Trade FX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive trade fx review examines Trade FX as a forex broker in 2025. It provides potential traders with essential insights into the platform's offerings and limitations. Based on available information from industry sources and user feedback, Trade FX presents a mixed picture for prospective clients. While Pro Trade FX offers basic forex trading services and some sources suggest TradeFX operates as a legitimate platform, significant concerns arise from the lack of transparent regulatory information and detailed trading conditions.

The platform appears to target forex traders seeking alternative trading venues. It particularly focuses on those exploring different broker options in the competitive forex market. However, our analysis reveals several areas where information transparency could be improved. User feedback from various platforms shows inconsistent experiences, with some traders expressing concerns about customer service quality and platform reliability. The absence of clear regulatory oversight and detailed fee structures raises questions about the broker's commitment to transparency and trader protection.

Important Notice

This trade fx review is based on publicly available information, user feedback, and industry reports as of 2025. Trading conditions and regulatory status may vary across different jurisdictions. Potential clients should conduct independent verification of all broker claims. The forex trading industry is subject to varying regulatory requirements in different regions, and what may be acceptable in one jurisdiction might not meet standards in another.

Our evaluation methodology incorporates user testimonials, industry analysis, and available platform information. However, the limited availability of comprehensive regulatory and operational data means some assessments are based on incomplete information. Traders should exercise due diligence and consider consulting with financial advisors before making trading decisions.

Rating Framework

Broker Overview

Trade FX operates in the competitive forex brokerage space. Specific details about its establishment date and corporate background remain unclear in available documentation. The company appears to focus primarily on providing forex trading services to retail clients, though comprehensive information about its business model and operational structure is limited in public sources. According to industry reports, the platform offers access to foreign exchange markets, though the specific scope of services and target market positioning requires further clarification.

The broker's business approach seems centered on forex and related derivative instruments. It caters to individual traders seeking exposure to currency markets. However, the lack of detailed information about company history, ownership structure, and operational milestones presents challenges for potential clients seeking comprehensive due diligence. This trade fx review finds that while the platform claims to offer trading services, the absence of clear corporate transparency may concern experienced traders who prioritize regulatory clarity and operational accountability.

Information about the specific trading platform technology, asset coverage beyond basic forex pairs, and regulatory oversight remains limited in available sources. The platform's positioning in the market appears to target retail forex traders, though without detailed information about minimum account requirements, leverage offerings, or specific trading conditions, it's difficult to determine the exact trader demographic the broker serves most effectively.

Regulatory Status: Available information does not clearly specify the primary regulatory jurisdictions under which Trade FX operates. This represents a significant transparency concern for potential clients seeking regulated trading environments.

