SV Markets 2025 Review: Everything You Need to Know

Executive Summary

This sv markets review gives you a complete look at SV Markets. SV Markets is a new forex and CFD broker that started in 2023, operating under FinCEN rules in the United States and trying to compete in retail trading with spreads from 1 pip and leverage up to 1:500 across many different types of assets.

SV Markets focuses on CFD trading. They give you access to forex, commodities, indices, bonds, cryptocurrencies, stocks, futures, and other financial products through their own SV Markets Tradingweb platform, targeting traders who want high leverage and diverse trading chances in global markets.

Real users give SV Markets mixed reviews - 3 positive, 1 neutral, and 2 exposure reviews. The broker has competitive spreads and fair commission rates, but customer service speed and user experience need work, and since they're so new, their reputation is still growing, making them better for experienced traders who can handle newer companies.

This review uses public information and user feedback to give you an honest and complete analysis if you're thinking about trading with SV Markets.

Important Notice

Regional Entity Differences: SV Markets works under United States rules with FinCEN watching over them. Traders from other countries should know that protections and services might be different depending on where they live, so international clients should check if they can use this broker and understand their local rules before starting.

Review Methodology: This review comes from public information, user stories, and regulatory data from 2025. We try to give you an unbiased review, but everyone's trading experience is different, so you should do your own research and think about what you need when picking any broker.

Scoring Framework

Overall Rating: 6.8/10

Broker Overview

Company Background and Establishment

SV Markets started in 2023 as a new player in the forex and CFD world. Even though they're new, they want to serve traders worldwide who need access to different financial markets through CFD trading, operating under FinCEN rules to stay legal.

Their business focuses on CFD trading, letting clients bet on price changes across different assets without owning them. This lets SV Markets offer many markets through one platform, which appeals to traders who like diverse strategies.

Platform and Asset Coverage

SV Markets uses their own SV Markets Tradingweb platform for different trading styles and skill levels. They give you access to forex pairs, commodities, global indices, government bonds, cryptocurrencies, individual stocks, futures, and other financial products.

This wide selection makes SV Markets a one-stop shop for traders who want exposure to different market areas. The platform works for both quick trades and longer investments, with leverage up to 1:500 for qualifying accounts, and according to this sv markets review, FinCEN oversight gives them a regulatory foundation while allowing competitive terms.

Regulatory Environment

SV Markets follows FinCEN rules in the United States, giving them a regulatory framework. This oversight makes sure they follow anti-money laundering rules and financial transparency standards.

