PM Financials 2025 Review: Everything You Need to Know

PM Financials has emerged as a notable player in the crowded forex brokerage landscape. Established in 2023, this broker is regulated by the Financial Services Commission (FSC) of Mauritius, offering a range of trading services that appeal to both novice and experienced traders. While the platform boasts competitive spreads and robust customer support, some users have reported concerns regarding the withdrawal process. This review will delve into the key features, advantages, and potential drawbacks of PM Financials, providing you with a comprehensive understanding of what to expect.

Note: It is important to consider that PM Financials operates under different entities in various regions, which can impact the regulatory oversight and security of your investments. This review aims to provide a fair and accurate evaluation based on the latest available data.

Ratings Overview

We score brokers based on user feedback, expert opinions, and factual data from credible sources.

Broker Overview

Founded in 2023, PM Financials is headquartered in Mauritius and is regulated by the Mauritius Financial Services Commission (FSC). The broker offers a user-friendly trading experience through the widely used MetaTrader 5 (MT5) platform, which is available on multiple devices including Windows, Mac, iOS, and Android. Traders can access a diverse range of asset classes, including forex, CFDs, metals, and commodities. However, the level of regulatory scrutiny may not be as stringent as that of top-tier regulators like the FCA or ASIC, which raises concerns among some potential users.

Detailed Analysis

Regulatory Geography

PM Financials operates under the regulations of the Mauritius FSC, which, while providing some level of oversight, is often viewed as less rigorous compared to regulators in more established financial markets. The lack of comprehensive verification of their licensing has led some analysts to express caution regarding the broker's legitimacy. According to BrokersView, the absence of detailed regulatory information hampers the broker's credibility.

