Allmarkets Pro 2025 Review: Everything You Need to Know

Executive Summary

This allmarkets pro review shows concerning findings about this trading platform. Potential investors must understand these issues before considering any engagement with this broker. Our comprehensive analysis of available information and user feedback reveals that Allmarkets Pro presents significant red flags. These warning signs warrant serious caution from anyone considering this platform.

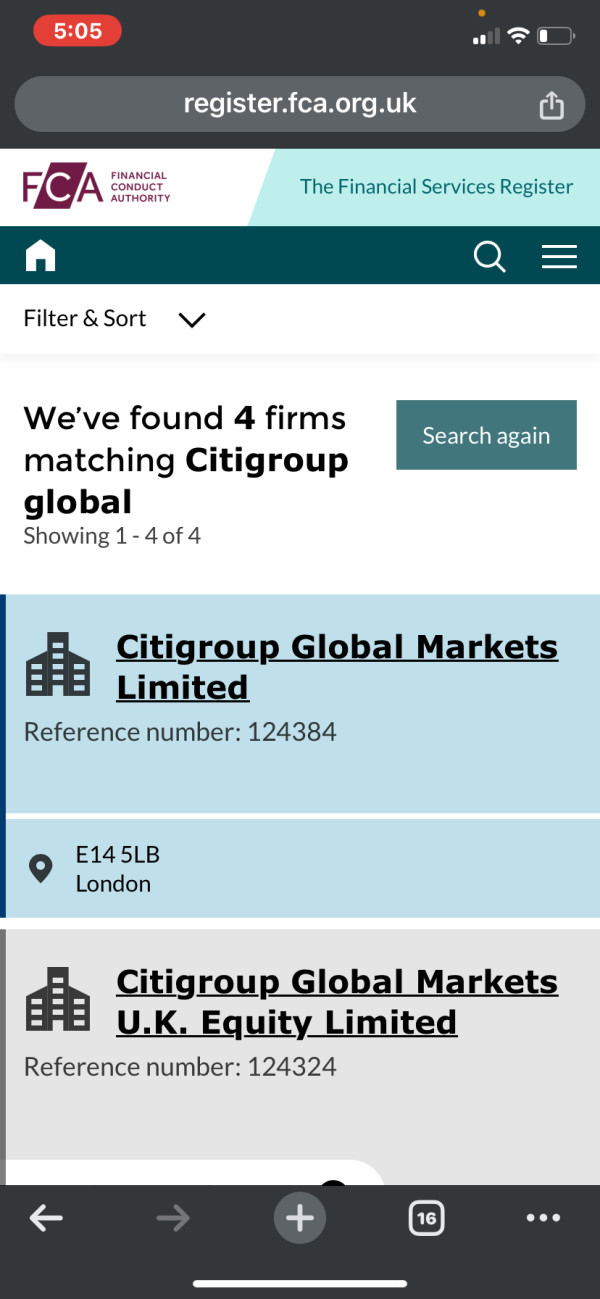

Our investigation shows that Allmarkets Pro operates without regulatory oversight from any major financial authority. This includes the Financial Conduct Authority and other recognized regulatory bodies that typically oversee legitimate trading platforms. Multiple sources have flagged this platform as a potential scam. Users consistently report negative experiences and questionable business practices that raise serious concerns.

The platform lacks transparency in its trading conditions. There is no clear information about spreads, commissions, minimum deposits, or other essential trading parameters that legitimate brokers typically disclose to their clients. User reviews consistently paint a negative picture of this broker. These reviews highlight major concerns about fund safety and withdrawal difficulties that traders have experienced.

This broker appears to target investors with higher risk tolerance. However, even for such traders, the risks associated with Allmarkets Pro far outweigh any potential benefits that might be offered. The absence of regulatory protection means traders have no recourse if issues arise with their funds or trading activities. This creates an extremely dangerous environment for any type of investment activity.

Given these findings, we strongly advise potential investors to consider regulated alternatives. These alternatives offer proper oversight, transparent trading conditions, and established track records in the financial services industry.

Important Notice

Investors should be aware that Allmarkets Pro operates as an unregulated entity across all regions. This means there are no jurisdictional variations in regulatory oversight because none exists anywhere. This universal lack of regulation creates consistent risks regardless of where traders are located geographically.

