Phoenix FX 2025 Review: Everything You Need to Know

Summary

This comprehensive phoenix fx review examines a forex broker that shows a mixed profile in the competitive trading world. Phoenix FX demonstrates both appealing entry-level features and concerning operational issues based on user feedback and Trustpilot evaluations. The broker's most notable features include an extremely low minimum deposit requirement of just $10 and aggressive leverage offerings up to 1:500. These features make it particularly attractive to new traders and those seeking high-leverage opportunities.

However, these attractive entry conditions face significant concerns about service quality and reliability. User reviews consistently highlight issues with customer service response times, trading execution problems including slippage and requoting, and questions about overall transparency. The broker's Trustpilot rating of 2 out of 5 reflects widespread user dissatisfaction across multiple service areas.

Phoenix FX primarily targets low-capital investors and high-leverage trading enthusiasts who prioritize accessibility over premium service quality. While the platform offers MetaTrader 5 and access to diverse asset classes including forex, indices, stocks, cryptocurrencies, and precious metals, the overall user experience suggests significant room for improvement. The broker needs to enhance operational excellence and customer satisfaction.

Important Notice

Regional Entity Differences: Available information does not specify detailed regulatory oversight. This may raise questions about legal compliance and operational legitimacy across different jurisdictions. Potential traders should exercise heightened due diligence given the absence of clear regulatory information in available documentation.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, market reports, and publicly available information. Due to limited detailed operational data, some assessments rely heavily on user experiences and third-party evaluations rather than direct platform testing.

Rating Framework

Broker Overview

Phoenix FX operates in the retail forex market segment. Specific founding details and comprehensive company background information are not detailed in available documentation. The broker appears to focus on providing accessible trading opportunities for retail investors, particularly those with limited initial capital or those seeking high-leverage trading environments.

The company's business model centers around offering competitive entry conditions while providing access to popular trading platforms and diverse asset classes. Phoenix FX uses the widely-recognized MetaTrader 5 platform as its primary trading interface. The platform supports multiple asset categories including foreign exchange pairs, stock indices, individual equities, cryptocurrency instruments, and precious metals trading.

According to available information, the broker offers three distinct account types designed to accommodate different trading preferences and capital levels. However, detailed regulatory oversight information remains unclear in current documentation. This represents a significant consideration for potential clients evaluating the broker's legitimacy and operational security. This phoenix fx review emphasizes the importance of understanding these limitations when considering the broker for trading activities.

The platform's emphasis on low barriers to entry, combined with aggressive leverage offerings, suggests a business strategy focused on attracting high-volume, smaller-account traders. The broker does not target institutional or high-net-worth clients seeking premium service levels and comprehensive support structures.

Regulatory Coverage: Available documentation does not specify particular regulatory authorities overseeing Phoenix FX operations. This may present compliance and security concerns for potential traders seeking regulated broker relationships.

Deposit and Withdrawal Methods: Specific funding and withdrawal mechanisms are not detailed in current available information. Traders require direct broker contact for clarification.

Minimum Deposit Requirements: Phoenix FX offers an exceptionally accessible $10 minimum deposit threshold. This makes it one of the lowest entry requirements in the retail forex market.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available documentation.

Available Trading Assets: The platform provides access to multiple asset classes including foreign exchange currency pairs, stock market indices, individual company stocks, cryptocurrency instruments, and precious metals trading opportunities.

Cost Structure: The broker advertises minimum spreads starting from 0 pips. However, specific commission structures and additional fee information requires further clarification.

Leverage Ratios: Maximum leverage reaches 1:500. This provides significant amplification opportunities for qualified traders while carrying corresponding risk considerations.

Platform Options: Primary trading interface utilizes MetaTrader 5. The platform offers standard charting, analysis, and order execution capabilities.

Geographic Restrictions: Specific regional availability limitations are not detailed in current documentation.

Customer Support Languages: Available language support options are not specified in accessible information. This phoenix fx review notes these information gaps as areas requiring direct broker clarification.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