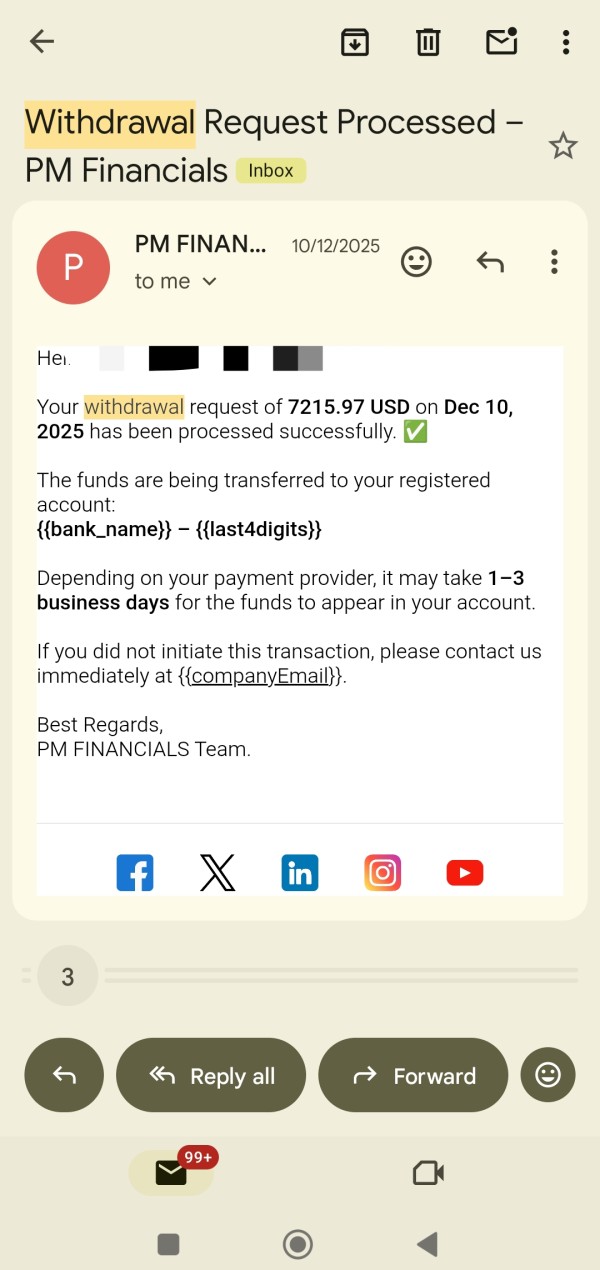

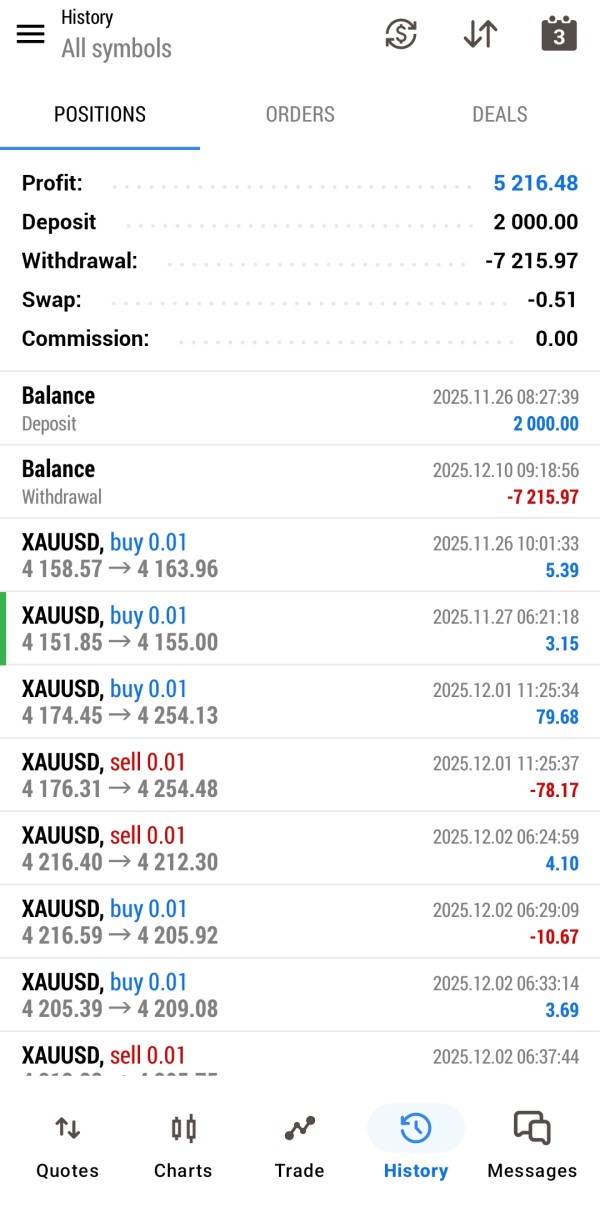

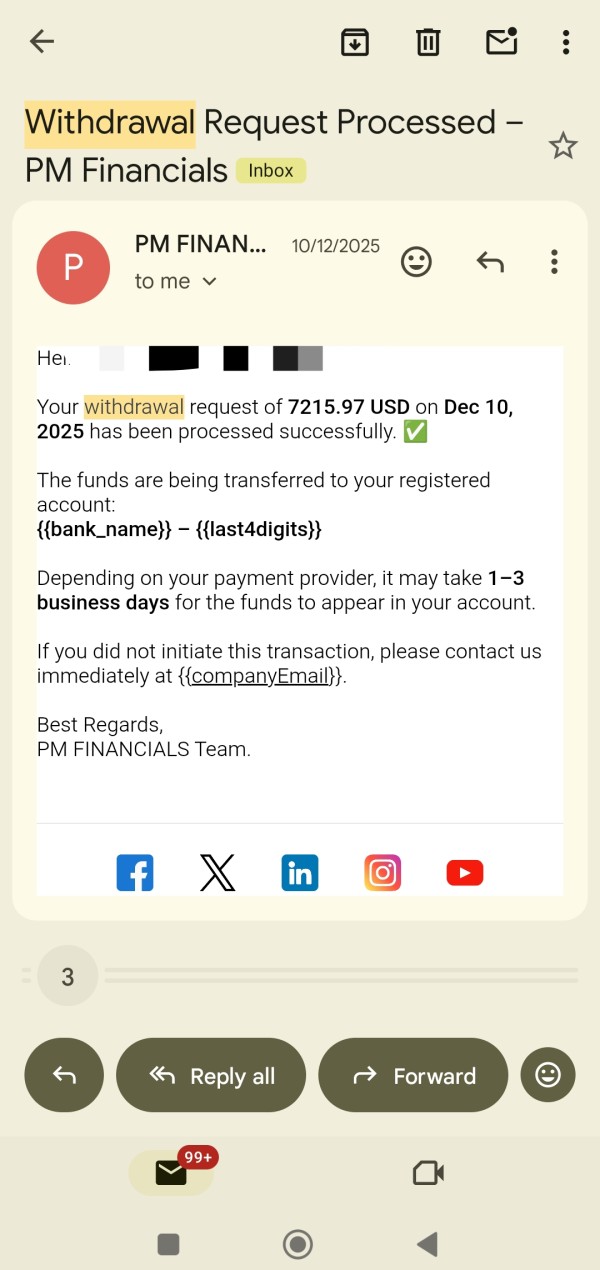

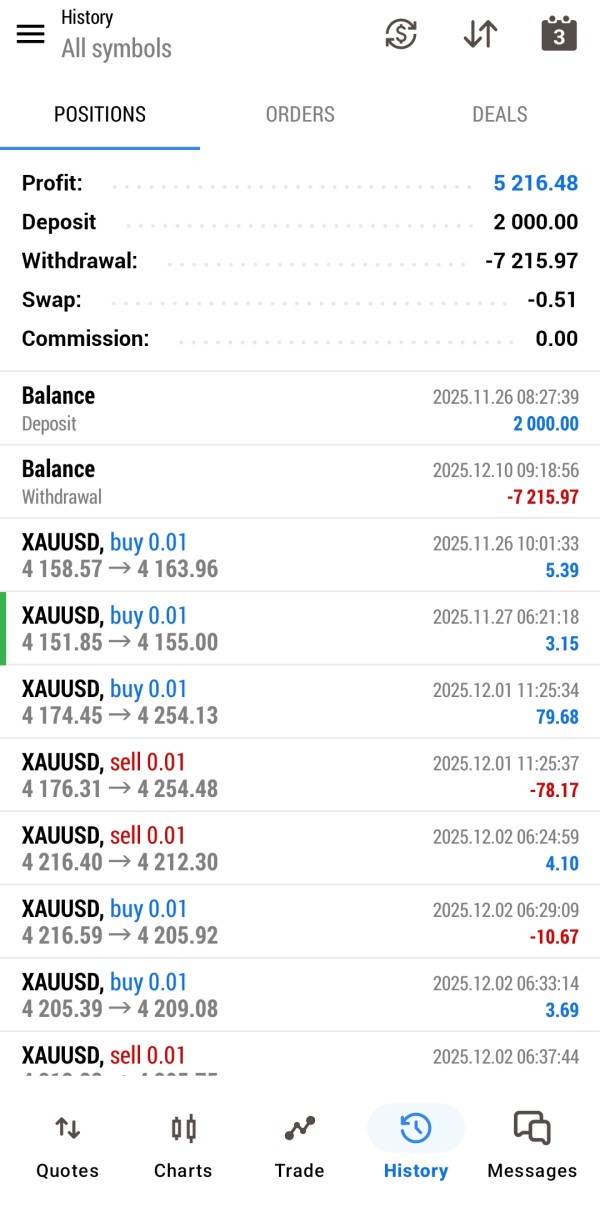

Deposit and Withdrawal Options

The broker accepts various funding methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. The minimum deposit requirement is set at $100, making it accessible for new traders. However, some users have reported slow withdrawal processes, which is a potential red flag for those prioritizing liquidity. According to FXDailyInfo, most withdrawals are completed within 24 hours, but user experiences vary.

PM Financials frequently offers promotions such as a $50 no deposit bonus for new clients, which can be an attractive incentive for traders looking to start their journey without a significant financial commitment. These promotions are designed to enhance the trading experience and encourage user engagement.

Tradable Asset Classes

Traders at PM Financials can access a wide array of financial instruments, including over 500 forex pairs, commodities, and indices. This variety allows traders to diversify their portfolios and explore different market opportunities. The broker prides itself on offering competitive spreads, with some major currency pairs starting as low as 0.1 pips, making it appealing for high-volume traders.

Cost Structure

The cost of trading with PM Financials is characterized by low commissions and tight spreads. The spreads for major currency pairs are competitive, with the broker often advertising spreads as low as 1.6 pips. This can significantly impact profitability for active traders. However, it is crucial to note that while the spreads are attractive, the effectiveness of the trading experience may depend on the broker's execution speed and reliability.

Leverage

PM Financials offers leverage of up to 1:400, which can amplify trading potential but also increases risk exposure. While this high leverage is appealing for seasoned traders, it may not be suitable for beginners who are still learning the ropes of forex trading.

The primary trading platform available is MetaTrader 5 (MT5), which is known for its advanced charting capabilities and user-friendly interface. The platform supports various trading styles, making it suitable for both technical and fundamental traders. Additionally, the mobile trading app provides flexibility for traders on the go.

Restricted Regions

