IFAFX Review 2

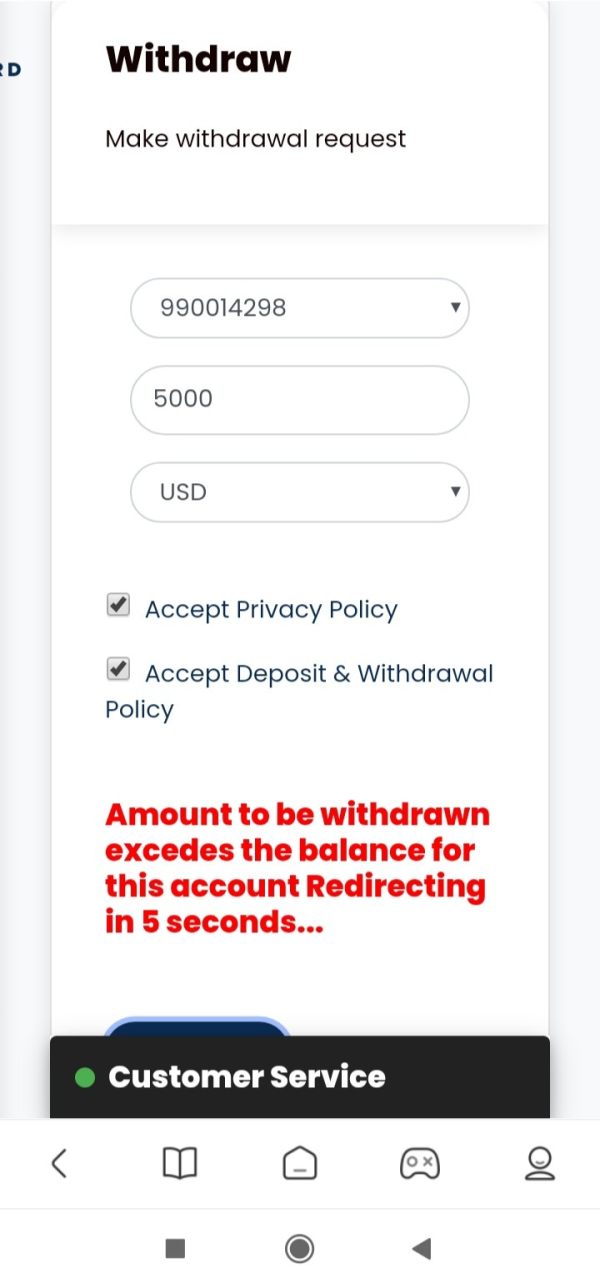

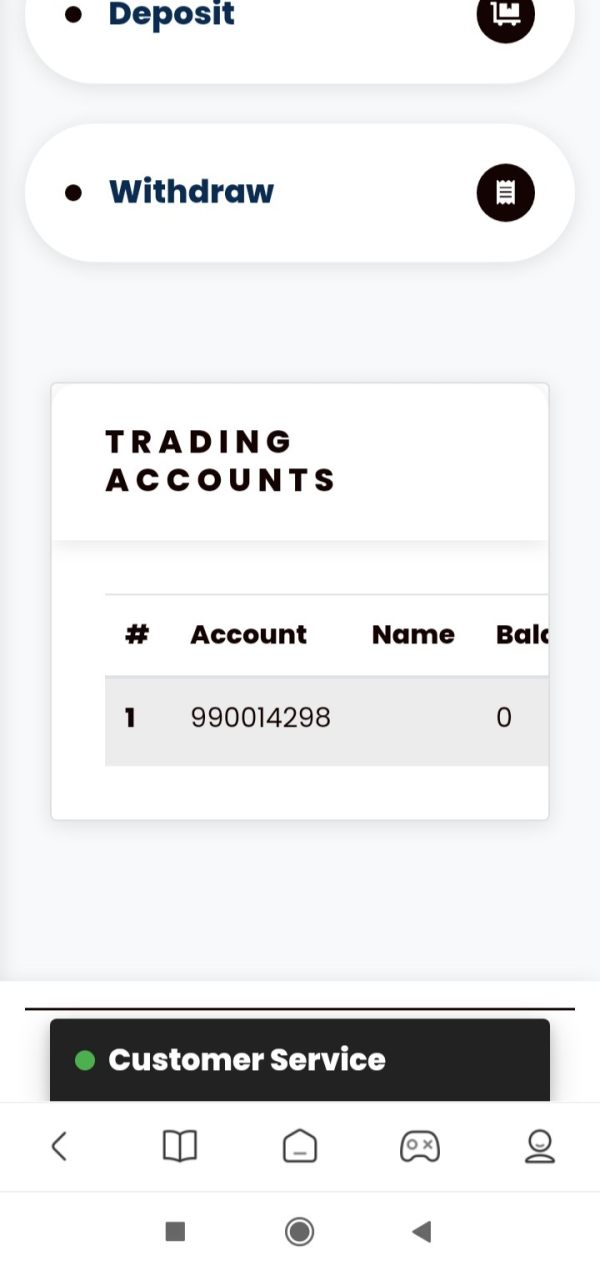

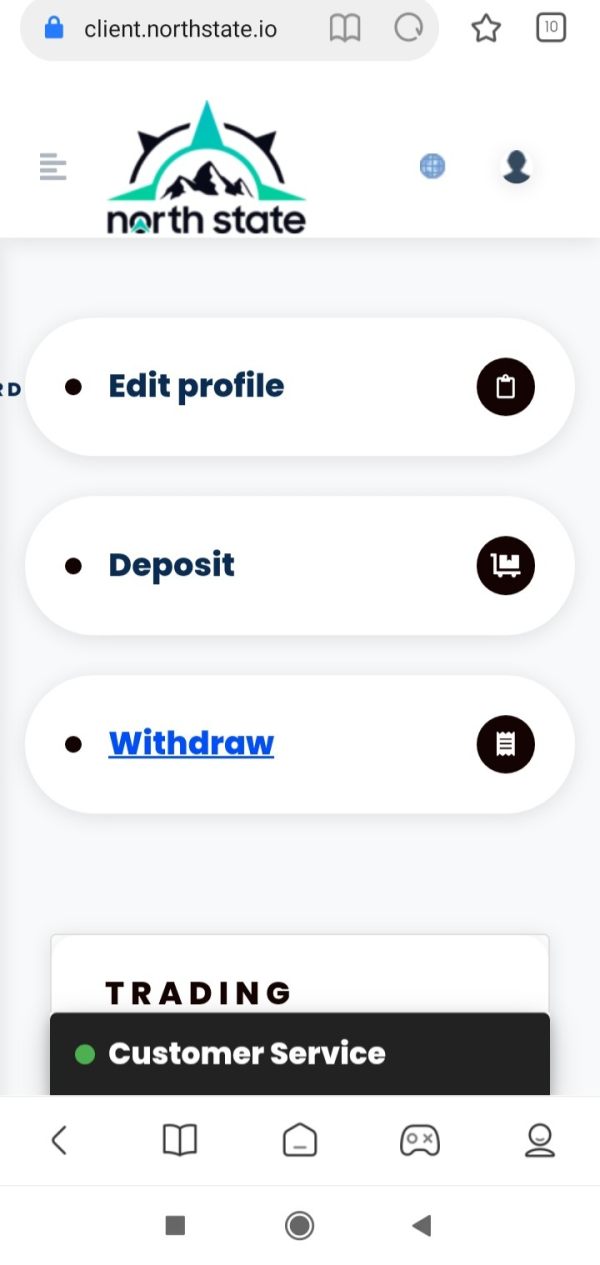

