Qsmov 2025 Review: Everything You Need to Know

Executive Summary

This qsmov review looks at a forex broker that has caused major problems in the trading world. Qsmov says it works from Canada and claims to have over 30 years of trading experience with more than one million users. Our research shows big concerns about whether this platform is real and trustworthy.

The broker offers many financial tools including forex, commodities, options, and cryptocurrencies for traders who want different investment choices. Even with these options, users always point out serious problems with taking out their money and poor customer support. Many review websites have marked Qsmov as a high-risk platform, which shows red flags about following rules and being honest about how it works.

Traders thinking about this platform should be very careful, especially because of many reports about withdrawal problems and bad customer service. The platform's rule-following status is not clear, with mixed information about its Canadian work and possible fake regulatory activities under the National Futures Association (NFA).

Important Notice

Regulatory Considerations: Qsmov's legitimacy changes a lot across different areas. The platform says it operates in Canada, but its actual regulatory status is questionable. Users must carefully research the broker's rule-following in their specific area before using the platform.

Review Limitations: This review uses available public information and user feedback. Since Qsmov itself provides limited transparency, this review may not cover all individual cases or recent changes. Traders should do their own research before making any investment decisions.

Rating Framework

Broker Overview

Qsmov started on June 29, 2020, calling itself a complete trading platform based in Canada. The company makes big claims about having over 30 years of trading experience and serving more than one million users worldwide. These claims don't match the broker's actual start date and the trust problems that have come up since it began.

The platform works with a business model that gives access to multiple asset classes, including foreign exchange markets, commodities trading, binary options, and cryptocurrency investments. Even with these different offerings, this qsmov review shows that the broker's actual reputation in the trading community is far from the professional image it tries to show.

The company's openness about how it works is questionable, with little verifiable information about its management team, financial backing, or real regulatory oversight. These factors add to the growing doubt about Qsmov's legitimacy as a reliable trading partner for serious investors.

Regulatory Jurisdiction: Qsmov claims to operate from Canada, but checking its regulatory status shows big concerns about compliance and legitimacy across different areas.

Deposit and Withdrawal Methods: Specific information about payment methods is not detailed in available resources, which raises transparency concerns by itself.

Minimum Deposit Requirements: The platform has not clearly shared minimum deposit amounts in publicly available materials.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available documentation.

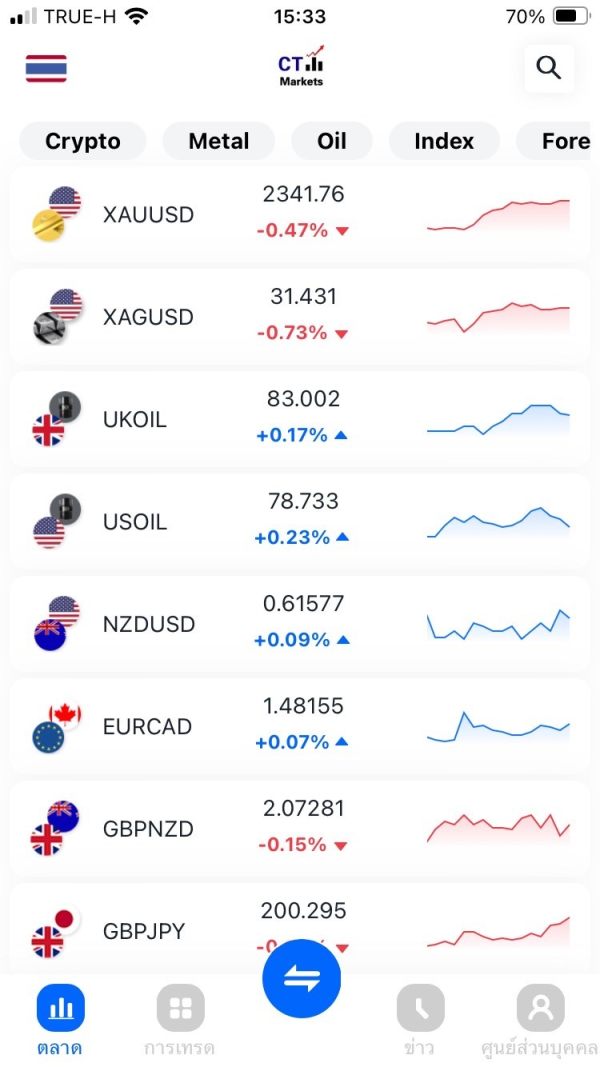

Tradeable Assets: The broker provides access to forex pairs, commodities, binary options, and cryptocurrency markets, appealing to traders seeking diverse investment opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not easily available, limiting traders' ability to judge the platform's competitiveness.

Leverage Ratios: Specific leverage offerings are not clearly stated in available materials.

Platform Options: The trading platform specifications and available software options are not detailed in accessible resources.

Geographic Restrictions: Users should know about potential regulatory differences and restrictions based on their location.

Customer Service Languages: Language support options for customer service are not specified in available materials.

This qsmov review highlights the concerning lack of transparency in many basic areas that traders typically need for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The review of Qsmov's account conditions shows a concerning lack of transparency and detailed information. Unlike established brokers that clearly outline their account types, features, and requirements, Qsmov provides very little publicly available information about its account structures. This lack of openness makes it hard for potential traders to understand what they're signing up for.

The absence of clear information about minimum deposit requirements, account tiers, and special features such as Islamic accounts or professional trading accounts is particularly troubling. This qsmov review found that user feedback about account opening processes is generally neutral to negative, with several traders reporting confusion about account terms and conditions.

When compared to industry standards, legitimate brokers typically provide complete account information, including detailed fee structures, account benefits, and clear terms of service. Qsmov's failure to meet these basic transparency standards raises big concerns about its operational legitimacy and commitment to customer service.

The lack of verifiable information about account protection measures, such as negative balance protection or segregated client funds, further hurts confidence in the platform's account conditions.

Qsmov offers a diverse range of financial instruments, including forex pairs, commodities, binary options, and cryptocurrencies, which represents one of the platform's stronger aspects. This variety can appeal to traders seeking to diversify their investment portfolios across multiple asset classes within a single platform.

However, the evaluation shows big gaps in supporting tools and resources that serious traders typically need. There is no mention of advanced research and analysis tools, market commentary, economic calendars, or educational resources that would help traders make informed decisions. The absence of detailed information about automated trading support, API access, or advanced order types further limits the platform's appeal to experienced traders.