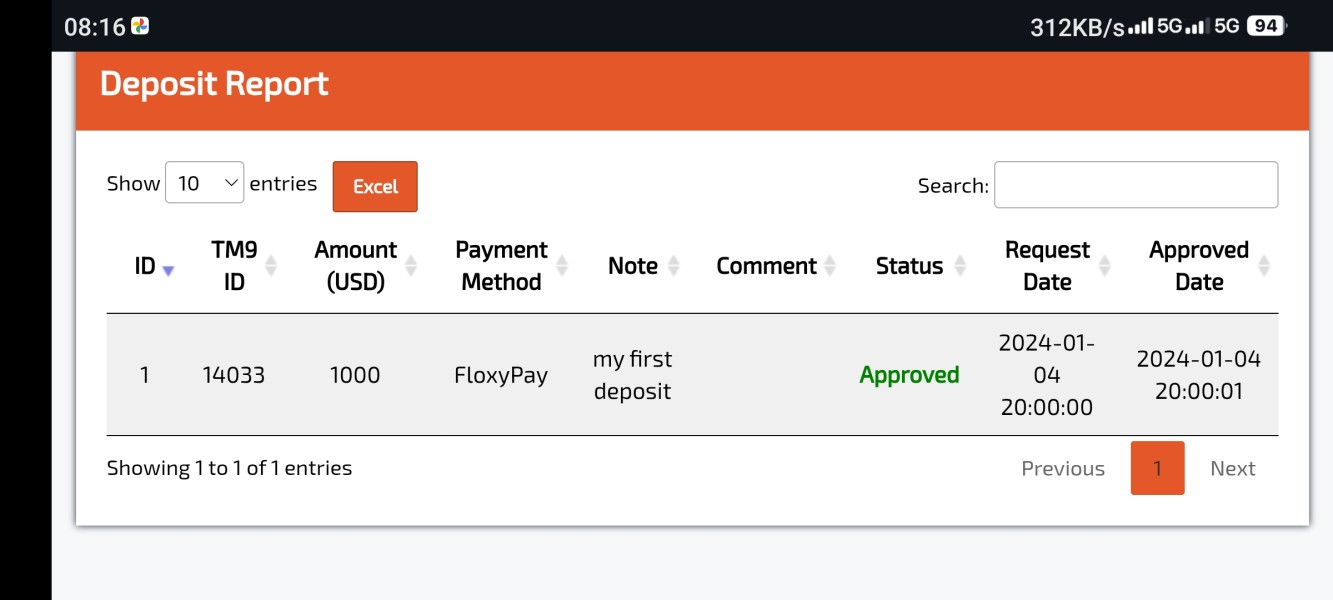

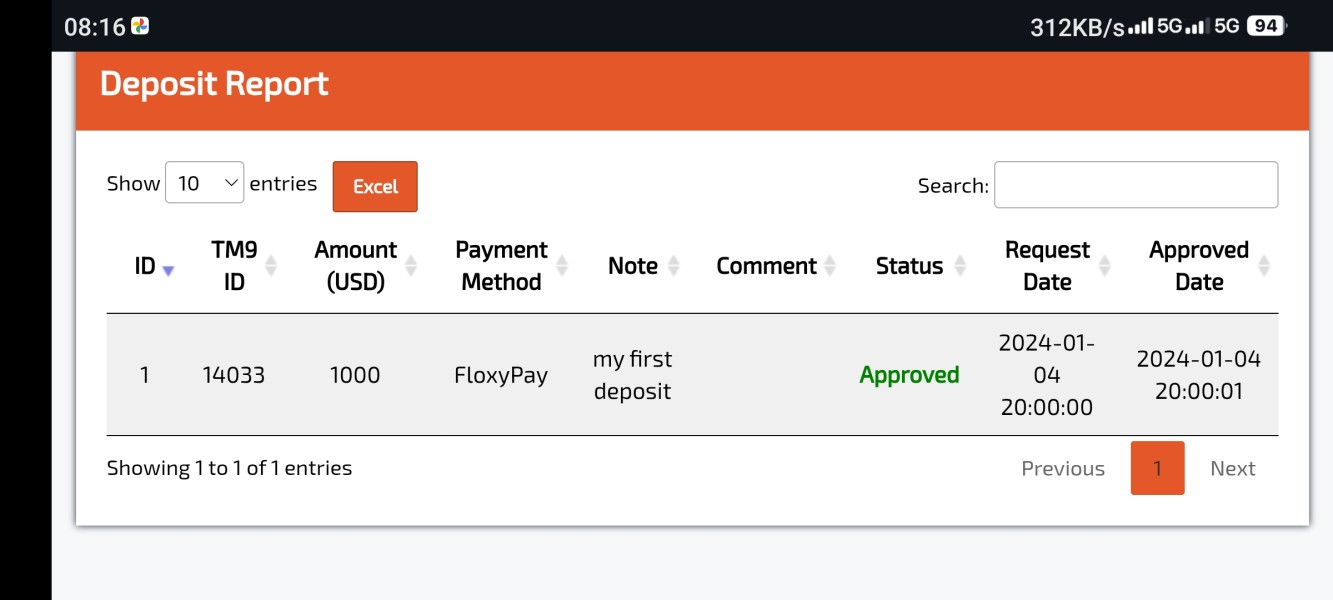

Phoenix FX demonstrates strong performance in account accessibility through its three-tier account structure designed to accommodate diverse trader profiles. The standout feature remains the exceptionally low $10 minimum deposit requirement. This effectively removes traditional barriers preventing new traders from entering forex markets. This approach contrasts sharply with industry competitors requiring hundreds or thousands of dollars for account activation.

The 1:500 maximum leverage offering provides substantial trading amplification opportunities, particularly appealing to traders seeking to maximize position sizes relative to available capital. However, this high leverage also amplifies potential losses. Users require careful risk management. Account opening procedures, while not detailed in available documentation, appear streamlined based on user feedback suggesting relatively quick activation processes.

User testimonials consistently acknowledge the accessibility benefits of low minimum deposits. Many express appreciation for the opportunity to begin trading with minimal initial investment. However, some experienced traders note that such low barriers sometimes correlate with reduced service quality expectations. Compared to premium brokers requiring substantial deposits, Phoenix FX clearly targets the entry-level market segment. This positioning comes with corresponding service level implications that potential users should carefully consider.

The account structure appears designed for volume rather than premium service delivery. This aligns with the overall business model but may not satisfy traders seeking comprehensive support and advanced features. This phoenix fx review emphasizes evaluating personal service expectations against the broker's evident market positioning.