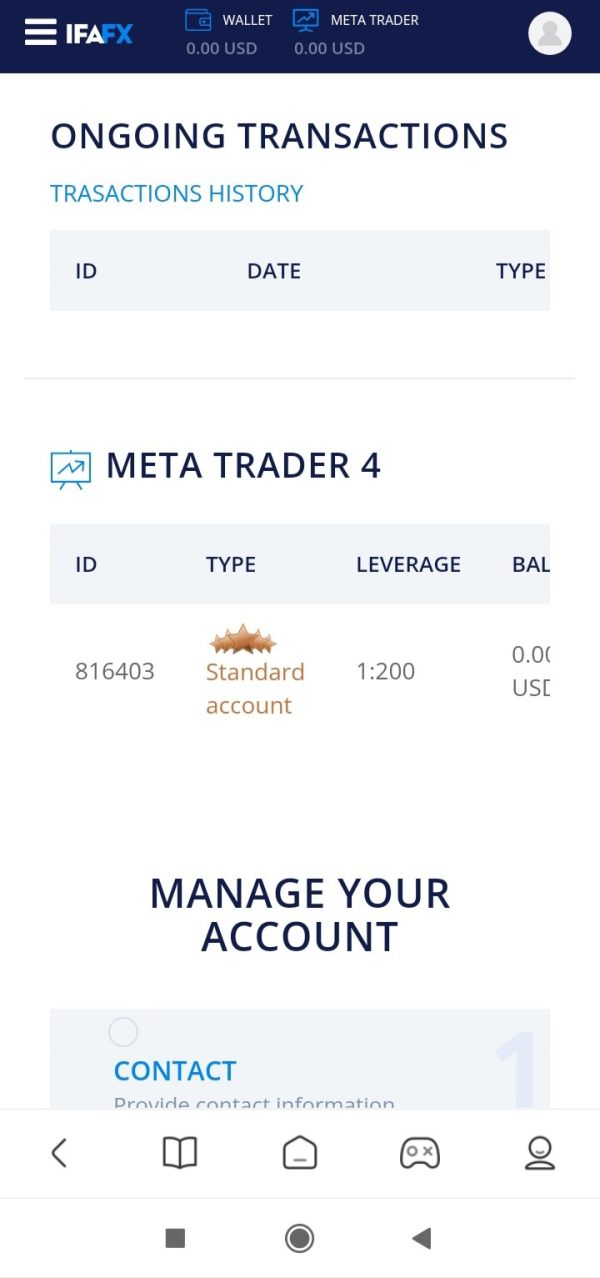

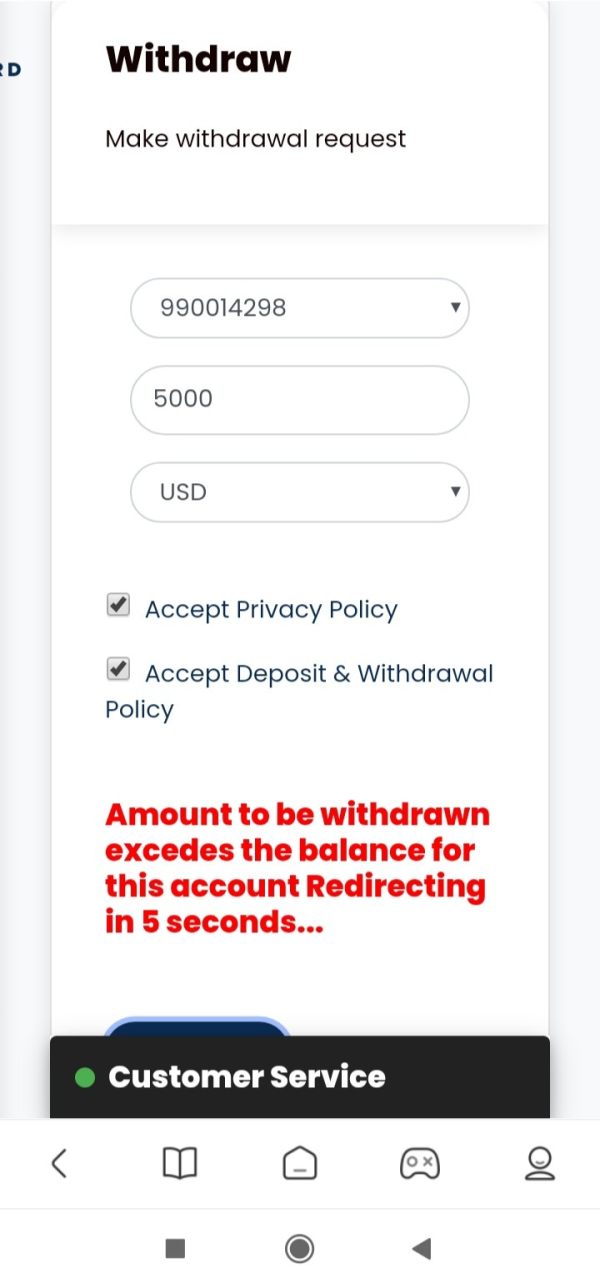

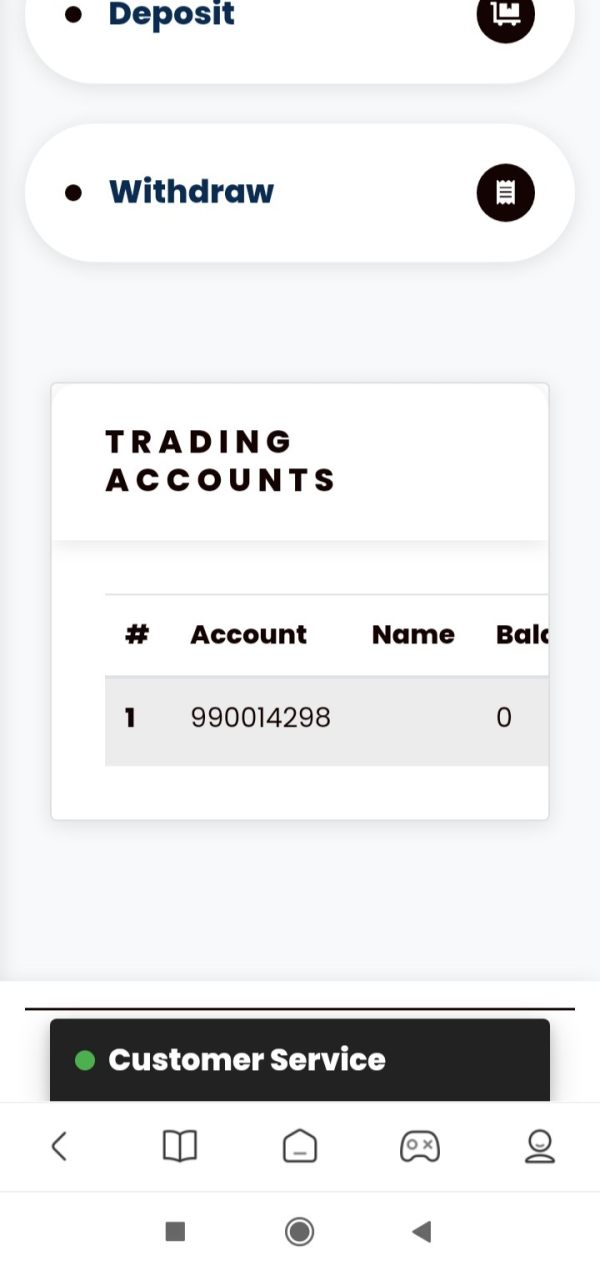

