Penzo 2025 Review: Everything You Need to Know

Executive Summary

This penzo review looks at a new online forex broker that has gotten mixed reactions from traders. Penzo is a forex brokerage firm that offers trading services across multiple financial markets, including foreign exchange, commodities, and cryptocurrency trading. The platform targets beginner and intermediate traders who want exposure to forex and crypto markets through easy-to-use trading solutions.

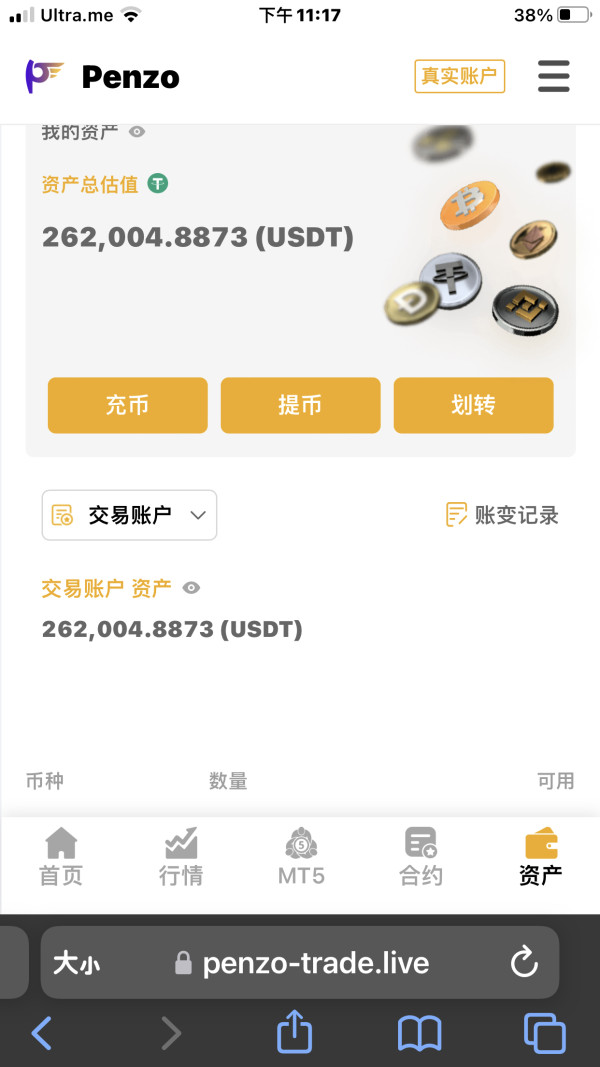

Our analysis shows concerning patterns in user feedback and service quality. According to WikiFX data, Penzo has a very low rating of 1.58 out of 10, which shows that users are not satisfied. The platform has received 15 formal complaints from users, which points to ongoing problems with service delivery. While Penzo gives access to different trading instruments through the MT5 platform, the overall user experience seems to fall short of industry standards, especially in customer support, transparency, and regulatory compliance.

The broker positions itself as a multi-asset trading platform that may appeal to traders looking for variety. However, potential users should carefully think about the documented service issues and limited regulatory information before putting money into the platform.

Important Disclaimers

Regional Entity Differences: Penzo's regulatory status changes across different areas, and specific regulatory information for various regions was not detailed in available materials. Potential traders should check the regulatory compliance status in their specific location before using the platform.

Review Methodology: This evaluation uses user feedback analysis, publicly available market information, and third-party rating platforms. The assessment reflects information available at the time of writing and users should do their own research. Given the limited official information available about certain aspects of Penzo's operations, traders should be extra careful and seek additional verification of key trading conditions before opening accounts.

Rating Framework

Broker Overview

Penzo started in the online trading world in 2021 as a forex and multi-asset brokerage firm. The company has its headquarters in Hong Kong and presents itself as a complete trading solution for retail traders who want access to international financial markets. Despite being fairly new, Penzo has tried to find its place in the competitive online brokerage sector by offering trading services across traditional forex pairs, commodity markets, and the increasingly popular cryptocurrency sector.

The broker's business model focuses on providing online trading access through digital platforms. It primarily targets individual traders rather than institutional clients. Penzo's approach emphasizes accessibility for newcomers to forex trading while also trying to serve more experienced traders with diverse asset offerings. However, putting this business model into practice has faced big challenges, as shown by user feedback and rating assessments.

The company operates through the widely recognized MT5 trading platform. It offers traders access to foreign exchange markets, commodities trading, and cryptocurrency instruments. This penzo review finds that while the asset variety may appeal to traders seeking diversification, the overall service delivery and support infrastructure need substantial improvement to meet standard industry expectations.

Regulatory Status: Available information does not give clear details about specific regulatory authorities overseeing Penzo's operations. This represents a significant concern for potential traders seeking regulated brokerage services.

