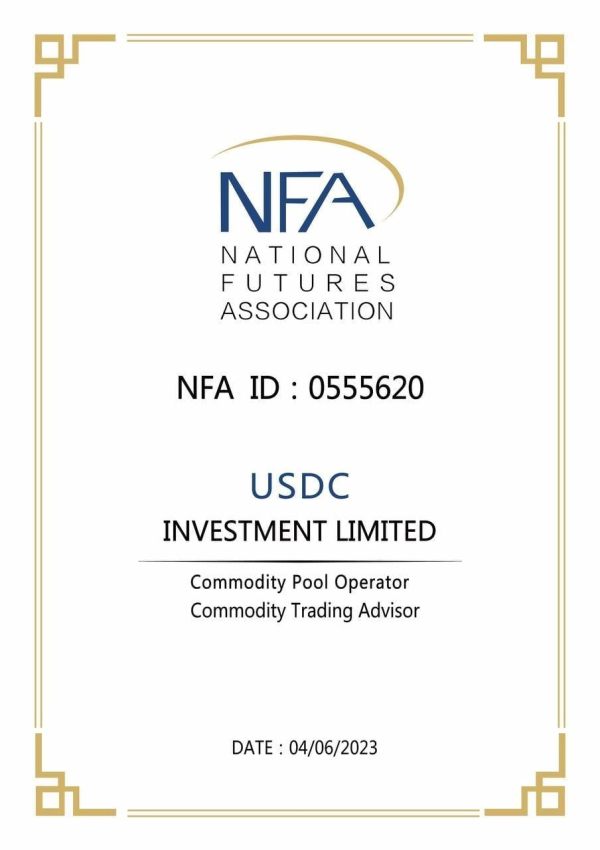

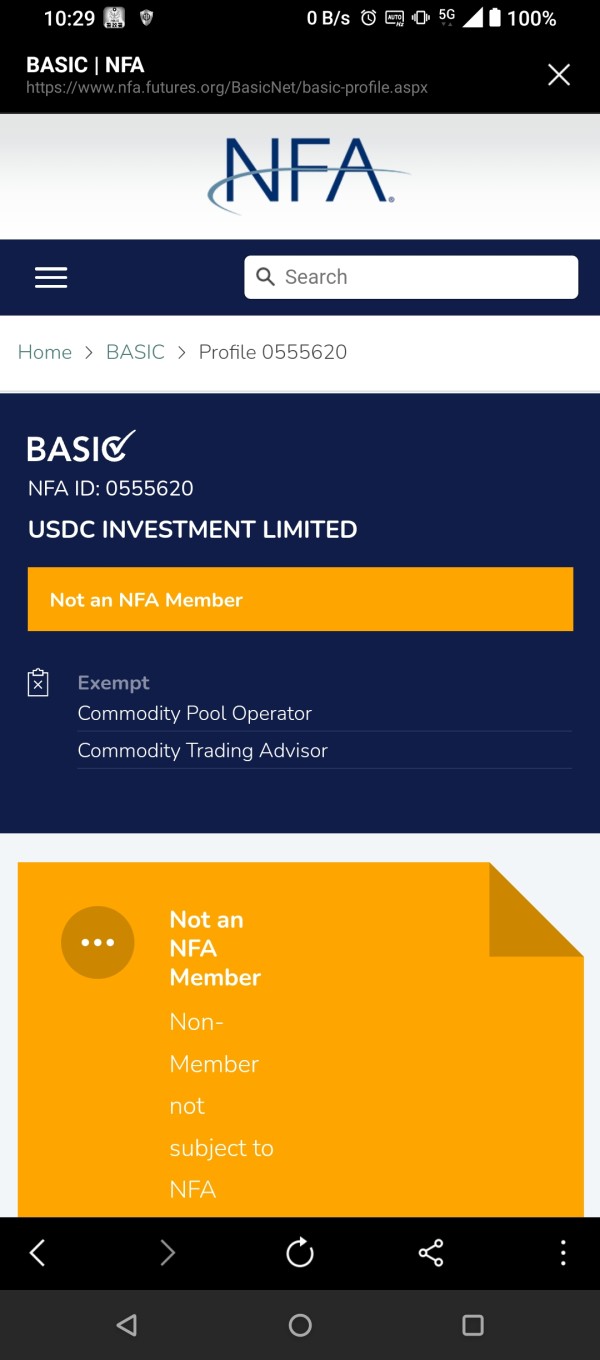

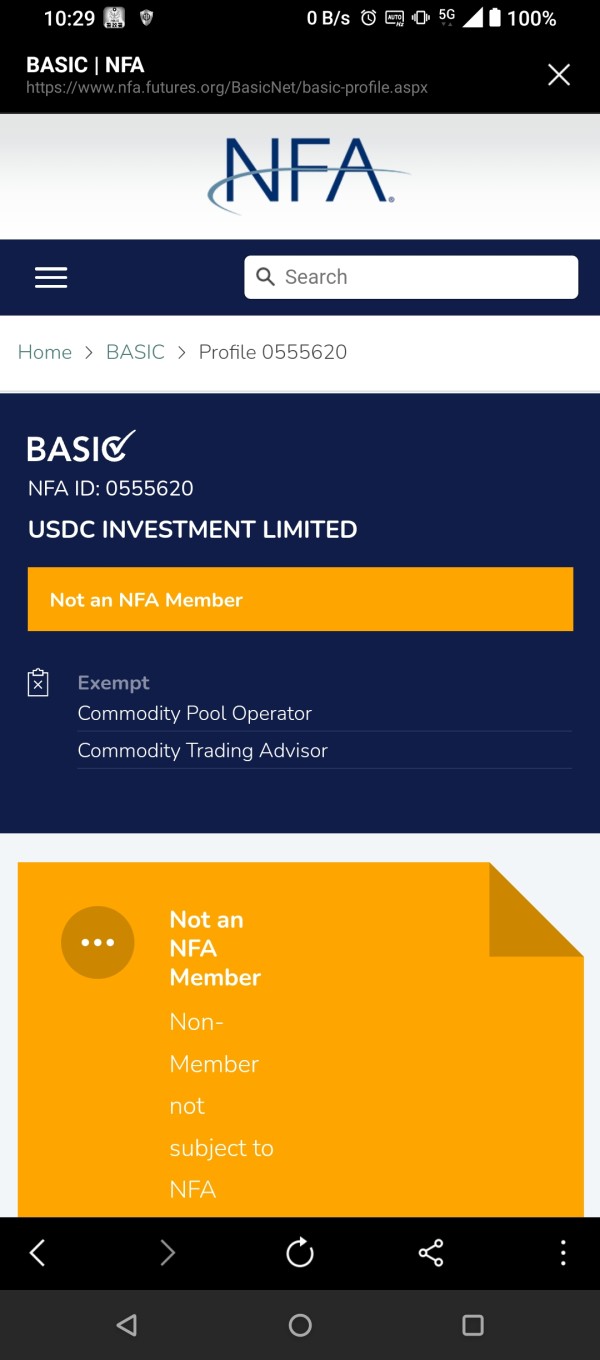

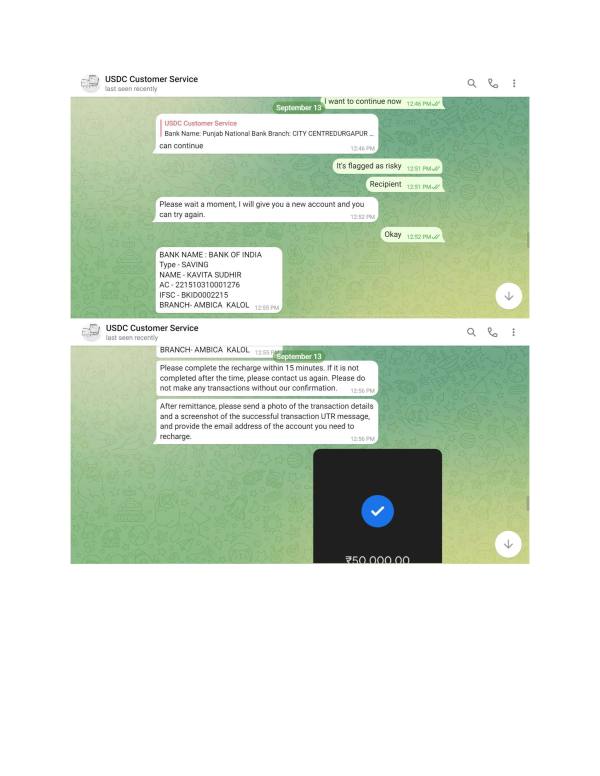

Regulatory Status: Available materials do not specify concrete regulatory oversight or licensing information. This represents a significant red flag for potential clients seeking regulated trading environments.