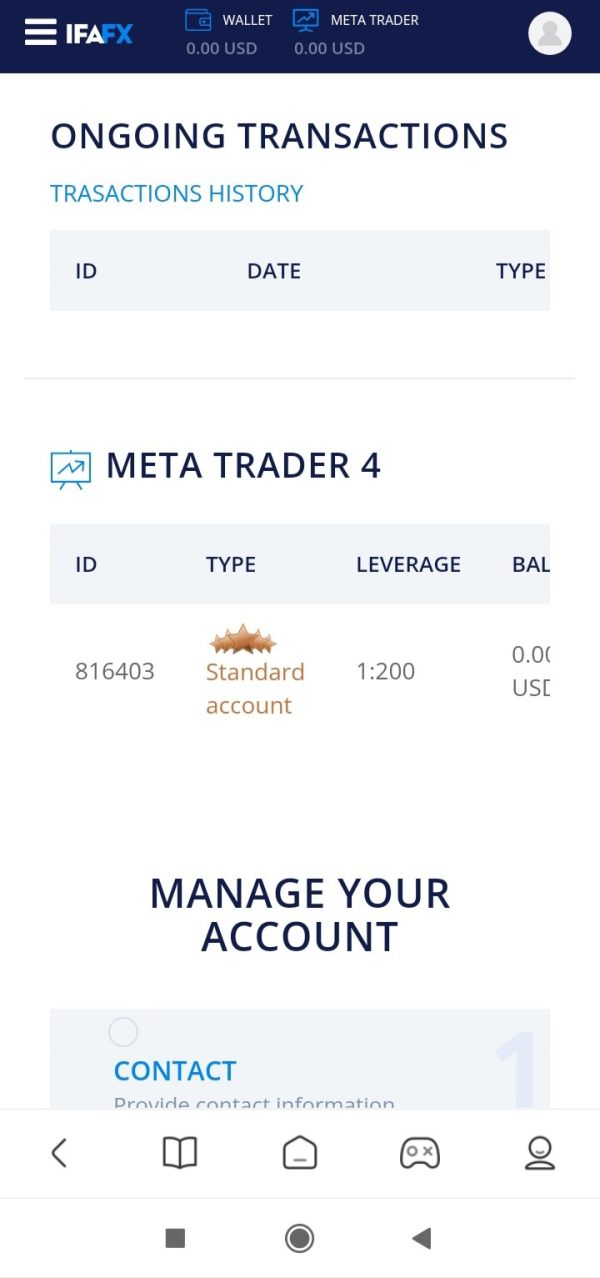

They did not approve my bonus of more than $600. I deposited $200.

