Truist Financial 2025 Review: Everything You Need to Know

1. Summary

Truist Financial is a mission-driven financial services company. It combines traditional banking with strong investment offerings that serve many different clients. Born from the merger of BB&T Bank and SunTrust Bank, Truist Financial operates under strict SEC regulations while also holding memberships with FINRA and SIPC. This truist financial review shows an institution that focuses on community building. The company offers many services ranging from consumer and small business banking to commercial, corporate, and investment banking, made better by wealth management solutions and specialized lending businesses. Users have given mostly positive feedback. This is shown by over 5,106 ratings on WalletHub, highlighting strong trust among its clients. The review shows a service that works well for individual investors and small businesses seeking different financial solutions. However, specific details such as account conditions, trading tools, and the user interface remain less clear in available sources. Overall, this truist financial review shows the company's commitment to following regulations and providing broad service access. This makes it a good choice for those seeking integrated financial expertise.

2. Caveats and Methodology

Truist Financial primarily operates within the United States. The SEC, FINRA, and SIPC provide regulatory oversight for the company's operations. This review is based on a detailed analysis of user feedback, official company information, and market reports. Although detailed information about specific account terms, deposit methods, and trading platforms are not fully explained in available materials, our evaluation follows a structured framework. This framework looks at key aspects of the financial service provider. Differences in regional operations or service conditions may exist, so readers should verify specific details through official regulatory bodies. Our scoring and analysis come from information available as of early 2025. While every effort has been made to maintain accuracy and relevance, potential changes may not be immediately reflected. We use a clear methodology in which each score and comment is backed by the most recent data and verified user feedback.

3. Score Framework

4. Broker Overview

Truist Financial Corporation came from the merger of BB&T Bank and SunTrust Bank. This created a powerful entity in the financial services landscape. Headquartered in Atlanta, Georgia, the institution has a rich history rooted in traditional banking practices while growing to include modern investment services. The company's diverse portfolio spans consumer and small business banking, commercial and corporate banking, as well as corporate and investment banking. Additionally, wealth management and specialized lending solutions are an important part of the suite. These services offer clients a complete financial platform. Through this truist financial review, it is clear that the corporation aims to deliver both reliability through its market presence and innovation by adding digital solutions for everyday banking. Despite the absence of detailed account conditions in the public domain, the general view is that Truist Financial's operational model supports a broad range of financial needs. The company has strong regulatory backing.

The company operates under a business model that supports both wholesale and consumer segments. Its strategy extends from everyday banking solutions to more complex financial products such as trust and asset management services. The firm works with many client groups, including individual retail customers and small enterprises looking for strong financial support. Regulatory oversight by the SEC, FINRA, and SIPC reassures clients about following strict financial practices and accountability measures. Although various trading platforms or asset classes are not clearly detailed in the provided business summary, the overall structure of Truist Financial shows a commitment to excellence and innovation in diverse banking services. This truist financial review captures the institution's dual focus on regulatory compliance and complete service coverage. This makes it a compelling option for those seeking secure and integrated financial management solutions.

Truist Financial holds a significant position as an SEC-registered broker. It operates under the careful oversight of FINRA and SIPC, which provides a secure foundation for investor trust. As outlined in our review, the regulatory region remains primarily in the United States. This ensures that clients benefit from established financial safeguards.

