SFX 2025 Review: Everything You Need to Know

Summary

This sfx review gives you a complete look at SFX Markets. SFX Markets is an offshore forex broker that works with loose rules, which creates risks for traders who might want to use their services. Information from Forex-Awards and Myfxbook shows that SFX Markets says it offers many different trading and technical solutions in the foreign exchange market. Our review shows that this broker charges more than average for trading costs. High costs can hurt profits for traders who trade often. The platform mainly helps forex traders who want different trading tools and technical solutions, but the lack of clear regulatory information makes us worry about how well they protect investors.

SFX Markets does offer various trading and technical solutions for their clients. The limited transparency about following regulations and higher-than-average trading costs mean that traders should be careful when thinking about using this broker for their trading activities.

Important Notice

SFX Markets works as an offshore forex broker, so it may operate under different regulatory rules in various places around the world. Investors should know about the legal risks that come with this setup. The regulatory framework that controls offshore brokers can change a lot depending on the region, which might affect how much investor protection you can get.

This review uses available key information summaries and data that anyone can access. User experiences may be different depending on where you live and what the local regulatory requirements are in your area. Traders should strongly check the broker's regulatory status in their specific area before opening an account with them.

Rating Framework

Broker Overview

SFX Markets works as an offshore forex broker. The company gives various trading and technical solutions to clients across global markets. Information from Forex-Awards shows that the company has set up its business in the competitive foreign exchange industry, though specific details about when it started and its corporate background are limited in available documentation.

The broker's business model focuses on offshore operations. This allows it to serve international clients but also creates questions about regulatory oversight and investor protection measures. The company's approach to the forex market focuses on providing multiple trading and technical solutions, though the specific nature of these offerings is not detailed in available sources.

Myfxbook and other industry sources report that SFX Markets operates mainly in the foreign exchange sector. Limited information is available about other asset classes or investment products. The broker's regulatory status stays unclear from available information, which is a big concern for potential traders seeking transparent and well-regulated trading environments.

Regulatory Jurisdiction: Available information summaries do not mention specific regulatory authorities and licenses. This creates concerns about oversight and investor protection.

Deposit and Withdrawal Methods: Available information does not tell us about the payment methods that SFX Markets supports, including processing times and potential fees.

Minimum Deposit Requirements: Current information sources do not detail the minimum deposit amount required to open an account with SFX Markets.

Bonuses and Promotions: The reviewed materials do not have any information about promotional offers, welcome bonuses, or ongoing trading incentives.

Tradeable Assets: The broker mainly focuses on forex trading. Available sources do not detail the specific currency pairs and market depth.

Cost Structure: Available information shows that SFX Markets' basic account trading costs are above average market levels. This may impact trader profitability and competitiveness compared to other brokers.

Leverage Ratios: The information summaries do not mention specific leverage offerings and maximum ratios available to traders.

Platform Options: Available documentation does not specify details about trading platforms, whether proprietary or third-party solutions like MetaTrader.

Regional Restrictions: Current sources do not have information about geographical limitations or restricted countries.

Customer Service Languages: The sfx review materials do not detail supported languages for customer support services.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions at SFX Markets get a below-average rating mainly because of limited transparency and higher-than-average trading costs. Available information shows that the broker's basic account structure involves trading costs that go beyond industry averages, which can significantly impact trader profitability, especially for high-frequency traders or those working with smaller account balances.

The lack of specific information about account types and their respective features makes it hard for potential clients to understand what they can expect from different service levels. The absence of detailed information about minimum deposit requirements, account opening procedures, and special account features such as Islamic accounts makes the low rating even worse. Without clear documentation of account terms and conditions, traders cannot make informed decisions about whether the broker's offerings match their trading strategies and financial capabilities.

This sfx review finds that the limited transparency about account structures and the confirmed above-average costs create barriers for traders seeking competitive and well-defined trading conditions.

SFX Markets gets a poor rating for tools and resources because there is no detailed information about trading tools, research capabilities, and educational resources in available documentation. Modern forex trading needs sophisticated analytical tools, real-time market data, economic calendars, and comprehensive research resources to support informed trading decisions.

The lack of information about these critical components suggests either inadequate offerings or poor communication about available resources. Educational resources are particularly important for both novice and experienced traders, as the forex market's complexity requires ongoing learning and skill development. The absence of information about webinars, tutorials, market analysis, or trading guides shows a significant gap in the broker's service offering.

Additionally, no information is available about automated trading support, algorithmic trading capabilities, or advanced charting tools. These are standard expectations in today's competitive forex brokerage environment. This lack of transparency and apparent absence of comprehensive trading resources significantly impacts the overall value proposition for potential clients.