This review is compiled based on publicly available information and user feedback from various sources. Due to the platform's limited transparency, some trading details remain unclear or unverified. Multiple independent sources have flagged Allmarkets Pro with scam warnings. We recommend investors exercise extreme caution when considering this platform for any trading activities.

Rating Framework

Broker Overview

Allmarkets Pro presents itself as a trading platform. However, specific details about its establishment date and company background remain unclear in available documentation. The platform's lack of transparency regarding its corporate structure and operational history raises immediate concerns. Potential investors seeking reliable trading partners should be aware of these transparency issues.

The company's business model appears to focus on online trading services. However, specific information about their operational approach, fee structure, and service delivery methods is notably absent from public sources. This opacity is particularly concerning given industry standards. These standards typically require clear disclosure of business practices to protect consumer interests.

Our allmarkets pro review reveals that the platform operates without oversight from established regulatory bodies. These include the FCA, CYSEC, and other major financial authorities that provide essential consumer protections. This unregulated status means traders lack the protections typically associated with licensed financial service providers. These protections include compensation schemes and regulatory dispute resolution mechanisms that safeguard investor interests.

Available information suggests the platform may offer various financial instruments. However, specific asset classes and trading conditions remain undisclosed to potential clients. The absence of clear information about trading platforms, technology infrastructure, and execution methods further compounds concerns. These concerns relate to the platform's legitimacy and operational capabilities in the competitive trading market.

Regulatory Status: Allmarkets Pro operates without regulation from any recognized financial authority. This unregulated status eliminates standard investor protections and oversight mechanisms. Legitimate brokers typically provide these essential safeguards to protect client interests and ensure fair trading practices.

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available sources. This creates uncertainty about how traders can manage their account finances effectively. Professional trading platforms typically provide clear information about all available funding options and processing times.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available documentation. This makes it difficult for potential traders to understand entry requirements for different account types. Legitimate brokers typically provide transparent information about minimum deposits and account tier requirements.

Promotional Offers: Details about bonuses, promotions, or special offers are not mentioned in available sources. However, unregulated brokers often use unrealistic promotional terms to attract clients without proper disclosure. These offers frequently contain hidden terms and conditions that disadvantage traders.

Tradeable Assets: Specific information about available trading instruments, asset classes, and market access is not clearly outlined. Available documentation fails to provide essential details about what traders can actually trade on this platform. Professional brokers typically offer comprehensive asset lists with detailed specifications for each instrument.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents informed decision-making about trading expenses and total cost of ownership. Transparent fee structures are essential for traders to evaluate platform competitiveness and plan their trading strategies effectively.

Leverage Options: Information about maximum leverage ratios and margin requirements is not specified in available sources. These details are crucial for risk management and trading strategy development. Professional platforms typically provide clear leverage information with appropriate risk warnings.

Platform Options: Details about trading platforms, mobile applications, and technological infrastructure are not clearly documented. This allmarkets pro review finds insufficient information about the actual trading technology offered to clients. Modern brokers typically provide comprehensive platform information including features, compatibility, and performance specifications.

Geographic Restrictions: Specific information about service availability in different regions is not detailed in available sources. This creates uncertainty about legal compliance and service accessibility for international traders. Legitimate brokers typically provide clear information about geographic restrictions and regulatory compliance requirements.

Customer Support Languages: Available support languages and communication options are not specified in accessible documentation. This lack of information makes it difficult for international clients to understand support availability. Professional brokers typically offer comprehensive language support with clearly defined service levels.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Allmarkets Pro receive the lowest possible rating. This is due to a complete lack of transparency and concerning operational practices that fail to meet industry standards. Available sources provide no specific information about account types, their features, or the requirements for different service levels.

The absence of clear minimum deposit information makes it impossible for potential traders to understand entry requirements. Traders also cannot plan their investment approach effectively without this basic information. Legitimate brokers typically offer detailed breakdowns of account tiers, associated benefits, and qualification criteria. None of these standard features are evident with Allmarkets Pro.

