Regarding the legitimacy of SFX forex brokers, it provides VFSC and WikiBit, .

Is SFX safe?

Pros

Cons

Is SFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

SFX MARKETS LTD

Effective Date:

2017-03-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is SFX Safe or a Scam?

Introduction

SFX Markets, established in 2011, positions itself as a player in the competitive forex market, offering a range of trading instruments including forex pairs, commodities, and cryptocurrencies. However, the forex trading landscape is fraught with risks, making it crucial for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide an objective analysis of SFX Markets, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation draws on data from reputable financial sources, user reviews, and regulatory disclosures to present a comprehensive overview of whether SFX is safe for trading or if it poses potential risks to investors.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is vital to its credibility and operational integrity. SFX Markets was previously regulated by the Vanuatu Financial Services Commission (VFSC), but its license has been revoked, leaving it without a valid regulatory authority overseeing its operations. This lack of regulation raises significant red flags regarding the safety of funds deposited with SFX.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | Unreleased | Vanuatu | Revoked |

The revocation of SFX's regulatory status is particularly concerning as it indicates potential non-compliance with financial regulations. Brokers operating without regulatory oversight can engage in practices that may jeopardize client funds, such as mismanagement or fraudulent activities. Furthermore, SFX's official website is currently inaccessible, suggesting possible abandonment of its trading platform. This situation necessitates caution, as trading with an unregulated broker increases the risk of losing one's investment.

Company Background Investigation

SFX Markets is registered as SFX Global Ltd., based in Saint Vincent and the Grenadines. The company has been operational for over a decade, but its history is marred by a lack of transparency and regulatory compliance. The management team's background remains unclear; there is little publicly available information regarding their qualifications or experience in the financial sector. This opacity raises concerns about the company's governance and accountability.

In terms of transparency, SFX Markets has been criticized for its insufficient disclosure of essential information regarding its operations, financial health, and management team. The absence of a functional website further complicates the ability of potential clients to conduct due diligence. A broker's transparency is critical for building trust and ensuring that clients are well-informed about the risks associated with trading. Given these factors, traders should approach SFX Markets with skepticism, as the lack of clarity and accountability is a significant warning sign.

Trading Conditions Analysis

SFX Markets offers various account types, each with different fee structures and trading conditions. However, the overall cost of trading with SFX appears to be on the higher side compared to industry averages. The broker provides leverage of up to 1:500, which can amplify both profits and losses, but this high leverage also increases risk exposure.

| Fee Type | SFX Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Structure | Variable | $3-$7 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by SFX, starting at 2 pips for major currency pairs, are less competitive than those from other brokers, which typically offer spreads ranging from 1 to 1.5 pips. Additionally, the commission structure is not clearly defined on their website, which raises concerns about potential hidden fees. Traders should be aware of these costs, as they can significantly impact overall profitability.

Customer Funds Security

The safety of client funds is paramount when selecting a forex broker. SFX Markets does not provide adequate information regarding its security measures, such as whether client funds are held in segregated accounts or if there are any investor protection mechanisms in place. The lack of a regulatory framework further exacerbates concerns regarding fund security.

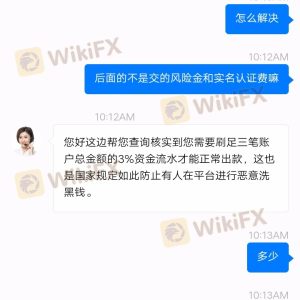

Historically, there have been reports of issues related to fund withdrawals from SFX Markets, with some users claiming they were unable to access their funds after making deposits. This history of withdrawal complaints highlights the potential risks associated with trading on an unregulated platform. Without proper oversight, there is no guarantee that clients will be able to recover their investments in the event of financial mismanagement or insolvency.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Reviews of SFX Markets reveal a pattern of dissatisfaction among users, particularly regarding withdrawal issues and customer service responsiveness. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow Response |

Many users have reported being unable to withdraw their funds, with some alleging that their accounts were blocked after making withdrawal requests. This pattern of complaints raises significant concerns about the reliability and integrity of SFX Markets. In one case, a trader reported that after depositing funds, they were unable to withdraw their money for an extended period, leading to frustration and financial strain.

Platform and Execution

The trading platform offered by SFX Markets is MetaTrader 4 (MT4), a widely used platform known for its robust features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage, has been called into question. Users have reported instances of high slippage during volatile market conditions, which can adversely affect trading outcomes.

Additionally, the lack of a demo account option limits the ability for potential clients to test the platform before committing real funds. This absence of testing opportunities is a significant drawback, as traders often rely on demo accounts to familiarize themselves with a broker's trading environment.

Risk Assessment

Trading with SFX Markets carries inherent risks, particularly due to its unregulated status and the historical complaints associated with the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Withdrawal Risk | High | History of withdrawal complaints and account blocking. |

| Transparency Risk | Medium | Lack of clear information regarding fees and management. |

To mitigate these risks, potential traders should consider investing with well-regulated brokers that offer clear fee structures, strong customer support, and transparent operations. Researching user reviews and regulatory information can help identify safer trading options.

Conclusion and Recommendations

In conclusion, the evidence suggests that SFX is not safe for trading due to its unregulated status, lack of transparency, and a concerning history of customer complaints. Traders should exercise extreme caution when considering this broker, as the potential for financial loss is significant.

For those seeking reliable trading options, it is advisable to explore brokers that are well-regulated and have a positive reputation in the industry. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may offer a safer trading environment with better investor protection. Ultimately, due diligence is essential in ensuring the safety and security of trading investments.

Is SFX a scam, or is it legit?

The latest exposure and evaluation content of SFX brokers.

SFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.