Is RIF-CAPITAL safe?

Business

License

Is RIF Capital A Scam?

Introduction

RIF Capital is a relatively new player in the forex trading market, having established its online presence in November 2023. The broker positions itself as a platform for both novice and experienced traders, offering a variety of trading instruments, including forex, cryptocurrencies, and CFDs. However, the rapid growth of online trading has led to an influx of unregulated and potentially fraudulent brokers, making it crucial for traders to conduct thorough evaluations before investing. This article aims to investigate the legitimacy of RIF Capital by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with its operations. The information presented is derived from a comprehensive review of multiple sources, including user feedback and expert analyses.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors for traders to consider, as it often determines the level of protection and recourse available in case of disputes. RIF Capital claims to operate from Australia, a region known for its stringent financial regulations. However, investigations reveal that RIF Capital lacks any valid licenses from recognized regulatory authorities such as the Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Licensed |

| FCA | N/A | United Kingdom | Not Licensed |

The absence of regulatory oversight raises significant red flags. ASIC has issued warnings against RIF Capital, categorizing it as an unregulated entity. This lack of regulation means that traders funds are not protected, and there is no oversight to ensure fair trading practices. Furthermore, the broker's claims about offering high leverage and zero-cost trading are often associated with fraudulent schemes, as they can lure inexperienced traders into risky investments without proper safeguards.

Company Background Investigation

RIF Capital's history is notably short, having been established in 2023. There is limited information available regarding its ownership structure and management team. The company operates under the name RIF Capital Pty Ltd, but details about the individuals behind the firm remain obscure. This lack of transparency is concerning, as reputable brokers typically provide information about their founders and key personnel, including their qualifications and industry experience.

The website of RIF Capital appears unprofessional, with numerous grammatical errors and a poorly designed interface, suggesting a lack of investment in creating a trustworthy online presence. The absence of a verifiable physical address further complicates the assessment of the broker's legitimacy. In the financial services industry, transparency and accountability are paramount, and RIF Capitals failure to provide clear information about its operations and management raises doubts about its credibility.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. RIF Capital advertises a variety of trading instruments, including forex pairs, cryptocurrencies, and CFDs. However, the specifics of their fee structure and the overall cost of trading are less clear. Many reviews indicate that RIF Capital employs a confusing fee model, with claims of low spreads and no withdrawal fees, which are often too good to be true.

| Fee Type | RIF Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | None stated | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

The promise of "unlimited leverage" is another significant concern. Such high leverage can amplify losses and is a common tactic used by unregulated brokers to attract clients. Traders should be wary of brokers that do not disclose their fees clearly or offer unrealistic trading conditions, as these may indicate deceptive practices designed to maximize the broker's profits at the expense of the trader.

Customer Funds Security

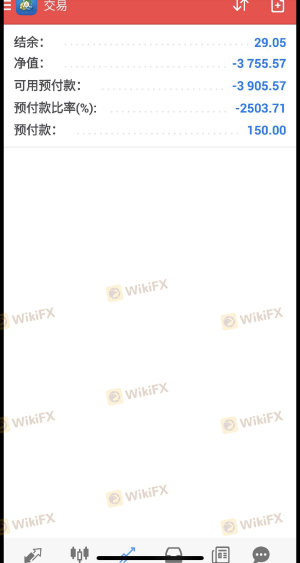

The security of customer funds is a paramount concern for any trader. RIF Capital has not provided sufficient information regarding its fund protection measures. There are no indications that the broker segregates client funds or participates in compensation schemes that would protect investors in the event of insolvency. This lack of clarity regarding fund security is alarming, especially considering the broker's unregulated status.

Furthermore, historical complaints against RIF Capital indicate issues with fund withdrawals, where clients have reported being unable to access their money after requesting withdrawals. Such practices are characteristic of fraudulent brokers, who often employ tactics to withhold funds from clients, leading to significant financial losses.

Customer Experience and Complaints

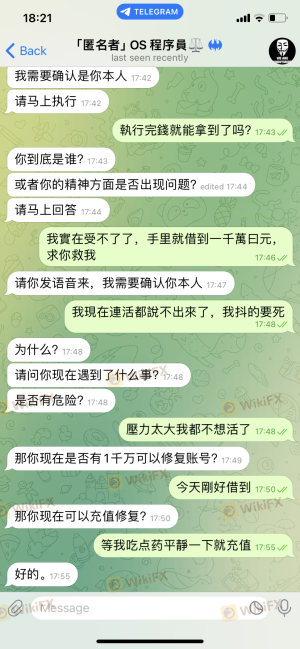

Customer feedback is a valuable source of information when assessing a broker's reliability. Numerous reviews and complaints about RIF Capital have surfaced, highlighting significant issues with customer service and fund withdrawals. Many users have reported that their accounts were blocked or that they faced aggressive sales tactics when attempting to withdraw their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| High-Pressure Sales Tactics | High | No response |

One typical case involves a trader who reported successfully making a profit but was subsequently denied access to their earnings when they requested a withdrawal. Such experiences are common among users of unregulated brokers, further emphasizing the need for caution when dealing with platforms like RIF Capital.

Platform and Execution Quality

Assessing the trading platform's performance is crucial for any trader. RIF Capital offers a web-based trading platform, but user reviews indicate that it suffers from stability issues and poor execution quality. Traders have reported instances of slippage, where orders are executed at different prices than expected, and high rejection rates for trades. These issues can significantly impact trading performance and profitability.

Moreover, the platform's design and user experience have been criticized for being outdated and unresponsive. A reliable trading platform should provide a seamless experience with quick order execution and minimal downtime, which does not appear to be the case with RIF Capital.

Risk Assessment

Engaging with RIF Capital presents several risks that potential investors should consider seriously. The lack of regulation, combined with numerous complaints about withdrawal issues and poor customer service, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for funds |

| Withdrawal Risk | High | Numerous complaints regarding access |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough research before investing and consider using regulated brokers that offer greater transparency and protection for client funds.

Conclusion and Recommendations

In conclusion, RIF Capital exhibits several characteristics of a potentially fraudulent broker. The lack of regulatory oversight, combined with numerous complaints about fund withdrawals and poor customer service, raises significant concerns about its legitimacy. Traders should exercise extreme caution when considering this broker for their trading activities.

For those seeking to invest in the forex market, it is advisable to choose regulated brokers with a proven track record of reliability and transparency. Some reputable alternatives include brokers such as IG Group, OANDA, or Forex.com, which are well-regulated and offer a safer trading environment. Always prioritize the security of your funds and conduct thorough due diligence before making any investment decisions.

Is RIF-CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of RIF-CAPITAL brokers.

RIF-CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RIF-CAPITAL latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.