Regarding the legitimacy of ROCK-WEST forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is ROCK-WEST safe?

Pros

Cons

Is ROCK-WEST markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MAIV LIMITED

Effective Date:

--Email Address of Licensed Institution:

support@rock-west.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.rock-west.com, https://www.rockwestprime.comExpiration Time:

--Address of Licensed Institution:

JUC Building, Office No. F7a, Providence Zone 18, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4376660Licensed Institution Certified Documents:

Is Rock-West A Scam?

Introduction

Rock-West is a forex broker that positions itself as a global player in the financial markets, offering a range of trading services, including forex, indices, commodities, and cryptocurrencies. Founded in 2019 and based in Seychelles, Rock-West claims to provide competitive trading conditions and a user-friendly platform. However, the influx of mixed reviews and regulatory scrutiny raises questions about its legitimacy and reliability. As the forex market can be rife with scams and unregulated entities, it is crucial for traders to carefully evaluate the brokers they choose to engage with. This article aims to provide an objective analysis of Rock-West, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on a comprehensive review of online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory framework surrounding a broker is vital for assessing its legitimacy and operational integrity. Rock-West operates under the oversight of the Seychelles Financial Services Authority (FSA), holding a retail forex license. However, the nature of offshore regulation often raises concerns regarding the quality of oversight and investor protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 044 | Seychelles | Verified |

While having a license from the Seychelles FSA suggests some level of compliance with local regulations, it is essential to note that the standards for offshore regulation are typically less stringent than those imposed by more reputable authorities like the FCA, ASIC, or CySEC. Furthermore, the lack of a robust regulatory framework means that traders have limited recourse in the event of disputes or financial issues. Reports of negative user experiences and withdrawal problems have surfaced, indicating potential lapses in compliance and operational integrity. Therefore, while Rock-West may be legally operating under its license, the quality and effectiveness of this regulation remain questionable.

Company Background Investigation

Rock-West is managed by Maiv Limited, a company registered in Seychelles. The broker claims to have been in operation for approximately two to five years, which raises questions about its stability and experience in the market. The absence of detailed information regarding the management team and their qualifications further complicates the transparency of the broker.

The company's website lacks comprehensive disclosures about its ownership structure and the backgrounds of its executives. Transparency is a cornerstone of trust in the financial services industry, and the limited information available about Rock-West's management raises red flags for potential investors. The use of stock images for staff profiles on their website adds to the suspicion, as this practice can indicate a lack of authenticity and may mislead clients regarding the broker's legitimacy.

Trading Conditions Analysis

Rock-West offers a range of trading accounts with varying conditions, including a low minimum deposit requirement of $25. However, the overall fee structure and trading conditions should be scrutinized closely.

| Fee Type | Rock-West | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0-2.0 pips |

| Commission Model | $0 on standard account | $5-10 per lot |

| Overnight Interest Range | Varies | Varies |

While the low spreads and absence of commissions on the standard account may appear attractive, the broker's hidden fees and lack of clarity regarding overnight interest rates could be problematic. The absence of detailed information about these costs can lead to unexpected charges, undermining the trading experience. Additionally, traders should be cautious of the high leverage offered (up to 2000:1), which, without proper risk management tools, can lead to significant losses.

Client Fund Safety

The safety of client funds is a critical consideration when evaluating a broker. Rock-West claims to implement measures for fund security, including segregated accounts for client deposits. However, the effectiveness of these measures is difficult to verify given the offshore regulatory context.

