NextLevel Trade 2025 Review: Everything You Need to Know

Summary: NextLevel Trade has emerged as a controversial player in the forex brokerage scene, with mixed reviews highlighting both potential benefits and significant risks. Key features include a user-friendly interface and a wide range of trading instruments, but concerns about regulatory compliance and customer service persist.

Note: It's essential to be aware that the various entities operating under similar names across different regions can lead to confusion. This review aims for fairness and accuracy by synthesizing multiple sources of information.

Ratings Overview

We evaluate brokers based on user feedback, expert opinions, and factual data.

Broker Overview

NextLevel Trade was established in 2024 and is headquartered in Comoros, specifically on Bonovo Road, Fomboni Island. The broker primarily operates under the MISA (Comoros) regulatory framework, which some experts have flagged as lacking in credibility compared to more stringent regulatory bodies. The trading platform offered is MetaTrader 5 (MT5), and traders can access a variety of assets including forex, commodities, cryptocurrencies, and indices.

Detailed Breakdown

Regulatory Regions

NextLevel Trade is regulated by MISA in Comoros, which has raised eyebrows due to its reputation as an offshore jurisdiction. This has led to skepticism about the broker's legitimacy and operational transparency.

Deposit/Withdrawal Currencies

The broker supports multiple base currencies, including AUD, EUR, GBP, and USD. However, specific details about withdrawal methods and any associated fees remain unclear.

Minimum Deposit

The minimum deposit required to open an account with NextLevel Trade is set at $100, which is relatively accessible compared to many other brokers.

No specific promotions or bonuses were mentioned in the sources, indicating a potential lack of competitive incentives for new traders.