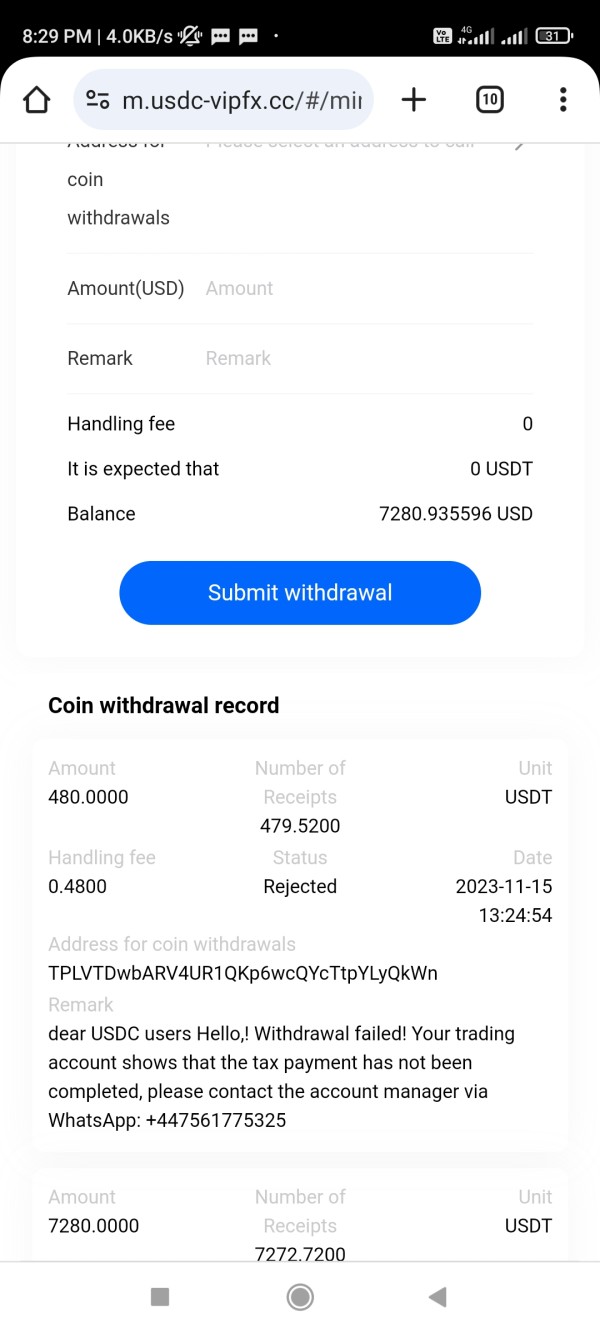

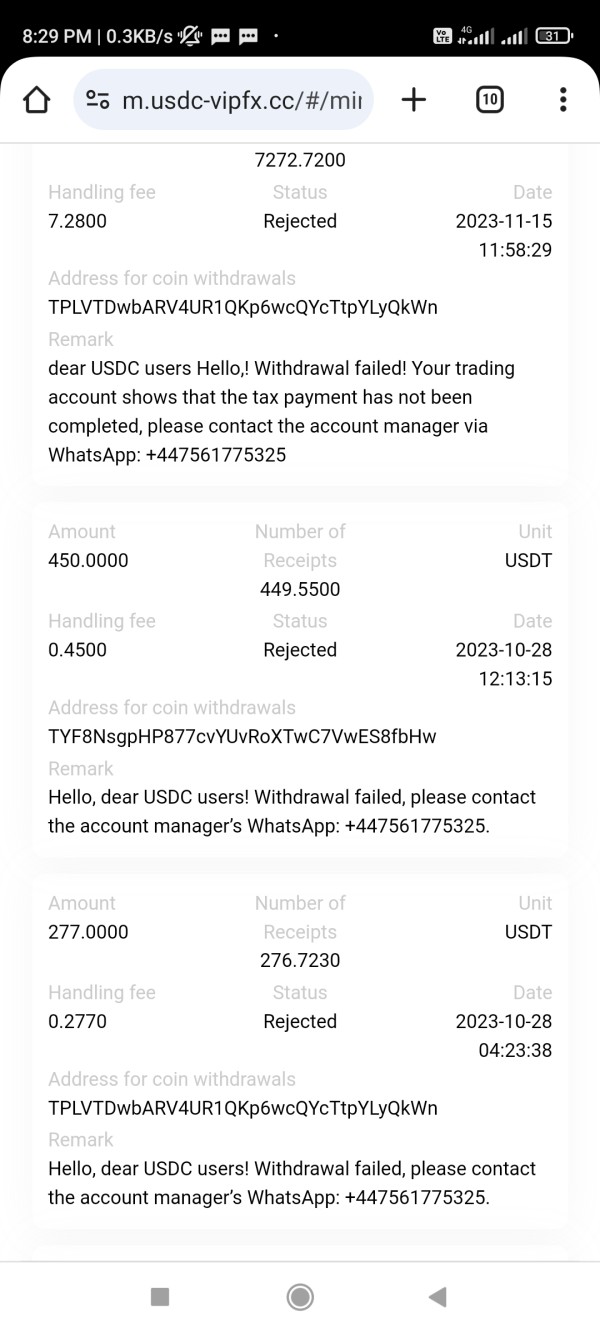

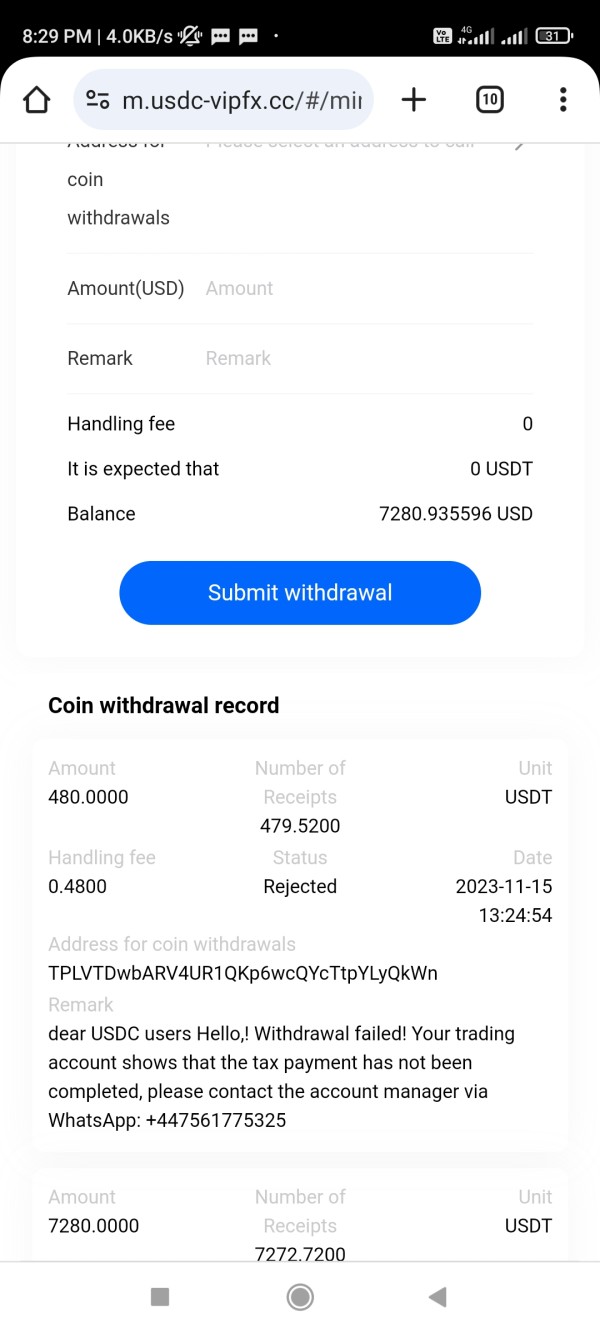

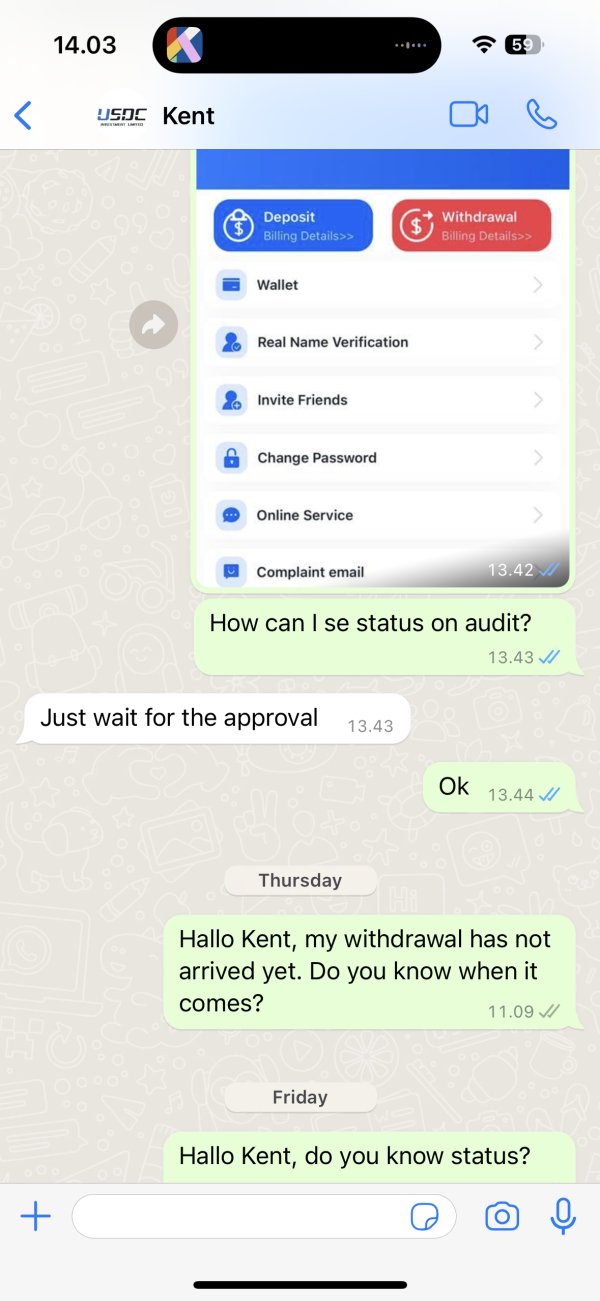

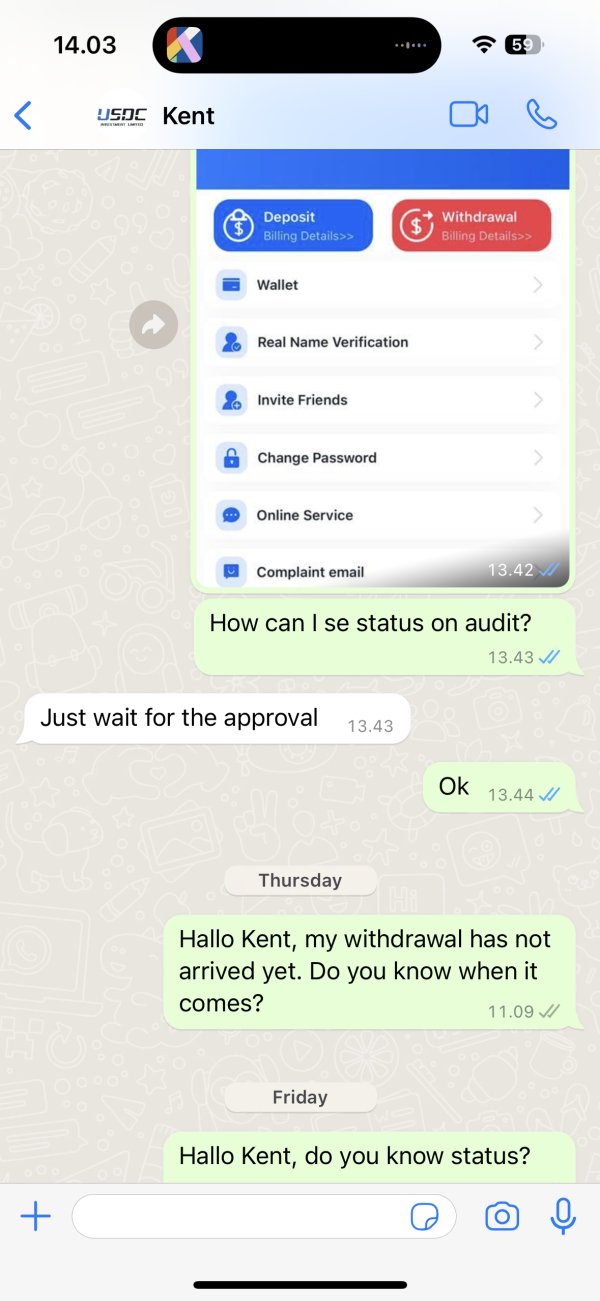

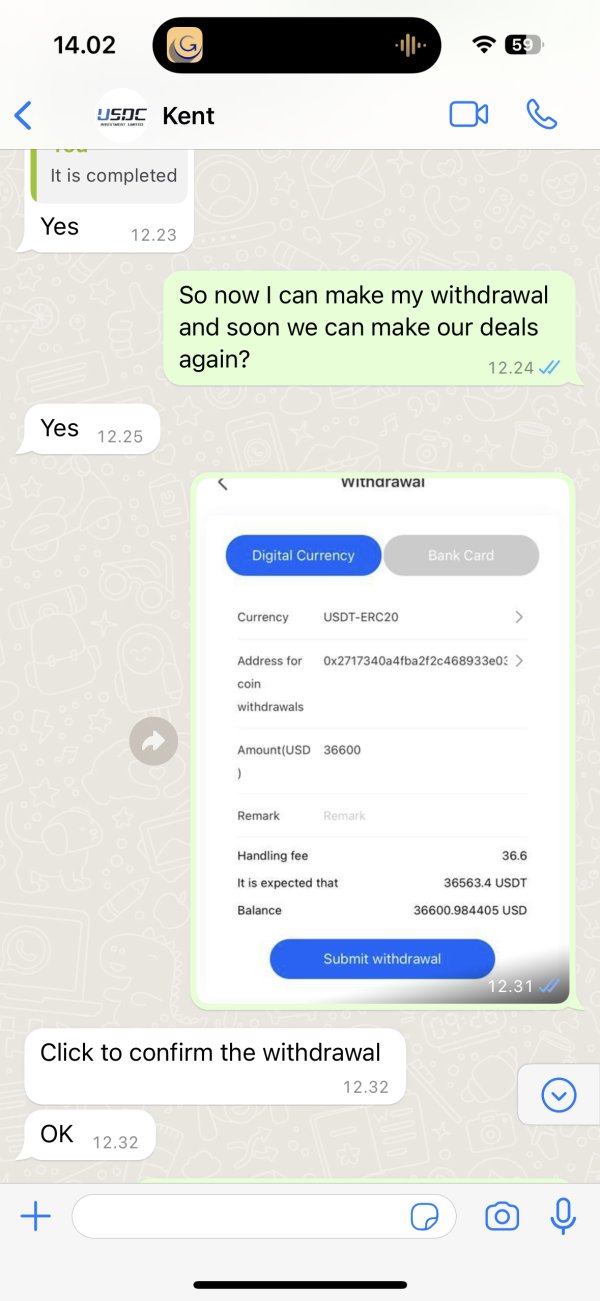

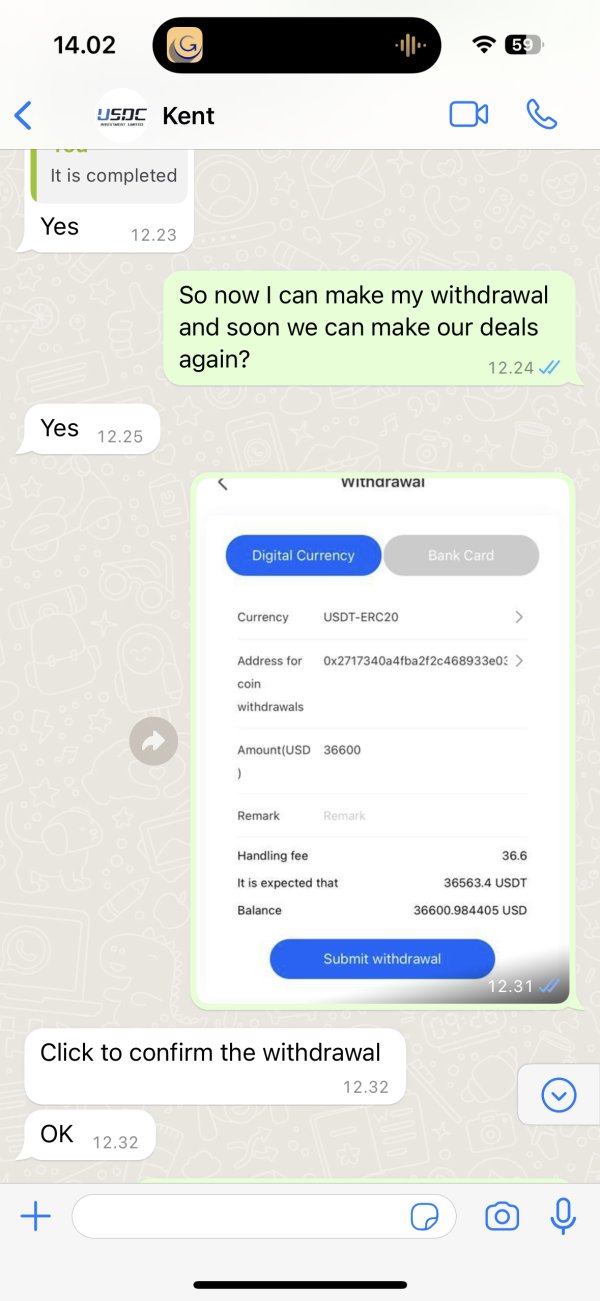

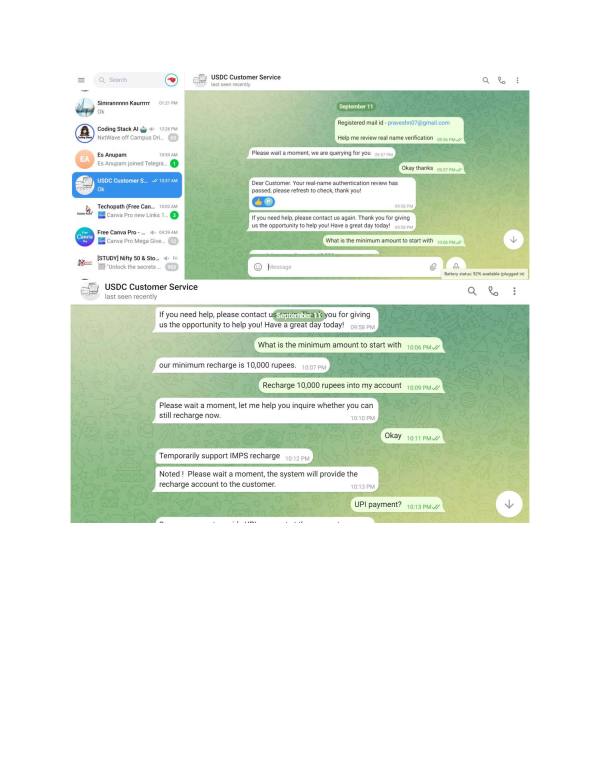

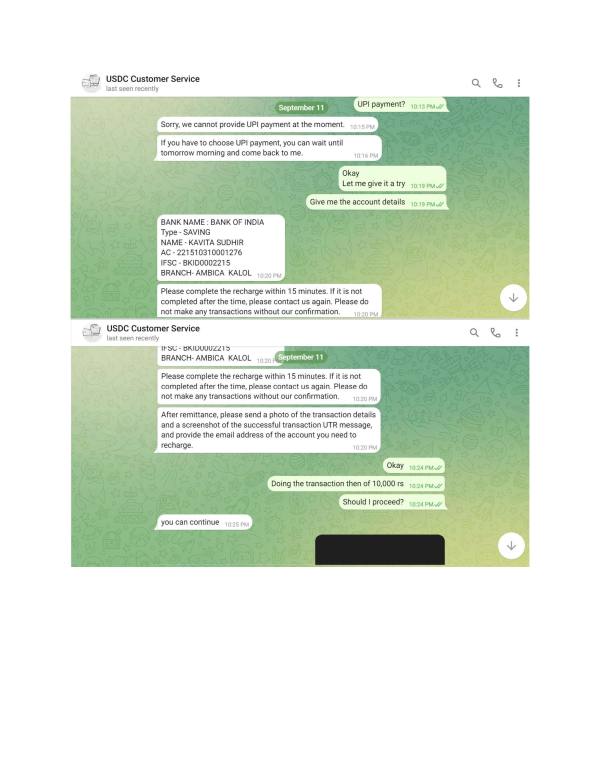

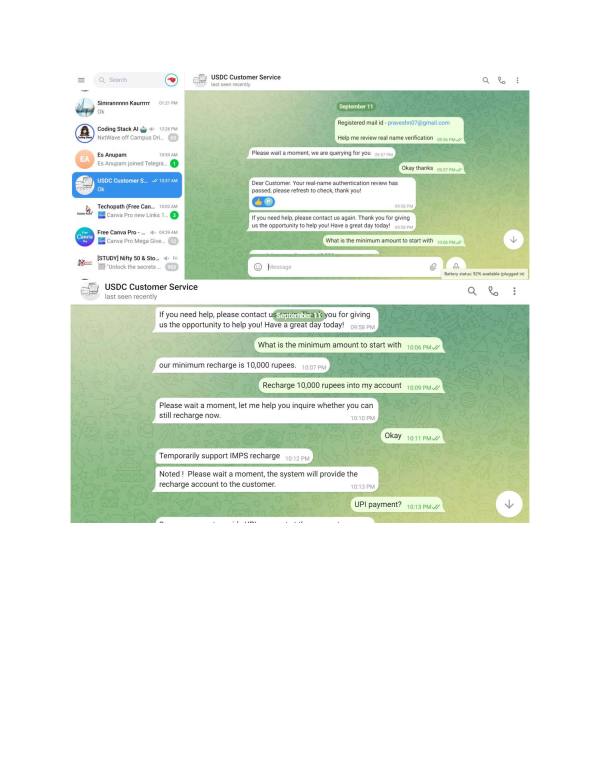

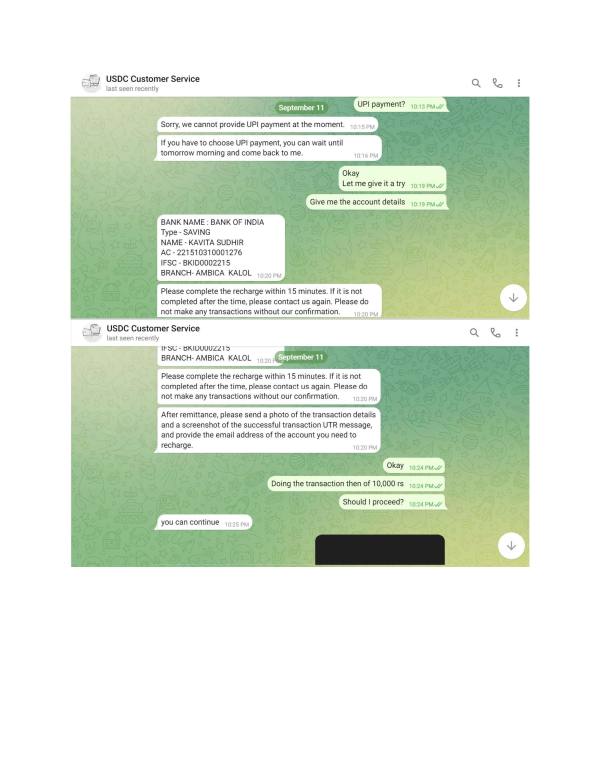

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees has not been disclosed in available documentation. Minimum Deposit Requirements: The broker has not clearly communicated minimum deposit amounts for different account types.

