Morgan Pre 2025 Review: Everything You Need to Know

Summary: The Morgan Pre brokerage has raised numerous concerns among traders and analysts alike, primarily due to its unregulated status and questionable practices. Many users report difficulties with withdrawals and a lack of transparency, leading to a consensus that this broker may not be a safe choice for trading.

Note: It's crucial to recognize that different entities operate under the same name across various jurisdictions, which may affect the regulatory oversight and safety of your investments. This review aims for fairness and accuracy by aggregating insights from multiple sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on an analysis of user experiences, expert opinions, and factual data regarding services and offerings.

Broker Overview

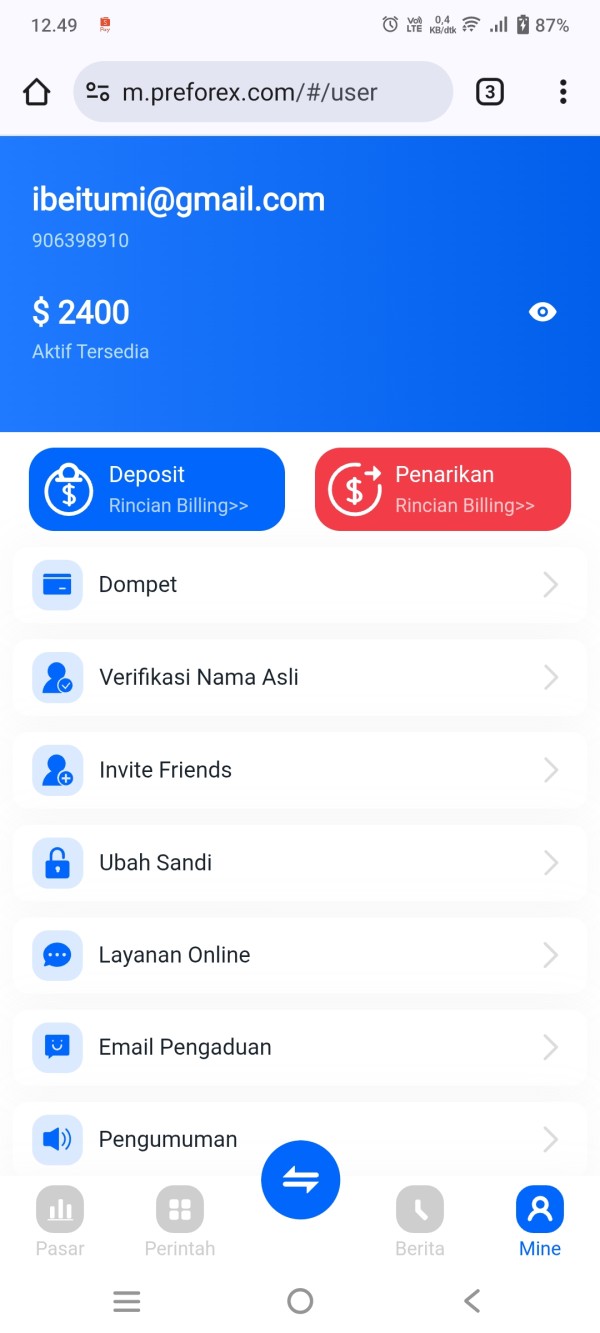

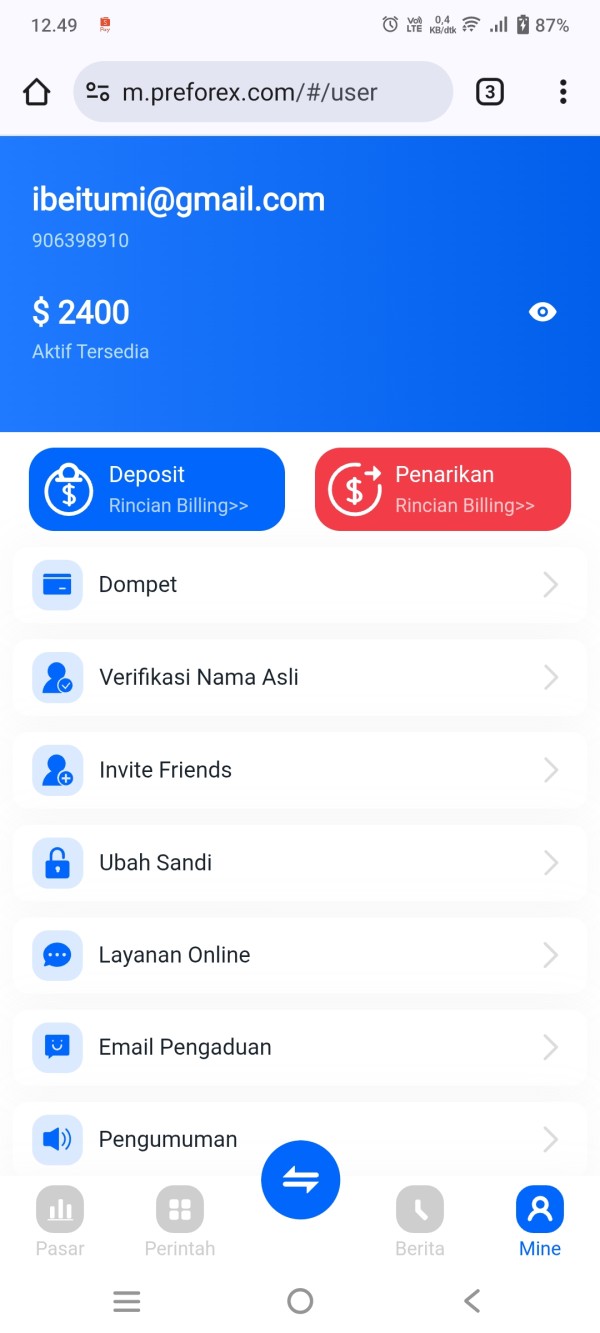

Morgan Pre Limited is a newly established forex broker, founded in 2024 and registered in New York City, USA. The broker operates through its proprietary platform, known as ST5, and does not support popular trading platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Morgan Pre claims to offer various trading services, including forex, commodities, stock indices, precious metals, and energy derivatives. However, the lack of regulatory oversight raises significant concerns regarding the safety of client funds.

Detailed Breakdown

Regulatory Status and Geographic Coverage

Morgan Pre claims to operate under several regulatory bodies, including the Investment Industry Regulatory Organization of Canada (IIROC) and the U.S. National Futures Association (NFA). However, investigations reveal that no records of Morgan Pre are found within these organizations, indicating a lack of legitimate regulation. This unregulated status is a major red flag for potential investors, as it exposes them to significant risks without any recourse in case of disputes or issues.

