Lontl 2025 Review: Everything You Need to Know

Executive Summary

This lontl review gives you a complete look at a broker that has gotten attention for bad reasons. Lontl started in 2021 and has its headquarters in the Cayman Islands, where it works as an unregulated financial services company that offers many trading products like forex, commodities, options, contract trading, and DeFi pool participation. Our investigation shows major red flags that potential traders must think about.

The overall view of Lontl is mostly negative because of many user complaints and proven fraud activities. ScamsReport.net and various user stories show that traders have reported they cannot withdraw funds and get poor customer service responses. The broker has no regulatory oversight, which makes these concerns worse and leaves traders with few options when problems happen.

Lontl seems to target traders who want diverse trading opportunities and may have lower regulatory requirements or awareness. But the growing evidence of problem practices makes this broker wrong for most serious traders. The platform offers variety in trading instruments through their own Lontl platform application, but this advantage is greatly overshadowed by trust and safety concerns.

Important Notice

Due to Lontl's unregulated status, users across different regions may face different levels of legal risk and protection gaps. The lack of regulatory oversight means that standard investor protections that are typically available through licensed brokers do not apply here. This review is based on complete analysis of user feedback, available market information, and documented complaints from multiple sources including WikiFX, REVIEWS.io, and BrokerScamReport.com.

Readers should note that information availability is limited due to the broker's lack of transparency, and some operational details remain unclear or unverified. All assessments are made based on available evidence as of the review date.

Rating Framework

Broker Overview

Lontl appeared in the financial services sector in 2021, positioning itself as a multi-asset trading platform based in the Cayman Islands. The company works without regulatory oversight from major financial authorities, which immediately raises concerns about trader protection and operational standards. According to available information, Lontl presents itself as a complete trading solution that offers access to various financial markets through their own platform.