This makes it difficult for potential clients to plan their initial investment. Bonus and Promotional Offers: No specific bonus programs or promotional incentives have been identified in available marketing materials or user reports.

Tradeable Assets: The platform supports foreign exchange currency pairs, global stock indices, commodity futures, and individual equity securities across multiple international markets. Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs remains unclear from available sources.

This hinders transparent cost comparison with competitors. Leverage Ratios: Specific leverage offerings for different asset classes and account types have not been clearly communicated in accessible materials.

Platform Options: USDC Investment operates through a proprietary trading platform. However, detailed feature specifications and compatibility information are limited. Geographic Restrictions: Information about restricted countries or regional limitations has not been clearly outlined in available documentation.

Customer Support Languages: The range of supported languages for customer service has not been specified in accessible materials. This usdc investment review highlights the concerning lack of transparency in basic operational details that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

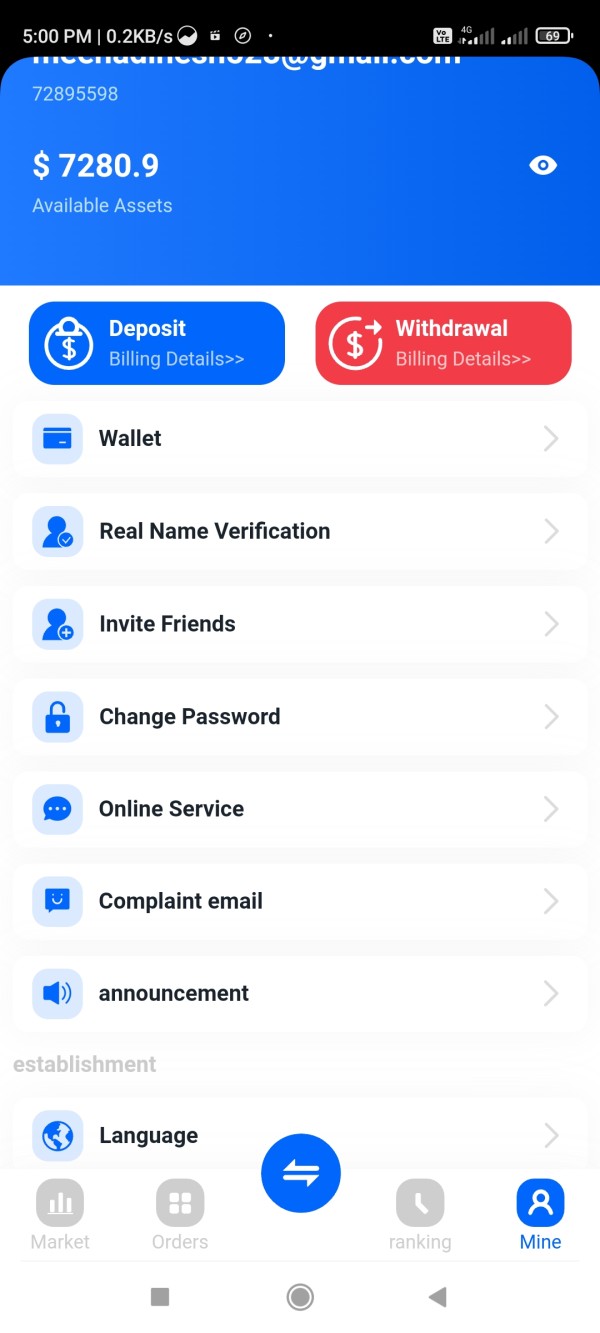

The account conditions offered by USDC Investment remain largely unclear. This contributes to our low rating in this category. Available information does not clearly outline the different account types, their features, or the benefits associated with each tier.