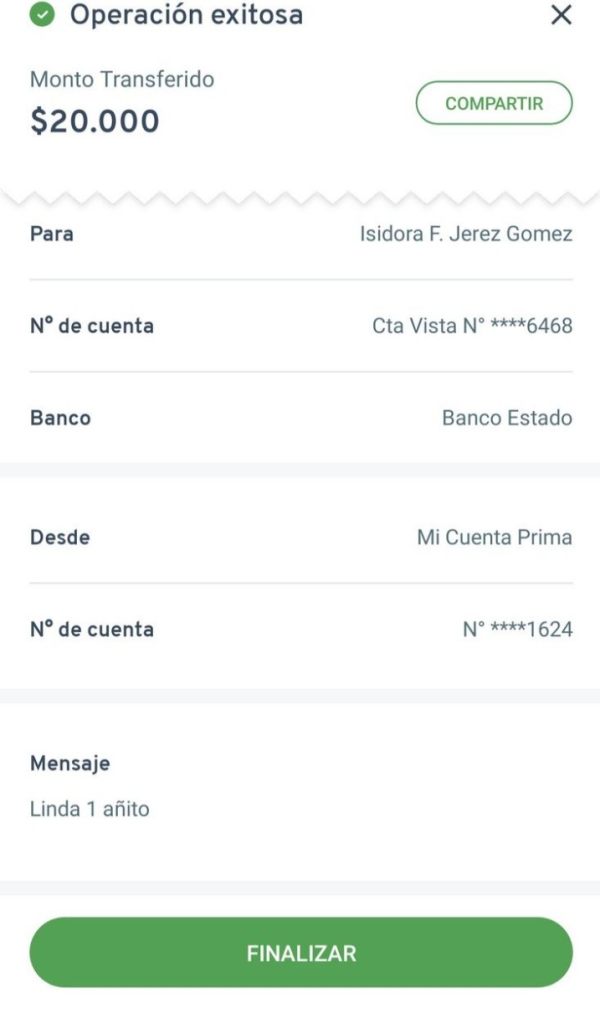

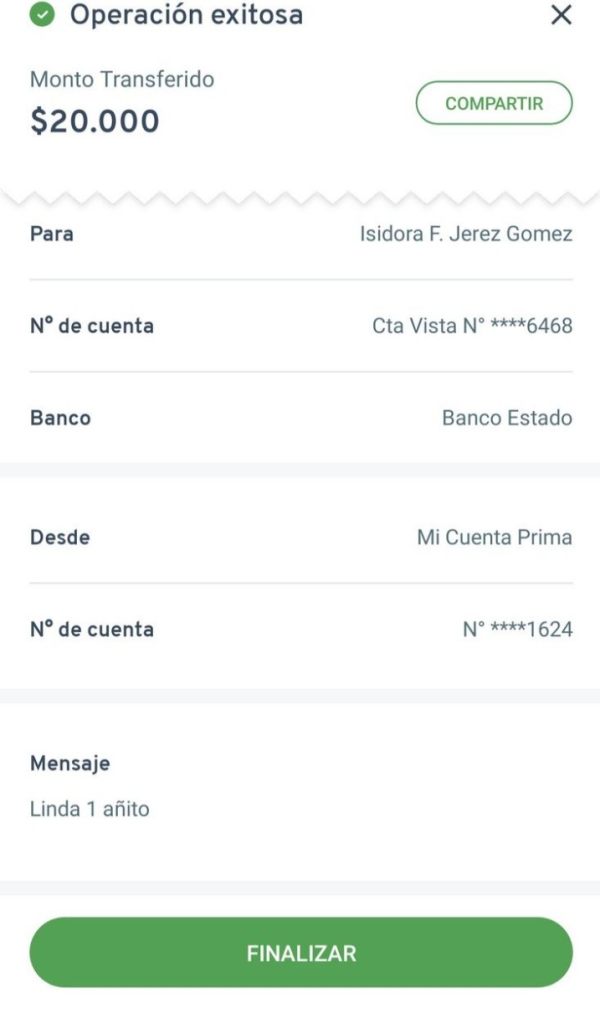

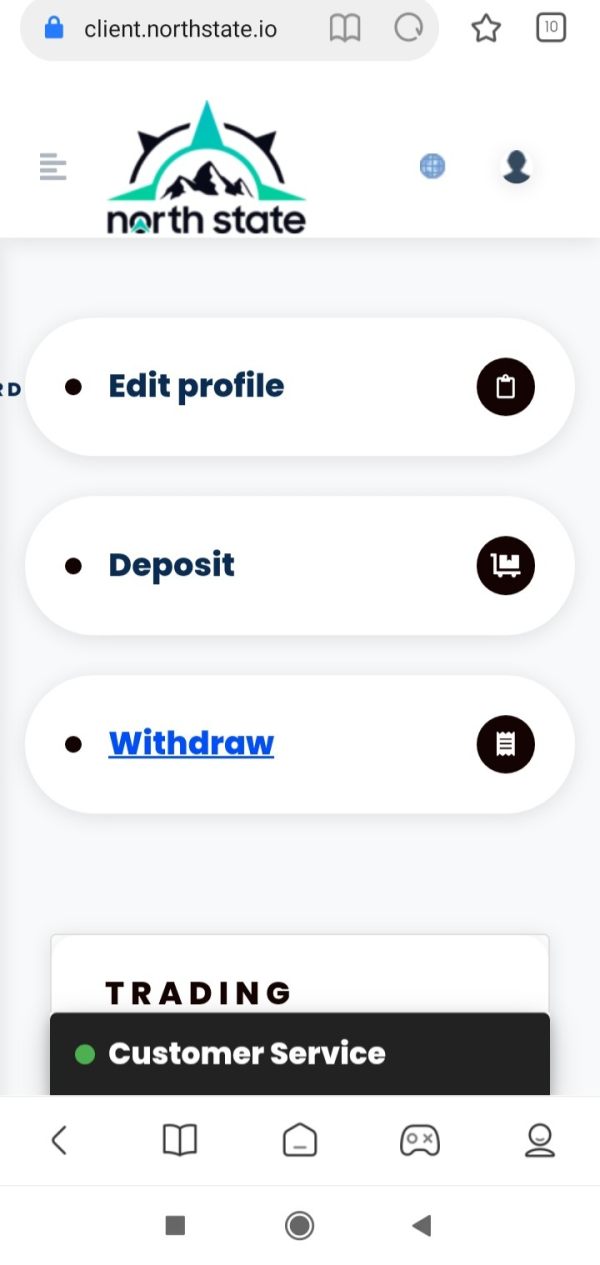

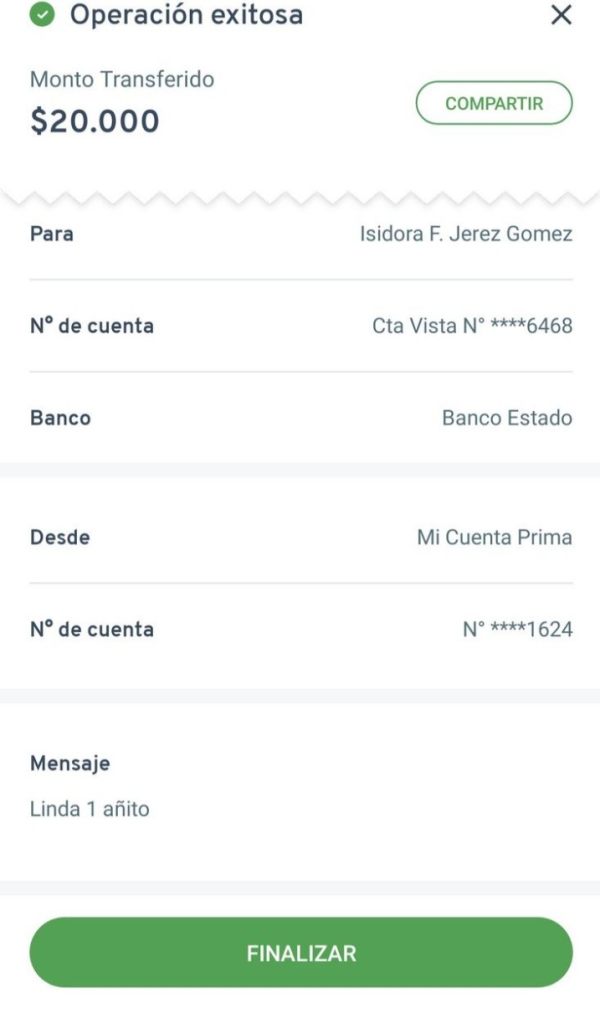

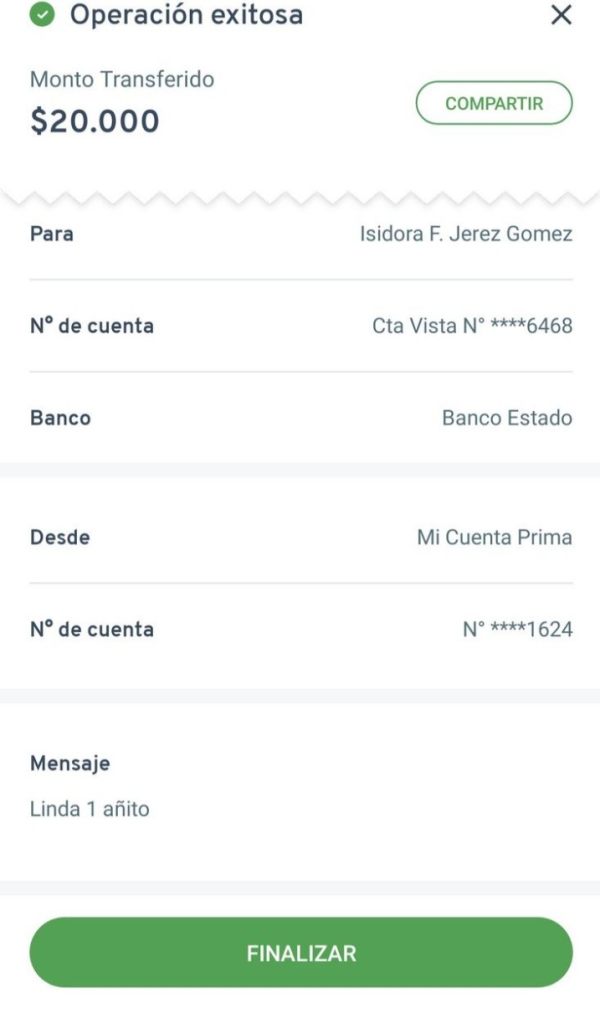

I deposited 20.000 pesos but they never showed it on my board.

IFAFX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

They did not approve my bonus of more than $600. I deposited $200.

I deposited 20.000 pesos but they never showed it on my board.

This Ifafx review looks at the American Funds Income Fund of America Class F-1, which is known as IFAFX. It's a mutual fund that focuses on providing income and capital growth through stock investments. Based on data from Fidelity Investments and Morningstar, IFAFX has a Net Asset Value of $26.19 as of July 3, 2025. The fund puts money into common stocks with the goal of giving investors both current income and long-term capital growth.

The fund shows moderate performance within its category. However, it has not performed as well as broader market indices like the S&P 500. Performance data shows that a $10,000 investment would have grown to $19,963 as of May 31, 2025. The same investment in the S&P 500 Index would have reached $33,535. The fund targets investors who want a balanced approach between making income and growing capital. It especially appeals to those looking for professional management of stock portfolios.

Regional Entity Differences: The information for IFAFX mainly covers the fund as offered through major investment platforms like Fidelity Investments. Investors should do their own research to understand specific terms and conditions. These may vary across different distribution channels and regions.

Review Methodology: This evaluation uses publicly available information from established financial data providers. These include Fidelity Investments and Morningstar. Due to limited comprehensive data availability, this review may not cover all potential factors. These factors could influence investment decisions.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account terms and conditions not detailed in available sources |

| Tools and Resources | N/A | Investment tools and research resources not specified in current data |