The MetaTrader 5 platform serves as Phoenix FX's primary technological offering. It provides traders with industry-standard charting capabilities, technical analysis tools, and order execution functionality. MT5's established reputation offers familiarity for experienced traders while providing sufficient functionality for newcomers developing their trading skills. The platform supports multiple asset classes, enabling portfolio diversification within a single interface.

However, user feedback consistently indicates limited availability of comprehensive market analysis and research resources beyond basic platform functionality. Educational materials appear minimal. This potentially disadvantages newer traders who would benefit from structured learning resources and market insights. Advanced analytical tools and proprietary research appear absent from the service offering. These limitations reduce the platform's appeal to traders seeking deeper market intelligence.

Automated trading support through MT5's Expert Advisor functionality provides some advanced capabilities for users comfortable with algorithmic trading strategies. However, the absence of detailed educational support for these features may limit their practical utility for less experienced users. Users generally describe the tool set as adequate for basic trading needs. They note it lacks the depth and sophistication available through more comprehensive broker offerings.

Market commentary and analysis resources appear particularly limited based on user reports. Traders note the need to seek external sources for market insights and trading ideas. This limitation may particularly impact traders who rely on broker-provided research for trading decisions and market understanding.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents a significant weakness in Phoenix FX's operational profile. User feedback consistently highlights inadequate response times and limited problem-resolution capabilities. Multiple user reports indicate extended waiting periods for support responses, particularly during market hours when timely assistance becomes crucial for trading decisions and technical issues.

Service quality concerns extend beyond response timing to include the effectiveness of support interactions. Users frequently report receiving generic responses that fail to address specific concerns or technical problems. The absence of detailed customer service channel information in available documentation suggests limited support infrastructure. This potentially explains the reported service deficiencies.

Problem resolution capabilities appear particularly limited. Users describe frustrating experiences attempting to resolve account issues, technical problems, or trading disputes. Several user testimonials describe situations where initial support contacts failed to generate satisfactory outcomes. These situations required multiple follow-up attempts to achieve resolution. This pattern suggests systemic service delivery challenges rather than isolated incidents.

Multilingual support availability remains unclear based on available documentation. This potentially limits accessibility for non-English speaking users. The absence of clear support hour information and communication channel details further complicates user expectations and service planning. These service limitations significantly impact the overall user experience and represent a primary concern for traders considering Phoenix FX for their trading activities.

Trading Experience Analysis (Score: 5/10)

Trading execution quality presents mixed results based on user feedback and performance reports. While the MetaTrader 5 platform provides stable basic functionality, users consistently report issues with slippage and requoting during market volatility periods. These execution problems can significantly impact trading profitability, particularly for scalping strategies or news-based trading approaches requiring precise entry and exit timing.

Platform stability generally receives moderate user ratings. Most traders report acceptable performance during normal market conditions. However, several users note occasional connectivity issues and platform freezing during high-impact news events or market opening periods. These stability concerns, while not universal, occur frequently enough to impact overall trading confidence and strategy execution.

Order execution speed appears adequate for most trading styles. Users engaged in high-frequency or scalping strategies report occasional delays that impact strategy effectiveness. The absence of detailed execution statistics or performance guarantees makes it difficult to establish clear expectations for order processing times and fill quality.

Spread stability receives mixed user feedback. Some traders report competitive pricing during quiet market periods while others note spread widening during volatile conditions. The advertised zero minimum spreads appear achievable under optimal conditions. Real-world trading conditions may produce higher effective costs. Mobile trading experience details are not comprehensively covered in available documentation, representing a gap in understanding complete platform accessibility. This phoenix fx review emphasizes the importance of testing execution quality through demo accounts before committing significant capital.

Trust and Reliability Analysis (Score: 3/10)

Trust and reliability represent Phoenix FX's most significant challenges. These issues primarily stem from the absence of clear regulatory oversight information in available documentation. The lack of specific regulatory authority details raises fundamental questions about operational legitimacy and client protection measures. These are particularly important considerations for traders prioritizing security and regulatory compliance.

Fund security measures are not detailed in accessible information. This creates uncertainty about client capital protection and segregation practices. This information gap becomes particularly concerning given the importance of understanding how client funds are handled and protected in the event of operational difficulties or business closure scenarios.

Corporate transparency appears limited. Users express concerns about the company's background, operational history, and management structure. The absence of detailed company information in public documentation contributes to overall trust concerns. This may indicate limited commitment to operational transparency that many traders expect from legitimate broker relationships.

The Trustpilot rating of 2 out of 5 reflects widespread user dissatisfaction and trust concerns across multiple operational areas. Third-party review platforms consistently show negative user experiences. Many reviews question the broker's legitimacy and operational practices. These external validation sources provide important context for evaluating overall reliability and user satisfaction levels.

Industry reputation appears limited. The broker has minimal positive recognition from established forex industry publications or rating organizations. The absence of industry awards, certifications, or positive professional reviews further compounds trust concerns. This suggests limited standing within the established forex broker community.

User Experience Analysis (Score: 4/10)

Overall user satisfaction levels remain below industry standards based on comprehensive feedback analysis and third-party rating platforms. The Trustpilot score of 2 out of 5 reflects systematic user dissatisfaction across multiple operational areas. This indicates widespread service delivery challenges that impact the complete user experience.

Interface design and usability receive mixed feedback. Some users appreciate the familiar MetaTrader 5 environment while others note limited customization options and outdated design elements. The platform's learning curve appears manageable for users with previous MT5 experience. Newcomers may require additional time to achieve proficiency with available features and functionality.