Tradable Asset Categories

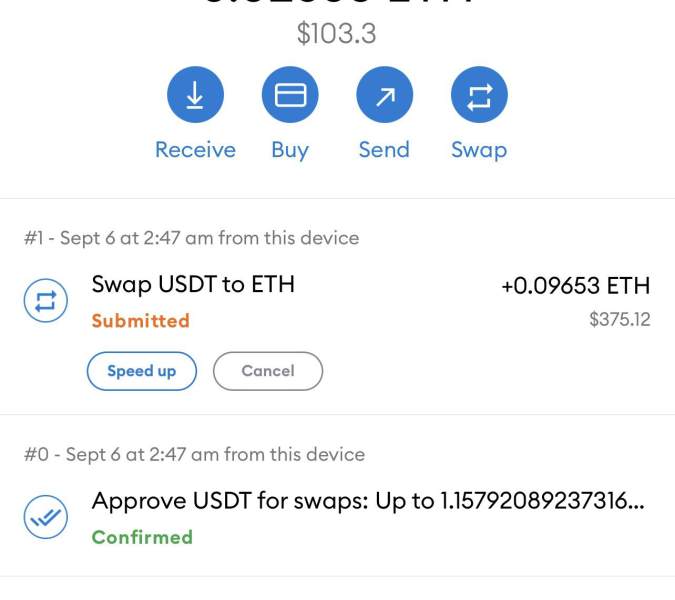

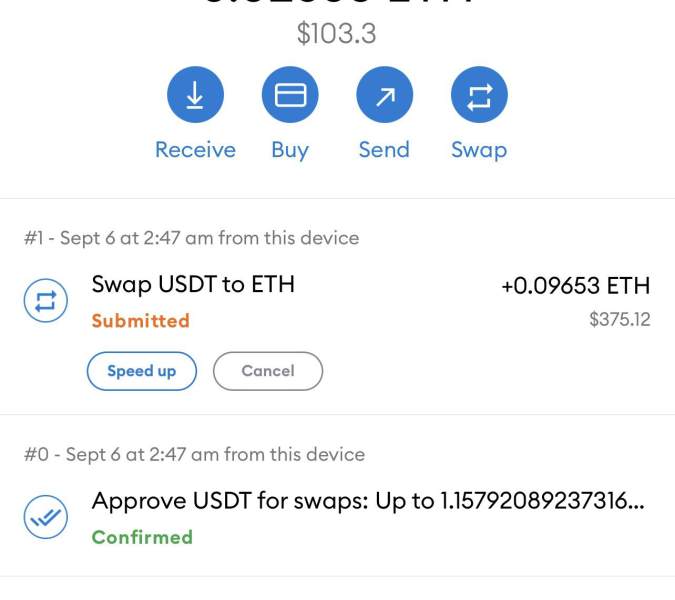

NextLevel Trade allows trading in various asset classes, including forex pairs, commodities, cryptocurrencies, and indices. This diversity may appeal to traders looking for a broad investment portfolio.

Costs (Spreads, Fees, Commissions)

