Maleyat 2025 Review: Everything You Need to Know

Summary

This comprehensive maleyat review provides an objective assessment of a UAE-based forex trading platform that has undergone significant changes since its establishment in 2021. Maleyat positions itself as a multi-asset broker catering to both beginner and experienced traders. The platform offers zero-commission trading across various asset classes including forex, precious metals, commodities, indices, stocks, and cryptocurrencies.

However, our analysis reveals several concerning aspects that potential traders should carefully consider. The broker operates under South African Financial Sector Conduct Authority (FSCA) regulation despite being headquartered in the UAE. This creates potential regulatory complexity that traders need to understand before investing.

Most notably, user feedback indicates that the company has changed its name from Maleyat to Naqdi, with reviewers suggesting this change may signal underlying operational issues. With 42 user reviews available on various platforms, the broker presents a mixed picture of limited transparency and incomplete information disclosure. While the zero-commission structure and multi-asset offering may appeal to cost-conscious traders, the lack of detailed information about spreads, minimum deposits, and trading conditions raises questions about overall transparency and reliability.

Important Notice

Regional Entity Differences: Maleyat operates with its headquarters in the United Arab Emirates while maintaining regulatory oversight under the South African Financial Sector Conduct Authority (FSCA). This cross-jurisdictional structure may result in different regulatory protections and operational standards depending on the trader's location and the specific entity they are dealing with.

Review Methodology: This evaluation is based on available public information, user feedback from multiple platforms, and regulatory data. Due to limited official disclosure from the broker, some assessment areas rely on user-reported experiences and third-party sources. Potential traders should conduct additional due diligence before making any trading decisions.

Rating Framework

Broker Overview

Maleyat emerged in the forex trading landscape in 2021 as a UAE-headquartered multi-asset broker targeting both novice and experienced traders. The company positions itself as a comprehensive trading solution provider, offering access to multiple financial markets through what it claims to be a zero-commission trading model. Despite its relatively recent establishment, the broker has attempted to build a presence in the competitive online trading space by focusing on asset diversity and cost-effective trading conditions.

The broker's business model centers around providing trading access to six major asset categories. These include foreign exchange pairs, precious metals, commodities, stock indices, individual stocks, and cryptocurrencies. This broad asset coverage suggests an attempt to serve as a one-stop trading destination for retail traders seeking diversified investment opportunities.

However, the company's operational transparency and detailed service information remain limited in publicly available sources. Regulatory oversight for Maleyat comes through the South African Financial Sector Conduct Authority (FSCA), despite the company's UAE headquarters location. This regulatory arrangement creates a unique jurisdictional structure that may affect trader protections and dispute resolution processes. The cross-border regulatory setup, combined with recent company name changes reported by users, adds complexity to the broker's operational profile that potential clients should carefully evaluate.

Regulatory Jurisdiction: Maleyat operates under the oversight of the South African Financial Sector Conduct Authority (FSCA). This provides regulatory framework compliance despite the UAE headquarters location.

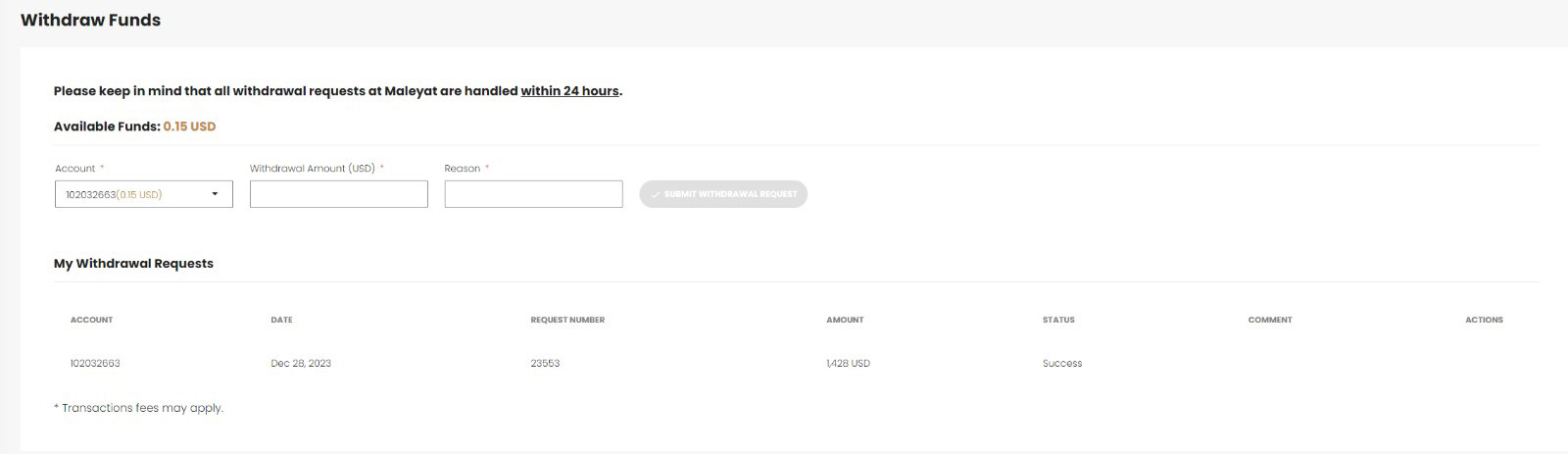

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods has not been detailed in available public sources. This requires direct inquiry with the broker for comprehensive payment processing information.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for account opening. This leaves potential traders without clear entry-level investment requirements.