User feedback suggests that while the asset variety is appreciated, the lack of complete trading tools and analytical resources hurts the overall trading experience. Professional traders often need sophisticated charting tools, technical indicators, and market analysis resources that appear to be missing from Qsmov's offering.

The platform's failure to provide detailed information about its trading tools and resources suggests either a lack of advanced features or poor communication about available capabilities.

Customer Service and Support Analysis (4/10)

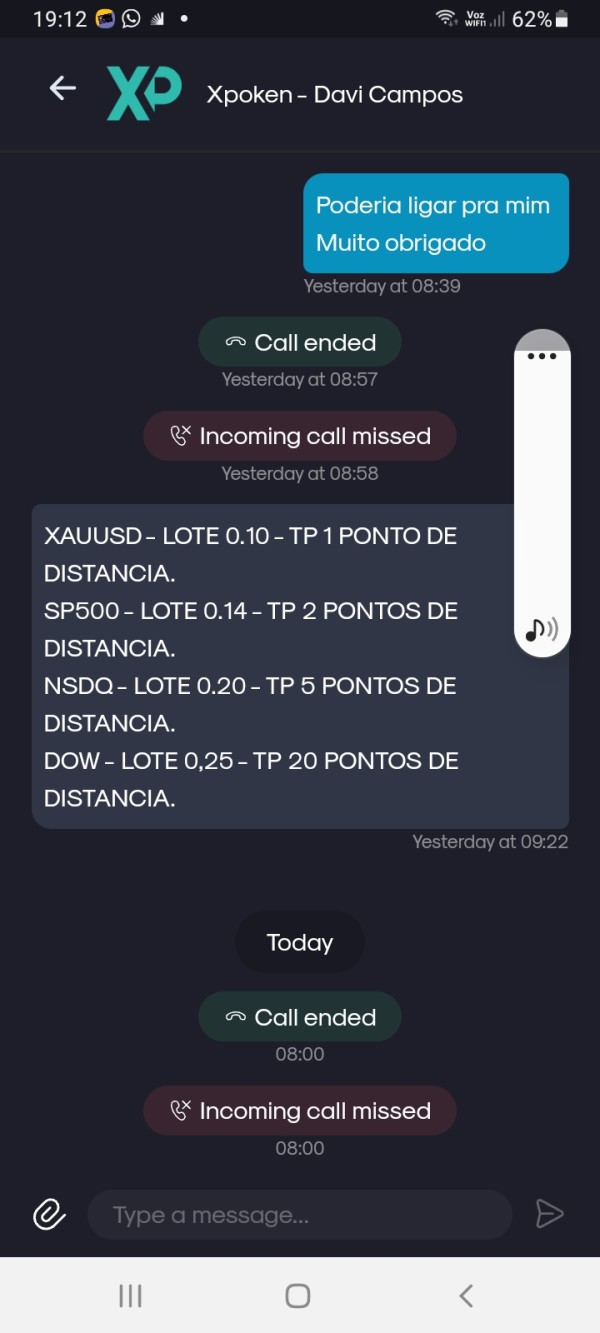

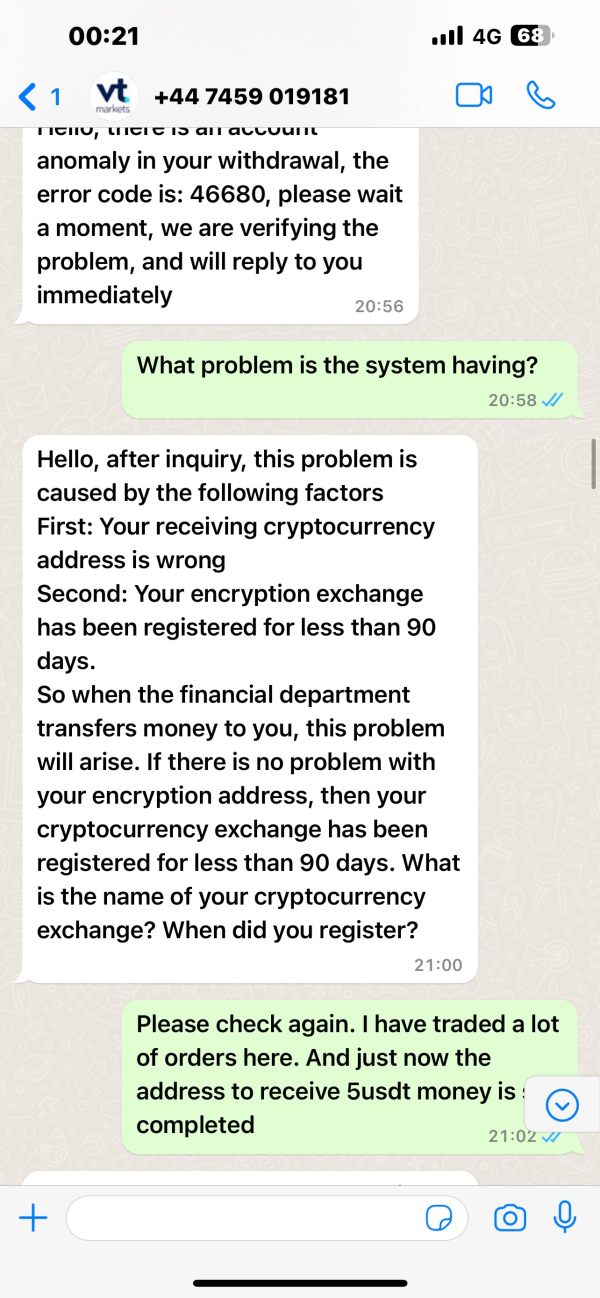

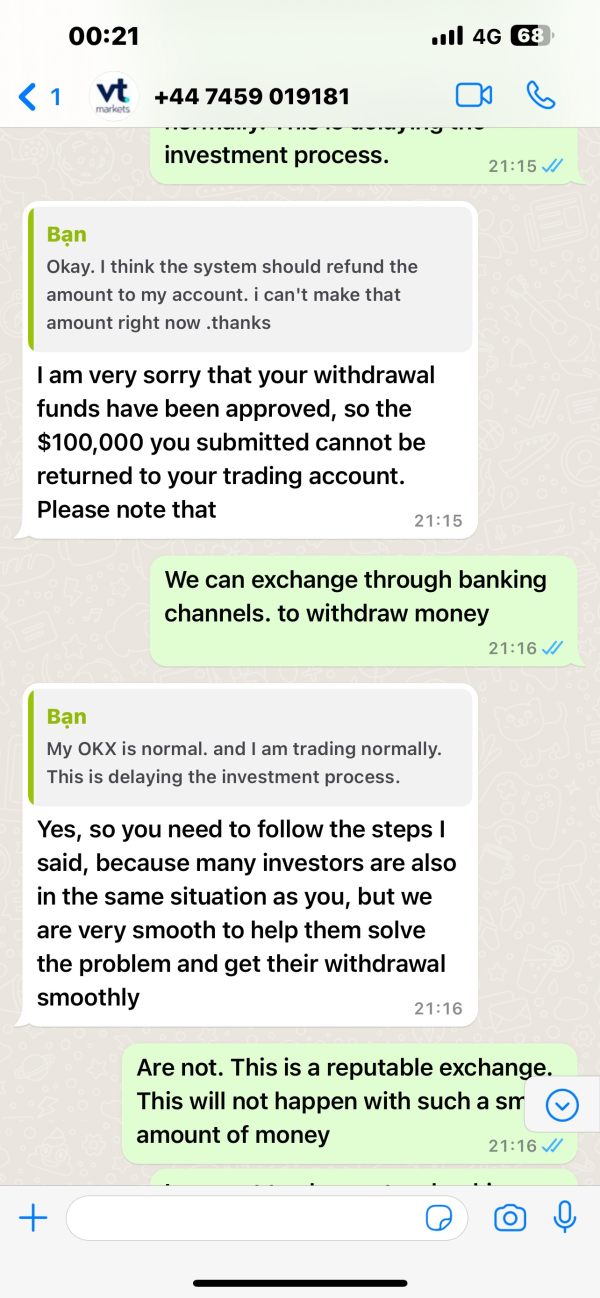

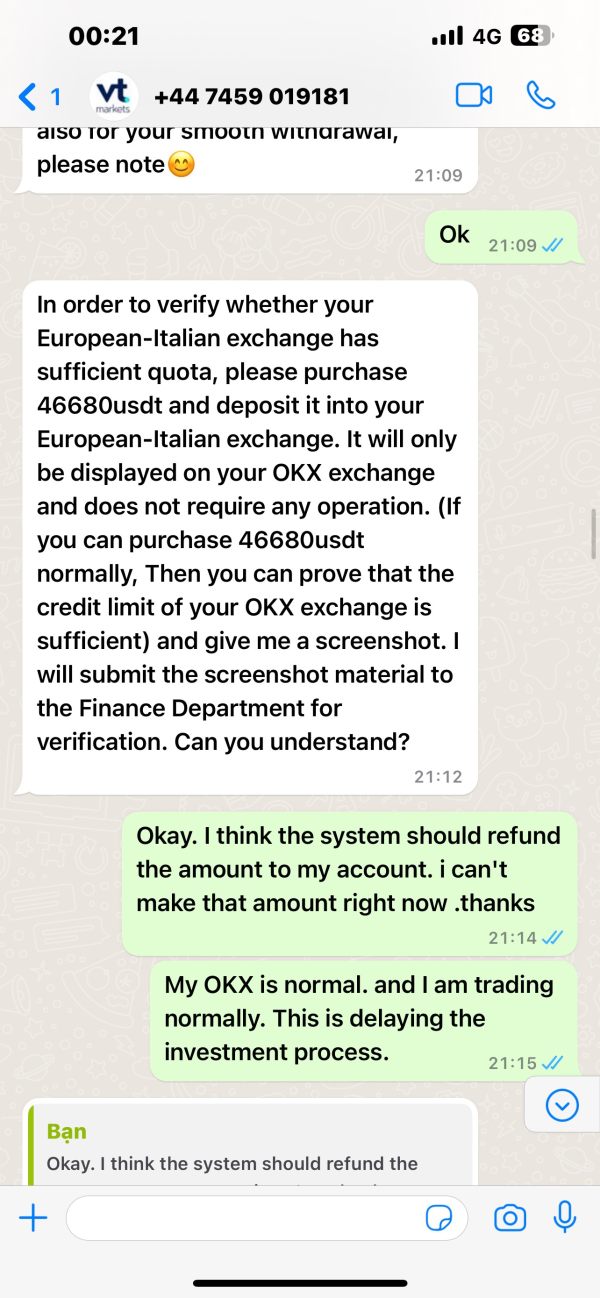

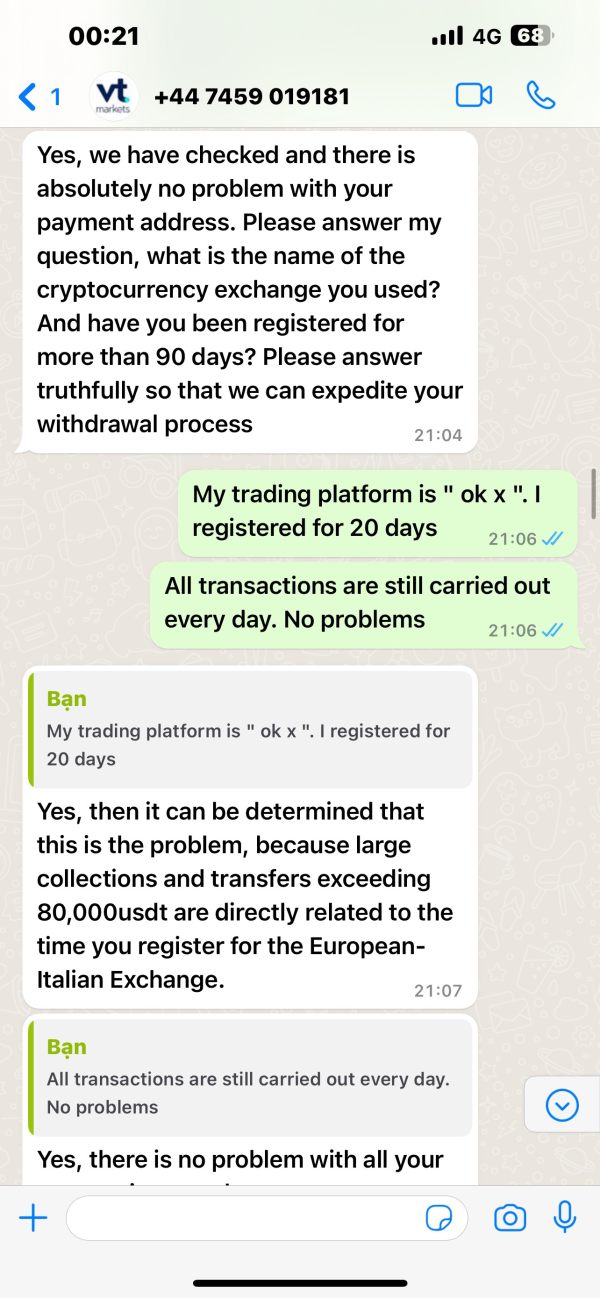

Customer service represents one of Qsmov's most significant weaknesses, according to multiple user reports and feedback sources. The platform has received many negative reviews specifically targeting the quality, responsiveness, and effectiveness of its customer support operations.

