FTG 2025 Review: Everything You Need to Know

Executive Summary

This ftg review gives you a complete look at FTG's trading services and where they stand in the market for 2025. FTG works through several companies like FTG International and Funded Traders Global, and they focus on technology to help traders. Glassdoor shows that FTG International gets 3 out of 5 stars from workers, with half of them saying they would recommend the company to others. FTG USA products have 668 reviews on ReviewMeta, which shows they have some presence in the market.

The company's main strength is that it promises to give traders new technology and support around the world. FTG teaches people through its Knowledge Bank platform and says it gives access to popular trading platforms. But our research shows big gaps in information about rules, specific trading conditions, and clear fee structures. We give an overall neutral rating because there isn't enough clear information about following regulations and detailed trading terms, which are important for keeping traders safe and helping them make good decisions.

Important Notice

This review covers different FTG companies that may follow different rules in places like Canada, Europe, and China. Traders should know that services, rule following, and how things work may be very different between these regional companies. The lack of clear rule information for some FTG operations creates important things to think about for potential clients.

This review uses information that anyone can find, user feedback, and official company messages. Since there isn't much detailed information about specific trading conditions and rule status, traders should strongly do more research and check current rule compliance before working with any FTG company.

Rating Framework

Broker Overview

FTG works as a company with many parts that serve different areas of the trading world. Available information shows that Foresight Trading Group was started when several professional trading groups worked together to create a complete support system for traders worldwide. The company says it focuses on technology and wants to give new solutions and educational resources to help traders succeed.

FTG International seems to work as a global technology company that specializes in providing after-sales service parts, while Funded Traders Global works more directly in trading education and support. The company focuses on teaching traders through the FTG Knowledge Bank, which makes regular content about achieving financial freedom and trading strategies.

The business plan centers on giving traders educational resources, broader market access, evaluation programs, and access to popular trading platforms. However, specific details about the actual trading platforms offered, asset classes available, and regulatory oversight remain unclear from available sources. This ftg review notes that the company's structure appears complex, with multiple entities potentially serving different functions within the broader FTG system.

Regulatory Status: Available information does not clearly show which regulatory bodies oversee FTG's operations, which is a big concern for potential traders seeking regulated brokerage services.

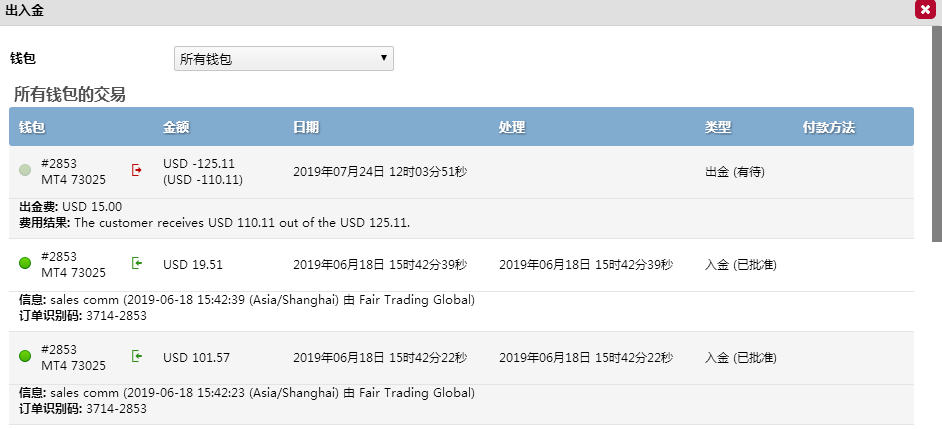

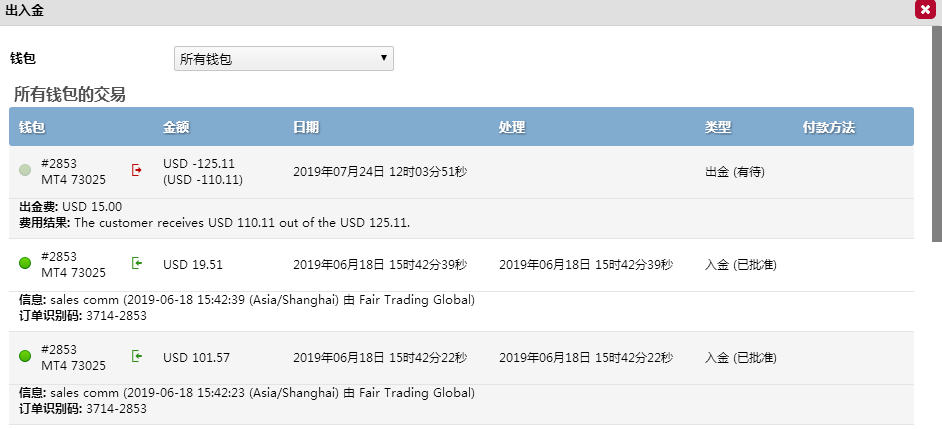

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and fees has not been detailed in sources we can access.

