ExpertOption 2025 Review: Everything You Need to Know

Executive Summary

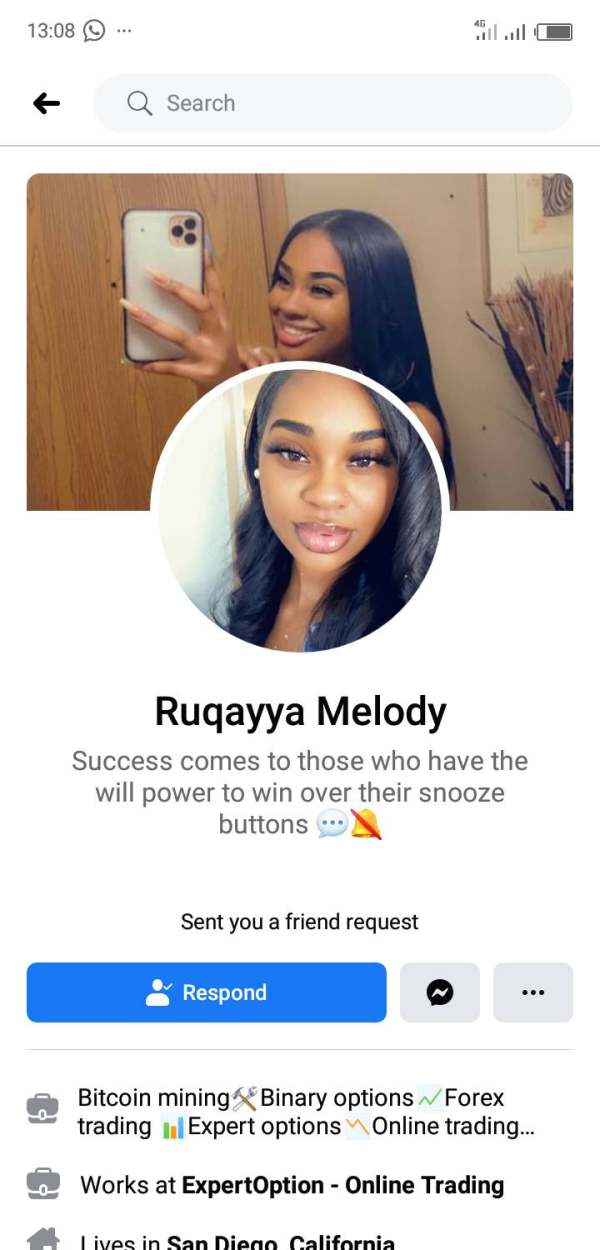

ExpertOption is an online trading platform. It has attracted about 12 million users worldwide, offering access to over 100 different assets across currencies, commodities, stocks, and indices. This ExpertOption review shows a platform with mixed reception in the trading community. The platform earns an overall rating of 4 out of 5 stars based on 227 reviews, though this positive average hides significant underlying concerns.

The platform has a user-friendly interface and promises fast deposit and withdrawal processing times. This has helped build its large user base. However, several review websites have flagged ExpertOption with "not recommended broker" warnings, and there are ongoing fraud claims in trading communities.

While 160 customers have rated their experience as excellent, the platform faces serious trust issues. Potential traders must carefully consider these problems. The broker mainly targets digital traders seeking diverse asset exposure, particularly those interested in binary options and CFD trading.

Despite its large user base and wide asset selection, the mixed reviews and regulatory concerns suggest that traders should approach this platform with extra caution. They should also do thorough research before investing.

Important Notice

This review is based on publicly available information and user feedback collected from various trading review platforms and forums. ExpertOption operates across multiple regions, and regulatory status may vary significantly between areas, potentially affecting the trading experience for users in different countries. The information presented here reflects the general consensus from available sources, though specific regulatory details were not fully detailed in the source materials.

Our evaluation method relies on user testimonials, third-party reviews, and publicly accessible platform information. We have not conducted direct testing of the platform's services, and traders are strongly advised to verify all information independently before making any financial commitments.