PM Financials does not explicitly list restricted regions on its website, but potential users should be aware that trading regulations vary by country. It is advisable to check local regulations to ensure compliance before opening an account.

Available Customer Support Languages

Customer support at PM Financials is available in English, with 24/5 support through live chat, email, and phone. The responsiveness and knowledge of the support team have been positively highlighted in user reviews.

Repeat Ratings Overview

In-Depth Breakdown

Account Conditions

While PM Financials provides a straightforward account setup with a low minimum deposit, the slow withdrawal process has been a concern for some users. This inconsistency can lead to frustration, particularly for traders who prioritize quick access to their funds.

The educational resources provided by PM Financials are robust, including webinars, video tutorials, and ebooks. These materials are beneficial for traders looking to enhance their skills and make informed decisions.

Customer Service and Support

Customer service has received high praise, with users reporting quick response times and knowledgeable support staff. This aspect is crucial for traders who may encounter issues or require assistance during their trading activities.

Trading Settings (Experience)

The trading experience on the MT5 platform is generally smooth, with minimal downtime reported. However, the effectiveness of trade execution can vary, which is an essential factor for active traders.

Trustworthiness

The regulatory status of PM Financials raises some concerns, particularly given the lack of stringent oversight compared to top-tier brokers. Users are advised to exercise caution and conduct thorough research before committing funds.

User Experience

Overall, the user experience on PM Financials is positive, with an intuitive interface and easy navigation. The platform's design caters to both beginners and experienced traders, enhancing the overall trading journey.

In conclusion, PM Financials offers a compelling package for forex traders, particularly those looking for competitive spreads and a user-friendly platform. However, potential users should weigh the benefits against the regulatory concerns and varying withdrawal experiences. As with any investment, conducting thorough research and understanding the risks involved is crucial before engaging with PM Financials.