Bonus and Promotional Offers: Current promotional structures, welcome bonuses, or ongoing trading incentives are not specified in available documentation. This suggests either absence of such programs or limited marketing disclosure.

Tradeable Assets: The platform provides access to six primary asset categories. These include foreign exchange currency pairs, precious metals trading, commodity markets, stock indices, individual equity positions, and cryptocurrency trading opportunities.

Cost Structure: While the broker advertises zero-commission trading, detailed information about spread structures, overnight financing costs, and other potential trading fees remains undisclosed in public sources. This maleyat review notes the importance of understanding complete cost structures before trading.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios available to traders have not been publicly detailed by the broker.

Platform Options: Trading platform specifications, software providers, and available trading interfaces are not comprehensively documented in accessible sources.

Geographic Restrictions: Regional availability and country-specific trading restrictions have not been clearly outlined by the broker.

Customer Support Languages: Available customer service languages and communication options require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation for Maleyat reveals significant information gaps that impact the overall assessment. The broker has not provided comprehensive details about account type variations, tier structures, or specific features that differentiate potential account offerings. This lack of transparency in account specification creates challenges for traders attempting to understand what services and conditions they can expect.

Minimum deposit requirements remain undisclosed. This makes it impossible for potential traders to assess entry barriers or plan their initial investment strategies. The absence of clear account opening procedures, required documentation, or verification timelines further complicates the onboarding assessment.

Additionally, specialized account options such as Islamic trading accounts, professional trader classifications, or institutional account features have not been detailed. The zero-commission trading claim represents the primary positive aspect of the account conditions, potentially offering cost savings compared to traditional commission-based brokers. However, without corresponding spread information or other fee disclosures, traders cannot accurately calculate total trading costs. This maleyat review emphasizes that incomplete account condition information significantly impacts trader decision-making capabilities and overall service transparency.

The tools and resources assessment reveals substantial deficiencies in available information about trading infrastructure and support materials. Maleyat has not provided detailed specifications about trading platforms, analytical tools, or research resources available to clients. This absence of technical information makes it difficult to evaluate the broker's technological capabilities or competitive positioning in platform functionality.

Research and market analysis resources, which are crucial for informed trading decisions, have not been documented or described in available sources. Educational materials, trading guides, webinars, or other learning resources that could benefit both beginner and experienced traders are not mentioned in the broker's public information. The lack of automated trading support details, including expert advisor compatibility or algorithmic trading capabilities, further limits the assessment of platform sophistication.

Without specific information about charting packages, technical indicators, economic calendars, or market news feeds, potential traders cannot evaluate whether the platform meets their analytical requirements. The poor scoring in this category reflects the significant information void regarding essential trading tools and educational resources that modern traders typically expect from their brokers.

Customer Service and Support Analysis (Score: 5/10)

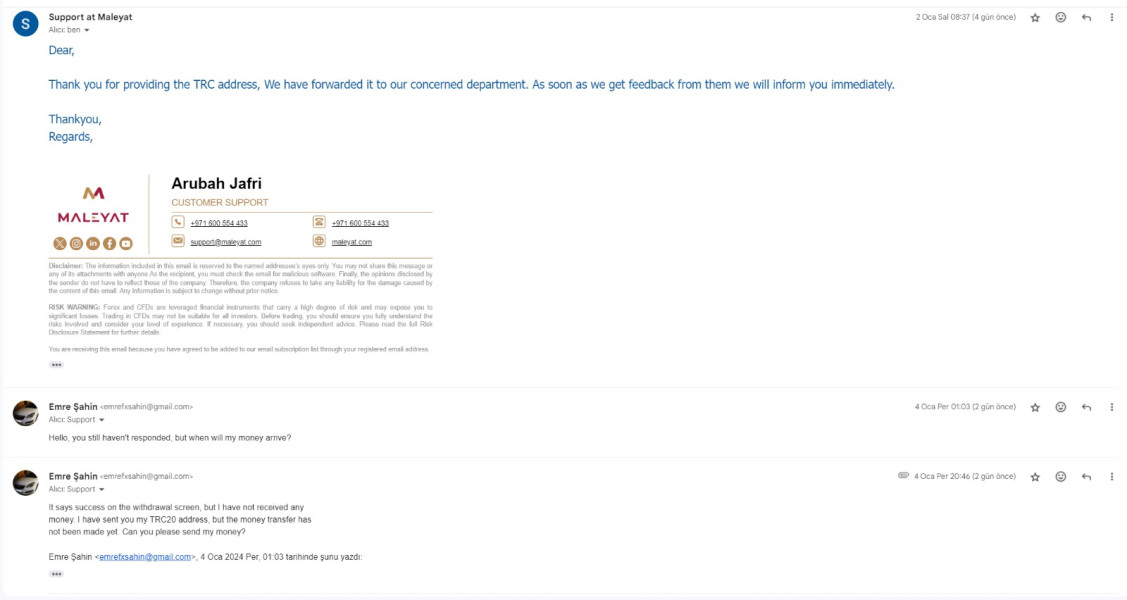

Customer service evaluation for Maleyat presents a mixed picture with limited concrete information about support quality and availability. The broker has not clearly outlined available customer service channels, whether through phone support, live chat, email ticketing systems, or other communication methods. Response time expectations and service level commitments remain undisclosed, making it difficult to assess support reliability.