Rating Framework

Broker Overview

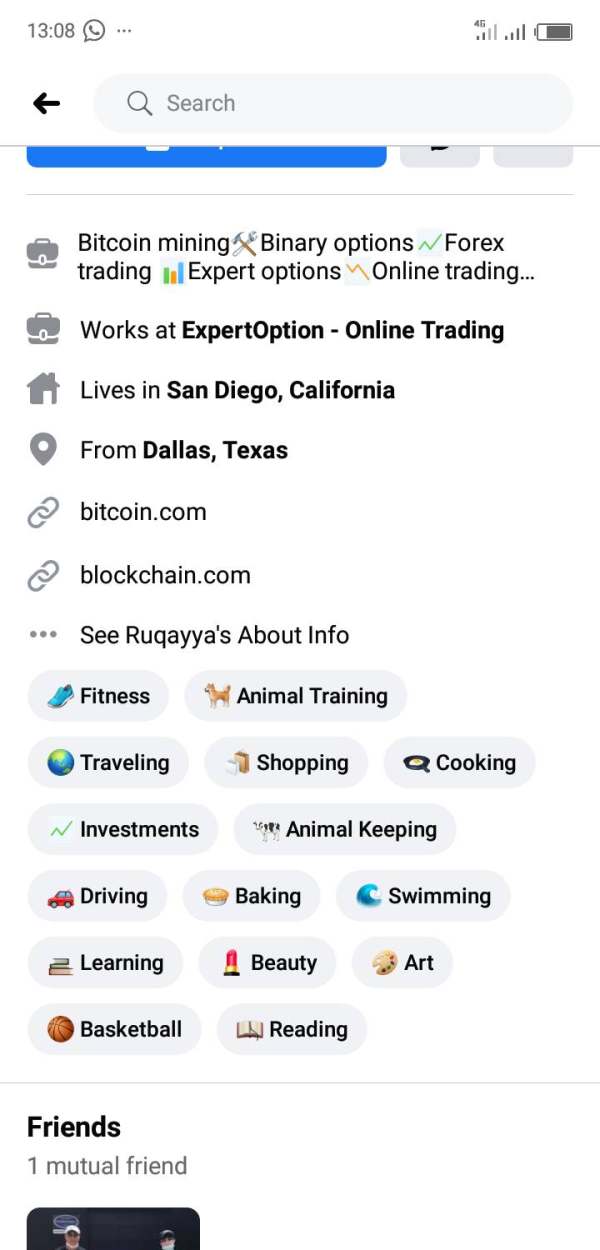

ExpertOption operates as an online trading platform that has built a significant presence in the digital trading space. The platform serves about 12 million registered users globally. The platform focuses on providing access to multiple asset classes including currencies, commodities, stocks, and indices, positioning itself as a complete solution for traders seeking diverse investment opportunities.

The broker's business model centers around binary options and CFD trading. It targets both new and experienced traders with its simple interface design. The company has built its reputation on offering a smooth trading experience with emphasis on quick account setup and fast transaction processing.