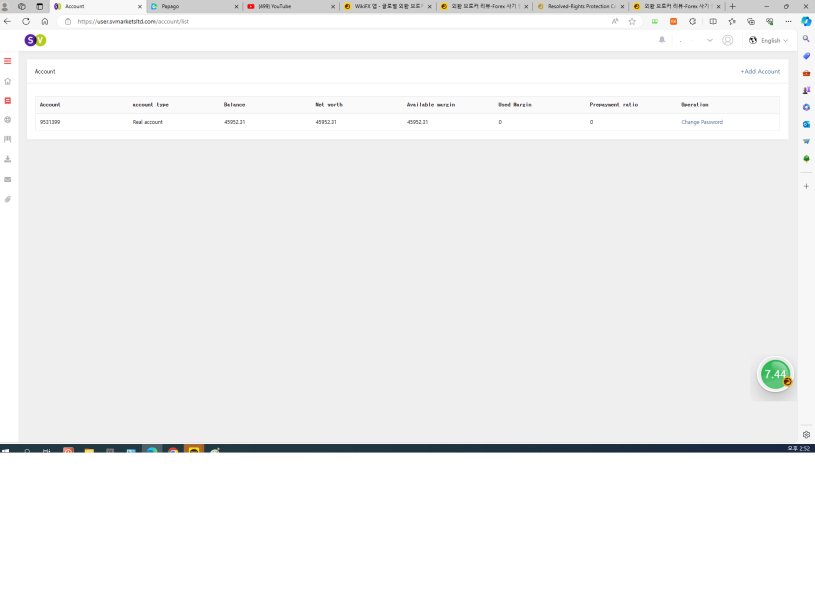

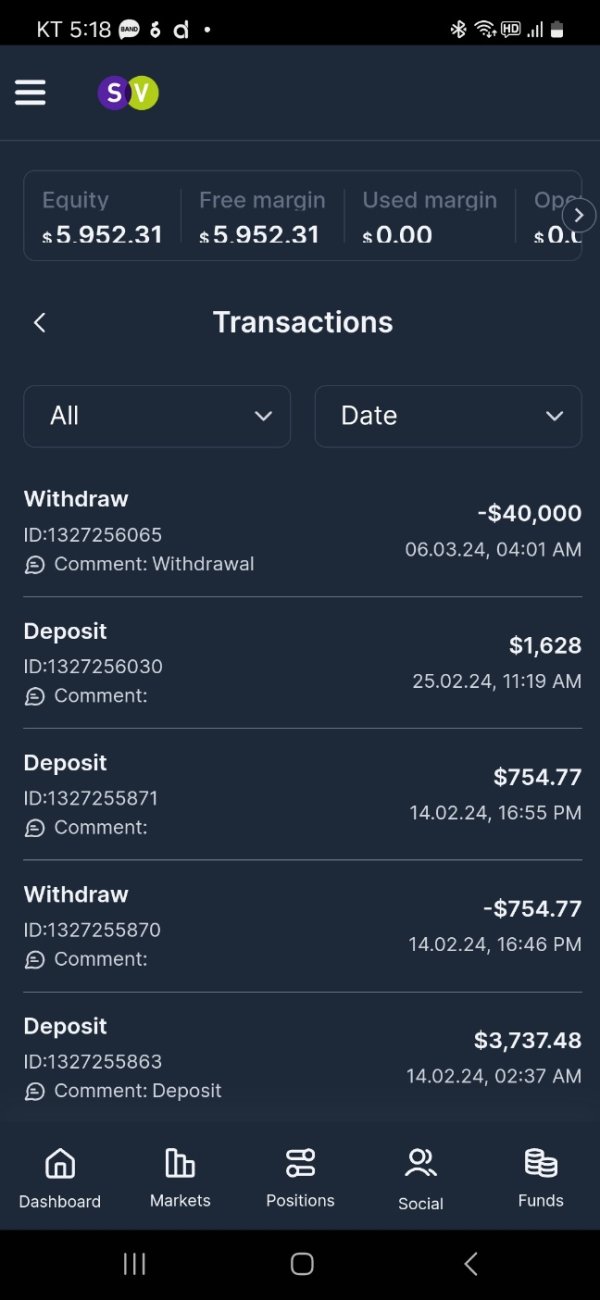

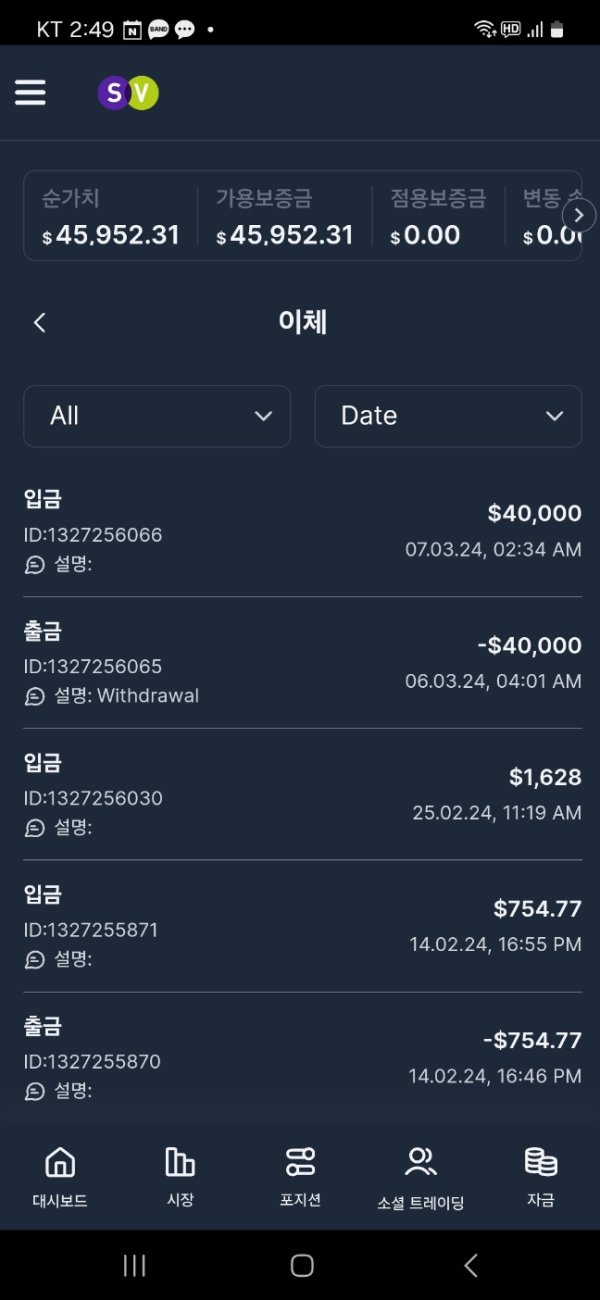

Deposit and Withdrawal Methods

Information about deposit and withdrawal methods isn't available in current materials. Future clients should contact the broker directly for complete information about funding options and processing procedures.

Minimum Deposit Requirements

Minimum deposit amounts aren't listed in current documentation. Traders should check account funding minimums directly with SV Markets before opening accounts.

Promotional Offers and Bonuses

Current promotions and bonus structures aren't detailed in available materials. Interested traders should ask directly about any available incentives or promotional programs.

Available Trading Assets

SV Markets provides forex currency pairs, commodities, stock indices, government bonds, cryptocurrencies, individual stocks, futures contracts, and additional financial derivatives. This diverse selection works for various trading strategies and risk preferences.

Cost Structure and Fees

The broker offers competitive spreads starting from 1 pip, though specific commission details aren't available. The transparent spread pricing suggests a straightforward cost model, but traders should verify all fees before trading.