Account opening procedures remain undocumented across all available sources. This creates uncertainty about verification requirements, documentation needs, and approval timelines for new clients. This lack of clarity is particularly concerning given standard industry practices. These practices emphasize transparency in onboarding processes to protect both brokers and clients.

User feedback consistently indicates poor experiences with account management and conditions. The combination of unclear terms, unregulated status, and negative user reports creates an environment where traders cannot make informed decisions. Traders cannot understand their rights and obligations when engaging with this platform.

This allmarkets pro review finds that the platform's approach to account conditions fails to meet basic industry standards. The platform lacks transparency, clarity, and customer protection measures that are essential for legitimate trading operations.

Allmarkets Pro's trading tools and resources receive the minimum rating. This is due to insufficient information and apparent lack of comprehensive trading support that modern traders require. Available sources provide no details about analytical tools, research resources, or educational materials. These resources would typically support trader decision-making and strategy development.

The platform appears to lack the research and analysis infrastructure that legitimate brokers provide. This includes market commentary, economic calendars, technical analysis tools, and fundamental research reports that are essential for informed trading decisions. These resources are standard offerings in the regulated broker space and are expected by professional traders.

Educational resources, which are crucial for trader development and risk management, are not documented in available sources. Legitimate brokers typically offer webinars, tutorials, market education, and trading guides to support client success. These educational materials also help brokers meet regulatory compliance requirements for client education.

Automated trading support, algorithmic trading capabilities, and advanced order types remain unspecified across all documentation. Modern trading platforms typically provide sophisticated tools for strategy implementation and risk management. None of these advanced features are clearly documented for Allmarkets Pro.

User feedback suggests inadequate tool availability and poor resource quality. The combination of limited transparency about available tools and negative user experiences indicates serious deficiencies. The platform fails to provide the comprehensive trading environment that serious traders require for successful market participation.

Customer Service and Support Analysis (Score: 1/10)

Customer service quality represents one of the most critical areas of concern for Allmarkets Pro. The platform earns the lowest possible rating based on available evidence and consistently negative user feedback. The platform's support infrastructure appears inadequate for addressing trader needs and concerns effectively.

Available documentation provides no clear information about customer service channels, availability hours, or response time commitments. Legitimate brokers typically offer multiple contact methods including phone, email, live chat, and sometimes video support. These brokers also provide clearly defined service level agreements that set client expectations appropriately.

Response time performance and service quality metrics are not available from any reliable sources. However, user feedback suggests significant issues with support responsiveness and problem resolution effectiveness across multiple areas. Traders report difficulties in obtaining assistance when needed, particularly regarding account and withdrawal issues that require urgent attention.

Multi-language support capabilities remain unspecified throughout all available documentation. This potentially limits access for international traders who require assistance in their native languages for complex trading matters. Professional brokers typically provide comprehensive language support to serve diverse client bases effectively and meet international service standards.

User feedback consistently highlights negative customer service experiences across multiple platforms and review sites. Reports include unresponsive support teams and inadequate problem resolution that leaves clients without proper assistance. The combination of poor user reports and lack of transparent service commitments creates significant concerns about the platform's ability to provide adequate customer support.

Trading Experience Analysis (Score: 1/10)

The trading experience offered by Allmarkets Pro receives the lowest rating. This is due to concerning user feedback and lack of transparent operational information that traders need to evaluate platform quality. Platform stability and execution quality are fundamental to successful trading, yet available sources provide no performance metrics or reliability data.

Order execution quality remains undocumented across all available sources and platform materials. There is no information about execution speeds, slippage rates, or fill quality statistics that professional traders require to evaluate platform performance. Legitimate brokers typically provide detailed execution statistics and performance transparency to demonstrate their operational excellence.

Platform functionality and feature completeness cannot be properly assessed due to limited available information. Modern trading platforms should offer comprehensive charting, analysis tools, order management systems, and risk management features. None of these essential features are clearly documented for Allmarkets Pro in any accessible materials.

Mobile trading experience details are not available in accessible sources or platform documentation. However, mobile functionality has become essential for modern traders who require flexible access to markets and account management capabilities. Professional platforms typically provide comprehensive mobile solutions with full feature parity to desktop versions.

