MGL Global 2025 Review: Everything You Need to Know

Summary

This mgl global review gives you a complete look at MGL Global. The company has drawn a lot of attention in financial services, but not for good reasons. MGL Global started in 2013 as a logistics and transportation company before moving into financial services. Our research shows serious problems that potential clients need to think about carefully.

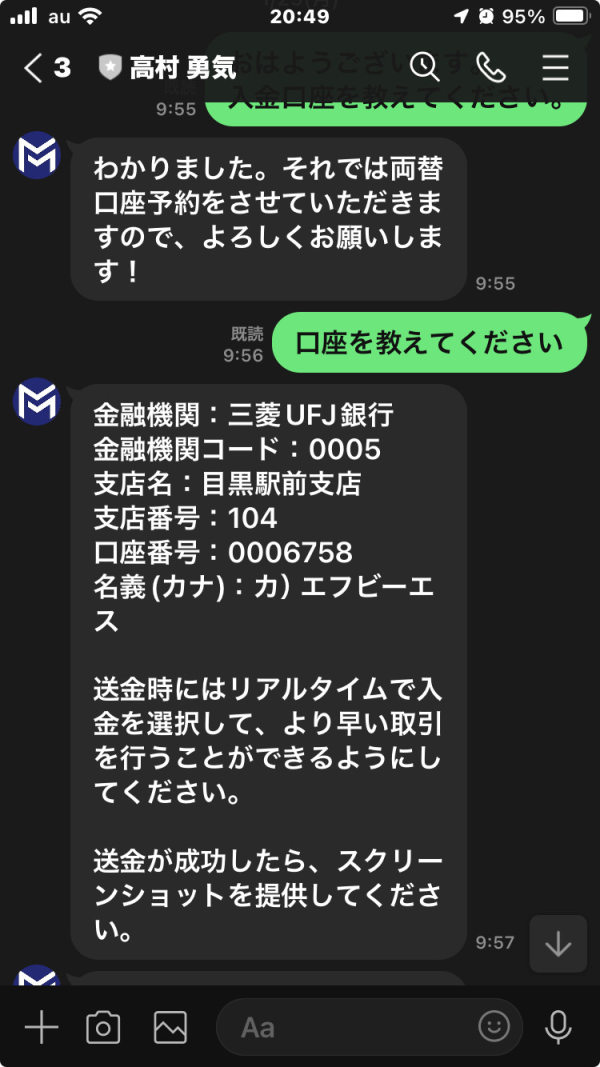

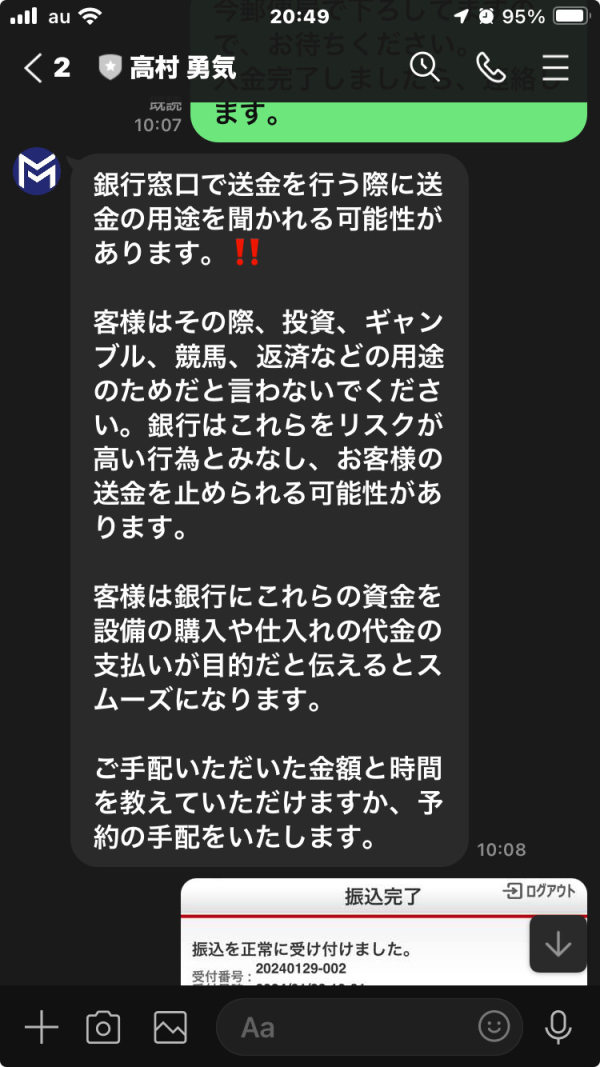

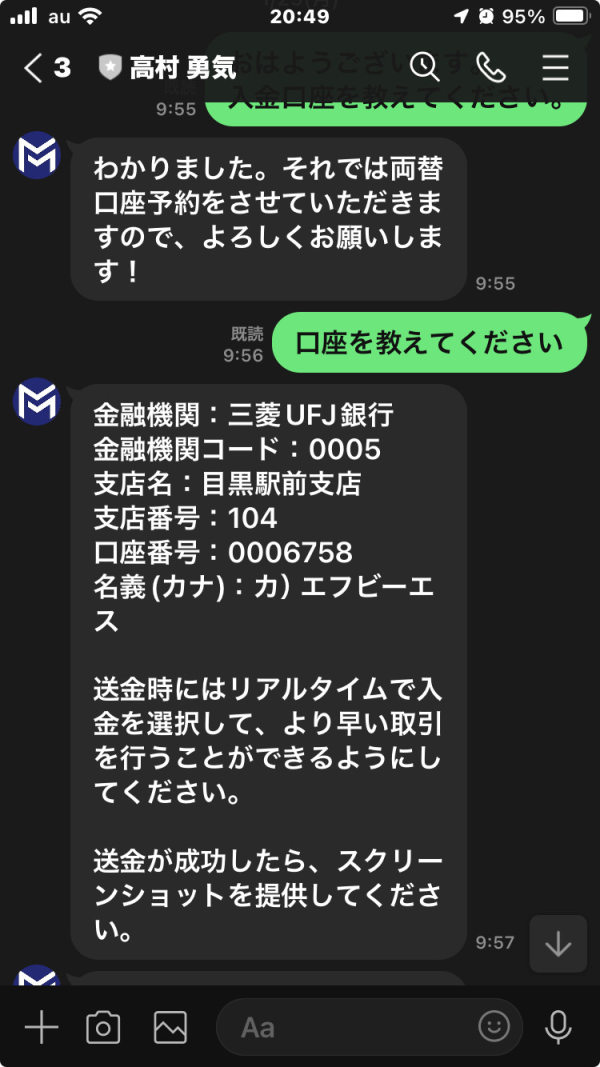

MGL Global faces major credibility issues based on our research and user feedback. The company runs financial services without proper oversight from regulators. User reviews consistently point to poor service and questionable business practices. With a very high minimum deposit of $25,000 and many fraud claims, MGL Global seems to target wealthy individuals, especially in Japan.

Former employees and clients mostly agree that the company has serious operational problems. Many reviews say the company is poorly managed. Some even call it fraudulent. These warning signs, plus the lack of clear regulatory information, create a worrying picture for investors who want reliable financial services.

Important Notice

Regional Entity Differences: MGL Global is registered in Venezuela and has offices in different countries. This complex setup may affect regulatory oversight and client protection. The company's international presence does not mean better credibility or service quality, as shown by consistent negative feedback across markets.

Review Methodology: This review uses publicly available information, user testimonials, and industry data. We have not tested MGL Global's services directly. You should consider this review alongside other independent sources before making financial decisions.

Rating Framework

Broker Overview

Company Background and Establishment

MGL Global Logistics started in 2013. The company first focused on transportation and supply chain management. Their original business centered on freight forwarding and logistics services before expanding into financial services. This transition has been problematic, with the company failing to build the same expertise in financial markets that it may have had in logistics.

The company's headquarters in Venezuela raises concerns about regulatory oversight and transparency. MGL Global maintains multiple international offices but has struggled to build a good reputation in financial services. Many clients report bad experiences and questionable business practices.