This lack of transparency makes it very difficult for potential clients to understand what they can expect from their trading relationship with the broker. Most reputable brokers provide detailed information about account minimums, fee structures, and special features such as Islamic accounts for religious compliance.

However, USDC Investment appears to have overlooked these basic disclosure requirements. The absence of clear account opening procedures and verification requirements further complicates the onboarding process for new clients. The limited information available suggests that the broker may offer standard retail trading accounts.

However, without specific details about leverage limits, margin requirements, or account protection measures, clients cannot make informed decisions. Furthermore, the lack of information about account maintenance fees, inactivity charges, or minimum trading requirements leaves potential clients unable to calculate the true cost of maintaining an account with USDC Investment.

This usdc investment review emphasizes the critical need for brokers to provide comprehensive account condition disclosures.

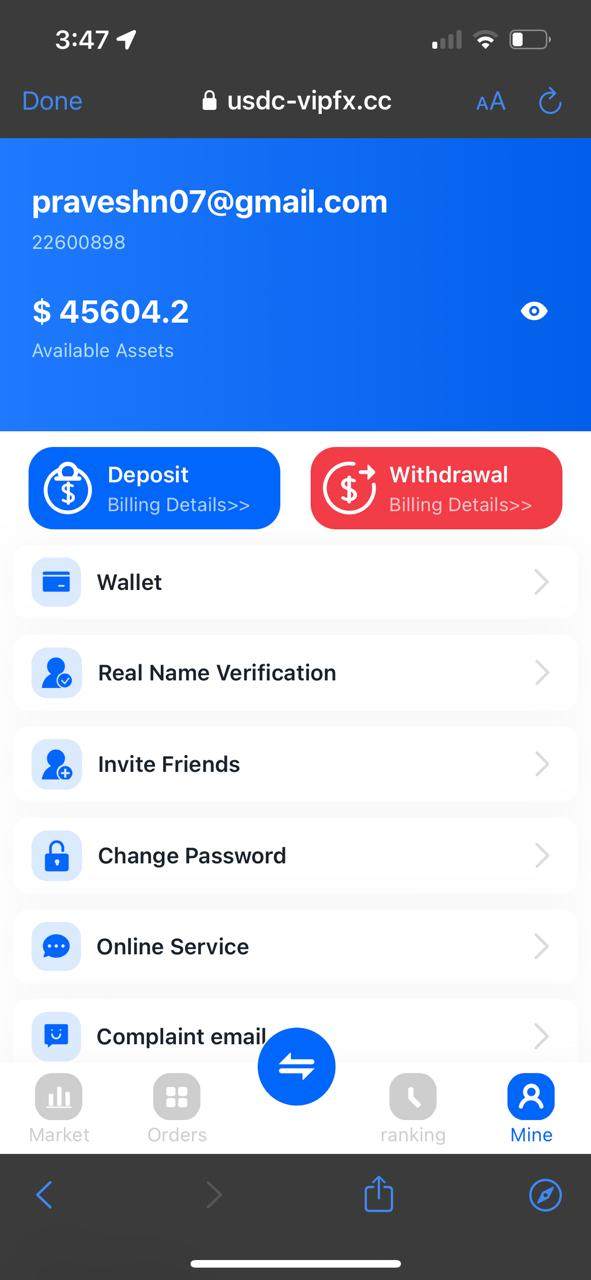

USDC Investment's proprietary trading platform represents both an opportunity and a concern for potential users. While developing custom trading software can offer unique features and optimized performance, the lack of detailed information about the platform's capabilities limits our ability to assess its true value.

The broker claims to support multiple asset classes through their platform. This could appeal to traders seeking diversified exposure. However, without specific details about charting capabilities, technical analysis tools, or automated trading support, it's difficult to determine whether the platform meets modern trading standards.

Most successful brokers complement their trading platforms with comprehensive educational resources, market analysis, and research tools. Unfortunately, available information does not indicate whether USDC Investment provides these essential support materials.

The absence of educational content is particularly problematic for newer traders who rely on broker-provided learning resources. The lack of information about third-party platform integration, such as MetaTrader compatibility, may limit the broker's appeal to experienced traders who prefer familiar interfaces. Additionally, without details about mobile trading capabilities or API access for algorithmic trading, the platform's versatility remains questionable.