User feedback regarding trading experience is predominantly negative across multiple review platforms. Reports suggest poor platform performance and execution issues that interfere with normal trading activities. This allmarkets pro review finds that the combination of limited transparency about trading infrastructure and negative user experiences creates significant concerns about the platform's ability to provide professional-grade trading services.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents the most critical concern with Allmarkets Pro. The platform earns the minimum possible rating due to its unregulated status and multiple red flags identified during our comprehensive analysis. The platform operates without oversight from any recognized financial regulatory authority, eliminating standard investor protections that legitimate brokers provide.

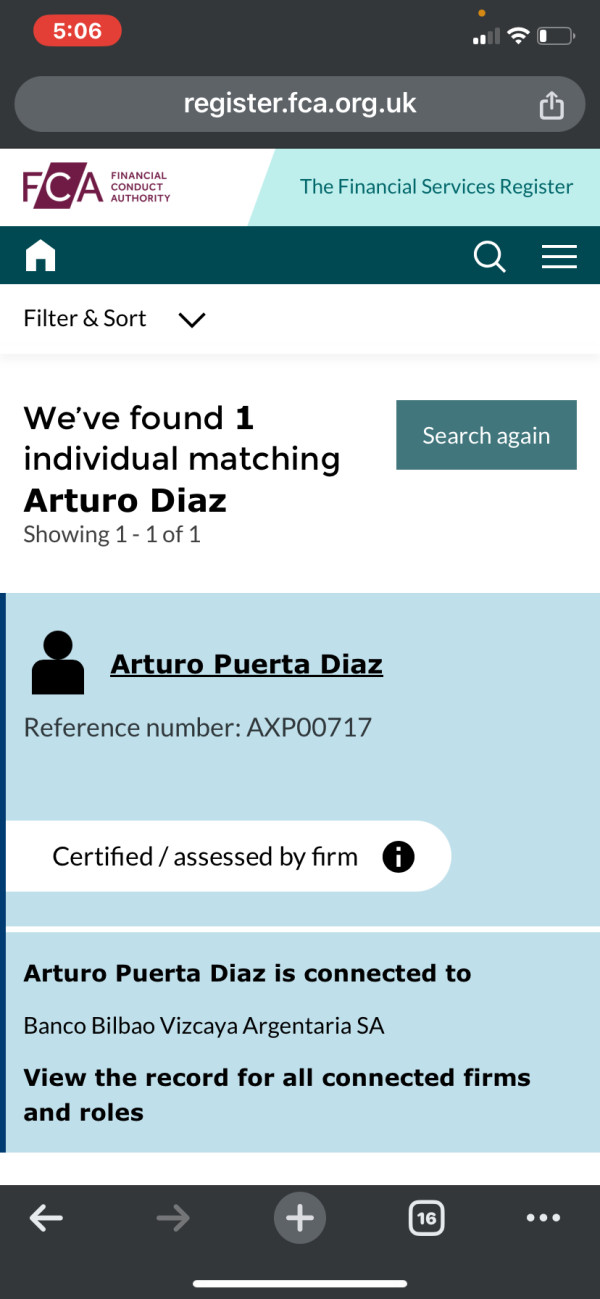

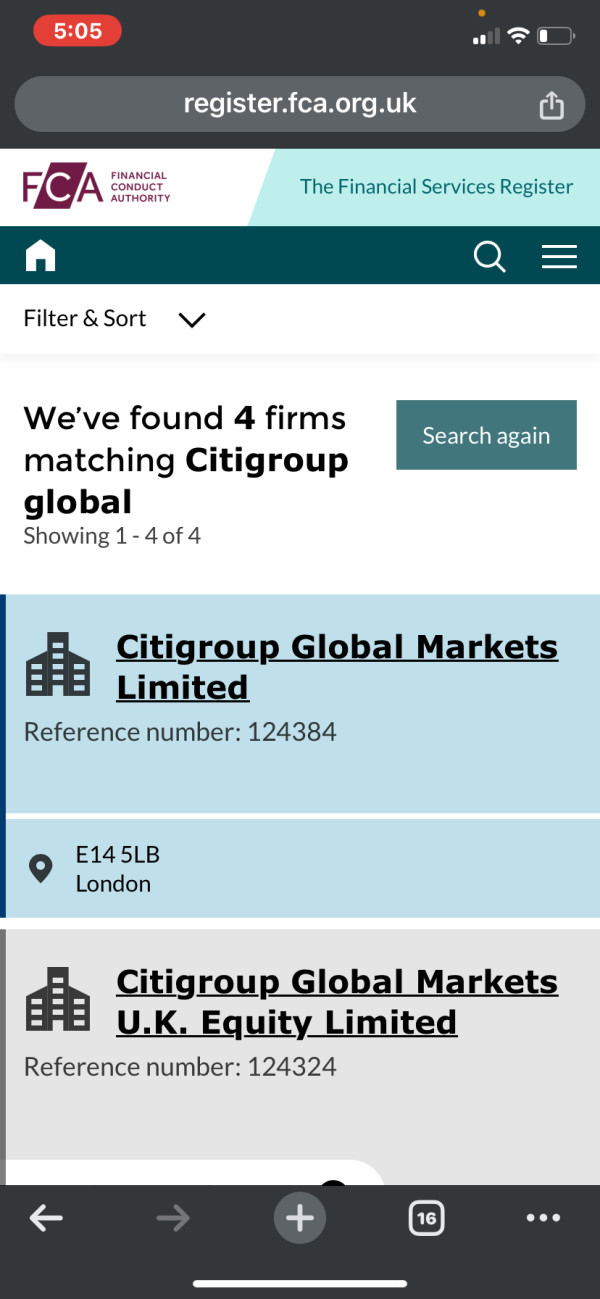

Regulatory verification confirms that Allmarkets Pro lacks authorization from major financial regulators. These include the FCA, CYSEC, ASIC, and other established oversight bodies that provide essential consumer protections. This unregulated status means traders have no recourse through regulatory channels if disputes or issues arise with their accounts or funds.

Fund safety measures and client money protection protocols are not documented anywhere in available materials. This creates significant risks for trader deposits and account balances that cannot be adequately protected. Regulated brokers typically maintain segregated client accounts and participate in compensation schemes that protect trader funds. These critical protections are absent with unregulated entities like Allmarkets Pro.

Multiple independent sources have flagged Allmarkets Pro with scam warnings across various review platforms and regulatory watch services. These warnings indicate widespread concern about the platform's legitimacy and operational practices from industry experts. These warnings from established review platforms and regulatory watch services represent serious red flags for potential investors.

Company transparency regarding ownership, management, and operational practices remains extremely limited across all available sources. Legitimate financial service providers typically maintain clear corporate disclosure and regulatory filing requirements. These requirements provide transparency about their operations and management structure that protects consumer interests.

User Experience Analysis (Score: 1/10)

User experience with Allmarkets Pro receives the lowest possible rating. This is based on consistently negative feedback and concerning operational practices reported across multiple platforms. Overall user satisfaction appears extremely poor, with multiple reports of problematic experiences across various aspects of the platform.

Interface design and usability information is not available in accessible sources or platform materials. However, user feedback suggests significant issues with platform functionality and user-friendly operation that interfere with normal trading activities. Modern trading platforms should provide intuitive interfaces that support efficient trading and account management for users of all experience levels.

Registration and verification processes remain undocumented throughout all available platform information. This creates uncertainty about onboarding requirements and approval procedures for new clients. Users report difficulties with account setup and verification processes, suggesting inadequate systems and support infrastructure that fails to meet industry standards.