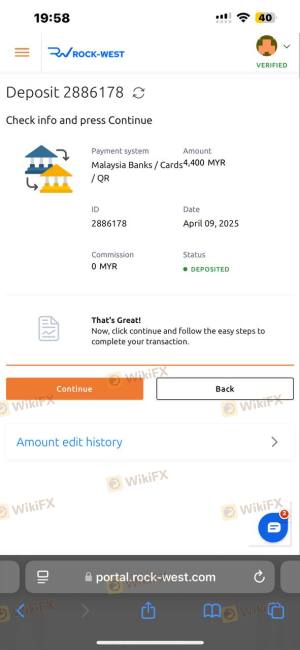

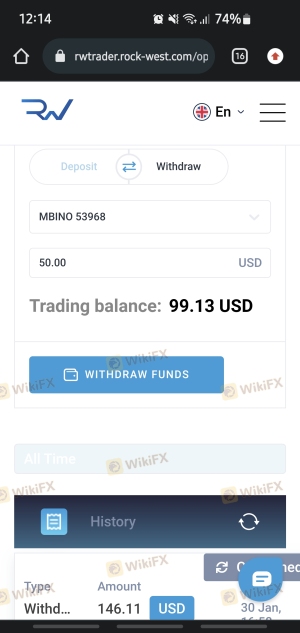

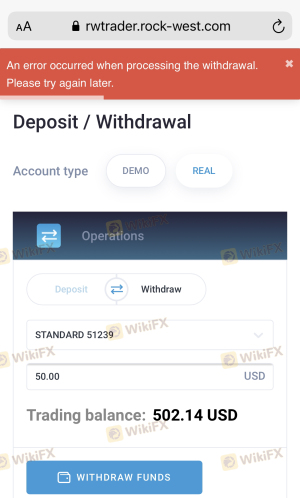

The absence of investor protection schemes, such as those provided by more reputable regulators, raises concerns about the safety of funds held with Rock-West. Historical complaints regarding withdrawal issues, including allegations of funds being inaccessible after successful trades, further exacerbate these concerns. Such incidents can indicate potential financial mismanagement or fraudulent practices, which are significant risks for traders.

Customer Experience and Complaints

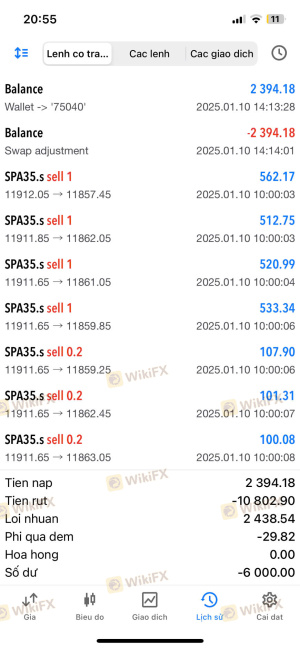

Customer feedback for Rock-West has been mixed, with numerous complaints highlighting issues related to account management and withdrawal processes. Common complaints include blocked withdrawals, unexplained profit deductions, and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/no response |

| Profit Deductions | High | No clarification provided |

| Customer Support | Medium | Limited availability |

For instance, one user reported being unable to withdraw their funds despite multiple requests, which raises concerns about the broker's operational transparency. Another trader claimed that their account was locked after they attempted to withdraw profits, indicating potential manipulation of account access. These patterns of complaints suggest systemic issues within the brokers operations, which could significantly affect user trust and satisfaction.

Platform and Trade Execution

The trading platform offered by Rock-West includes MetaTrader 5 and its proprietary Rock-West Trader application. While MetaTrader 5 is widely regarded for its robust features and user-friendly interface, concerns about execution quality and potential slippage have been raised.

Users have reported instances of delayed order execution and increased slippage during volatile market conditions. Such issues can adversely affect trading outcomes, particularly for those employing high-frequency trading strategies. Furthermore, any signs of platform manipulation, such as sudden changes in spreads or execution delays, warrant further scrutiny.

Risk Assessment

Engaging with Rock-West carries several risks that potential traders should consider carefully. The lack of stringent regulation, mixed customer feedback, and reported operational issues contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Fund Safety Risk | High | Reports of withdrawal issues and fund access |

| Customer Support Risk | Medium | Inconsistent responses and support availability |

To mitigate these risks, traders should conduct thorough due diligence, consider alternative brokers with stronger regulatory frameworks, and utilize risk management strategies to protect their investments.

Conclusion and Recommendations

In conclusion, while Rock-West presents itself as a competitive trading platform with attractive conditions, significant red flags suggest that it may not be a trustworthy broker. The combination of offshore regulation, mixed customer feedback, and reports of operational issues raises concerns about the safety and reliability of trading with Rock-West.

Traders should exercise caution and consider alternative options that offer stronger regulatory oversight and better customer support. For those seeking reliable trading experiences, brokers regulated by reputable authorities such as the FCA or ASIC are recommended. Ultimately, protecting ones capital and ensuring a secure trading environment should be a top priority for any trader.

Is ROCK-WEST a scam, or is it legit?

The latest exposure and evaluation content of ROCK-WEST brokers.

ROCK-WEST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROCK-WEST latest industry rating score is 4.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.