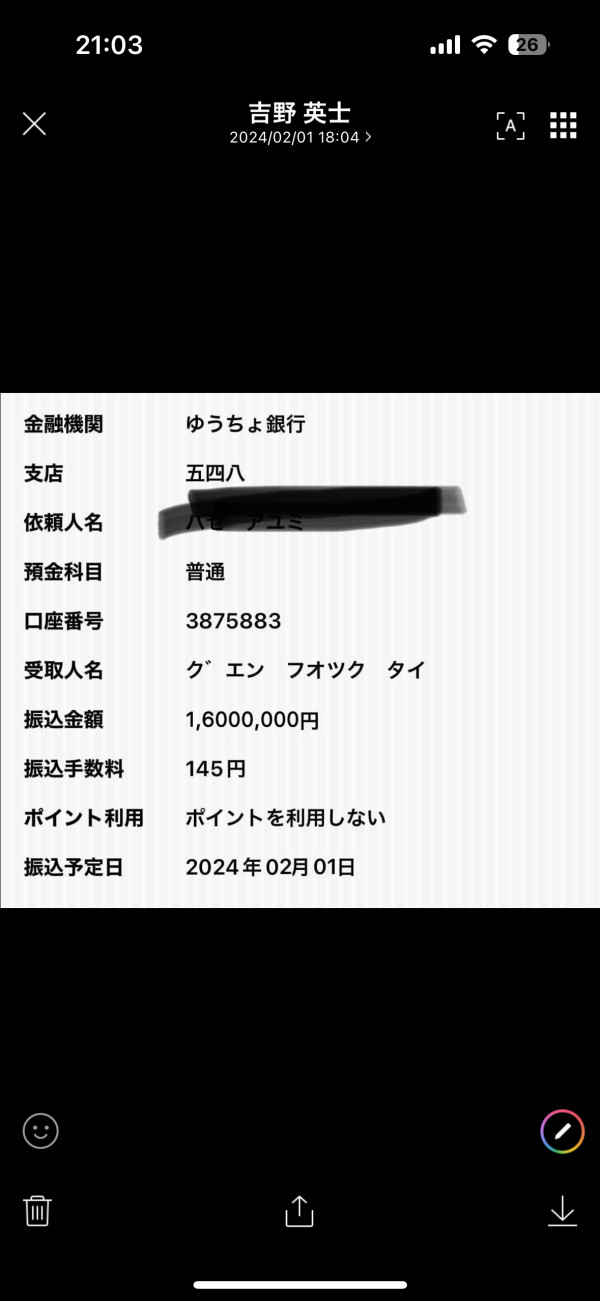

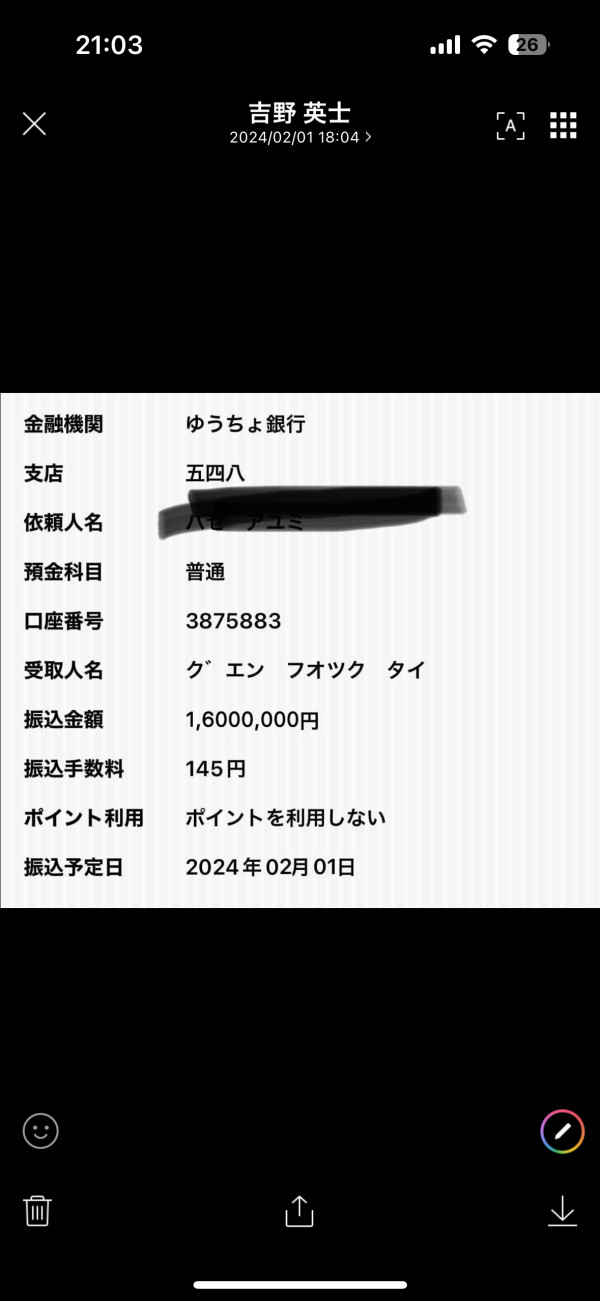

Regarding deposit and withdrawal processes, specific deposit methods are not well described in the available profiles. Similarly, the minimum deposit requirements remain unspecified, leaving potential clients to seek further detailed information directly from Truist Financial's official channels. Likewise, promotional bonuses are not clearly noted in the reviewed materials. This limits the scope of incentivized offerings.

When considering tradable assets, detailed information is lacking. This is also the case for the corresponding cost structures which refer to fees and commission specifics. The absence of clear commentary on leverage ratios further contributes to an incomplete view. Platform selection is not well-documented, with no clear data on diverse trading platforms or specialized service options for varied traders. Additionally, there are no clear regional limitations stated, and customer support language details remain under-reported. This information gap shows the need for prospective clients to directly verify platform specifics and fee structures before engaging in trading.

Despite these omissions, the overall narrative of Truist Financial remains strong. It is anchored by a complete suite of banking and investment services. This truist financial review emphasizes the company's focus on regulatory adherence and diverse service provision while highlighting areas where additional transparency could further enhance client confidence.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The available materials offer no detailed insights into the specific types of accounts provided by Truist Financial. There is no information on the minimum deposit requirements, account fees, or the details involved in the sign-up process. This gap in available data makes it challenging to thoroughly judge the flexibility or competitiveness of the account offerings. Prospective clients are not provided with details regarding specialized account types, such as accounts designed to suit Islamic finance principles or other tailored banking solutions. The lack of specific