Leverage Options

Maximum leverage reaches 1:500, making SV Markets attractive to traders wanting higher leverage ratios. This leverage level needs careful risk management and typically suits experienced traders.

Platform Selection

The proprietary SV Markets Tradingweb platform serves as the main trading interface, supporting various strategies and offering market analysis tools to help trader decisions.

This sv markets review shows that while the broker provides competitive basic trading conditions, some operational details need direct verification with the company.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 7/10)

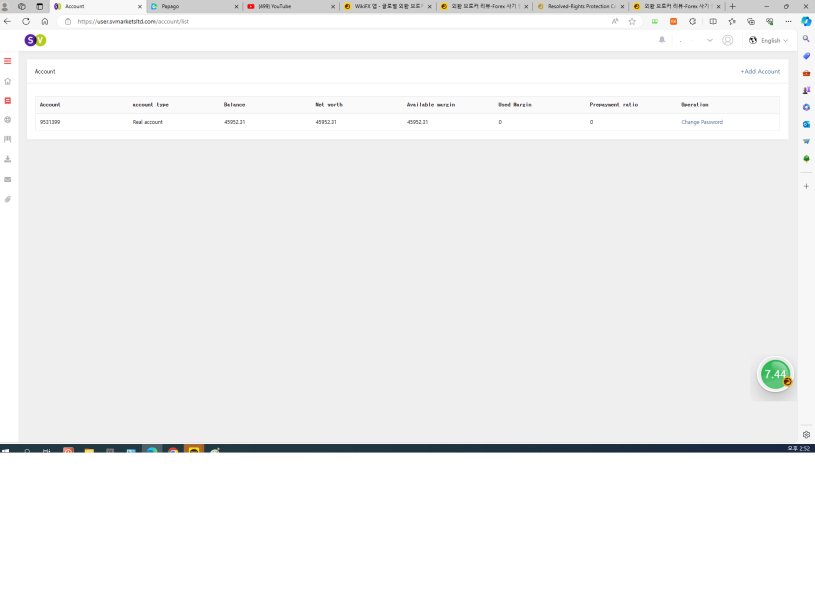

SV Markets shows solid account conditions with competitive spreads starting from 1 pip, putting it favorably within industry standards for new brokers. However, missing details about account types, minimum deposits, and specific features limits our ability to fully assess the broker's account offerings.

The absence of clearly defined account tiers or specialized options like Islamic accounts may limit appeal to certain trader groups. While competitive spreads suggest reasonable trading costs, unavailable commission details prevents complete cost analysis for potential clients.