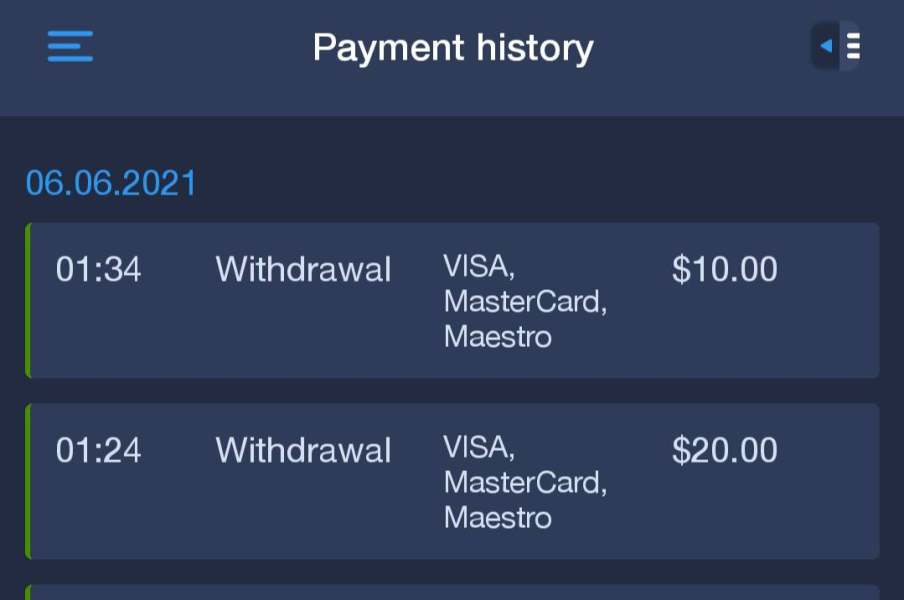

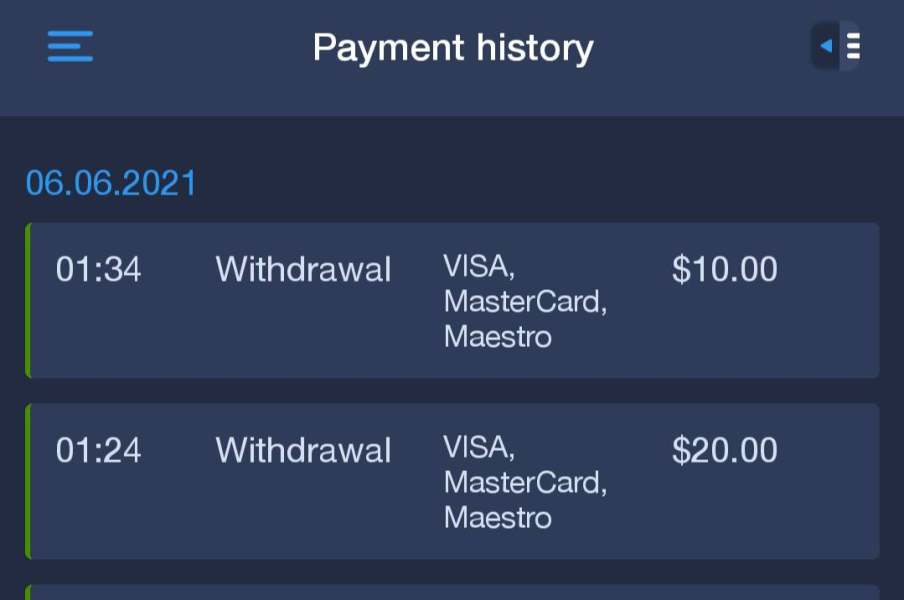

According to user reports, the platform maintains competitive processing times for deposits and withdrawals. This has been one of its more consistently praised features among the user base.

ExpertOption uses its own trading platform, also named ExpertOption, which serves as the main interface for all trading activities. The platform offers access to more than 100 different assets spanning major currency pairs, popular commodities, leading stock indices, and individual equity instruments. However, specific details regarding the company's founding date, headquarters location, and primary regulatory oversight were not clearly specified in available source materials, raising questions about corporate transparency that potential users should investigate further.

Regulatory Status: The available information does not provide clear details about specific regulatory authorities overseeing ExpertOption's operations. This represents a significant concern for traders prioritizing regulatory protection and oversight.

Deposit and Withdrawal Methods: User feedback consistently highlights fast processing times for both deposits and withdrawals as one of the platform's strengths. However, specific payment methods and processing timeframes were not detailed in the source materials.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in the available information. Potential users need to contact the platform directly for these crucial details.

Promotional Offers: The source materials did not contain information about current bonus structures, promotional campaigns, or special offers available to new or existing clients.

Available Trading Assets: The platform provides access to over 100 different trading instruments across four main categories. These include currencies (including major and minor forex pairs), commodities (precious metals, energy, and agricultural products), stocks (individual company shares), and indices (major market benchmarks from global exchanges).

Cost Structure: Detailed information regarding spreads, commissions, overnight fees, and other trading costs was not available in the source materials. This makes it difficult to assess the platform's competitiveness from a pricing perspective.

Leverage Options: Specific leverage ratios offered by the platform were not mentioned in the available information. This is crucial information for traders planning their risk management strategies.

Trading Platform Options: ExpertOption operates exclusively through its own trading platform, which bears the same name as the company and serves as the sole interface for all trading activities.

Geographic Restrictions: The source materials did not specify which countries or regions face trading restrictions or regulatory limitations when accessing the platform.

Customer Support Languages: While the platform serves a global audience of 12 million users, specific information about supported languages for customer service was not detailed in the available sources.

This ExpertOption review reveals significant information gaps that potential traders should address through direct communication with the platform before making any financial commitments.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of ExpertOption's account conditions faces significant limitations due to insufficient information in available source materials. The platform does not clearly specify the different account types available to traders. This makes it impossible to assess whether the broker offers tiered account structures with varying benefits, features, or requirements.

