RCM 2025 Review: Everything You Need to Know

Executive Summary

RCM operates as a futures brokerage and execution service provider. This rcm review shows that the company offers online trading platforms for different levels of futures traders, but there are major concerns about regulatory transparency and corporate disclosure. RCM appears to focus on traders interested in futures markets and alternative investments. RCM Alternatives has gained recognition for consistent performance in the quantitative funds sector.

The platform has won some industry awards for innovative client support services. However, the lack of clear regulatory information and limited transparency raises questions about the broker's reliability. Employee satisfaction ratings suggest moderate workplace conditions, which may affect service quality. For potential clients, RCM offers specialized futures trading capabilities while lacking the transparency standards expected from top-tier financial service providers.

Important Notice

This evaluation uses publicly available information and user feedback from various sources. RCM's regulatory status and operational transparency appear limited compared to industry standards. The information in this rcm review reflects data available as of 2025, and potential clients should verify all claims and services independently before using the platform.

Cross-regional entity differences may exist, and services may vary by jurisdiction. The assessment uses company background information, user feedback, and industry recognition data where available.

Rating Framework

Broker Overview

RCM operates in the financial services sector with a focus on futures brokerage and execution services. The company has established itself as a provider of online trading platforms designed for traders across different experience levels, from beginners to professionals requiring advanced features. The rise of internet technology and mobile applications has created opportunities for platforms like RCM to offer sophisticated trading solutions.

RCM Alternatives has gained recognition in recent years for its support of quantitative funds and alternative investment strategies. The platform emphasizes providing multiple avenues for client connectivity, which became particularly important during challenging market conditions. Reports suggest that after difficult periods in the financial markets, the company focused on delivering innovative and consistent support to help quant funds grow their operations.

The company's business model centers around futures trading and alternative investments, with emphasis on risk management and client education. However, specific details about the company's founding date, headquarters location, and regulatory framework remain unclear in available documentation. This rcm review finds that while RCM offers specialized services in the futures market, the lack of comprehensive public information limits the ability to fully assess the broker's credentials and operational scope.

Regulatory Status: Specific information about RCM's regulatory oversight and licensing is not detailed in available sources. This raises concerns about transparency and compliance standards.