Service Model and Market Focus

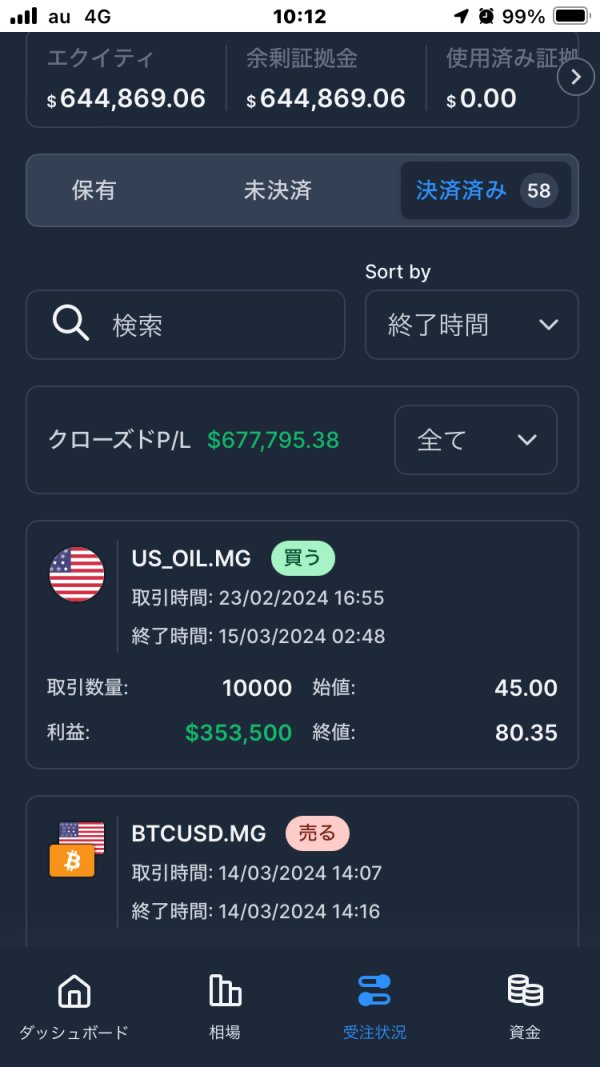

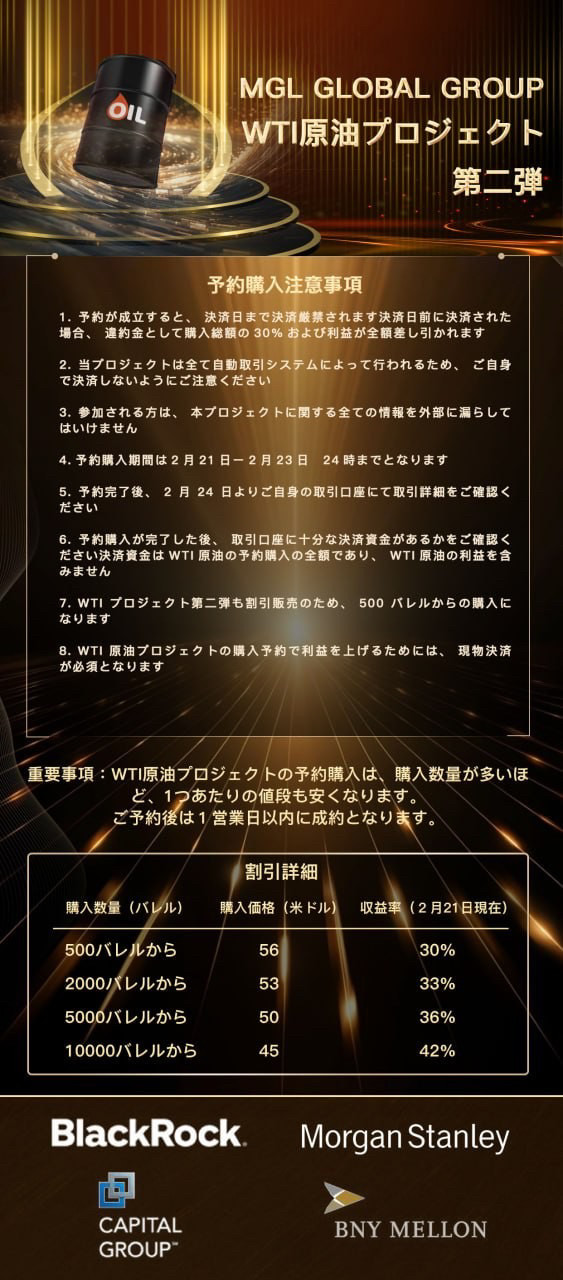

MGL Global's financial services division mainly targets forex trading. Specific details about their trading setup remain limited. The company focuses particularly on the Japanese market, though their service problems seem to exist everywhere. Unlike established financial service providers, MGL Global lacks complete information about their trading platforms, technology, and risk management.

The company's business model relies heavily on high minimum deposits. This potentially targets wealthy investors who may be less concerned about price. However, this approach has not led to better service quality, as shown by consistently negative user feedback across multiple review platforms.