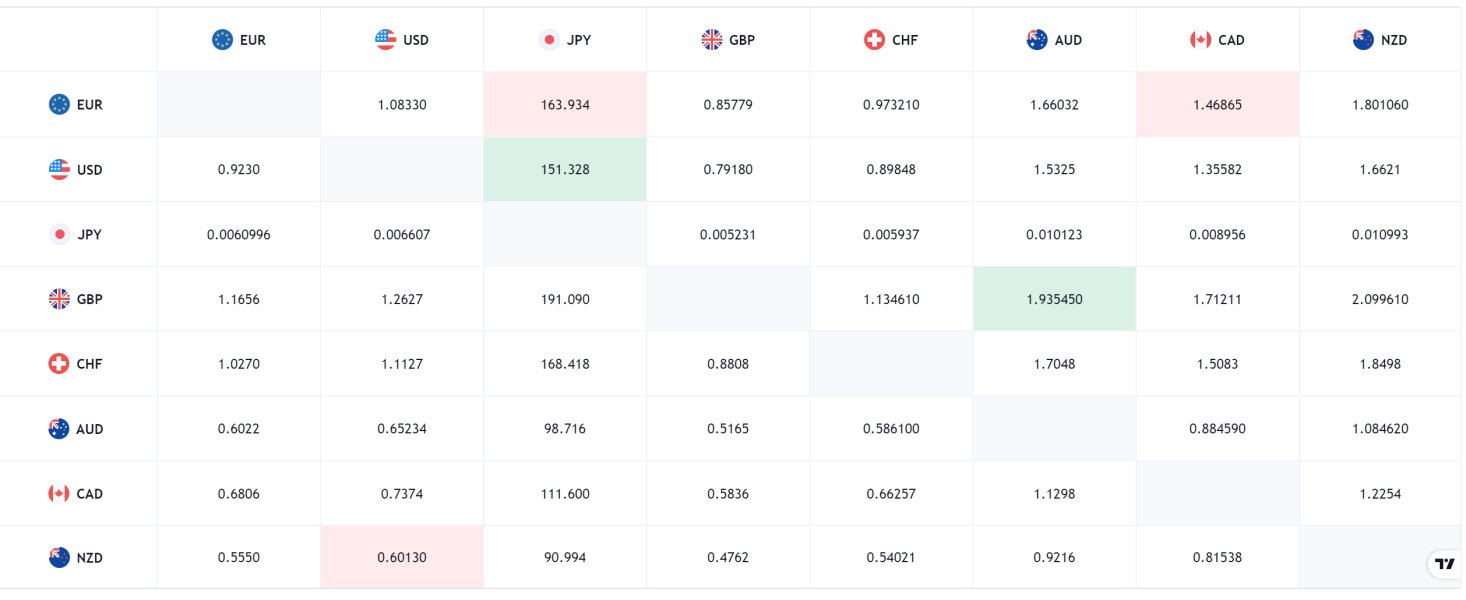

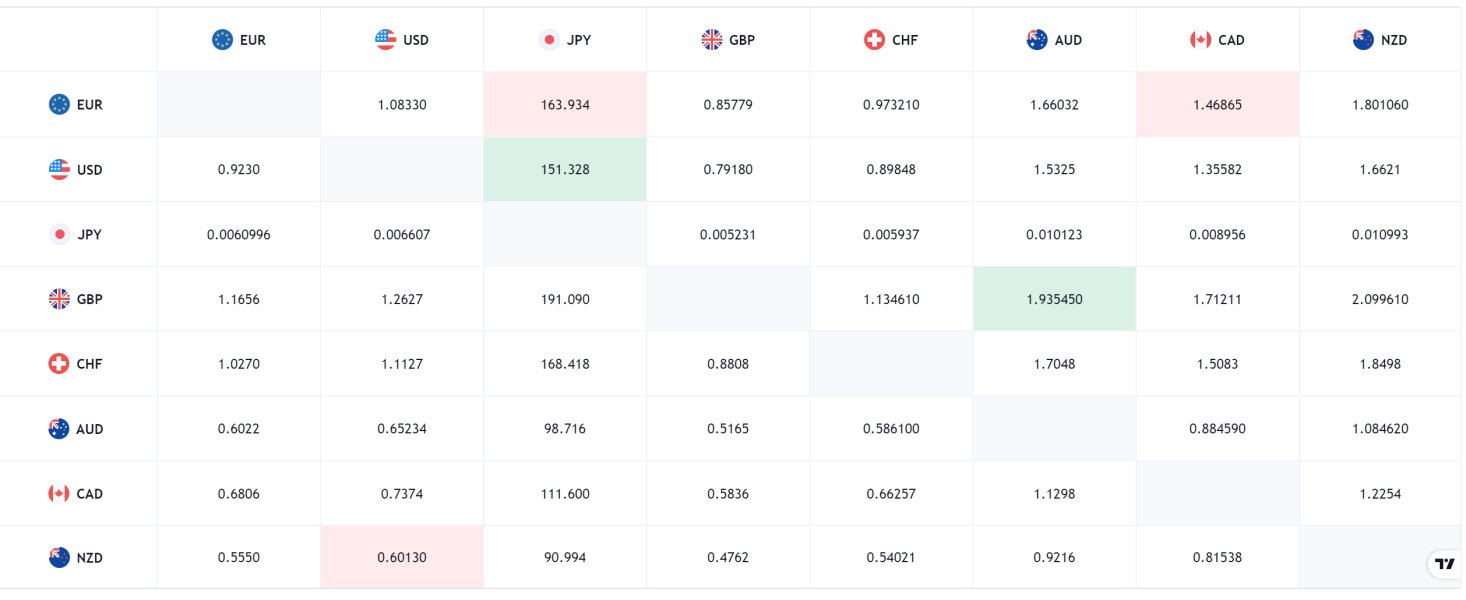

The broker's business model centers around giving access to forex markets, commodities trading, options, contract trading, and DeFi pool participation. This diverse offering suggests an attempt to capture traders interested in both traditional and emerging financial instruments. However, the lack of detailed information about their operational structure, fee schedules, and risk management procedures shows poor transparency standards that are concerning for potential clients.

The company operates through the Lontl platform application, which serves as the primary interface for all trading activities. Despite offering multiple asset classes, the broker's credibility is significantly hurt by numerous user complaints and the absence of regulatory compliance. This lontl review reveals that while the broker may appear attractive due to its diverse offerings, the underlying operational issues make it a risky choice for traders.