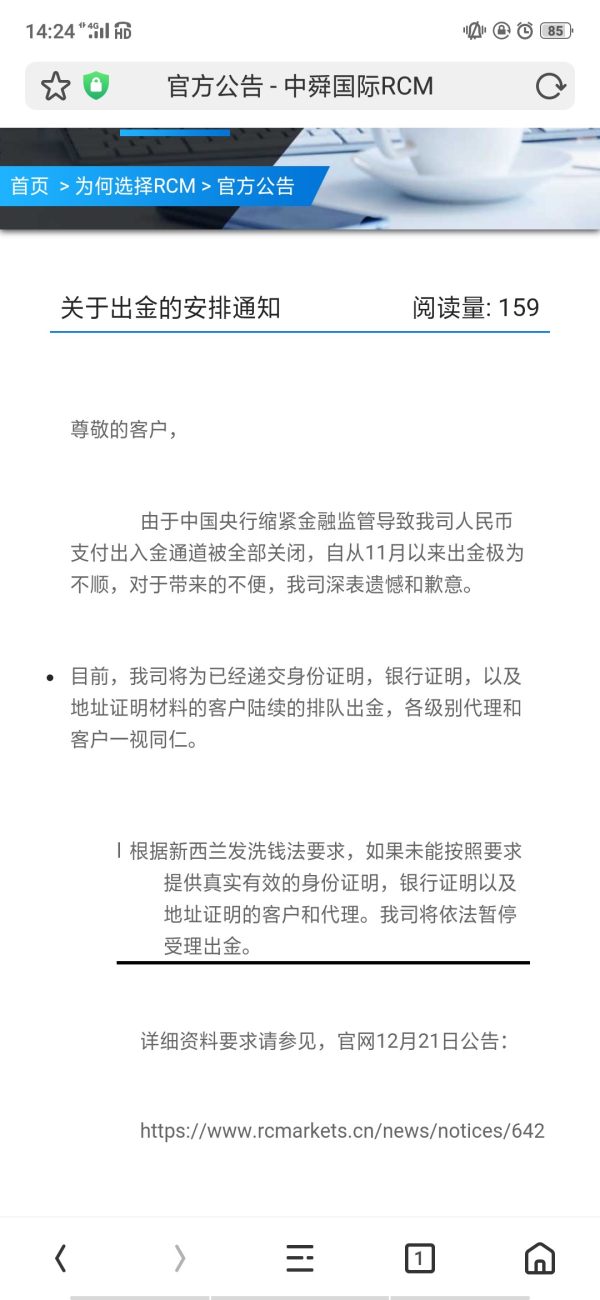

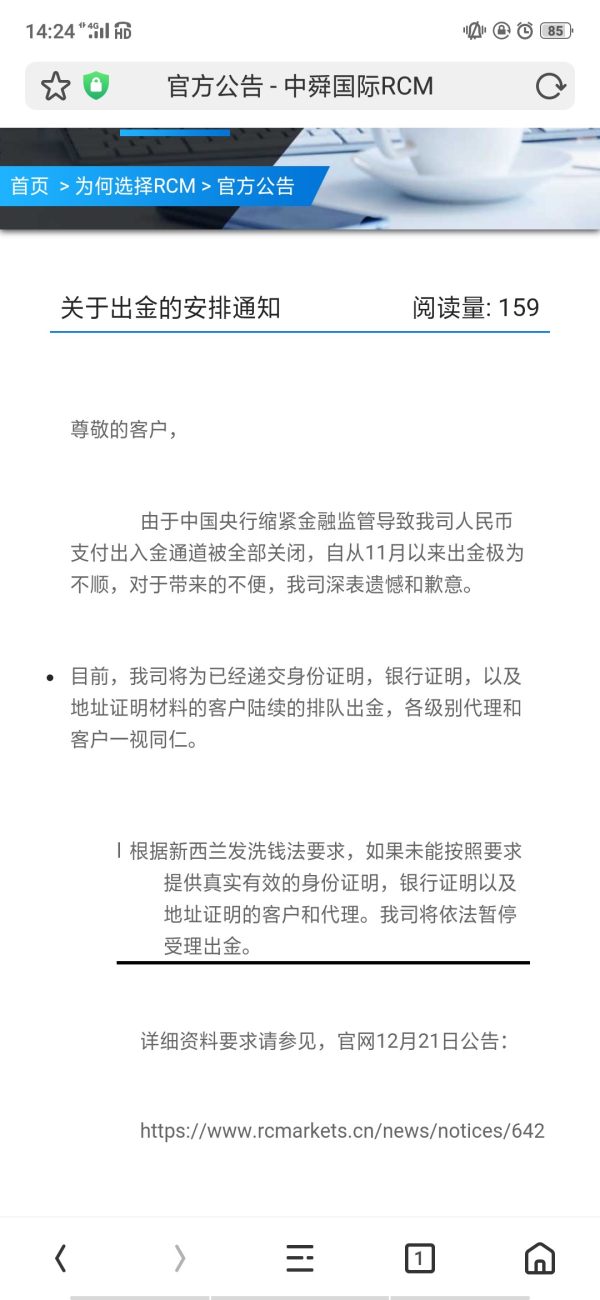

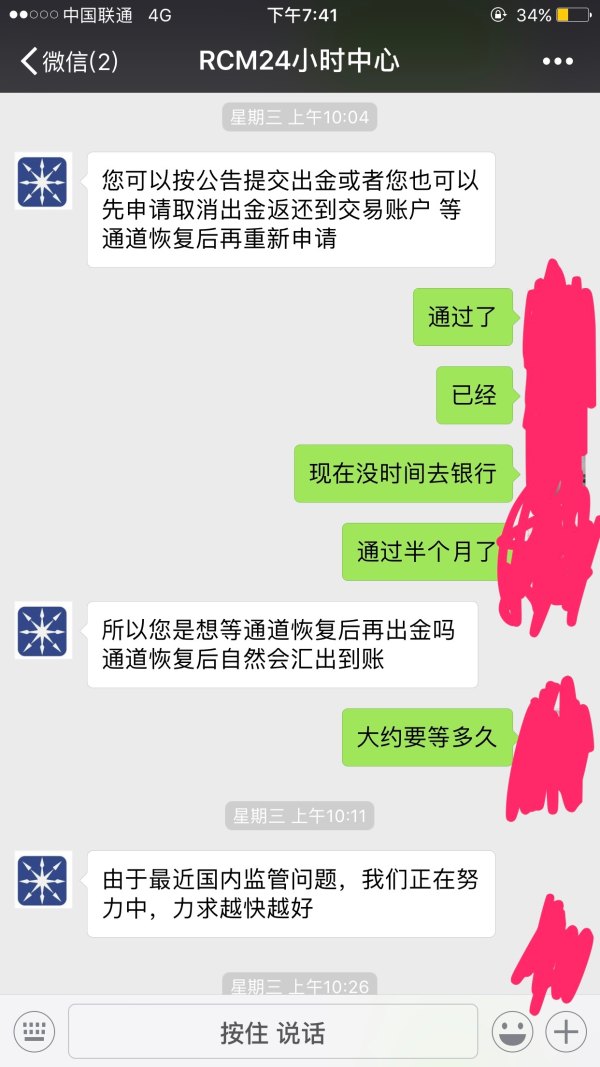

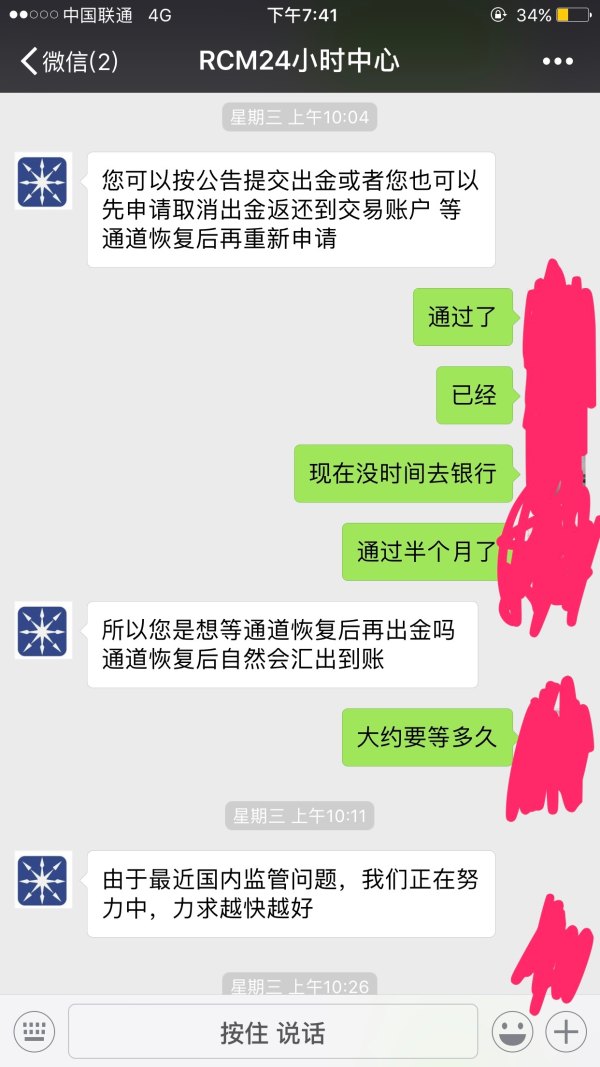

Deposit and Withdrawal Methods: Available sources do not provide specific information about supported payment methods, processing times, or associated fees for funding accounts or withdrawing profits.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not mentioned in the available documentation.

Bonuses and Promotions: No information about welcome bonuses, trading incentives, or promotional offers is available in the current sources.

Tradeable Assets: While the platform focuses on futures trading, specific details about available instruments, markets, and asset classes are not outlined in available materials.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs is not detailed in the accessible sources. This makes it difficult to assess the platform's competitiveness.

Leverage Ratios: Specific leverage offerings for different instruments and account types are not mentioned in available documentation.

Platform Options: RCM Alternatives provides online trading platforms designed for futures traders of varying experience levels. The platforms take advantage of internet speed and mobile technology developments.

Geographic Restrictions: Specific information about restricted territories or regional limitations is not available in current sources.

Customer Support Languages: Available sources do not specify which languages are supported by the customer service team.

This rcm review highlights the significant information gaps that potential clients should consider when evaluating RCM as a trading partner.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of RCM's account conditions reveals significant information limitations that impact the overall evaluation. Available sources do not provide comprehensive details about account types, minimum deposit requirements, or specific features offered to different trader categories. This lack of transparency makes it challenging for potential clients to understand what they can expect when opening an account with RCM.

