DGCX Review 2

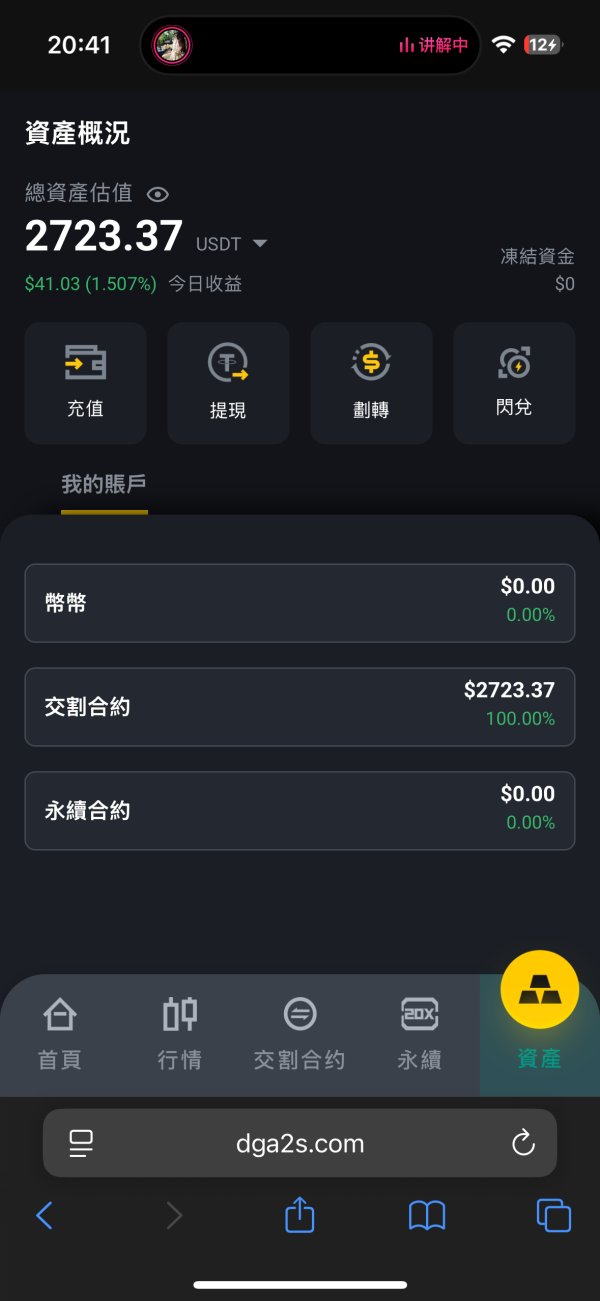

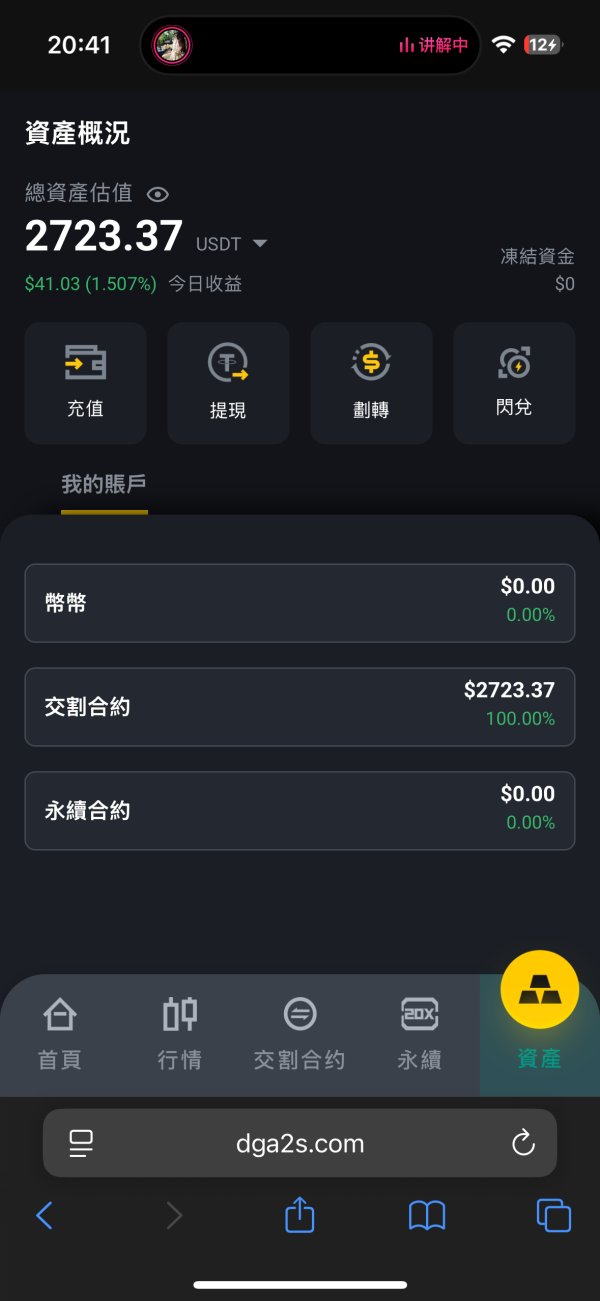

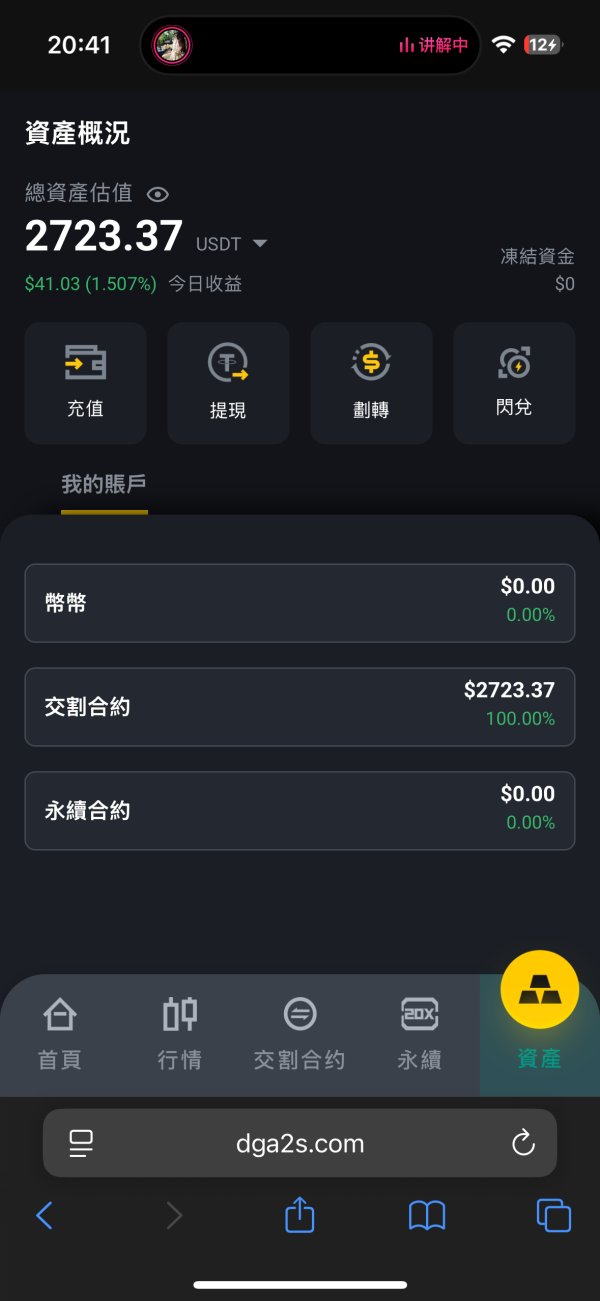

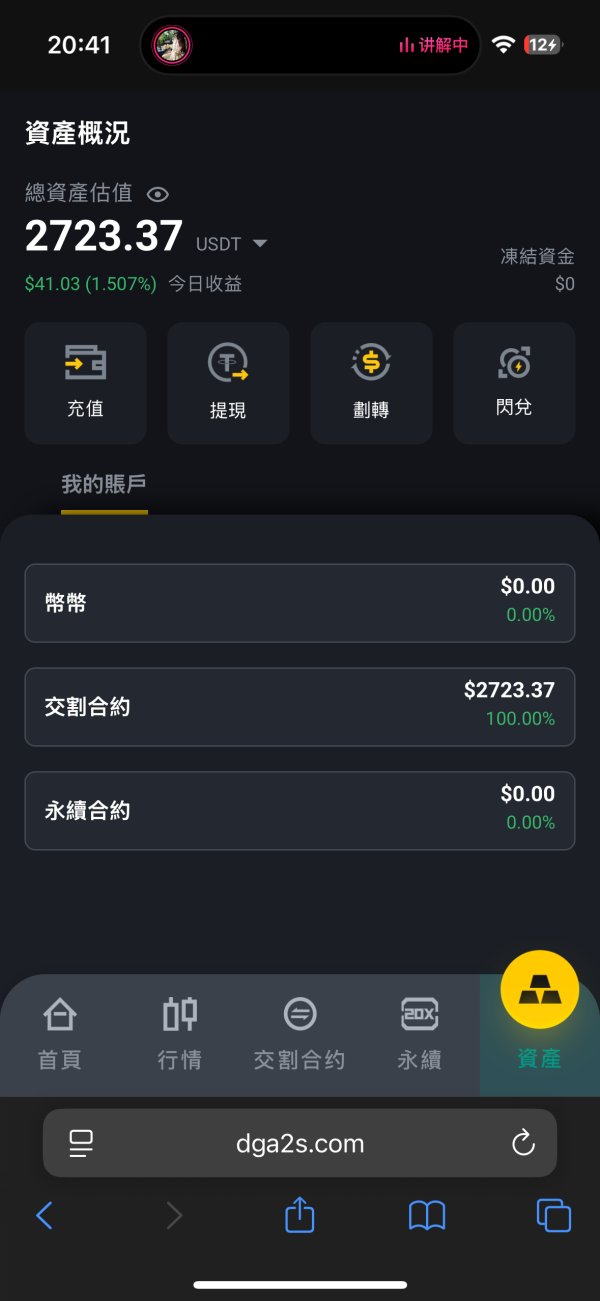

Unable to withdraw, requesting the exchange to process the withdrawal to my address.

Now, 2 million members are unable to make withdrawals despite their efforts.

DGCX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Unable to withdraw, requesting the exchange to process the withdrawal to my address.

Now, 2 million members are unable to make withdrawals despite their efforts.

The Dubai Gold & Commodities Exchange stands as a top trading platform in the Middle East and North Africa region. It excels in gold and commodity derivatives trading. This complete dgcx review shows that the platform has received mostly positive user feedback and industry recognition, but potential traders should know about reported withdrawal problems that have appeared in user testimonials.

DGCX became the first derivatives exchange in the MENA region when it started operations in November 2005. The platform has won notable recognition. It received the "Best Global Commodities Exchange" award from Global Banking & Finance Review, which shows its market position and operational abilities. With 267 active members, DGCX mainly attracts investors who want opportunities in gold and commodity trading markets.

User feedback shows the platform performs well in trading execution and market access. Some traders have reported challenges with the withdrawal process. The exchange operates under regulatory oversight from the Dubai Multi Commodities Centre, though it lacks authorization from major international financial regulators such as the FCA, ASIC, or NFA.

DGCX operates under the regulatory framework of the Dubai Multi Commodities Centre. Potential traders should note that the platform does not hold licenses from major international financial regulatory bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or the National Futures Association. This regulatory positioning may influence the platform's credibility in international markets and should be considered when evaluating trading options.