User feedback shows spreads stay competitive during normal market conditions, with some positive comments about pricing transparency. However, negative reviews suggest account-related communications could improve, especially regarding terms and conditions explanations.

Compared to established brokers, SV Markets' account conditions appear standard but lack the detailed structure and variety that experienced traders might expect. The broker would benefit from providing more comprehensive account information and potentially developing tiered options to serve different trader profiles better.

This sv markets review suggests that while basic account conditions are competitive, enhanced transparency and detailed specifications would strengthen the broker's appeal to discerning traders.

SV Markets excels in providing diverse trading instruments across multiple asset classes, offering comprehensive market exposure through a single platform. The broker's strength lies in its wide selection of tradeable assets, including forex, commodities, indices, bonds, cryptocurrencies, stocks, and futures, enabling portfolio diversification and varied strategies.

The platform includes market analysis tools designed to support trader decisions, though specific details about research depth and analysis quality aren't extensively documented. User feedback suggests available tools meet basic analytical needs, with some traders appreciating the market insights provided.

The proprietary SV Markets Tradingweb platform appears to incorporate standard trading tools and technical indicators, though advanced features and automation capabilities aren't clearly specified in available materials. Educational resources and learning materials aren't prominently featured in current documentation, which may limit appeal to novice traders seeking comprehensive educational support.

Industry experts generally view tool diversity positively, particularly for brokers serving traders with varied interests across different markets. The multi-asset approach allows SV Markets to compete effectively with larger, more established brokers in terms of market access, even as a newer market entrant.

The broker's focus on providing analytical support demonstrates commitment to trader success, though expansion of educational resources and advanced trading tools could further enhance the overall offering for different experience levels.

Customer Service and Support Analysis (Score: 6/10)