Minimum Deposit Requirements: The minimum amount required to open and maintain trading accounts with FTG entities remains unspecified in available documentation.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or incentive programs are not clearly outlined in the reviewed materials.

Available Assets: The range of tradeable instruments, including forex pairs, commodities, indices, and cryptocurrencies, has not been specifically detailed in available sources.

Cost Structure: Important information about spreads, commissions, overnight fees, and other trading costs remains unclear, making it difficult for traders to assess the true cost of trading with FTG.

Leverage Options: Maximum leverage ratios available to different account types and regulatory regions are not specified in the available information.

Platform Selection: While the company mentions providing access to "the world's most popular trading platform," specific platform names and features are not detailed.

Geographic Restrictions: Information about countries or regions where FTG services may be restricted or unavailable is not clearly provided.

Customer Support Languages: The languages in which customer support is available have not been specified in the reviewed materials.

This ftg review highlights the big information gaps that potential traders should know about when considering FTG's services.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The review of FTG's account conditions shows big information gaps that greatly impact our assessment. Available sources do not provide clear details about the types of trading accounts offered, their specific features, or the requirements for each account level. This lack of openness makes it hard for potential traders to understand what they can expect when opening an account with FTG.

The absence of information about minimum deposit requirements is particularly concerning, as this is basic information that traders need to make informed decisions. Without clear details about account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim traders, potential clients cannot properly assess whether FTG's offerings match their trading needs and religious requirements.

The company's focus on providing evaluation programs suggests some form of account assessment or testing may be available, but specific details about these programs, their duration, requirements, and outcomes are not clearly explained. This ftg review notes that the lack of clear account condition information greatly impacts the overall user experience and decision-making process.

Furthermore, without clear information about account maintenance fees, inactivity charges, or other potential costs associated with maintaining an account, traders cannot accurately calculate the total cost of their relationship with FTG. This information gap represents a big weakness in FTG's openness and client communication.

FTG's approach to tools and resources centers around their Knowledge Bank platform, which reportedly produces fresh concepts and guides on achieving financial freedom. This educational focus represents a positive aspect of their service offering, showing commitment to trader development and education. The Knowledge Bank appears to be regularly updated with new content, suggesting ongoing investment in educational resources.

However, specific details about the quality, depth, and completeness of these educational materials are not available for detailed assessment. The company claims to provide traders with education and evaluation programs, but the specific nature of these programs, their effectiveness, and user feedback regarding their value remain unclear.

The absence of information about technical analysis tools, market research resources, economic calendars, or other essential trading tools represents a big gap in our evaluation. Modern traders expect access to complete analytical resources, real-time market data, and advanced charting capabilities, but FTG's offerings in these areas are not clearly documented.

While the company mentions providing access to popular trading platforms, the specific tools and features available within these platforms, as well as any proprietary tools developed by FTG, are not detailed. This lack of specifics makes it difficult for traders to assess whether FTG's tool suite meets their analytical and trading needs.

Customer Service and Support Analysis (5/10)

The evaluation of FTG's customer service capabilities is limited by the lack of specific information about support channels, availability, and service quality. While the company provides contact information and mentions help and support services, detailed information about response times, support quality, and customer satisfaction levels is not readily available.

The company's website shows the availability of support services, but specific details about whether support is available via phone, email, live chat, or other channels are not clearly outlined. For traders who may need immediate help during market hours, the availability and responsiveness of customer support can be critical factors in their trading success.

Without access to user testimonials or feedback specifically addressing customer service experiences, it's challenging to assess the actual quality of support provided. The general employee satisfaction rating of 3 out of 5 stars suggests moderate satisfaction levels among FTG staff, which may indirectly reflect on customer service quality, but this connection is not definitively established.

The absence of information about multilingual support capabilities, support hours, or specialized assistance for different account types or trading issues represents another gap in our assessment. Traders operating in different time zones or speaking different languages need assurance that appropriate support will be available when needed.

