Regarding the legitimacy of RCM forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is RCM safe?

Business

License

Is RCM markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

RENAISSANCE CAPITAL MARKETS LIMITED

Effective Date:

2010-11-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2021-03-19Address of Licensed Institution:

RENAISSANCE CAPITAL MARKETS Suite 1, Level 15, 21 Queen Street Auckland Central Auckland 1010Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is RCM Safe or Scam?

Introduction

RCM, or Regal Core Markets, has emerged as a player in the forex trading landscape, positioning itself as a platform for traders seeking opportunities in currency exchange. However, the rise of unregulated and offshore brokers in the forex market has raised concerns among traders regarding the safety and legitimacy of their investments. It is crucial for traders to meticulously evaluate any forex broker before committing their funds, as the lack of regulation can lead to significant financial risks. This article investigates whether RCM is a safe trading option or if it exhibits characteristics of a scam. Our assessment framework incorporates regulatory scrutiny, company background, trading conditions, client fund security, customer experiences, platform performance, and risk evaluation.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. RCM claims to be registered in Vanuatu and asserts that it operates under the oversight of the Vanuatu Financial Services Commission (VFSC). However, Vanuatu is known for its lax regulatory environment, making it an attractive location for many unregulated brokers.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | N/A | Vanuatu | Unverified |

The absence of a robust regulatory framework raises significant concerns about RCM's operations. The VFSC does not impose stringent requirements for brokers, which can lead to inadequate trader protection. Furthermore, RCM has been flagged by multiple review sites as a potentially unsafe trading platform, indicating a pattern of complaints and negative experiences among users. The lack of reliable regulatory oversight is a major red flag, suggesting that RCM may not be a safe environment for trading.

Company Background Investigation

RCM, owned by Regal Core Markets Limited, operates as an offshore entity registered in Vanuatu. The companys history and ownership structure are essential to understanding its credibility. Unfortunately, detailed information about the management team and their professional backgrounds is scarce, which raises questions about the transparency of the broker.

The companys website lacks comprehensive contact details, further obscuring its legitimacy. Traders are often left with no means to verify the company's claims or to reach out for support, which is indicative of a lack of accountability. Transparency in operations and clear communication are vital for establishing trust in a broker, and RCM appears to fall short in these areas.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer can significantly impact a trader's experience and profitability. RCM presents a range of trading options, but the overall cost structure is concerning. Reports suggest that RCM employs an aggressive fee model that may not be in line with industry standards.

| Fee Type | RCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Standard |

| Overnight Interest Range | High | Moderate |

The high spreads and unclear commission structures can lead to unexpected costs for traders, potentially eroding profits. Furthermore, the presence of hidden fees or complicated withdrawal processes has been reported, which may indicate a lack of transparency and fairness in their trading conditions. Such practices are often associated with untrustworthy brokers, raising further doubts about whether RCM is safe for trading.

Client Fund Security

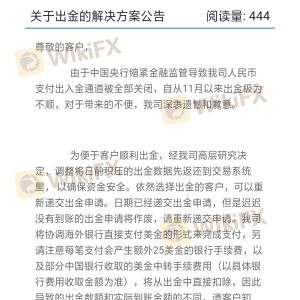

The safety of client funds is paramount when choosing a forex broker. RCM claims to implement various security measures; however, the lack of regulatory oversight raises concerns about the effectiveness of these measures. The broker does not provide clear information regarding segregated accounts, investor protection schemes, or negative balance protection policies.

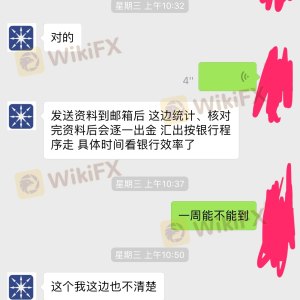

Traders have reported issues with fund withdrawals, with many claiming that their requests were ignored or delayed indefinitely. This history of fund security disputes is alarming and suggests that RCM may not prioritize client fund safety. Without adequate safeguards in place, traders could be at risk of losing their investments, highlighting the importance of thorough due diligence when considering RCM as a trading option.

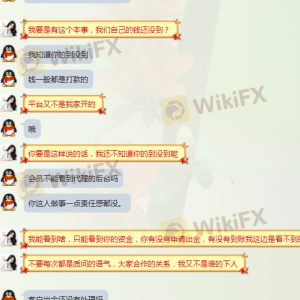

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of RCM reveal a pattern of negative experiences, with many traders expressing dissatisfaction with the broker's customer support and responsiveness. Common complaints include difficulties in withdrawing funds, lack of communication, and the presence of aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

For instance, traders have reported that their withdrawal requests were met with delays, and in some cases, their accounts were frozen without explanation. Such experiences suggest that RCM may not be committed to providing a satisfactory trading environment, raising further doubts about its legitimacy. The recurring nature of these complaints indicates that RCM is not a safe choice for traders seeking reliable service.

Platform and Trade Execution

The performance of a trading platform is critical for traders, as it directly affects their ability to execute trades efficiently. RCM offers a trading platform that has faced scrutiny regarding its stability and execution quality. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, the lack of transparency regarding the platforms operational integrity raises concerns about potential manipulation. Traders must be cautious, as any signs of platform manipulation can be indicative of a broader issue within the broker's operations. A reliable trading platform should provide seamless execution and transparency, which appears to be lacking with RCM.

Risk Assessment

Using RCM as a trading platform carries inherent risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation and oversight. |

| Fund Security Risk | High | Issues with fund withdrawals and security measures. |

| Customer Service Risk | Medium | Poor response to client complaints. |

| Trading Conditions Risk | High | Unclear fees and high spreads. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with better regulatory standing and customer service records. Engaging with well-regulated brokers can provide a safer trading experience and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that RCM exhibits several characteristics that raise significant concerns about its safety and legitimacy as a forex broker. The lack of robust regulation, poor customer experiences, and issues with fund security indicate that RCM may not be a safe choice for traders.

For those considering forex trading, it is advisable to seek out brokers with strong regulatory backing and a proven track record of customer satisfaction. Alternatives such as brokers regulated by the FCA in the UK or ASIC in Australia may offer a more secure trading environment. Ultimately, traders should exercise caution and perform due diligence before engaging with RCM or any similar brokers.

In summary, is RCM safe? The overwhelming evidence suggests that it is not, and traders should approach with caution.

Is RCM a scam, or is it legit?

The latest exposure and evaluation content of RCM brokers.

RCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RCM latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.