| Customer Service and Support | N/A | Customer service quality metrics not available in source materials |

| Trading Experience | N/A | Trading platform functionality not detailed in available information |

| Trust and Reliability | N/A | Comprehensive regulatory and safety information not provided |

| User Experience | N/A | User satisfaction data not available in current source materials |

IFAFX represents the American Funds Income Fund of America Class F-1. It's managed by one of the most established mutual fund families in the United States. The fund operates with a clear investment mandate focusing on equity securities that provide both dividend income and potential for capital appreciation. According to Morningstar's analysis framework, the fund is evaluated based on Process and People pillars. However, specific establishment dates and detailed company background information are not specified in available materials.

The fund's investment approach centers on building a diversified portfolio of common stocks. These stocks are selected for their income-generating potential and growth prospects. This strategy positions IFAFX as a moderate allocation option within the broader universe of equity income funds. The fund's management team employs fundamental analysis and research-driven security selection. However, detailed information about specific investment processes remains limited in current source materials.

Investment Structure and Approach: IFAFX operates as a traditional open-end mutual fund. This allows investors to purchase and redeem shares at the daily NAV. The fund's Class F-1 designation typically indicates specific fee structures and distribution arrangements. However, detailed cost breakdowns are not provided in available sources. This Ifafx review notes that the fund falls within the Global Moderate Allocation category according to Morningstar's classification system.

Regulatory Oversight: Specific regulatory information and oversight details are not mentioned in available source materials. This requires investors to conduct independent verification through official fund documents.