Regulatory Status: Our research shows that MGL Global lacks clear authorization from recognized financial authorities. This absence of proper oversight represents a significant risk for potential clients.

Deposit and Withdrawal Methods: Specific information about supported payment methods is not available in public documentation. This raises transparency concerns.

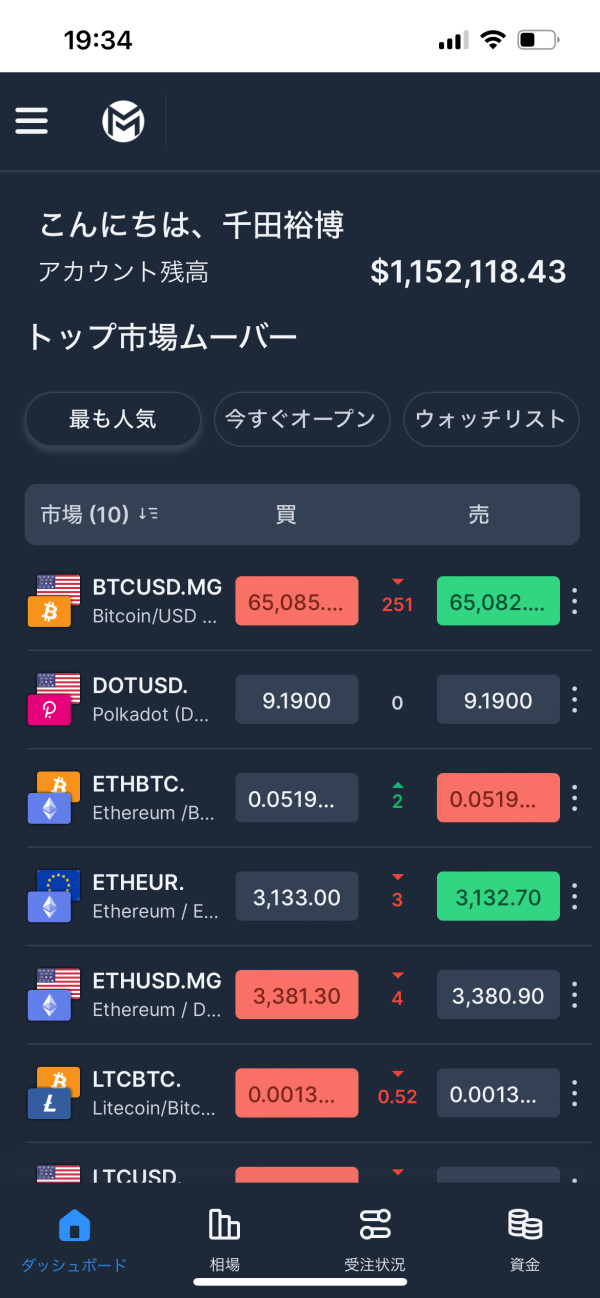

Minimum Deposit Requirements: The company requires a substantial minimum deposit of $25,000. This is significantly higher than industry standards and potentially excludes many retail investors.

Promotional Offers: No specific bonus or promotional programs are detailed in available materials. This suggests limited marketing incentives.

Trading Assets: The company primarily focuses on forex trading. The range of available currency pairs and other financial instruments remains unclear.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not transparently provided. This makes cost comparison with competitors difficult.

Leverage Options: Specific leverage ratios offered by MGL Global are not clearly stated in available documentation.

Platform Selection: The trading platforms used by MGL Global are not specifically identified in accessible materials.

Geographic Restrictions: Information about service availability in different regions is limited in public documentation.

Customer Support Languages: Specific language support options are not detailed in available materials.

This mgl global review reveals significant information gaps that potential clients should find concerning.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Account Accessibility and Requirements

MGL Global's account conditions have several concerning aspects that contribute to its low rating. The most significant barrier is the exceptionally high minimum deposit requirement of $25,000. This far exceeds industry standards where many reputable brokers offer accounts starting from $100-$500. This substantial entry barrier effectively excludes retail traders and smaller investors, raising questions about the company's target market strategy.

The lack of transparency regarding different account types represents another significant weakness. Established brokers typically offer multiple account tiers with varying features, deposit requirements, and trading conditions. MGL Global's failure to clearly communicate account options suggests either a limited service offering or poor marketing transparency.