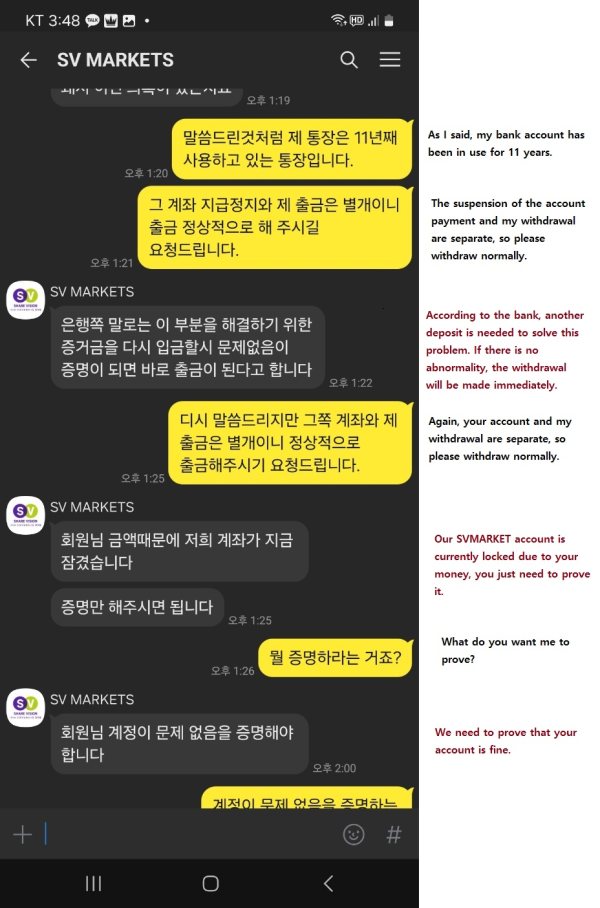

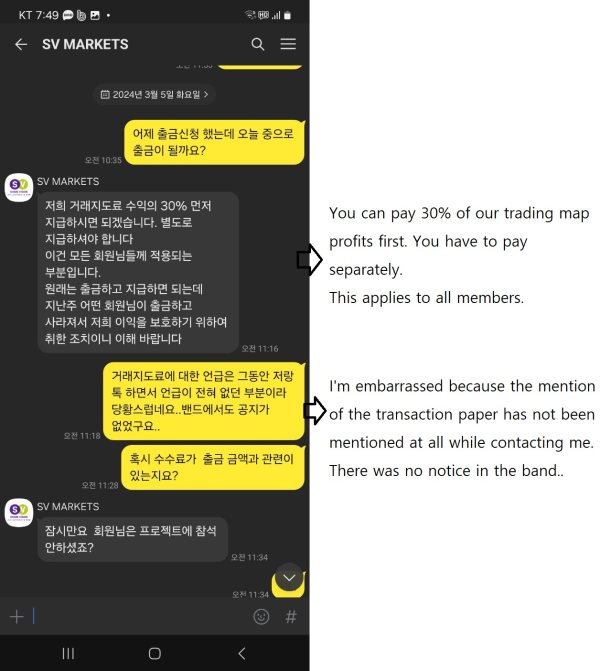

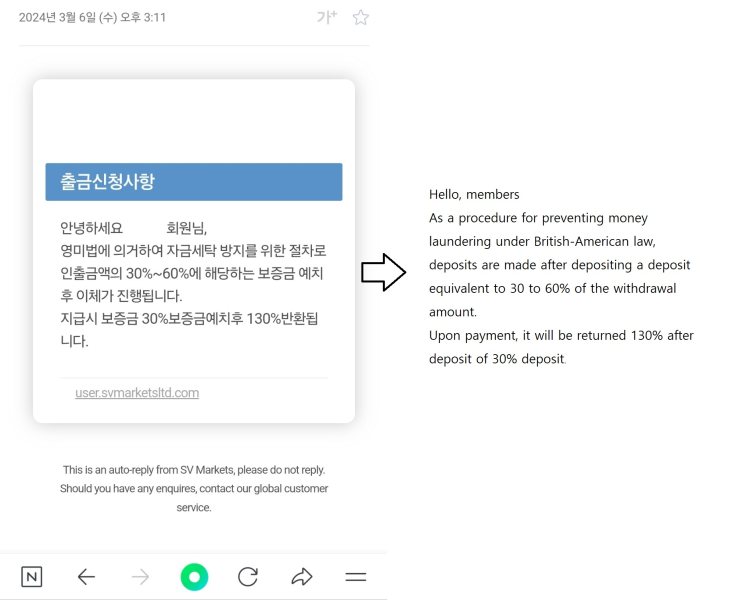

Customer service represents an area where SV Markets shows room for improvement based on available user feedback. While specific customer service channels and availability hours aren't detailed in current documentation, user reviews indicate mixed experiences with support responsiveness and service quality.

Negative feedback particularly highlights slower response times and occasional difficulties in resolving account-related inquiries. Some users report neutral experiences, suggesting service quality may be inconsistent or dependent on the inquiry nature, and the lack of clearly specified multilingual support options may also limit accessibility for international clients.

Available user testimonials suggest that while basic support needs are generally addressed, the overall service experience falls short of expectations set by more established brokers. Issues appear to center around response timing rather than resolution capability, indicating potential resource allocation challenges common among newer brokerage firms.

The absence of detailed information about customer service infrastructure, including available communication channels, operating hours, and specialized support teams, makes it difficult for potential clients to understand what level of support they can expect. This lack of transparency itself contributes to lower confidence in the support system.

Improvement in customer service responsiveness and establishment of clear service level standards would significantly enhance SV Markets' overall client experience and could positively impact user satisfaction ratings in future assessments.

Trading Experience Analysis (Score: 7/10)

The trading experience with SV Markets receives generally positive feedback regarding platform performance and execution quality. User reviews indicate that the SV Markets Tradingweb platform demonstrates good stability and reasonable execution speeds during normal market conditions, contributing to a satisfactory trading environment.

Platform functionality appears to include standard charting tools and technical indicators necessary for market analysis, though advanced features and customization options aren't extensively detailed in available information. The spread stability mentioned in user feedback suggests consistent pricing conditions, which is important for trading strategy execution.

Order execution quality, while not specifically documented with performance metrics, appears adequate based on user experiences. However, detailed information about slippage rates, requote frequency, and execution statistics would provide a more comprehensive picture of trading conditions.

The mobile trading experience isn't specifically addressed in current documentation, which may be a consideration for traders who require mobile platform access. Given the increasing importance of mobile trading, this represents a potential area for information enhancement.

Overall trading conditions appear suitable for various trading styles, with the high leverage options (up to 1:500) particularly appealing to traders employing leverage-intensive strategies. The diverse asset selection supports multiple trading approaches, from forex scalping to longer-term commodity or index trading.