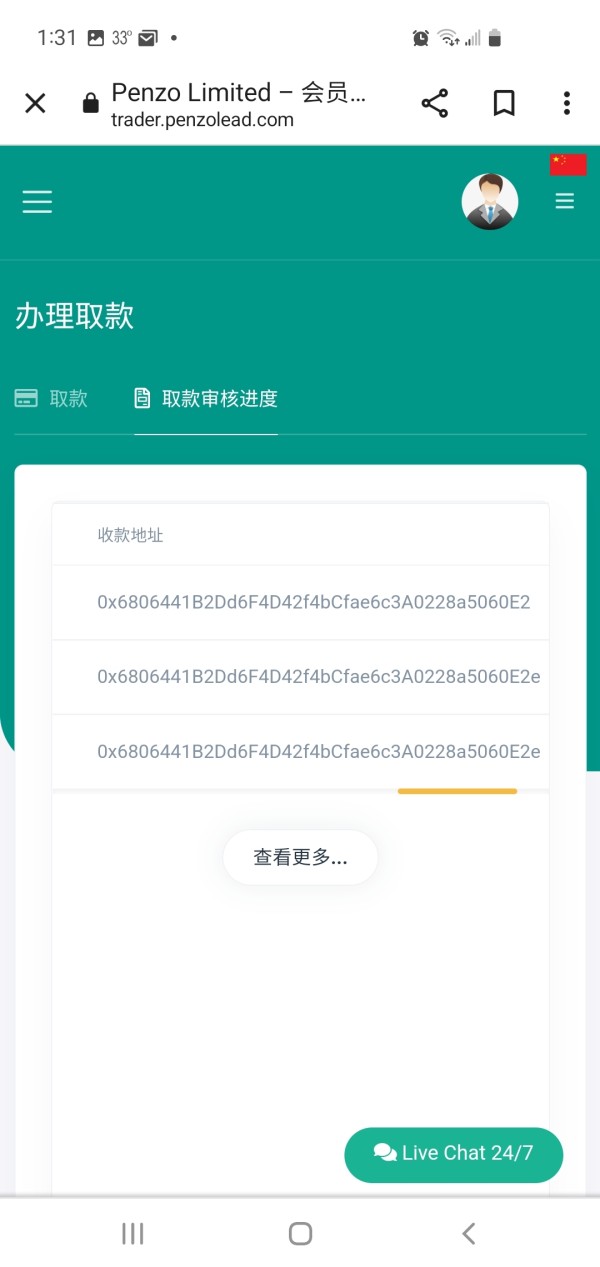

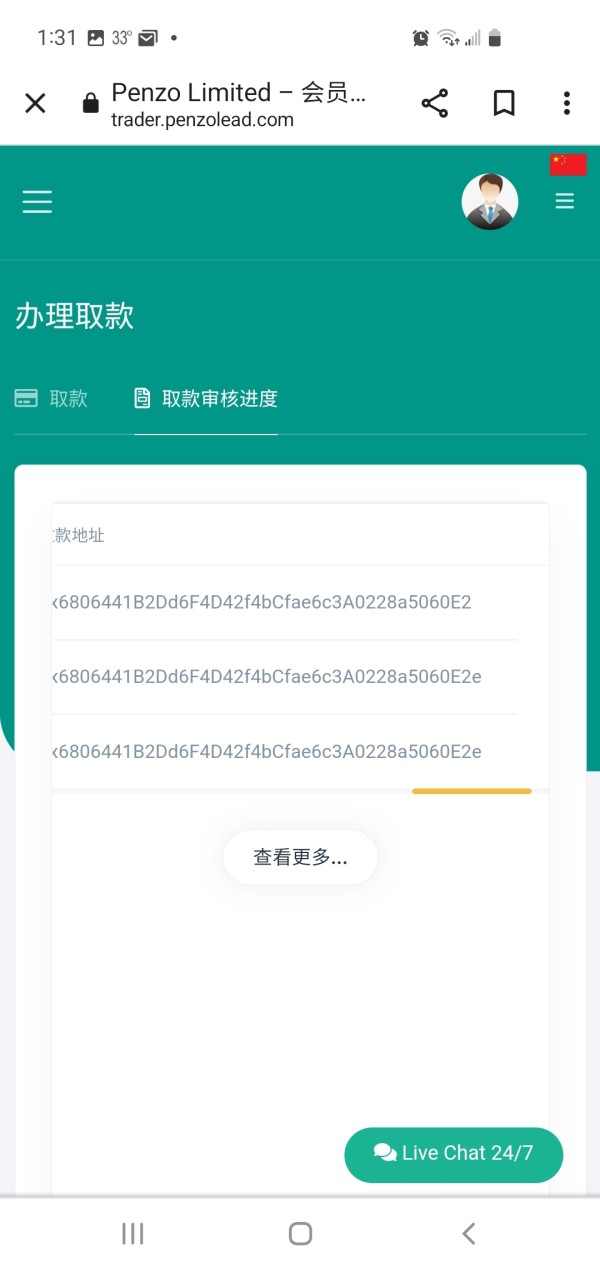

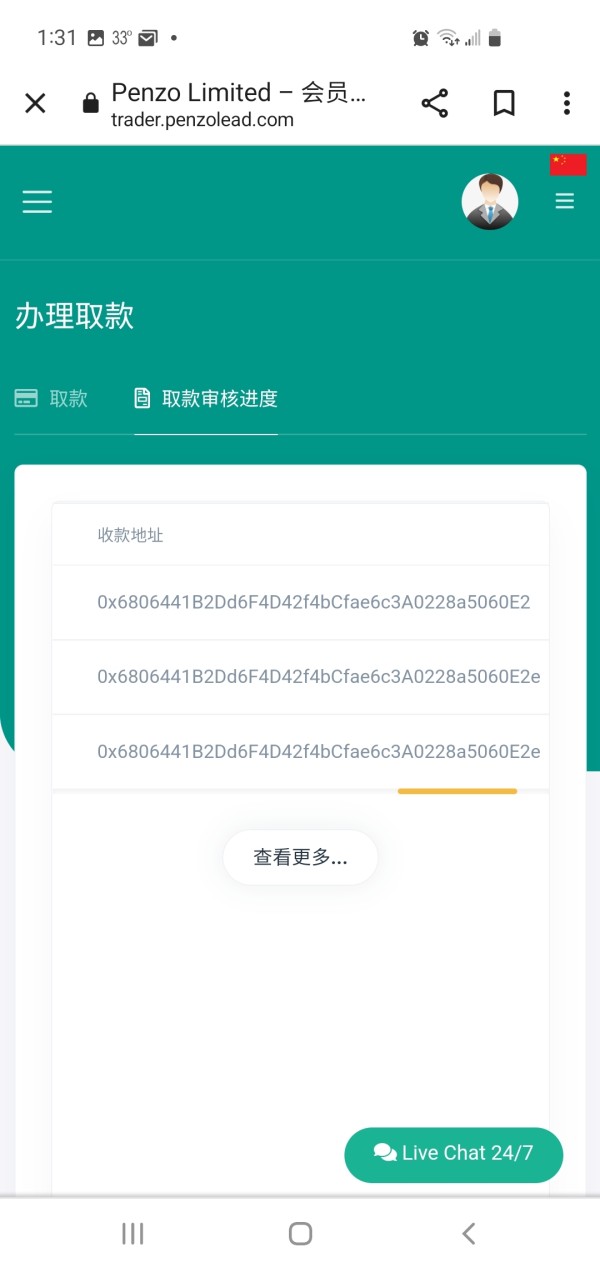

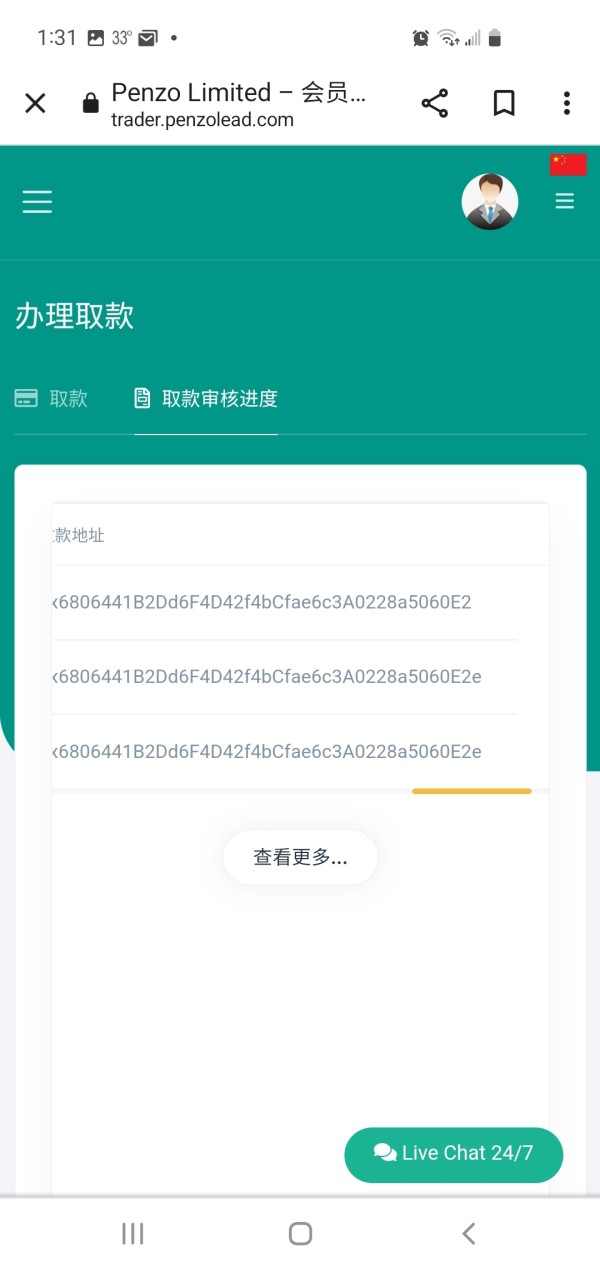

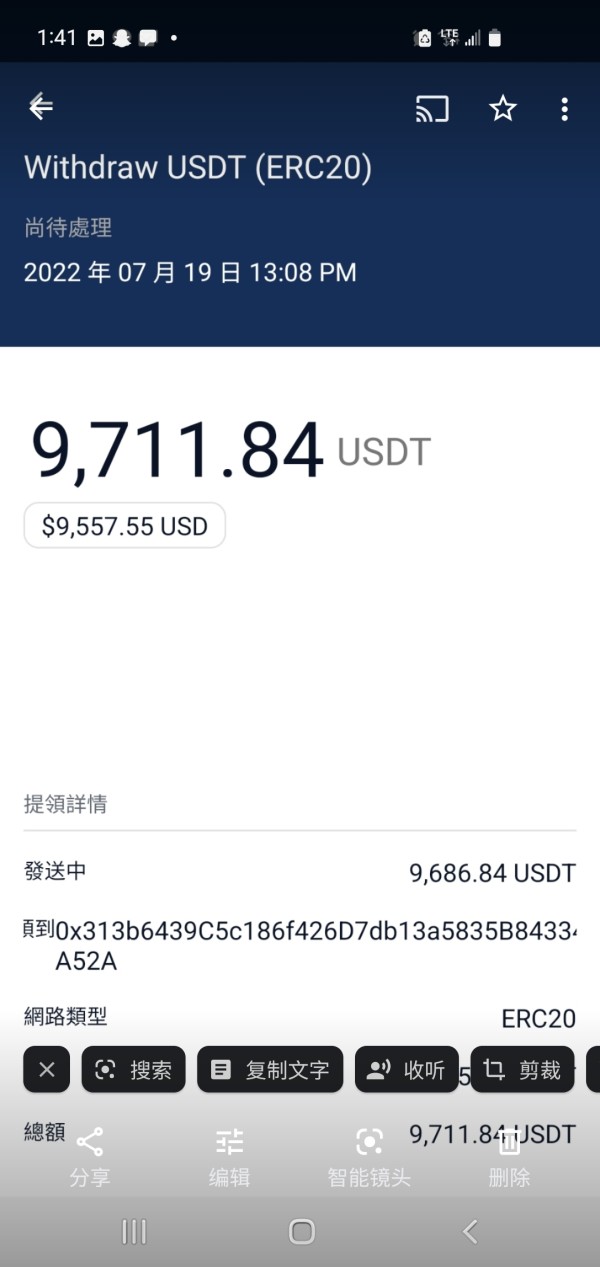

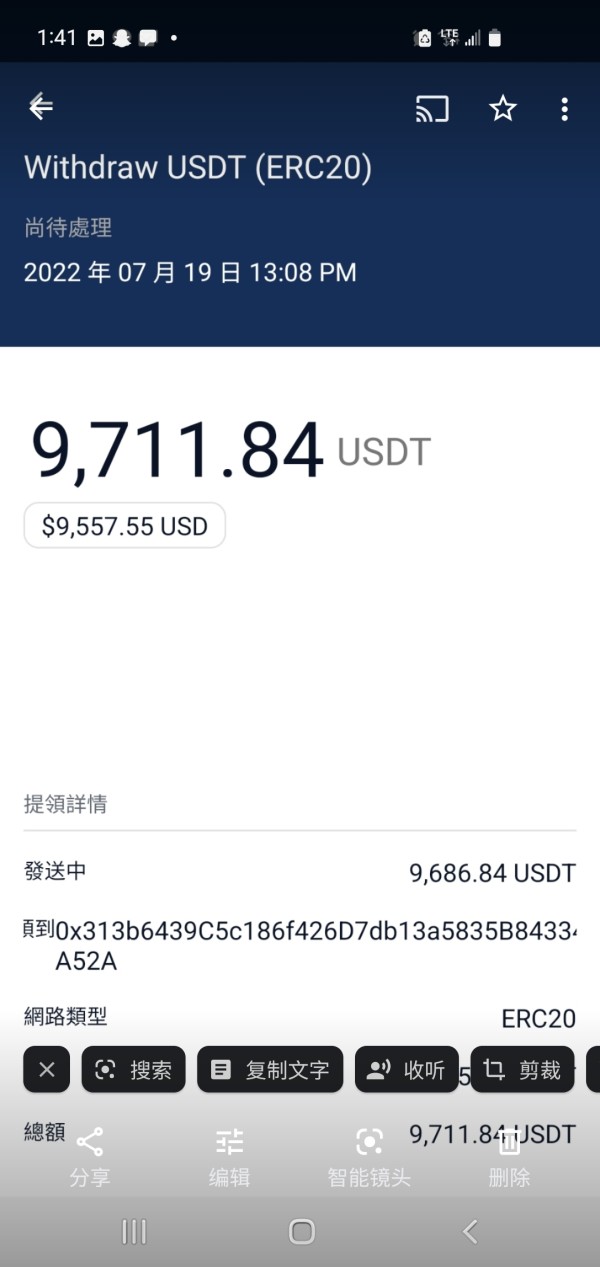