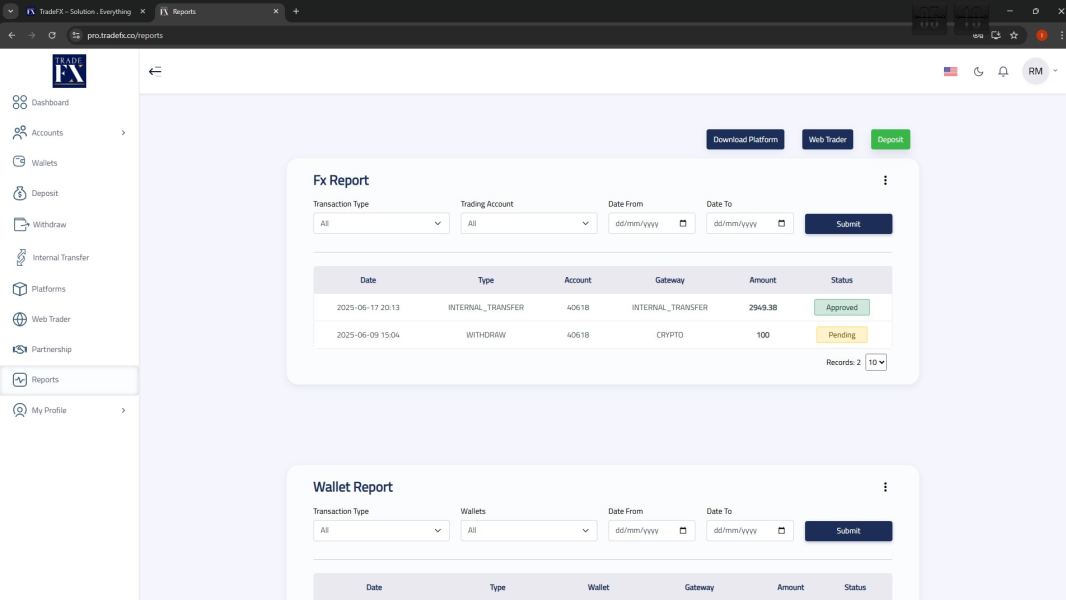

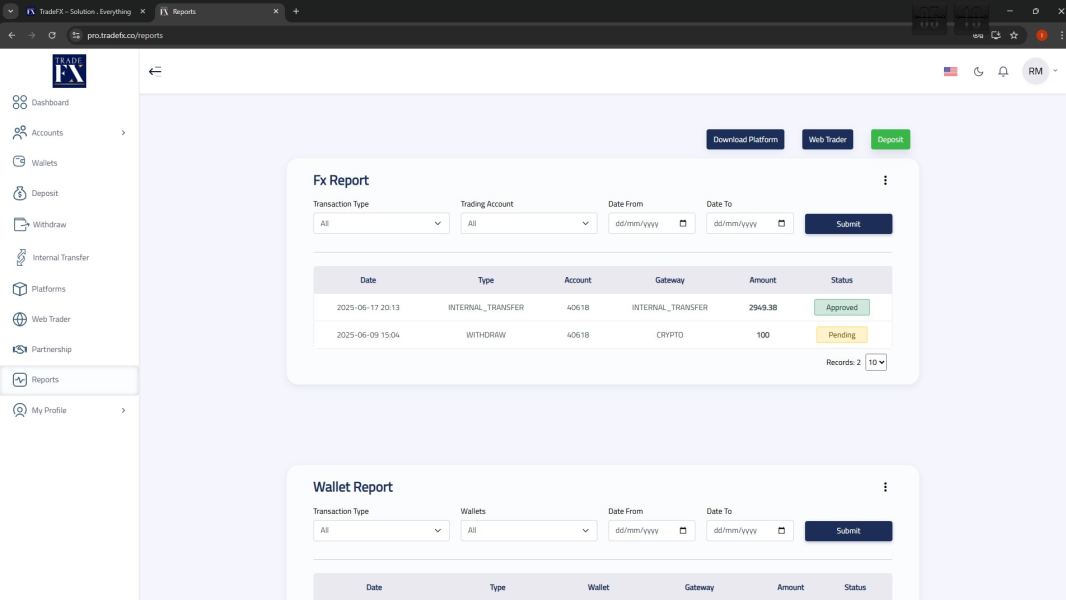

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. This limits traders' ability to evaluate fund management convenience.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available documentation. This makes it difficult for potential clients to assess account accessibility.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs are not clearly outlined in available sources.

Available Assets: The platform appears to focus primarily on forex trading, with potential access to CFDs and related derivative instruments. Comprehensive asset listings are not detailed in available information.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not transparently provided in available sources. This is a significant limitation for cost-conscious traders.

Leverage Ratios: Maximum leverage offerings and their variations across different account types or jurisdictions are not clearly specified in available documentation.

