Is Lontl safe?

Pros

Cons

Is Lontl A Scam?

Introduction

Lontl is an online forex broker that has recently emerged in the trading landscape, offering a variety of trading instruments, including forex, commodities, and options. As with any financial service provider, particularly in the volatile world of forex trading, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to evaluate brokers carefully to protect their investments.

This article investigates Lontl's legitimacy by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The analysis draws on various online reviews and reports to provide a comprehensive overview of whether Lontl is a trustworthy broker or a potential scam.

Regulatory and Legitimacy

The regulatory framework governing forex brokers is vital for ensuring the safety and security of traders' funds. A regulated broker is typically subject to stringent oversight, which can help protect investors from fraud and malpractice. Unfortunately, Lontl operates without any valid regulatory license, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of any regulatory oversight means that Lontl does not adhere to the standards set by recognized financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This lack of regulation poses serious risks to traders, as there is no governing body to hold the broker accountable for its actions. Moreover, reports suggest that Lontl has a low trust score, with multiple sources indicating potential scam activities. Traders should be wary of engaging with unregulated brokers, as they may not offer the same level of protection and recourse that regulated entities provide.

Company Background Investigation

Lontl was established in 2021 and claims to be based in the Cayman Islands. However, the limited information available about its ownership structure and management team raises questions about its transparency and credibility. The absence of detailed background information on the company's website or in third-party reviews makes it challenging to assess the qualifications and experience of the individuals behind Lontl.

A broker's management team plays a crucial role in its operations, and a lack of transparency in this area can be a red flag. Without clear information on the leadership and their professional backgrounds, it becomes difficult for traders to trust the integrity of the broker. Furthermore, the company's relatively recent establishment adds to the uncertainty, as newer brokers may lack the track record necessary to instill confidence in potential clients.

Trading Conditions Analysis

Lontl offers a variety of trading instruments, including forex pairs, commodities, and options. However, the overall fee structure and trading conditions associated with the broker are critical factors that traders must consider. Reports indicate that Lontls trading fees are not competitive compared to industry standards, and some users have reported unexpected charges, which is a common characteristic of fraudulent brokers.

| Fee Type | Lontl | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Structure | Hidden Fees | Transparent |

| Overnight Interest Range | Unclear | Defined |

The presence of hidden fees and a lack of clarity regarding the commission structure can be indicative of a broker that does not prioritize its clients' interests. Traders should be cautious of brokers that do not provide transparent information about their fee structures, as this can lead to unexpected costs that erode profitability.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Lontl's lack of regulatory oversight raises significant questions about its fund security measures. Reports suggest that Lontl does not implement robust fund segregation practices, which means traders' funds may not be kept separate from the broker's operating capital. This lack of segregation can put traders at risk if the broker encounters financial difficulties.

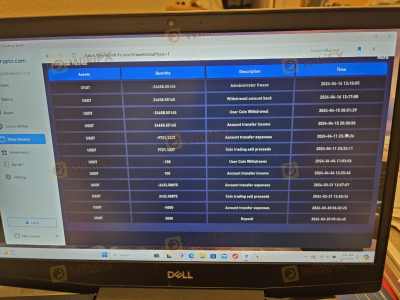

Moreover, without any investor protection schemes in place, traders have little recourse in the event of a dispute or if the broker fails to return funds. Historical complaints about Lontl indicate that some users have experienced difficulties withdrawing their funds, a common tactic employed by scam brokers to retain clients' money.

Customer Experience and Complaints

User feedback is an essential component of assessing a broker's reputation. Reviews for Lontl reveal a mix of experiences, with a notable number of complaints regarding withdrawal issues and lack of customer support. Many users have reported that their withdrawal requests were either delayed or denied, which is a significant red flag that suggests potential fraudulent activity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unresponsive |

Typical cases involve clients who successfully deposited funds but faced significant hurdles when attempting to withdraw their money. Such patterns of behavior are characteristic of scam brokers, who often allow small withdrawals to build trust before blocking larger ones.

Platform and Trade Execution

Lontl offers a proprietary trading platform that aims to provide users with a seamless trading experience. However, reports about the platform's performance indicate that it may not be as stable as claimed. Issues such as slippage, order rejections, and platform downtime have been reported by users, which can severely impact trading performance.

The execution quality is also a critical factor for traders. Delays or slippage during volatile market conditions can lead to significant losses. If a broker's platform exhibits signs of manipulation or fails to execute trades as expected, it raises serious concerns about the broker's integrity.

Risk Assessment

Engaging with Lontl comes with inherent risks primarily due to its unregulated status and history of complaints. Traders should be aware of the following risk categories:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund segregation and protection |

| Withdrawal Risk | High | History of delayed or denied withdrawals |

To mitigate these risks, traders should consider using regulated brokers with established reputations and transparent practices. Conducting thorough research and reading user reviews can help identify potential issues before committing any funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Lontl operates in a high-risk environment with several red flags indicating potential scam activities. The absence of regulatory oversight, coupled with numerous complaints about withdrawal issues and lack of transparency, raises significant concerns for potential traders.

For those considering forex trading, it is advisable to avoid Lontl and seek out brokers that are regulated by reputable authorities. Established brokers with transparent fee structures, strong customer support, and a proven track record of reliability are more likely to provide a safe trading environment.

If you are looking for trustworthy alternatives, consider brokers like IC Markets, Pepperstone, or AvaTrade, which are well-regulated and have positive reputations in the trading community. Always prioritize safety and transparency when choosing a forex broker to protect your investments.

Is Lontl a scam, or is it legit?

The latest exposure and evaluation content of Lontl brokers.

Lontl Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lontl latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.