information results in a default rating based on standard assumptions as not all criteria could be directly evaluated. Compared to other brokers, this absence of detail leaves a significant information void. This limits the strength of our evaluation for this dimension. Users searching for detailed information on account opening procedures may find it necessary to pursue direct communication with the institution. Overall, while the regulatory framework gives a level of reliability, the lack of specific account condition details is a critical shortcoming. This section of the truist financial review highlights the need for further clarity from the provider on account-related features. This is essential for building deeper client confidence.

The review of tools and resources provided by Truist Financial reveals that detailed information on the available trading tools, research capabilities, and educational resources is noticeably absent. Although Truist Financial offers a broad range of financial services, the specific assets dedicated to enhancing clients' trading decisions are not clearly described. These include advanced charting software, automated trading supports, or market analysis tools. Without these specifics, it becomes difficult to evaluate the overall quality and effectiveness of the platform's tools from a technical perspective. Furthermore, the review does not address the presence of supplementary materials such as webinars, tutorials, or expert commentary. These might aid novice traders. For seasoned investors, the absence of detailed information on advanced research tools can be a gap relative to industry standards. In comparison with competing brokers, this limitation may lead to a perception that while Truist Financial offers complete banking solutions, its trading resource support might not be as enriched or client-oriented as expected. This area of improvement is significant for a more complete financial offering. As such, this section of the truist financial review stresses that additional information is necessary to fully appreciate the technological and educational infrastructure. This could enhance the overall trading experience.