Trading Experience Analysis (4/10)

The assessment of FTG's trading experience is greatly limited by the lack of detailed information about platform performance, execution quality, and overall trading environment. While the company claims to provide access to popular trading platforms, specific details about platform stability, execution speeds, slippage rates, and order processing quality are not available for evaluation.

The absence of information about trading platform features, user interface design, and functionality makes it impossible to assess whether FTG's trading environment meets modern trader expectations. Essential features such as one-click trading, advanced order types, mobile compatibility, and platform customization options are not detailed in available sources.

Without specific data about execution quality, including average execution times, rejection rates, or requote frequency, traders cannot assess the reliability of FTG's trading infrastructure. These factors are crucial for traders who depend on precise execution for their trading strategies, particularly those engaged in scalping or high-frequency trading approaches.

The lack of information about trading environment characteristics, such as whether FTG operates as a market maker, ECN, or STP broker, leaves traders without crucial information about how their orders are processed and executed. This ftg review emphasizes that understanding the broker's execution model is essential for making informed trading decisions.

Trust and Reliability Analysis (3/10)

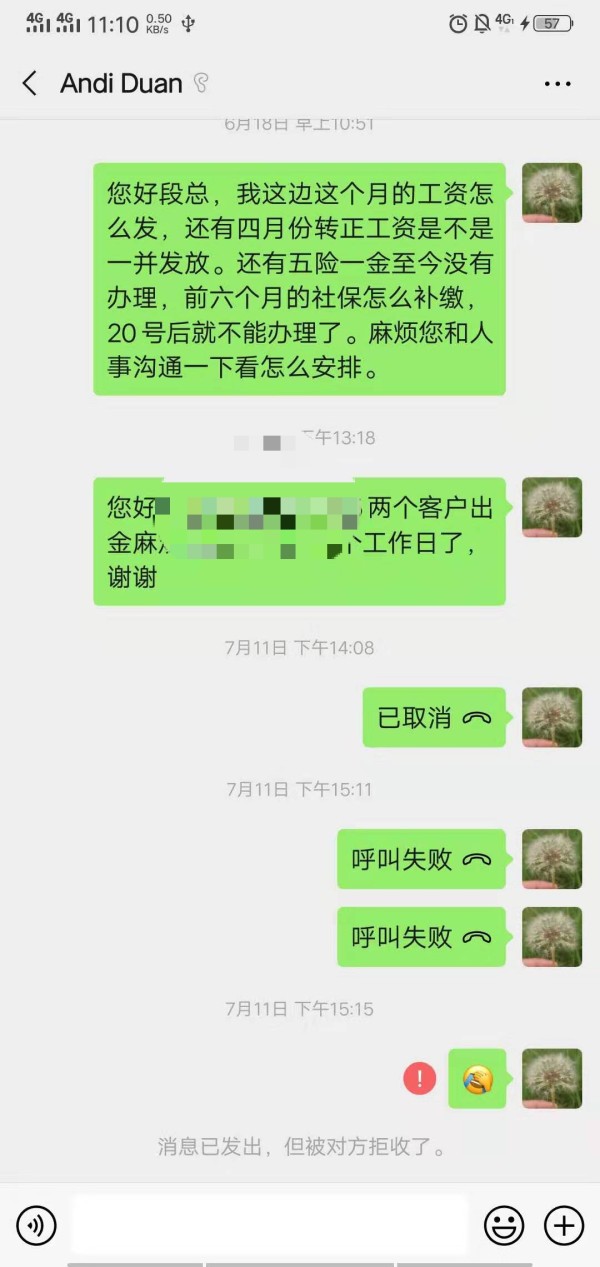

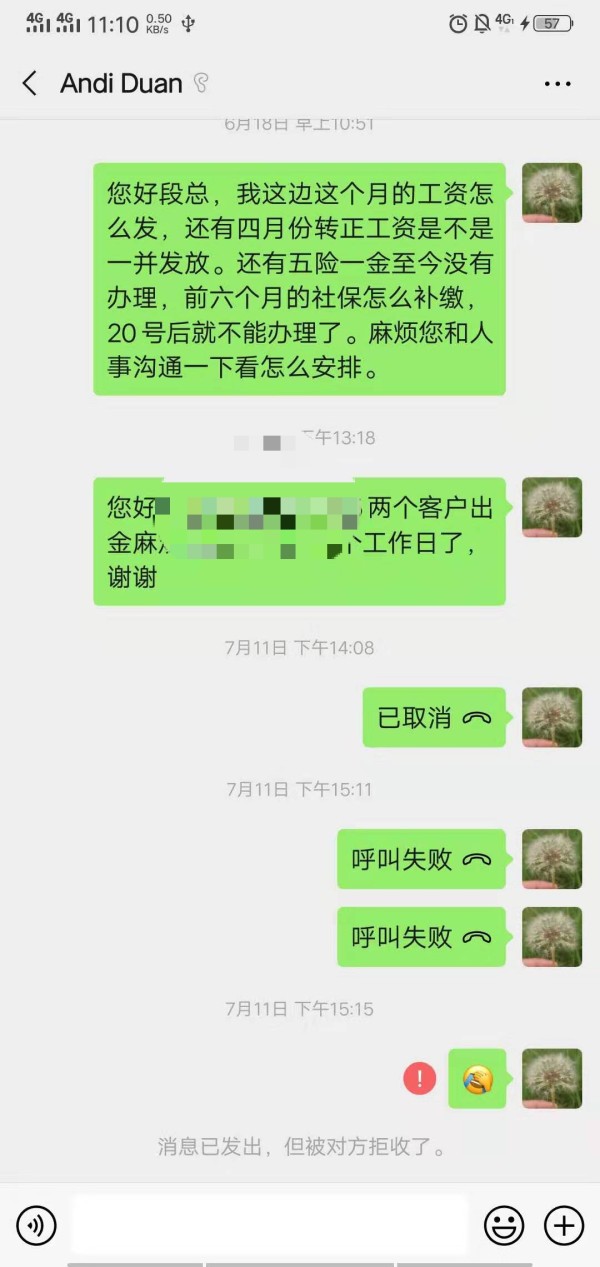

The trust and reliability assessment of FTG reveals big concerns that potential traders should carefully consider. The most prominent issue is the lack of clear regulatory information, which is fundamental to establishing trust in any financial services provider. Without transparent disclosure of regulatory oversight, license numbers, and compliance frameworks, traders face uncertainty about the legal protections available to them.

According to some sources, questions have been raised about the legitimacy and credibility of FTG Markets, which adds to concerns about the overall trustworthiness of FTG entities. These questions about legitimacy, combined with the absence of clear regulatory information, create a challenging environment for establishing confidence in the organization.

The complexity of FTG's organizational structure, with multiple entities operating under similar names but potentially different regulatory frameworks, adds another layer of complexity to trust assessment. Traders need clear understanding of which entity they are dealing with and what regulatory protections apply to their specific situation.

Without information about client fund segregation, insurance coverage, or other financial protection measures, traders cannot assess the safety of their deposits. The absence of transparency regarding company financial statements, audit reports, or regulatory compliance records further complicates the trust evaluation process.

User Experience Analysis (4/10)

The user experience evaluation is based on limited available data, primarily the employee satisfaction metrics from Glassdoor, which show FTG International achieving a 3 out of 5-star rating with 50% of employees recommending the company. While these metrics provide some insight into the organizational culture, they don't directly reflect the client experience.

The absence of detailed user feedback about platform usability, account opening processes, or overall service satisfaction makes it challenging to assess the actual user experience. Modern traders expect intuitive interfaces, streamlined processes, and responsive service, but specific information about these aspects of FTG's service delivery is not available.