Customer Service and Support Analysis

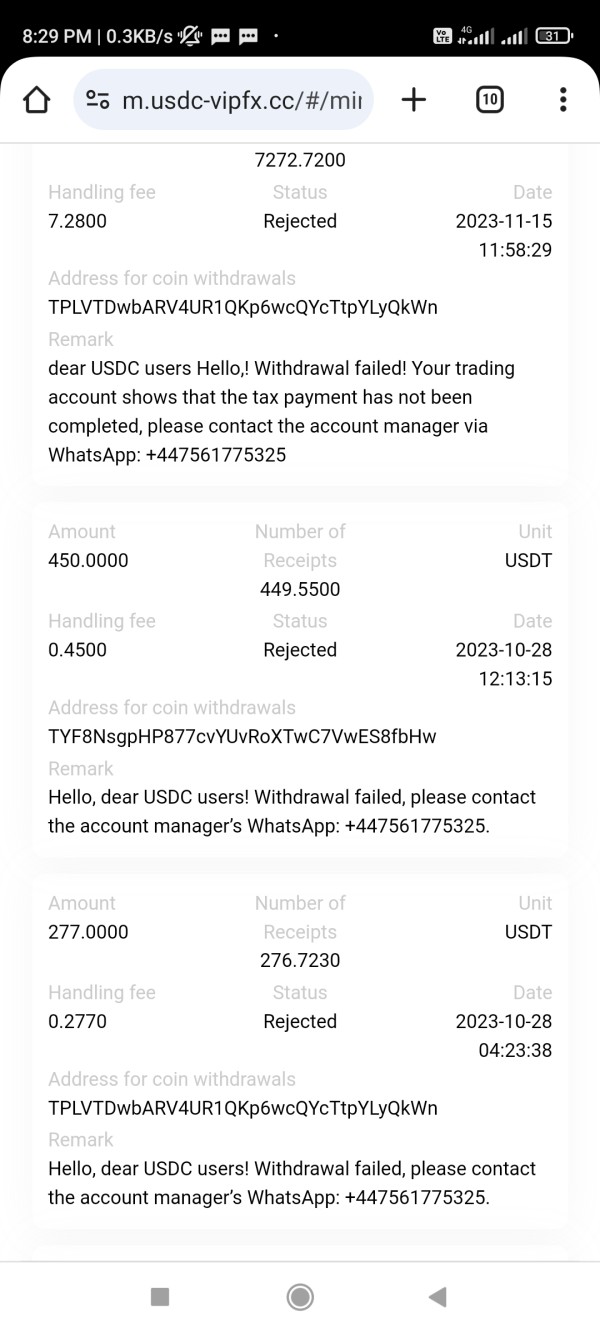

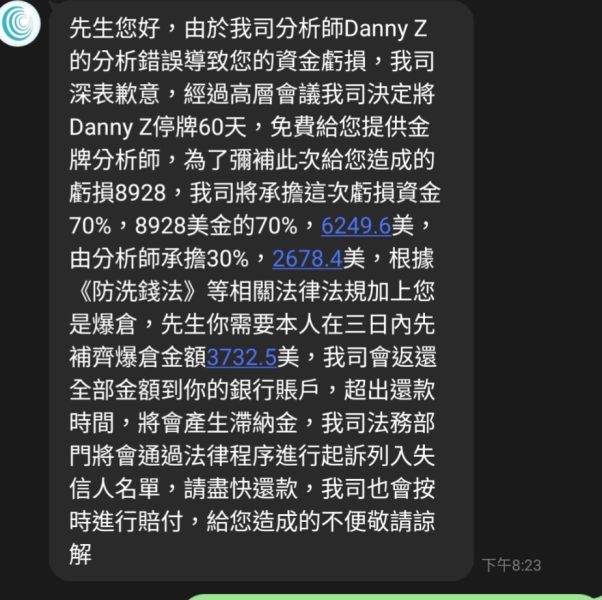

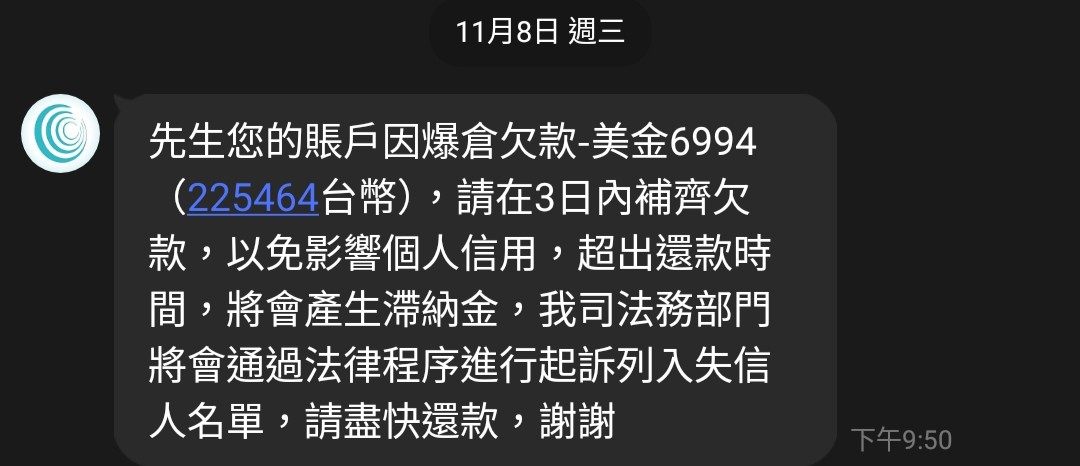

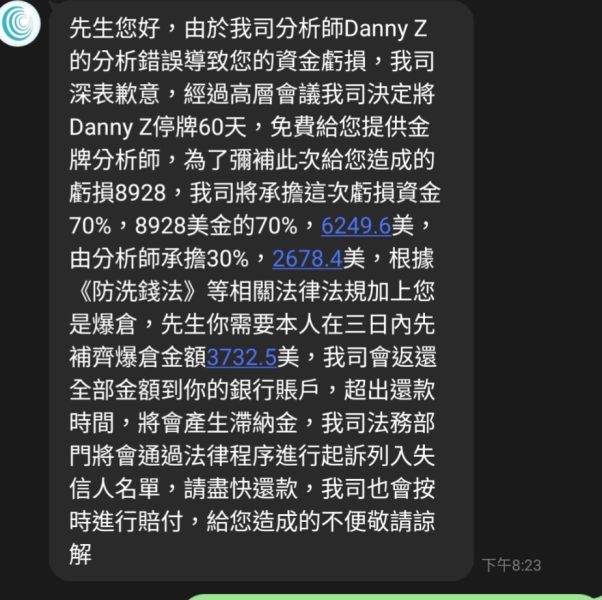

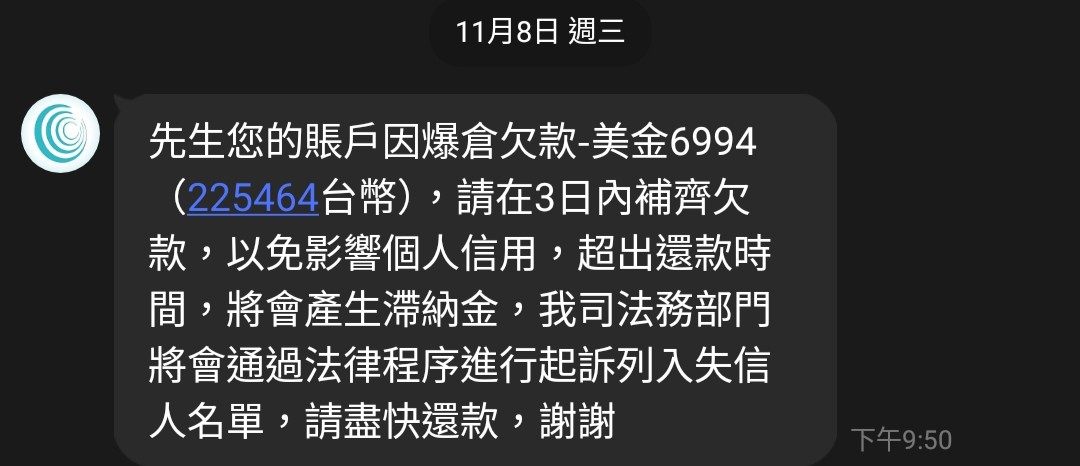

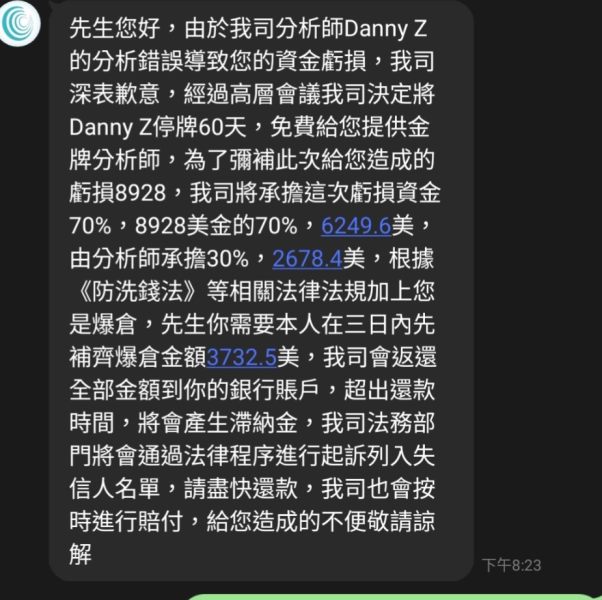

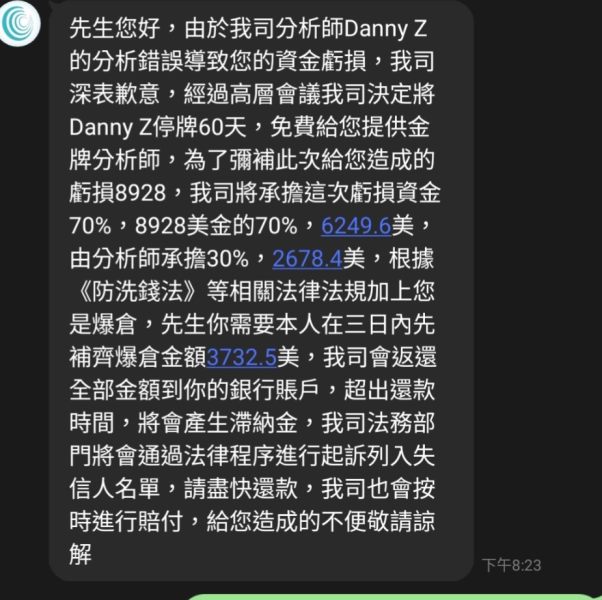

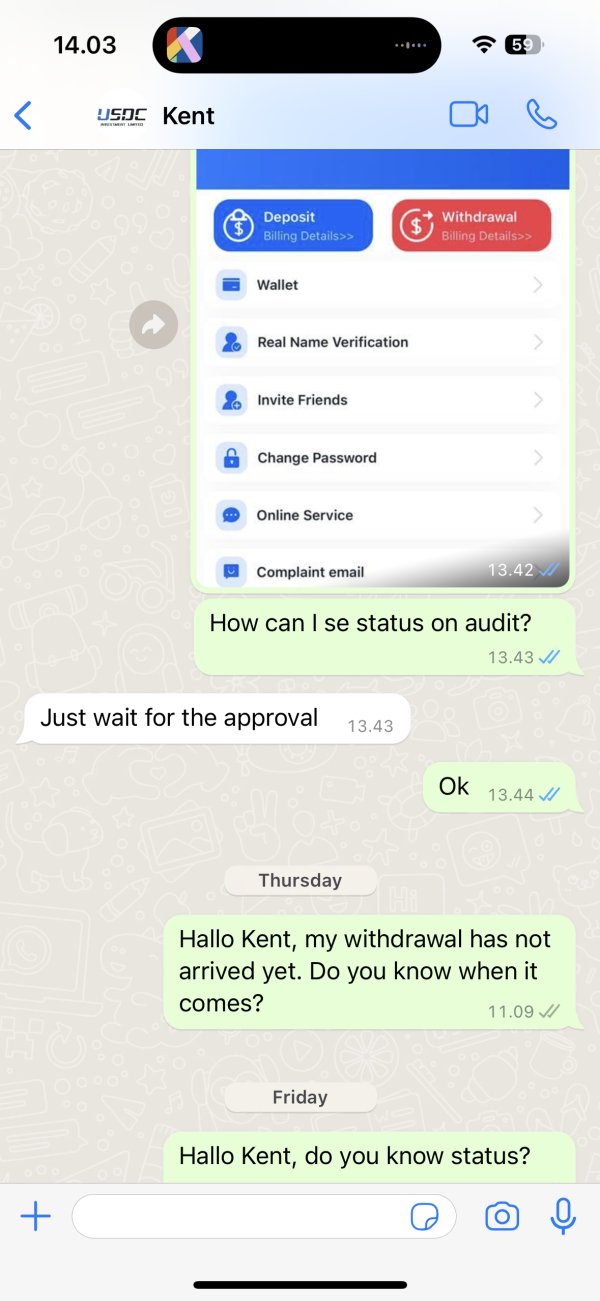

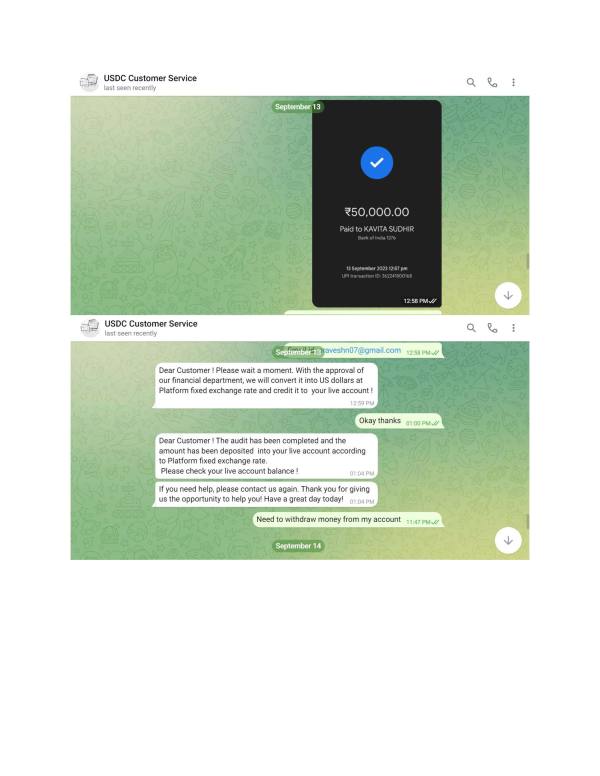

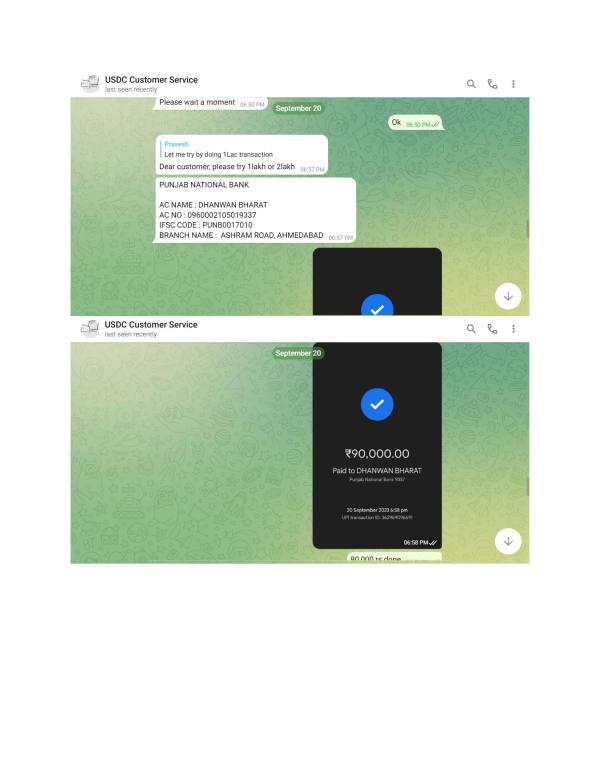

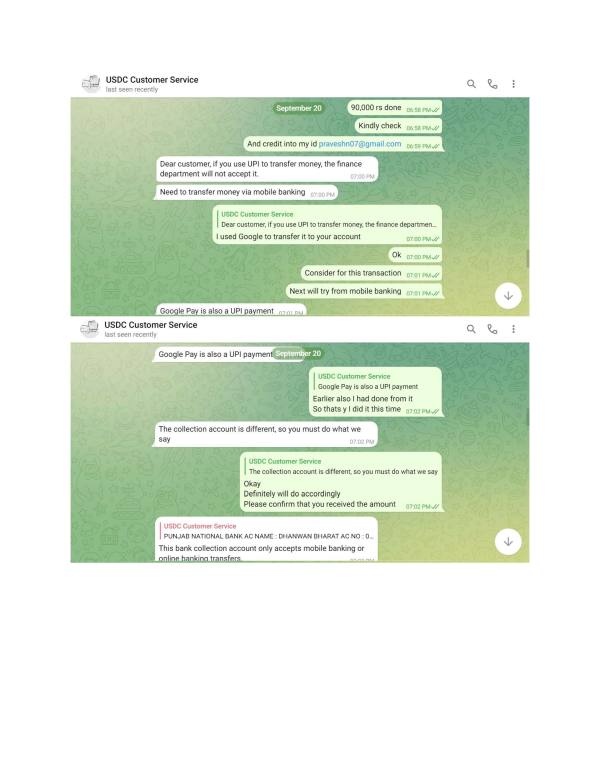

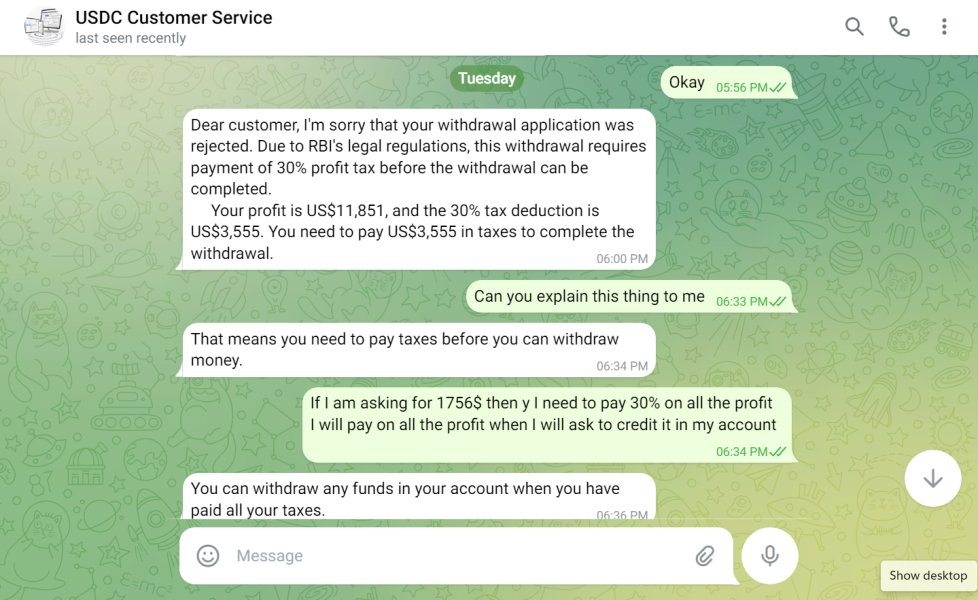

Customer service represents a critical weakness for USDC Investment. This is evidenced by the high volume of complaints relative to the broker's short operational history. Receiving 16 user complaints within a three-month period suggests systematic issues with service delivery and customer satisfaction management.

The available information does not specify the customer support channels offered, response time commitments, or service availability hours. This lack of transparency in support operations compounds the concerns raised by the complaint volume.

Effective customer service requires multiple communication channels, reasonable response times, and knowledgeable support staff capable of resolving complex trading-related issues. The absence of detailed information about multilingual support capabilities may also limit the broker's accessibility to international clients. In today's global trading environment, comprehensive language support is essential for serving diverse client bases effectively.

Without clear escalation procedures or complaint resolution processes, clients may find themselves without adequate recourse when issues arise. The high complaint volume combined with limited information about support infrastructure suggests that USDC Investment has not prioritized customer service excellence in their operational development.

