Lioppa 2025 Review: Everything You Need to Know

Executive Summary

This lioppa review gives you a complete look at Lioppa Global Markets Ltd. This forex broker has gotten a lot of attention in the trading world, but for worrying reasons. Lioppa started in 2023 and says it's a multi-asset algorithmic trading platform that offers forex, commodities, and digital currency trading services. The broker advertises competitive features like spreads starting from 0.0 pips and leverage up to 1:500, which look good to traders who want low-cost trading.

But our research shows serious red flags that potential clients need to think about. TraderKnows and other industry sources say Lioppa Global Markets Ltd might be running fraudulent activities and works without proper regulatory oversight. The company claims to be based in the UK but lacks verification from recognized financial regulatory authorities, which raises big concerns about client fund safety and whether the business is legitimate. Even though the broker offers trading conditions that seem attractive to high-risk traders, especially those who want low spreads and high leverage, the lack of regulatory protection and growing fraud allegations make this broker extremely risky for potential investors.

Important Disclaimers

Regional Entity Differences: Lioppa does not give clear information about specific regulatory frameworks across different jurisdictions. This may expose international traders to additional risks and legal uncertainties. The lack of transparent regulatory disclosure means traders in various regions may face different levels of protection or, more likely, no protection at all.

Review Methodology: This evaluation uses publicly available information, industry reports from sources like TraderKnows, Forex-fun, and Liberty-reviews, plus user feedback from various trading community platforms. Since Lioppa itself provides limited official documentation, this analysis relies heavily on third-party assessments and fraud warnings from industry watchdogs.

Rating Framework

Broker Overview

Lioppa Global Markets Ltd entered the forex market in 2023. The company positions itself as a modern multi-asset algorithmic trading platform. According to available company information, the firm claims to be headquartered in the United Kingdom and focuses on providing financial trading services across forex, commodities, and digital currencies. The company says it caters to traders who want advanced algorithmic trading solutions with competitive pricing structures.

The broker's business model targets cost-conscious traders by offering zero-spread starting conditions and high leverage ratios up to 1:500. However, the company's operational transparency remains questionable since detailed information about its trading platform technology, execution model, or market maker/STP classification is not readily available. This lioppa review found that while the company promotes itself as offering cutting-edge trading solutions, the lack of verifiable operational details and the absence of regulatory backing create significant concerns about the legitimacy of these claims and the safety of client investments.

Regulatory Status: Available information does not specify any recognized financial regulatory authority overseeing Lioppa's operations. This absence of regulatory oversight represents a critical risk factor for potential clients since it means no official body monitors the broker's financial practices or ensures client fund protection.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources. This lack of transparency regarding funding mechanisms raises additional concerns about operational legitimacy.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Lioppa is not specified in available documentation. This makes it difficult for potential clients to assess accessibility and plan their investment approach.

Bonuses and Promotions: No information is available regarding promotional offers, welcome bonuses, or ongoing trading incentives. This suggests either the absence of such programs or poor marketing transparency.

Tradable Assets: According to available information, Lioppa offers trading in forex pairs, commodities, and digital currencies. However, the specific range of instruments, number of currency pairs, or types of commodities available remains unspecified.

Cost Structure: The broker advertises starting spreads from 0.0 pips with commission-free trading, which appears competitive. However, the sustainability and consistency of these pricing claims cannot be verified without regulatory oversight.

Leverage Ratios: Maximum leverage is advertised at 1:500, which is relatively high and may appeal to experienced traders seeking amplified market exposure. This also increases risk significantly though.

Platform Options: Specific trading platform information is not detailed in this lioppa review based on available sources. This leaves potential clients without clarity about software options or technological capabilities.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions offered by Lioppa present a mixed picture that requires careful consideration. On the positive side, the advertised starting spreads of 0.0 pips represent competitive pricing that could appeal to cost-conscious traders, particularly those engaging in high-frequency or scalping strategies. The commission-free structure, if genuine, would further enhance the cost-effectiveness of trading operations.

However, significant information gaps undermine confidence in these account conditions. The absence of clear minimum deposit requirements makes it impossible for potential clients to properly assess account accessibility or plan their investment approach. Furthermore, no information is available about different account tiers, special features, or account-specific benefits that typically differentiate professional brokers from less established operators.

The lack of details regarding account opening procedures, verification requirements, or documentation needed raises additional concerns about operational transparency. Without clear information about Islamic accounts, professional trader accommodations, or institutional services, potential clients cannot adequately evaluate whether Lioppa's account structure meets their specific trading needs.

User feedback regarding account conditions remains limited, with the available reviews primarily focusing on concerns about legitimacy rather than specific account features. This lioppa review notes that the attractive pricing advertised may be offset by the risks associated with the broker's questionable regulatory status and operational transparency.

The evaluation of Lioppa's tools and resources reveals significant information deficiencies that impact the overall assessment. Available sources do not provide specific details about the trading platforms offered, leaving potential clients without crucial information about software capabilities, charting tools, or technical analysis features that are essential for informed trading decisions.