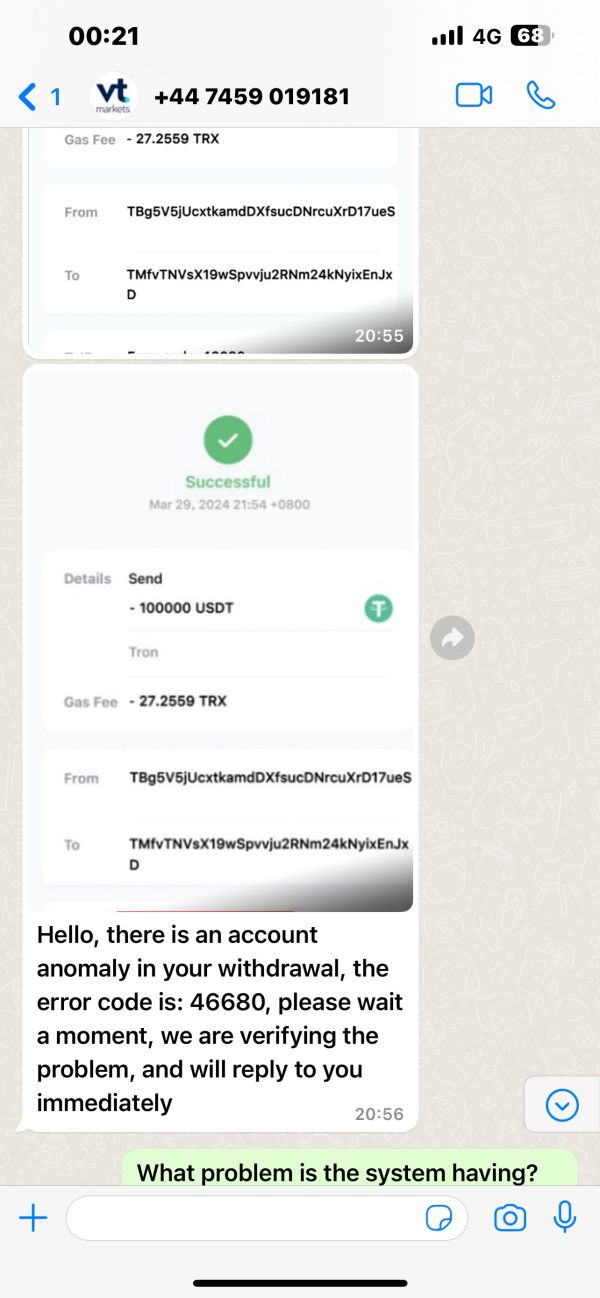

Users consistently report slow response times, unhelpful responses, and difficulty reaching qualified support representatives who can address complex trading or account issues. The lack of clear information about available customer service channels, operating hours, and multilingual support options further adds to these problems.

Professional traders and serious investors typically need reliable, knowledgeable customer support that can quickly resolve technical issues, account problems, or trading disputes. The negative feedback surrounding Qsmov's customer service suggests the platform fails to meet these basic requirements, potentially leaving traders without adequate support when they need it most.

The absence of detailed information about escalation procedures, complaint resolution processes, or customer service guarantees indicates a lack of structured support systems that legitimate brokers typically maintain.

Trading Experience Analysis (6/10)

The trading experience on Qsmov receives mixed reviews from users, with several concerning issues affecting overall platform performance. User feedback indicates problems with platform stability, execution quality, and the overall trading environment that can significantly impact trading results.

Reports of slippage, requotes, and inconsistent order execution suggest that the platform may not provide the reliable trading environment that serious traders need. These technical issues can be particularly problematic for active traders or those using specific trading strategies that depend on precise execution.

The lack of detailed information about platform specifications, server locations, execution speeds, and technology infrastructure makes it difficult to assess the platform's technical capabilities objectively. This qsmov review found that users express concerns about the overall reliability of the trading environment.

Mobile trading experience and platform functionality across different devices are not well documented, limiting traders' ability to assess whether the platform meets their accessibility and flexibility requirements.

Trust and Reliability Analysis (3/10)

Trust and reliability represent Qsmov's most significant weaknesses, with multiple red flags raising serious concerns about the platform's legitimacy and operational integrity. The broker's regulatory status remains questionable, with conflicting information about its Canadian operations and potential regulatory compliance issues.

Multiple assessment websites and review platforms have flagged Qsmov as a high-risk broker, citing concerns about its regulatory status, operational transparency, and user reports of problematic experiences. The lack of clear regulatory oversight and verifiable licensing information significantly hurts the platform's credibility.