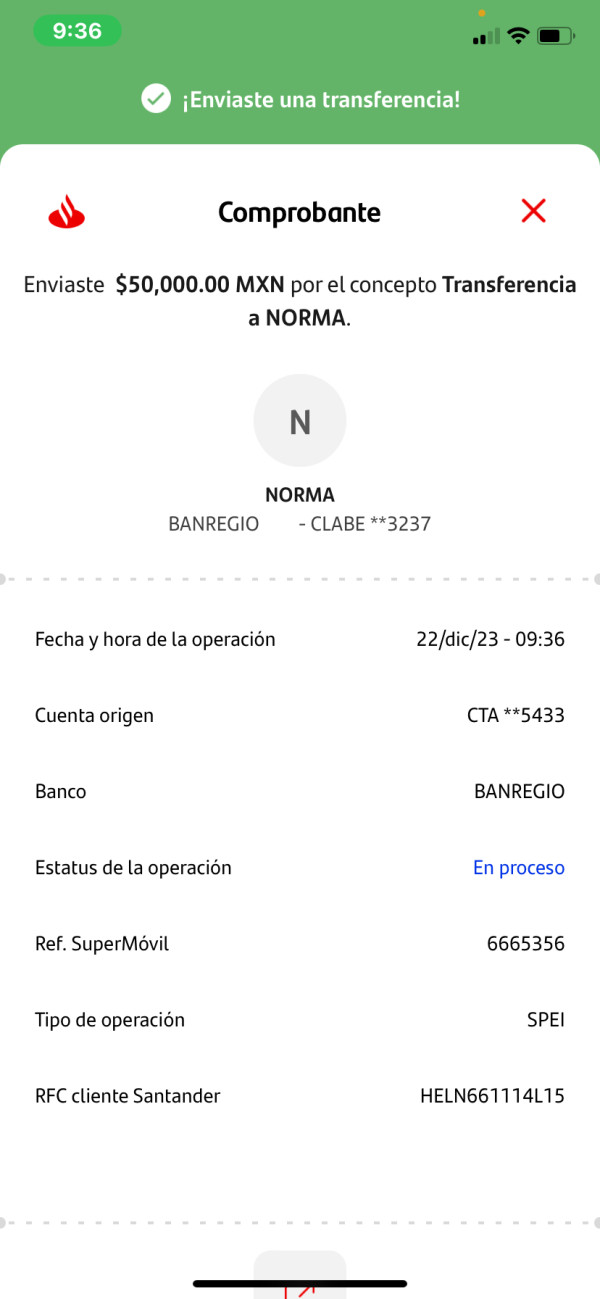

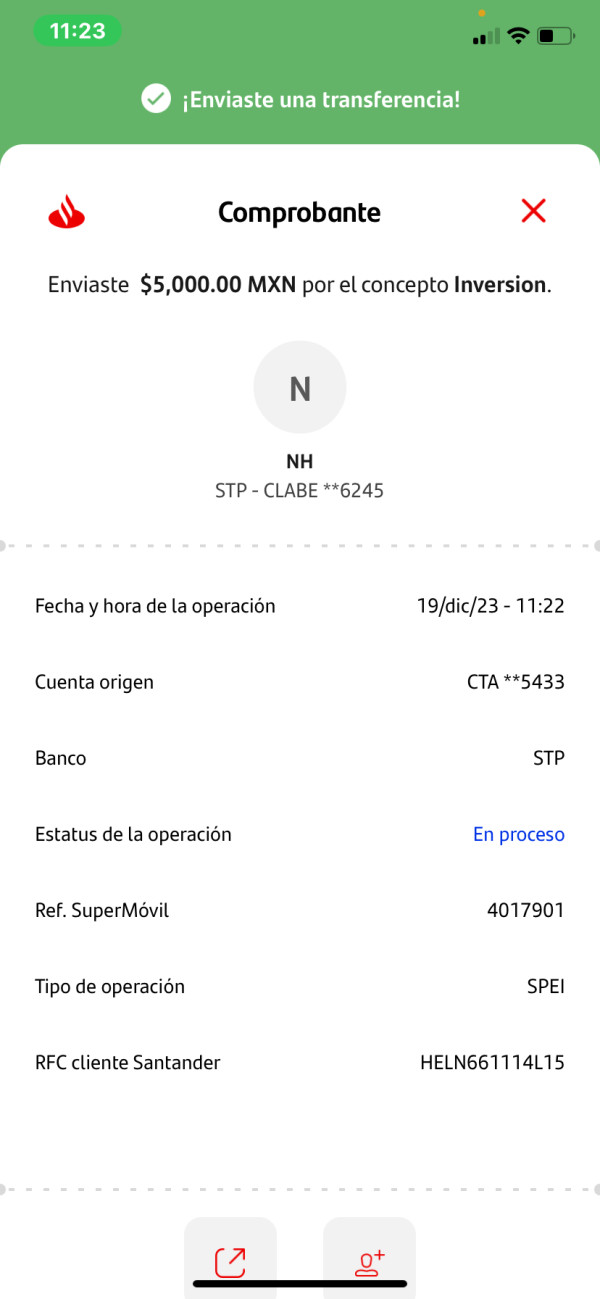

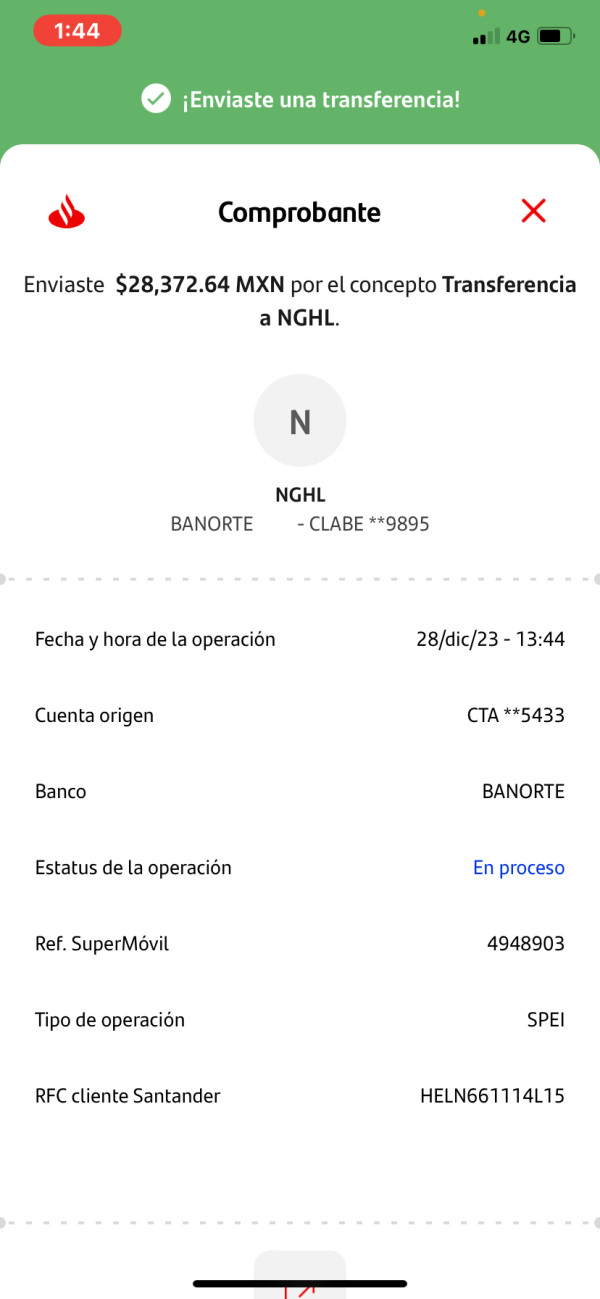

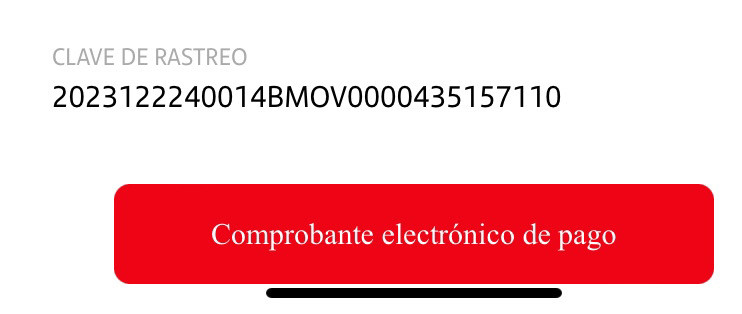

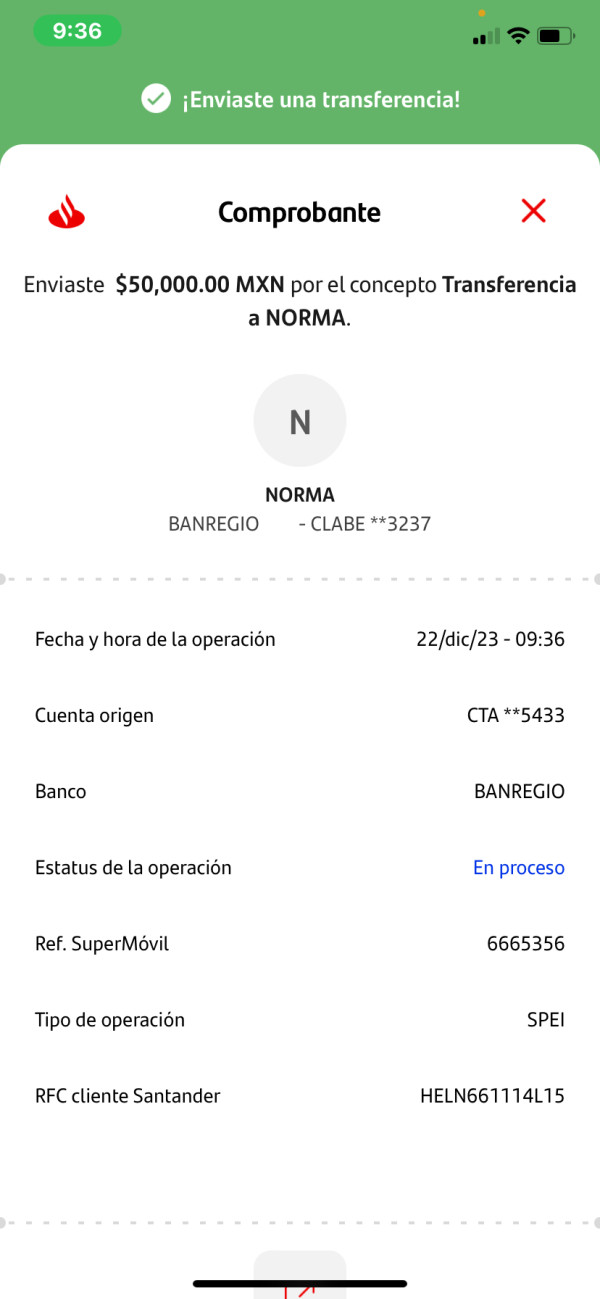

Fund management experiences appear particularly problematic based on consistent user reports across multiple review platforms. User reports indicate difficulties with deposits and especially withdrawals that create serious concerns about fund safety. These issues represent serious concerns about the platform's handling of client funds and operational integrity.

User feedback consistently highlights concerns about potential fraudulent activities and scam behavior across multiple independent sources. The combination of withdrawal difficulties, poor customer service, and unregulated status creates an environment where users face significant risks. Users lack adequate protection or recourse mechanisms when problems arise with their accounts or trading activities.