Regulatory Status: No regulatory oversight mentioned in available documentation, operating in an unregulated environment that provides no investor protection.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods are not detailed in available sources, though user complaints suggest significant issues with fund withdrawal processes.

Minimum Deposit Requirements: Minimum deposit information is not specified in available documentation, indicating poor transparency in account setup requirements.

Bonuses and Promotions: No information regarding bonus structures or promotional offers is available in the reviewed sources.

Tradeable Assets: The platform offers forex pairs, commodities, options, contract trading, and DeFi pool participation, providing a diverse range of trading instruments across traditional and digital markets.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in the reviewed sources, which is concerning for cost-conscious traders.

Leverage Ratios: Specific leverage ratios are not mentioned in available documentation, leaving traders without crucial information about risk exposure.

Platform Options: Trading is conducted through the proprietary Lontl platform application, though detailed platform features and capabilities are not well documented.

Geographic Restrictions: Specific regional limitations are not detailed in available sources.

Customer Service Languages: Available customer service language support is not specified in the reviewed documentation.

This lontl review highlights the significant information gaps that potential traders face when considering this broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Lontl receive a poor rating due to the complete lack of transparency regarding account types, minimum deposit requirements, and setup procedures. Available sources provide no specific information about different account tiers, their respective features, or the process required to establish an account. This opacity is particularly concerning in an industry where clear account terms are fundamental to trader confidence.

The absence of detailed account information suggests either poor operational organization or deliberate hiding of terms that might scare away potential clients. Legitimate brokers typically provide complete account specifications including minimum deposits, account types (standard, premium, VIP), and special features such as Islamic accounts for Muslim traders. Lontl's failure to provide this basic information is a significant red flag.