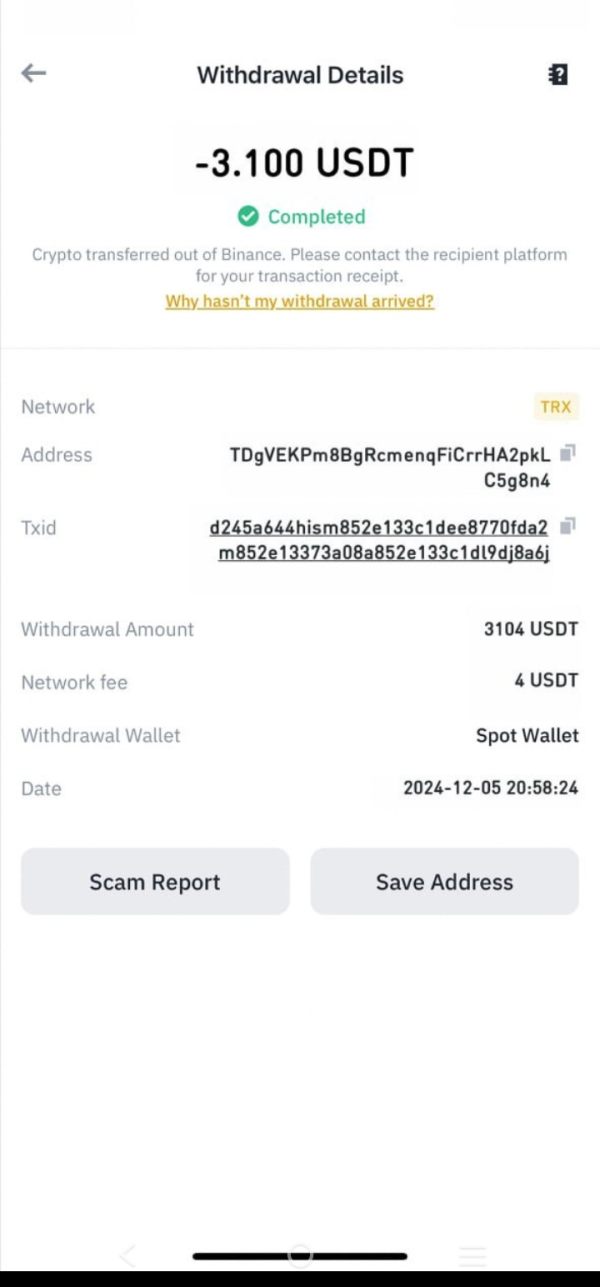

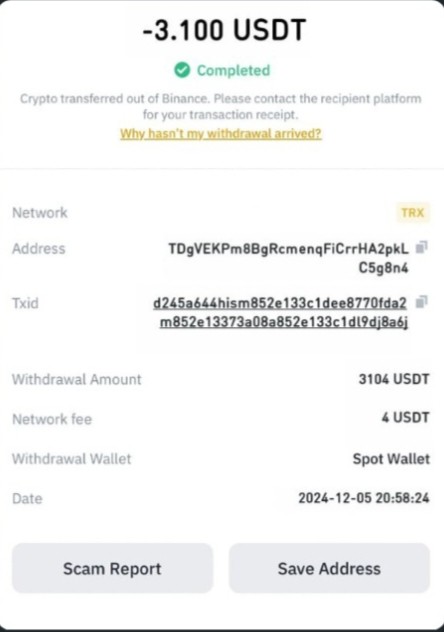

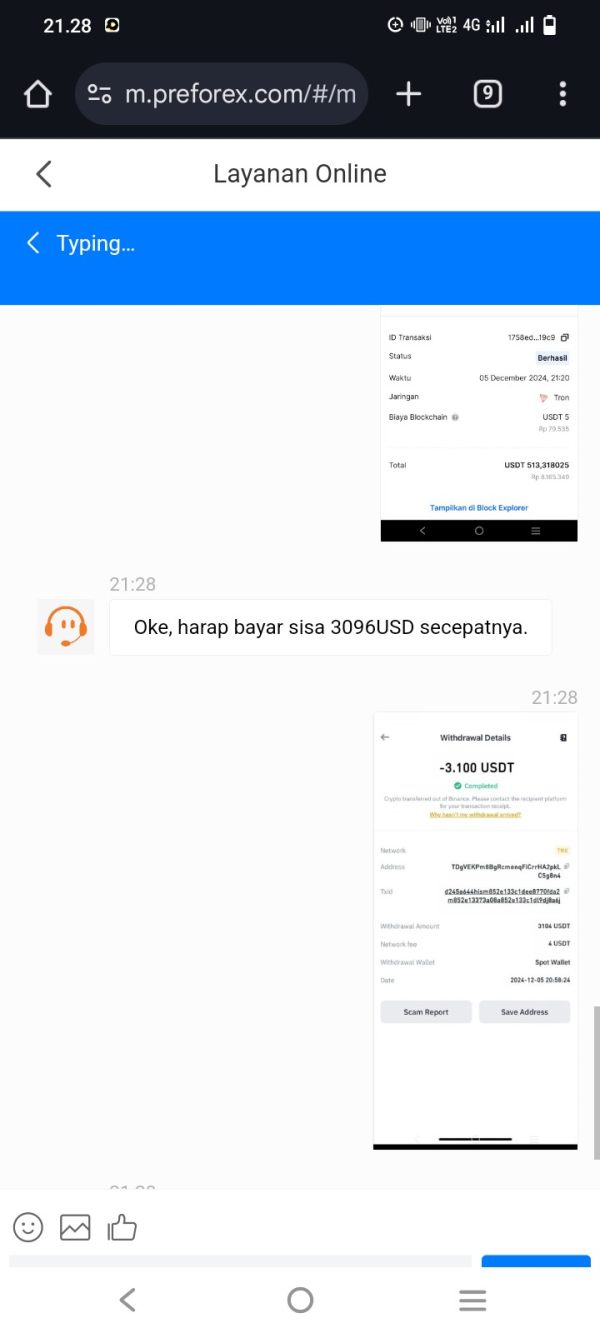

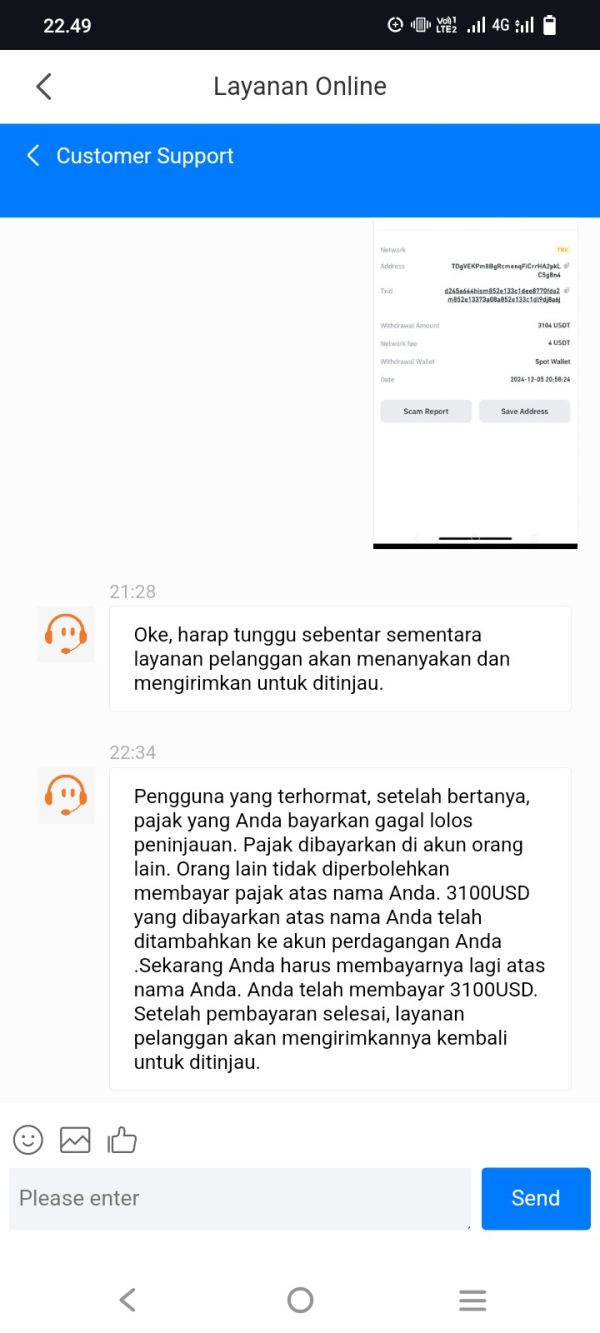

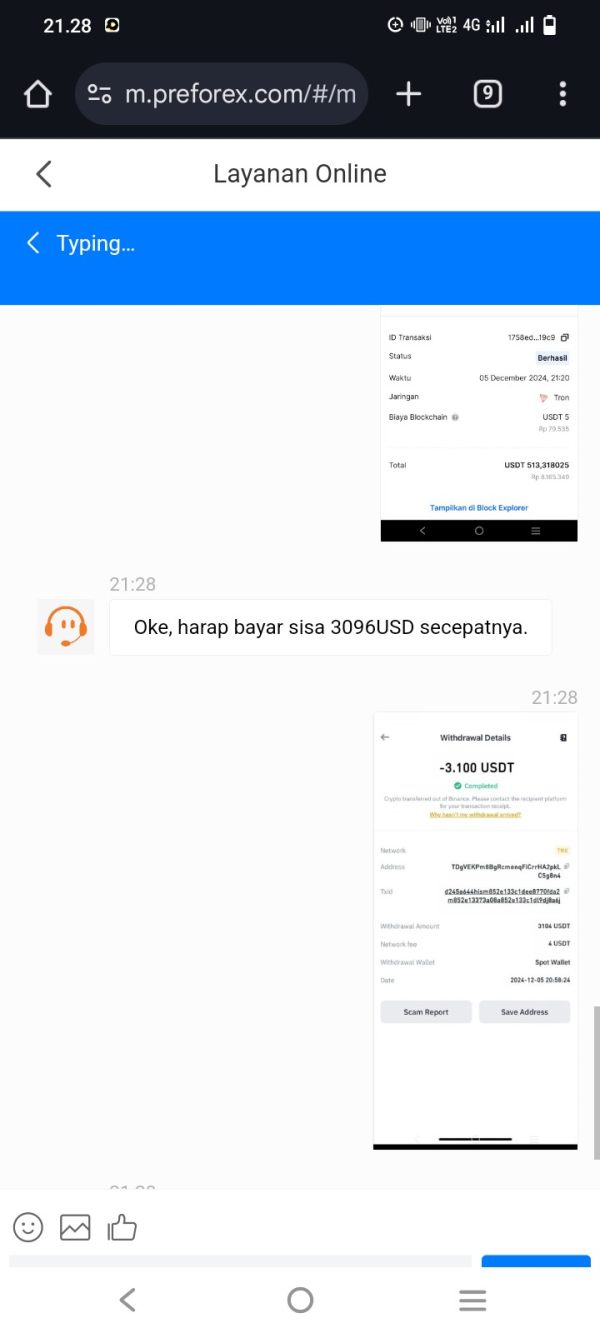

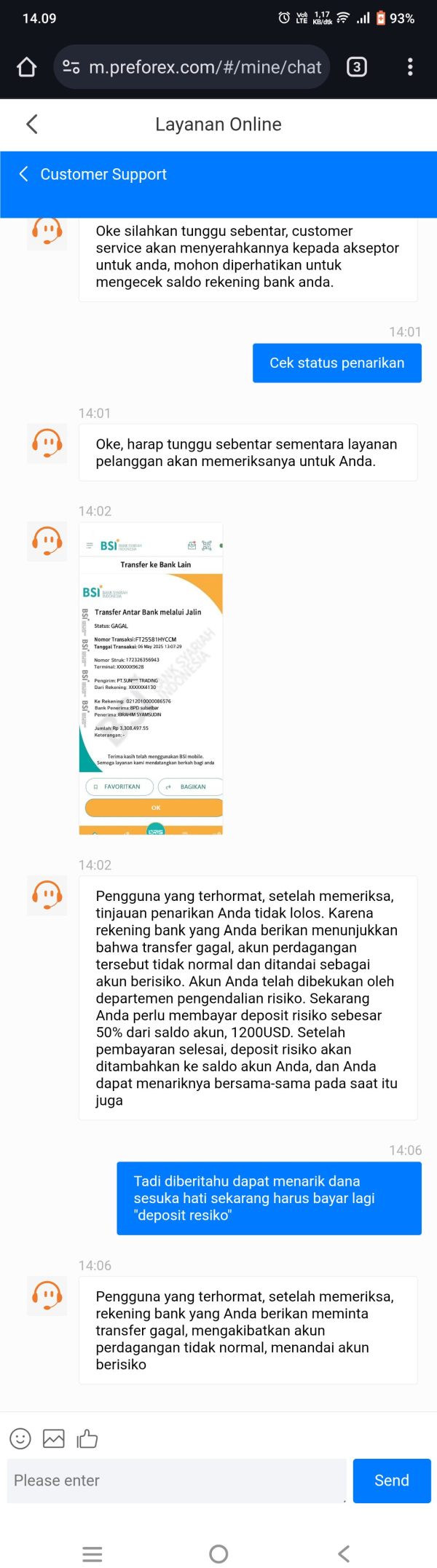

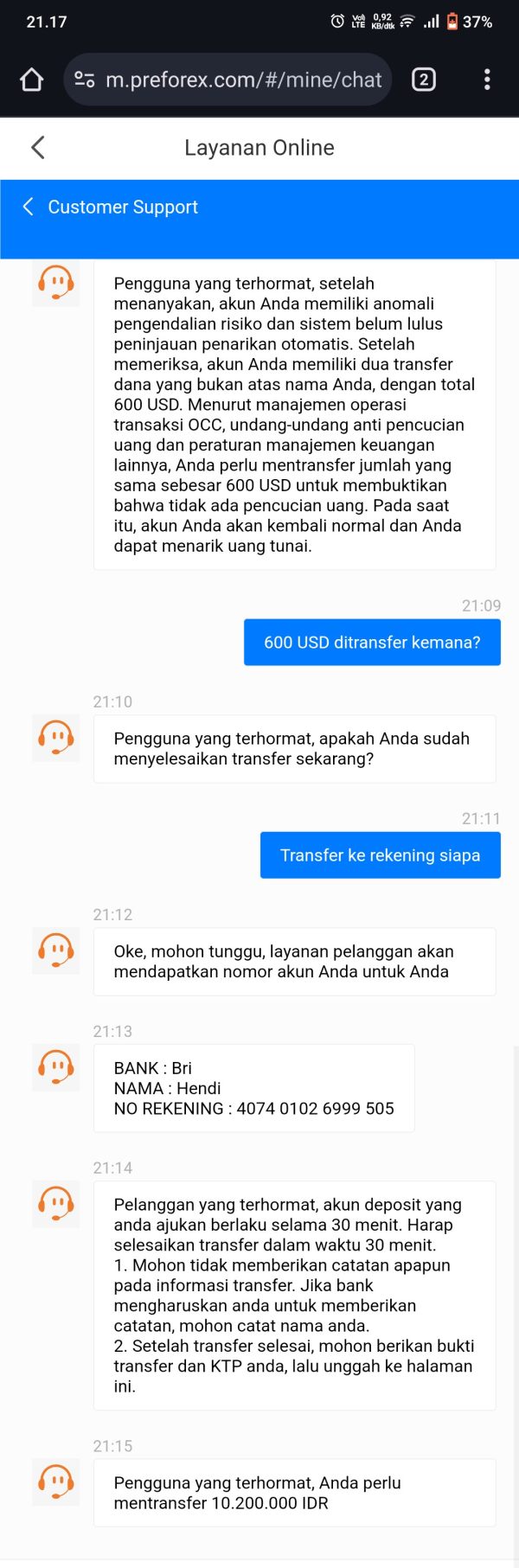

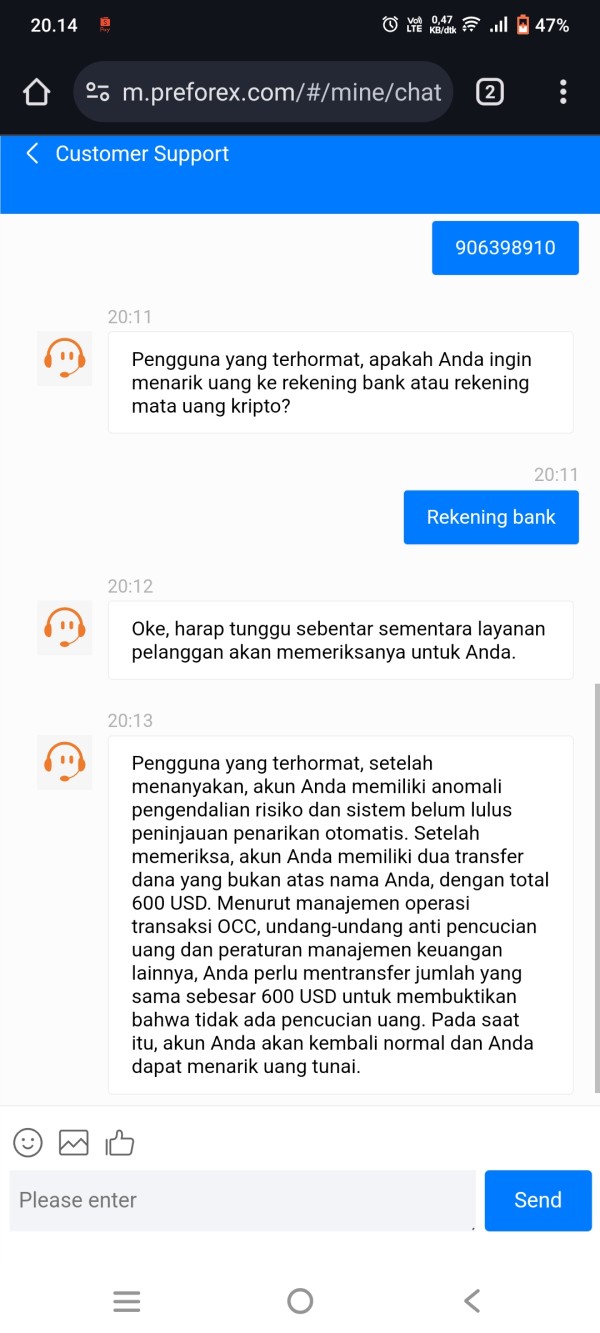