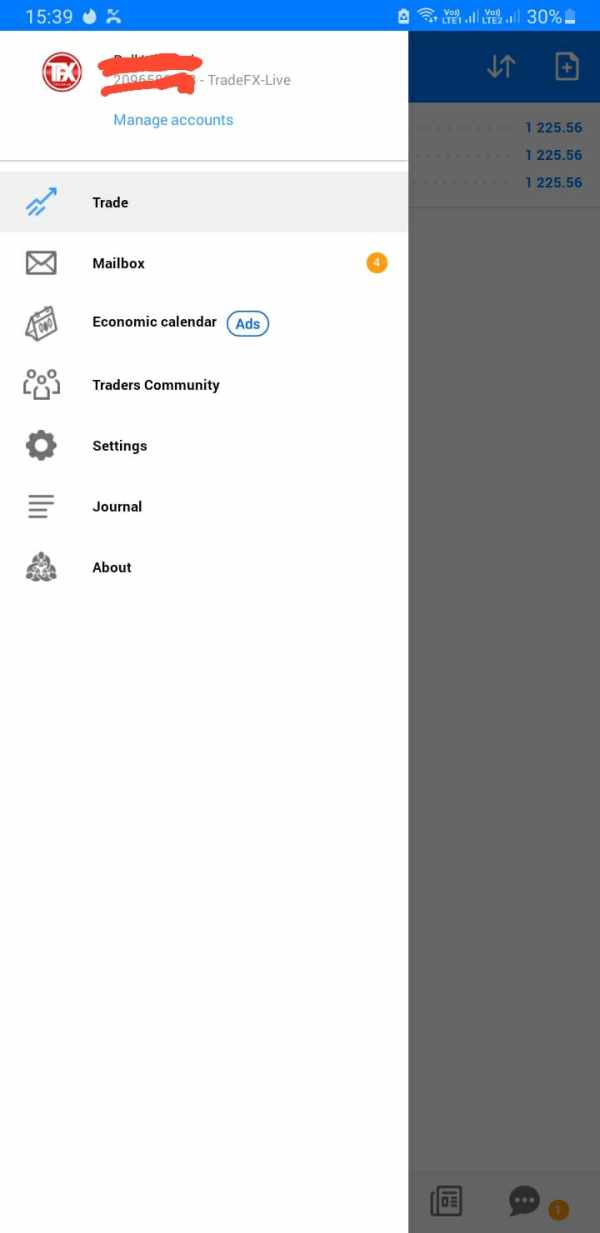

Platform Options: Details about trading platform software, mobile applications, and web-based trading interfaces are not comprehensively covered in available sources.

Geographic Restrictions: Information about restricted countries or regional limitations is not clearly specified in available documentation.

Customer Support Languages: Available support languages and regional service capabilities are not detailed in accessible sources.

This trade fx review notes that the limited availability of specific operational details represents a significant transparency challenge. Potential clients should consider this carefully.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions offered by Trade FX present a mixed picture based on available information. While the platform appears to provide basic forex trading accounts, specific details about account types, their distinctive features, and associated benefits remain unclear in available documentation. This lack of transparency significantly impacts the evaluation of account condition quality and suitability for different trader profiles.

Minimum deposit requirements are crucial for accessibility assessment. They are not clearly specified in available sources. This absence of fundamental account information makes it difficult for potential clients to determine whether the platform aligns with their financial capabilities and trading objectives. The account opening process, based on limited user feedback, appears to be standard for the industry, though specific verification requirements and timeframes are not detailed.

Special account features, such as VIP accounts, Islamic accounts, or professional trader designations, are not mentioned in available information. This trade fx review finds that the lack of comprehensive account condition details represents a significant limitation for traders seeking to compare options effectively. The absence of clear account tier structures and their respective benefits suggests either limited account variety or insufficient transparency in presenting available options.

User feedback regarding account setup experiences is sparse. No clear consensus emerges about the efficiency or user-friendliness of the account opening process. The lack of detailed account condition information ultimately limits traders' ability to make informed decisions about platform suitability.

Trade FX appears to offer basic trading tools and resources. Comprehensive details about the scope and quality of these offerings remain limited in available sources. The platform seems to provide fundamental trading capabilities necessary for forex market participation, but advanced analytical tools and research resources are not clearly documented or promoted in available information.

Research and analysis resources are crucial for informed trading decisions. They are not extensively detailed in available sources. The absence of information about market analysis, economic calendars, trading signals, or expert commentary suggests either limited research offerings or insufficient promotion of available resources. Educational materials, which are increasingly important for broker differentiation, are not clearly outlined in accessible documentation.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, is not specifically mentioned in available sources. This represents a potential limitation for traders seeking advanced trading automation features. The platform's technological infrastructure and tool integration capabilities remain unclear based on available information.

User feedback regarding tool effectiveness and resource quality is limited. This makes it difficult to assess real-world performance and user satisfaction with available features. While basic trading functionality appears to be present, the lack of detailed information about advanced tools and resources limits the platform's appeal to sophisticated traders seeking comprehensive trading environments.