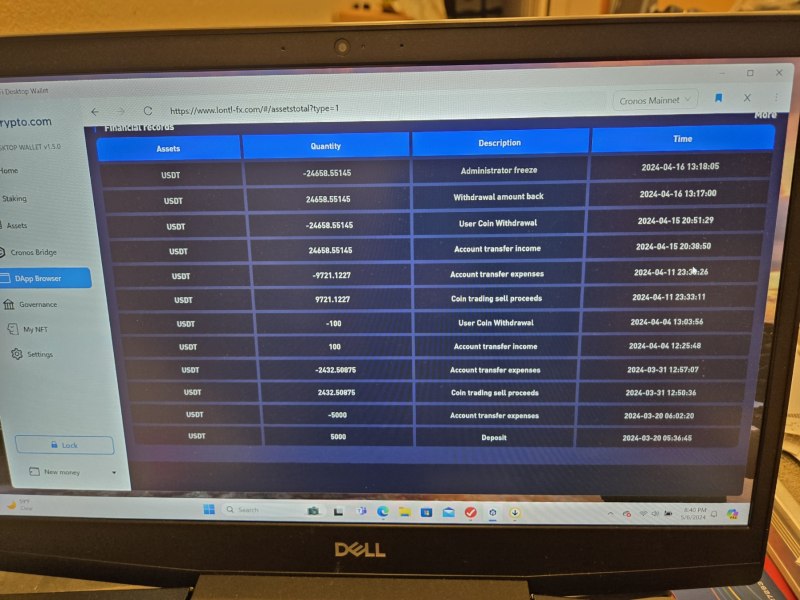

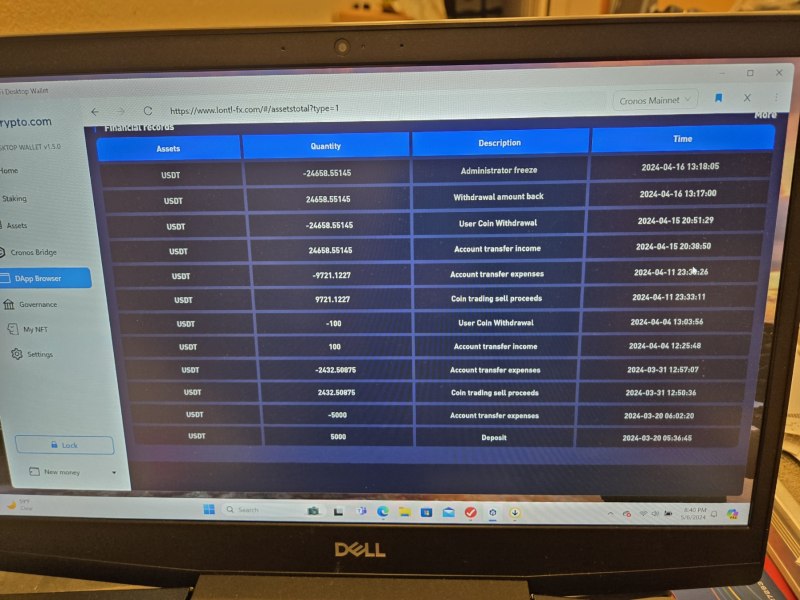

User feedback shows complications in the account management process, with several complaints about difficulties in accessing funds and unclear account terms. According to WikiFX reports, traders have experienced problems that suggest inadequate account infrastructure or deliberate barriers to fund access. Compared to regulated brokers that maintain clear account structures and transparent terms, Lontl's approach appears deliberately vague and potentially problematic.

The lack of special account features, unclear verification processes, and absent customer protection measures make Lontl's account conditions substantially below industry standards. This lontl review emphasizes that potential traders should expect significant challenges in understanding and managing their account relationship with this broker.

Lontl's tools and resources receive a below-average rating primarily because while the broker offers multiple trading products through their platform, the quality and depth of trading tools remain unclear. The platform provides access to forex, commodities, options, contract trading, and DeFi pool participation, suggesting some variety in trading opportunities. However, the lack of detailed information about analytical tools, charting capabilities, and research resources is concerning.

The broker's own platform application appears to be the primary tool for trading activities, but specific features such as technical analysis tools, economic calendars, market research, or educational resources are not documented in available sources. This absence of detailed tool specifications makes it difficult for traders to assess whether the platform meets their analytical and trading needs.

User feedback regarding platform tools is limited, with most available reviews focusing on withdrawal issues rather than trading functionality. The lack of educational resources, research materials, or advanced trading tools suggests that Lontl may not adequately support trader development or informed decision-making. Professional traders typically require complete analytical tools, real-time market data, and research resources that appear to be absent or inadequately documented.

Automated trading support, API access, and advanced order types are not mentioned in available documentation, suggesting that sophisticated traders may find the platform lacking in essential features. The overall assessment shows that while basic trading functionality may be available, the depth and quality of tools and resources fall short of industry standards.

Customer Service and Support Analysis (Score: 4/10)

Customer service and support receive a poor rating based on documented user complaints and the apparent lack of effective problem resolution. According to multiple sources including ScamsReport.net and user reviews, Lontl's customer service has failed to adequately address serious issues, particularly regarding fund withdrawals. The absence of clearly defined customer service channels, response time commitments, and support availability hours further adds to these concerns.

User testimonials consistently report slow response times and ineffective problem resolution, with several traders indicating that their withdrawal requests have been ignored or inadequately addressed. BrokerScamReport.com documentation suggests that customer service representatives either lack the authority or willingness to resolve legitimate trader concerns, which is particularly problematic for an unregulated broker where customer service may be the only recourse for problem resolution.

The lack of multiple communication channels such as live chat, phone support, or complete ticket systems shows inadequate customer service infrastructure. Professional brokers typically provide 24/7 support, multiple contact methods, and clear escalation procedures for complex issues. Lontl appears to lack these standard support features, leaving traders with limited options when problems arise.

Multi-language support information is not available, which may create additional barriers for international traders. The combination of poor responsiveness, limited contact options, and documented failure to resolve serious issues makes Lontl's customer service substantially below acceptable standards for financial services.

Trading Experience Analysis (Score: 4/10)

The trading experience with Lontl receives a poor rating due to user reports of platform instability and the overall lack of detailed information about execution quality and trading conditions. While the broker offers multiple asset classes including forex, commodities, options, and DeFi instruments, user feedback suggests that the actual trading experience is problematic and unreliable.