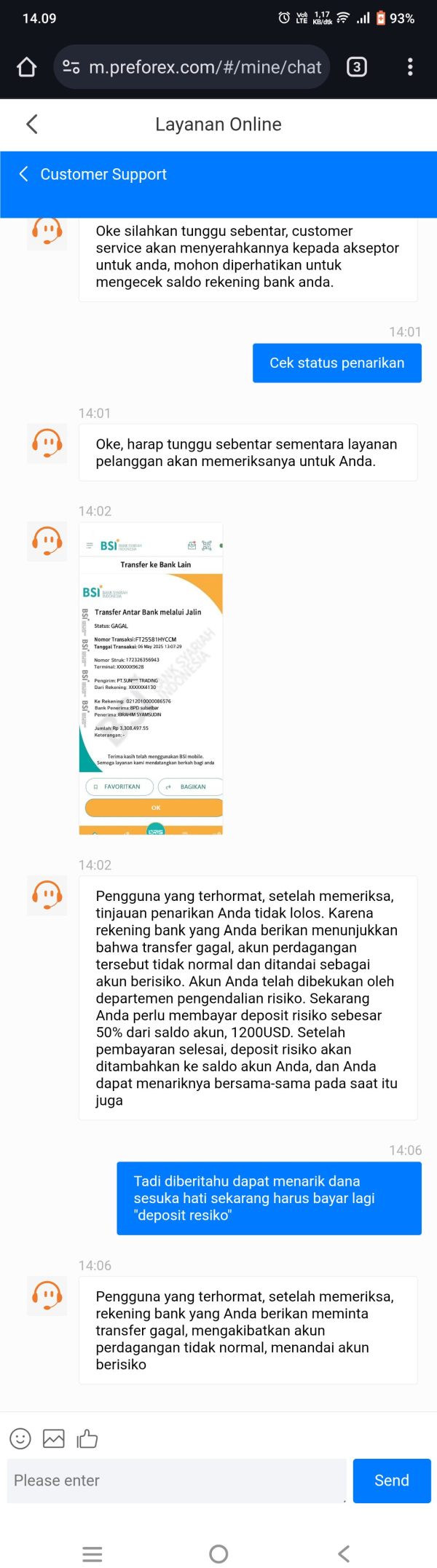

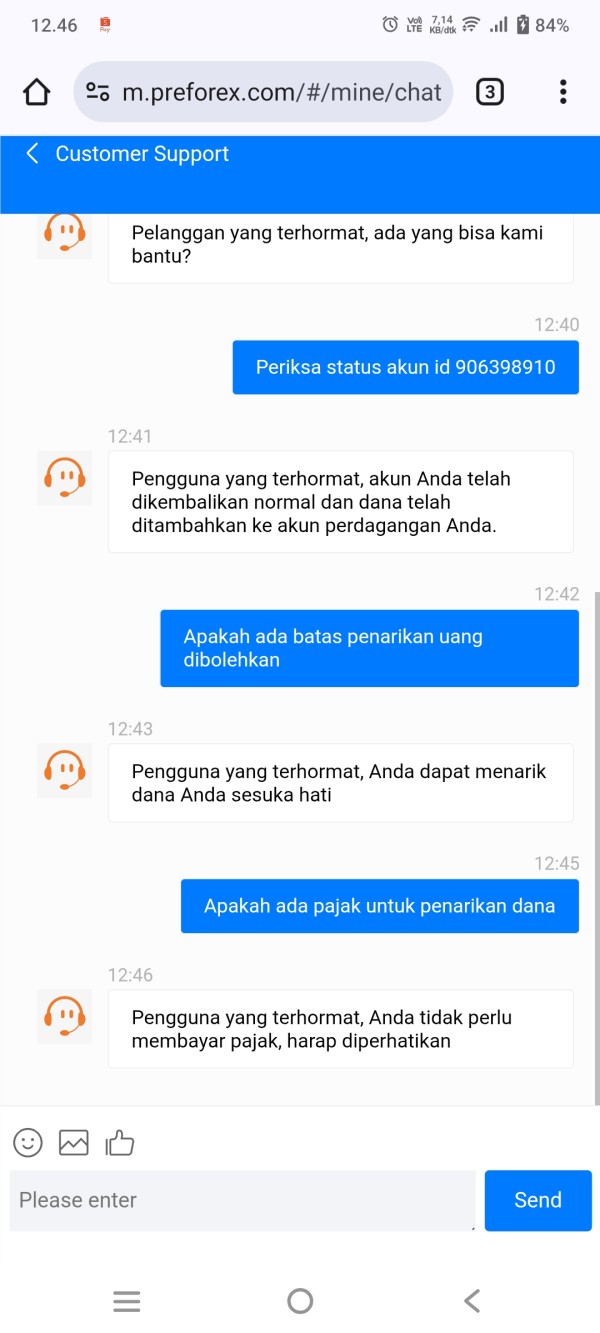

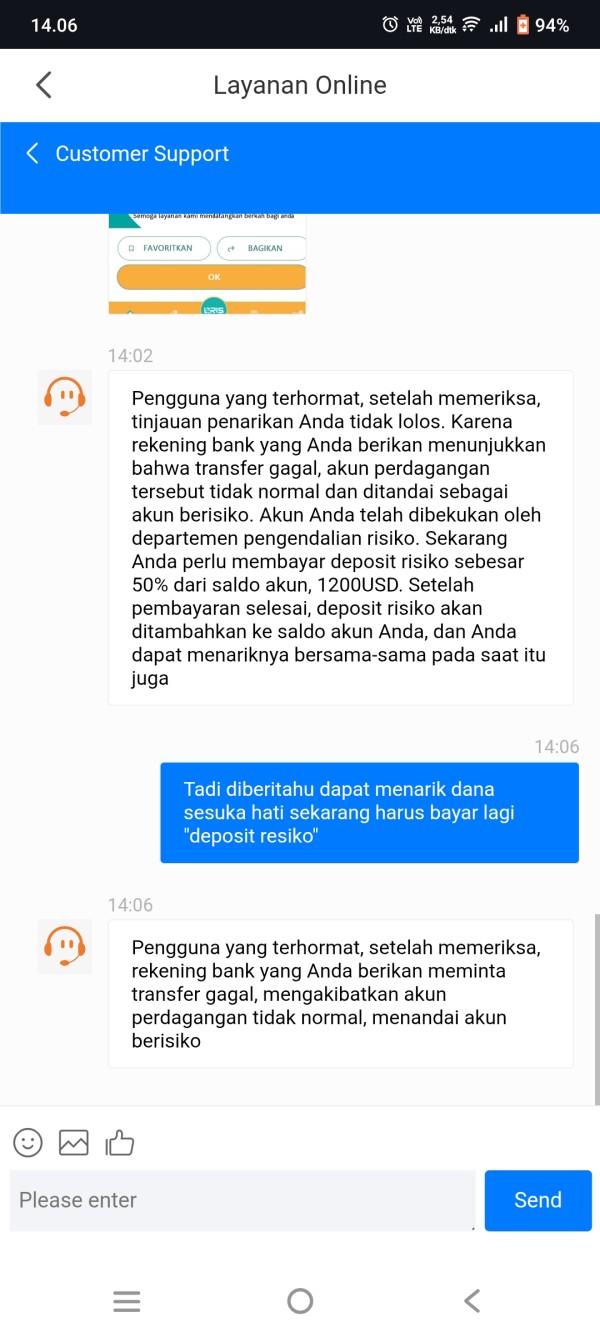

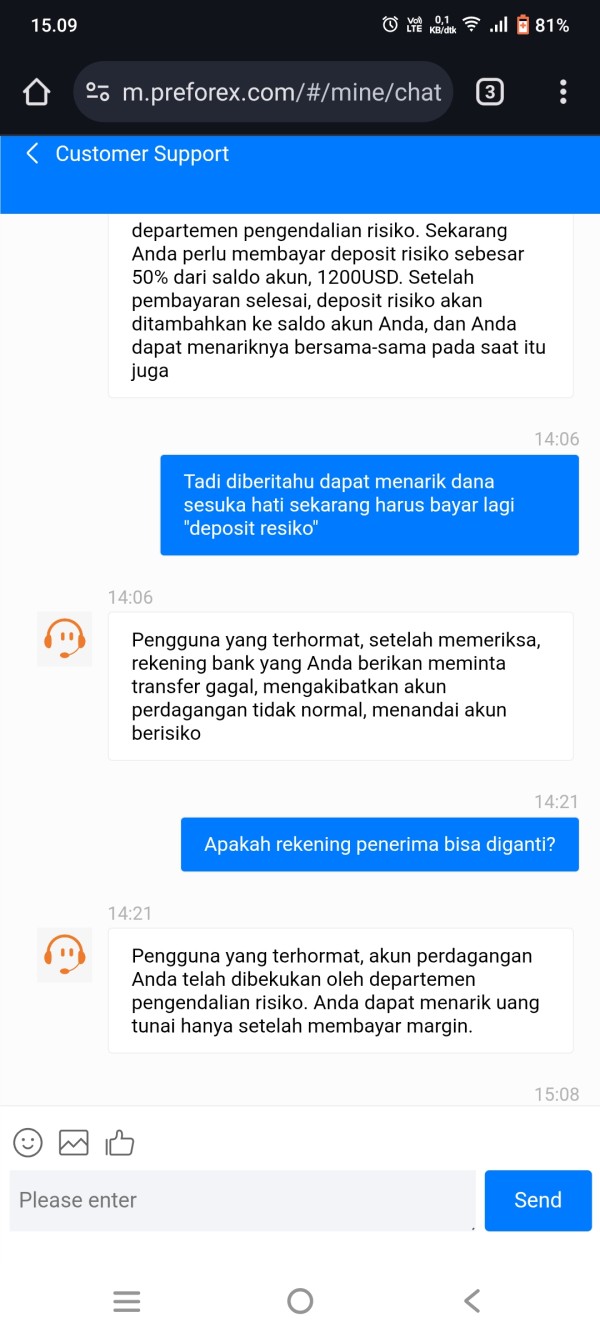

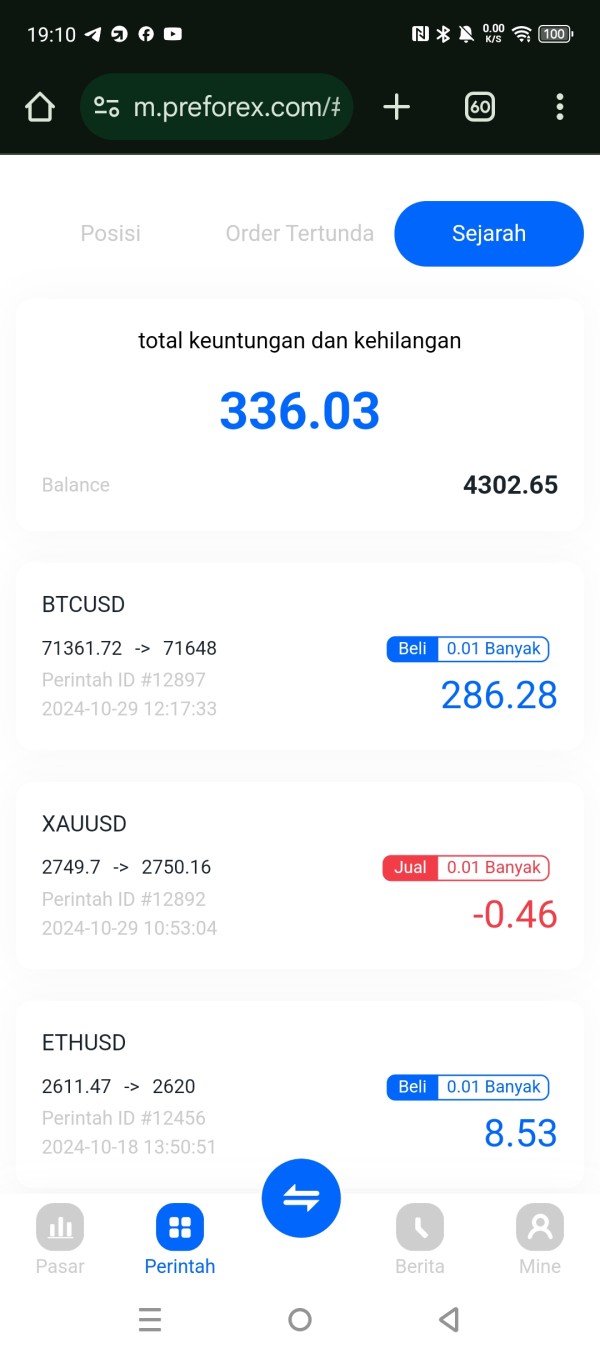

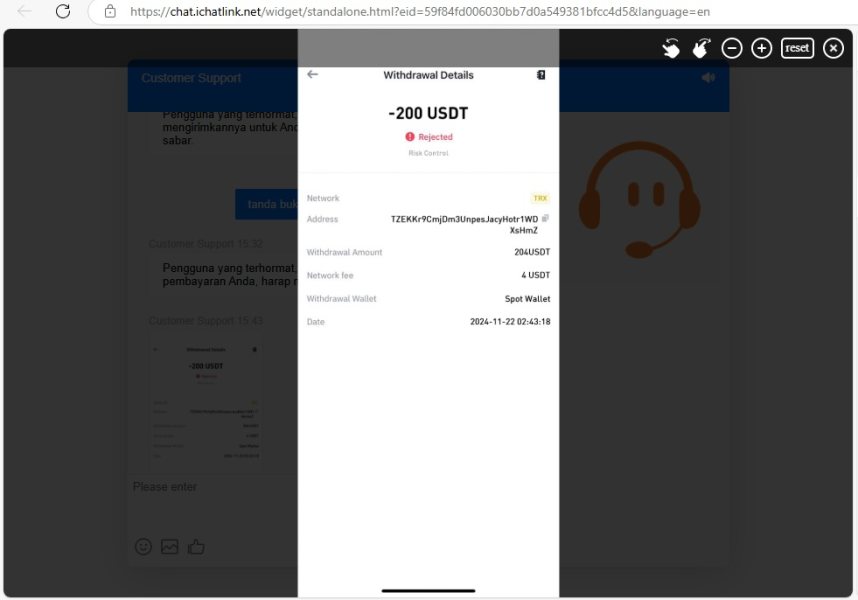

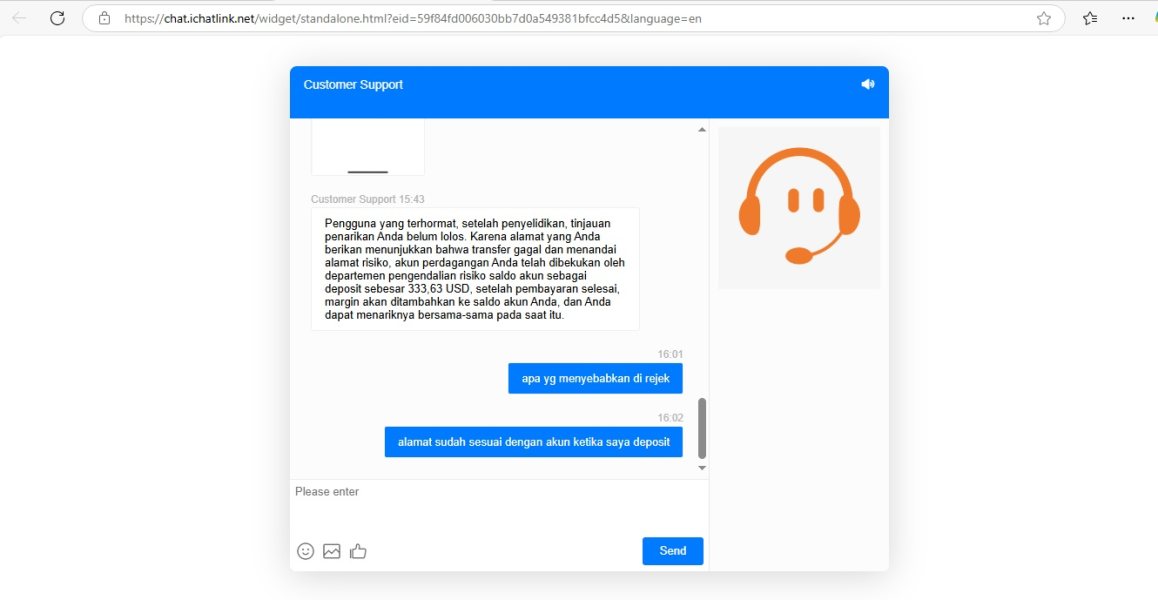

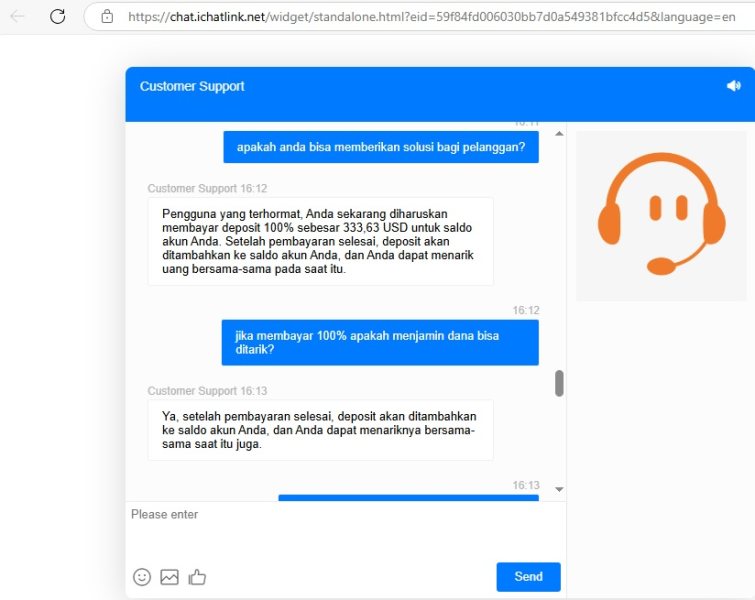