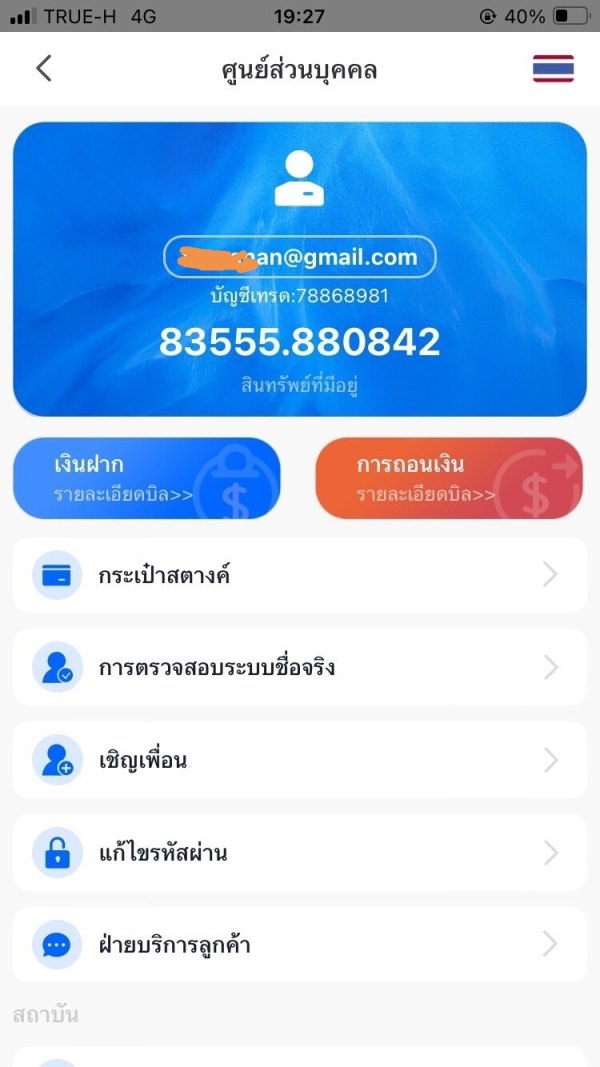

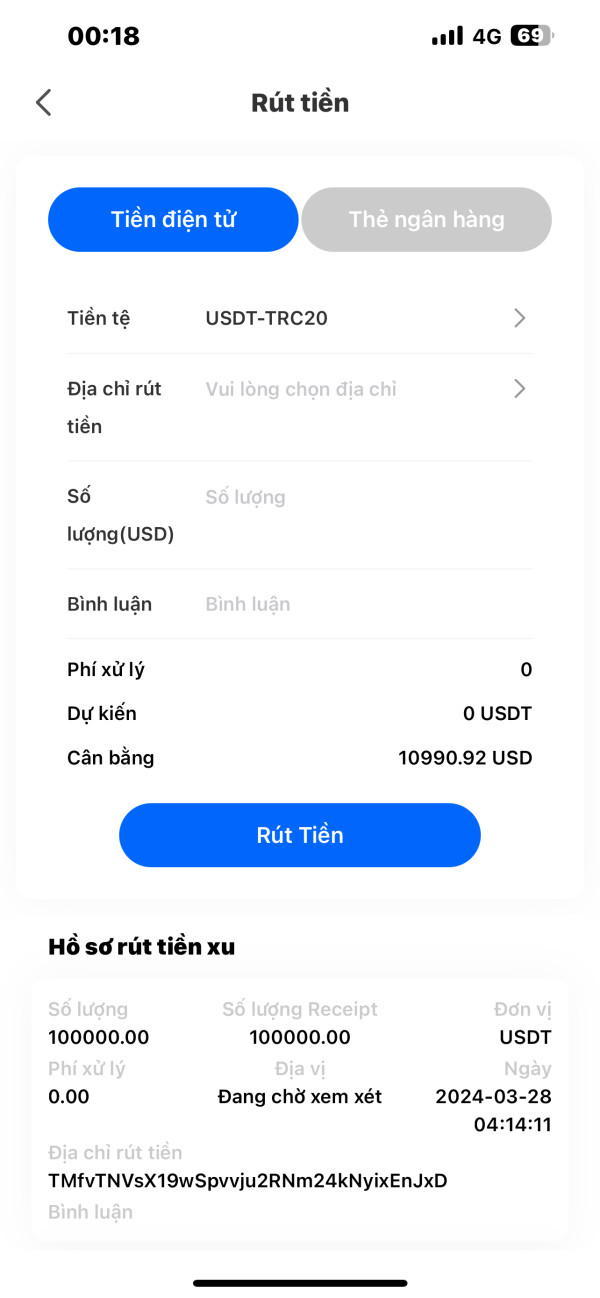

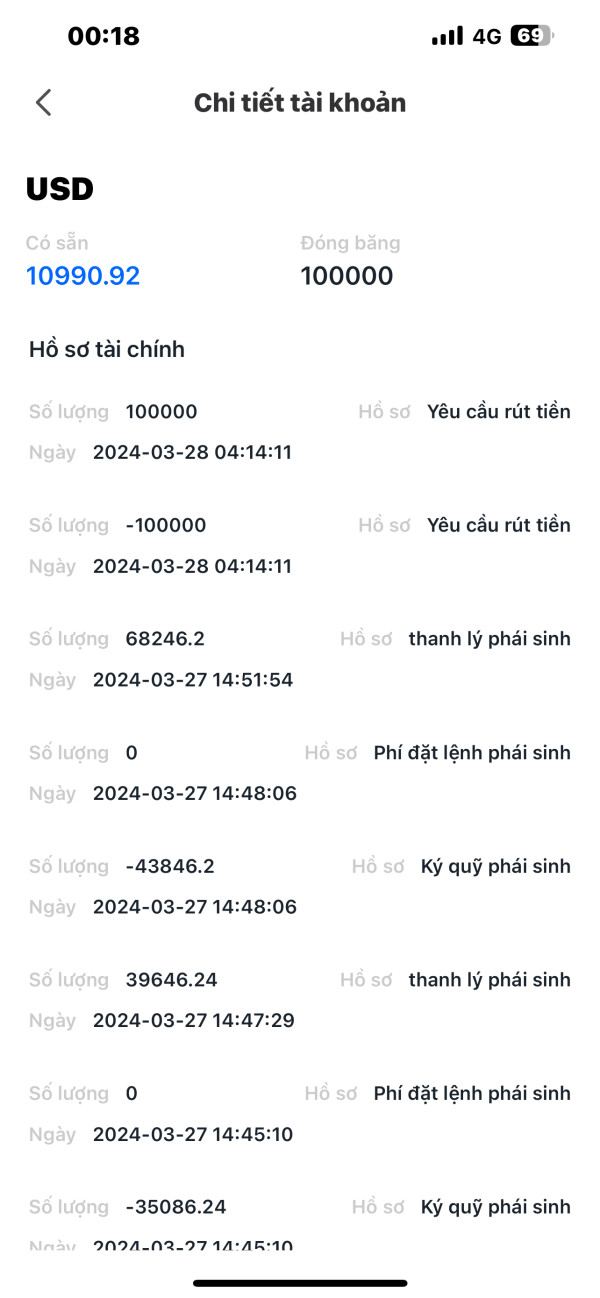

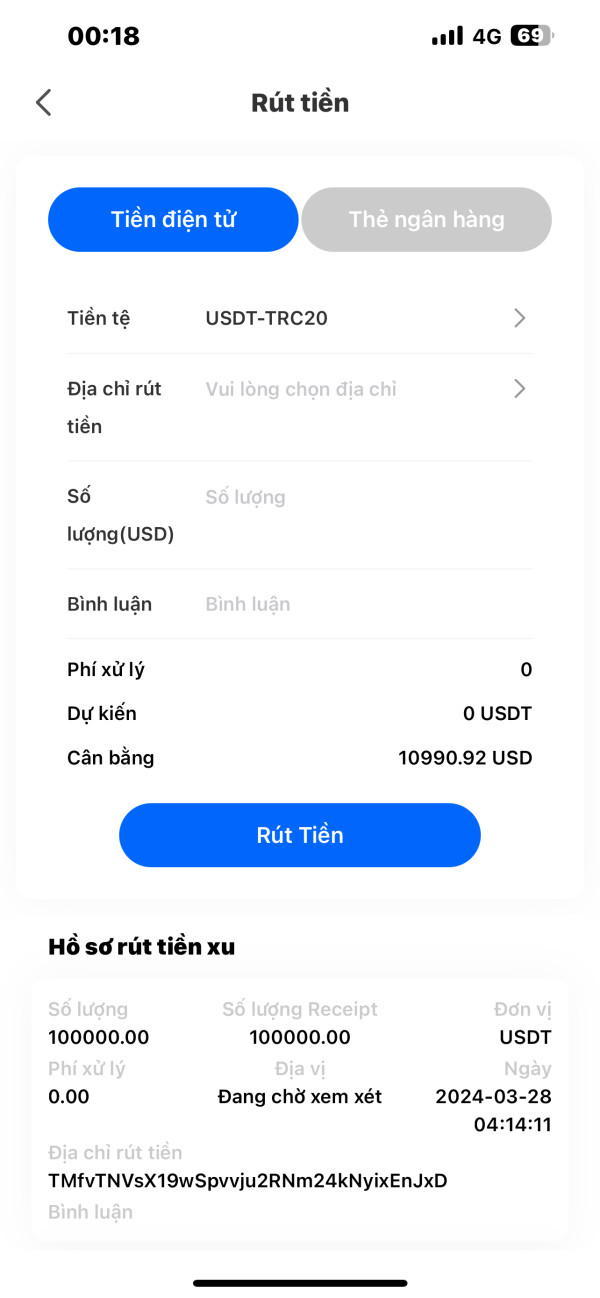

Fund safety measures, such as client fund segregation, deposit insurance, or regulatory protection schemes, are not clearly documented or verified. This absence of basic safety measures raises serious concerns about the security of trader deposits and the platform's ability to honor withdrawal requests.

The platform's limited operational history, combined with negative user experiences and regulatory concerns, creates a risk profile that serious traders should carefully consider before committing funds to the platform.

User Experience Analysis (5/10)

Overall user satisfaction with Qsmov appears to be below industry standards, with particular concerns about fund withdrawal processes and customer service interactions. The platform's user experience is significantly hurt by operational issues that affect traders' ability to manage their accounts effectively.