Registration and account verification processes are not comprehensively detailed in available documentation. User feedback suggests relatively straightforward procedures. However, some users report confusion during initial setup phases. This potentially indicates inadequate guidance or support during onboarding processes.

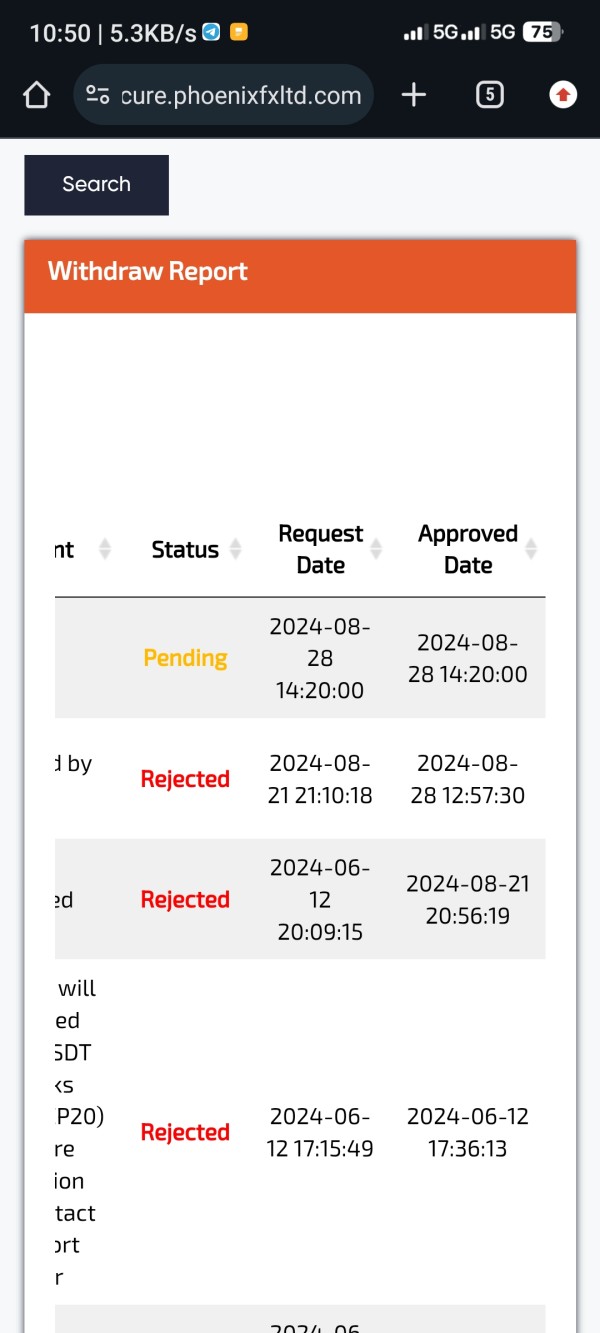

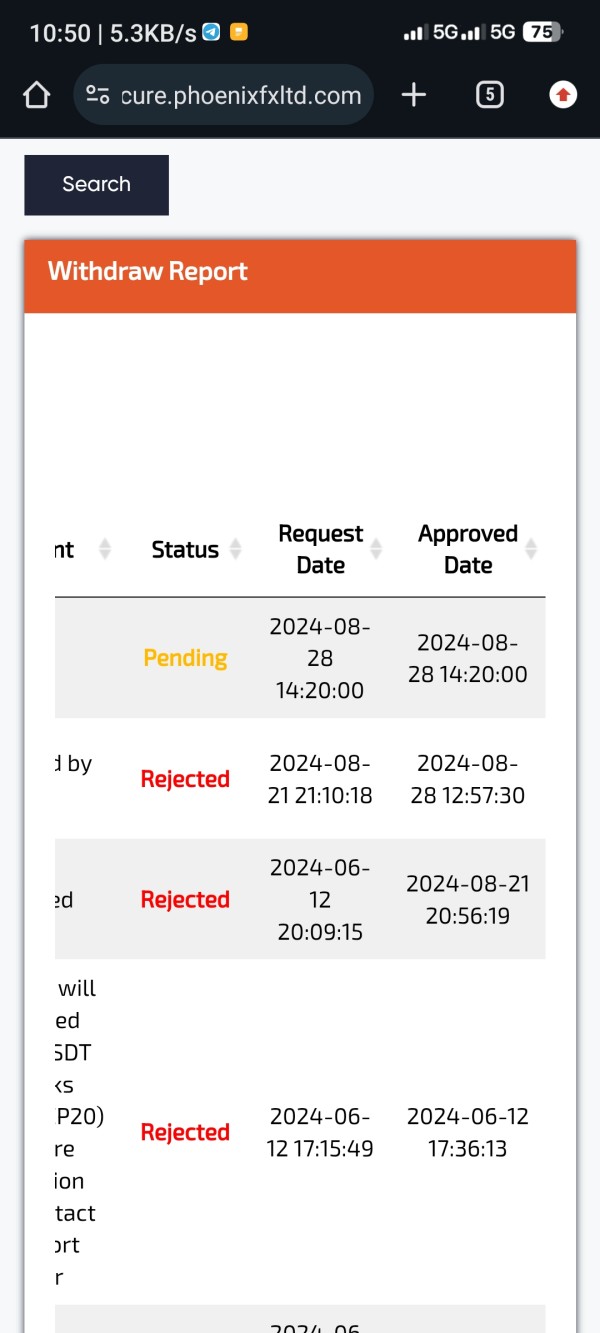

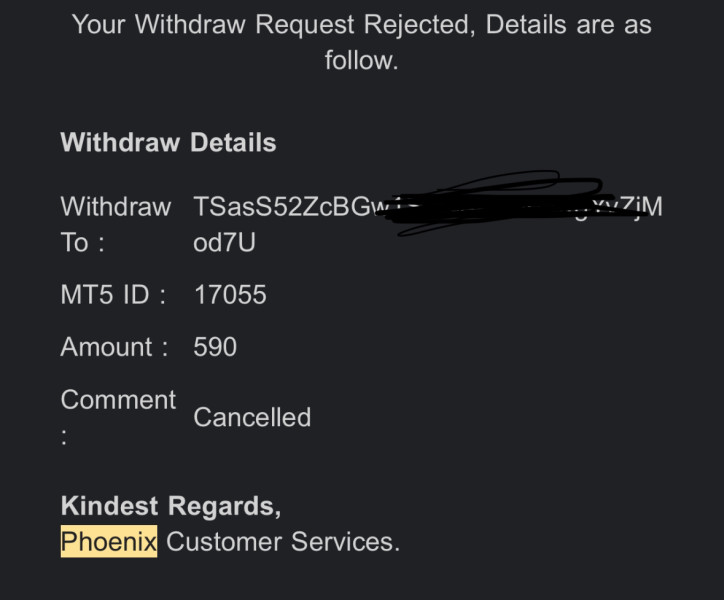

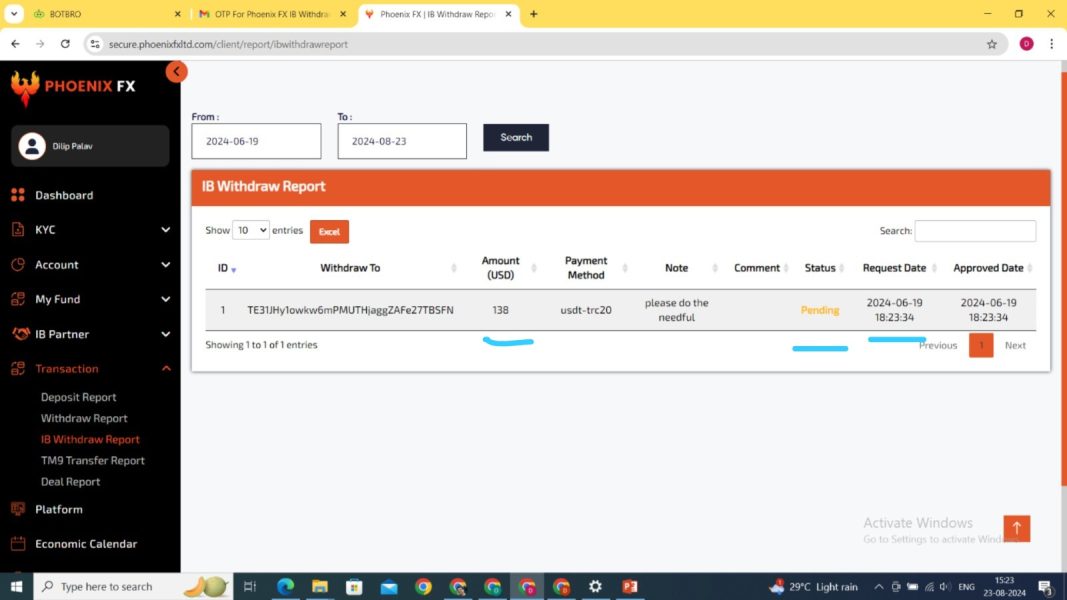

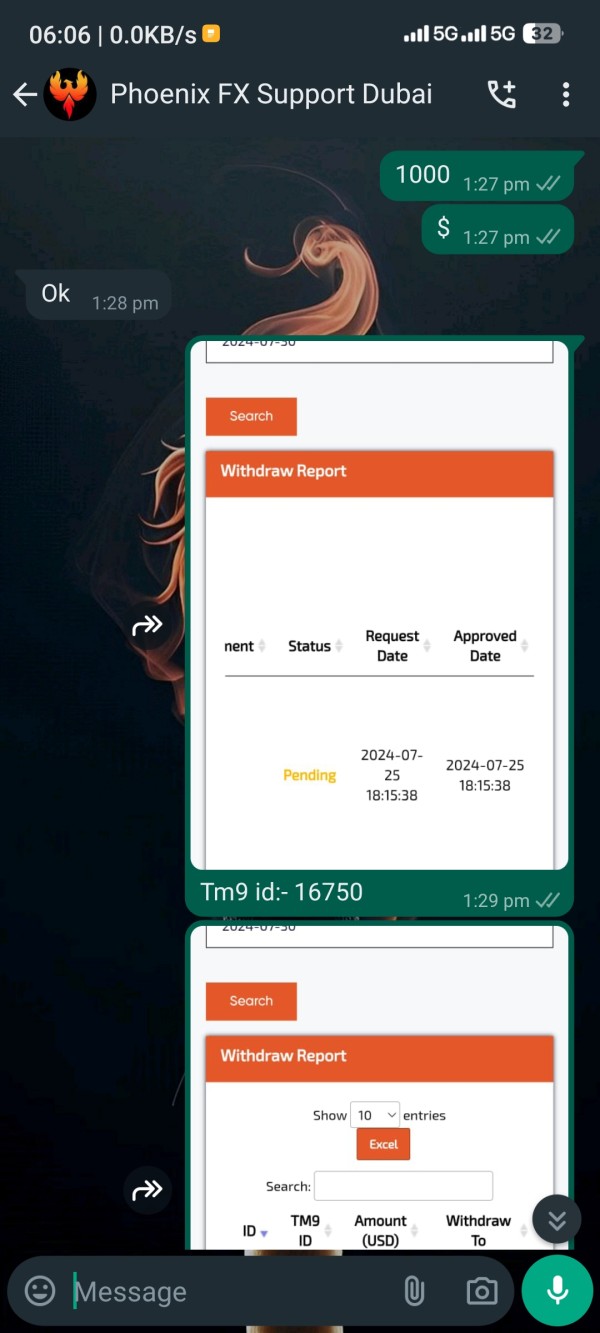

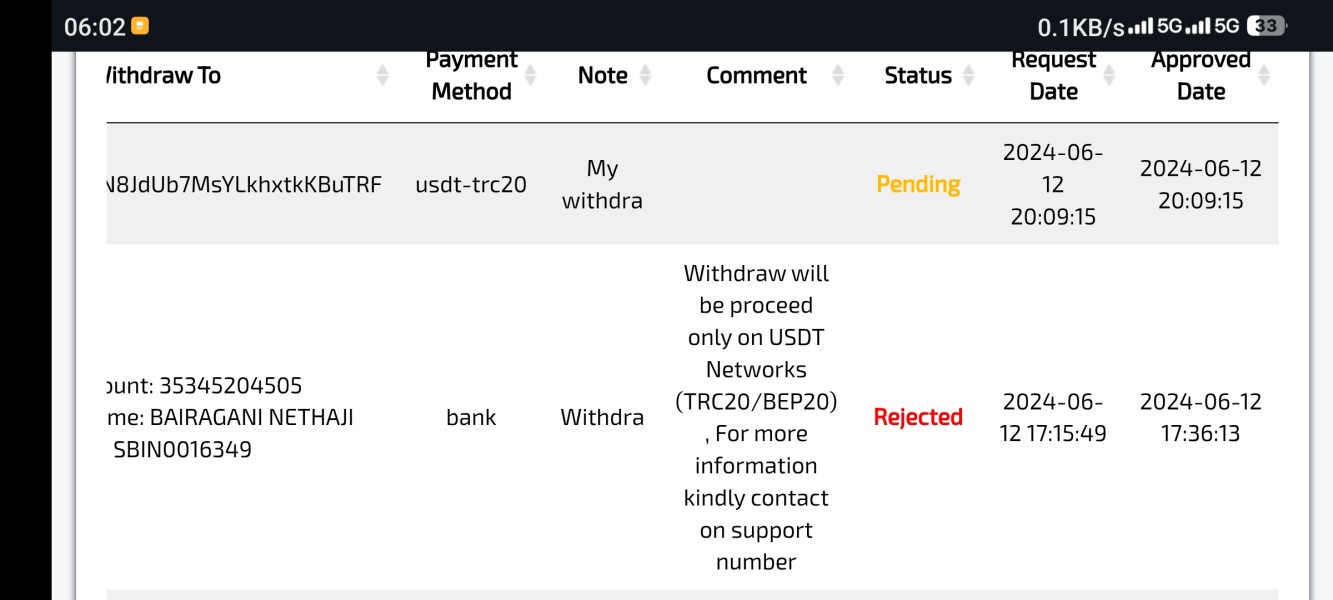

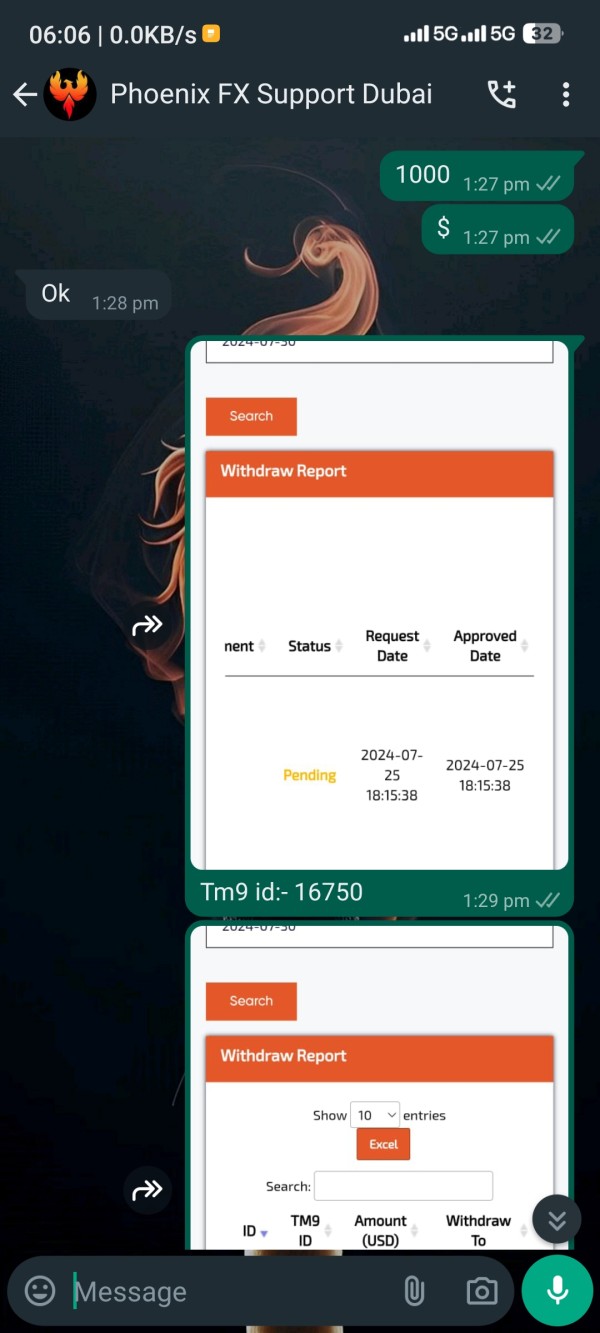

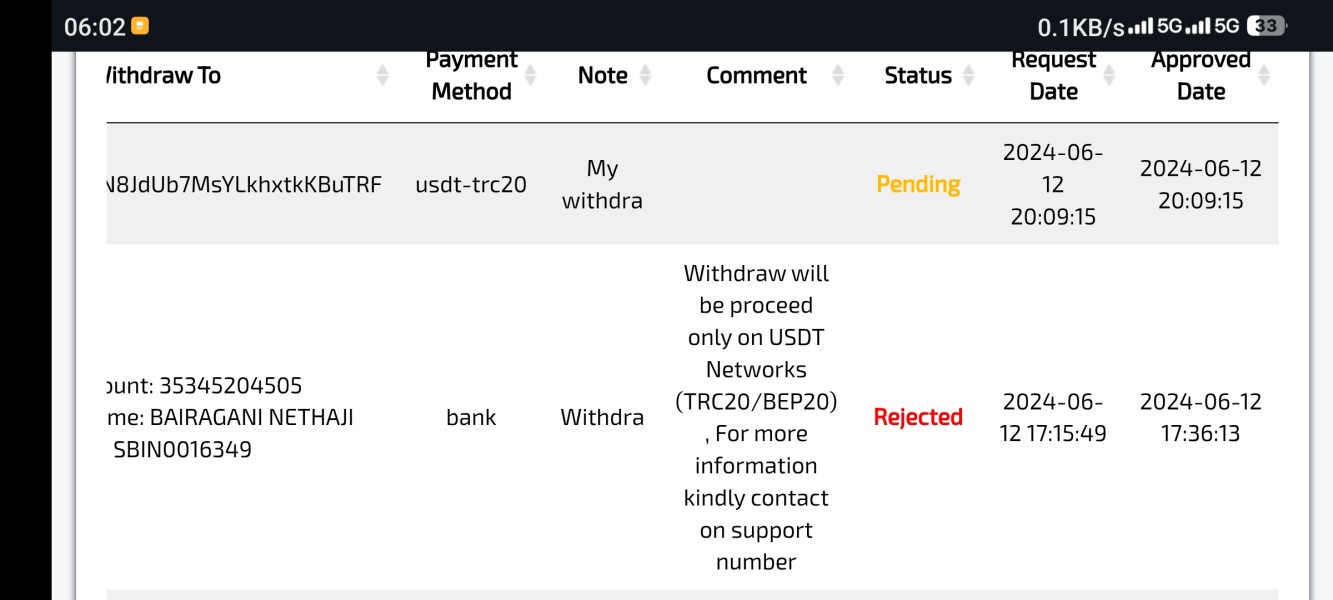