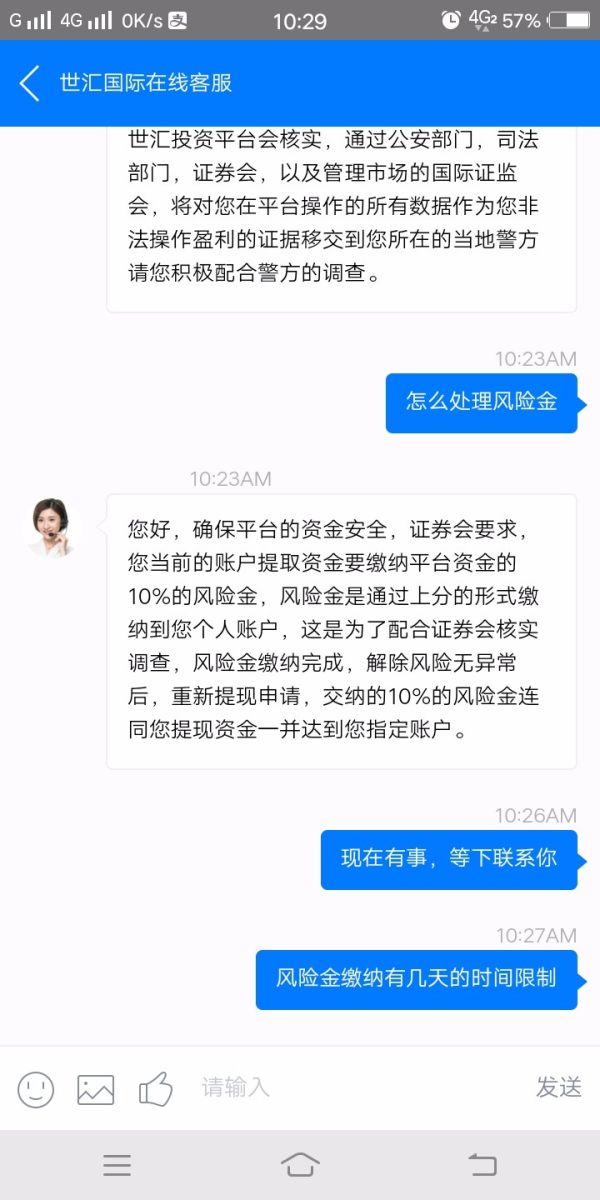

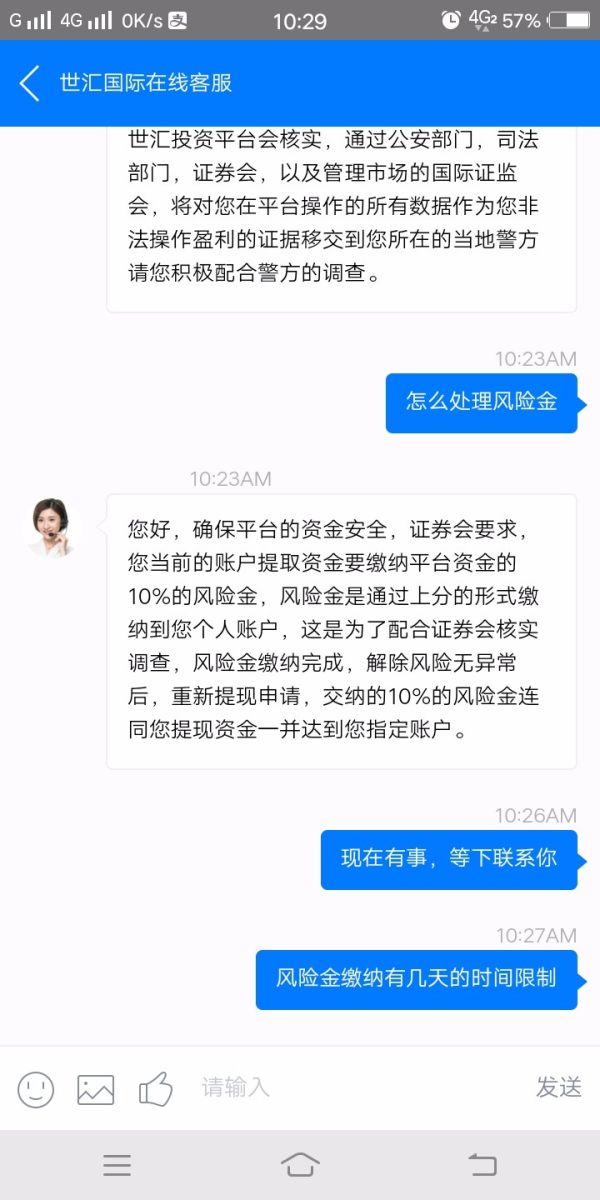

Customer Service and Support Analysis (4/10)

The customer service and support evaluation for SFX Markets is hurt by the complete lack of available information about support channels, response times, and service quality metrics. Effective customer support is crucial in forex trading, where market conditions can change rapidly and traders may need immediate assistance with technical issues, account problems, or trading-related queries.

The absence of information about available support channels such as live chat, phone support, email assistance, or help desk tickets creates concerns about the broker's commitment to client service. Response time expectations, service availability hours, and the quality of support provided are not documented in available sources, making it impossible to assess whether SFX Markets can meet traders' support needs effectively. Multi-language support capabilities, which are essential for international offshore brokers, are also not specified.

