Is Qsmov safe?

Business

License

Is Qsmov A Scam?

Introduction

Qsmov is a global brokerage firm based in Canada that claims to offer a wide range of financial instruments, including forex, commodities, options, and cryptocurrencies. As the forex market continues to grow, it is crucial for traders to carefully evaluate the credibility and legitimacy of brokers before investing their hard-earned money. With the rise of scams and fraudulent activities in the online trading space, traders must remain vigilant and conduct thorough research. This article aims to provide an objective assessment of Qsmov by analyzing its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks.

Regulatory and Legitimacy

The regulatory environment is a critical factor in determining the trustworthiness of a brokerage. Qsmov claims to be regulated by the National Futures Association (NFA) in the United States, with a license number of 0557315. However, multiple sources have raised concerns about the validity of this license, suggesting it may be a clone or fraudulent. The lack of valid regulation can be a significant red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association | 0557315 | United States | Suspected Clone |

The absence of legitimate regulatory oversight raises questions about Qsmov's commitment to compliance and client security. Regulatory bodies play a vital role in protecting investors by ensuring that brokers adhere to strict standards and practices. Brokers without valid regulation may not have the same level of accountability, which can expose traders to significant risks. Given these concerns, it is advisable for potential clients to approach Qsmov with caution.

Company Background Investigation

Qsmov was founded in 2019 and has positioned itself as a global brokerage firm catering to a diverse clientele. However, there is limited information available regarding its ownership structure and management team. Transparency is essential for building trust, and the lack of publicly available information may lead to skepticism among potential investors.

The management team's background and professional experience are crucial in assessing the firm's credibility. A strong team with a proven track record in the financial industry can significantly enhance a broker's reputation. Unfortunately, Qsmov has not provided sufficient details about its management team, which raises concerns about its operational integrity.

Moreover, the company's transparency regarding its operations and policies is lacking. A reputable broker should provide clear information about its services, fees, and trading conditions. The absence of such information can create an environment of uncertainty for potential clients, making it challenging to assess the broker's reliability.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. Qsmov claims to offer competitive trading fees; however, the specifics of its fee structure remain unclear. A transparent broker should provide detailed information about spreads, commissions, and overnight interest rates.

| Fee Type | Qsmov | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | Varies by Broker |

| Commission Model | Not Disclosed | Varies by Broker |

| Overnight Interest Range | Not Disclosed | Varies by Broker |

The lack of clarity surrounding these fees can be a cause for concern. Traders should be wary of any hidden fees that may significantly impact their trading profitability. Additionally, brokers that do not disclose their fee structures may be attempting to obscure unfavorable trading conditions, which could lead to negative trading experiences for clients.

Client Fund Safety

The safety of client funds is one of the most critical aspects to consider when evaluating a broker. Qsmov claims to employ various measures to ensure the security of clients' funds, including data protection laws and advanced encryption technology. However, without valid regulatory oversight, the effectiveness of these measures cannot be adequately assessed.

The segregation of client funds is essential for protecting investors in the event of a broker's insolvency. Additionally, investor protection schemes, such as those offered by regulatory bodies, can provide an extra layer of security for clients. Unfortunately, due to Qsmov's questionable regulatory status, it is unclear whether client funds are adequately protected.

Furthermore, historical incidents involving fund safety issues can serve as indicators of a broker's reliability. Any past controversies or disputes related to client funds should be thoroughly investigated before committing to a broker. At present, there are no documented fund safety issues specific to Qsmov, but the lack of regulation raises concerns about the potential for future problems.

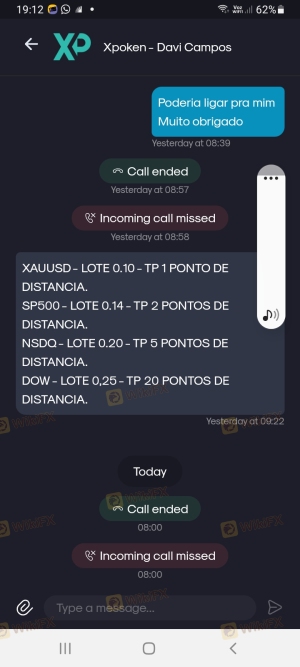

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reputation. Reviews and testimonials can provide valuable insights into the experiences of existing clients. Unfortunately, Qsmov has received mixed reviews, with several users reporting difficulties in withdrawing funds and poor customer service responses.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Inconsistent |

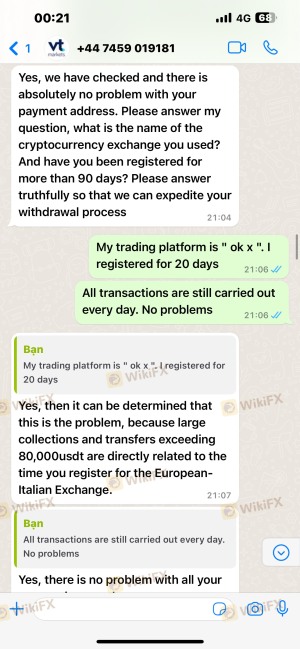

Common complaints revolve around withdrawal difficulties, with some clients alleging that their accounts were frozen or that they were asked to deposit additional funds to access their money. Such experiences can be alarming for potential investors, as they indicate a lack of transparency and reliability.

One notable case involved a client who reported a successful trading experience but subsequently faced challenges when attempting to withdraw a substantial amount. The client was informed that their account needed to be upgraded to facilitate the withdrawal, raising suspicions about the broker's practices. This type of feedback can deter potential clients and highlights the importance of choosing a reputable broker.

Platform and Trade Execution

The trading platform's performance is a critical aspect of the trading experience. Qsmov offers a web-based trading platform that is claimed to be technologically advanced. However, the lack of details regarding its execution quality, slippage rates, and order rejection rates raises concerns.

Traders expect a seamless trading experience with minimal delays and high execution reliability. Any signs of platform manipulation or poor execution can significantly impact trading outcomes. Unfortunately, without comprehensive user feedback and performance metrics, it is challenging to assess the platform's reliability effectively.

Risk Assessment

Using Qsmov presents several risks that potential clients should carefully consider. The primary concerns revolve around the broker's regulatory status, transparency, and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of valid regulation raises concerns about oversight. |

| Fund Safety | High | Uncertainty regarding fund protection measures. |

| Customer Service | Medium | Mixed reviews indicate potential issues with support. |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a small initial investment, and remain vigilant about any unusual requests or practices from the broker.

Conclusion and Recommendations

In conclusion, Qsmov raises several red flags that warrant caution among potential investors. The broker's lack of valid regulation, transparency issues, and mixed customer feedback suggest that it may not be a safe choice for trading. While Qsmov offers a variety of financial instruments, the risks associated with its operations may outweigh the potential benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers with established regulatory credentials, transparent fee structures, and positive customer reviews. Reliable options may include well-regulated firms that prioritize client safety and provide comprehensive support. Ultimately, thorough research and due diligence are essential for making informed trading decisions in the ever-evolving forex market.

Is Qsmov a scam, or is it legit?

The latest exposure and evaluation content of Qsmov brokers.

Qsmov Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Qsmov latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.