Customer Service and Support Analysis (Score: 4/10)

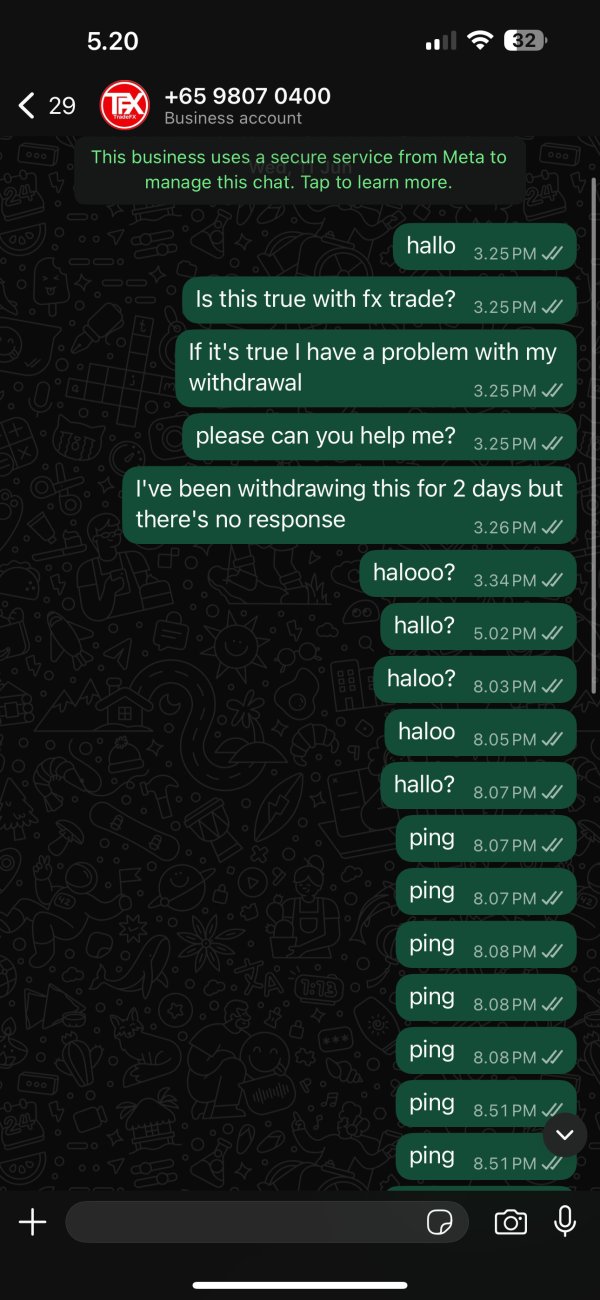

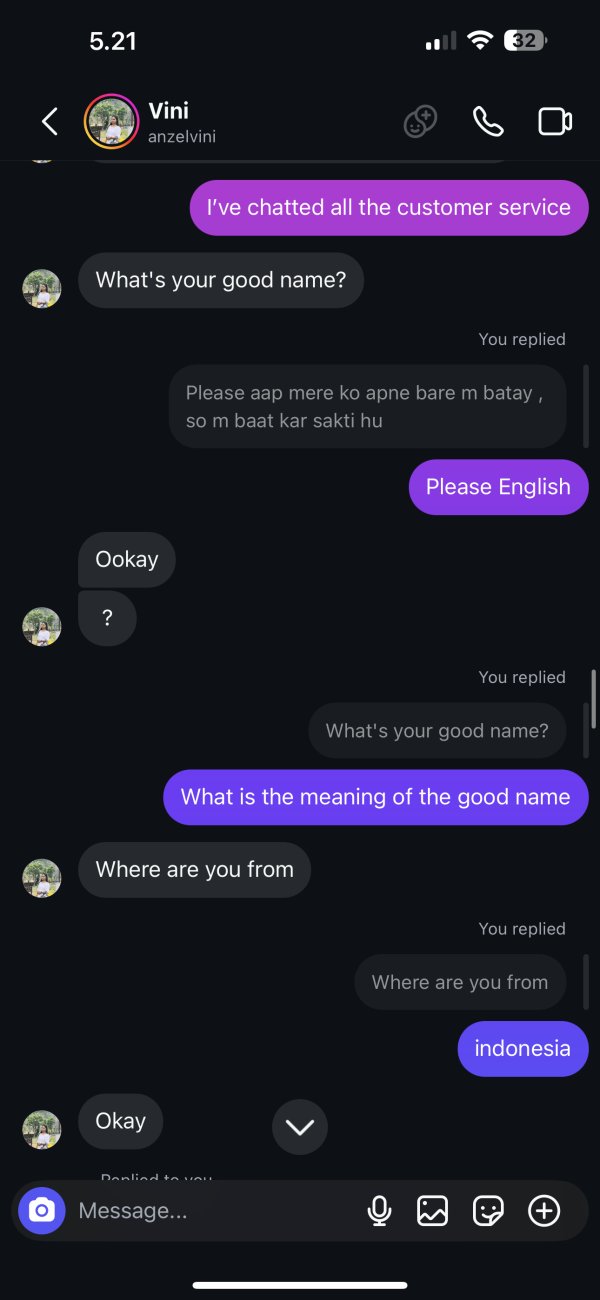

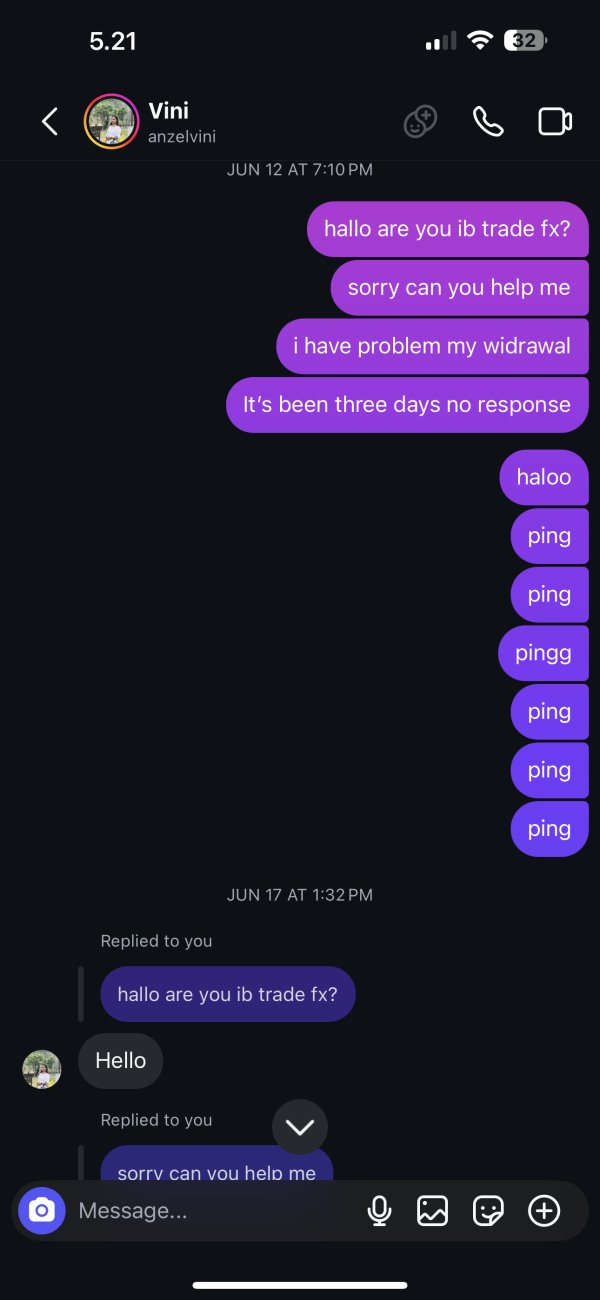

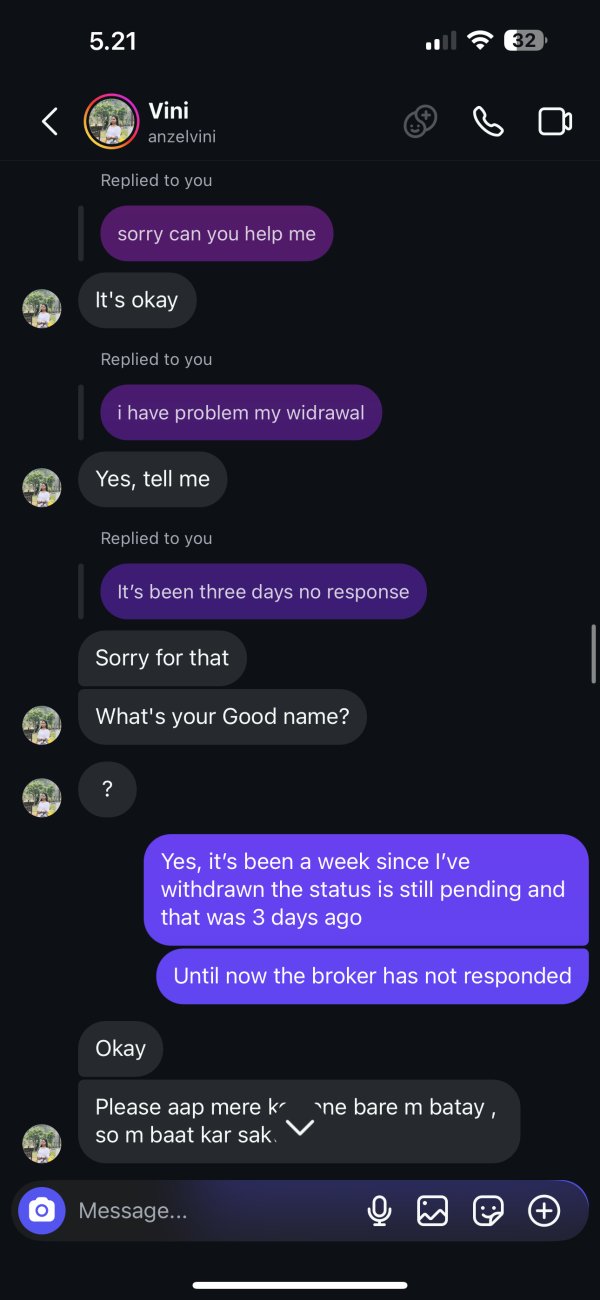

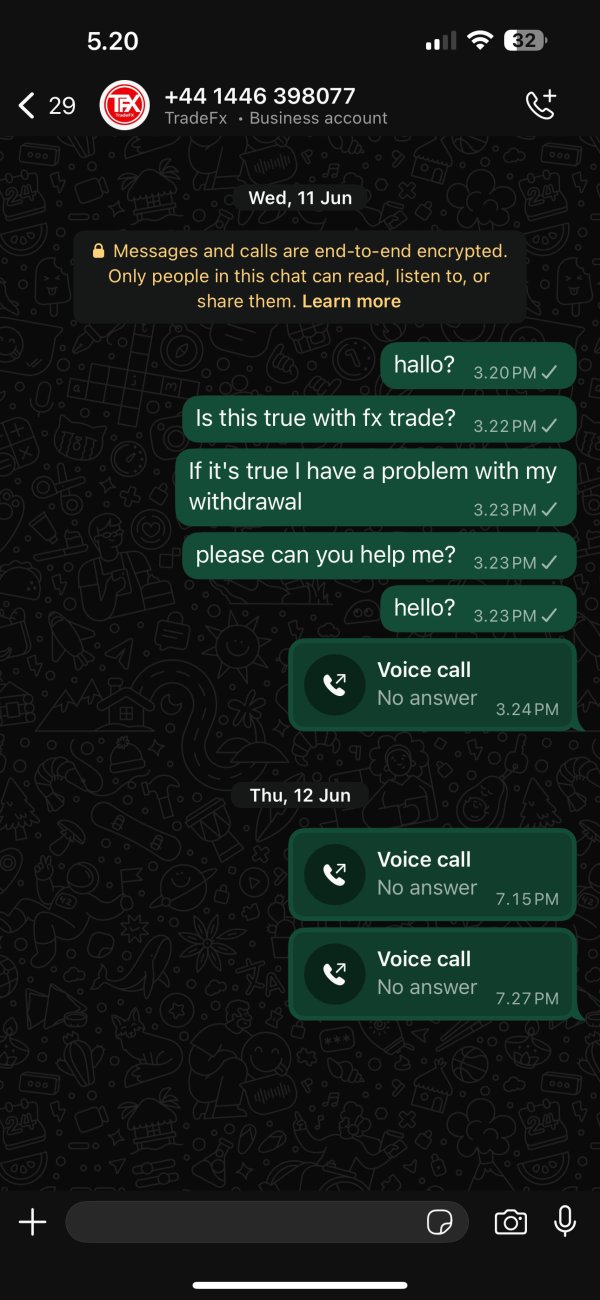

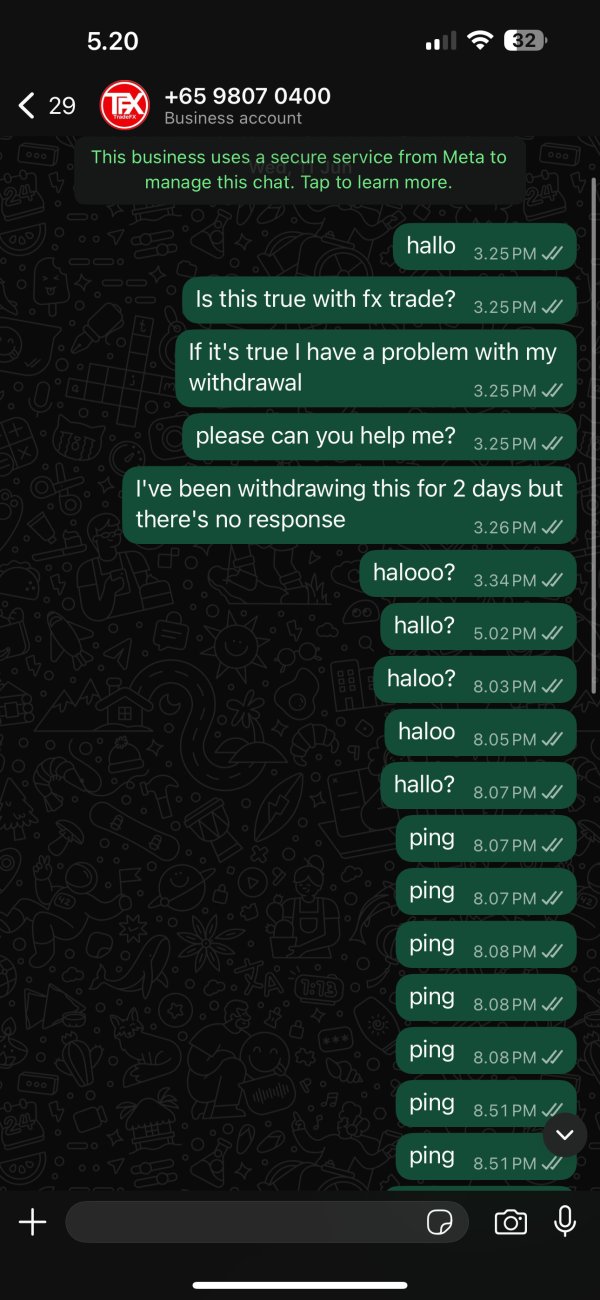

Customer service quality emerges as a significant concern in this trade fx review. Available user feedback suggests inconsistent support experiences. Reports from various sources indicate that customer service responsiveness and effectiveness may not meet industry