Without documented customer feedback, service quality metrics, or case studies showing problem resolution capabilities, potential clients cannot evaluate whether the broker provides adequate support for their trading activities.

Trading Experience Analysis (5/10)

The trading experience at SFX Markets gets an average rating because there is insufficient information about platform performance, execution quality, and overall trading environment. Critical factors such as platform stability, order execution speed, and system reliability are not detailed in available documentation, making it difficult to assess the actual trading experience clients can expect.

SFX review materials do not provide insights into platform functionality, user interface design, or the overall trading environment quality. Order execution quality, including factors like slippage, requotes, and execution speed during volatile market conditions, remains undocumented. The absence of information about mobile trading capabilities, platform compatibility across different devices, and advanced trading features limits the ability to evaluate the broker's technological offerings.

Without user feedback about platform performance, trading conditions during different market sessions, or technical performance data, the trading experience assessment must remain neutral. However, the lack of transparency itself suggests potential limitations in the broker's technological infrastructure and user experience design.

Trust Factor Analysis (4/10)

SFX Markets' trust factor gets a below-average rating mainly because of the acknowledged loose regulatory oversight and the absence of detailed regulatory information. Trust is fundamental in forex trading, where clients deposit significant funds and rely on brokers for fair execution and fund security.

The classification as an offshore forex broker with relatively loose regulatory oversight immediately creates concerns about investor protection, dispute resolution mechanisms, and adherence to industry standards. The lack of specific information about regulatory licenses, compliance measures, and fund security protocols further undermines confidence in the broker's trustworthiness. Industry reputation, third-party evaluations, and transparency about corporate structure and ownership are not available in current documentation.

Without clear information about negative event handling, regulatory compliance history, or independent verification of business practices, potential clients face significant uncertainty about the broker's reliability. The sfx review indicates that the regulatory concerns and limited transparency create substantial trust deficits that potential traders must carefully consider.

User Experience Analysis (3/10)

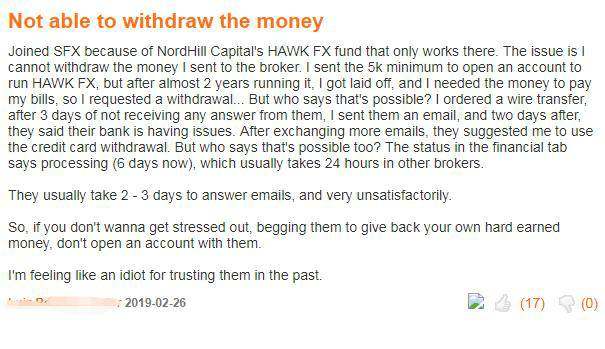

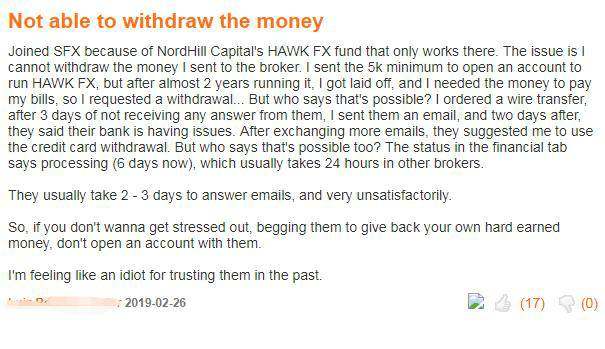

User experience at SFX Markets gets a poor rating because there is no user feedback, satisfaction metrics, and detailed information about the client journey. User experience includes all aspects of interaction with the broker, from initial registration and account verification through ongoing trading activities and fund management.

The lack of available user testimonials, satisfaction surveys, or documented user experiences prevents a comprehensive evaluation of how well the broker serves its clients' needs. Interface design quality, ease of navigation, registration process efficiency, and overall usability are not documented in available sources. The absence of information about common user complaints, feature requests, or improvement initiatives suggests limited focus on user experience optimization.

Without data about user retention rates, satisfaction scores, or feedback mechanisms, it's impossible to assess whether SFX Markets prioritizes client experience or responds effectively to user needs and concerns.

Conclusion

This comprehensive sfx review shows that SFX Markets, while offering diverse trading and technical solutions as an offshore forex broker, presents significant concerns that potential traders must carefully consider. The broker's classification as having relatively loose regulatory oversight, combined with trading costs above industry averages, creates a challenging proposition for traders seeking reliable and cost-effective trading environments.

The most suitable users for SFX Markets would be experienced forex traders who specifically seek diversified trading tools and technical solutions and are comfortable with the inherent risks of offshore broker relationships. The main advantages include the broker's focus on providing multiple trading and technical solutions, which may appeal to traders seeking variety in their trading approach. However, the disadvantages significantly outweigh these benefits, including the lack of clear regulatory information, above-average trading costs, limited transparency about services and features, and absence of detailed user feedback or satisfaction data.