Is USDC Investment safe?

Pros

Cons

Is USDC Investment Safe or a Scam?

Introduction

USDC Investment is a relatively new player in the forex market, positioned as a brokerage firm offering a range of trading options across various asset classes, including forex, commodities, and cryptocurrencies. As with any financial entity, particularly in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The potential for scams and unregulated operations makes it imperative for investors to critically assess the legitimacy of trading platforms. This article aims to provide an objective evaluation of USDC Investment, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, and associated risks. Our investigation draws on multiple credible sources, including reviews and regulatory filings, to present a comprehensive overview of the broker's operations.

Regulation and Legitimacy

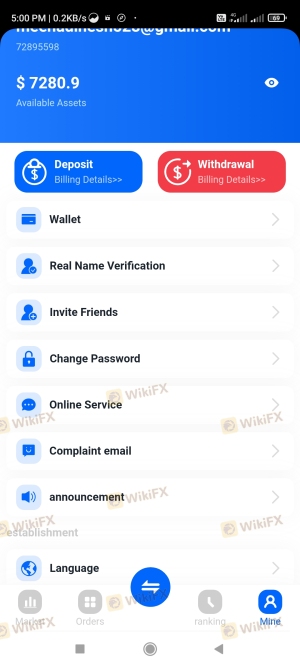

The regulatory status of a brokerage firm is a pivotal factor in determining its trustworthiness. USDC Investment claims to operate under the auspices of the National Futures Association (NFA) in the United States. However, a deeper investigation reveals that the broker lacks valid regulatory oversight, raising significant concerns about its legitimacy and operational integrity. Below is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0555620 | United States | Unverified |

The absence of proper regulation implies that USDC Investment does not adhere to the stringent standards set forth by recognized financial authorities. Such oversight is essential for ensuring the protection of client funds and maintaining transparency in trading practices. The lack of regulatory compliance not only exposes traders to higher risks but also raises questions about the broker's operational practices and commitment to ethical trading. Therefore, it is crucial for traders to exercise caution when considering USDC Investment, as the absence of regulation significantly diminishes the safety of trading with this broker.

Company Background Investigation

USDC Investment is a relatively new entity in the forex brokerage landscape, having been established within the past year. However, specific details regarding its ownership structure and operational history remain ambiguous. The company claims to be based in the United States, yet there is limited verifiable information available about its physical location or corporate governance. The management team behind USDC Investment lacks publicly accessible profiles that could provide insights into their expertise and experience in the financial sector.

Transparency is a critical component of trust in the financial industry, and the lack of detailed information about USDC Investment's management raises red flags. Traders should be wary of engaging with brokers that do not provide clear and accessible information regarding their operational history and leadership team. This opacity can often indicate a lack of accountability and may suggest potential issues with the broker's reliability. As a result, it is essential for traders to remain vigilant and consider the implications of partnering with a broker that does not prioritize transparency.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital for assessing the overall cost of trading. USDC Investment presents a proprietary trading platform that allows for a variety of trading options. However, the specifics regarding their fee structure are not readily available, which complicates the decision-making process for potential clients. Below is a comparison of core trading costs:

| Fee Type | USDC Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not available | 1.5% - 3.0% |

The lack of transparency surrounding trading costs is concerning. Traders may find themselves facing unexpected fees or unfavorable trading conditions, which could significantly impact their profitability. Moreover, the absence of a demo account further complicates matters, as potential clients cannot test the platform or its trading conditions before committing real funds. This lack of clarity regarding fees and trading conditions is a significant factor that traders should consider when evaluating whether USDC Investment is safe or a potential scam.

Customer Funds Security

The safety of customer funds is paramount in the forex trading environment. USDC Investment claims to implement various security measures to safeguard client assets. However, the absence of regulatory oversight raises questions about the effectiveness of these measures. Key aspects of fund security include:

Segregation of Funds: It is unclear whether USDC Investment segregates client funds from its operational funds, a practice that is standard among regulated brokers to protect client assets in the event of insolvency.

Investor Protection: There is no information available regarding any investor protection schemes or insurance policies that would safeguard client funds in the event of a broker failure.

Negative Balance Protection: The broker has not disclosed whether it offers negative balance protection, which is crucial for preventing clients from losing more than their invested capital.

The lack of transparency regarding these critical safety measures poses a significant risk to traders. Historical issues related to fund security, such as withdrawal difficulties and unresponsive customer service, have further compounded concerns about USDC Investment's reliability. Therefore, potential clients must carefully weigh these factors when considering whether to engage with this broker.

Customer Experience and Complaints

Analyzing customer feedback is essential for gauging the overall reliability of a brokerage firm. Reviews of USDC Investment reveal a troubling pattern of complaints, particularly regarding withdrawal issues and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Limited |

| Misleading Marketing | High | Unclear |

Many clients have reported difficulties in withdrawing their funds, often facing requests for additional deposits or fees before their withdrawals are processed. This practice is a common red flag associated with scam brokers, as it can indicate a deliberate attempt to delay or deny access to client funds. Additionally, customer service has been criticized for being inadequate, with many users reporting long wait times and unhelpful responses.

One notable case involved a user who was initially able to generate profits but faced a barrage of withdrawal obstacles, ultimately leading to their funds being locked after they refused to pay additional fees. Such experiences raise significant concerns about the legitimacy of USDC Investment and whether it is indeed a safe platform for trading.

Platform and Trade Execution

The performance of a trading platform is crucial for traders, impacting their ability to execute trades efficiently. USDC Investment offers a proprietary platform, but user reviews indicate that it may not meet industry standards for stability and performance. Traders have expressed concerns regarding order execution quality, including instances of slippage and rejected orders. These issues can significantly hinder trading strategies and lead to financial losses.

Moreover, the lack of transparency regarding the platform's operational capabilities raises further questions. Potential clients should be wary of brokers that do not provide clear information about their platform's performance metrics, as this could indicate a lack of reliability. Signs of potential platform manipulation, such as frequent technical issues or unexplained discrepancies in trade executions, can also serve as red flags for traders considering USDC Investment.

Risk Assessment

Engaging with any brokerage carries inherent risks, and USDC Investment is no exception. Below is a risk assessment summarizing key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation increases vulnerability. |

| Financial Risk | High | Withdrawal issues and hidden fees can lead to losses. |

| Operational Risk | Medium | Platform stability concerns may affect trading. |

Given the high-risk profile associated with USDC Investment, traders should exercise extreme caution. It is advisable to conduct thorough research and consider alternative, regulated brokers that offer greater transparency and security for client funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that USDC Investment raises significant red flags that warrant caution. The lack of regulatory oversight, ambiguous trading conditions, and troubling customer feedback indicate that this broker may not be a safe option for traders. Potential clients should be particularly wary of the withdrawal issues and poor customer service experiences reported by existing users.

For traders seeking a reliable and safe trading environment, it is advisable to consider alternative brokers that are well-regulated, transparent, and have a proven track record of positive customer experiences. Brokers such as Pepperstone, FP Markets, and XM are recommended alternatives that offer robust regulatory frameworks and excellent customer support. In light of the findings, it is clear that USDC Investment is not a safe choice for forex trading, and potential clients should proceed with caution.

Is USDC Investment a scam, or is it legit?

The latest exposure and evaluation content of USDC Investment brokers.

USDC Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USDC Investment latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.