The absence of information about research and analysis resources represents a major gap in service offerings. Professional traders typically require access to market analysis, economic calendars, news feeds, and expert commentary to make informed trading decisions. The lack of clarity about whether Lioppa provides these essential resources suggests either inadequate service offerings or poor communication of available features.

Educational resources, which are increasingly important for broker differentiation and trader development, are not mentioned in available documentation. The absence of webinars, tutorials, trading guides, or market education materials may indicate limited commitment to client development and success.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or API access, remains unspecified despite the company's positioning as an "algorithmic trading platform." This contradiction between marketing positioning and available information raises questions about the accuracy of the company's self-representation and the actual sophistication of its technological offerings.

Customer Service and Support Analysis (4/10)

Customer service evaluation for Lioppa proves challenging due to the limited information available about support channels, response times, and service quality metrics. The absence of clearly defined customer service contact methods, including phone numbers, email addresses, or live chat availability, creates immediate concerns about client support accessibility.

Response time guarantees, which professional brokers typically provide to ensure client confidence, are not mentioned in available sources. This lack of service level commitments suggests either inadequate customer service infrastructure or insufficient transparency about support capabilities. Professional traders particularly require reliable support for technical issues, account management, and urgent trading-related queries.

The quality of customer service cannot be adequately assessed without user testimonials specifically addressing support experiences. Available reviews focus primarily on fraud concerns rather than detailed customer service evaluations, limiting the ability to provide comprehensive service quality analysis.

Multilingual support capabilities, essential for international brokers serving diverse client bases, are not specified in available documentation. The absence of information about support languages, regional service hours, or localized assistance may indicate limited international service capabilities despite the broker's apparent targeting of global markets.

Trading Experience Analysis (6/10)

The trading experience evaluation for Lioppa reveals both potentially attractive features and significant uncertainties. The advertised low spreads starting from 0.0 pips could provide favorable trading conditions for active traders, particularly those employing strategies sensitive to transaction costs. However, the sustainability and consistency of these spreads during different market conditions remains unverified.

Platform stability and execution speed, critical factors for trading success, cannot be assessed due to the absence of specific platform information or user performance testimonials. Without details about server locations, execution technology, or latency specifications, potential clients cannot evaluate whether Lioppa's infrastructure meets their trading requirements.

Order execution quality, including slippage rates, requote frequency, and fill rates, lacks documentation in available sources. These metrics are essential for traders to assess the reliability of trade execution and the likelihood of achieving intended trading results. The absence of such information represents a significant transparency gap.

Mobile trading capabilities, increasingly important for modern traders requiring market access flexibility, are not detailed in this lioppa review based on available information. The lack of mobile app specifications or mobile platform features may indicate limited technological development or poor communication of available capabilities.

Trustworthiness Analysis (2/10)