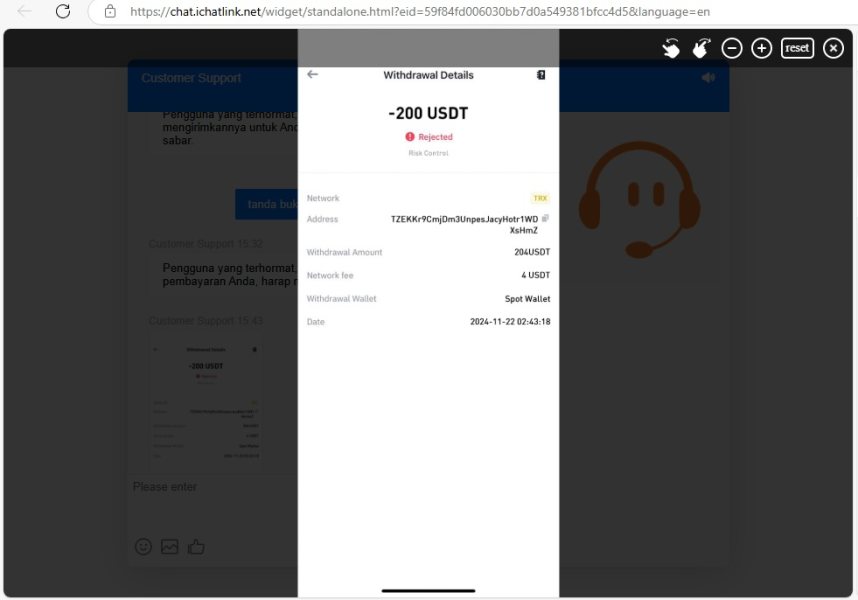

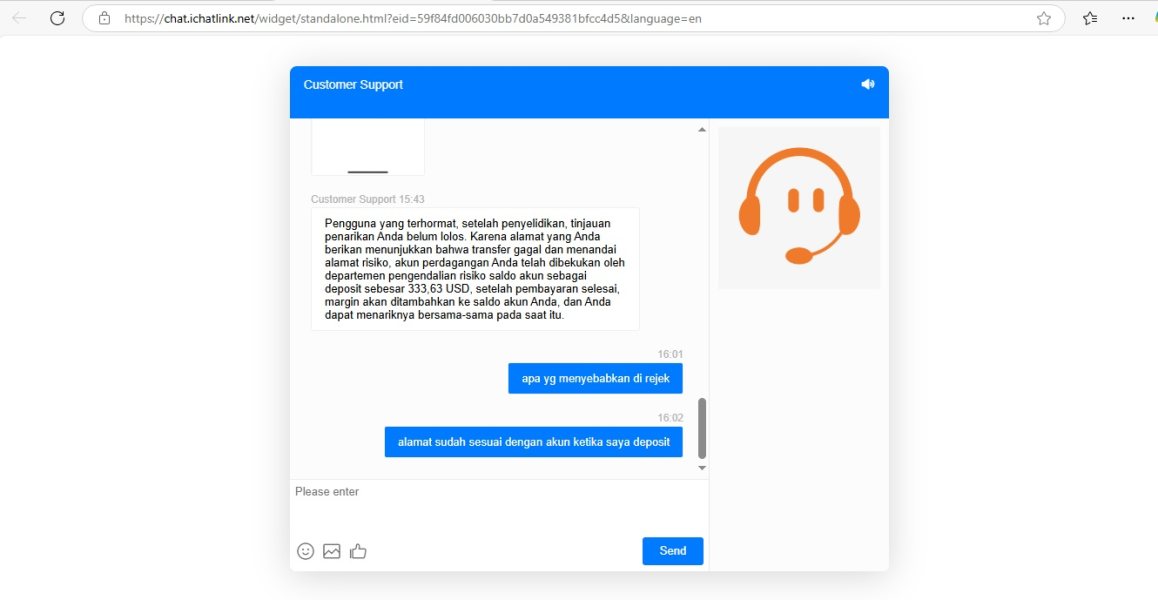

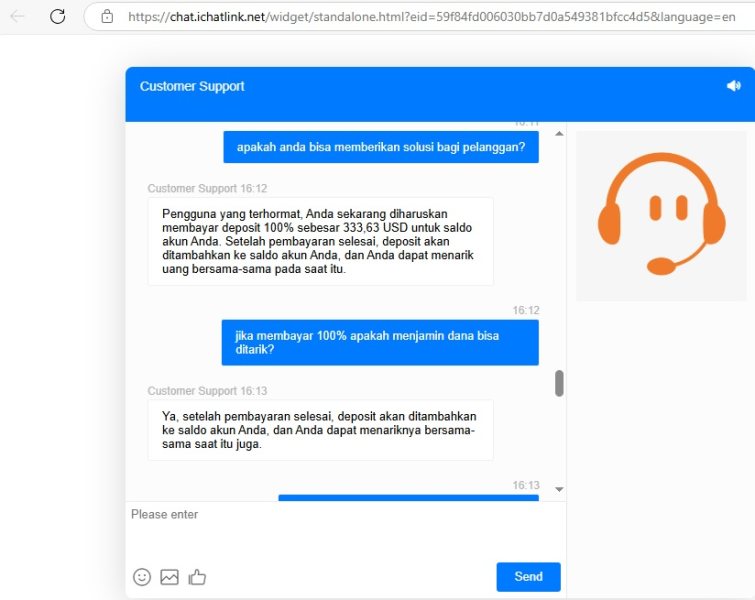

Deposit/Withdrawal Methods and Currency

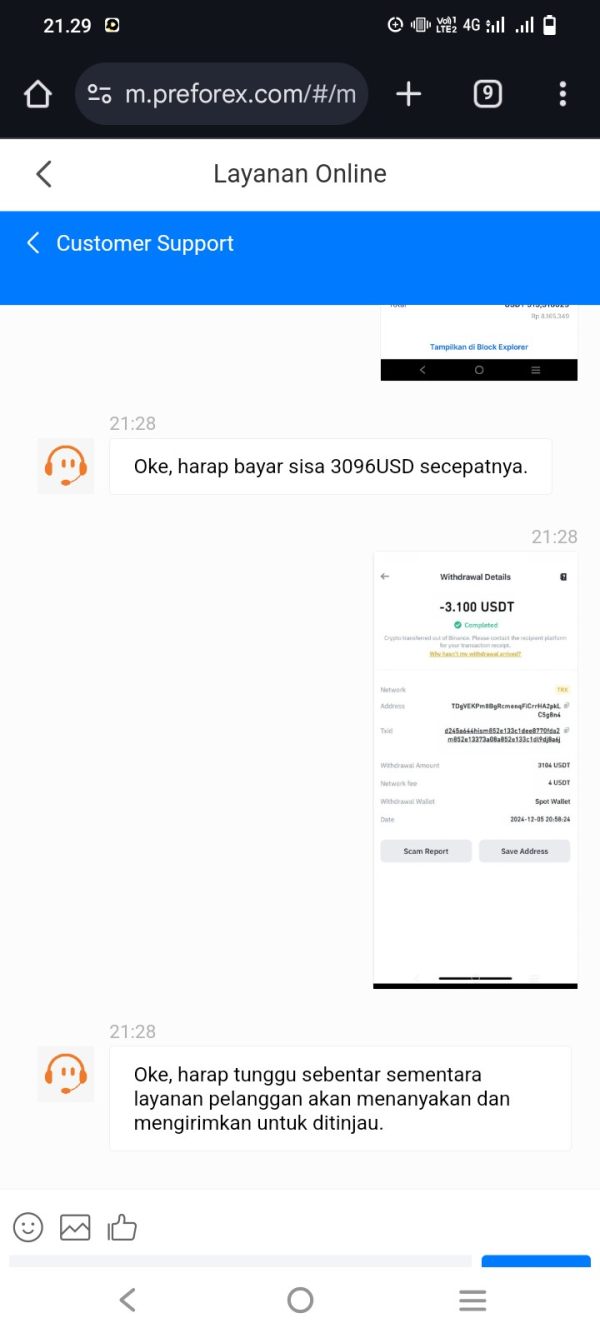

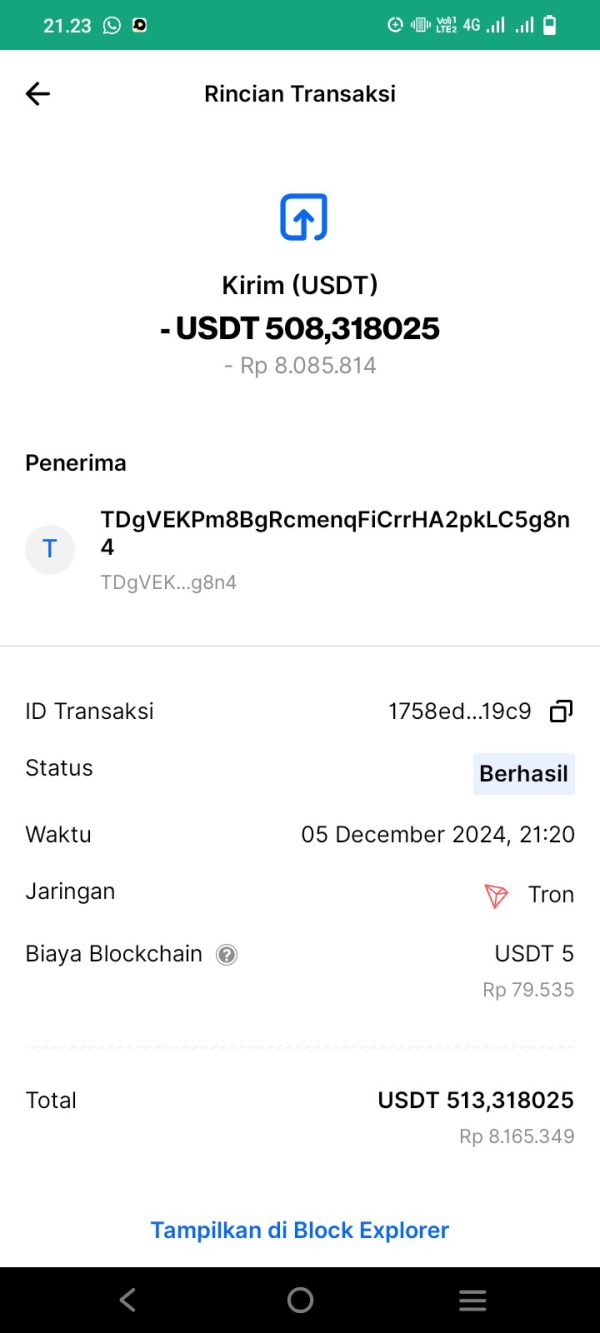

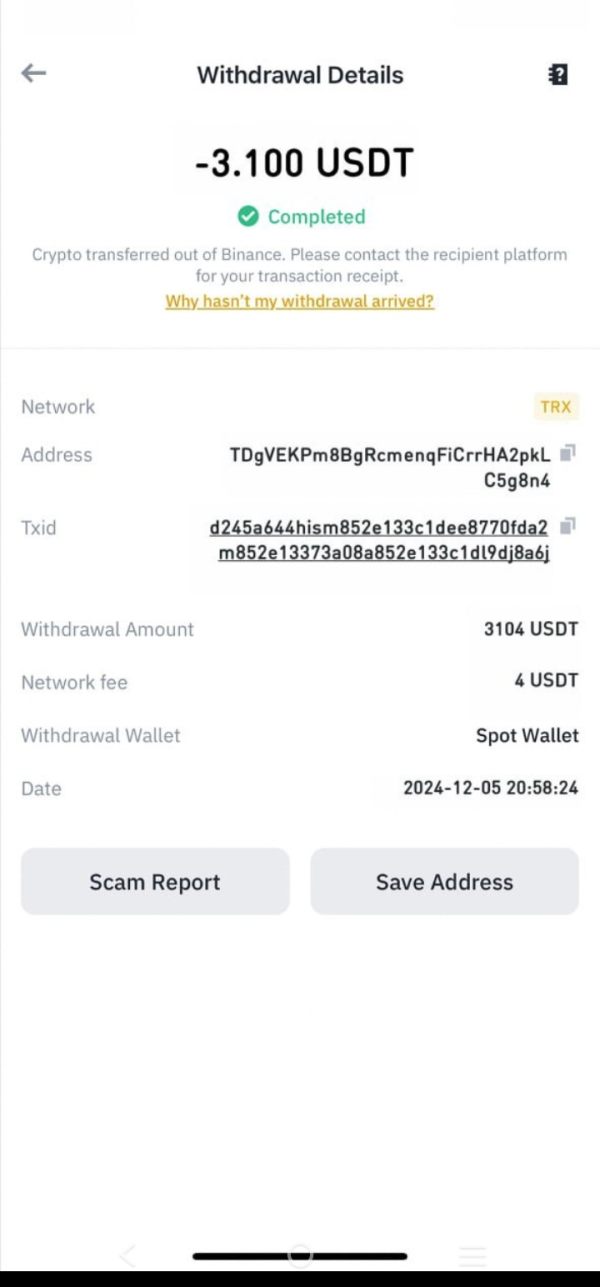