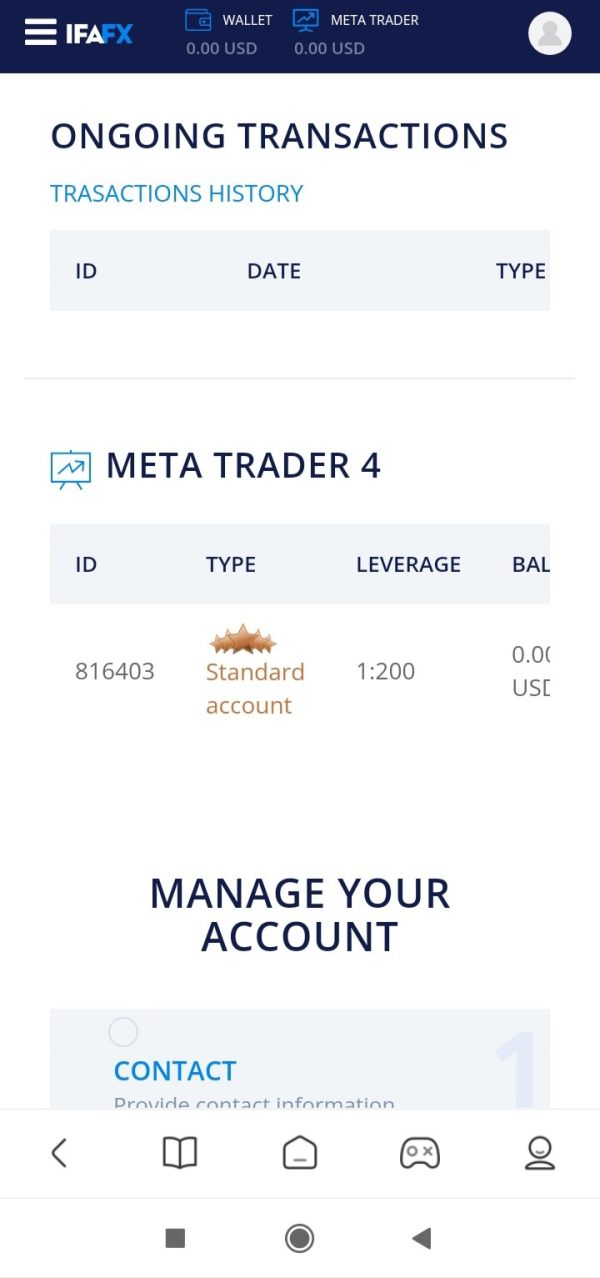

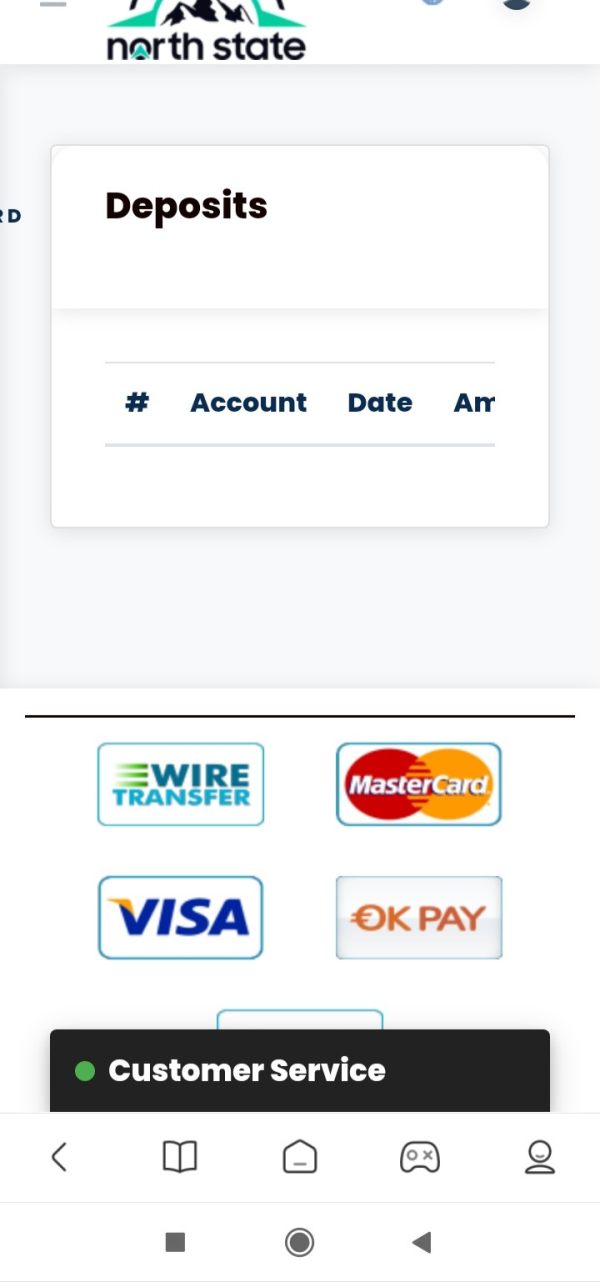

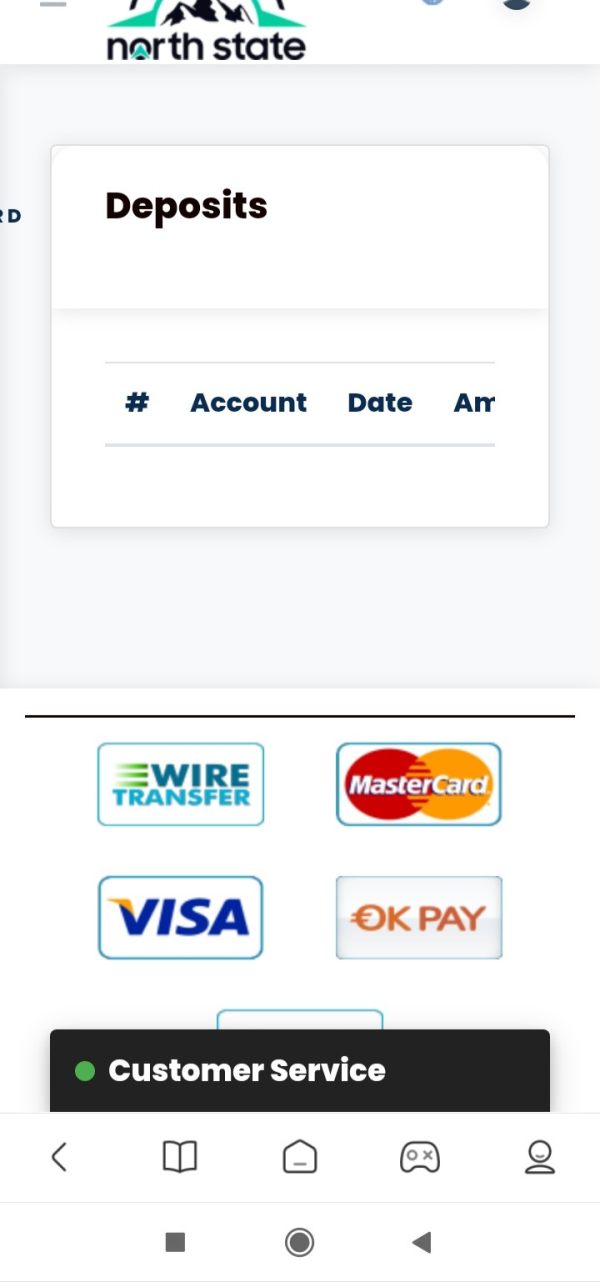

Deposit and Withdrawal Methods: Information regarding specific methods for investing in and redeeming shares from IFAFX is not detailed in current source materials.

Minimum Investment Requirements: Minimum investment thresholds for IFAFX are not specified in available information sources.

Promotional Offers: Details about any promotional offers or incentive programs are not mentioned in current source materials.

Available Assets: The fund primarily focuses on common stock investments. It targets securities that provide income and capital appreciation potential. According to available data, IFAFX maintains exposure to equity markets through carefully selected stock positions.

Cost Structure: While the fund operates as Class F-1 shares, specific expense ratios, management fees, and other cost components are not detailed in available source materials. This represents a significant information gap for potential investors conducting due diligence.

Leverage Ratios: Information regarding leverage utilization is not specified in current source materials.

Platform Options: The fund is available through major investment platforms including Fidelity Investments. However, details about other distribution channels are not comprehensively covered.

Geographic Restrictions: Regional availability and restrictions are not specified in available information sources.

Customer Service Languages: Supported languages for customer service are not mentioned in current source materials.

This Ifafx review identifies significant information gaps. Potential investors should address these through direct consultation with fund distributors and official prospectus documents.