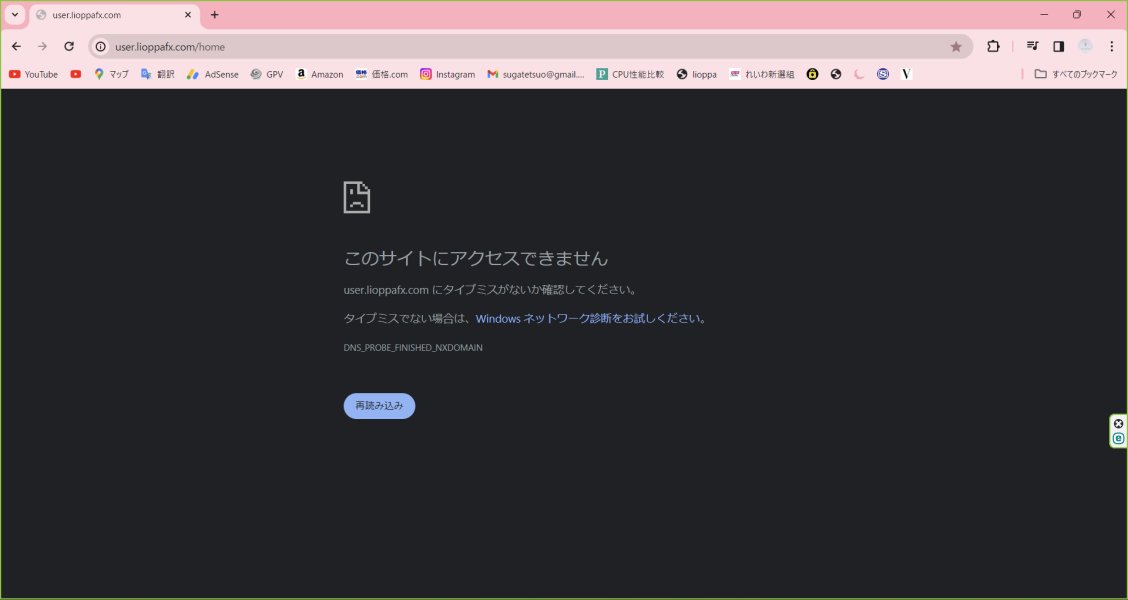

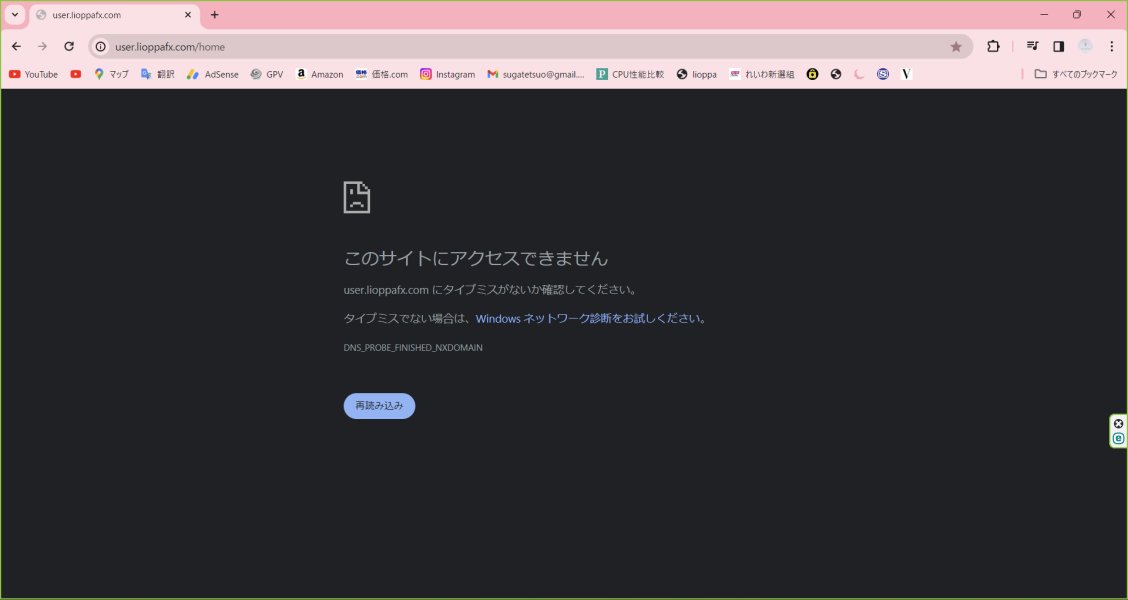

The trustworthiness assessment of Lioppa reveals severe concerns that potential clients must carefully consider. According to TraderKnows reports, Lioppa Global Markets Ltd is suspected of fraudulent activities, representing the most serious red flag in broker evaluation. These fraud allegations, combined with the complete absence of regulatory oversight, create an extremely high-risk environment for potential investors.

The lack of regulation by recognized financial authorities means client funds lack institutional protection typically provided by regulatory frameworks. Without regulatory oversight, clients have no recourse through official channels if disputes arise or if the broker fails to meet obligations. This absence of regulatory backing is particularly concerning given the fraud allegations circulating in the trading community.

Company transparency, essential for building client trust, appears severely limited based on available information. The lack of detailed company information, management team disclosure, or operational transparency raises questions about the broker's commitment to professional standards and client protection.

Industry reputation, based on available reports and reviews, trends heavily negative due to fraud warnings and the absence of positive industry recognition. The concentration of negative attention from industry watchdogs and review platforms suggests systemic concerns rather than isolated complaints.

User Experience Analysis (4/10)

User experience evaluation for Lioppa is significantly hampered by limited authentic user feedback and the prevalence of fraud warnings in available reviews. The overall user satisfaction appears low based on the concentration of negative exposure reports and fraud allegations rather than detailed trading experience testimonials.

Interface design and usability cannot be properly assessed due to the absence of specific platform information or user interface descriptions in available sources. Without screenshots, feature descriptions, or user navigation testimonials, potential clients cannot evaluate the practical aspects of using Lioppa's trading environment.

Registration and verification processes lack detailed documentation, creating uncertainty about account opening procedures and the time required to begin trading. Professional brokers typically provide clear information about documentation requirements and processing timeframes, and the absence of such details raises operational transparency concerns.

Fund operation experiences, including deposit and withdrawal procedures, processing times, and fee structures, are not detailed in available user feedback. This information gap prevents potential clients from understanding the practical aspects of managing their trading accounts and accessing their funds when needed.

Conclusion

This comprehensive lioppa review reveals a broker that presents significant risks despite advertising potentially attractive trading conditions. While the offered features of 0.0 pip starting spreads and 1:500 leverage may initially appeal to cost-conscious and high-leverage seeking traders, the severe trustworthiness concerns overshadow these potential benefits.

The broker appears most suitable for high-risk tolerance traders willing to accept substantial uncertainty in exchange for potentially favorable trading costs. However, given the fraud allegations and complete absence of regulatory protection, even risk-tolerant traders should exercise extreme caution and consider these factors carefully before committing funds.

The main advantages include competitive advertised spreads and high leverage availability, while the critical disadvantages encompass suspected fraudulent activities, lack of regulatory oversight, limited operational transparency, and predominantly negative industry reputation. Based on this analysis, potential clients are strongly advised to prioritize regulated alternatives that offer greater security and transparency, even if trading costs may be slightly higher.