standards, particularly when compared to established brokers with robust support infrastructures.

Available communication channels and their accessibility are not clearly detailed in available sources. This limits potential clients' understanding of how to access support when needed. Response times are crucial for active traders requiring timely assistance. They are not specified in available documentation, though user feedback suggests potential delays in issue resolution.

Service quality assessments based on user experiences indicate room for improvement in support effectiveness and professionalism. The lack of detailed information about support team expertise, multilingual capabilities, and specialized trading assistance suggests potential limitations in comprehensive client service delivery.

Operating hours for customer support are not clearly specified. This could impact international clients trading across different time zones. The absence of comprehensive support infrastructure details, combined with user feedback indicating service concerns, contributes to the below-average rating in this critical area. Effective customer service is essential for broker credibility, and the current information suggests Trade FX may need significant improvements in this area.

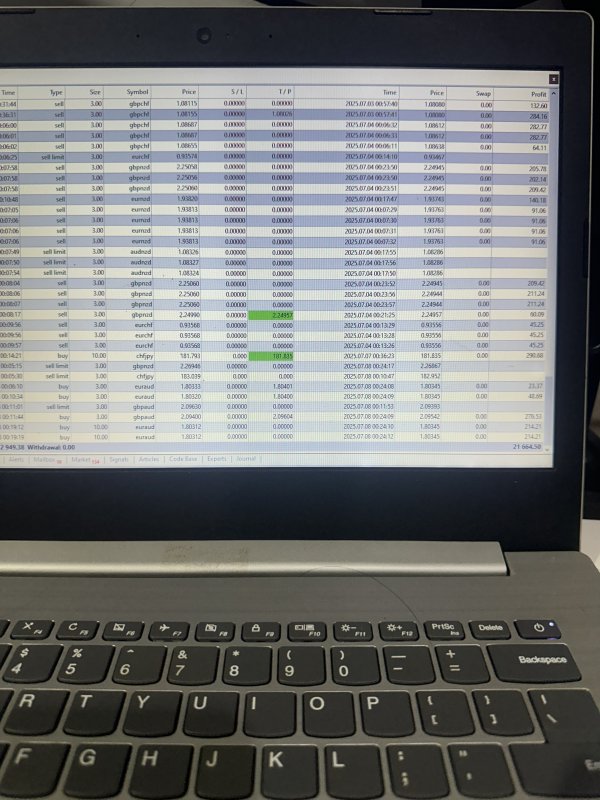

Trading Experience Analysis (Score: 5/10)

The trading experience offered by Trade FX receives an average rating based on limited available information and mixed user feedback. Platform stability and execution speed are fundamental to successful trading operations. They are not comprehensively documented in available sources, making it difficult to assess real-world performance under various market conditions.