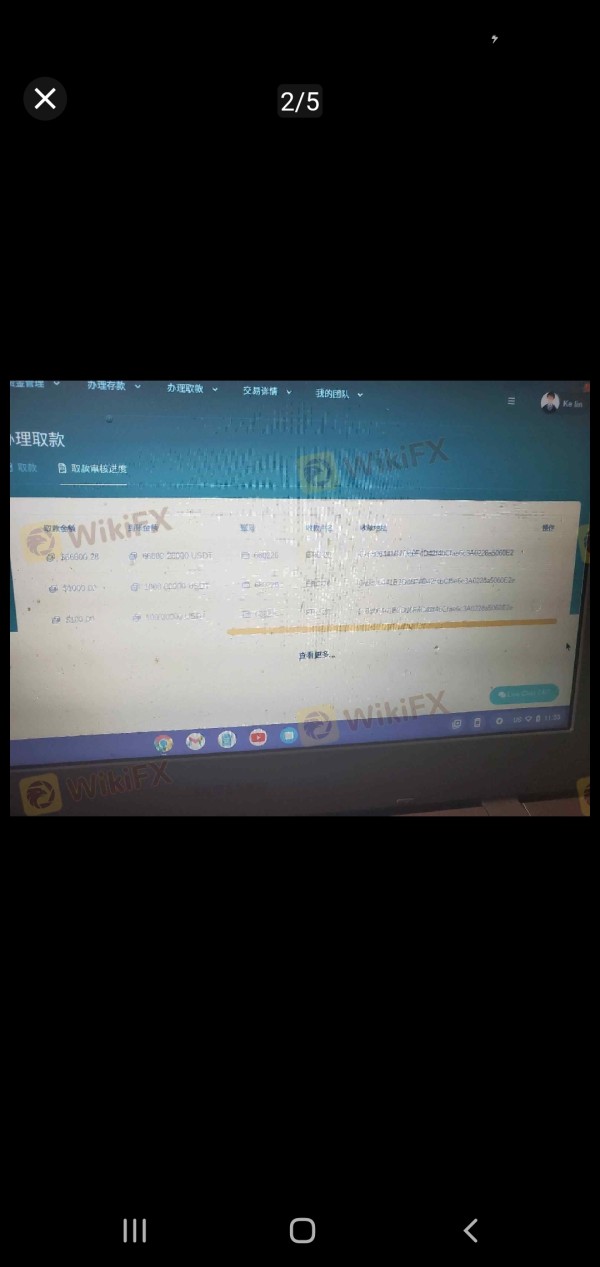

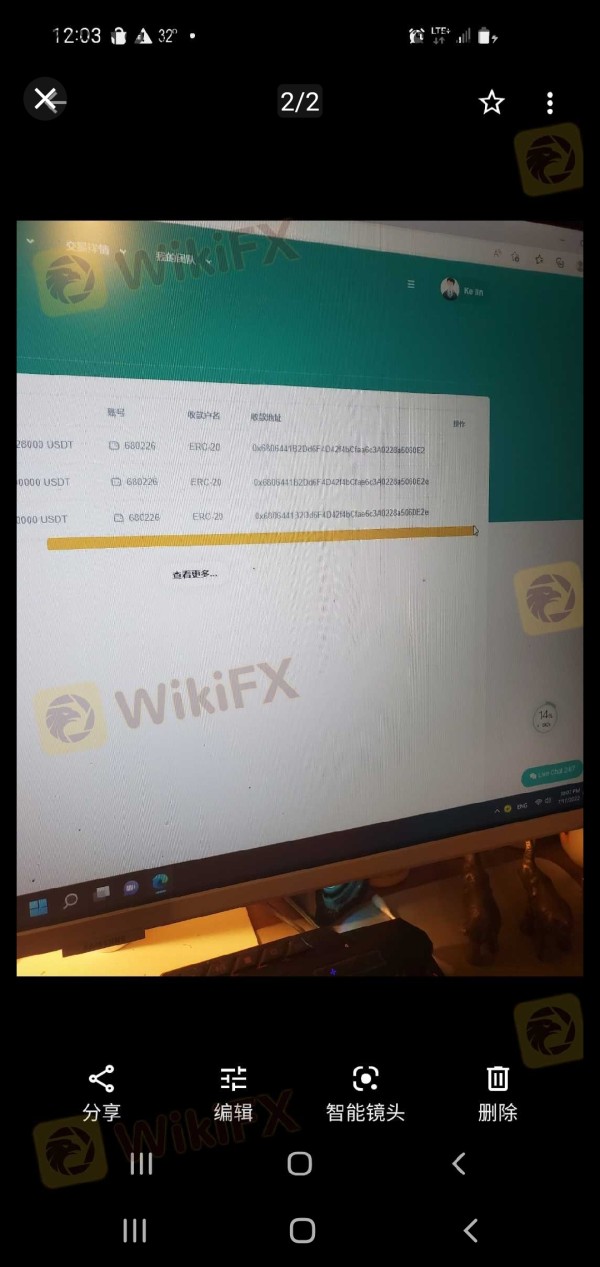

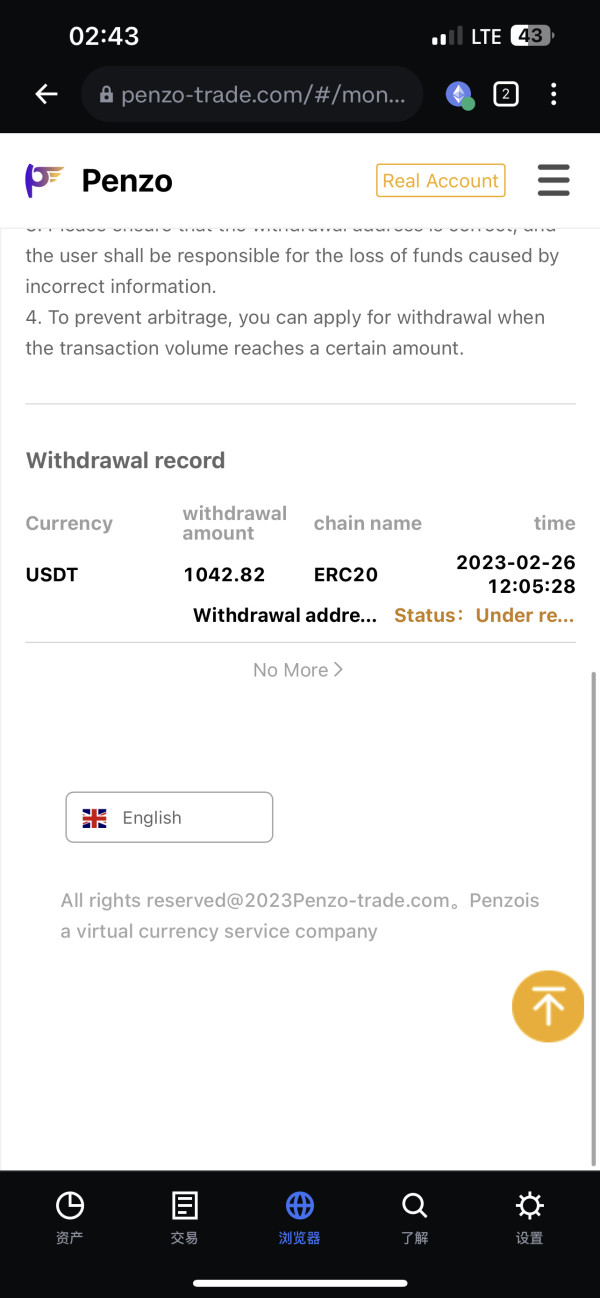

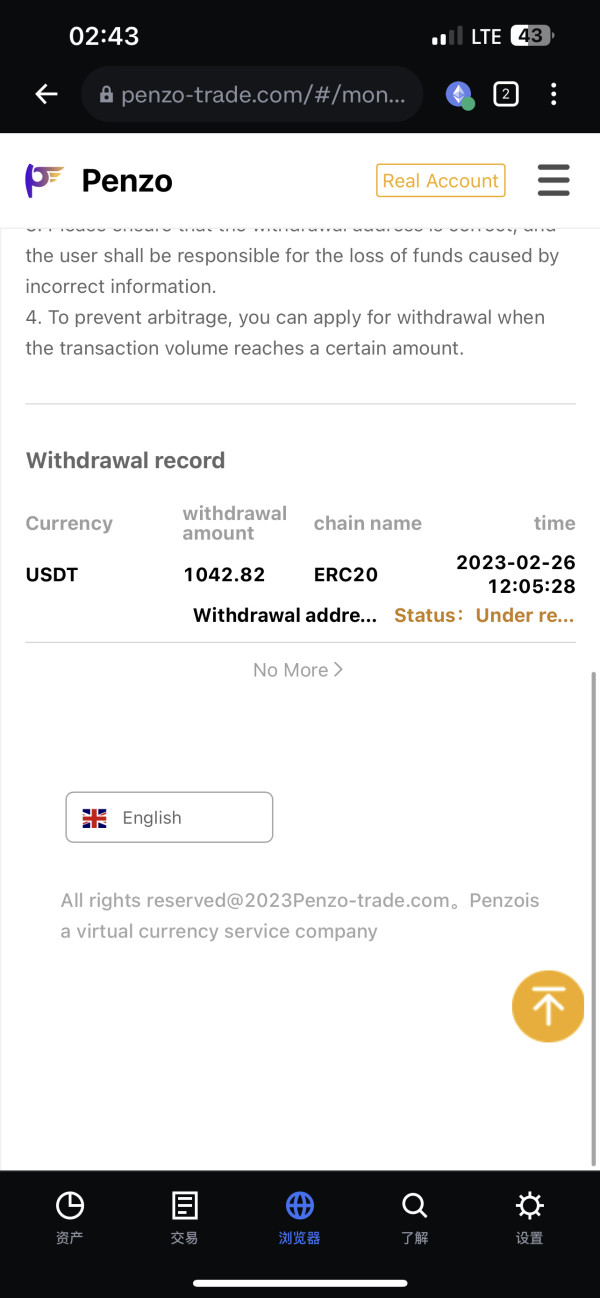

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees was not detailed in accessible materials. This indicates a lack of transparency in financial operations.

Minimum Deposit Requirements: The broker has not clearly communicated minimum deposit thresholds for different account types. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns were not available in reviewed materials.