This review is based on available user feedback, market information, and publicly accessible data. The analysis aims to provide prospective investors with a complete understanding of DGCX's offerings, capabilities, and potential limitations to help informed decision-making.

| Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition details not available in source materials |

| Tools and Resources | 8/10 | Electronic trading platform available; some brokers offer MetaTrader 5 support |

| Customer Service and Support | 6/10 | User reports of withdrawal difficulties; specific customer service details limited |

| Trading Experience | 8/10 | Generally positive user feedback on trading execution and platform performance |

| Trust and Reliability | 5/10 | Limited international regulatory oversight; lacks major financial authority licenses |

| User Experience | 7/10 | Overall positive user reviews balanced against withdrawal process concerns |

The Dubai Gold & Commodities Exchange established its operations in November 2005. This marked a significant milestone as the first derivatives exchange in the Middle East and North Africa region. Located in Dubai, this financial and commodity derivatives exchange has built a substantial presence with 267 active members, offering diversified trading products primarily focused on commodity derivatives. The platform's strategic position in Dubai has enabled it to serve as a bridge between Eastern and Western markets, particularly in gold and commodity trading sectors.

DGCX operates as a specialized exchange focusing primarily on gold and other commodity derivatives trading. The platform has developed its infrastructure to support electronic trading capabilities. Some associated brokers provide access through the popular MetaTrader 5 trading platform. The exchange's business model centers on providing institutional and retail traders with access to derivative products, particularly those seeking exposure to precious metals and commodity markets. Regulatory oversight for DGCX comes from the Dubai Multi Commodities Centre, though the platform does not maintain licenses from other major international financial regulatory authorities such as the FCA, ASIC, or NFA.

Regulatory Jurisdiction: DGCX operates under the regulatory supervision of the Dubai Multi Commodities Centre. The platform has not obtained authorization from major international financial regulatory bodies including the Financial Conduct Authority, Australian Securities and Investments Commission, or the National Futures Association, which may impact its international market credibility.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in the available source materials. User feedback indicates some challenges with withdrawal processing.

Minimum Deposit Requirements: The minimum deposit requirements for trading accounts are not specified in the available source materials. This would require direct inquiry with the platform or associated brokers.

Bonus and Promotional Offers: Details regarding bonus structures or promotional offerings are not mentioned in the available source materials.

Tradeable Assets: DGCX specializes in commodity and financial derivatives, with particular emphasis on gold and other precious metal derivatives. It caters to traders seeking exposure to commodity markets.

Cost Structure: Specific information about spreads, commissions, and other trading costs was not detailed in the available source materials. This would require direct verification with the platform.

Leverage Ratios: Leverage specifications are not mentioned in the available source materials.

Platform Options: DGCX provides an electronic trading platform for direct access. Some associated brokers offer MetaTrader 5 platform support for enhanced trading functionality.

Geographic Restrictions: Specific geographic limitations are not detailed in the available source materials.

Customer Support Languages: Supported languages for customer service are not specified in the available source materials.

This dgcx review highlights the need for potential traders to conduct direct inquiries about specific trading conditions and requirements.

The specific details regarding DGCX's account conditions remain limited in the available source materials. This presents a challenge for complete evaluation. According to the information gathered, there is no detailed breakdown of account types, their respective features, or the specific requirements for different trader categories. This lack of transparency in account structure information may require prospective traders to engage directly with DGCX or associated brokers to understand available options.

Minimum deposit requirements, which are crucial for trader decision-making, are not specified in the available documentation. This information gap extends to account opening procedures, verification requirements, and any special account features that might be available to different trader segments. The absence of clear account condition details may indicate either limited public disclosure or the need for personalized consultation during the account opening process.

Without specific information about Islamic accounts, professional trader accounts, or other specialized account types, potential users cannot fully assess whether DGCX accommodates diverse trading needs and religious requirements. The platform's approach to account management and the range of available options remain unclear based on current available information.