Without clear information about account opening procedures, verification requirements, or special account features, traders cannot make informed decisions about whether RCM meets their specific needs. The absence of detailed account condition information also raises questions about the broker's commitment to transparency and client education.

Industry standards typically require brokers to clearly outline account types, associated fees, and minimum balance requirements. The fact that this information is not readily available in RCM's public materials suggests either limited marketing efforts or a preference for direct client consultation rather than public disclosure.

The lack of specific account condition details significantly impacts the user experience and makes it difficult to compare RCM with other brokers in the market. This rcm review finds that the absence of comprehensive account information represents a major limitation for potential clients seeking to evaluate the platform's suitability for their trading needs.

RCM's tools and resources offering appears to focus primarily on futures trading platforms. The platform emphasizes leveraging technological advances in internet connectivity and mobile applications. The platform reportedly provides solutions suitable for different trader experience levels, from beginners to professionals requiring advanced features.

However, specific details about trading tools, research resources, educational materials, and automated trading support are not comprehensively documented in available sources. This limitation makes it difficult to assess the quality and breadth of tools provided to clients.

The company's focus on futures trading suggests that specialized tools for this market segment may be available. However, without detailed documentation, potential clients cannot evaluate whether these tools meet their specific requirements. Modern traders typically expect access to advanced charting tools, market analysis, educational resources, and automated trading capabilities.

The absence of detailed information about research and analysis resources is particularly concerning. These tools are crucial for informed trading decisions. Educational resources are also important for trader development, especially for beginners entering the futures market.