Tradeable Assets: Penzo offers trading opportunities across three main categories: foreign exchange pairs, commodity markets, and cryptocurrency instruments. This provides some diversification for trader portfolios.

Cost Structure: Critical information about spreads, commission rates, overnight fees, and other trading costs was not readily available. This hampers trader ability to assess true trading expenses.

Leverage Ratios: Specific leverage offerings and margin requirements were not detailed in available information. This represents a significant information gap for risk assessment.

Platform Options: The broker primarily operates through the MT5 platform. This platform is widely recognized in the industry for its functionality and reliability.

Geographic Restrictions: Information about regional limitations or restricted countries was not specified in available materials.

Customer Support Languages: Details about multilingual support capabilities were not provided in accessible documentation.

This penzo review identifies significant transparency gaps that potential traders should consider carefully before using the platform.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

Penzo's account conditions present significant transparency challenges that contribute to its low rating in this category. The broker has not provided complete information about available account types. This makes it difficult for potential traders to understand their options.

Standard industry practice includes offering multiple account tiers with varying features, minimum deposits, and trading conditions. However, Penzo's approach lacks this clarity. The absence of detailed minimum deposit requirements represents a substantial information gap.

Most reputable brokers clearly communicate entry-level deposit amounts. This allows traders to assess accessibility and plan their trading capital accordingly. Without this fundamental information, potential clients cannot make informed decisions about whether Penzo's services align with their financial capabilities.

Account opening procedures and verification requirements also lack detailed documentation. Professional brokers typically provide step-by-step guidance for account establishment, including required documentation and processing timelines. The limited information available suggests that Penzo may not have established complete onboarding procedures that meet industry standards.

