Is Penzo safe?

Pros

Cons

Is Penzo Safe or a Scam?

Introduction

Penzo is a relatively new player in the forex trading market, having been established in 2021. Operating out of Hong Kong, it offers a platform for trading various financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to expand, traders are increasingly faced with a plethora of brokers, making it imperative to evaluate their credibility and safety. The rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough due diligence before investing their funds. This article aims to provide an objective analysis of Penzo, assessing its credibility, regulatory standing, and overall safety for traders. Our evaluation will be based on a combination of regulatory information, customer feedback, and industry standards.

Regulation and Legitimacy

Regulation is a critical factor in determining whether a forex broker is trustworthy. A regulated broker is subject to oversight by financial authorities, which helps ensure that they operate within legal frameworks and adhere to industry standards. In the case of Penzo, it claims to be licensed by the National Futures Association (NFA), but this license is categorized as unauthorized. This raises significant concerns about the broker's legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0548011 | USA | Unauthorized |

The lack of proper regulation is a red flag for potential investors. While Penzo presents itself as a legitimate broker, the unauthorized status of its NFA license suggests that it does not meet the necessary regulatory requirements. This lack of oversight can expose traders to various risks, including the potential for fraud and mismanagement of funds. Furthermore, historical compliance issues or regulatory actions against the broker have not been disclosed, adding to the uncertainty surrounding its operations. Therefore, when evaluating whether Penzo is safe, the absence of credible regulatory oversight is a major concern.

Company Background Investigation

Penzo's operational history is relatively short, having been founded in 2021. The broker's ownership structure is not transparent, as there is little information available regarding its management team or their professional backgrounds. This lack of transparency can be a significant concern for potential investors, as it raises questions about the broker's accountability and operational integrity.

Furthermore, the absence of detailed information about the company's history, development, and ownership can lead to skepticism about its credibility. A well-established broker typically provides comprehensive information regarding its management team, including their qualifications and experience in the financial industry. In the case of Penzo, such disclosures are notably lacking, which diminishes the broker's perceived trustworthiness. Moreover, the information provided on its website appears to be generic and does not offer insights into the company's operational practices or values. Therefore, when assessing whether Penzo is safe, the opacity surrounding its company background is a significant point of concern.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for any trader. Penzo advertises competitive trading conditions, including access to the MetaTrader 5 platform and various financial instruments. However, a closer look reveals a lack of transparency regarding its fee structure, which is essential for traders to make informed decisions.

| Fee Type | Penzo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.2 - 0.5 pips |

| Commission Model | Not specified | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

While the spread of 0.1 pips on major currency pairs seems attractive, the absence of clear information regarding commissions and other fees raises concerns. Traders may find themselves facing unexpected costs that could significantly impact their profitability. Additionally, the lack of a transparent overnight interest policy can create confusion about potential costs associated with holding positions overnight. This opacity in trading conditions leads to a greater risk of traders being caught off guard by hidden fees, further questioning whether Penzo is safe for trading.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. A reputable broker should implement stringent measures to protect client assets, including segregating client funds from operational funds and offering investor protection schemes. In the case of Penzo, there is limited information available about its security measures.

It is crucial to assess whether Penzo provides adequate fund segregation, which is a standard practice among regulated brokers. Additionally, the broker's stance on negative balance protection is unclear, which could leave traders vulnerable to significant losses in volatile market conditions. The absence of documented safety measures raises concerns about how well Penzo safeguards its clients' investments. Historical disputes or incidents involving the mishandling of funds have not been reported, but the lack of transparency regarding fund security protocols is a significant drawback. Consequently, potential investors should carefully consider these factors before determining if Penzo is safe for their trading activities.

Customer Experience and Complaints

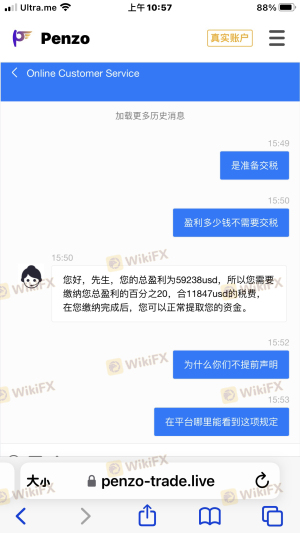

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of Penzo, several complaints have surfaced, indicating a pattern of user dissatisfaction. Common complaints include difficulties with fund withdrawals and inadequate customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Poor Customer Support | Medium | Limited availability |

A notable case involved a trader who successfully withdrew funds initially but faced significant challenges during subsequent withdrawal attempts, leading to frustration and claims of fraudulent practices. The trader reported being asked to pay excessive fees for tax purposes, which raised alarms about the broker's legitimacy. Such experiences suggest that customers may encounter significant hurdles when attempting to access their funds, further questioning whether Penzo is safe for trading.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Penzo utilizes the MetaTrader 5 platform, which is widely recognized for its advanced features and user-friendly interface. However, user reviews indicate mixed experiences regarding platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. While the MT5 platform generally offers reliable execution, any signs of manipulation or unreliable performance can lead to serious concerns about the broker's integrity. Therefore, evaluating the platform's performance is essential in determining whether Penzo is safe for executing trades.

Risk Assessment

Utilizing any forex broker carries inherent risks, and Penzo is no exception. The lack of regulation, transparency, and customer complaints all contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unauthorized status of NFA license. |

| Transparency Risk | Medium | Limited information about ownership and management. |

| Customer Service Risk | High | Numerous complaints regarding support and withdrawals. |

To mitigate these risks, potential investors should consider diversifying their trading activities and opting for brokers with established reputations and regulatory oversight. Conducting thorough research and seeking out reviews from credible sources can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence gathered indicates that Penzo raises significant red flags regarding its safety and credibility. The unauthorized regulatory status, lack of transparency, and numerous customer complaints suggest that traders should exercise extreme caution when considering this broker. While Penzo may offer attractive trading conditions, the potential risks associated with inadequate oversight and questionable practices outweigh the benefits.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of customer satisfaction and transparent operations. Brokers such as Exness or GMI may offer safer trading environments with better regulatory protections. Ultimately, understanding the risks and conducting thorough due diligence are essential steps in ensuring a secure trading experience.

Is Penzo a scam, or is it legit?

The latest exposure and evaluation content of Penzo brokers.

Penzo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Penzo latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.