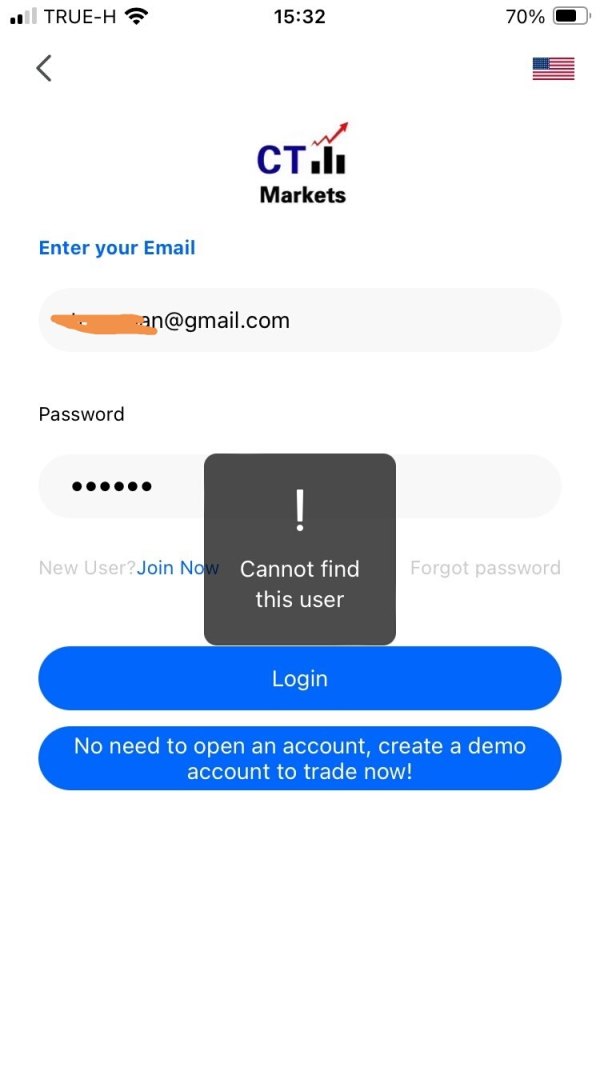

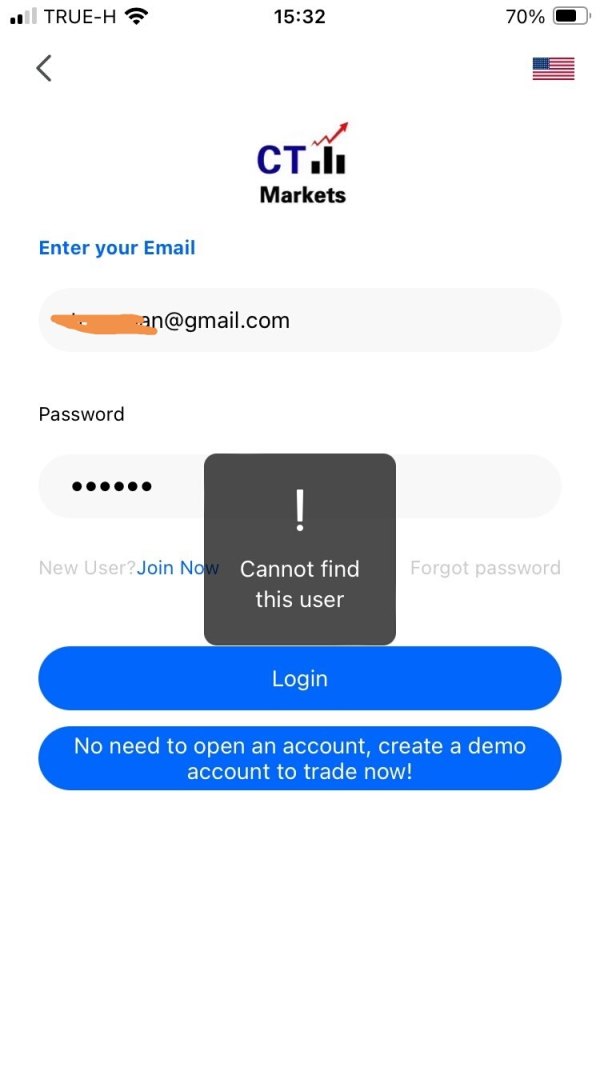

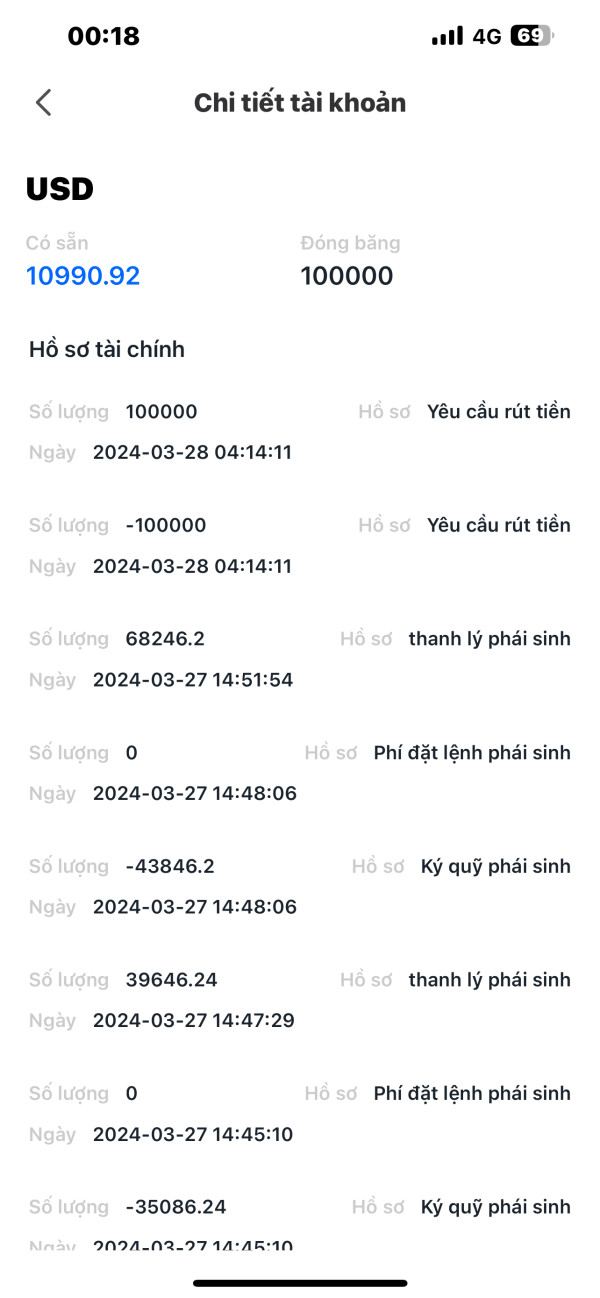

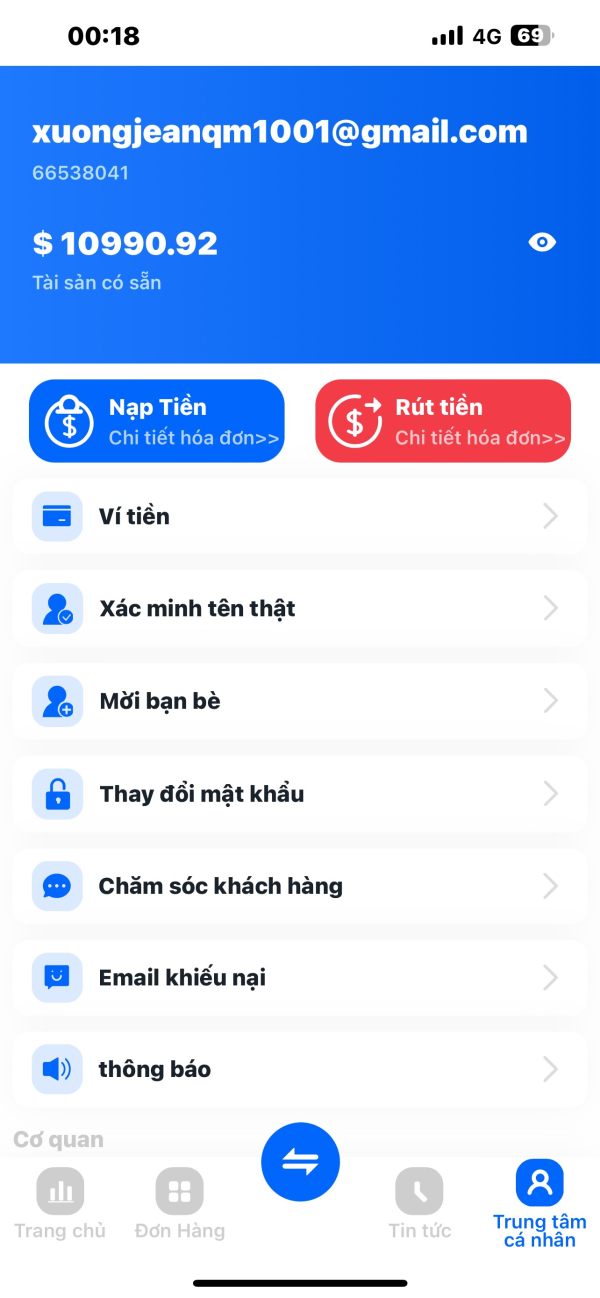

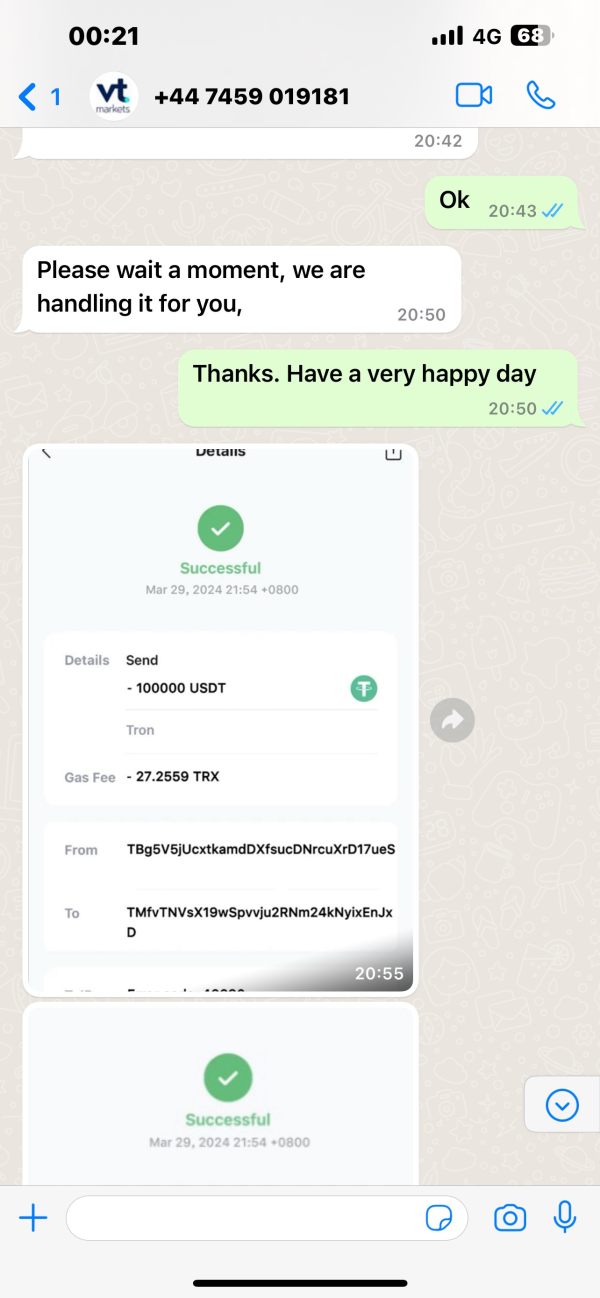

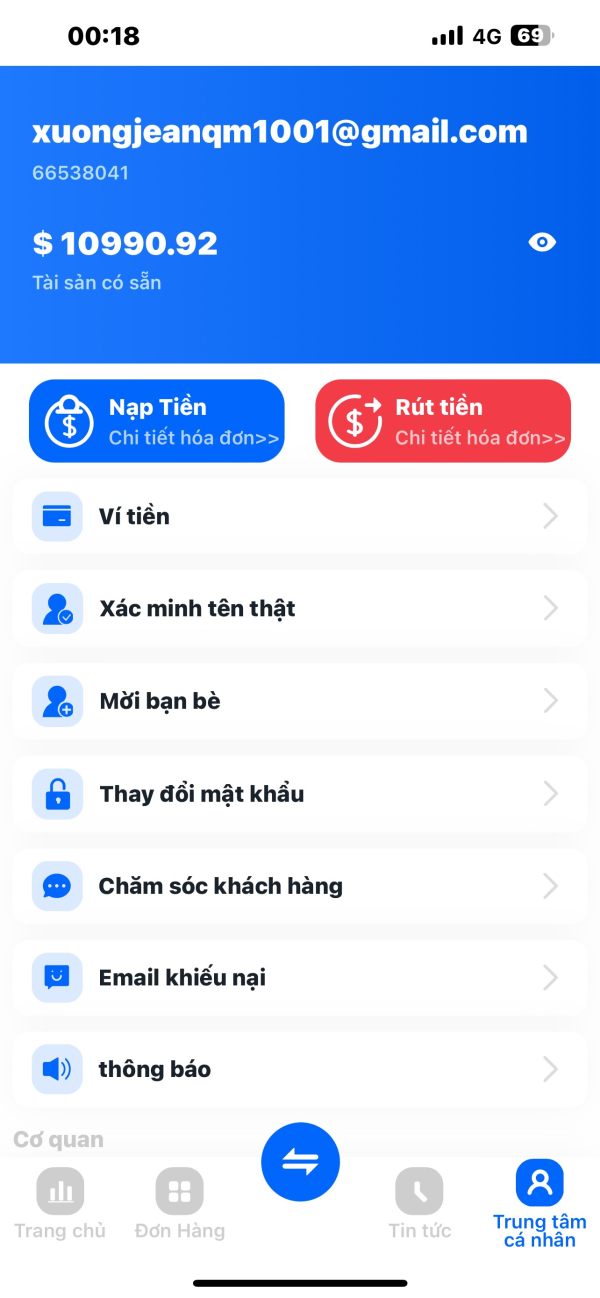

Withdrawal problems represent the most frequently cited user complaint, with multiple reports of delayed or problematic fund retrieval processes. These issues can seriously impact traders' confidence in the platform and their ability to access their own funds when needed.

The registration and account verification processes receive mixed feedback, with some users reporting confusion about requirements and procedures. Interface design and platform usability information is limited, making it difficult to assess the platform's user-friendliness objectively.

This qsmov review identifies the target user base as traders interested in diverse asset classes, particularly forex and cryptocurrency markets. However, the numerous operational issues and negative user experiences suggest that the platform may not adequately serve even this target demographic's needs.

Conclusion

Based on this complete evaluation, Qsmov receives a mostly negative assessment that should serve as a warning to potential users. While the platform offers access to multiple asset classes including forex, commodities, and cryptocurrencies, significant concerns about its legitimacy, regulatory compliance, and operational reliability overshadow these potential benefits.

The broker's main strengths lie in its diverse asset offerings, which may appeal to traders seeking variety in their investment options. However, these advantages are substantially outweighed by serious weaknesses in customer service, withdrawal processes, regulatory transparency, and overall operational integrity.

Traders, particularly those new to forex and cryptocurrency markets, should exercise extreme caution when considering Qsmov as their trading platform. The numerous red flags, negative user experiences, and questionable regulatory status suggest that more established and properly regulated alternatives would better serve most traders' needs and provide greater security for their investments.