JRJR 2025 Review: Everything You Need to Know

Summary

This comprehensive jrjr review presents a concerning picture of an offshore-regulated forex broker that has gotten significant negative feedback from users. JRJR was established in 2003 and is based in Hong Kong. The broker offers forex and CFD trading through the MetaTrader 4 platform, providing access to metals, CFDs, and currency pairs. However, according to WikiBit reports, the broker operates under offshore regulatory status with less than one year of regulated time, which raises serious questions about its legitimacy and safety.

The platform targets traders who want forex and CFDs trading opportunities. User feedback suggests potential fraudulent activities. While JRJR provides the industry-standard MT4 platform and offers online customer service through cs@jrjr.com, multiple sources indicate that users have expressed concerns about the platform's safety and legitimacy. The broker's offshore regulatory status, combined with negative user experiences and safety concerns, positions JRJR as a high-risk option for potential traders. This evaluation is based on available public information and user feedback. It highlights the importance of thorough research before engaging with this broker.

Important Notice

Regional Entity Differences: JRJR operates under offshore regulatory jurisdiction. This means different legal frameworks may apply depending on your geographical location. The broker's regulatory status varies significantly from traditional regulated entities, potentially affecting trader protections and dispute resolution mechanisms.

Review Methodology: This evaluation is based on publicly available information from multiple sources including WikiBit, user feedback, and official broker communications. Given the limited transparent information available about JRJR's operations, traders should exercise extreme caution and conduct additional independent research before making any investment decisions.

Rating Framework

Broker Overview

JRJR was established in 2003 as a Hong Kong-based financial services provider specializing in forex and derivatives trading. The company positions itself as a broker offering access to international financial markets through electronic trading platforms. According to available information, JRJR operates primarily as an online forex and CFD broker, targeting retail traders seeking exposure to currency markets and contract for difference instruments. The broker's business model centers around providing trading access to various financial instruments while operating under an offshore regulatory framework.

The platform uses MetaTrader 4 as its primary trading interface. It offers access to forex pairs, CFDs, and metals trading. JRJR's asset portfolio includes major and minor currency pairs, precious metals, and various CFD instruments. However, the broker operates under offshore regulatory supervision with less than one year of regulated time, as reported by WikiBit. This jrjr review reveals that while the company has been in operation since 2003, its current regulatory status raises questions about compliance and trader protection standards.

Regulatory Jurisdiction: JRJR operates under offshore regulatory status, though specific regulatory body details are not clearly disclosed in available materials. The broker has less than one year of regulated time according to WikiBit reports.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This requires direct contact with the broker for clarification.

Minimum Deposit Requirements: The minimum deposit amount is not specified in available documentation. This represents a transparency concern for potential clients.

Bonus and Promotions: No specific information about promotional offers or bonus programs is available in current sources.

Tradeable Assets: JRJR provides access to forex pairs, CFDs, and metals trading. It offers a moderate range of financial instruments for traders.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not clearly outlined in available materials. This requires direct inquiry with the broker.

Leverage Ratios: Specific leverage information is not disclosed in available sources. This is concerning for risk management assessment.

Platform Options: The broker exclusively uses MetaTrader 4 (MT4) as its trading platform. It provides standard charting and analysis tools.

Geographic Restrictions: Information about geographic limitations and restricted territories is not specified in available documentation.

Customer Service Languages: While customer service is available via cs@jrjr.com, specific language support details are not clearly documented.

This jrjr review highlights significant information gaps that potential traders should address before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by JRJR present significant transparency issues that concern potential traders. Available information does not clearly specify account types, minimum deposit requirements, or account tier structures. This lack of transparency makes it difficult for traders to understand what they're signing up for and compare offerings with other brokers in the market.

The absence of detailed information about account opening procedures, required documentation, or verification processes raises red flags about the broker's operational standards. Professional forex brokers typically provide comprehensive account information. This includes Islamic account options, demo account availability, and clear fee structures. JRJR's failure to provide these basic details suggests either poor communication practices or intentional opacity.

Furthermore, the lack of information about account maintenance fees, inactivity charges, or minimum balance requirements makes it impossible for traders to calculate the true cost of maintaining an account. This jrjr review emphasizes that the limited account information available represents a significant disadvantage for informed decision-making. It contributes to the low rating in this category.

JRJR's trading infrastructure centers around the MetaTrader 4 platform, which provides a solid foundation for forex and CFD trading activities. MT4 offers standard charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The platform's reliability and user-friendly interface represent positive aspects of JRJR's service offering.

The broker provides access to multiple asset classes including forex pairs, CFDs, and metals. This gives traders reasonable diversification opportunities within their trading portfolios. This asset variety allows for different trading strategies and risk management approaches, which is beneficial for traders seeking exposure to various market segments.

