Is Phoenix FX safe?

Pros

Cons

Is Phoenix FX Safe or Scam?

Introduction

Phoenix FX Ltd is a relatively new player in the forex market, established in 2023 and headquartered in Saint Lucia. It positions itself as a versatile trading platform offering a wide range of financial instruments, including forex currency pairs, commodities, and cryptocurrencies. However, the rapid emergence of numerous online brokers has raised concerns among traders about the legitimacy and safety of these platforms. Given the high stakes involved in forex trading, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to provide an objective analysis of Phoenix FX, focusing on its regulatory status, company background, trading conditions, client safety, and customer experiences. The evaluation is based on a comprehensive review of available online resources and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. A well-regulated broker is subject to strict oversight, which helps protect traders from fraud and malpractice. In the case of Phoenix FX, it claims to operate under the regulation of the Anjouan Offshore Finance Authority (A.O.F.A.), with the license number L15610/PFX. However, the credibility of offshore regulators is often questioned due to their lax enforcement of compliance standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| A.O.F.A. | L15610/PFX | Saint Lucia | Unverified |

While Phoenix FX promotes itself as a regulated entity, the absence of robust oversight raises red flags. Moreover, the UK Financial Conduct Authority (FCA) has issued warnings against unregulated brokers operating under similar names, advising traders to exercise caution. The lack of a solid regulatory framework can expose traders to significant risks, including the potential loss of funds without any recourse.

Company Background Investigation

Phoenix FX Ltd's company history is relatively short, having been founded in 2023. The ownership structure remains unclear, with no publicly available information about its founders or key stakeholders. This lack of transparency is concerning, as a reputable broker typically provides detailed information about its management team and corporate governance.

The management team‘s background is crucial in assessing a broker’s reliability. Unfortunately, there is little information available regarding the qualifications and experience of Phoenix FX's leadership. This absence of data may lead potential clients to question the broker's operational integrity and expertise in the financial markets.

Furthermore, the level of transparency and information disclosure is vital for building trust. Phoenix FX's website lacks comprehensive educational resources and detailed explanations of its services, which could hinder the decision-making process for novice traders. A broker that prioritizes transparency is more likely to gain the trust of its clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its competitiveness. Phoenix FX presents a low minimum deposit requirement of $10, which is appealing for new traders. The broker claims to offer leverage of up to 1:500, which can amplify both profits and losses. However, high leverage also increases risk exposure, making it essential for traders to exercise caution.

The overall fee structure at Phoenix FX includes various account types, each with different spreads and commission models. The following table summarizes the key trading costs associated with Phoenix FX:

| Fee Type | Phoenix FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1-2 pips |

| Commission Model | Zero for Super Account | Varies (often $5-$10) |

| Overnight Interest Range | Varies | Varies |

While the spreads appear competitive, the absence of clarity regarding overnight interest rates and other fees could pose challenges for traders seeking to understand their total cost of trading. Additionally, the lack of a clear commission structure may lead to unexpected charges, which could deter potential clients.

Client Fund Safety

The safety of client funds is of paramount importance when choosing a forex broker. Phoenix FX claims to implement various security measures to protect client capital, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable, especially given the broker's offshore regulatory status.

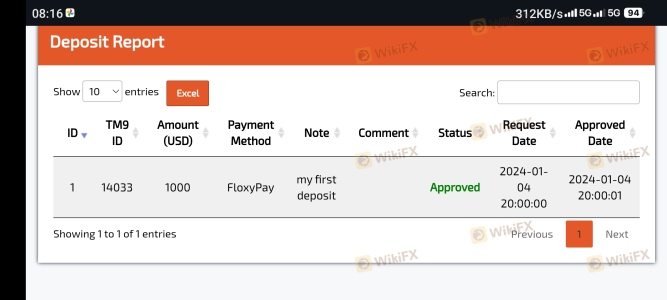

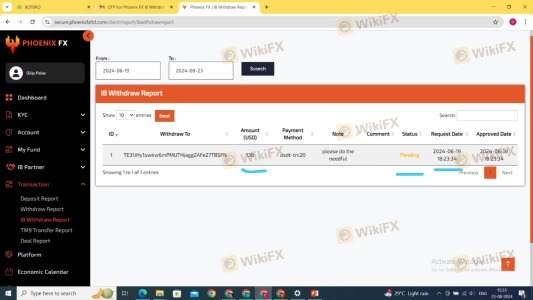

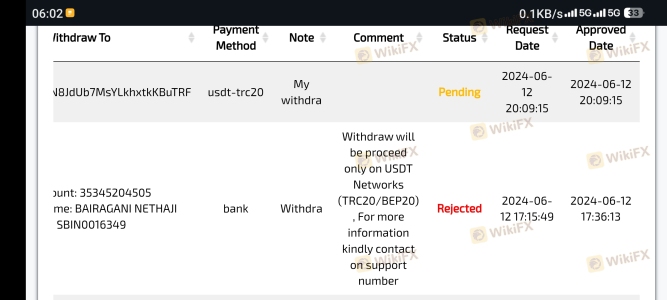

The lack of robust investor protection schemes typically found in well-regulated environments means that traders' funds may not be safeguarded against broker insolvency or fraudulent activities. Furthermore, there have been reports of difficulties in fund withdrawals and unresolved disputes, which raise concerns about the broker's financial stability and operational integrity.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability. Analyzing user experiences with Phoenix FX reveals a mixed bag of reviews. While some traders report satisfactory experiences, others highlight significant issues, particularly concerning fund withdrawals and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

| Transparency Concerns | High | Poor |

Many users have expressed frustration over prolonged withdrawal processes, with reports of requests taking weeks or even months to be processed. This pattern indicates potential operational inefficiencies or a lack of commitment to customer service. Additionally, the company's response to complaints appears to be inadequate, further eroding trust among existing and potential clients.

Platform and Execution

The trading platform provided by Phoenix FX is another critical aspect of its service. The broker utilizes the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, user reviews suggest that the platform may experience occasional stability issues and execution delays, which can affect trading performance.

Moreover, concerns about slippage and order rejections have been reported, leading to questions about the broker's execution quality. A reliable broker should demonstrate consistent and transparent execution practices, as any signs of manipulation can significantly undermine trader confidence.

Risk Assessment

Engaging with Phoenix FX presents several risks that traders should carefully consider. The combination of offshore regulation, unclear company background, and mixed customer feedback contributes to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust oversight |

| Operational Risk | Medium | Withdrawal issues reported |

| Execution Risk | Medium | Slippage and rejections |

To mitigate these risks, traders should approach Phoenix FX with caution. It is advisable to start with a small investment and thoroughly test the platform before committing significant funds. Additionally, traders should maintain realistic expectations regarding potential returns and be prepared for the inherent volatility of forex trading.

Conclusion and Recommendations

In conclusion, the analysis of Phoenix FX reveals several concerning factors that suggest it may not be a safe choice for forex trading. The lack of robust regulation, unclear company background, and numerous customer complaints raise significant red flags. While the broker offers attractive trading conditions, the associated risks may outweigh the benefits.

Traders should exercise caution when considering Phoenix FX and may want to explore alternative options that provide stronger regulatory oversight and better customer reviews. Recommended alternatives include brokers that are regulated by reputable authorities, such as the FCA or ASIC, which offer greater protection and transparency.

Ultimately, thorough research and careful consideration are essential when selecting a forex broker to ensure a safe and rewarding trading experience.

Is Phoenix FX a scam, or is it legit?

The latest exposure and evaluation content of Phoenix FX brokers.

Phoenix FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Phoenix FX latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.