Trading Experience Analysis

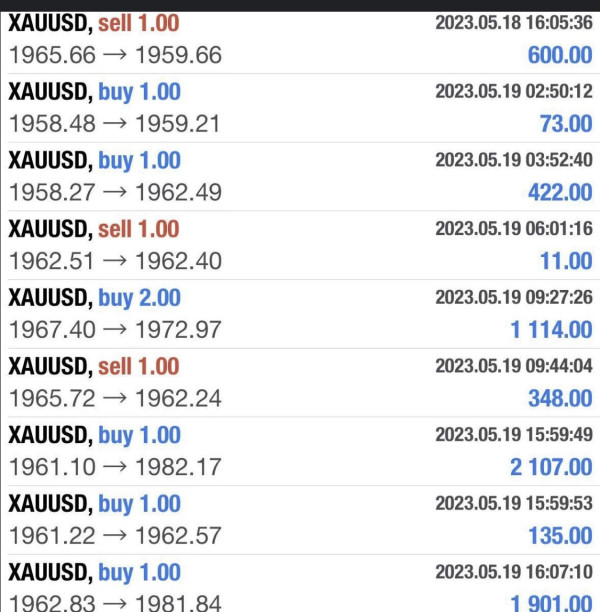

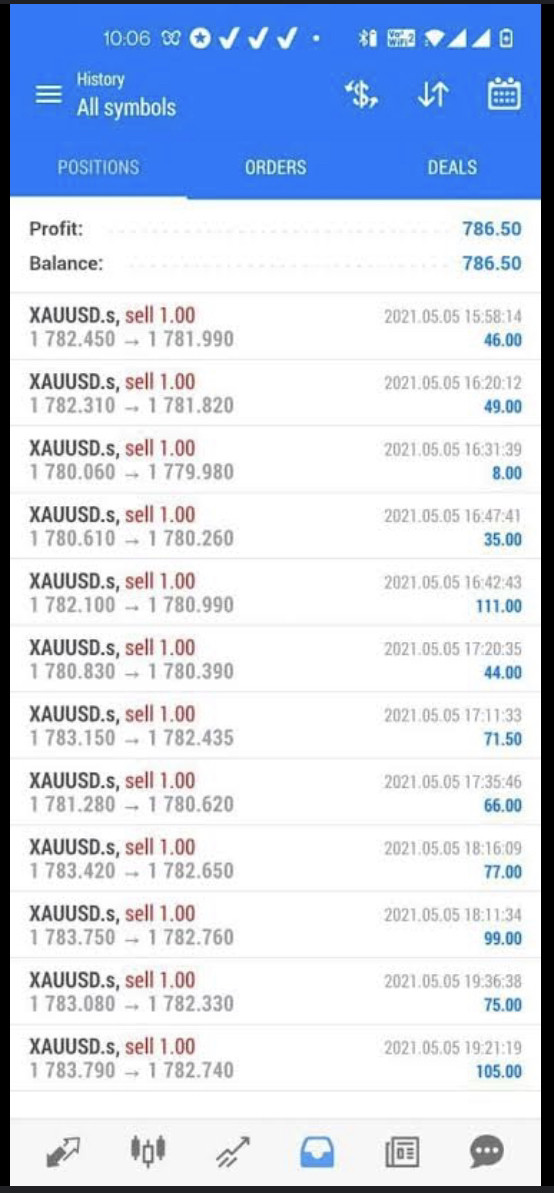

The trading experience offered by USDC Investment appears to be a mixed proposition based on available feedback and platform information. While the broker claims to offer access to multiple asset classes through their proprietary platform, the actual user experience seems to fall short of expectations based on the low overall ratings.

Platform stability and execution quality are fundamental requirements for successful trading. Yet specific performance metrics or user testimonials about these critical aspects are notably absent. The lack of detailed information about order execution speeds, slippage rates, or platform uptime statistics makes it impossible to assess the technical quality of the trading environment.

The proprietary platform approach, while potentially offering unique features, also presents risks related to reliability and functionality. Without the proven track record of established platforms like MetaTrader, users may encounter unexpected technical issues or limitations that could impact their trading performance.

Mobile trading capabilities and cross-device synchronization are increasingly important for modern traders. However, information about these features remains unclear. The absence of detailed platform specifications or user interface demonstrations further complicates the assessment of the overall trading experience quality in this usdc investment review.

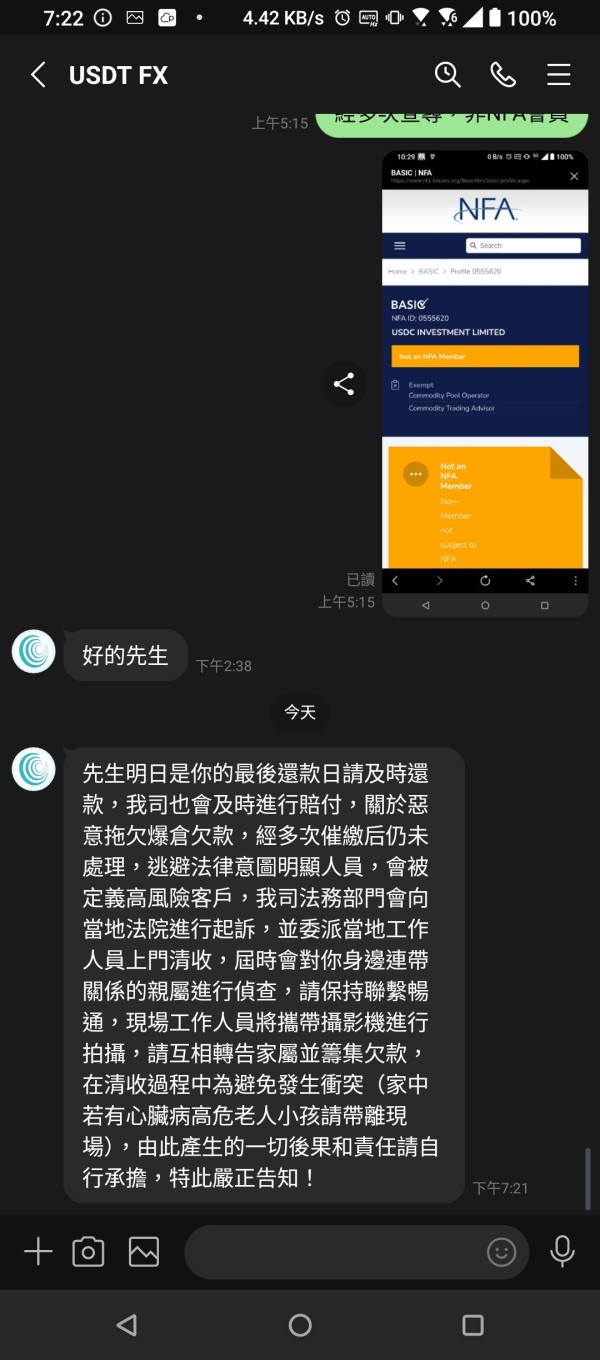

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of USDC Investment's operations. This is reflected in the extremely low WikiFX rating of 1.31 out of 10. This rating suggests significant issues with the broker's credibility and operational standards that potential clients should carefully consider.

The absence of clear regulatory information is particularly troubling in an industry where regulatory oversight provides essential client protections. Reputable brokers typically highlight their regulatory status prominently and provide detailed information about client fund segregation and protection measures.

USDC Investment's failure to provide this fundamental information raises serious questions about their commitment to industry best practices. The lack of transparency regarding company ownership, financial backing, and operational history further undermines confidence in the broker's stability. Without audited financial statements or regulatory filings, clients have no way to assess the company's financial health or long-term viability.

The high complaint volume relative to the broker's operational period suggests ongoing issues with service delivery and client satisfaction. These complaints, combined with the low trust ratings, indicate that USDC Investment faces significant challenges in establishing credibility within the trading community.

User Experience Analysis

The overall user experience with USDC Investment appears to be significantly below industry standards. This is evidenced by the low WikiFX rating and high complaint frequency. User satisfaction is typically reflected in multiple aspects of the trading relationship, from initial account opening through ongoing platform usage and customer support interactions.

The lack of detailed information about the registration and verification processes suggests that new users may encounter unclear or cumbersome onboarding procedures. Streamlined account opening with clear documentation requirements is a basic expectation in modern online trading.

Yet USDC Investment has not provided transparency in this area. Interface design and platform usability are critical factors in user satisfaction, particularly for traders who spend significant time analyzing markets and executing trades. Without detailed platform demonstrations or user interface screenshots, it's impossible to assess whether the proprietary platform meets contemporary design and functionality standards.

The high complaint volume suggests that users frequently encounter issues that require customer service intervention. This indicates potential problems with platform reliability, account management, or fund operations. These recurring issues likely contribute to overall user frustration and the poor ratings reflected in our usdc investment review assessment.

Conclusion

USDC Investment presents a concerning profile for potential forex and CFD traders seeking a reliable and transparent broker. While the company offers access to multiple asset classes through their proprietary platform, the numerous red flags and poor user feedback significantly outweigh any potential benefits.

The broker appears most suitable for traders willing to accept higher risks in exchange for access to diverse markets. However, we strongly advise thorough due diligence before proceeding. The lack of regulatory transparency, combined with poor user ratings and high complaint volumes, suggests that more established and regulated alternatives would better serve most traders' needs.

The primary advantages include multi-asset trading capabilities and a potentially unique proprietary platform. However, these are far overshadowed by significant disadvantages including extremely low trust ratings, lack of regulatory clarity, poor customer service indicators, and insufficient operational transparency.

These factors make USDC Investment a high-risk choice for serious traders.