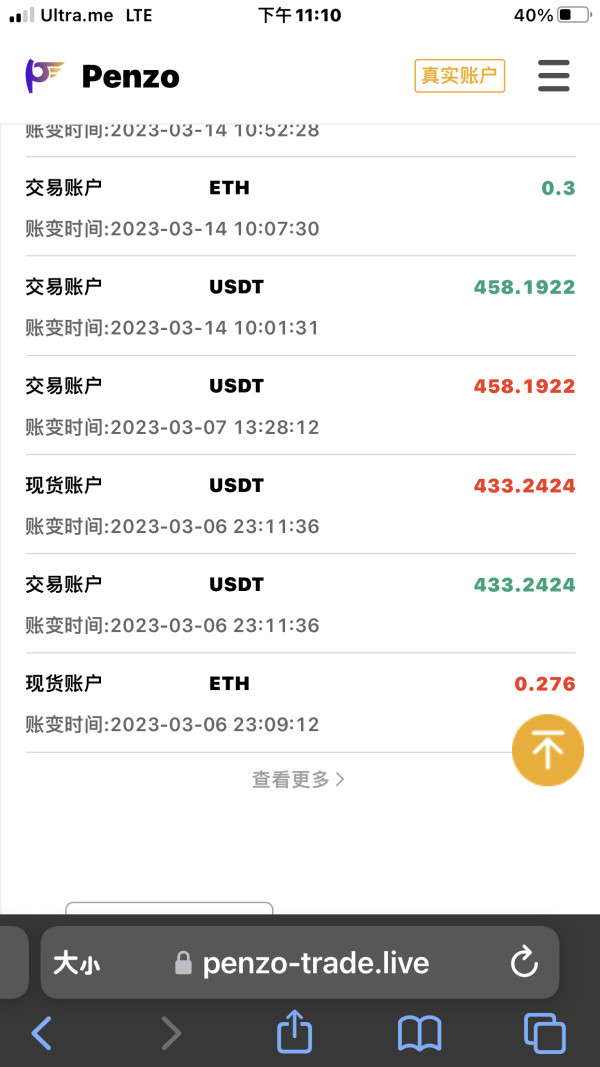

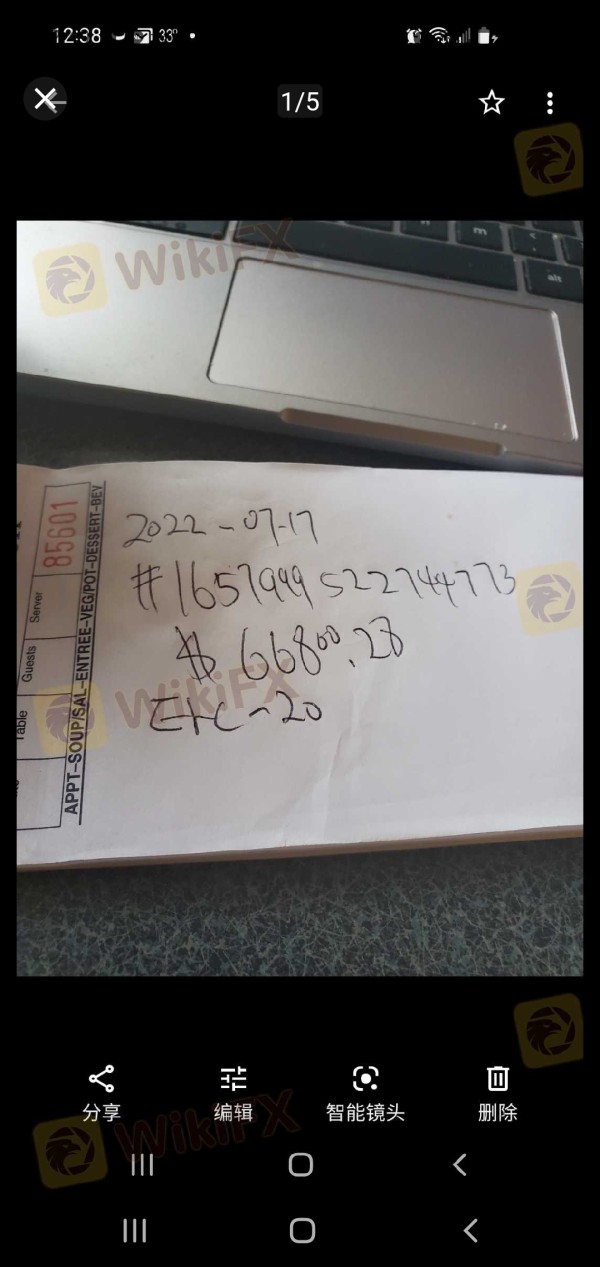

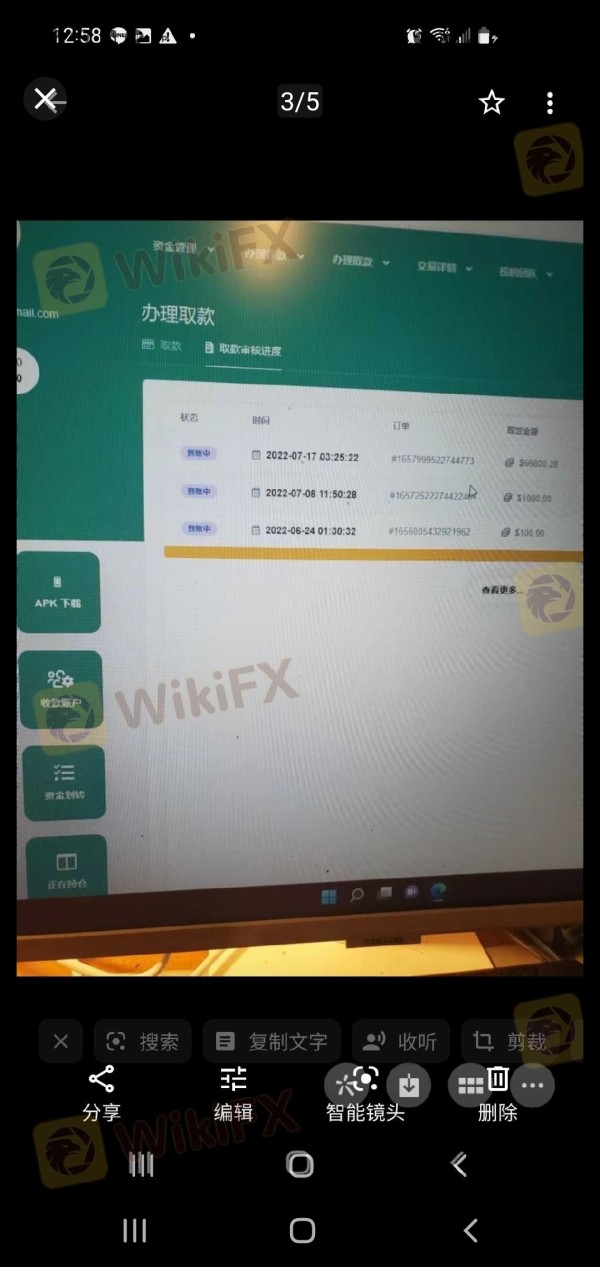

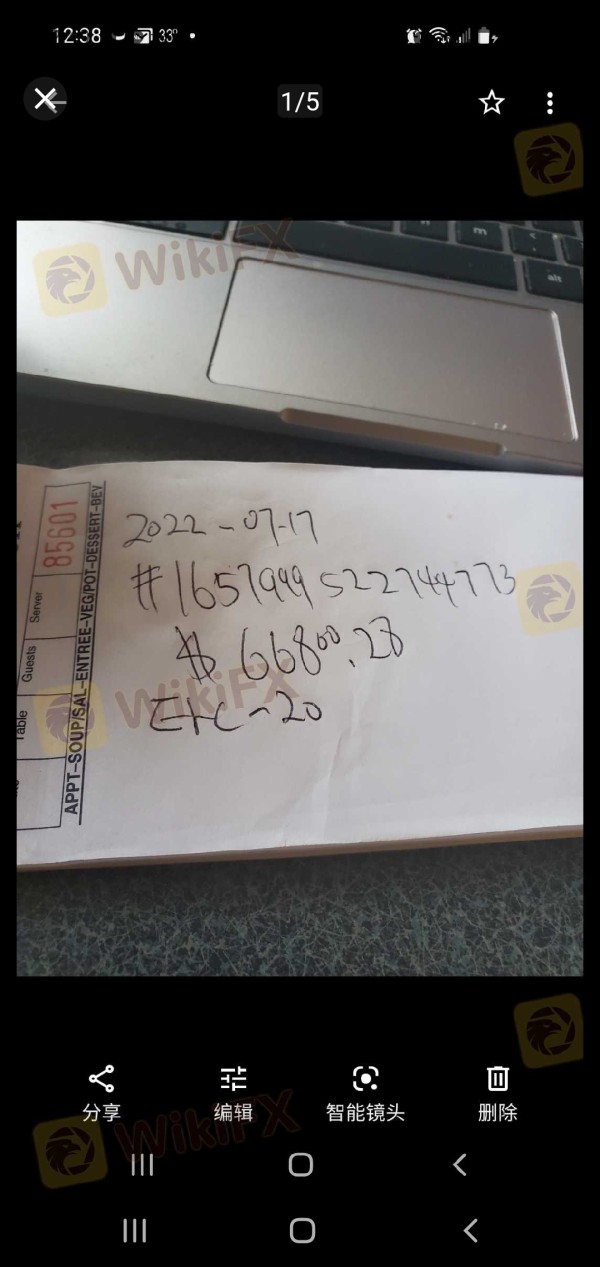

User complaints documented in the 15 formal grievances often reference account-related issues. These include difficulties with account access and unclear terms of service. This penzo review finds that compared to established brokers who maintain transparent account structures, Penzo's lack of detailed account information creates unnecessary uncertainty for potential traders.

Penzo's trading tools and resources offering centers primarily around the MT5 platform. This represents both a strength and a limitation. While MT5 is a professional-grade trading platform with robust functionality, relying solely on this single platform without additional proprietary tools or resources limits the overall value proposition for traders.

The MT5 platform does provide essential trading capabilities including advanced charting, technical analysis tools, and automated trading support through Expert Advisors. These features can serve the basic needs of most retail traders and provide a familiar environment for those experienced with MetaTrader platforms.

However, the absence of additional educational resources, market research, or proprietary analysis tools significantly impacts the overall rating. Leading brokers typically supplement their platform offerings with complete educational materials, daily market analysis, webinars, and trading guides. These resources are particularly valuable for the beginner and intermediate traders that Penzo claims to target.

User feedback regarding tool availability has been generally negative. Traders express dissatisfaction with the limited scope of available resources. The lack of complete market research, economic calendars, or trading signals leaves traders dependent on external sources for market analysis and trading ideas.