This sv markets review indicates that while the basic trading experience meets industry standards, enhanced platform documentation and performance transparency would benefit potential clients in their evaluation process.

Trust and Reliability Analysis (Score: 7/10)

SV Markets' trust profile is anchored by its FinCEN regulation in the United States, which provides a legitimate regulatory framework and enhances credibility compared to unregulated alternatives. This regulatory oversight ensures compliance with anti-money laundering standards and provides some level of operational transparency.

However, as a broker established in 2023, SV Markets lacks the extensive track record that builds long-term trust with traders. The company's relatively short operational history means that its reliability during various market conditions and crisis situations remains unproven, which naturally affects overall trust assessment.

Specific information about client fund protection measures, segregated account policies, and insurance coverage isn't detailed in available materials. These factors are crucial for trust evaluation, and their absence in public documentation may concern security-conscious traders.

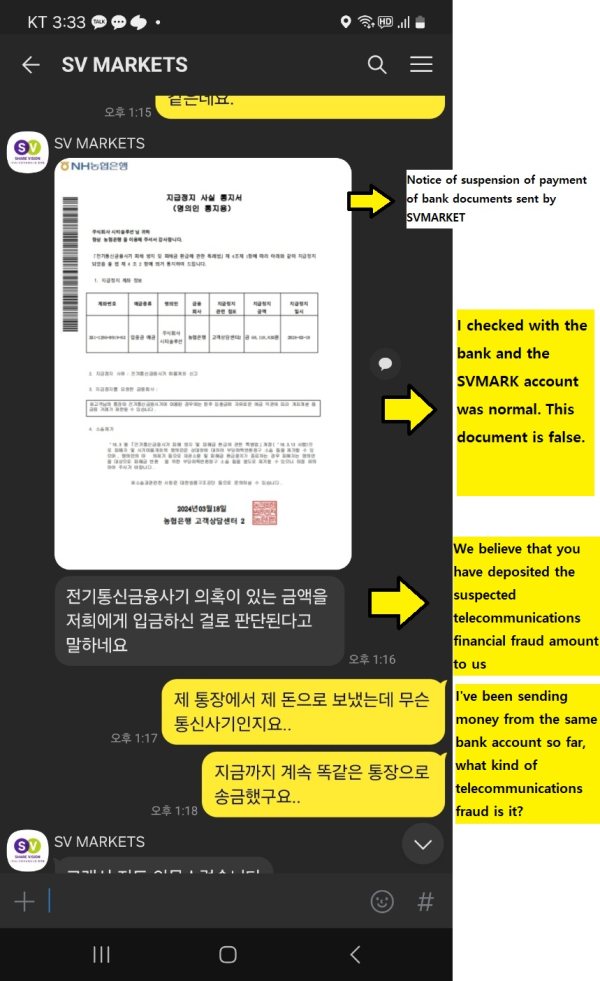

User feedback regarding trust is mixed, with some neutral reviews suggesting that while no major red flags exist, the broker hasn't yet established the confidence level associated with more established firms. The presence of exposure reviews alongside positive feedback indicates that user experiences vary, which isn't uncommon for newer brokers building their reputation.

Third-party evaluations and industry recognition are limited, which is expected for a recently established broker but nonetheless affects overall trust scoring. The verification of FinCEN regulatory status provides a foundation of legitimacy, though additional transparency measures would strengthen the trust profile.

Building trust typically requires consistent performance over time, transparent communication about policies and procedures, and demonstrated commitment to client protection - areas where SV Markets can continue developing its reputation.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with SV Markets presents a balanced picture with both positive and negative feedback reflecting the typical experience range for emerging brokers. User reviews show a neutral to slightly positive trend, with 3 positive reviews balanced against 1 neutral and 2 exposure reviews, indicating varied experiences among the client base.

Interface design and platform usability aren't extensively detailed in available documentation, though user feedback suggests the platform meets basic functionality requirements. The lack of detailed information about registration processes, account verification procedures, and onboarding experience represents an area where enhanced transparency would benefit potential clients.