This lack of transparency regarding account classifications represents a concerning gap for potential clients who need to understand their options before committing funds. Minimum deposit requirements, which serve as a crucial factor for many traders when selecting a broker, were not disclosed in the reviewed materials. Without this fundamental information, traders cannot properly plan their initial investment or compare ExpertOption's accessibility against other platforms in the market.

The absence of clear account opening procedures and verification requirements further complicates the assessment of how user-friendly the onboarding process might be. The platform's failure to provide comprehensive account condition details suggests either poor communication strategy or potential transparency issues that could concern prospective clients. ExpertOption review sites consistently note this information deficit, which contributes to the mixed reception the platform receives in trading communities.

Traders considering this platform should directly contact customer service to obtain detailed account information before proceeding with registration.

ExpertOption demonstrates reasonable strength in its tools and resources offering, primarily through its provision of over 100 trading assets across multiple categories. The platform's asset diversity includes currencies, commodities, stocks, and indices, providing traders with substantial opportunities for portfolio diversification. User feedback consistently praises the platform's interface design for being intuitive and user-friendly, suggesting that the basic trading tools meet standard expectations for functionality and accessibility.

However, the available information lacks detail about advanced trading tools, technical analysis resources, or educational materials that modern traders typically expect from comprehensive trading platforms. The absence of information regarding charting capabilities, technical indicators, automated trading support, or research resources represents a significant knowledge gap that affects the overall assessment of the platform's utility for serious traders. The platform's proprietary trading system appears to focus on simplicity rather than advanced functionality, which may appeal to novice traders but could limit more experienced users seeking sophisticated analysis tools.

Without detailed information about research capabilities, market analysis resources, or educational content, it's difficult to determine whether ExpertOption provides adequate support for trader development and informed decision-making.

Customer Service and Support Analysis

Customer service quality emerges as a mixed aspect of ExpertOption's offering, with user feedback revealing inconsistent experiences across the platform's support channels. While some users report satisfactory interactions with customer service representatives, negative reviews frequently cite poor support quality and inadequate problem resolution as significant concerns. This inconsistency in service delivery suggests systematic issues within the support infrastructure that potential users should consider carefully.

The available information does not specify the customer service channels offered by the platform, response time expectations, or the hours during which support is available. Such fundamental support details are typically transparent on reputable trading platforms, and their absence raises questions about the platform's commitment to customer service excellence. Users have reported varying experiences with support responsiveness, indicating that service quality may depend on factors such as account size, issue complexity, or regional location.

Multilingual support capabilities, crucial for a platform serving 12 million global users, were not detailed in the available source materials. This information gap becomes particularly concerning when considering that effective customer support requires clear communication, especially when addressing account issues, technical problems, or dispute resolution. The mixed user feedback regarding customer service quality contributes to the platform's moderate rating in this category and suggests that improvements in support infrastructure could significantly enhance user satisfaction.

Trading Experience Analysis

The trading experience on ExpertOption receives generally positive feedback regarding transaction processing speed, with users consistently highlighting fast deposit and withdrawal times as a notable platform strength. This operational efficiency in money movement represents a significant advantage for active traders who require reliable access to their funds. The platform's proprietary trading interface reportedly offers straightforward navigation and user-friendly design, contributing to a generally accessible trading environment.

However, the trading experience assessment faces limitations due to insufficient information about critical performance metrics such as order execution speed, slippage rates, and requote frequency. These technical aspects significantly impact trading profitability and user satisfaction, yet they remain unaddressed in available source materials. The lack of detailed information about platform stability, server uptime, or technical performance during high-volatility periods raises questions about the platform's reliability under challenging market conditions.

Mobile trading capabilities, essential for modern traders requiring flexibility and accessibility, were not comprehensively detailed in the reviewed materials. Additionally, the absence of information regarding trading environment characteristics such as spread competitiveness, liquidity provision, and execution quality makes it difficult to assess whether ExpertOption provides a genuinely competitive trading experience compared to established alternatives in the market.