Order execution quality, including fill rates, slippage characteristics, and rejection rates, is not detailed in available documentation. This absence of performance metrics represents a significant limitation for traders seeking to evaluate platform reliability and execution efficiency. Platform functionality completeness, including charting capabilities, order types, and trading tools integration, remains unclear based on available information.

Mobile trading experience is increasingly important for active traders. It is not specifically addressed in available sources. The lack of information about mobile app features, functionality, and user experience limits assessment of the platform's adaptability to modern trading preferences and lifestyle requirements.

User feedback regarding overall trading experience is sparse and inconsistent. No clear consensus emerges about platform strengths or weaknesses. The absence of detailed performance data and comprehensive user testimonials contributes to uncertainty about the platform's ability to deliver satisfactory trading experiences across different market conditions and trader requirements.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent significant concerns in this trade fx review. This is primarily due to the lack of clear regulatory information and transparency in operational details. The absence of specific regulatory oversight details raises questions about client protection measures and adherence to industry standards for broker operations and client fund security.

Fund safety measures, including segregated account policies, deposit insurance, and client money protection protocols, are not clearly outlined in available sources. This lack of transparency regarding client fund security represents a major concern for potential clients prioritizing capital protection and regulatory compliance in their broker selection process.

Company transparency, including ownership structure, financial reporting, and operational disclosure, appears limited based on available information. The absence of comprehensive corporate information makes it difficult for potential clients to conduct thorough due diligence and assess the broker's long-term viability and commitment to regulatory compliance.

Industry reputation and third-party validation are not well-established in available sources. There is limited recognition from industry organizations or regulatory bodies. User concerns about security and reliability, combined with the lack of clear regulatory oversight, contribute to the below-average rating in this critical evaluation area. Trust is fundamental to broker-client relationships, and current information suggests significant room for improvement in transparency and regulatory clarity.

User Experience Analysis (Score: 5/10)

User experience evaluation reveals mixed feedback and limited comprehensive information about overall client satisfaction with Trade FX services. Available user testimonials and reviews present inconsistent experiences, with both positive and negative feedback appearing in various sources, though detailed experiential accounts remain sparse.

Interface design and platform usability are not comprehensively documented in available sources. This limits assessment of the platform's user-friendliness and accessibility for traders with varying experience levels. Registration and account verification processes, while appearing to follow industry standards, lack detailed user experience documentation that would help potential clients understand the onboarding experience.

Fund management experiences, including deposit and withdrawal processes, are not extensively covered in available user feedback. This makes it difficult to assess the efficiency and user-friendliness of financial operations. Common user complaints, based on limited available feedback, appear to center around customer service quality and platform transparency concerns.

The absence of detailed user demographic analysis makes it difficult to determine which types of traders might find the platform most suitable for their needs. This trade fx review finds that while some users report satisfactory experiences, the lack of comprehensive user experience data and mixed feedback contribute to an average rating in this important evaluation category.

Conclusion

This comprehensive trade fx review reveals a broker that operates in the competitive forex market but faces significant challenges in transparency and service delivery. Based on available information and user feedback, Trade FX appears to offer basic forex trading services but lacks the comprehensive disclosure and regulatory clarity that experienced traders typically seek when selecting a broker.

The platform may be suitable for novice traders exploring forex market entry. However, the lack of detailed information about trading conditions, regulatory oversight, and comprehensive service offerings suggests that potential clients should exercise considerable caution and conduct thorough independent research before committing funds.

The primary concerns identified include insufficient regulatory transparency, limited customer service quality, and the absence of detailed operational information that would enable informed decision-making. While the platform claims to offer forex trading services, the overall evaluation suggests that traders seeking reliable, well-regulated, and transparent broker relationships might benefit from considering more established alternatives with clearer operational disclosure and stronger regulatory oversight.