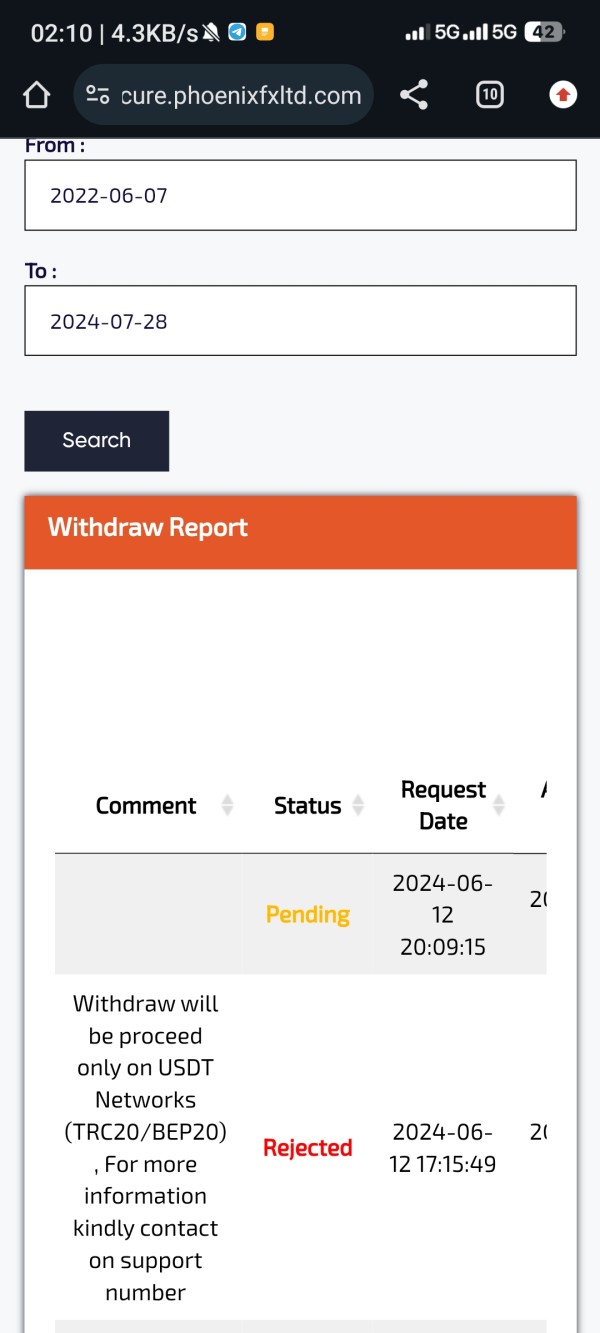

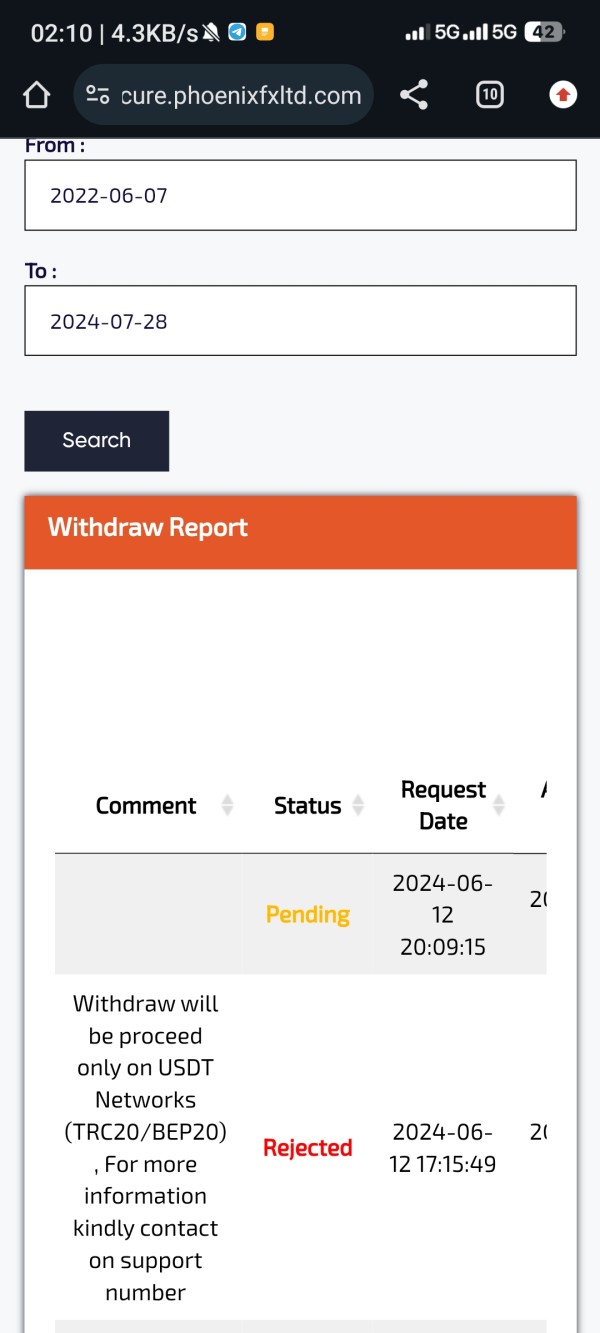

Funding and withdrawal experiences generate significant user complaints. Multiple reports describe slow processing times and complicated procedures for accessing account funds. These operational difficulties create substantial frustration for users requiring timely access to their capital. They represent a major barrier to positive user experiences.

Common user complaints center on customer service quality, trading execution problems, and concerns about overall transparency and legitimacy. The consistency of these concerns across multiple review platforms