Platform stability concerns are evident from user complaints, though specific technical performance data is not available in the reviewed sources. The absence of detailed information about order execution speeds, slippage rates, and price accuracy makes it difficult to assess the quality of the trading environment. Professional traders require reliable execution, competitive spreads, and stable platform performance, which appear to be questionable with Lontl.

Mobile trading experience details are not documented, though the mention of a "platform application" suggests some mobile functionality exists. However, without specific information about mobile features, offline capabilities, or cross-device synchronization, traders cannot adequately assess the platform's usability across different devices and situations.

The trading environment's liquidity and execution quality remain unclear due to the lack of transparent reporting and the broker's unregulated status. User feedback focuses more on withdrawal difficulties than trading execution, suggesting that traders may not reach the point of extensive platform testing due to other operational issues. This lontl review shows that the overall trading experience falls well short of professional standards.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability receive the lowest rating due to Lontl's unregulated status and documented fraudulent activities reported by multiple users. The broker operates without oversight from recognized financial regulatory authorities, which eliminates standard investor protections and accountability mechanisms that legitimate brokers must maintain. This regulatory absence is a fundamental trust issue that affects all other aspects of the broker's operations.

Multiple sources, including ScamsReport.net and WikiFX, document user reports of fraudulent activities and inability to withdraw funds. According to available user feedback, trust ratings as low as 8% and 25% have been reported, showing widespread user dissatisfaction and concerns about the broker's legitimacy. These consistently negative trust indicators suggest systematic operational problems rather than isolated incidents.

The company's transparency regarding fund security measures, segregated accounts, and investor protection protocols is virtually non-existent. Legitimate brokers typically provide detailed information about client fund protection, insurance coverage, and regulatory compliance measures. Lontl's failure to provide this essential information, combined with user reports of fund access problems, creates serious trust concerns.

Industry reputation analysis reveals mostly negative coverage across multiple review platforms and scam reporting websites. The accumulation of negative reports, combined with the lack of positive verification from regulatory bodies or industry organizations, shows that Lontl poses significant risks to trader funds and should be avoided by serious investors.

User Experience Analysis (Score: 3/10)

User experience receives a poor rating based on documented user dissatisfaction and operational issues that significantly impact trader interactions with the platform. Overall user satisfaction appears low, with multiple complaints about fund withdrawal difficulties and poor customer service responsiveness. The limited positive feedback available suggests that most users encounter significant problems during their engagement with the broker.

Interface design and usability information is not detailed in available sources, though the existence of a platform application suggests some attempt at user-friendly design. However, without specific information about navigation, feature accessibility, and user interface quality, it's difficult to assess the platform's usability standards. The lack of detailed platform documentation itself suggests poor attention to user experience considerations.

Registration and verification processes are not clearly documented, which can create confusion and frustration for new users. Professional brokers typically provide clear onboarding procedures, document requirements, and timeline expectations. Lontl's lack of transparent process documentation may contribute to user confusion and dissatisfaction.

Fund operation experiences, based on user reports, appear to be particularly problematic. Multiple users have reported difficulties with withdrawals, suggesting that the fundamental user experience of accessing their own funds is compromised. This represents a critical failure in user experience that overshadows any potential positive aspects of the platform.

Common user complaints center around withdrawal difficulties and poor customer service, showing systematic problems rather than isolated issues. The user profile appears to include traders seeking diverse trading opportunities, but the negative feedback suggests that even users with lower regulatory expectations find the service inadequate.

Conclusion

This complete lontl review reveals a broker with significant operational deficiencies and trust issues that make it unsuitable for serious traders. While Lontl offers multiple trading instruments including forex, commodities, options, and DeFi products, the advantages of asset diversity are completely overshadowed by fundamental problems in reliability, customer service, and fund security.

The broker may initially appear attractive to traders seeking diversified trading opportunities with potentially lower barriers to entry. However, the documented user complaints, unregulated status, and poor transparency make Lontl a high-risk choice that should be approached with extreme caution, if at all.

The primary advantages include access to multiple asset classes and a proprietary trading platform, but these are significantly outweighed by critical disadvantages including lack of regulatory oversight, documented withdrawal difficulties, poor customer service, and widespread negative user feedback. Based on this analysis, traders are strongly advised to consider regulated alternatives that provide proper investor protection and transparent operations.