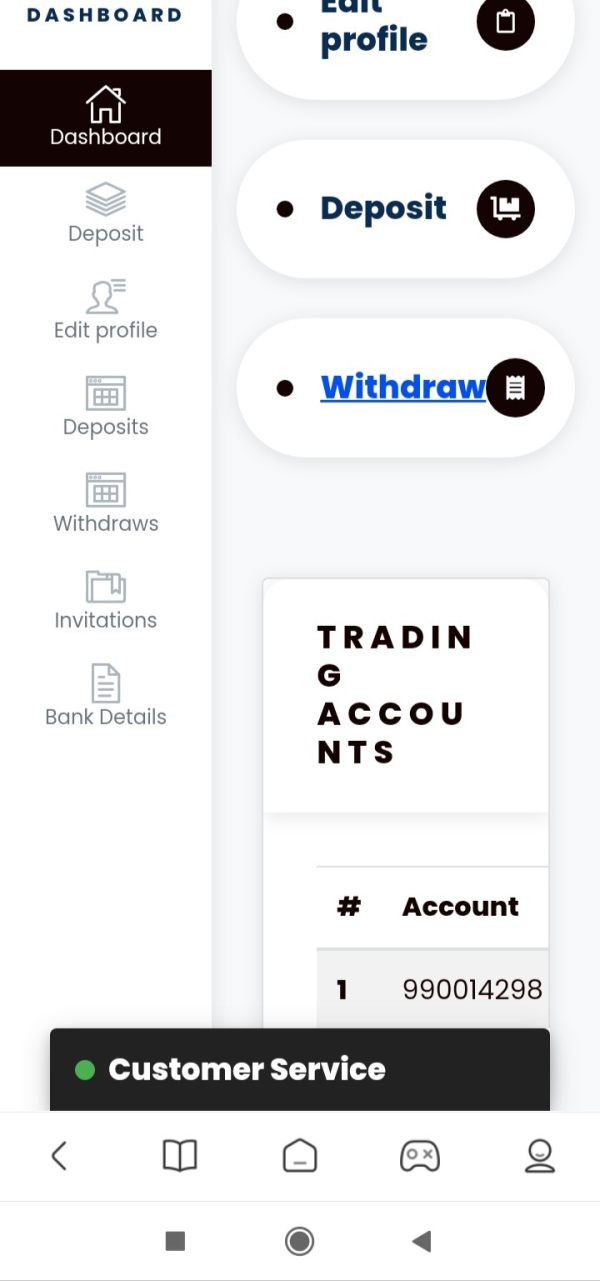

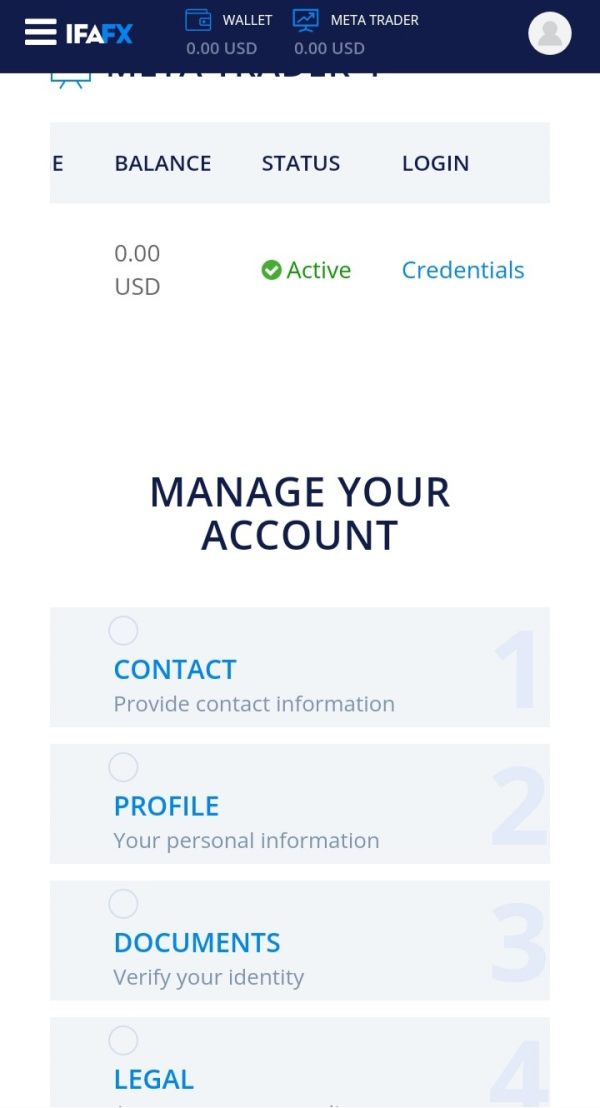

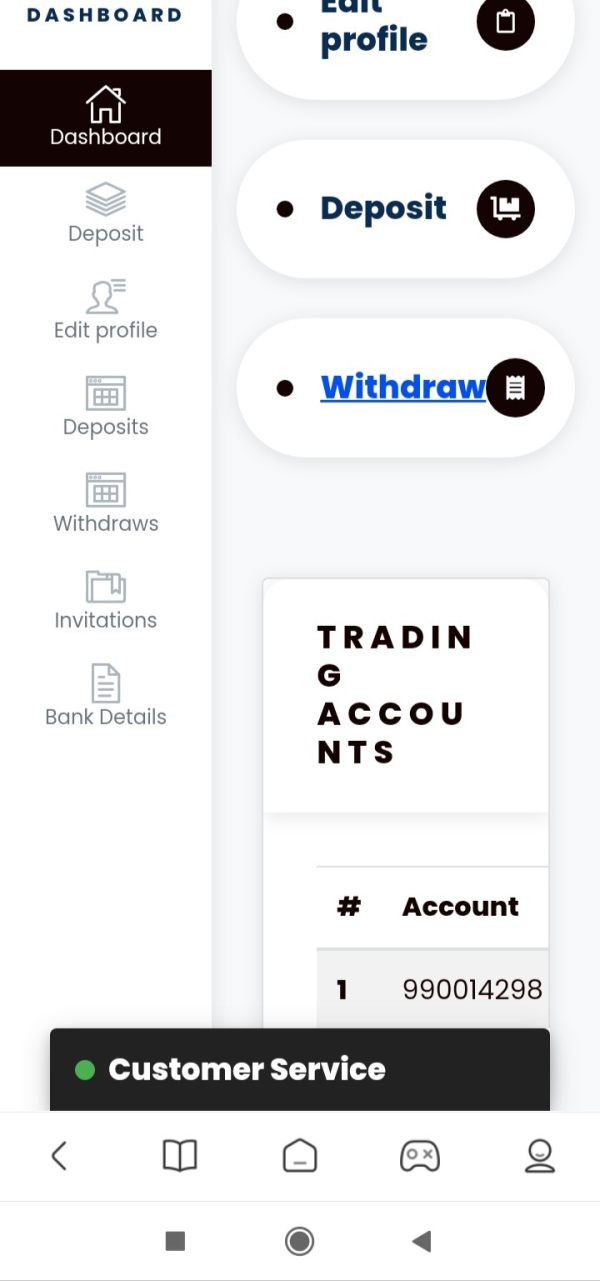

The account conditions for IFAFX remain largely unspecified in available source materials. This presents challenges for comprehensive evaluation. Traditional mutual fund structures typically offer various account types including individual taxable accounts, retirement accounts, and institutional arrangements. However, specific options for IFAFX are not detailed in current information sources.