However, the evaluation reveals limited information about additional research resources, market analysis, educational materials, or proprietary trading tools. Modern forex brokers typically offer comprehensive market research, daily analysis, economic calendars, and educational content to support trader development. The absence of detailed information about these supplementary resources suggests that JRJR may lag behind industry standards in providing comprehensive trader support beyond basic platform access.

Customer Service and Support Analysis (Score: 4/10)

JRJR provides customer service through email communication at cs@jrjr.com. This offers a basic level of support accessibility for traders. However, the limited communication channels raise concerns about response times and support quality, particularly during urgent trading situations or technical issues.

The absence of detailed information about customer service hours, multiple language support, or alternative contact methods such as live chat or telephone support suggests limited customer service infrastructure. Professional forex brokers typically offer 24/5 support during market hours with multiple communication channels to ensure trader assistance availability.

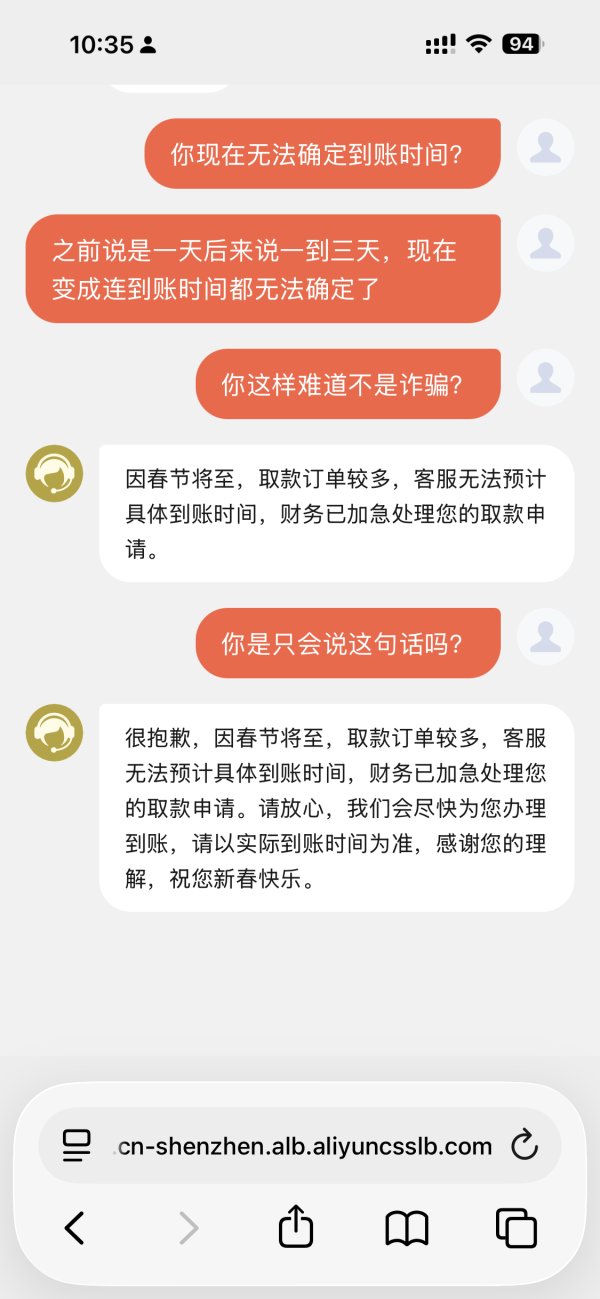

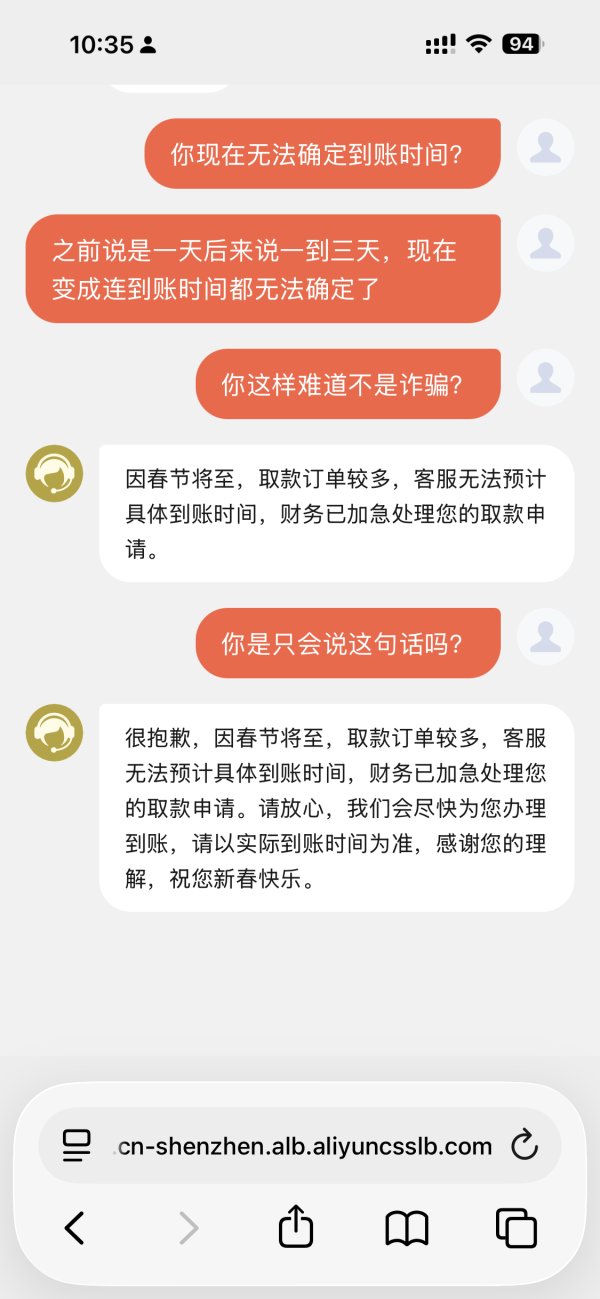

User feedback indicates negative experiences with customer service responsiveness and problem resolution. These reports suggest that while customer service exists, the quality and effectiveness may not meet trader expectations. The combination of limited contact options and negative user feedback contributes to concerns about the broker's commitment to customer satisfaction and support quality.

Trading Experience Analysis (Score: 3/10)