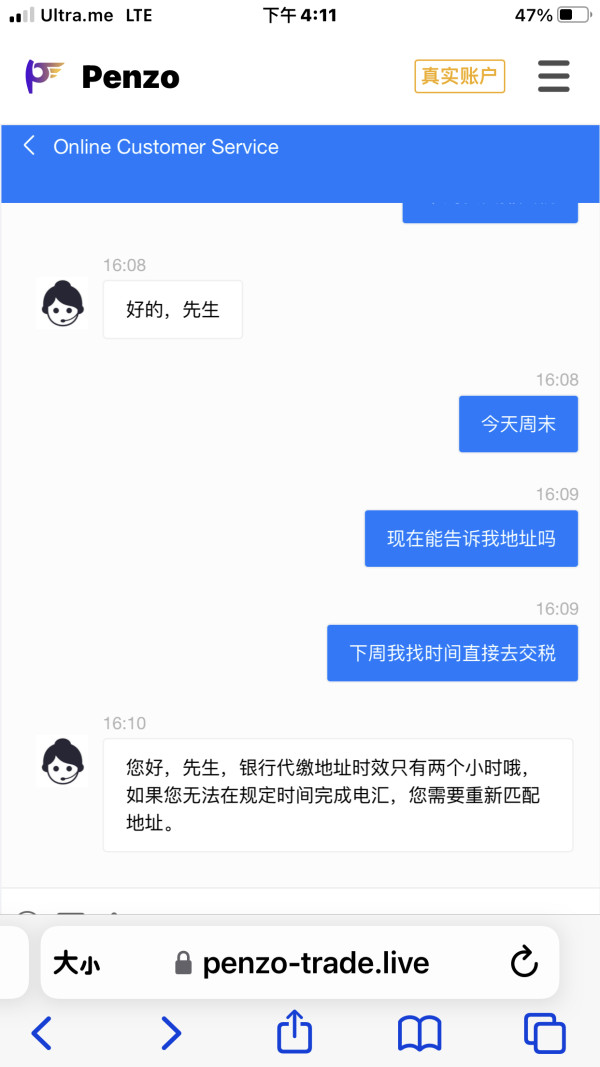

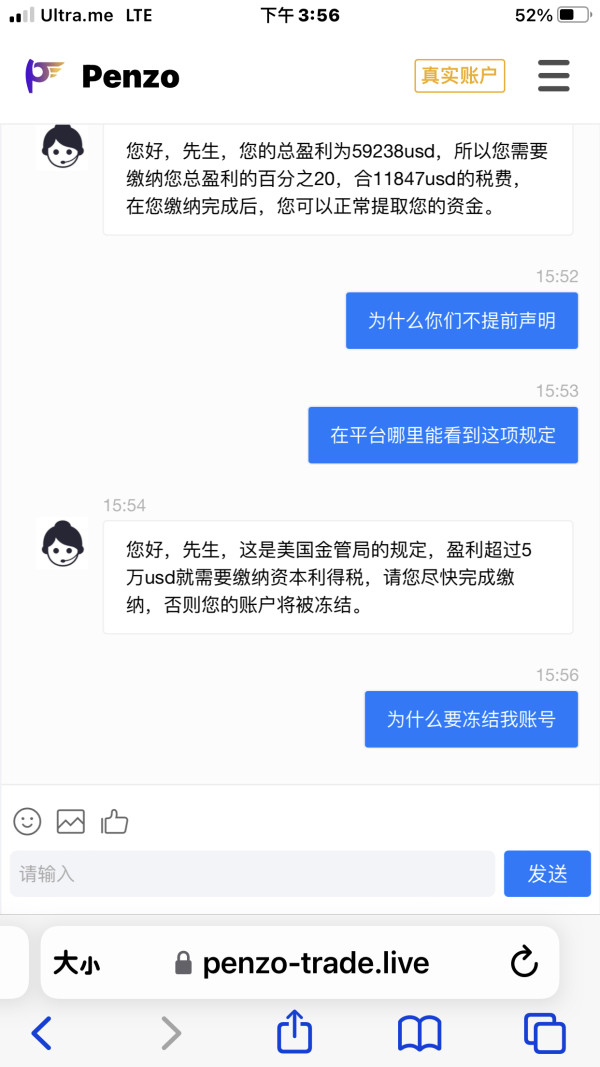

Customer Service Analysis (3/10)

