Is ALLMARKETS PRO safe?

Business

License

Is Allmarkets Pro Safe or a Scam?

Introduction

Allmarkets Pro is a forex and cryptocurrency broker that has recently gained attention in the trading community. Positioned as a platform for trading various financial instruments, it claims to offer competitive trading conditions and a user-friendly interface. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to thoroughly evaluate the legitimacy of brokers before investing their hard-earned money. In this article, we will investigate the safety and reliability of Allmarkets Pro by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a review of online resources, user feedback, and industry reports to provide a comprehensive view of whether Allmarkets Pro is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety. A regulated broker is typically required to adhere to strict guidelines that protect investors and ensure fair trading practices. In the case of Allmarkets Pro, it is important to note that the broker is unregulated. This lack of oversight raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory framework means that Allmarkets Pro is not subject to any external audits or compliance checks. This situation is particularly troubling, as it leaves traders vulnerable to potential fraud or mismanagement of funds. Moreover, the broker claims to be regulated but fails to provide specific details or documentation, which is a significant red flag. The lack of transparency regarding its operations and regulatory compliance raises questions about the broker's intentions and reliability.

Company Background Investigation

Allmarkets Pro operates under the name KX Netcom SA de CV, with its registered address in Mexico City. However, details about the companys history and ownership structure are scant. There is limited information available regarding its establishment, operational history, or the individuals behind the company. This lack of transparency can be concerning for potential investors, as it is crucial to know who is managing the trading platform and their qualifications.

The management team‘s professional experience is another critical aspect to consider. Without a clear understanding of the team’s background, it is difficult to assess whether they possess the necessary expertise to operate a trading platform successfully. Furthermore, the companys website does not provide adequate information about its operational practices or governance structure, which further diminishes trust.

Trading Conditions Analysis

When evaluating whether Allmarkets Pro is safe, an analysis of its trading conditions is essential. The broker claims to offer competitive spreads and various account types, but specific details about its fee structure are often vague. A transparent broker typically provides clear information about its costs, including spreads, commissions, and overnight fees.

| Fee Type | Allmarkets Pro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Vague | 1.0 - 2.0 pips |

| Commission Model | Vague | Varies |

| Overnight Interest Range | Vague | 0.5% - 2.0% |

The lack of clarity regarding these costs is concerning. Traders may find themselves facing unexpected fees or unfavorable trading conditions. Furthermore, the absence of a detailed fee structure could lead to misunderstandings and disputes over costs, which is not ideal for maintaining a trustworthy trading relationship.

Customer Fund Safety

The safety of customer funds is paramount in assessing the overall reliability of a broker. Allmarkets Pro does not provide clear information about its measures for securing client deposits. It is crucial for brokers to implement strong security protocols, such as segregating client funds from operational funds and providing investor protection mechanisms.

Unfortunately, Allmarkets Pro has not disclosed any information regarding these safety measures. The absence of fund segregation, investor protection, or negative balance protection policies poses a significant risk to traders. Moreover, there have been no documented incidents of fund security issues, but the lack of transparency raises concerns about the potential for future problems.

Customer Experience and Complaints

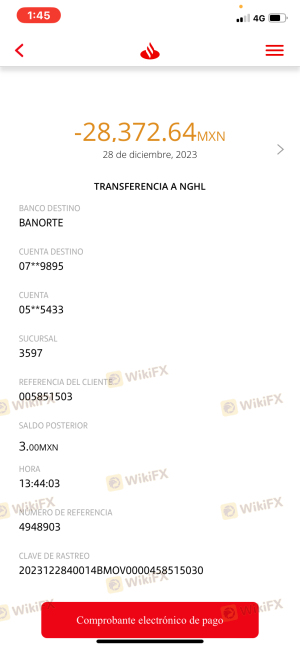

Analyzing customer feedback is critical in determining whether Allmarkets Pro is safe. Numerous online reviews have highlighted a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and unresponsive communication channels.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Poor |

| Transparency of Fees | High | Poor |

Two notable cases involve users reporting significant delays in processing withdrawal requests, leading to frustration and financial loss. In both instances, the company's lack of responsiveness exacerbated the situation, leading to a negative perception of the broker. These complaints indicate a troubling trend and suggest that Allmarkets Pro may not prioritize customer satisfaction or support.

Platform and Trade Execution

The performance of the trading platform is another critical aspect to consider. Allmarkets Pro claims to offer a user-friendly interface with advanced trading tools. However, user reviews indicate mixed experiences regarding platform stability and execution quality. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes.

Traders expect reliable execution and minimal slippage, particularly in volatile market conditions. Any signs of platform manipulation or poor execution can be detrimental to a trader's success and raise serious concerns about the broker's integrity.

Risk Assessment

Using Allmarkets Pro comes with inherent risks, primarily due to its unregulated status and lack of transparency. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation, high risk of fraud |

| Fund Security | High | Lack of transparency on fund safety |

| Customer Support | Medium | Poor response to complaints |

| Trading Conditions | High | Vague fees and potential hidden costs |

To mitigate these risks, potential traders should consider conducting thorough research, starting with small investments, and always ensuring they have a clear understanding of the brokers terms and conditions before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Allmarkets Pro raises several red flags regarding its safety and reliability. The lack of regulation, transparency, and poor customer feedback indicate that this broker may not be a safe option for traders. While some users may have had positive experiences, the overall consensus points towards a concerning trend of complaints and operational issues.

For traders seeking a reliable broker, it is advisable to consider alternatives that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Some recommended brokers include those regulated by the FCA, ASIC, or CFTC, which provide a safer trading environment and better protection for investors. Always prioritize brokers that demonstrate transparency, robust customer support, and clear trading conditions to ensure a secure trading experience.

Is ALLMARKETS PRO a scam, or is it legit?

The latest exposure and evaluation content of ALLMARKETS PRO brokers.

ALLMARKETS PRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ALLMARKETS PRO latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.