Minimum investment requirements represent a critical factor for potential investors. Yet this information is not provided in available materials. Most Class F-1 mutual fund shares historically target specific investor segments, often requiring substantial minimum investments or particular distribution arrangements. However, IFAFX-specific thresholds remain unclear.

The account opening process for IFAFX likely follows standard mutual fund industry practices. This involves completion of application forms, identity verification, and investment suitability assessments. However, specific procedural details, required documentation, and processing timeframes are not outlined in current source materials.

Special account features such as systematic investment plans, automatic reinvestment options, or Islamic-compliant investment alternatives are not mentioned in available information. This Ifafx review notes that potential investors must seek detailed account condition information directly from authorized distributors or official fund documentation. This helps them make informed decisions about investment suitability and operational requirements.

Available information regarding trading tools and analytical resources for IFAFX investors is severely limited in current source materials. Modern mutual fund platforms typically provide portfolio analysis tools, performance tracking capabilities, and research resources. However, specific offerings for IFAFX remain unspecified.

Research and analysis resources represent crucial components of informed investment decision-making. Yet details about available market research, fund analysis reports, or economic commentary are not provided in current information sources. Morningstar's analysis framework mentions Process and People pillars for evaluation, suggesting some analytical coverage exists. However, comprehensive details are not available.

Educational resources for IFAFX investors are not detailed in available materials. Contemporary investment platforms often provide educational content including market insights, investment strategy guides, and fund-specific information. However, specific offerings related to IFAFX are not documented in current sources.

Automated investment features such as systematic investment plans, rebalancing tools, or portfolio optimization resources are not mentioned in available information. The absence of detailed tool and resource information represents a significant gap for investors seeking comprehensive platform capabilities and support services.

Customer service information for IFAFX is notably absent from available source materials. This prevents comprehensive evaluation of support quality and accessibility. While Fidelity Investments appears as a distribution platform, specific customer service arrangements, support channels, and service quality metrics are not detailed in current information sources.

Response time expectations and service availability schedules are not specified in available materials. Professional investment platforms typically offer multiple contact methods including phone support, online chat, and email assistance. However, specific arrangements for IFAFX investors remain unclear.

Service quality assessments require user feedback and performance metrics that are not provided in current source materials. The absence of customer satisfaction data, complaint resolution procedures, and service level commitments represents a significant information gap. This affects potential investors evaluating platform reliability.

Multi-language support capabilities and international service arrangements are not mentioned in available information. Global investors often require specialized support services. Yet specific provisions for IFAFX customers are not documented in current sources, limiting evaluation of service accessibility for diverse investor populations.

The trading experience for IFAFX investors cannot be comprehensively evaluated based on available source materials. Mutual fund trading typically involves daily NAV pricing and settlement procedures. However, specific execution details, order processing capabilities, and transaction management features are not outlined in current information sources.

Platform stability and performance metrics are not provided in available materials. Modern investment platforms require reliable infrastructure for order processing, account management, and information access. Yet specific performance standards and reliability measures for IFAFX trading are not documented.

Order execution quality represents a critical factor for mutual fund investors. This particularly applies to pricing accuracy, settlement efficiency, and transaction confirmation processes. However, specific execution quality metrics and performance standards are not detailed in current source materials for this Ifafx review.

Mobile platform capabilities and digital trading features are not mentioned in available information. Contemporary investors increasingly rely on mobile access for account management, trading execution, and portfolio monitoring. However, specific mobile platform features for IFAFX investors remain unspecified in current sources.

Trust and reliability assessment for IFAFX faces significant limitations due to insufficient regulatory and operational information in available source materials. While the fund operates under the American Funds brand, specific regulatory registrations, compliance frameworks, and oversight arrangements are not detailed in current information sources.

Fund safety measures including investor protection protocols, asset segregation procedures, and regulatory compliance standards are not specified in available materials. These factors represent fundamental considerations for investment safety and regulatory compliance. Yet comprehensive details remain unavailable for thorough evaluation.

Company transparency regarding fund operations, investment processes, and performance reporting cannot be fully assessed based on current information sources. While basic NAV and performance data are available through platforms like Fidelity Investments, detailed operational transparency measures are not documented.

Industry reputation and track record information for IFAFX management and the broader American Funds organization are not comprehensively covered in available source materials. Historical performance data shows moderate results compared to benchmark indices. However, detailed reputation metrics and industry standing assessments are not provided.

Overall user satisfaction metrics for IFAFX are not available in current source materials. This prevents comprehensive evaluation of investor experience quality. User feedback, satisfaction surveys, and experience ratings that typically inform platform assessments are not documented in available information sources.

Interface design and platform usability cannot be evaluated based on available materials. Modern investment platforms require intuitive navigation, clear information presentation, and efficient transaction processing. However, specific user interface features for IFAFX access are not detailed in current sources.

Registration and account verification processes are not outlined in available information. Streamlined onboarding procedures represent important user experience factors. Yet specific requirements, processing times, and verification steps for IFAFX investment are not documented.

Fund operation experience including transaction processing, statement delivery, and account management capabilities are not detailed in current source materials. The absence of user experience data limits comprehensive evaluation of platform functionality and investor satisfaction levels.

This Ifafx review reveals significant information limitations that constrain comprehensive evaluation of the American Funds Income Fund of America Class F-1. While basic performance data indicates moderate results with a current NAV of $26.19, the absence of detailed operational information, regulatory specifics, and user feedback data prevents thorough assessment. This affects evaluation of investment suitability and platform quality.

The fund appears suitable for investors seeking professional equity management with income and capital appreciation objectives. It particularly appeals to those comfortable with moderate allocation strategies. However, the substantial information gaps regarding account conditions, costs, customer service, and regulatory oversight require potential investors to conduct extensive additional research. This research should be done through official fund documents and authorized distributors before making investment decisions.

FX Broker Capital Trading Markets Review