The target user demographic for this platform would theoretically be high-risk tolerance investors seeking alternative trading opportunities. However, even for such traders, the risks associated with Allmarkets Pro appear to outweigh any potential benefits significantly.

Conclusion

This comprehensive allmarkets pro review reveals significant concerns that make this platform unsuitable for serious traders and investors. The combination of unregulated status, lack of transparency, and consistently negative user feedback creates an environment with excessive risk. Traders face minimal protection and numerous operational concerns that cannot be adequately addressed.

Allmarkets Pro fails to meet basic industry standards across all evaluated dimensions. The platform earns the lowest possible ratings in every category we analyzed during this comprehensive review. The platform's unregulated status eliminates essential investor protections, while the absence of transparent trading conditions and documented operational practices raises serious questions. These questions relate to the platform's legitimacy and ability to provide professional trading services.

While this platform might theoretically appeal to traders with extremely high risk tolerance, the identified red flags and scam warnings suggest different conclusions. Even risk-seeking investors should avoid this platform entirely based on the evidence we have gathered. The lack of regulatory oversight, combined with negative user experiences and transparency issues, creates an unacceptable risk profile. This risk profile makes the platform unsuitable for any serious trading activity.

Potential investors are strongly advised to consider regulated alternatives that offer proper oversight and transparent trading conditions. These alternatives provide documented fee structures and established track records in the financial services industry. The forex and CFD trading space offers numerous legitimate, regulated brokers that provide professional trading environments with appropriate investor protections.