Regarding the legitimacy of MALEYAT forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is MALEYAT safe?

Pros

Cons

Is MALEYAT markets regulated?

The regulatory license is the strongest proof.

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Naqdi Group (PTY) LTD

Effective Date: Change Record

2021-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

242 CORLETT DR BRAMLEY JOHANNESBURG 2018Phone Number of Licensed Institution:

97155 1759797Licensed Institution Certified Documents:

Is Maleyat A Scam?

Introduction

Maleyat is a forex broker that positions itself as a multi-asset trading platform, offering a variety of financial instruments to traders worldwide. Operating primarily in the United Arab Emirates, it claims to provide access to forex, commodities, indices, cryptocurrencies, and stocks. With the rise of online trading, it has become increasingly essential for traders to evaluate the credibility and safety of their chosen brokers. The forex market is rife with both legitimate opportunities and potential scams, making due diligence crucial for protecting investments.

This article aims to provide a comprehensive analysis of Maleyat, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The methodology employed involves a thorough review of available data from credible sources, user feedback, and expert opinions to arrive at an objective conclusion regarding Maleyat's legitimacy.

Regulation and Legitimacy

The regulatory framework governing forex brokers is vital for ensuring the safety of client funds and the overall integrity of trading operations. Maleyat claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. However, various reports have raised concerns about the legitimacy of this claim, labeling it as a "suspicious clone." Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FSCA | 51598 | South Africa | Suspicious Clone |

The FSCA is a reputable regulatory body that oversees financial institutions in South Africa. However, the designation of Maleyat as a "suspicious clone" raises significant red flags. A clone firm typically mimics a legitimate broker to deceive clients, which can lead to severe financial risks for traders. The absence of valid regulatory oversight can result in a lack of investor protection, making it imperative for potential clients to exercise caution.

Company Background Investigation

Maleyat Group (PTY) Ltd operates the Maleyat brokerage, and while the company claims to have been established in 2021, details about its ownership and management remain vague. The lack of transparency regarding the company's history and executive team raises concerns about its credibility. A reputable broker typically provides clear information about its founders, management team, and operational history.

The management teams background and expertise are crucial indicators of a broker's reliability. Unfortunately, there is limited information available about the individuals behind Maleyat, which is a significant concern for potential investors. The absence of a well-defined corporate structure and clear leadership can lead to questions about the broker's operational integrity and commitment to ethical trading practices.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders looking to maximize their investment potential. Maleyat claims to provide competitive trading conditions, including a range of account types and trading instruments. However, the overall fee structure and any unusual charges warrant closer scrutiny. Below is a comparison of core trading costs:

| Fee Type | Maleyat | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0 - 1.5 pips |

| Commission Model | Zero Commission | $5 - $10 per trade |

| Overnight Interest Range | Not Specified | Varies by broker |

While Maleyat advertises zero commissions and average spreads of 1.4 pips, the lack of transparency regarding overnight interest rates and other fees raises concerns. Traders should be wary of hidden costs that could significantly impact their trading profitability. Additionally, the absence of detailed information on withdrawal and deposit fees is a notable omission, as it can affect overall trading costs.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. Maleyat claims to implement various security measures, including segregated accounts to protect client funds. However, the lack of comprehensive information regarding investor protection schemes and negative balance protection raises concerns. Traders must be aware of historical issues or controversies related to fund security.

Unregulated brokers often lack the necessary safeguards to protect client investments, making them susceptible to financial malpractice. The absence of clear policies regarding fund security can be a significant risk factor for potential investors. It is crucial for traders to verify that their chosen broker has robust measures in place to ensure the safety of their funds.

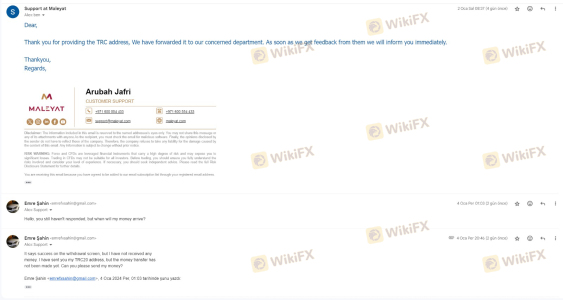

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Maleyat indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing their funds. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Issues | High | Poor |

Many users have expressed frustration over the withdrawal process, often citing delays or outright denials when attempting to access their funds. The company's response to these complaints has been described as inadequate, with many customers reporting unresponsive customer service. This pattern of complaints is alarming and suggests that potential investors should exercise caution before engaging with Maleyat.

Platform and Execution

The performance of the trading platform is another crucial aspect of the trading experience. Maleyat offers its proprietary web-based platform, which claims to be user-friendly and efficient. However, reports of execution issues, including slippage and order rejections, have emerged. Traders have raised concerns about the platform's reliability and whether it meets the standards expected in the industry.

A broker's ability to execute trades promptly and accurately is vital for traders, especially those employing high-frequency trading strategies. Any signs of platform manipulation or technical failures can significantly impact a trader's performance and profitability. Therefore, a thorough evaluation of the platform's execution quality is necessary for potential clients.

Risk Assessment

Engaging with any broker carries inherent risks, and Maleyat is no exception. Below is a summary of the key risk areas associated with using this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Fund Security Risk | High | Unclear policies on fund protection. |

| Customer Service Risk | Medium | Poor response to client complaints. |

| Platform Reliability | Medium | Reports of execution issues and slippage. |

To mitigate these risks, potential clients should conduct thorough research and consider trading with brokers that have established reputations and regulatory oversight. Engaging with a regulated broker can provide a layer of security that unregulated platforms like Maleyat may lack.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Maleyat exhibits several characteristics commonly associated with scam brokers. The lack of transparent regulatory oversight, poor customer feedback, and significant risks surrounding fund security and platform reliability raise serious concerns about the legitimacy of this broker.

Traders should be cautious and consider alternative options that offer better regulatory protection, transparent fee structures, and positive customer reviews. Reputable brokers such as IG, OANDA, and Forex.com are recommended alternatives that provide a secure trading environment and a commitment to client safety.

In conclusion, while Maleyat may present itself as a viable trading option, the inherent risks and negative feedback suggest that traders should proceed with caution, if at all.

Is MALEYAT a scam, or is it legit?

The latest exposure and evaluation content of MALEYAT brokers.

MALEYAT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MALEYAT latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.