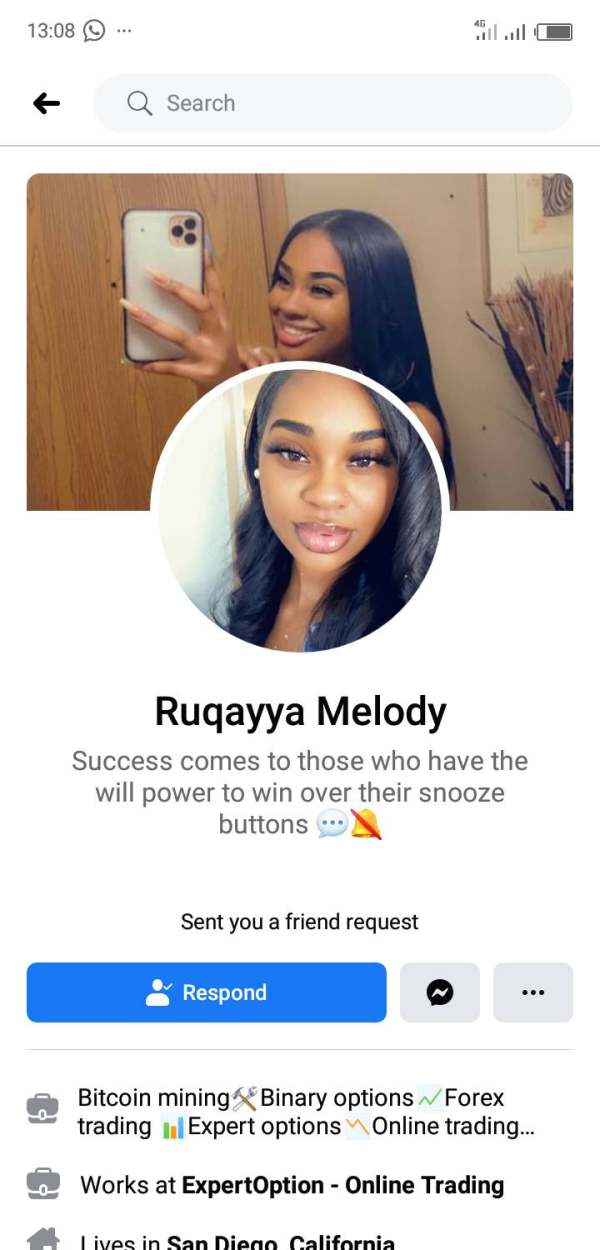

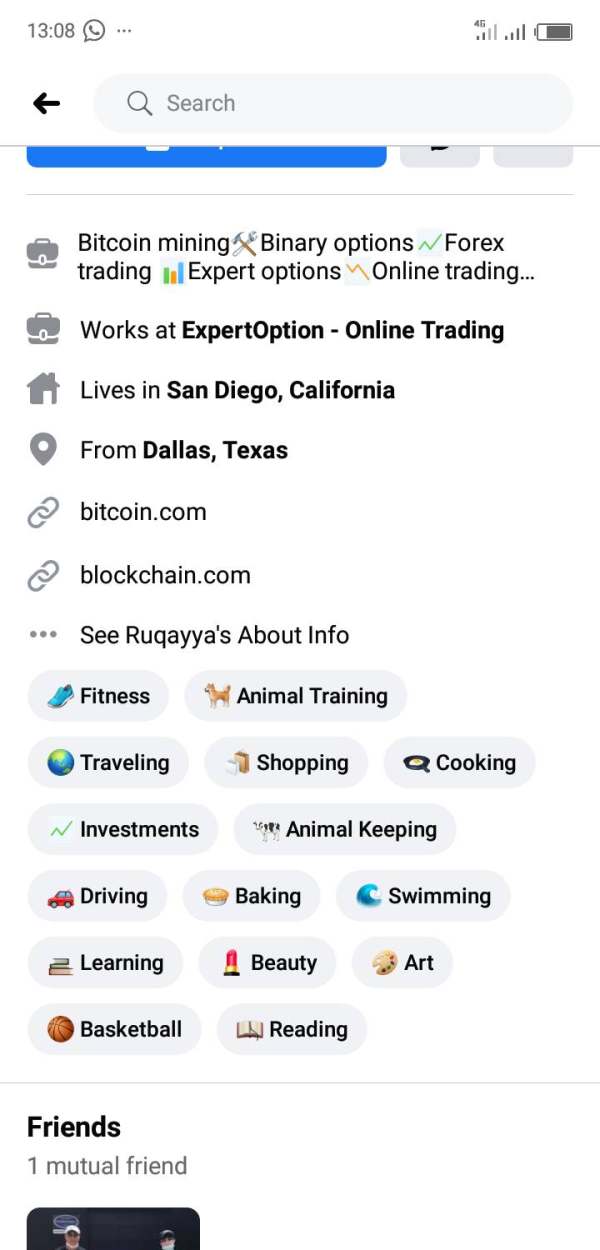

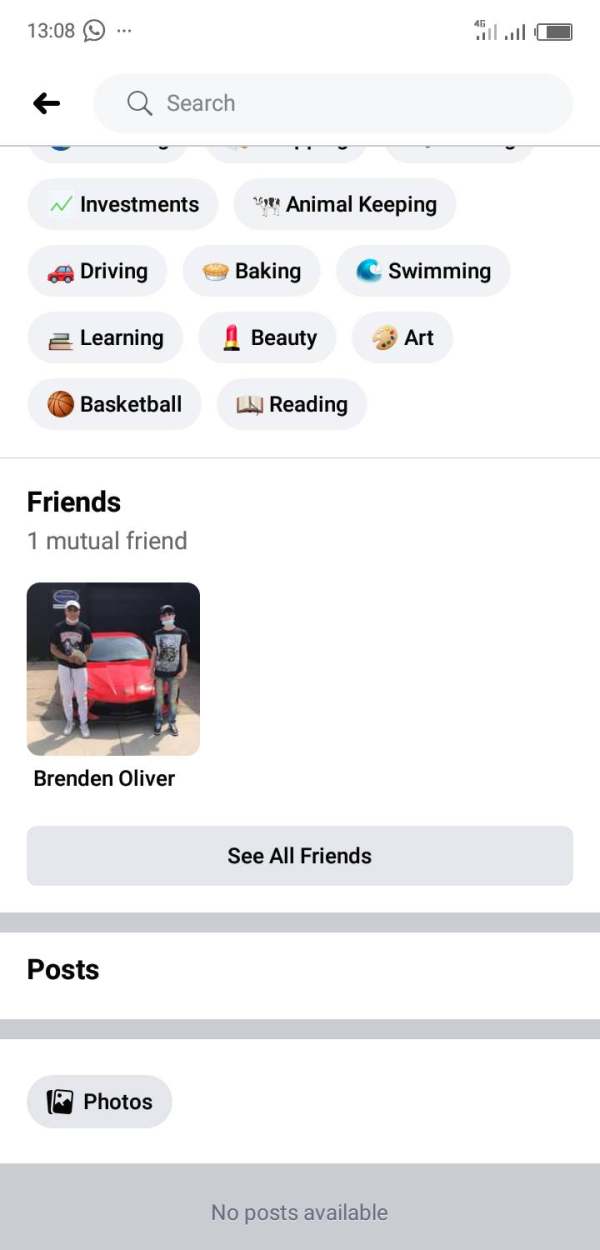

Trust and Reliability Analysis

Trust and reliability represent ExpertOption's most concerning evaluation area, with several review websites explicitly marking the platform as a "not recommended broker" and fraud warnings appearing in various trading communities. These red flags significantly impact the platform's credibility and raise serious questions about its legitimacy and operational practices. The presence of scam allegations, while not necessarily conclusive, indicates sufficient concern within the trading community to warrant extreme caution from potential users.

The lack of clear regulatory information compounds these trust issues, as reputable trading platforms typically provide transparent details about their licensing authorities, regulatory compliance, and oversight mechanisms. Without visible regulatory protection, traders face increased risks regarding fund security, dispute resolution, and legal recourse in case of problems. The absence of information about client fund segregation, insurance protection, or other safety measures further undermines confidence in the platform's reliability.

Company transparency appears limited, with insufficient information available about management structure, financial reporting, or corporate governance practices. These transparency deficits, combined with negative community feedback and warning flags from review sites, create a concerning picture for potential users prioritizing security and reliability. The mixed user reviews, while showing some positive experiences, cannot overshadow the significant trust concerns that have emerged from multiple sources.