This dgcx review emphasizes the importance of direct communication with DGCX representatives to obtain complete account condition details before making trading decisions. Prospective traders should specifically inquire about minimum deposits, account types, and any special features that may be available but not publicly advertised.

DGCX demonstrates solid capabilities in its trading infrastructure. It provides an electronic trading platform that facilitates direct market access for commodity and financial derivatives. The platform's technological foundation appears robust, supporting the trading activities of its 267 members across various commodity markets. Additionally, the availability of MetaTrader 5 through some associated brokers enhances the trading experience by providing access to advanced charting tools, automated trading capabilities, and complete market analysis features.

The electronic trading platform offered by DGCX enables real-time trading execution and market data access. This is essential for commodity derivatives trading where timing and market movements are critical. However, specific details about research and analysis resources, educational materials, or proprietary trading tools are not extensively detailed in the available source materials, suggesting that traders may need to rely on third-party resources or broker-provided tools for complete market analysis.

User feedback indicates generally positive experiences with the trading tools and platform functionality. Specific technical performance metrics or comparative analysis with other platforms are not available in the current information set. The integration of MetaTrader 5 support through partner brokers adds significant value, as this platform is widely recognized for its advanced trading capabilities and extensive customization options.

The absence of detailed information about educational resources, market research tools, or automated trading support beyond MetaTrader 5 integration represents an area where prospective traders should seek additional clarification directly from DGCX or associated brokers to understand the full scope of available trading resources.

Customer service evaluation for DGCX presents a mixed picture based on available user feedback and reported experiences. Specific details about customer service channels, response times, and support quality are not fully detailed in the source materials. User reports highlight significant concerns regarding withdrawal processing that directly impact the customer service experience.

The most notable customer service issue reported by users involves difficulties with withdrawal requests. Some traders indicate challenges in processing withdrawals to their designated addresses. This concern significantly impacts the overall customer service rating, as efficient and reliable fund management is a critical aspect of broker-client relationships. The withdrawal difficulties reported suggest potential gaps in customer service responsiveness or operational procedures.

Information about available customer service channels, such as phone support, email assistance, live chat, or ticket systems, is not specified in the available materials. Details about service hours, multilingual support capabilities, or specialized support for different trader categories remain unclear. This lack of transparency in customer service structure may concern potential traders who value accessible and responsive support.

The absence of specific information about service quality metrics, average response times, or customer satisfaction scores makes it difficult to provide a complete assessment of DGCX's customer service capabilities. Prospective traders should specifically inquire about customer service availability, response procedures, and escalation processes, particularly regarding fund management and withdrawal procedures, before committing to the platform.

User feedback regarding the trading experience on DGCX indicates generally positive responses. This suggests that the platform delivers satisfactory performance in core trading functions. According to available reports, traders have expressed positive views about their overall trading experience, which includes factors such as order execution, platform stability, and market access quality. This positive feedback suggests that DGCX maintains adequate standards in its primary trading operations.

The electronic trading platform provided by DGCX appears to meet user expectations for functionality and reliability. Specific technical performance data such as execution speeds, slippage rates, or platform uptime statistics are not available in the source materials. The positive user sentiment indicates that the platform likely maintains reasonable standards for order processing and market connectivity, which are essential for effective commodity derivatives trading.

Platform functionality and user interface design details are not extensively covered in the available information. This makes it difficult to assess the completeness of trading tools, charting capabilities, or advanced order types. However, the integration with MetaTrader 5 through associated brokers provides users with access to sophisticated trading features and analytical tools that enhance the overall trading experience.

Mobile trading capabilities and cross-device synchronization features are not specifically mentioned in the available materials. This represents an area where prospective traders should seek additional information. The generally positive user feedback on trading experience suggests that DGCX maintains competitive standards in platform performance, though specific technical specifications and comparative performance metrics would provide more complete insights.

This dgcx review indicates that while the trading experience receives positive user feedback, detailed technical specifications and performance metrics would enhance transparency and user confidence.