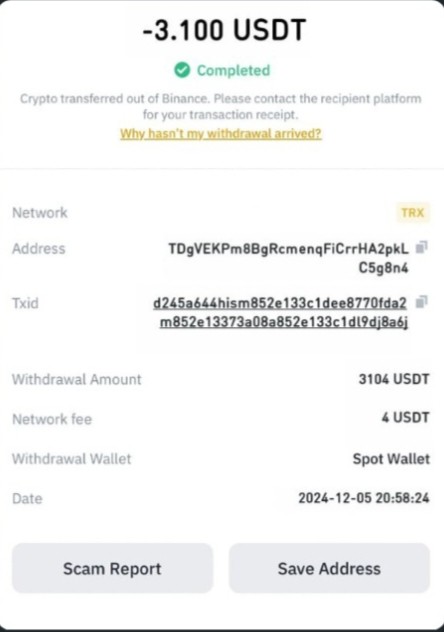

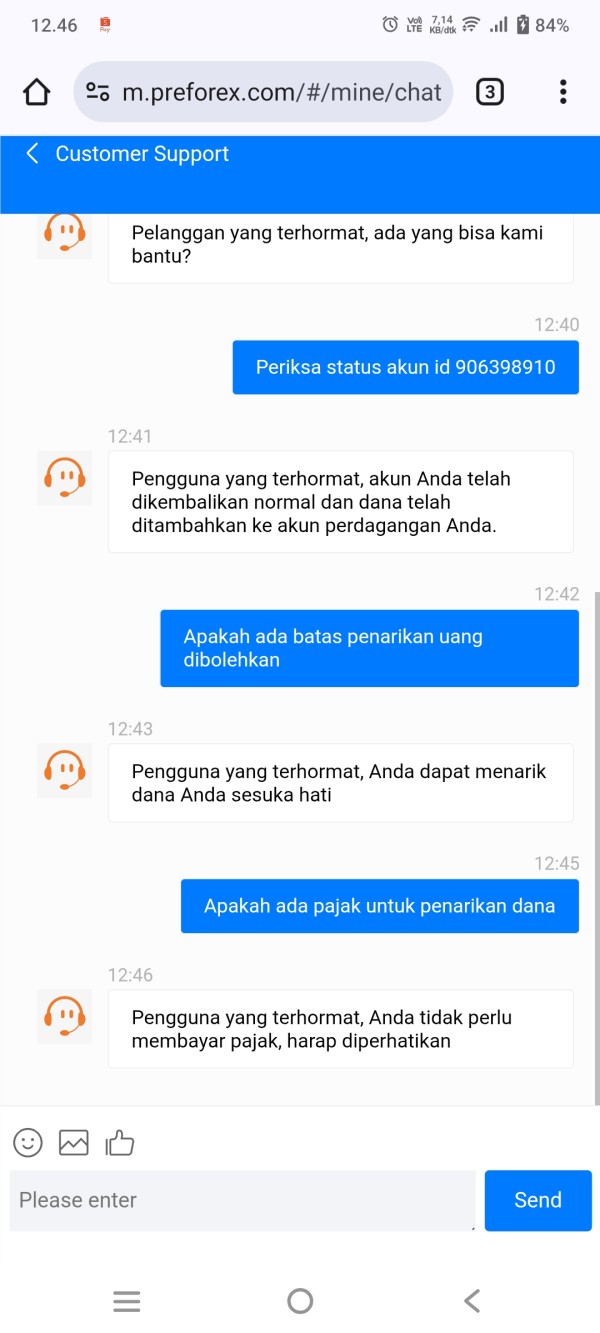

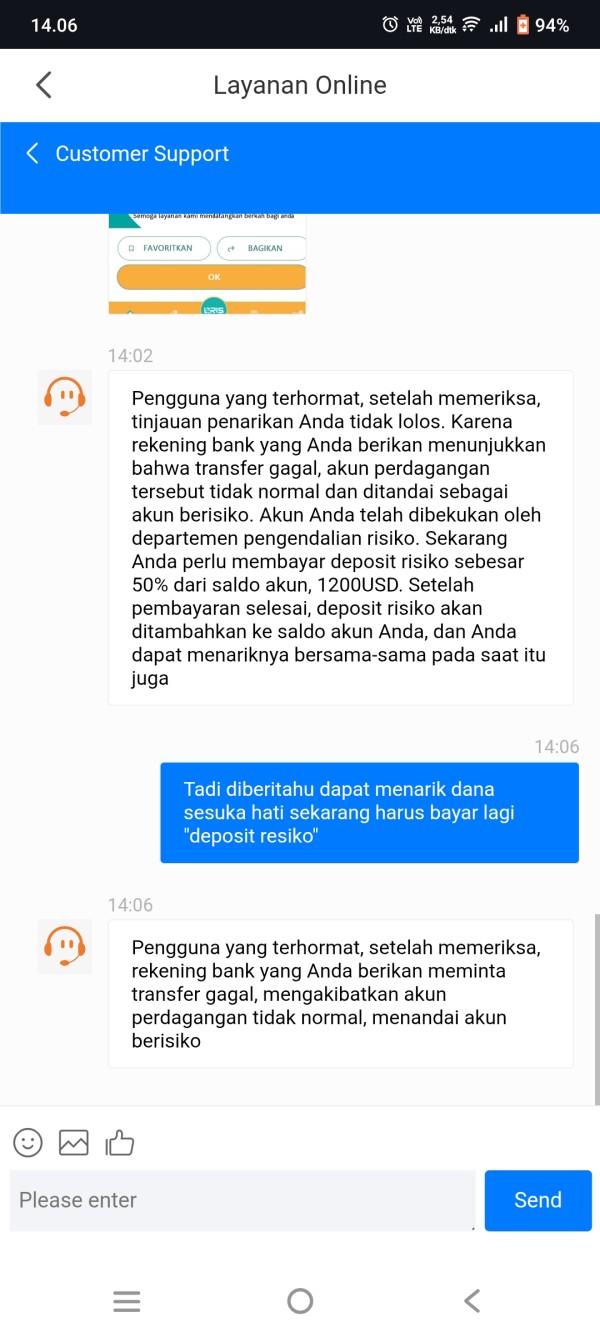

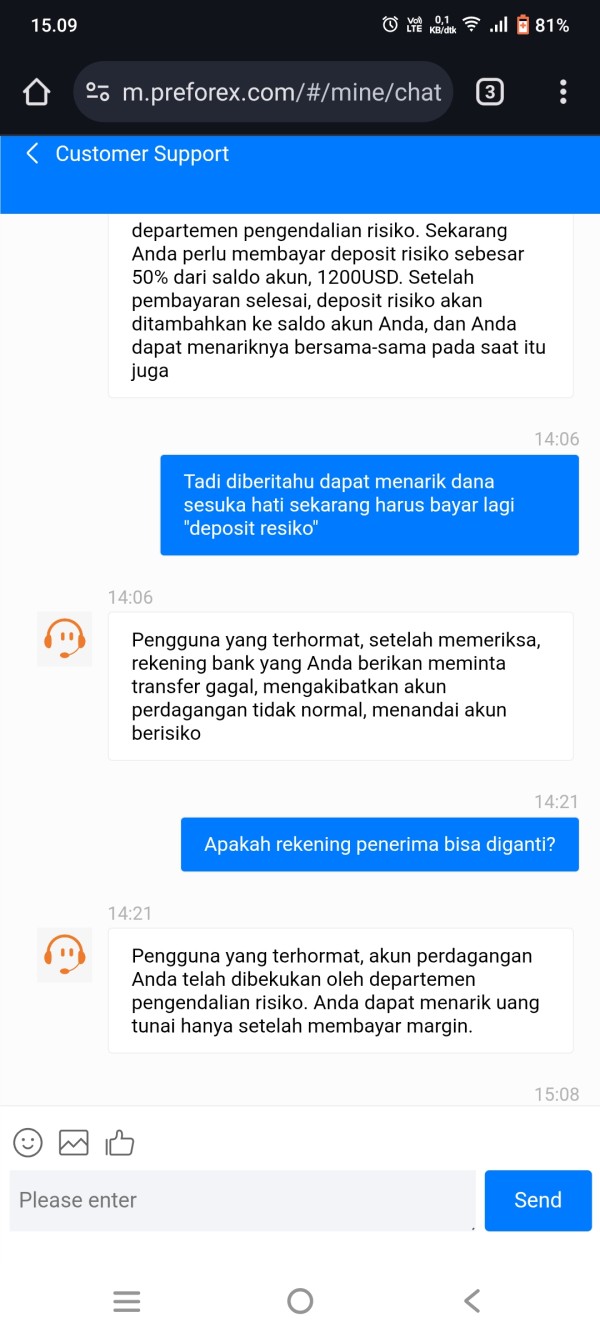

Morgan Pre accepts deposits in various currencies, but specific details regarding supported cryptocurrencies are not clearly outlined in the available reviews. Users have reported problems with withdrawals, citing that requests are often denied or require additional deposits that equal the account balance. One user lamented, “Even when I won trades, I could never withdraw my profits. All my money is gone,” highlighting the serious concerns regarding the broker's withdrawal practices.

The minimum deposit required to open a trading account with Morgan Pre is as low as $5, which may seem attractive to novice traders. However, the broker's structure often leads to significant risks due to its high leverage offerings of up to 1:1000. Such leverage can result in rapid account liquidation, especially for inexperienced traders.