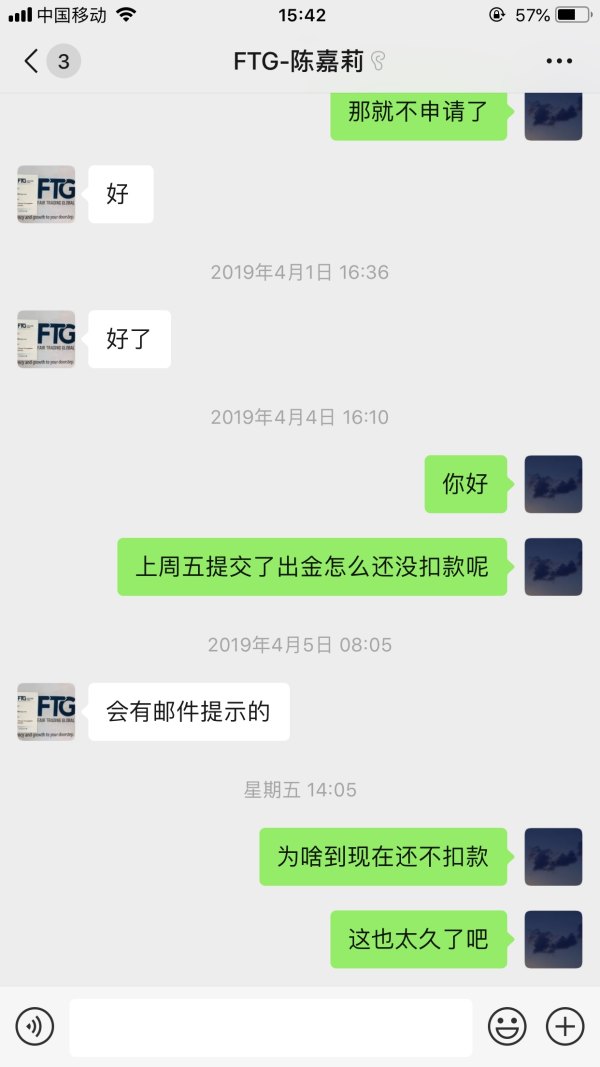

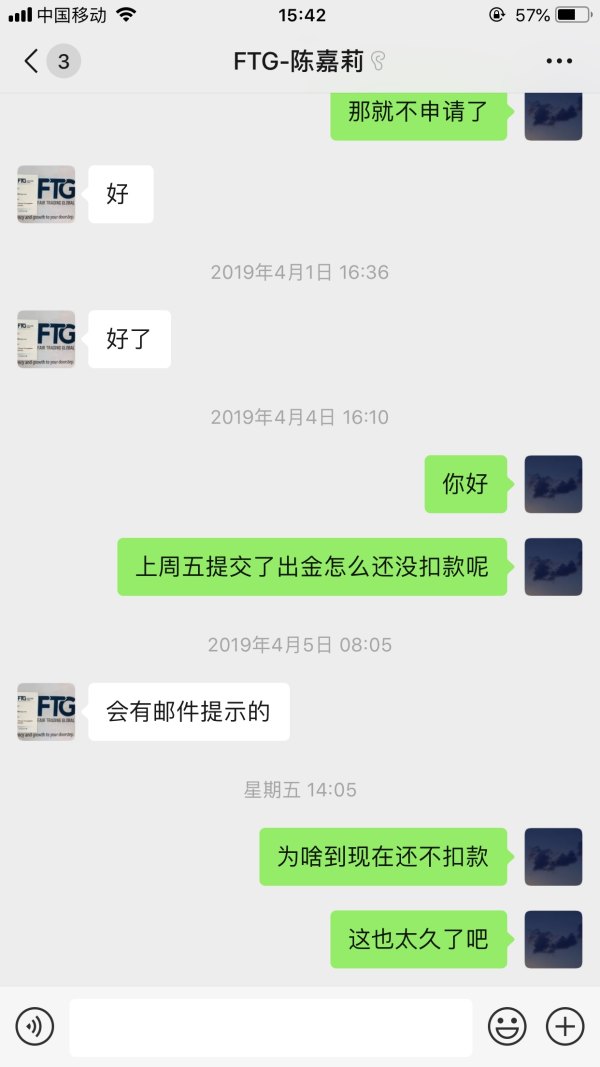

Without information about the registration and account verification process, potential clients cannot anticipate the time and documentation requirements for getting started with FTG. Similarly, the absence of details about funding processes, withdrawal procedures, and associated timeframes creates uncertainty about the practical aspects of working with the company.

The lack of user testimonials, case studies, or detailed reviews from actual traders represents a big gap in understanding the real-world experience of FTG's clients. This information deficit makes it difficult for potential traders to set appropriate expectations or understand potential challenges they might encounter.

Conclusion

This comprehensive ftg review reveals a complex organization with multiple entities operating under the FTG brand, but big information gaps that impact our ability to provide a definitive assessment. While FTG demonstrates commitment to trader education through its Knowledge Bank platform and claims to provide innovative technology and support, the lack of transparent information about regulatory compliance, trading conditions, and specific service details creates substantial uncertainty.

The organization appears most suitable for traders who prioritize educational resources and are comfortable navigating services with limited transparency about regulatory oversight and specific trading terms. However, traders seeking clearly regulated services with transparent fee structures and detailed service information may find FTG's current information disclosure insufficient for their needs.

The primary strengths identified include the focus on trader education and the claim of providing access to popular trading platforms. However, significant weaknesses include the absence of clear regulatory information, limited transparency about trading conditions and costs, and insufficient user feedback to assess service quality comprehensively.