The trust and reliability assessment of DGCX reveals a complex picture that balances industry recognition against regulatory limitations. DGCX operates under the regulatory oversight of the Dubai Multi Commodities Centre, which provides a level of regulatory framework. This falls short of the complete oversight offered by major international financial authorities such as the FCA, ASIC, or NFA. This regulatory positioning may influence international trader confidence and access to certain protections typically associated with major financial regulatory jurisdictions.

On the positive side, DGCX has achieved significant industry recognition, notably being awarded "Best Global Commodities Exchange" by Global Banking & Finance Review. This award suggests industry acknowledgment of the platform's operational capabilities and market position. It contributes positively to its overall reputation within the commodities trading sector. Such recognition typically reflects factors including market innovation, operational efficiency, and service quality.

However, user reports of withdrawal difficulties present a significant concern for trust and reliability assessment. Fund security and efficient withdrawal processing are fundamental aspects of broker trustworthiness. Reported challenges in this area directly impact user confidence. The withdrawal issues mentioned by users suggest potential operational or procedural gaps that could affect the overall reliability of fund management services.

The absence of detailed information about client fund protection measures, segregation policies, or insurance coverage further complicates the trust assessment. While DGCX's position as an established exchange with industry recognition provides some credibility foundation, the combination of limited international regulatory oversight and reported withdrawal difficulties requires careful consideration by prospective traders regarding risk tolerance and fund security priorities.

Overall user satisfaction with DGCX appears to trend positive based on available feedback. This is balanced against specific operational concerns that affect the complete user journey. Users have generally expressed positive sentiments about their trading experience, suggesting that the platform meets expectations in core functionality areas such as market access, trading execution, and platform performance. This positive feedback indicates that DGCX delivers satisfactory service in its primary operational areas.

However, the user experience is significantly impacted by reported difficulties with withdrawal processing. This represents a critical aspect of the overall trading relationship. Fund management and withdrawal efficiency are fundamental components of user experience, and challenges in this area can substantially affect user satisfaction regardless of positive trading performance. The withdrawal difficulties reported by some users suggest areas where operational improvements could enhance the overall user experience.

Interface design and platform usability details are not extensively covered in the available source materials. The generally positive user feedback suggests adequate standards in user interface development. The availability of MetaTrader 5 through associated brokers provides users with access to familiar and sophisticated trading interfaces, which can significantly enhance the overall user experience for traders familiar with this platform.

The registration and account verification processes are not detailed in the available information. This represents an area where prospective users should seek specific information about onboarding procedures and requirements. User demographic analysis suggests that DGCX primarily attracts traders interested in gold and commodity trading opportunities, indicating that the platform successfully serves its target market segment despite some operational challenges.

Improvement opportunities exist particularly in withdrawal processing efficiency. This could significantly enhance overall user satisfaction and trust levels. The platform's focus on commodity derivatives trading appears to align well with user expectations and market demand.

This complete dgcx review reveals that DGCX represents a noteworthy option for traders specifically interested in gold and commodity derivatives trading. It particularly serves those seeking exposure to Middle Eastern and North African markets. The platform's distinction as the first derivatives exchange in the MENA region and its industry recognition as "Best Global Commodities Exchange" demonstrate its established market position and operational capabilities.

DGCX appears most suitable for investors and traders who prioritize access to commodity derivatives markets and are comfortable with the regulatory framework provided by DMCC oversight. The generally positive user feedback regarding trading experience suggests that the platform delivers satisfactory performance in core trading functions. This makes it potentially attractive for traders focused on commodity market opportunities.

However, prospective users should carefully consider the reported withdrawal difficulties and the limited international regulatory oversight when evaluating DGCX against their risk tolerance and operational requirements. The platform's strengths in market access and trading execution must be weighed against potential challenges in fund management and the absence of major international regulatory protections. Traders should conduct thorough due diligence and consider direct communication with DGCX representatives to clarify specific operational procedures and requirements before committing to the platform.

FX Broker Capital Trading Markets Review