suggests systematic operational challenges rather than isolated incidents. User recommendations typically advise caution when considering Phoenix FX. Many suggest alternative brokers offering superior service levels and operational reliability.

The typical user profile appears to include budget-conscious beginners attracted by low minimum deposits. Retention rates appear limited based on negative feedback patterns. Experienced traders generally express dissatisfaction with service quality and operational limitations. This suggests the broker may struggle to satisfy users with higher service expectations and trading sophistication.

Conclusion

This phoenix fx review reveals a broker with attractive entry conditions undermined by significant operational and service quality challenges. While Phoenix FX succeeds in providing accessible trading opportunities through low minimum deposits and high leverage options, these advantages are substantially offset by poor customer service, execution problems, and concerning transparency limitations.

The broker appears most suitable for budget-conscious beginners seeking high-leverage trading opportunities who prioritize low entry barriers over comprehensive service quality. However, even this target demographic should carefully consider the documented service limitations and trust concerns before committing capital to the platform.

Primary advantages include exceptionally low minimum deposit requirements and competitive leverage offerings that remove traditional barriers to forex market participation. However, significant disadvantages encompass poor customer service quality, execution reliability issues, limited educational resources, and concerning absence of clear regulatory oversight information. These limitations substantially impact the overall value proposition. They suggest exploring alternative broker options may provide superior trading experiences and operational security.