User feedback consistently shows dissatisfaction with account terms and conditions. Former clients have reported unexpected fees, unclear contract terms, and difficulties understanding their account status. The absence of detailed account documentation and terms of service readily available for review further compounds these concerns.

Multiple user testimonials indicate that the account opening process lacks professional standards expected from legitimate financial service providers. This mgl global review finds that the company's account conditions fail to meet basic industry expectations for transparency and customer protection.

Trading Infrastructure and Support Tools

MGL Global's offering of trading tools and resources appears severely limited based on available information and user feedback. Unlike established brokers who provide comprehensive market analysis, economic calendars, technical indicators, and educational resources, MGL Global fails to demonstrate a robust toolkit for traders.

The absence of detailed information about available trading platforms represents a critical problem. Professional forex brokers typically offer multiple platform options, including MetaTrader 4/5, proprietary platforms, and mobile applications. MGL Global's lack of platform transparency suggests either outdated technology infrastructure or deliberate opacity about their trading environment.

Educational resources, which are standard offerings from reputable brokers, appear to be non-existent or poorly promoted. New traders typically rely on educational materials, webinars, and market analysis to develop their skills. The absence of these resources indicates a lack of commitment to client success and professional development.

Research and analysis capabilities seem notably absent from MGL Global's service portfolio. Established brokers provide daily market analysis, economic research, and trading signals to support client decision-making. The lack of these fundamental tools suggests an incomplete service offering that may leave clients without essential trading support.

Customer Service and Support Analysis (Score: 2/10)

Service Quality and Responsiveness

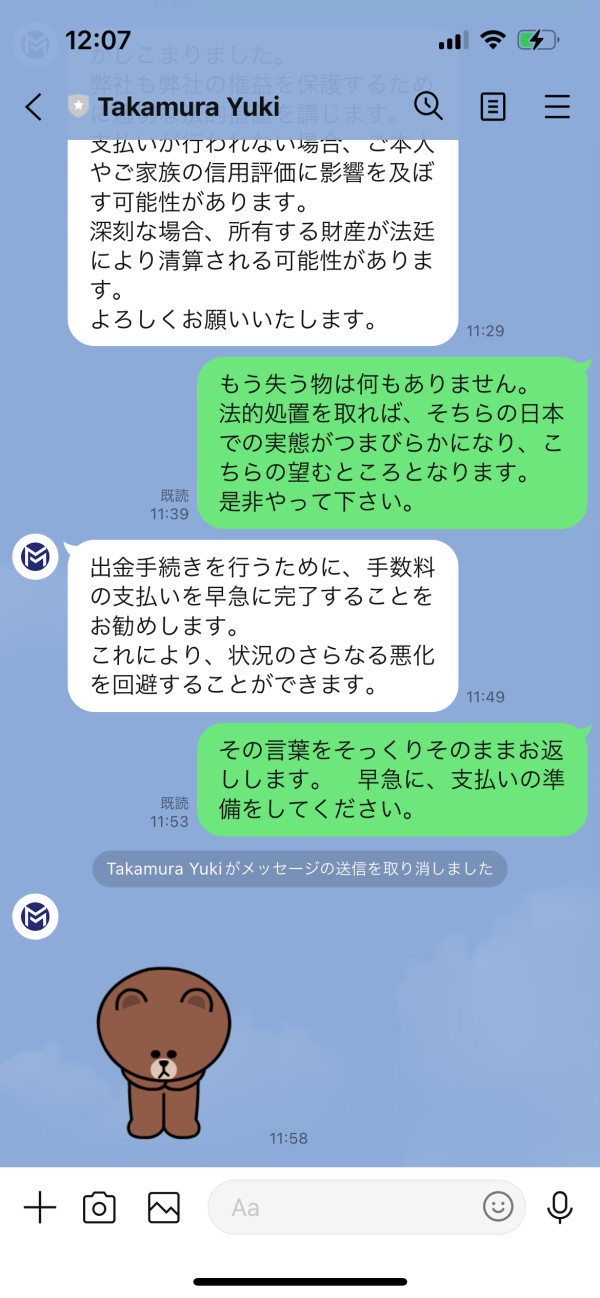

Customer service represents one of MGL Global's most significant weaknesses, as evidenced by overwhelmingly negative user feedback. Multiple reviews describe the company's support as unprofessional, unresponsive, and inadequate for addressing client concerns. This pattern of poor service delivery appears consistent across different time periods and client segments.