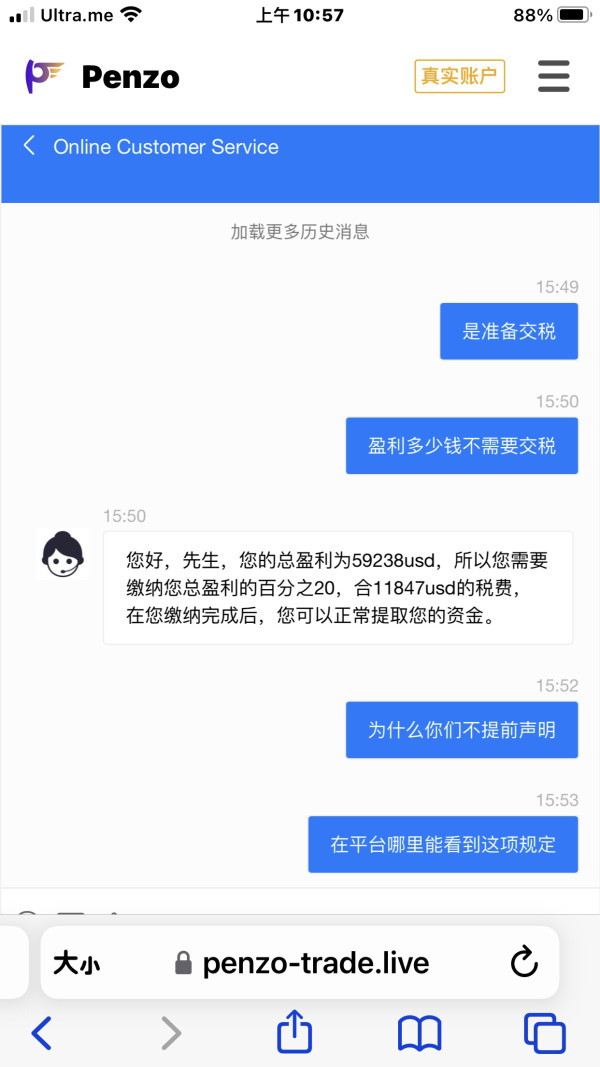

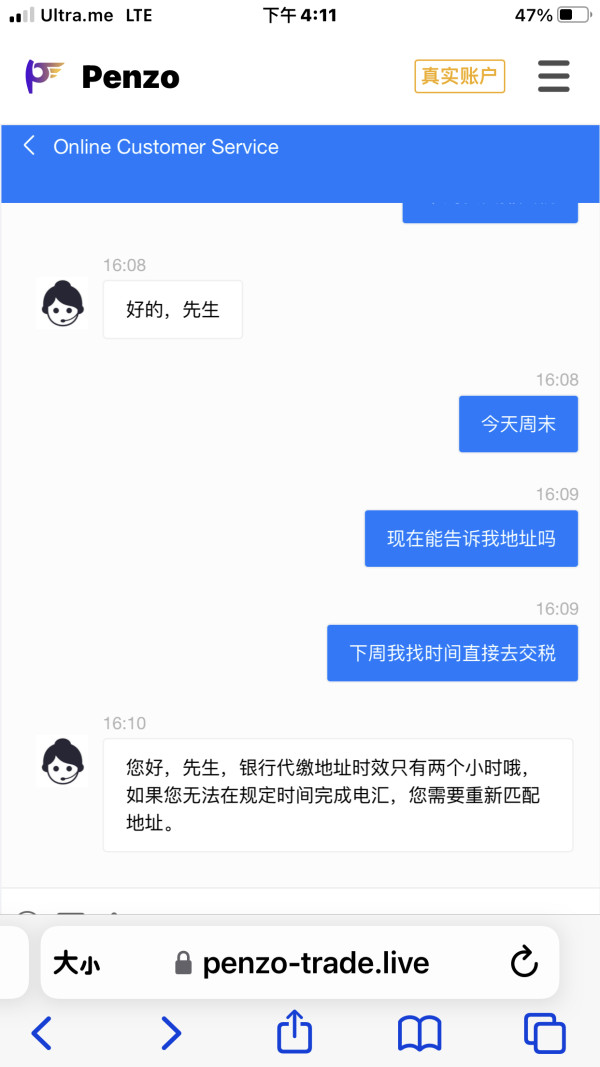

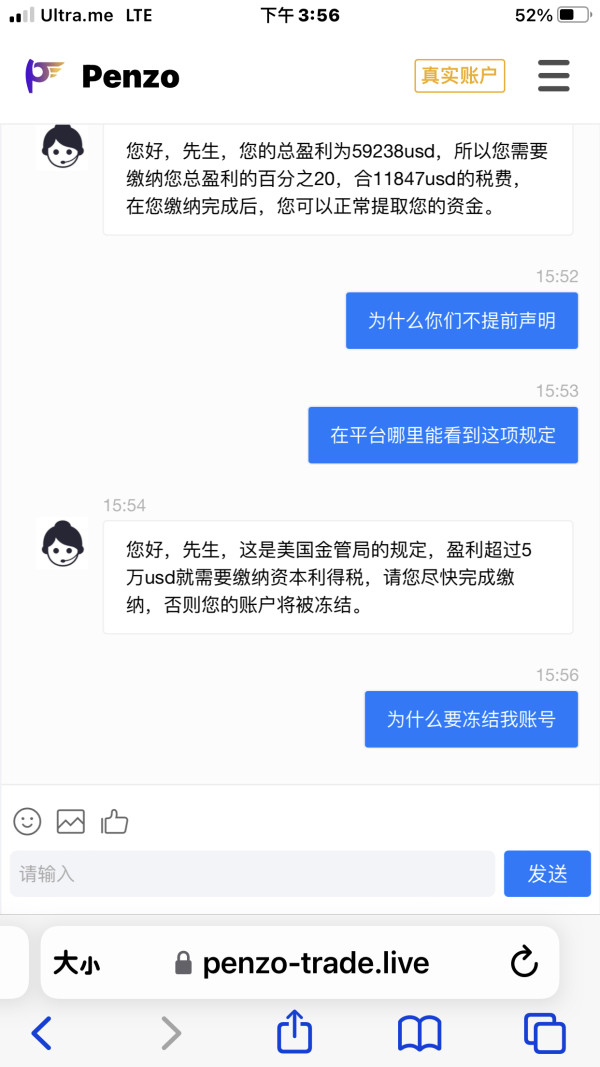

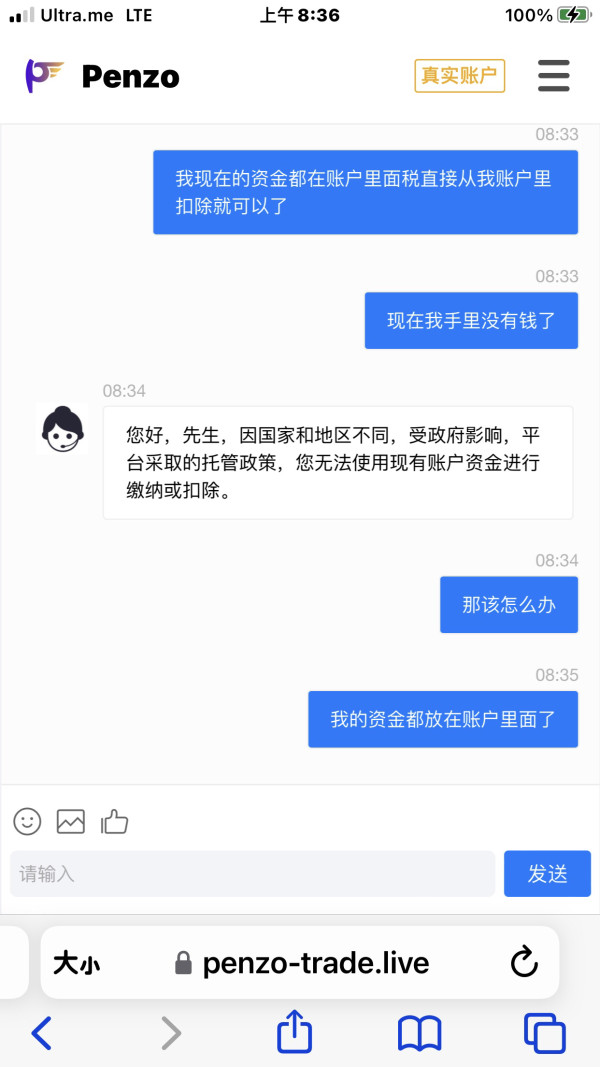

Customer service represents one of Penzo's most significant weaknesses. This is evidenced by the substantial number of user complaints and negative feedback patterns. The 15 documented complaints on WikiFX highlight systematic issues with service quality and responsiveness that directly impact trader satisfaction and confidence.

User feedback consistently points to extended response times for support inquiries. This can be particularly problematic in the fast-moving forex market where timing is crucial. Traders report difficulties in reaching customer support representatives and receiving timely assistance with account or trading issues.

The quality of service interactions also appears to fall short of industry standards. Users have reported unprofessional responses and inadequate resolution of their concerns. Effective customer support should provide knowledgeable assistance, clear communication, and prompt problem resolution, but Penzo's track record suggests deficiencies in these areas.

The absence of detailed information about available support channels, operating hours, and multilingual capabilities further compounds these issues. Professional brokers typically offer multiple contact methods including live chat, phone support, and email assistance with clearly defined response time commitments.

Trading Experience Analysis (4/10)

The trading experience offered by Penzo presents mixed results. Some fundamental platform capabilities are offset by significant information gaps and user satisfaction issues. The MT5 platform foundation provides essential trading functionality, but the overall experience appears to suffer from implementation and support challenges.

Platform stability and execution quality are critical factors for forex traders. Yet specific performance data regarding order execution speeds, slippage rates, and system uptime was not available in reviewed materials. This lack of transparency makes it difficult for traders to assess whether Penzo can deliver the reliable execution required for effective trading strategies.

User feedback regarding trading experience has been predominantly negative. Complaints often reference platform issues and trading difficulties. While some of these issues may be related to user experience rather than platform functionality, the pattern of negative feedback suggests systematic problems with service delivery.

The absence of detailed spread information, commission structures, and trading costs significantly impacts trader ability to assess the true cost of trading with Penzo. Transparent pricing is fundamental to trader decision-making, and this penzo review identifies this as a critical weakness in the overall trading experience.

Trust and Reliability Analysis (2/10)

Trust and reliability represent Penzo's most concerning weakness. Multiple factors contribute to significant doubts about the broker's credibility and operational standards. The absence of clear regulatory information represents a fundamental red flag for potential traders seeking secure and compliant brokerage services.

Regulatory oversight provides essential protections for trader funds and ensures adherence to industry standards for operational practices. The lack of detailed regulatory information makes it impossible to verify whether Penzo operates under appropriate supervision or maintains required client fund protections such as segregated accounts or deposit insurance.

The WikiFX rating of 1.58 out of 10 reflects widespread user dissatisfaction and raises serious questions about the broker's ability to deliver reliable services. This extremely low rating, combined with 15 formal complaints, suggests systematic issues that extend beyond isolated service problems.

Company transparency is another significant concern. Limited information is available about corporate structure, ownership, or operational procedures. Reputable brokers typically provide complete information about their corporate background, regulatory status, and operational practices to build trader confidence.

User Experience Analysis (3/10)

Overall user satisfaction with Penzo appears to be substantially below industry standards. This is evidenced by consistently negative feedback and formal complaints. The pattern of user dissatisfaction suggests systematic issues with service delivery that impact multiple aspects of the trading experience.

The user interface and platform accessibility, while benefiting from the familiar MT5 environment, appear to be undermined by poor support and service quality. Even the most sophisticated trading platform cannot overcome fundamental issues with customer service and operational reliability.

Registration and verification processes lack clear documentation. This creates uncertainty for potential traders about onboarding requirements and timelines. Professional brokers typically provide transparent guidance about account opening procedures, but Penzo's approach appears to lack this clarity.

The 15 documented complaints represent significant user dissatisfaction and suggest that Penzo has not established effective procedures for addressing trader concerns. The types of issues raised in these complaints often relate to fundamental service delivery problems rather than minor operational concerns.

Based on available feedback, this penzo review concludes that while Penzo may be suitable for traders willing to accept higher risk and uncertainty, the documented service issues make it unsuitable for risk-averse traders or those seeking reliable, professional brokerage services.

Conclusion

This complete evaluation reveals that Penzo faces significant challenges in delivering professional brokerage services that meet industry standards. While the broker offers access to diverse markets including forex, commodities, and cryptocurrencies through the MT5 platform, fundamental issues with transparency, customer service, and regulatory clarity severely impact its overall viability as a trading partner.

The extremely low WikiFX rating of 1.58 and accumulation of 15 user complaints indicate systematic problems that extend beyond isolated service issues. The absence of clear regulatory information and transparent operational details creates unnecessary risk for potential traders, particularly those seeking secure and reliable brokerage relationships.

Based on this analysis, Penzo cannot be recommended for risk-averse traders or those prioritizing regulatory protection and service reliability. While some traders may find value in the platform's market access, the documented service issues and transparency gaps suggest that most traders would be better served by more established and regulated alternatives in the competitive forex brokerage market.