6.3 Customer Service and Support Analysis

Customer service and support are critical for any financial institution. Yet the available documentation for Truist Financial does not detail the specifics of its customer support infrastructure. There is limited discussion regarding the communication channels available, such as telephone, email, or live chat, and no information is provided on support availability or response times. Additionally, the review does not share details on multilingual support or dedicated assistance for account issues. The absence of documented case examples or detailed user feedback further complicates a complete evaluation. While regulatory compliance and adherence to quality standards suggest basic levels of service, the lack of detailed transparency prevents a full understanding of how promptly and effectively customer issues are addressed. In practical terms, potential clients must rely on generic branding rather than evidenced support practices. This analysis within our truist financial review highlights that while regulatory oversight does offer an assurance of baseline service, the gap in clear customer service details remains a concern. This is especially true for users who highly value immediate and efficient support in financial operations.

6.4 Trading Experience Analysis

The trading experience at Truist Financial is another area where detailed insights are notably sparse. The available information does not provide clear assessments regarding platform stability, order execution speed, or the overall functionality of the trading interface. There is no commentary available on whether the trading platform is user-friendly, nor are there any reports concerning mobile trading experiences. Consequently, users looking for a carefully documented trading environment may find this lack of substantial data challenging. The absence of objective measures such as latency reports or order execution quality metrics leaves many critical questions unanswered. In comparison to specialized trading platforms that boast complete performance statistics and real-time data, Truist Financial's offering falls short of providing the detailed operational metrics that modern traders seek. This is captured in this truist financial review. This gap suggests the necessity for more in-depth performance evaluations and independent tests to fully assess the trading experience. While the regulatory backdrop assures a baseline of safety and reliability, the technological and user-interface dimensions require further explanation for a complete picture.

6.5 Trust Factor Analysis

Trust is a key factor in evaluating any financial institution. Truist Financial benefits from its regulatory affiliations. As an SEC-registered entity with FINRA and SIPC membership, the company does provide a foundational layer of security and trust. However, while these elements are reassuring, the public domain lacks further details on additional measures for funds safety, company transparency, and historical handling of potential negative events. The review does not provide insights into how the company addresses issues when they arise or any proactive risk management strategies they might employ. Furthermore, the broader industry reputation—beyond these regulatory markers—is not clearly documented through additional independent ratings or detailed third-party analysis. Even though the strong regulatory oversight imparts a level of baseline trust, the absence of extensive information and historical performance audits means that there remains room for improvement in demonstrating complete reliability. This truist financial review recognizes that while the trust factor is strengthened by regulatory adherence, expanding the scope of transparency and proactive client communication would significantly enhance confidence among investors.

6.6 User Experience Analysis

User experience is paramount in shaping overall satisfaction. Yet our available documentation does not offer detailed insights on Truist Financial's digital interface or the registration and verification processes. There is little to no information on how intuitive the platform's design is, or whether clients are satisfied with the ease of fund transfers and overall navigation. Important aspects such as the look and feel of the online environment, the speed of transactions, and responsiveness to client feedback remain undocumented in available sources. Additionally, no clear user testimonials or aggregated feedback have been detailed to capture common pain points or highlights in the user journey. As such, while the intrinsic value of a seamless user interface is recognized industry-wide, this gap means that prospective users must rely largely on the institution's regulatory credentials rather than firsthand experience insights. The truist financial review in this domain indicates that although the company's financial services span a wide range, further emphasis on optimizing digital and operational user experiences would benefit both new and existing clients. Enhancements in this area could drive higher satisfaction scores and foster stronger long-term loyalty.

7. Conclusion

Truist Financial stands as a complete financial services provider that caters to both individual investors and small business clients. The firm effectively combines traditional banking with advanced investment services, supported by strong regulatory oversight from the SEC, FINRA, and SIPC. As highlighted in this truist financial review, the company's primary strengths lie in its diverse service offerings and robust trust factors. However, potential clients should note that detailed information regarding account conditions, trading tools, customer support mechanisms, and overall user experience remains less transparent. For those seeking a one-stop solution for broad financial management, Truist Financial represents a viable option. It does have areas that warrant further clarity and enhancement.