Response times to client inquiries are reportedly excessive. Some users indicate that their concerns went unaddressed for extended periods. In the fast-paced forex market, delayed customer support can result in significant financial losses, making this problem particularly serious for active traders.

The quality of support interactions, when they do occur, is consistently described as substandard. Users report dealing with support staff who appear to lack adequate knowledge about the company's services, trading procedures, and problem resolution protocols. This suggests insufficient training and poor internal communication systems.

Communication channels and availability are not clearly defined in the company's public materials. This creates additional barriers for clients seeking assistance. Professional brokers typically offer multiple contact methods including phone, email, live chat, and social media support with clearly defined operating hours and response expectations.

Trading Experience Analysis (Score: 3/10)

Platform Performance and Execution Quality

The trading experience offered by MGL Global appears to fall significantly short of industry standards based on available user feedback and operational indicators. Users have reported issues with order execution, including problematic slippage and delayed trade processing that can negatively impact trading outcomes.

Platform stability concerns have been raised by former clients, though specific technical details about the trading infrastructure are not readily available. Reliable platform performance is crucial for forex trading, where market volatility requires real-time execution and consistent system availability.

Liquidity issues have been mentioned in user feedback. This suggests that MGL Global may lack access to deep liquidity pools that ensure competitive pricing and efficient order execution. This can result in wider spreads, poor fill rates, and overall suboptimal trading conditions for clients.

The absence of detailed information about trading conditions, including typical spreads, execution speeds, and available order types, makes it difficult for potential clients to assess whether MGL Global can meet their trading requirements. This lack of transparency itself represents a significant concern for serious traders.

Trust and Reliability Analysis (Score: 1/10)

Regulatory Compliance and Corporate Transparency

Trust and reliability represent MGL Global's most critical weakness, earning the lowest possible rating due to multiple concerning factors. The absence of clear regulatory authorization from recognized financial authorities creates fundamental questions about client protection and operational legitimacy.

Fraud allegations mentioned in various reviews represent perhaps the most serious concern regarding MGL Global's trustworthiness. While specific legal outcomes are not detailed in available materials, the presence of such allegations significantly impacts the company's credibility and potential client confidence.

Corporate transparency is notably lacking. Limited publicly available information exists about company leadership, financial statements, operational procedures, and regulatory compliance measures. Legitimate financial service providers typically maintain comprehensive disclosure practices to build client trust and meet regulatory requirements.

The company's registration in Venezuela, combined with unclear regulatory status, raises additional concerns about oversight and client protection mechanisms. Reputable brokers typically maintain licenses from well-established regulatory bodies such as the FCA, CySEC, or ASIC, providing clients with clear recourse mechanisms and protection schemes.

User Experience Analysis (Score: 2/10)

Overall Client Satisfaction and Usability

User experience with MGL Global is overwhelmingly negative based on available feedback from former employees and clients. The consistent pattern of dissatisfaction suggests systemic issues rather than isolated incidents. This indicates fundamental problems with the company's service delivery model.

Interface design and platform usability information is limited, but user feedback suggests that the overall experience is frustrating and unprofessional. Modern forex brokers typically invest heavily in user experience design to ensure intuitive navigation and efficient trade execution.

The registration and verification process appears to be problematic based on user reports. Some indicate difficulties in account setup and documentation requirements. Professional brokers streamline these processes while maintaining compliance with regulatory requirements.

Common user complaints center around poor service quality, lack of transparency, and concerns about fund safety. The frequency and consistency of these complaints across different review platforms suggest that these are ongoing operational issues rather than temporary problems.

This mgl global review concludes that the overall user experience falls well below acceptable standards for a financial service provider. Multiple aspects require significant improvement to meet basic industry expectations.

Conclusion

This comprehensive mgl global review reveals a financial service provider with significant operational and credibility challenges that potential clients should carefully consider. With an overall rating of 2.2/10, MGL Global demonstrates concerning problems across all evaluated criteria. These range from basic service delivery to fundamental trust and reliability issues.

The company's exceptionally high minimum deposit requirement of $25,000, combined with poor customer service, limited transparency, and absence of proper regulatory oversight, makes it unsuitable for most retail forex traders. The consistent pattern of negative user feedback and fraud allegations further reinforces concerns about the company's legitimacy and operational standards.

Recommendation: Based on this analysis, we cannot recommend MGL Global to forex traders seeking reliable, transparent, and professionally managed trading services. Potential investors should consider well-established, properly regulated brokers with proven track records of client satisfaction and regulatory compliance.