Is NextLevel Trade safe?

Business

License

Is NextLevel Trade A Scam?

Introduction

NextLevel Trade is an online forex broker that positions itself as a platform for trading various financial instruments, including forex, cryptocurrencies, commodities, and indices. Established in 2023, it claims to offer innovative trading solutions with a user-friendly interface and advanced tools. However, as the forex market has seen a rise in fraudulent activities, it is essential for traders to exercise caution when evaluating brokers. This article aims to provide an objective analysis of NextLevel Trade by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk assessment. The findings are based on a comprehensive review of multiple online sources, including user feedback, regulatory databases, and expert opinions.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the legitimacy of any trading platform. NextLevel Trade operates under the supervision of the Comoros International Services Authority (MISA), which provides retail forex licenses. However, the effectiveness and credibility of this regulation are often questioned, as many offshore regulatory bodies do not enforce stringent compliance standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | BF X 2024048 | Comoros | Verified |

While NextLevel Trade holds a license, it is important to note that being regulated by a less reputable authority raises concerns about the potential for mismanagement and lack of investor protection. The absence of oversight from more recognized regulators, such as the FCA (UK) or ASIC (Australia), diminishes the credibility of its operational framework. Furthermore, some reviews have flagged the broker as blacklisted or not recommended by various financial watchdogs, indicating that potential investors should approach with caution.

Company Background Investigation

NextLevel Trade is registered in Comoros, specifically at Bonovo Road, Fomboni Island. The company claims to have been operational for a short period, having been founded in 2023. The ownership structure and management team details are not readily available, leading to questions regarding transparency. A lack of information about the founders and their professional backgrounds may indicate a red flag for potential investors.

The absence of a comprehensive disclosure policy can further complicate the decision-making process for traders. Transparency in company operations is crucial for building trust, and the lack of such information raises concerns about the broker's intentions. A well-established broker typically provides detailed information about its management team, including their experience in the financial sector, which NextLevel Trade fails to do.

Trading Conditions Analysis

NextLevel Trade offers a variety of trading instruments with competitive spreads; however, the overall fee structure remains a critical area of concern. The broker does not offer a demo account, which is generally a standard feature among reputable brokers, making it difficult for potential clients to assess the trading environment before committing funds.

| Fee Type | NextLevel Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The spread on major currency pairs starts at 1.3 pips, which is within the industry average but does not offer a significant competitive edge. The lack of a clear commission structure raises questions about hidden fees that could impact profitability. Traders should be wary of any unexpected charges that may arise during trading or withdrawal processes, as these can significantly affect overall returns.

Customer Fund Safety

The safety of client funds is paramount in the forex trading industry. NextLevel Trade claims to employ various security measures, including fund segregation and negative balance protection. However, the effectiveness of these measures remains uncertain due to the broker's offshore status.

The absence of a compensation scheme for investors adds another layer of risk. In the event of insolvency or mismanagement, traders may find it challenging to recover their funds. Historically, offshore brokers have been associated with higher risks of fund misappropriation, which necessitates thorough due diligence from potential investors.

Customer Experience and Complaints

Customer feedback is critical in assessing the reliability of any trading platform. NextLevel Trade has received mixed reviews, with some users reporting satisfactory experiences while others have flagged issues related to withdrawal delays and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Customer Support | Medium | Limited options |

| Misleading Marketing Claims | High | No acknowledgment |

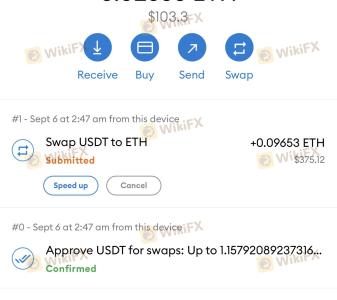

Common complaints include difficulties in withdrawing funds, which can be a significant red flag for potential investors. A review of customer experiences indicates that the companys response to complaints is often slow, which could further exacerbate user dissatisfaction. One notable case involved a trader who experienced significant delays in fund withdrawal, leading to frustration and loss of trust in the broker.

Platform and Execution Quality

NextLevel Trade utilizes the MetaTrader 5 (MT5) platform, which is widely recognized for its robust features and user-friendly interface. However, user experiences regarding platform stability and order execution quality vary. Reports of slippage and rejected orders have been noted, which can impact trading performance, particularly in volatile market conditions.

The overall execution quality is essential for traders, especially those engaging in high-frequency trading or scalping strategies. Any signs of platform manipulation or technical issues can severely affect a trader's ability to capitalize on market opportunities.

Risk Assessment

Using NextLevel Trade presents a variety of risks that potential investors should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack enforcement. |

| Fund Safety Risk | High | No compensation scheme for investors. |

| Customer Service Risk | Medium | Reports of slow response to complaints. |

| Execution Risk | Medium | Issues with slippage and order rejections. |

To mitigate these risks, traders should only invest amounts they can afford to lose and consider diversifying their trading portfolio across multiple brokers. Additionally, conducting regular reviews of the broker's performance and regulatory status can help in making informed decisions.

Conclusion and Recommendations

In conclusion, while NextLevel Trade presents itself as a viable trading option, significant concerns regarding its regulatory status, transparency, and customer experiences warrant caution. The combination of offshore regulation, limited information about the management team, and reports of withdrawal issues raises red flags that potential investors should not ignore.

For traders seeking a reliable and regulated forex broker, it may be prudent to consider alternatives with stronger regulatory oversight and a proven track record of customer satisfaction. Brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC are generally more trustworthy and offer better protection for investor funds.

Is NextLevel Trade a scam, or is it legit?

The latest exposure and evaluation content of NextLevel Trade brokers.

NextLevel Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NextLevel Trade latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.