While RCM may offer quality tools and resources, the lack of transparent information about these offerings limits the platform's appeal to potential clients who want to understand exactly what they will have access to before committing to the service.

Customer Service and Support Analysis

Customer service evaluation for RCM is limited by the availability of specific information about support channels, response times, and service quality metrics. Available data suggests employee satisfaction ratings around 4.2 out of 5, which may indirectly indicate reasonable workplace conditions that could translate to service quality.

However, critical information about customer service channels, availability hours, multilingual support, and response time standards is not detailed in accessible sources. Modern traders expect multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ resources.

The lack of specific information about customer service capabilities makes it difficult to assess how well RCM supports its clients. This is particularly important during critical trading situations or technical issues. Response time is crucial in trading environments where market conditions can change rapidly.

Without documented customer service standards or user feedback about support experiences, potential clients cannot evaluate whether RCM provides the level of assistance they might require. This is particularly important for newer traders who may need more frequent support and guidance.

The absence of clear customer service information represents a significant transparency gap that could impact client confidence and satisfaction. Quality customer support is essential for maintaining positive trading relationships and resolving issues efficiently.

Trading Experience Analysis

The trading experience evaluation for RCM centers around its futures trading platform capabilities. The platform reportedly accommodates traders across different experience levels. The platform appears to leverage modern internet technology and mobile applications to provide trading access, suggesting awareness of current technological standards.

However, specific information about platform stability, execution speed, order types, and trading features is not comprehensively documented. These technical aspects are crucial for evaluating the actual trading experience that clients can expect.

Without detailed user feedback about platform performance, order execution quality, or slippage rates, it's challenging to assess how well RCM's platform performs under various market conditions. Professional traders particularly need reliable execution and minimal technical disruptions.

The lack of specific information about mobile trading capabilities, advanced order types, and platform customization options limits the ability to evaluate whether RCM meets modern trading standards. Additionally, information about platform uptime, connection speeds, and technical support for trading issues is not available.

This rcm review finds that while RCM positions itself as serving different trader levels, the absence of detailed platform specifications and user experience feedback makes it difficult to verify these claims or compare the service with industry standards.

Trust and Reliability Analysis

Trust and reliability assessment for RCM reveals significant concerns due to limited transparency about regulatory oversight and operational details. The absence of clear regulatory information in available sources raises questions about the broker's compliance with financial services standards and client protection measures.

Regulatory oversight is fundamental to broker trustworthiness. It provides client protection through capital adequacy requirements, segregated client funds, and dispute resolution mechanisms. Without clear regulatory information, potential clients cannot assess the level of protection they would receive.

The lack of transparency about company operations, financial statements, and regulatory compliance creates uncertainty about RCM's reliability as a trading partner. Industry recognition through awards may provide some positive indicators, but these do not substitute for regulatory oversight and transparent operations.

Client fund safety measures, insurance coverage, and segregation policies are not detailed in available sources. This is concerning for potential clients considering significant investments. These protections are standard expectations in regulated financial services.

The absence of comprehensive trust and reliability information significantly impacts RCM's credibility in the competitive broker landscape, where transparency and regulatory compliance are increasingly important client selection criteria.

User Experience Analysis

User experience evaluation for RCM is constrained by limited available feedback and interface information. While employee satisfaction ratings suggest moderate workplace conditions, this provides only indirect insights into client experience quality.

Specific information about platform interface design, ease of use, registration processes, and account management features is not comprehensively documented. These factors significantly impact daily trading experience and client satisfaction.

The absence of detailed user feedback about navigation, functionality, and overall satisfaction makes it difficult to assess how well RCM serves its client base. Modern trading platforms are expected to provide intuitive interfaces that accommodate both novice and experienced traders.

Information about mobile application quality, web platform performance, and cross-device synchronization is not available. This limits the ability to evaluate RCM's adaptation to current user expectations for flexible trading access.

Without comprehensive user experience data, potential clients cannot determine whether RCM's platform design and functionality align with their preferences and trading requirements, representing a significant evaluation limitation.

Conclusion

This rcm review reveals a broker with specialized focus on futures trading that faces significant transparency challenges. While RCM offers online trading platforms for different trader experience levels and has received some industry recognition, the lack of comprehensive regulatory information and operational transparency raises concerns about overall reliability.

RCM appears most suitable for experienced traders who prioritize specialized futures trading capabilities over extensive transparency and regulatory clarity. The platform may appeal to clients interested in alternative investments and quantitative trading strategies, particularly given the recognition received by RCM Alternatives.

However, the significant information gaps regarding account conditions, costs, regulatory oversight, and user experience represent major limitations that potential clients must carefully consider. The absence of clear regulatory information is particularly concerning in today's financial services environment where client protection and transparency are paramount.