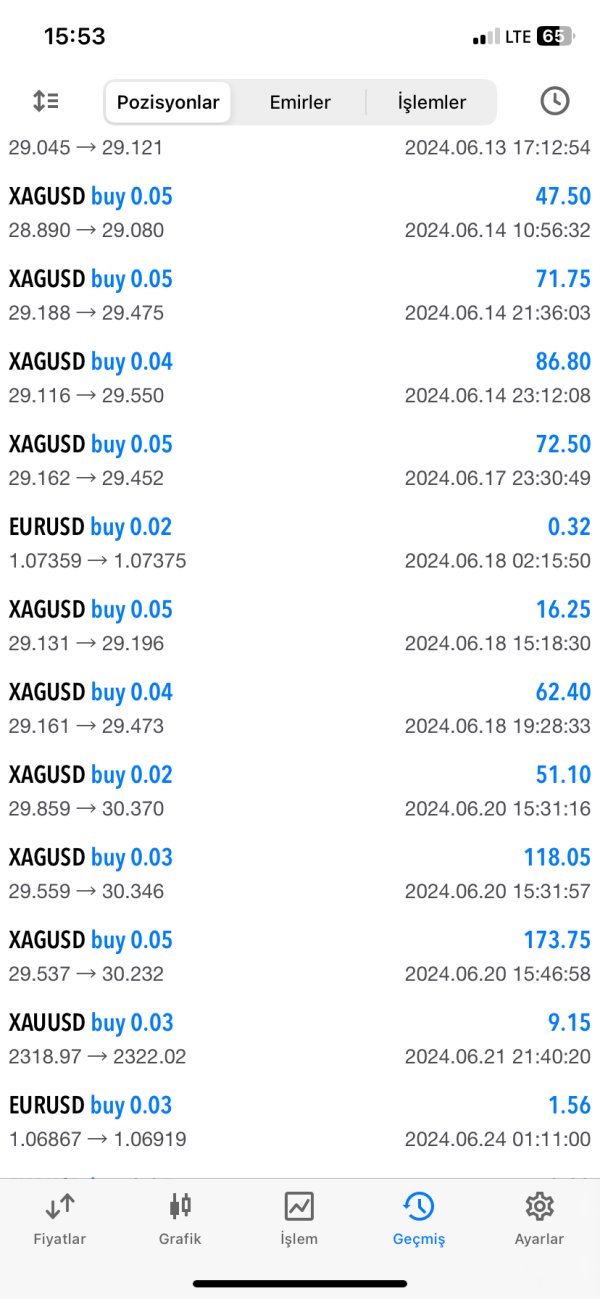

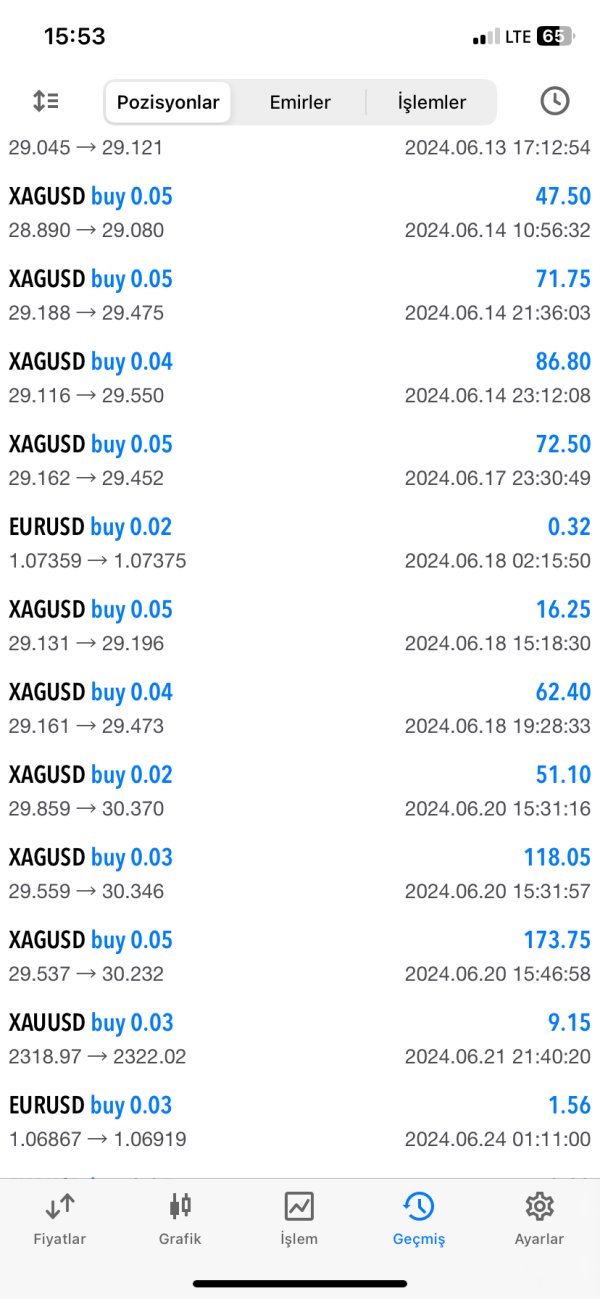

The average spread for the EUR/USD pair is reported to be approximately 1.3 pips. However, there is limited information on additional fees or commissions that might apply, which can be a red flag for potential investors.

Leverage

The broker offers a maximum leverage of 1:500, which is attractive for traders looking to maximize their trading potential. However, high leverage also increases risk significantly.

NextLevel Trade exclusively utilizes the MT5 platform, which is well-regarded among traders for its advanced features. However, the absence of a demo account is a notable drawback.

Restricted Regions

Countries such as Turkey and the United States are explicitly not accepted, which could limit access for many potential traders.

Available Customer Service Languages

Customer support primarily operates through email and phone, with no clear indication of the languages supported beyond English.

Repeated Ratings Overview

Detailed Rating Breakdown

Account Conditions

While the minimum deposit is relatively low, the lack of a demo account and limited educational resources may deter new traders. As highlighted by Forex Penguin, the absence of a demo account limits the ability to practice without financial risk.

NextLevel Trade offers basic tools but lacks comprehensive educational materials or advanced trading tools that many traders expect. This deficiency can hinder the trading experience, especially for beginners.

Customer Service

Customer service has been rated poorly, with users reporting difficulties in reaching support. The reliance on email and phone without live chat options is a significant drawback, particularly in a fast-paced trading environment.

Trading Experience

Traders have noted that the MT5 platform provides a good trading experience, with fast execution speeds. However, the high leverage offered can lead to significant risks, which traders must manage carefully.

Trustworthiness

The regulatory status of NextLevel Trade raises concerns. The MISA regulation is not viewed as robust as those from top-tier regulatory bodies, leading to questions about the broker's reliability. As noted in various reviews, potential traders should exercise caution.

User Experience

The user experience is generally positive due to the platform's user-friendly interface. However, the lack of educational resources and the limited customer service options detract from the overall experience.

In conclusion, NextLevel Trade presents both opportunities and risks. While it offers a range of trading instruments and a user-friendly platform, potential investors should carefully consider the regulatory environment and customer service quality before committing funds.