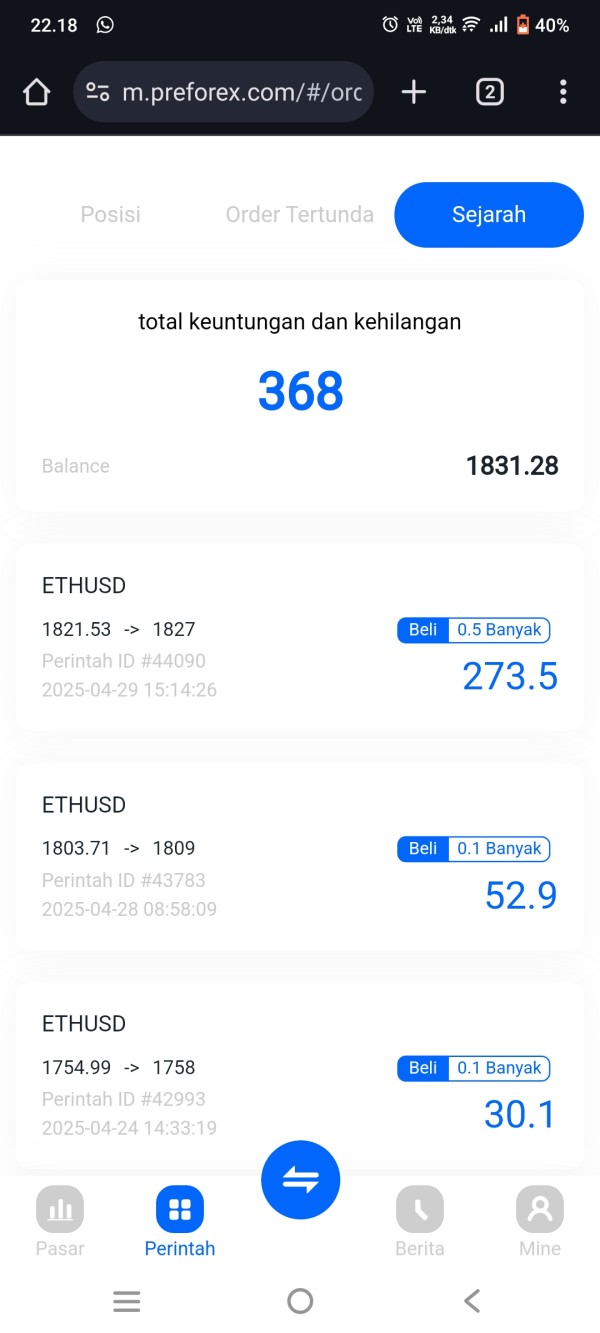

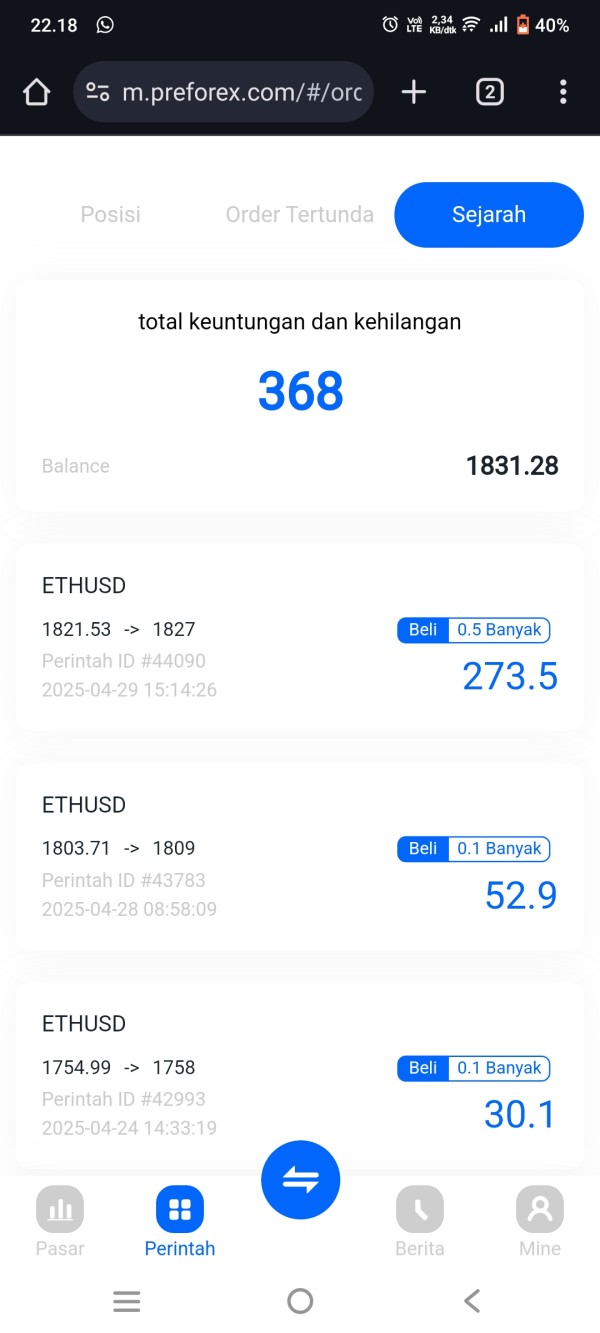

Asset Classes and Trading Costs

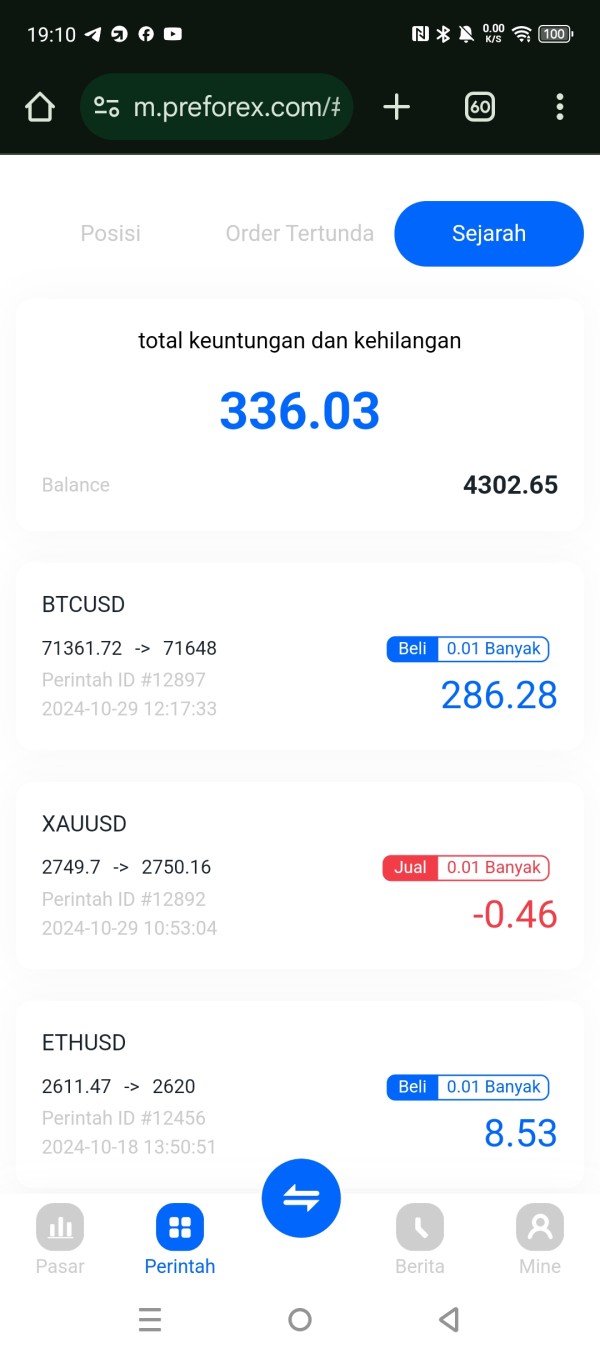

Morgan Pre offers a range of asset classes, including over 50 currency pairs, commodities, and precious metals. However, the costs associated with trading, such as spreads and commissions, are not transparently disclosed. User reviews suggest that while trading may seem profitable, the reality of withdrawing funds is fraught with complications, leading many to question the broker's integrity.

Morgan Pre's leverage offerings are alarmingly high, reaching up to 1:1000, which is significantly above the industry standard. Such high leverage can amplify both potential profits and losses, making it especially risky for novice traders. The platform itself, ST5, lacks the robustness and features of industry-standard platforms like MT4 and MT5, which raises concerns about execution quality and user trust.

Restricted Regions and Customer Support

The reviews indicate that Morgan Pre has not specified which regions it restricts from trading, but the lack of regulation suggests that it may not be a suitable choice for traders in highly regulated markets. Customer service appears to be a significant issue, with reports of slow responses and inadequate support, further damaging the broker's reputation.

Final Ratings Overview

Detailed Analysis

-

Account Conditions: While the low minimum deposit is appealing, the associated risks due to high leverage and withdrawal issues significantly undermine the account's attractiveness.

Tools and Resources: The absence of popular trading platforms like MT4 and MT5, combined with a proprietary system that lacks advanced features, limits traders' capabilities.

Customer Service: User experiences indicate a severe lack of support, with many reporting difficulties in resolving issues, which is critical in the trading environment.

Trading Setup: The overall trading experience is marred by high-risk leverage and a platform that does not meet the standards expected by seasoned traders.

Trustworthiness: The unregulated status and misleading claims about regulatory oversight make Morgan Pre a broker that many experts and users deem unreliable.

User Experience: Overall user experiences are negative, with many traders expressing frustration over deposit and withdrawal issues, leading to a lack of trust in the broker.

In conclusion, based on the comprehensive review of Morgan Pre, it is advisable for potential traders to exercise caution and consider more reputable and regulated brokers for their trading needs. The numerous red flags associated with Morgan Pre, including its unregulated status and poor user experiences, indicate that it may not be a safe environment for trading.