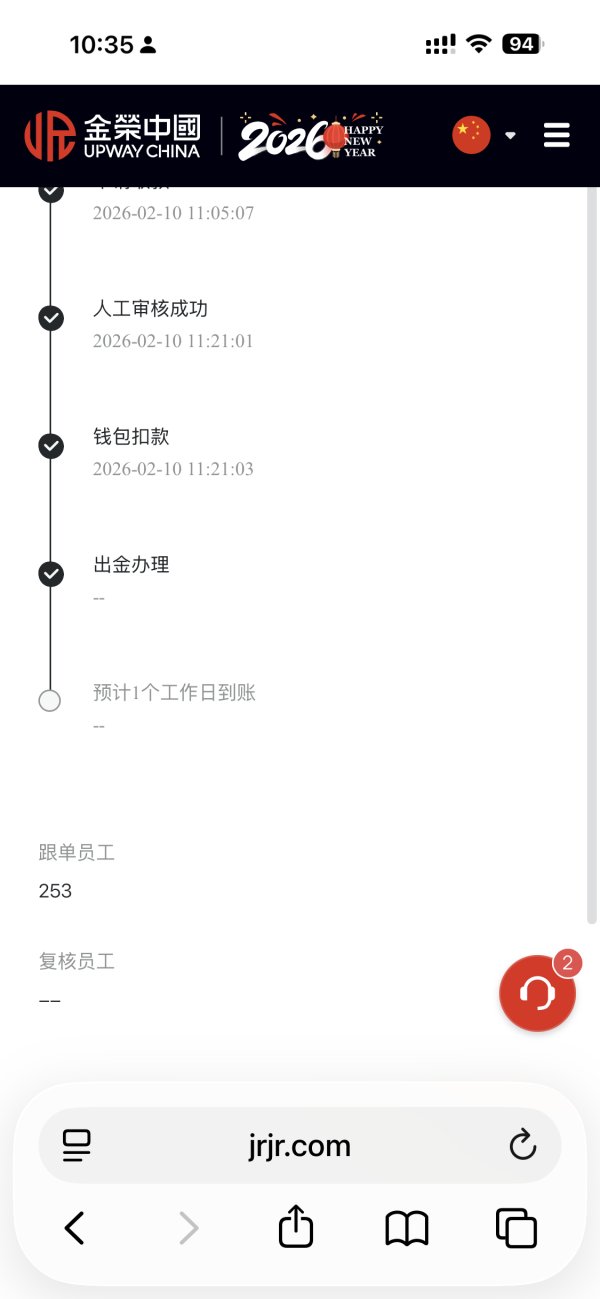

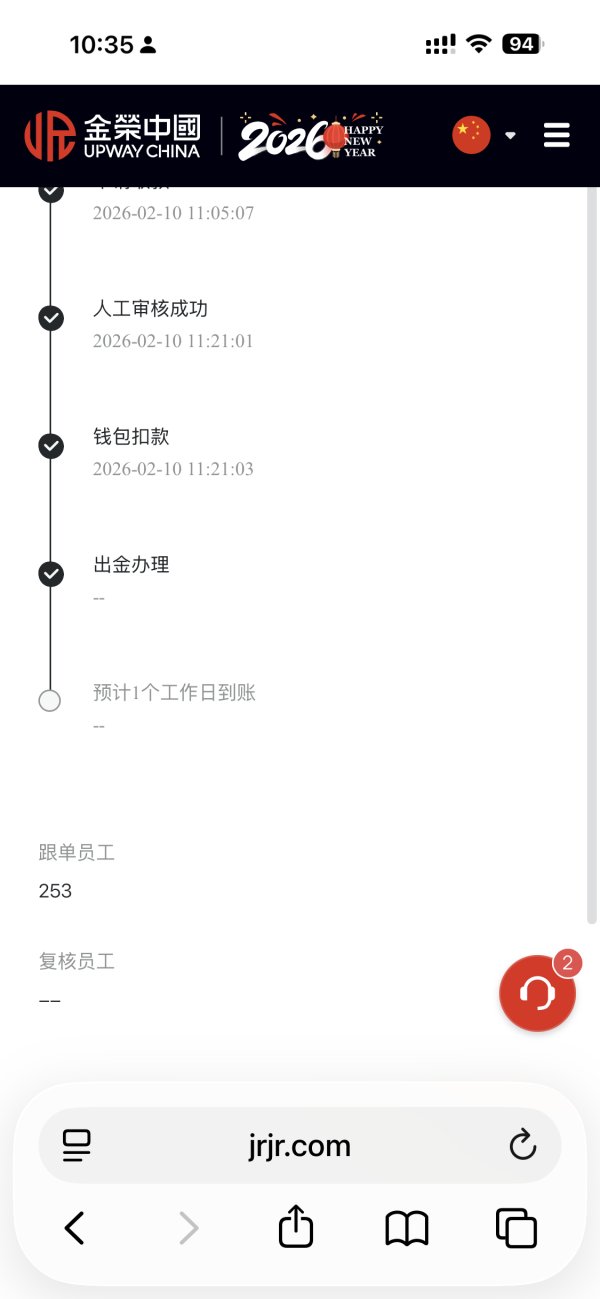

The trading experience with JRJR faces significant challenges based on available user feedback and transparency issues. Reports suggest that some users consider the platform potentially fraudulent. This severely impacts confidence in the trading environment and execution quality.

Platform stability, order execution speed, and pricing accuracy are crucial factors for successful trading experiences. However, the lack of detailed performance data, execution statistics, or transparency about trading conditions makes it difficult to assess the actual trading environment quality. Professional brokers typically provide detailed information about average execution speeds, slippage statistics, and re-quote frequencies.

The negative user feedback regarding potential fraudulent activities represents the most serious concern for trading experience quality. Such reports suggest problems with fund security, withdrawal processing, or trading execution integrity. This jrjr review emphasizes that these concerns significantly impact the overall trading experience rating and should be carefully considered by potential traders.

Trust and Safety Analysis (Score: 2/10)

JRJR's trust and safety profile presents serious concerns for potential traders. The broker operates under offshore regulatory status with less than one year of regulated time, according to WikiBit reports. This regulatory situation provides limited trader protections compared to brokers regulated by major financial authorities.

Offshore regulation typically offers fewer safeguards for client funds, limited dispute resolution mechanisms, and reduced oversight of business practices. The combination of offshore status and minimal regulation time suggests that JRJR has not established a proven track record under regulatory supervision.

