Is Stargaze Capital safe?

Business

License

Is Stargaze Capital A Scam?

Introduction

Stargaze Capital is an online forex broker that has recently emerged in the trading market, claiming to offer a variety of financial services including forex, indices, commodities, and more. As with any trading platform, it is crucial for traders to conduct thorough due diligence before investing. The forex market is rife with opportunities, but it also presents risks, especially when dealing with unregulated brokers. This article aims to provide an objective analysis of Stargaze Capital, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on a review of online resources, regulatory warnings, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a vital factor that determines its legitimacy and trustworthiness. A regulated broker is subject to scrutiny by financial authorities, which helps protect traders' funds and ensures fair trading practices. Unfortunately, Stargaze Capital operates without any regulatory oversight, raising significant concerns about its safety and transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Stargaze Capital is not held accountable by any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of oversight is alarming, as it leaves traders vulnerable to potential fraud and mismanagement of their funds. Moreover, the broker has been flagged by various regulators, including the Comisión Nacional del Mercado de Valores (CNMV) in Spain and the Autorité des Marchés Financiers (AMF) in France, for unauthorized provision of financial services.

Company Background Investigation

Stargaze Capital claims to be based in the UK, but its actual ownership and operational history remain unclear. The broker was established in 2023, and there is limited information available regarding its management team or corporate structure. The anonymity surrounding its ownership is a red flag, as reputable brokers typically provide transparent information about their executives and business operations.

Furthermore, the lack of historical data raises questions about the broker's reliability and commitment to ethical trading practices. Transparency is crucial in the financial services industry, and the failure to disclose key information about the company can lead to distrust among potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Stargaze Capital provides a tiered account structure with varying minimum deposit requirements, but specific details about spreads, commissions, and other trading costs are not readily available.

| Cost Type | Stargaze Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2-3% |

The absence of clear information regarding trading costs can lead to unexpected expenses for traders, potentially eroding their profits. Additionally, the broker's lack of transparency regarding fees is concerning, as it may indicate hidden charges or unfavorable trading conditions.

Customer Fund Safety

The safety of customer funds is paramount when selecting a broker. Stargaze Capital does not provide adequate measures to ensure the security of clients' funds. The absence of segregated accounts, investor protection schemes, and negative balance protection policies exposes traders to significant risks.

Historically, unregulated brokers have been known to mismanage client funds, leading to financial losses for traders. Without any regulatory oversight, there is no recourse for clients who may face issues with fund withdrawals or account management.

Customer Experience and Complaints

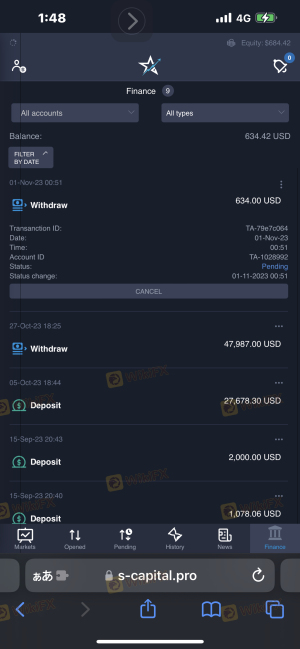

Customer feedback is an essential component of assessing a broker's reliability. Unfortunately, reviews of Stargaze Capital reveal a pattern of negative experiences, with many users reporting difficulties in withdrawing funds and experiencing aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Aggressive Sales Tactics | Medium | Inadequate |

Typical complaints include reports of pending withdrawals and unsolicited calls pressuring clients to deposit more funds. These issues not only highlight the broker's questionable practices but also indicate a lack of effective customer support.

Platform and Trade Execution

The trading platform offered by Stargaze Capital is another critical aspect to consider. The broker utilizes a web-based trading platform, which may lack the robustness and reliability of established platforms like MetaTrader 4 or 5.

Concerns have been raised regarding order execution quality, including instances of slippage and rejected orders. Such issues can significantly impact a trader's ability to execute their strategies effectively, leading to potential financial losses.

Risk Assessment

Engaging with Stargaze Capital presents several risks that potential investors should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight leaves traders vulnerable. |

| Fund Security Risk | High | Lack of fund protection and transparency. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

To mitigate these risks, traders should consider alternatives with established regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, Stargaze Capital exhibits numerous red flags that suggest it may not be a trustworthy broker. The lack of regulation, transparency, and poor customer feedback indicate potential risks for traders. Therefore, it is advisable for potential investors to exercise extreme caution and consider alternative, regulated brokers that offer better security and support.

For traders seeking reliable options, brokers like RoboForex and FXTM, which are well-regulated and have positive reputations, may provide safer trading environments. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is Stargaze Capital a scam, or is it legit?

The latest exposure and evaluation content of Stargaze Capital brokers.

Stargaze Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Stargaze Capital latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.