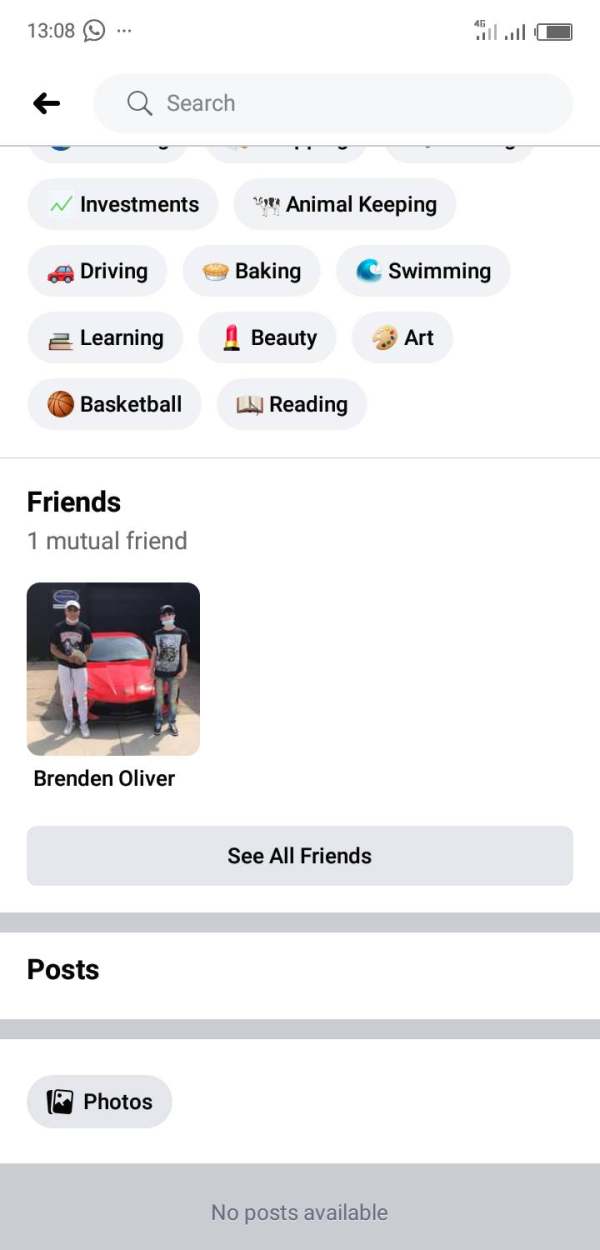

User Experience Analysis

User experience on ExpertOption presents a polarized picture, with the platform achieving an average rating of 4 out of 5 stars from 227 reviews, yet simultaneously facing significant criticism and fraud allegations. This contradiction suggests that while some users find value in the platform's offerings, others have encountered serious problems that have colored their overall experience negatively. The 160 excellent ratings indicate that certain users have had genuinely positive experiences, particularly regarding the platform's interface usability and transaction processing speed.

The user-friendly interface design receives consistent praise from satisfied customers, suggesting that ExpertOption has succeeded in creating an accessible trading environment for its target demographic. Fast withdrawal processing times contribute positively to user satisfaction, addressing one of the most common complaints traders have about online platforms. However, the presence of fraud warnings and negative reviews indicates that user experience quality may vary significantly depending on factors such as account size, trading volume, or geographic location.

Registration and verification processes were not detailed in available source materials, making it impossible to assess the convenience and efficiency of account setup procedures. The polarized nature of user feedback suggests that while some traders find the platform meets their needs adequately, others have encountered significant problems that resulted in negative experiences. This inconsistency in user satisfaction levels indicates potential systemic issues that prospective users should carefully investigate before committing funds to the platform.

Conclusion

ExpertOption presents a complex case study in online trading platforms, offering substantial asset diversity and user-friendly interface design while simultaneously facing significant trust and reliability concerns. The platform's ability to attract 12 million users demonstrates its appeal to certain trader segments, particularly those seeking straightforward access to multiple asset classes through a simplified trading interface. However, the presence of fraud warnings, "not recommended" designations from review sites, and mixed user feedback creates a concerning backdrop that potential users cannot ignore.

The platform appears most suitable for traders who prioritize asset variety and interface simplicity over regulatory protection and advanced trading tools. However, given the serious trust concerns and lack of transparent regulatory information, even this limited recommendation comes with substantial warnings. The fast processing times for deposits and withdrawals represent genuine operational strengths, but these advantages are overshadowed by the platform's credibility challenges and transparency deficits that could expose users to significant risks.

Prospective traders should approach ExpertOption with extreme caution, conducting thorough independent research and considering alternative platforms with clearer regulatory status and stronger community reputations before making any financial commitments.