The availability of multilingual support, which is particularly important for an international broker, has not been specified. Operating hours for customer service, timezone coverage, and weekend support availability are also not detailed in accessible sources. The absence of clear escalation procedures or specialized support for different account types further complicates the service assessment.

User feedback regarding customer service experiences is limited. The available reviews do not provide comprehensive insights into support quality, problem resolution effectiveness, or overall satisfaction levels. The moderate scoring reflects the uncertainty surrounding service quality rather than confirmed positive or negative experiences, highlighting the need for more transparent communication about customer support capabilities and commitments.

Trading Experience Analysis (Score: 4/10)

The trading experience assessment for Maleyat is significantly hampered by the lack of detailed platform information and user feedback specifics. Platform stability, execution speed, and order processing quality cannot be properly evaluated without comprehensive technical specifications or extensive user experience reports. The absence of information about trading platform providers, server locations, or infrastructure capabilities limits the ability to assess execution reliability.

Order execution quality, including slippage rates, requote frequency, and fill rates during high volatility periods, has not been documented or reported by users in available sources. Platform functionality completeness, such as advanced order types, risk management tools, and trading automation features, remains unspecified. Mobile trading capabilities and cross-device synchronization features are also not detailed.

The trading environment assessment lacks crucial information about market depth, liquidity provision, and whether the broker operates market maker or STP/ECN models. This maleyat review notes that without concrete execution statistics or detailed user trading experiences, the platform's suitability for different trading styles and strategies cannot be reliably determined.

Trustworthiness Analysis (Score: 5/10)

Trustworthiness evaluation reveals both regulatory positives and concerning operational aspects that require careful consideration. Maleyat's regulation under the South African Financial Sector Conduct Authority (FSCA) provides a legitimate regulatory framework, offering some level of oversight and potential trader protection. However, the cross-jurisdictional structure between UAE headquarters and South African regulation creates complexity in understanding applicable protections.

A significant concern emerges from user reports indicating the company has changed its name from Maleyat to Naqdi. Reviewers suggest this change may indicate underlying operational issues. Such name changes can sometimes signal attempts to distance from previous operational problems or negative feedback, warranting careful investigation by potential traders.

Fund safety measures, segregated account policies, and deposit protection schemes have not been clearly detailed by the broker. Company transparency regarding ownership structure, financial statements, or operational history is limited in public sources. The absence of detailed information about negative balance protection, compensation schemes, or dispute resolution procedures further impacts the trustworthiness assessment. While regulatory oversight provides some foundation for trust, the combination of limited transparency and reported name changes creates uncertainty requiring additional due diligence.

User Experience Analysis (Score: 4/10)

User experience assessment is constrained by limited detailed feedback despite the presence of 42 user reviews across platforms. The available reviews do not provide comprehensive insights into overall satisfaction levels, specific platform usability, or detailed service experiences. Interface design quality, navigation ease, and platform intuitiveness cannot be properly evaluated without more extensive user feedback or platform demonstrations.

Registration and account verification processes have not been detailed by users or the broker. This makes it difficult to assess onboarding efficiency and user-friendliness. Fund operation experiences, including deposit and withdrawal processes, processing times, and associated difficulties, are not comprehensively documented in available user feedback.

The most notable user concern relates to the company name change from Maleyat to Naqdi, with users suggesting this change indicates potential issues. This feedback raises questions about operational consistency and communication transparency. Without more detailed user experiences covering platform functionality, customer service interactions, and overall satisfaction metrics, the user experience assessment remains limited and warrants cautious evaluation by potential traders.

Conclusion

This maleyat review concludes that Maleyat presents a mixed proposition for potential traders. Several significant areas of concern outweigh its limited apparent advantages. While the broker offers zero-commission trading and multi-asset access across six different asset categories, the substantial lack of transparency and incomplete information disclosure creates considerable uncertainty for potential clients.

The broker appears most suitable for traders who prioritize low-cost trading and require multi-asset access. It particularly appeals to those comfortable with limited information disclosure and willing to conduct extensive due diligence. However, the combination of cross-jurisdictional regulatory complexity, reported name changes, and insufficient operational transparency makes it less suitable for traders seeking comprehensive information and established operational track records.

Primary advantages include the zero-commission structure and broad asset category coverage. Significant disadvantages encompass limited transparency, incomplete fee disclosure, unclear platform specifications, and concerning user reports about company name changes. Potential traders should exercise considerable caution and conduct thorough independent research before considering this broker for their trading activities.