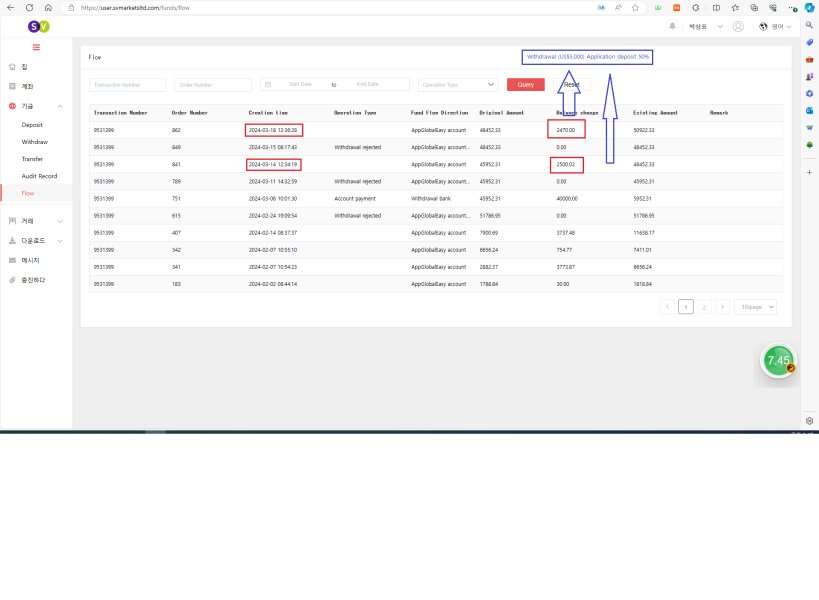

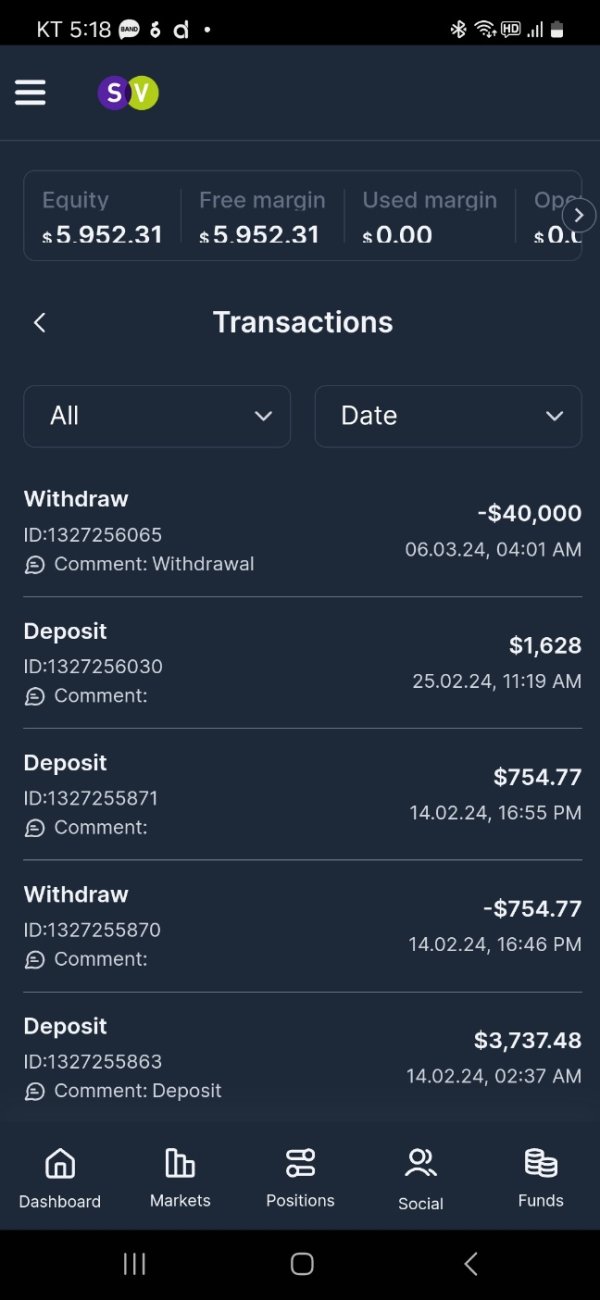

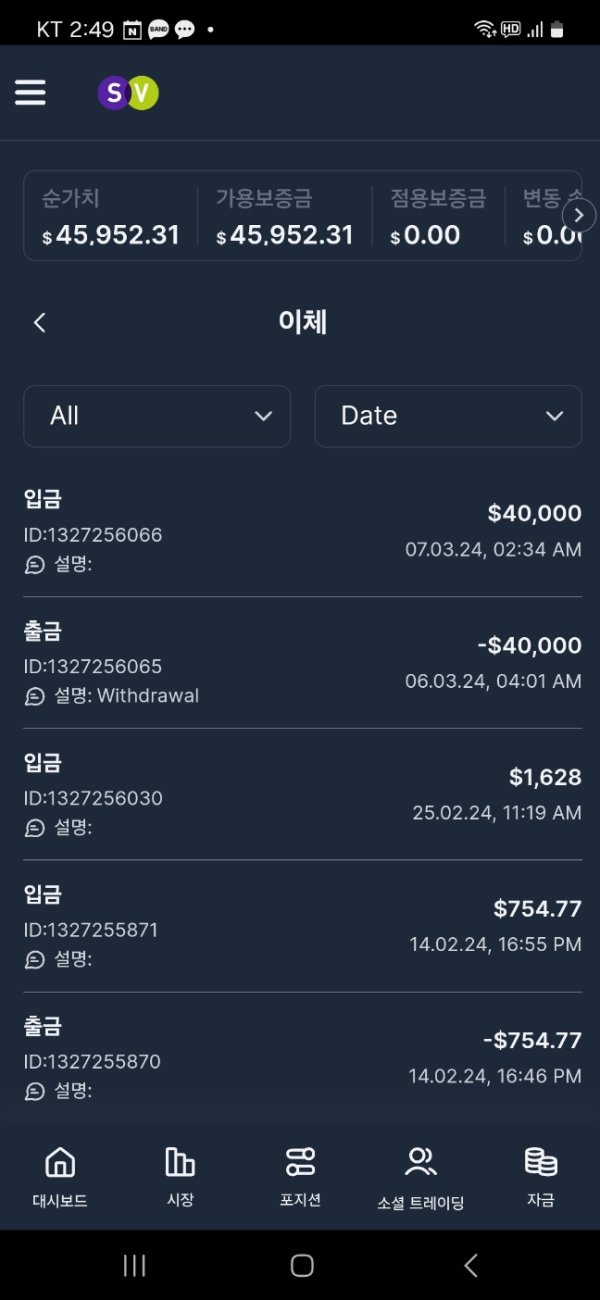

Funding and withdrawal experiences aren't well-documented in current user feedback, making it difficult to assess this crucial aspect of user experience. Clear information about transaction processing times, fees, and procedures would significantly improve user confidence and experience evaluation.

Common user complaints appear to focus on customer service responsiveness rather than platform functionality or trading conditions, suggesting that operational improvements in support could significantly enhance overall user satisfaction. The mixed nature of reviews indicates that while some users find the service adequate, others experience frustrations that could be addressed through service improvements.

The broker appears to attract traders seeking high leverage and diverse asset access, which aligns with its stated positioning. However, users expecting comprehensive support and detailed service information may find the current offering somewhat limited compared to more established alternatives.

Recommendations for improvement include enhanced customer service training, clearer communication of policies and procedures, and improved transparency regarding account operations and fee structures.

Conclusion

SV Markets presents a mixed profile as an emerging forex and CFD broker in 2025. While the broker offers competitive fundamental trading conditions including low spreads starting from 1 pip and high leverage up to 1:500, several areas require improvement to match established industry standards.

The broker is best suited for experienced traders who prioritize high leverage access and diverse asset selection over comprehensive support services. Traders seeking multi-asset exposure through a single platform may find SV Markets appealing, particularly those comfortable navigating newer market entrants with developing service infrastructure.

Key Strengths: Competitive spreads, high leverage options, diverse asset selection, and legitimate regulatory oversight through FinCEN provide a solid foundation for trading operations.

Primary Weaknesses: Limited transparency regarding account details and operational procedures, inconsistent customer service quality, and lack of comprehensive educational resources may deter some potential clients.

This sv markets review concludes that while SV Markets shows potential as a trading platform, prospective clients should carefully consider their support needs and risk tolerance when evaluating this relatively new broker against more established alternatives.