User feedback indicating potential fraudulent activities represents the most significant trust concern. When traders express safety concerns and question a broker's legitimacy, it reflects serious operational or ethical issues. The absence of clear information about client fund segregation, deposit protection schemes, or transparent business practices further compounds these trust concerns.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with JRJR appears significantly compromised based on available feedback and transparency issues. User reports suggesting potential fraudulent activities indicate serious problems with the overall service experience and platform reliability.

The lack of clear information about user interface design, platform ease of use, and account management processes makes it difficult to assess the practical user experience. Professional brokers typically provide detailed platform tours, user guides, and transparent processes for account management and fund operations.

Common user complaints appear centered around safety concerns and platform legitimacy questions. These fundamental issues override other user experience factors such as platform design or feature availability. When users question a broker's basic legitimacy, it indicates severe problems with the overall service experience that cannot be compensated by technical features or platform capabilities.

Conclusion

This comprehensive jrjr review reveals significant concerns about the broker's safety, transparency, and regulatory status. While JRJR offers access to MetaTrader 4 and multiple trading instruments, the offshore regulatory status with minimal regulation time, combined with negative user feedback suggesting potential fraudulent activities, creates substantial risks for potential traders.

The broker may appeal to traders seeking forex and CFD trading opportunities. However, the safety concerns and transparency issues make it unsuitable for most retail traders. The main advantages include MT4 platform access and multi-asset trading capabilities, while the significant disadvantages encompass regulatory concerns, negative user feedback, and limited transparency about trading conditions and costs. Potential traders should exercise extreme caution and consider regulated alternatives with established safety records.